Yves here. There’s one point I quibble with in Nathan’s otherwise fine piece. It is in depicting banks as at the top of the money food chain. They aren’t. Even before the past crisis, loans sat overwhelmingly on the books of investors like pension funds, sovereign wealth funds, insurers, endowments and foundations,, not banks. And we are seeing efforts perversely to bail out credit funds (run by private equity firms) rather than the end investors the US cares about, such as its public pensions. So even though all payments do clear through banks, their presence in the payments system does not mean they are necessarily as exposed as lenders as other players.

By Nathan Tankus. Originally published at Notes on the Crises

For weeks now there have been calls for widespread payment suspensions or holidays. These calls have especially focused on utilities, rent and household debts. For the most part, very few have directly argued against these proposals. They have simply been politically ignored in exchange for attempts to accomplish “paycheck protection”, larger unemployment insurance benefits and, of course, the famous 1200 dollars. The CARES act did have some forbearance for those with government guaranteed mortgages, but there was very little for renters. One person who has criticized payment suspensions/holidays is professor Perry Mehrling. Here is Joe Weisenthal asking him about this precise issue on Odd Lots (I’ve edited the transcript for clarity):

Weisenthal: Why can’t we just put a pause on everything; all payments stop? Nobody has to pay their mortgage for the next 3 months. Nobody has to pay their rent etc. keep cash in people’s pockets while they’re not working and so forth.

Mehrling: This is a high-level Point. So here’s the thing from the money view. one person’s cash outflows are another person’s cash inflows so when you say ‘one way for me to build up my cash balances to match my diminished inflows is to stop paying’ that of course spreads the virus right? Because then somebody else is going to have a diminished cash inflow. So that’s the concern… so you want to make sure that you don’t have a multiplier effect that comes from that and you can do that, if you’re using the government’s balance sheet more generally

There is much merit to what Mehrling is saying. One person’s interest or rental payment is indeed another person’s disposable income. Government support is likely necessary whether you suspend payments or not. Where I disagree with Mehrling (and thus support a payment holiday) is on **how** that government support should come and whether we need to preserve pre-existing social relations exactly as they appeared pre-crisis.

First, while it’s true that a payment holiday simply pushes the “balancing inflows and outflows” problem up the payments chain, that does actually help. Those who are higher up in payment chains have larger net-worths (including financial net-worths) and are better able to finance themselves while incurring losses. Landlords can make payments more easily than unemployed households can. Landlords, in fact, should lose equity during a crisis. Indeed, the only real justification for landlord net incomes and capital gains is as payment for the possibility that they may get wiped out by extreme, unforeseeable events. At the very least, if we come to the conclusion that we are going to protect bigger players from losses than we need to rethink their capacity to extract rental, interest and other payments from ordinary households and small businesses.

Of course, when you get high enough up the chain of payments, you reach the banking system. Banks are in the best position to lose equity because what an acceptable net-worth for banks is is purely determined by financial regulators. Regulators can lower overall capital requirements for the duration of the crisis and a time period afterwards. Alternatively, they could simply indemnify banks against losses associated with payment holidays. We’re already part way there, as troubled debt restructuring has basically disappeared as a category in financial accounting. This would, in essence, be taking advantage of chartered banks’ role as franchised money creators. They can make payments as long as they have guaranteed access to liquidity and they have that access for as long as financial regulators declare them in regulatory compliance. When necessary, we have a ready made process for recapitalizing smaller chartered banks in the form of FDIC resolution. The resolution of the largest banks is more complicated and can be avoided if it’s deemed to be destabilizing.

Things are more complicated when it comes to the broader financial system. Yet, if there is any time we could manage that process, it would be now. The collateral schedule (what is acceptable to secure a loan from the Federal Reserve and at what ‘haircuts’) has been expanded widely for the duration of the crisis. Commercial mortgage backed securities are being purchased by, and pledged to, the Federal Reserve. Residential mortgages are not really a concern as “private label” (non-government guaranteed) mortgage backed securities stopped since the crisis and mortgages are either sold to Fannie Mae and Freddie Mac or held on commercial bank’s balance sheets. Repo financing is more freely available than ever. Some of the most marginal players- especially around financial technology lenders coming out of silicon valley- may not be well integrated into these financial circuits. Here, I think these lenders’ suffering is a good thing. The conventional argument against letting creditors take losses is it makes credit less available. However, under these circumstances, it’s far preferable for households to have additional disposable income than additional credit.

This approach would still require additional government funds over and above regulatory forbearance to the financial system. However, it would require far smaller amounts of money and that money could be devoted to reorganizing social relations. Landlords could be bought out to form limited-equity co-ops and community land trusts. Banks, post resolution, could be bought out and democratized. Keeping the exact same payment relations preserves the status quo- which is better than a crisis collapse. However, it’s not the best option we have available. These creditors have been taking on uncertainties in exchange for income and we should have them play their proper role and get wiped out during a crisis. In some ways managing this process would be more complex, but it would also be extremely rewarding. A payments holiday also ensures that everyone gets the help they need, while people can fall through the cracks in our current suite of programs. Overall, a payments holiday for households and small businesses has many administrative advantages, is easily managed given our current suite of interventions (especially by the Federal Reserve) and is far more equitable than trying to keep pre-Coronavirus social relations going as is. Never let a crisis go to waste.

Re: Payments Holiday.

I ask two questions regarding legal implications of such a plan.

1. Interference with contracts. In my state (North Carolina) the law is pretty clear; the state cannot interfere with legally negotiated contracts.

2. Which leads to the second issue. Taking of property (or property rights) without compensation. A delay in payments would amount to a default allowing the creditor to seek redress against the debtor. Any law preventing the use of a legal remedy would be a taking of the creditors rights. Likewise, the failure of the debtor to abide by the contract would lessen the value of the security property itself.

It seems to me that the best way to handle these issues is for the government to actually purchase the debts, and then either renegotiate the underlying contract or release the debt in part or whole.

Oh I like your idea at the end.

Re #1 – it’s a law, laws can be changed.

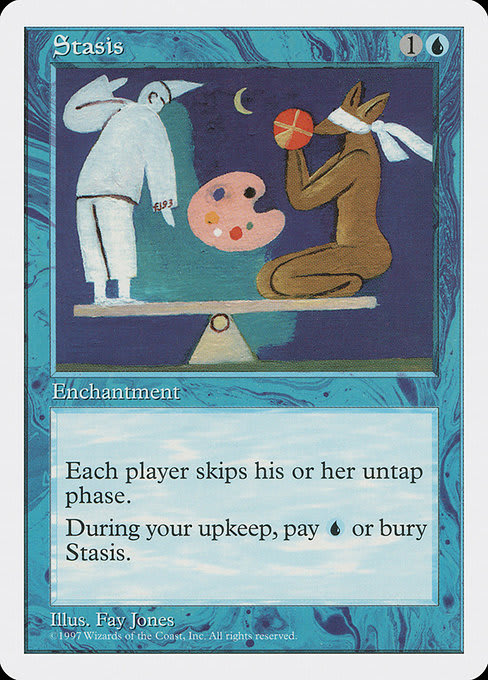

Re #2 – I said just blanking out 3 months would be a good idea. The mortgage/rent holder is compensated by getting his rights extended by 3 months. Like adding 3 lbs to each end of a see-saw.

If anybody replied to when I first proposed this, please feel free to dump your thoughts here again. I have completely lost track of where I first asserted this.

They just did it with student loans. 6 months extension at 0% interest. So no student loan payments required until end of September and the 6 months is added on to the end of the loan, so the interest and payment clock restarts at the end of September. Its like Brigadoon where 6 months will simply not have happened.

They might be happy if they have 6 months 0% interest if we get negative rates at some point over the next year.

Since most securitized mortgages are FHA etc guaranteed, similar to student loans, the same can be done with those.

The student loan moratorium only applies to the subset of student loans actually owned by the federal government (direct loans and federally held loans originated under the now defunct FFEL program). The fact that the federal government is guarantor of a student loan (FFEL loans before 2010) is not the “hook” underlying the moratorium in the CARES Act.

Can confirm. My student loan payments haven’t stopped. Only federal student loan borrowers get the forbearance.

Just received an email from my loan holder(Nelnet):

“If you’re affected by COVID-19 and need our support, we’re here to help. Even though your student loans in the account(s) listed above do not qualify for federal assistance under the recent CARES Act, we have options to reduce or postpone your payments.

Postponing Payments

You can request a 90-day coronavirus forbearance* at Nelnet.com/nelnetforms/emailus to temporarily suspend your payments.

Select “Coronavirus Forbearance” as the topic in the online form.

You may also want to review other options such as an Economic Hardship or an Unemployment Deferment as you may qualify for an interest subsidy with a deferment, but not a forbearance. Log in to your Nelnet.com account and select Payments, then Repayment Options to get started.

Reducing Your Monthly Payment Amount

If possible, keep making payments since interest is still accruing on your account. However, if you need to reduce your payment amount, you can explore other repayment plans, including Income-Driven Repayment (IDR), which bases your payment amount on your income and student loan debt. Log in to your Nelnet.com account and select Payments, then Repayment Options to explore repayment plans.

*During forbearance, interest still accrues on your outstanding principal balance. You’re responsible for the interest, but you have two options:

Pay the accrued interest before your forbearance ends, or

Make no payments during the forbearance. The payment(s) made following the end of your forbearance will be applied first to any unpaid fees, then unpaid accrued interest, and lastly to your outstanding principal balance.”

Thank you, Yves.

I have a question. Is there a convenient term for “investors like pension funds, sovereign wealth funds, insurers, endowments and foundations”? I’m sort of aware that banks aren’t the ultimate beneficiaries of all the wealth they hoover up, but ‘bank’ is a four letter word, unlike that mouthful. Does rentiers cover it, for example?

As for “whether we need to preserve pre-existing social relations exactly as they appeared pre-crisis”, it has been said that crises present opportunities. This one is clearly a huge, global crisis, with corresponding opportunities. I entirely agree it would be tragic to let it go to waste. Our real power has rarely been so obvious.

‘Is there a convenient term for “investors like pension funds, sovereign wealth funds, insurers, endowments and foundations”’

How about Top Money Hoarders ? Rentiers is just a little too esoteric… “everyday Americans” (God I hate that term) don’t have any idea what a “rentier” is.

BTW, just picked this up over at The Automatic Earth:

https://nypost.com/2020/04/16/43k-us-millionaires-will-get-stimulus-averaging-1-6m-each/

Nice work if you can get it, eh? But I guess in terms of money-hoarding, these guys are just pikers compared to the big boys.

Don’t have clients this strataspheric but a CPA friend informs me that it is not optional.

This cohort MUST amend 2018 tax returns and take this $$.

Almost makes one think a fire sale is coming – and what good is a fire sale if nobody buys anything?

I had thought that in conventional economics, wages were supposed to be the risk-free proceeds of selling labor, profits the winnings resulting from taking risks, and rents the risk-free income from being a, um, do-nothing rentier. Not that that’s a good thing, but rent and profit are supposed to be different categories.

In my ongoing USSR-USA collapse comparison, could we see a scenario where everybody in the USA ends up pretty much ‘owning’ their domicile/apartment by occupying it, as in the Soviet Union?

All forbearance will do is delay the inevitable, and then 3 or 4 months later you have to pay it all, plus penalties. Like that’s gonna happen, ha!

Doesn’t seem so far fetched in the wake of the ‘you’ll eventually get $1200 to tide you over until this ends, m’ok?’ nonsense, and soon to be broke counties and states…

A holiday is fine as long as additional charges aren’t imposed. If an individual skips a payment usually more interest accumulates. This increases the cost of the loan. If loans are suspended but additional interest is accumulated than this ends up as a bonus for lenders.

Thank you.

Landlords, renters, homeowners with mortgages, homeowners without mortgages, businesses who own their property all have one thing in common: local property tax bill, albeit indirectly for renters.

Anybody know a government worker who has missed a check? Anybody know of a public entity reducing expenses to a meaningful degree?

You are about to see a whole bunch of local and state worker furloughs and layoffs soon. Their budgets are gettting hammered by income and sales tax reductions. If they can’t quickly raise money in the bond markets, they will need to start layoffs when their rainy day funds are gone.

“Anybody know a government worker who has missed a check?” Some are essential. How Useful versus Useless government workers? Here’s an example, The Golden Gate that had its bonds paid off decades ago and thus should be free, but charges near $7 a crossing to fund these salaries:These are not Useful employees like maintenance, engineers, or bus drivers, merely paper pushers:

$406,074.61 for the general manager,

$203,668.32 for the Senior Project Manager, etc

https://transparentcalifornia.com/salaries/search/?a=golden-gate-bridge-highway-and-transportation-district&q=manager&y=2018

It could and should be run by a parallel bureaucracy, CALTRANS, the state of California that manages all the other bridges.

Here’s an special government district energy re-seller, with a $340,000 a year performative “managers” salary tacked onto electricity rates for basically nothing.

https://www.mcecleanenergy.org/wp-content/uploads/2018/07/Resolution-No.-2018-07-Establishing-the-Annual-Salary-for-The-Chief-Executive-Officer-1.pdf

Look at all these California “special districts” and their salaries:

https://transparentcalifornia.com/agencies/salaries/special-districts/

If they need to exist, and we pay these salaries, then why are we handing 12% of our income to the State, which could and should obviate these districts?

One or the other, but not both.

Tankus states – “Banks are in the best position to lose equity because what an acceptable net-worth for banks is is purely determined by financial regulators. Regulators can lower overall capital requirements for the duration of the crisis and a time period afterwards.”

Tankus is mistaken. Regulators cannot change statutes. The Prompt Corrective Action statute, 12 U.S.C. 1831o, requires regulators to close critically undercapitalized banks. This statute resulted from the regulators’ disastrous practice of allowing insolvent “zombie” institutions to continue operations during the thrift crisis of the 1980s.

The banks have engineered a “heads I win, tails you lose” system. Banks enjoy profits during economic upturns, and force bailouts during economic downturns due to the dire potential consequences of the failure of a major institution. Tankus seems to pick “tails.” Perhaps he has forgotten about Lehman Brothers.

>There is much merit to what Mehrling is saying. One person’s interest or rental payment is indeed another person’s disposable income.

No there isn’t as it generally is not. Yes there are “many” – we have a few here – householders with a tenant over-the-garage or two. But financially they are dwarfed by the (generally incorporated) owners of apartment complexes and such.

So “one person’s interest or rental payment” is one of many streams into this other (corporate) person’s income.

If you are generating income from a 20-unit 5 story apartment building, and you can’t financially handle 3 months of suspended payments with a 3 month rental agreement extension, you are doing it wrong.

And I’m not saying there is a moratorium on these rental payments. I’m saying that people can take advantage of said offer. If you are unfortunately on the front lines of this (hospital worker), you can pay your rent/mortgage/never-never and not worry about the extension.

So said “person” that owns the building has a chance of getting some payments to at least cover the occasional busted toilet et al.

During the 1930’s property taxes in Chicago/Cook County were suspended for one year and were never made up. At property closings today people are still paying property taxes one year in arrears, 90 years later.

Insane!

A debtors’ strike seems more likely, and more effective, than a debt jubilee.

And although I’m not religious, the New Testament story of Jesus cleansing the temple keeps coming to mind…

I have posted this before:

#1. Extend everyone’s agreements by three months.

#2. The Fed picks up the interest payments.

No penalties, no payments made by debtors, no loss in the long run by the creditors. They are frozen for three months.

Congress would not have to worry about this if they could get their moronic act together. Paying everyone’s paycheck takes care of everything. But got forbid Congress might ever rub two brain cells together.

Amusing, if so many were not having their livelihoods destroyed.

Virus or no virus, the financial result was inevitable.

The never let a crisis go to waste crowd gets the bonus of population immobilization.

No smart parent working in the real economy is going to defer decisions for a $1200 non-recurring check that covers next to no recurring bills, and same goes for the SBA loan which turns into a grant at the discretion of others. All the disaster relief will end up as inflation on top of what is being temporarily deferred, because it was conjured with no relation to productivity.

Health is primarily a function of socio-economic position, and this lockdown effect on the economy is going to cost far more lives for far longer than this virus, its next wave, or all the viruses after that.

They are rolling out post WWII stimulus, with no connection to a real economy, dramatically increasing the relative size of debt-laden and so-out of touch organizations.

Amazon is not going to save the economy.

The whole point of pension financing is mass extortion.

The folks printing money and voting for same can’t build a bridge, and those who can are not going to show up for electronic money.

Anyone can build a bridge to nowhere as an economic activity, which has been going on for 50 years.

Is Biden to going to give back bankruptcy to kids holding all that fraudulent university debt, so they can get on with their lives and there is a discussion about why universities are a real estate ghetto scam? Been to Yale or Harvard lately? Is something useful actually going to come from all this?