By Michael Hudson, with Dirk Bezemer, Steve Keen and T.Sabri Öncü

Michael Hudson is a research professor of Economics at University of Missouri, Kansas City, and a research associate at the Levy Economics Institute of Bard College. His latest book is “and forgive them their debts”: Lending, Foreclosure and Redemption from Bronze Age Finance to the Jubilee Year

Dirk Bezemer is a Professor of Economics at the University of Groningen in The Netherlands..

Steve Keen is a Professor and Distinguished Research Fellow at the Institute for Strategy, Resilience and Security of University College London (www.isrs.org.uk). He blogs at www.patreon.com/profstevekeen

T. Sabri Öncü (sabri.oncu@gmail.com) is an economist based in İstanbul, Turkey

Summary

After being attacked by monetarists and others for many decades, MMT and the idea that running government budget deficit is stabilizing instead of destabilizing are suddenly gaining applause from the parts of the political spectrum that long opposed MMT: the banking and financial sector, especially the Republicans. But what is applauded is in many ways something quite different than the leading MMT advocates have long supported.

Modern Monetary Theory (MMT) was developed to explain the logic of running government budget deficits to increase demand in the economy’s consumption and capital investment sectors so as to maintain full employment. But the enormous U.S. federal budget deficits from the Obama bank bailout after the 2008 crash through the Trump tax cuts and Coronavirus financial bailout have not pumped money into the economy to finance new direct investment, employment, rising wages and living standards. Instead, government money creation and Quantitative Easing have been directed to the finance, insurance and real estate (FIRE) sectors. The result is a travesty of MMT, not its original aim.

By subsidizing the financial sector and its debt overhead, this policy is deflationary instead of supporting the “real” economy. The effect has been to empower the banking sector, whose product is credit and debt creation that has taken an unproductive and indeed extractive form.

This can clearly be seen by dividing the private sector into two parts: The “real” economy of production and consumption is wrapped in a financial web of debt and rent extraction – real estate rent, monopoly rent and financial debt creation. Recognizing this breakdown is essential to distinguish between positive government deficit spending that helps maintain employment and rising living standards, as compared to “captured” government spending to subsidize the FIRE sector’s extraction and debt deflation leading to chronic austerity.

Origins and Policy Aims of MMT

MMT was developed to explain the monetary logic in running budget deficits to support aggregate demand. This logic was popularized in the 1930s by Keynes, base on his idea of a circular flow between employers and wage-earners. Deficit spending was seen as providing public employment and hence consumer spending to absorb enough production to enable the economy to keep producing at a profit. The policy goal was to maintain (or recover) reasonably full employment.

But production and consumption are not the entire economy. Modern Monetary Theory (MMT) was formally developed in the 1990s, with roots that can be traced by Abba Lerner’s theory of functional finance, and by Hyman Minsky and others seeking to integrate the financial sector into the overall economic system in a more realistic and functional way than the Chicago School’s monetarist approach on the right wing of the political spectrum. A key point in its revival was Warren Mosler’s insight that a currency-issuing country does not “tax to spend”, but instead must spend before its citizens can pay tax in that currency.

MMT was also Post-Keynesian in the sense of advocating government budget deficits as a means of pumping purchasing power into the economy to achieve full-employment. Elaboration of this approach showed how such deficits created stability instead of the instability that results from private-sector debt dynamics. At an extreme, this approach held that recessions could be cured simply by deficit spending. Yet despite the enormous deficit spending by the U.S. and Eurozone in the wake of the 2008 crash, the overall economy continued to stagnate; only the financial and real estate markets boomed.

At issue was the role of government in the economy. The major opponents of public enterprise and infrastructure, of budget deficits and market regulation, was the financial sector. “Austrian” and Chicago-style monetary theorists strongly opposed MMT, asserting that government budget deficits would be inflationary, citing Germany’s Weimar inflation of the 1920s, and Zimbabwe, and portraying government deficits (and indeed, active government programs and regulation) as “interference” with “free markets.”

MMTers pointed out that running a budget surplus, or even a balanced budget, absorbed income from the economy, thereby shrinking demand for goods and services and leading to unemployment. Without government deficits, the economy would be obliged to rely on private-sector banks for the credit needed to grow.

That occurred in the United States in the final years of the Clinton administration when it actually ran a budget surplus. But with a public sector surplus, there had to be a corresponding and indeed identical private sector deficit. So the effect of that policy was to leave either private debt financing or a trade surplus as the only ways in which economic growth could obtain the monetary support that was needed. This built in structural claims for interest and amortization that were deflationary, ultimately leading to the political imposition of debt deflation and economic austerity after the 2008 debt crisis.

Republican and Financial Sector Opposition to Budget Deficits and MMT

If governments do not provide enough purchasing power by running budget deficits to enable the economy to grow, the role of providing money and credit will have to be relinquished to banks – at interest, and for purposes that the banks decide on (mainly, loans to buy real estate, stocks and bonds). In this respect banks are competitors with government over who will provide the economy’s money and credit – and for what purposes.

Banks want the government out of the way – not only regarding money creation, but also for financial and price policies, tax policy and laws governing corporate behavior. Finance wants to appropriate public monopolies, by taking payment in natural resources or basic public infrastructure when governments are, by policy rather than necessity, short of their own money, or of foreign exchange. (In times past, this required warfare; today foreign debt is the main lever.)

To get into this position, banks need to block governments from creating their own money. The result is a conflict between private bank credit and pubic money creation. Public money is created for social purposes, primarily to maintain production and consumption growth. But bank credit nowadays is created largely to finance the transfer of property and financial assets – real estate, stocks and bonds.

Opposing the Logic for running Budget Deficits

The Reagan-Bush administration (1981-82) ran budget deficits not to pay for social spending, but as a result of tax cuts, above all for real estate.[1] The resulting budget deficit led to proposed “cures” in the form of fiscal cutbacks in social spending, starting with Social Security, Medicare and education. This aim became explicit by the Clinton Administration (1993-2000), and President Obama convened the Simpson-Bowles “National Commission on Budget Responsibility and Reform” in 2010. Its name reflects its recommendation that “responsibility” meant a balanced budget, which in turn required that social spending programs be rolled back.

Opponents of public spending programs saw the rise in government debt resulting from budget deficits as providing a political leverage to enact fiscal cutbacksin spending. Many Republicans and “centrist” Democrats had long sought a reason to scale back Social Security. Austrian and Chicago-School monetarists urged that government shrink its activity, privatizing as many of its functions as possible to let “the market” allocate resources – a largely debt-financed market whose resource and monetary allocation would shift away from governments to financial centers – from Washington to Wall Street, and in other countries to the City of London, the Paris Bourse and Frankfurt. However, no such critique was levied against military spending, and the government responded to the 2000 dot.com and 2008 junk-mortgage financial crises by enormous monetary subsidy and bailouts of the economy’s credit and asset sector.

The Obama and Trump Financial Bailouts as a Travesty of MMT

To advocates of MMT, and indeed to most post-Keynesian economists, the positive function of budget deficits is to spend money and therefore income into the economy. And by “the economy” is meant the production-and-consumption sector, not the financial and property markets. That “real” economy could have been saved in a number of ways. One way would have been to scale back mortgage debts (and debt service) to realistic market prices and rent rates. Another would have been simply to create monetary grants and subsidies to enable debtors to remain in their homes. That would have kept the financial system solvent as well as employment and existing home ownership rates.

But Obama double-crossed his voters by not rolling out bad mortgage debts and other obligations to realistic market prices, and instead bailing out the banks for credit creation in the form of bad loans (“liars’ loans” to NINJA borrowers, and bad financial bets on derivatives by brokerage firms that were designated as “banks” in order to receive Federal Reserve credit and bailouts. With bank balance sheets impairing their ability to create new credit, the government stepped in by creating its own credit. This gave the banks, shadow banks and other non-bank financial institutions a bonanza of credit – replete with the opportunity to buy up foreclosed homes and create rental properties This policy was organized by Blackstone, and turned the crisis into an opportunity to make enormous rates of return for its participants. The effect was to intensify the economy’s polarization, as investors typically needed a minimum $5 million tranche to join.

The Federal Reserve’s $4.6 trillion in Quantitative Easing did not show up as money creation, because it was technically a swap of assets – like Aladdin’s “new lamps for old, in this case “good credit for junk.” The effect of this swap was much like a deposit inflow. It enabled banks to ride out the downturn while making a killing in the stock and bond markets, and to lend for takeover loans and related financial speculation.

Wall Street’s Financial Capture of MMT To Inflate Asset Prices, Not Revive the Economy

At issue is how to measure “the economy.” For the wealthy One Percent, and even the Ten Percent, “the economy” is “the market,” specifically the market value of the assets that they own: their real estate, stocks and bonds. This property and financial wrapping for the “real” production-and-consumption economy has steadily risen in proportion to wages and industrial profits. It has risen largely by government money and credit creation (and tax breaks for property and finance), along with its economic rent, interest and financial charges and service fees, which are counted as part of Gross Domestic Product [GDP], as ifthey were actual contributions to the “real” economy.

So we are dealing with two economic spheres: the means of production, tangible capital and labor on the one hand (what is supposed to be measured by GDP), and the market for financial and property assets, along with their rentiercharges that ae taken fromthe income earned by this labor and real capital.

Financial engineering replaces industrial engineering – along with political engineering by lobbyists seeking tax breaks, rent-extraction privileges, and government subsidy. To increase property and financial asset prices and corporate behavior, companies are drawing on credit and government subsidy not to increase their production and employment, but to bid up their stock prices by share buyback programs and high dividend payouts. Buybacks are called “repaying capital,” so literally this policy is one of disinvestment, not investment. It is favored by tax laws (taxing “capital” gains at a lower rate or not at all, as compared to taxes on dividends).

The Blind Spot of Vulgarized MMT: The FIRE Sector vs. the “Real” Economy

Much superficial confusion between the FIRE sector and the production-and-consumption economy comes from repeating the over-simplification of classical monetary formula MV=PT, namely, dividing the economy into private and government sectors. Setting aside the balance of payments (the international sector), it follows that government spending will pump money into the domestic economy, and that conversely, budget surpluses will suck money out.

The problem is that this analysis, used by many MMTers, for instance, the Levy Institute’s typical chart, does not distinguish between government spending into the FIRE sector and asset markets as compared to spending into the “real” economy on employment and production (including the building of public infrastructure, for instance). Without this distinction it is not possible to see whether deficit spending is productive by aiming at supporting employment and output, or merely aims at supporting asset prices and making sure that creditors do not lose the value of their financial claims on debtors – claims that have become unpayable and thus are a bottomless pit of government deficit spending in the end.

Trying to keep the financial sector and its debt overhead afloat implies imposing austerity on the rest of the economy, IMF-style. So “MMT for Wall Street” is an oxymoron, and is the opposite of MMT for a full employment economy.

MMT, Public and Private Debt

Money is debt. Government money creation for public purposes – to pay for employment and output – spurs prosperity. But in its present form, private-sector debt creation has become largely extractive, and thus leads to the opposite effect: debt deflation.

Governments can pay public debt without defaulting, as long as this debt is denominated in their own domestic currency, because the governments can always print the money to pay. To the extent that public debt results from spending that supports output, employment and growth, this process is not inflationary. The government gives value to money by accepting it in payment of taxes. So the monetary system is inherently bound up with fiscal policy. The classical premise of such policy has been to minimize the economy’s cost structure by taxing mainly unearned income (economic rents), not wages and profits in the production-and-consumption sector.

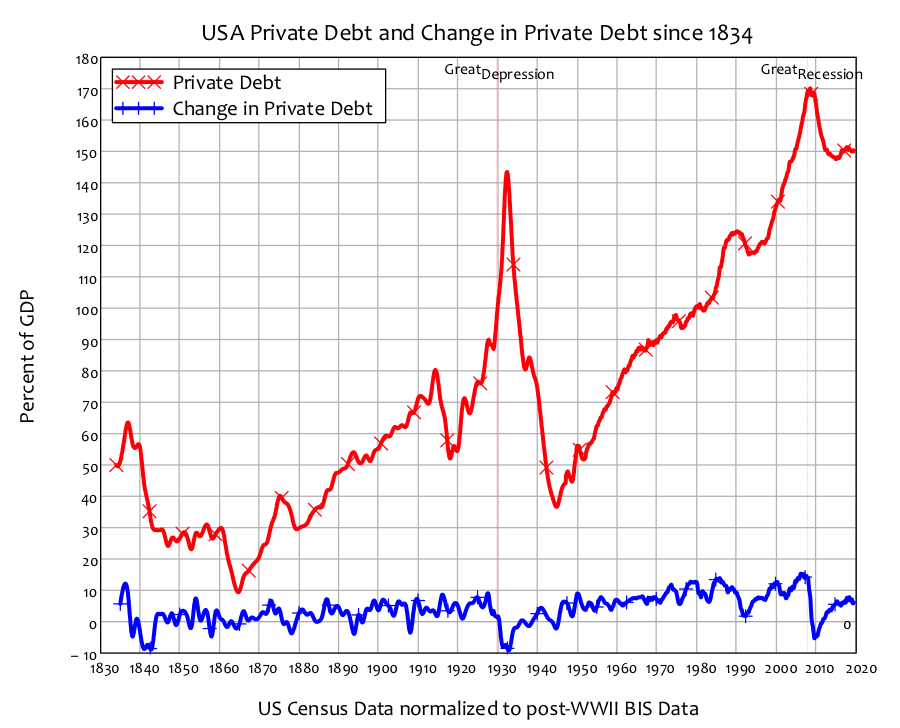

The problem nowadays is private debt. Most such debt is created by banks. This bank credit – debts owed by bank customers – tends to increase faster than the ability of debtors to earn enough income to pay it. The reason is that most of private debt is not used for productive, income-generating purposes, but to finance the transfer property ownership (affecting asset prices in proportion to the rate of credit growth for such purposes). That use of credit – not associated with the production-and-consumption economy – leads to debt deflation. Instead of providing the economy with purchasing power (as in running government budget deficits), private debt works over time to extract interest and amortization from the economy, along with servicing fees.

The typical mortgage, including its interest charges ends up exceeding the value that the property seller received. As a result of compound interest, the mortgage debt is repaid several times to the bank. The effect is to make banks the main recipient of rental income (as mortgage debt service) and ultimately the main beneficiaries of “capital” gains (that is, asset-price gains).

What gives bank credit its monetary characteristics – and enables debt to be monetized as a means of payment – is the government’s willingness to treat banks as a public utility and guarantee bank deposits (up to a specified limit) and ultimately to guarantee bank solvency.

A budget deficit resulting from a financial bailout reflects the inability of the economy to carry its exponentially growing debt overhead. Because this overhead increases as a result of the mathematics of compound interest, the size of bailouts must increase – and with it, the budget deficit (plus swap agreements) to subsidize this debt overgrowth as an alternative to imposing losses by banks and financial investors.

That is what we have seen since the financial crisis of 2008, both in Europe and the United States. Led by the financial sector, much of the economic mainstream finally has come to embrace the idea of budget deficits – now that these deficits are benefiting primarily the financial and other parts of the FIRE sector, not the population at large, that is, not the “real” economy that was the focus of Keynesian economics and MMT.

This kind of endorsement for government money creation thus should not be considered an application of MMT, because its policy goal is almost diametrically opposite. Much as the Reagan-era budget deficits were used as the first part of a one-two punch to roll back social spending (Social Security, Medicare, education, etc.), so today’s Obama-Trump deficits are being used to warn that the economy must preserve fiscal “stability” by rolling back social programs in order to bail out the financial economy. Wall Street magically has become transmogrified into “the economy.” Labor and industry are viewed simply as deadweight expenditures on the financial sector and its attempted symbiosis with the central bank and Treasury.

The Financial Sector, Private Capital and Austerity and Central Planning

If Wall Street is bailed out once again at the expense of the “real” economy of production and consumption, America will have turned decisively away from democracy into a financial oligarchy. Ironically, the initial logic is the claim that an active state is inherently less efficient than the private sector, and thus should be shrunk (in the words of lobbyist Grover Norquist, “to a size so small that it can be drowned in a bathtub”). But relinquishing resource allocation to the financial sector leads to its product – that is, debt – creating a crisis that requires unprecedented government intervention to “restore order,” defined as saving banks and financial investors from loss. This can only be achieved by shifting the loss onto the economy at large.

Today, the financial sector – banks and financial investors – play the role that the landlord did in the 19thcentury. Its land rents made Britain and continental Europe high-cost economies, as prices exceeded cost-value. That is what classical economics was all about – to bring market prices in lines with actual, socially and economically necessary costs of production. Economic rent was defined as unnecessary costs, which were merely payments for privilege: hereditary landownership, and monopolies that creditors had carved out of the public domain or won as legal compensation for financing public war debts.

The rentierclass not only was the major income recipient of the economic surplus, it controlled government, via the upper house – the House of Lords in Britain, and similar houses across continental Europe. Today, the Donor Class controls electoral politics in the United States, via the Citizens United ruling. Political office has become privatized, and sold to the highest bidders. And these are from the financial sector – from Wall Street and financialized corporations.

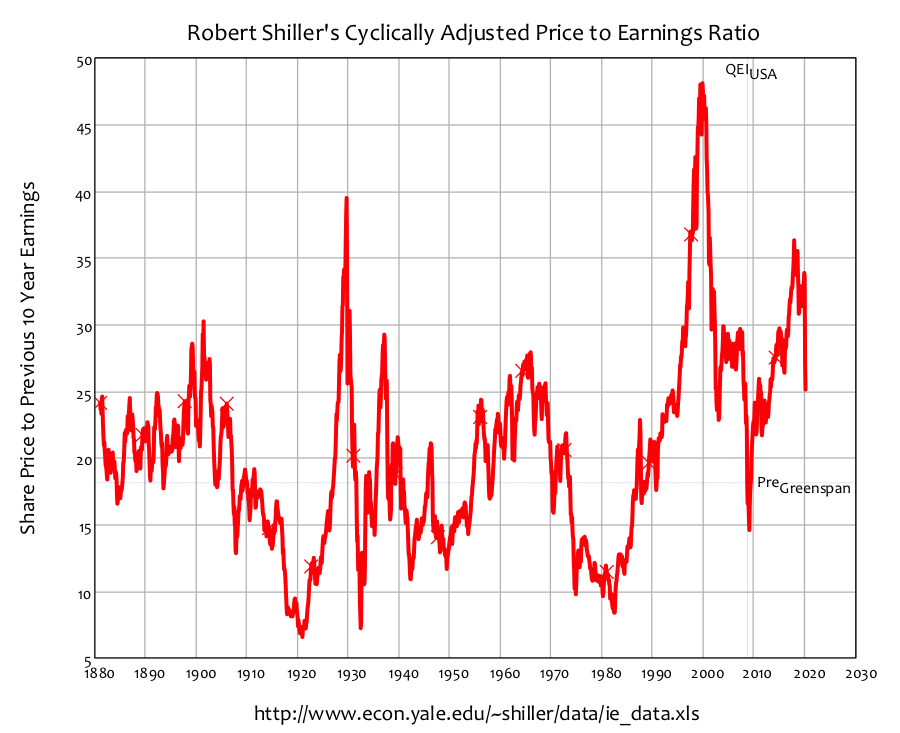

The post-2008 stock market and bond-market boom raised the DJIA from 8500 to 30,000. This gain was engineered by central bank support far in excess of what a “free market” would have priced stock at. Before QE, U.S. shares had fallen only slightly below the market average for the previous century. QE drove it to its highest level outside the 1929 and 2000 bubbles. Even after the Coronacrash, shares are still overpriced compared to pre-“Greenspan Put” prices.

The result is best thought of as a blister, not a bubble. Its only hope of surviving without bursting is for the government to continue to support it in the face of a drastically shrinking post-coronavirus economy.

So the question is what will be saved: The economy’s means of livelihood, or an oligarchy of predators living in luxury off this shrinking livelihood?

All this was explained by classical economists in their labor theory of value, which was designed to isolate economic rent and other non-production overhead charges (perceived to be mainly services in the 18thand 19thcentury, especially by the wealthy classes).

The Hudson Paradox: Money, Prices and the RentierEconomy

Without distinguishing between the FIRE sector and the “real” economy there is no way to explain the effects of government budget deficits on asset-price inflation and commodity-price inflation

Here is a seeming paradox. Bank credit is created mainly against collateral being bought on credit – primarily real estate, stocks and bonds. The effect of increasing loans against these assets is to raise their prices – mainly for housing, and secondarily for financial securities. Higher housing costs require new home buyers to take on more and more debt in order to buy a home. Their higher debt service leaves less disposable income to spend on goods and services.[2]

The asset-price inflation effect of money creation by banks is thus to exert a downwardimpact on commodity prices, to the extent that the carrying cost on bank credit reduces the net purchasing power of debtors to buy goods and services. This deflationary effect of bank money ends in a bad-debt crash, to which the government responds by bailing out the financial sector with a combination of money creation and central bank swaps (which do not appear as money creation). This is just the reverse of the MV = PT tautology, which only measures the volumeof new money (M) without considering its use– what it is spent on. By failing to distinguish the use of bank credit to buy assets (hence, adding to asset-price inflation) as compared to government deficit spending, both the old monetary formulae and the frequent MMT contrast between public and private sectors neglect the need to distinguish the FIRE sector’s “wealth and debt” transactions from how wages and profits are spent in the production-and-consumption economy.

The commercial banking system’s “endogenous” money creation takes the form of credit at interest. The volume of this interest-bearing debt grows exponentially, absorbing and extracting more and more income from industry and labor. The effect on the overall economy is debt deflation.

It may be epitomized as

Give a man a fish, and you feed him for a day;

Teach him how to fish, and you lose a customer.

But give him a loan to buy a boat and net to fish, and he will end up paying you all the fishes he catches. You have a debt servant.

__________

[1]Real estate was given a fictitiously short accelerated depreciation allowance – as if a building lost its entire value in just 7½ years, providing all rental income to be charged as an expense and even to generate a fictitious tax-accounting tax loss. This catalyzed the great conversion of rental properties to co-ops. Landlords (called “developers”) took out a mortgage equal to the entire market price of the building, and then sold apartments at a price not only greater than zero, but typically equal to the entire mortgage. It was one of the great “wealth creation” ploys in modern history. And it was left out of the National Income and Product Accounts (NIPA), which used “realistic” depreciation – which still pretended that buildings were losing value, despite the maintenance and repair expenditures to prevent such loss.

[2]Higher stock and bond prices lower the yield of dividend income. (Most such income is spent on new financial assets, not goods and services, so the effect of lower yields probably is minimal, and may be offset by a “wealth effect” of higher asset prices and net worth.)

Good summary of Fire vs MMT. There is a second misapplication of MMT that I would like the authors to address : the Military – Industrial Job Guarantee.

Excellent suggestion! Nixon went from hard money, goldbug territory to soft money, fiat, MMT territory because gunz ‘n bombz in VietNam. He opened up unlimited money to the MIC. Dick Cheney,who was around at the time understood this perfectly.

MMT describes quite well the mechanics of the fiat, soft money gun. It doesn’t address very well the issue of whose finger is on the trigger and who it is pointed at.

(This boldface type feels like I’m shouting)

Interesting. I edited the page at home to take out the extra ‘b’ tag after that section heading. So I restored the article to normal, and I could read it at home, but even at home, the comments are still all bold.

I saved the page as html from Firefox and edited the less than char “b” greater than char bold tag before the “opposing the logic”.

Things look much better, even the comments are not bolded.

Of course, this ends up with a snapshot of the page not the live one.

The value of money is entirely defined in the way it is spent. So I agree with you. We need better oversight on the way it is spent. I’m not against the MIC so much as I am against the lack of information about the ways it spends the money we give it. I understand that secrecy is important – sometimes – but the amounts of money they are getting really demands an accounting. Not money in money out accounting. That’s just a artifact of spread sheets – but the rationale behind the spending – what is to be accomplished? Not just accomplished 10 years from now, but 100 years from now. And to that end – let’s call it Open Money – we should have sovereign priorities that protect the environment – that’s going to be another massive “expenditure”. The good news is, as Hudson says, the only thing that gives money value is the way it is used.

That MMT would be abused was both predictable and predicted. MMT itself claims to be a study of what was actually being done, followed by linear reasoning that doing so is “ok” and thus desirable. Quelle surprise that those in power have different ideas, making new realities for us to study as that old hack Cheney said.

That’s the case with everything. The government should play a central role in innovation. It has. It was central to the creation of computers, the internet, civilian aircraft, nanotechnology, touch screen technology, satellites, GPS systems, biotech breakthroughs. That all came out of NASA, the NIH, the military, land grant universities and direct financial support. The Japanese had MITI and had no real military. It, the state being central to these innovations, can be used in many different ways and contexts. That doesn’t damn MMT any more than the state playing a central role in innovation. It is how that is used, who makes the decisions, who it benefits, the societal and environmental impacts it has. Besides, what is the alternative to this? Commodity money? A sea of crypto currencies? How exactly do complex societies deal with the environmental crisis without the insights from MMT? Cause it is ridiculous for many reasons to think private financial capital can or will confront the environmental crisis. It isn’t MMT, or anything, in isolation that is to blame. It is who has power and who doesn’t.

Maybe I am being overly simple-minded again, but MMT doesn’t seem like that much of a big deal. Obviously, money is effective if people think they can get something they want for it — services, labor, power, repute, whatever. A sovereign government can make the money effective by having the power to seize any resources within its realm, and sometimes exercising that power, which, being sovereign, it can do up to the limits of the resources of that realm. That is, money can be created, but it must be backed up ultimately by force: hence, the necessity of government, the Gewaltmonopol, to create money in this way. But this leads us directly to the problem of the ruling class, who own and operate the government as well as many other important state institutions, such as the media and the major industrial corporations. It is obvious that they will manipulate the behavior of the government to what they perceive as their advantage. The primary advantage, to them, will be the maintenance and extension of their power, manifested in the ways they perceive and understand. Otherwise they would not be the ruling class. So the use of MMT-like policies and actions to swell the mythical coffers of the financial industry, real estate, the stock market, and so forth, seem guaranteed, inherent in the idea of government, which as noted above, have been the main mode of operating ‘progress’, for better or worse.

People could do things differently but at this time most of them lack the necessary culture, information, and will. The exercise of power is attractive in its simplicity.

Your argument boils down to “the ends justify the means.” With some hand waving away of the most likely ends as concisely stated by Anarcissie. However, the means are the ends, and these means are particularly suited to centralized ends like war, cronyism, and insulating the ruling class from the negative consequences of their bad decisions — socialism for the rich. We don’t have capitalism, or else bad decisions would result in different people holding the capital resources and thus new decision makers after the old fail. And MMT not only does nothing to prevent that happening, but is the primary tool in ensuring socialism for the rich and isolation from the consequences of their bad decisions.

MMT is not a policy. Therefore it is not “a primary tool in ensuring socialism for the rich and isolation from the consequences of their bad decisions”. But it has been misused by the finance and political oligarchy. And this was possible because the whole MMT-THEORY was not widely understood. It can be used from the right and the left.

Here you go…(an interview with Seymour Melman, an author cited by Michael Hudson). It’s from 1970, but still germane.

Right off the bat, I see a problem framing this article as if there are “two” sides…

without actually making one distinction.

If there is a “pro-MMT” camp… which in my understanding is really a post warren mosler thing… even if certain ideas were around before.That he claims his brand of voo doo is structured around.

And a ” monetarist”, or” austrian” camp, the austerity people…

This in my mind is akin to the battle between the democratic establishment, and the republican establishment being our “frame” of what political spectrum is.

Where are the monetary reformers ?

The progressive argument that many of the natural realities of money, are possible in context of its creation as fiat, (as MMT tries to push), But is LEGALLY constrained from operating without the context of being created as debt, by private banking practices, by the federal reserve act, which created the fed, and its organizational relationship to the private banking sector(and the automatic relationship to the FIRE sector).

If something akin to a new chicago plan were to be implemented, something like “the NEED act” as was proposed in 2011 112th congress HR 2990,

The progressive positive uses of money creation, would stop creating a national debt we can never repay, but always make “interest” payments on;and could offer a transparency ,so that when that money is created by the treasury, and not private banks… we can exercise our democratic republic in such a way as to … direct that money to something useful….like a universal healthcare system, education,infrastructure,stockpiles of emergency equip, etc… And not to socio-pathic wall street/ fire sector buttheads.

This article looks like the real reason why MMT is so wrong. It is like political science that pretends the levers of power are uneffected by personalities and their relationships with each other… which as grown-ups we have ALL of history to show is not the case.

So this article discusses the flaws of MMT without actually conveying the options in the real world.

Did you miss the point about the deflationary results of asset price and commodity price inflation? The real problem is the classical, conceptual distinction between earned and unearned income has been buried in accounting practice (in economics, unearned is now considered ‘earned’). Today roughly 80% of bank loans are to the real estate sector; a hundred years ago, in Federal Reserve member banks, it was under 30%! A quote from the Board of Governors of the Federal Reserve, from The Report of the Branch, Chain, and Group Banking Committee, Vol. 2 –

“…the cause of banking difficulties in recent years has been the extension of activities of banks beyond the traditional field of commercial banking and into the field of capital financing and real estate loans.”

This is from 1931. Again…. 1931.

The real bills doctrine, which required lending to be self liquidating, was what The Federal Reserve Act was originally based on, which encouraged investments in capital turnover, not investments of passive extraction. Banking with a portfolio largely dedicated to non-productive activity hampers growth, polarizing and destabilizing communities in the process.

Gradually socializing site value rents to subsidize infrastructure is one place to start. Why should values created by the community be privatized?

I didn’t miss it , I just don’t think how the chairs on the titanic are laid out is really all that important.

since the FRA, lots of things have changed… that doesn’t mean they are not the same.

In 1931 and before…. numbers were made up… even more than they are today. There were no laws against stock market manipulation. Private wealth didn’t have audits.

100 years ago the JP morgan syndicate was some 200 corporations, accounting for @1/6 of the GDP of the USA. The rockefeller syndicate was just behind them.. then add the likes of the astors.mellons,whitney’s,vander bilt’s,carnegie,brown,walker,etc…

All of them were doing all kinds of things…everywhere…

and you think what numbers on some account spreadsheet matter?

Those are some rose colored glasses you have there.

Why do you think that particular point you brought up matters?

I should actually have said, I am NOT saying what you said is untrue, but has nothing to do with HOW the fed came into existence, and has nothing to do with creating money as” debt”, for whom… and by whom. and who OWES that debt. to WHOM.

Whatever workaround people use in every decade, is just “fashion”.

For standards sake.

Yeah we’re screwed, just pointing out there are bureaucratic and debt overhead reducing alternatives if/when the pitchforks gather.

The distinction Hudson just made between MMT and private banking is as big as the Grand Canyon. That’s probably why we don’t see it – we think that giant gash running through our thinking and our economy is normal.

Rubbish!! It explains how MMT can be used in ridiculous ways that do not benefit ordinary people and society in general just a small group!

It sounds like what is needed is more of a discussion of the history of how the federal reserve act was created. And the points of view in the preceding century between the “public money” people and the “private money” people.

since the founding of this republic, there have been voices trying to work out our monetary system. And there has been alignment with finance and foreign governments, to hinder it . Since the first experiment with “continentals”, when an untested new experiment of a nation was sabotaged by the british who counterfeited the bills wildly…. to the present day where this shining city on a hill… is a slum… but still.. the experiment is in motion….

And people really need to know the real options… not just the slumlords rules.

Yesm It is important to know the history of money. Prior to the Continental (which Tom Paine attributed to a major reason the Colonies won the War of Independence, some of the colonies experimented with their own currency in order to fund infrastructure (roads, bridges…). During the Civil War, The North had “Greenbacks” instead of borrowing money from other countries. Without a discussion of the Federal Reserve and how to rid ourselves of it for Public good, I just don’t see much changing.

from The People’s Money (Part 1)

[italics added]

For the three problems see J D Alt’s conclusion here:

https://www.nakedcapitalism.com/2019/10/the-peoples-money-part-1.html

In spite of the ingenious methods devised by statesmen and financiers to get more revenue from large fortunes, and regardless of whether the maximum sur tax remains at 25% or is raised or lowered, it is still true that it would be better to stop the speculative incomes at the source, rather than attempt to recover them after they have passed into the hands of profiteers.

If a man earns his income by producing wealth nothing should be done to hamper him. For has he not given employment to labor, and has he not produced goods for our consumption? To cripple or burden such a man means that he is necessarily forced to employ fewer men, and to make less goods, which tends to decrease wages, unemployment, and increased cost of living.

If, however, a man’s income is not made in producing wealth and employing labor, but is due to speculation, the case is altogether different. The speculator as a speculator, whether his holdings be mineral lands, forests, power sites, agricultural lands, or city lots, employs no labor and produces no wealth. He adds nothing to the riches of the country, but merely takes toll from those who do employ labor and produce wealth.

If part of the speculator’s income – no matter how large a part – be taken in taxation, it will not decrease employment or lessen the production of wealth. Whereas, if the producer’s income be taxed it will tend to limit employment and stop the production of wealth.

Our lawmakers will do well, therefore, to pay less attention to the rate on incomes, and more to the source from whence they are drawn.

Written around 1925

By whom, if you please.

So anyone invested in Boeing is fine according to this? He is producing airplanes and has 150.000 employees.

in a way yes.

any money going into boeing as a speculation ends up employing people and actually doing something.

you can have a ponzi esque situation due to reflexivity but in general a company is able to employ labour and invest into new things.

the more curious is the “hudson paradox” which is pretty obvious based on how banking in the 21st century works but oh well he is a smart guy so fine to name something after him. what happens when these speculations form a basis on the creation of money? where an asset value go ups, you get more equity and you increase leverage. People buy those bonds and use those bonds as collateral to borrow more money from the banks. the whole thing then becomes a house of cards because as soon as the value of the shares go down significantly enough, credit creation dries up and the basis for a lot of the “gains” in the sharemarket reverse.

in some ways the sharemarket has become a proxy for the economy because of this. economy goes down and money creation stops. federal reserve can only backstop prices so that they stay artificially high. end result is japan and the same deflation that the article is saying.

Money is a commodity, invented to help people by facilitating transactions. It is not wealth in itself. Wealth is natural resources, water, food, land, education, skill, spirit, ingenuity, art.

Taxation is also an invention.

At the start of the Phantom Menace, Star Wars, we are told it is the taxation on trade routes that is in dispute and the Trade Federation decides to protest.

You wonder if the rich are taxed, instead of trade routes, and if the republic is funded not by taxes.

Not a commodity, a social agreement. Money doesn’t exist in nature and while people like to think of gold as money, money existed in multiple forms prior to gold coinage.

Exactly

Thinking of money as a “thing” is a category error.

This — it’s the original sin of gold-standard and mercantilist thinking

Are some types of money things?

Is a penny today a thing?

Were money coins in the 17th century things?

I like to think of a penny as a token that you can show to prove that you own 1/100 of a unit of account. Yeah, this idea has made sometimes more, sometimes less, sense in various money regimes through history. Under fiat, I think it works pretty well.

You can’t eat a penny, so what’s the value? The value is social, that others will trade you something for an otherwise meaningless token.

The shekel, an early form of money, was originally the amount of grain necessary to feed a person for a day. Now that’s real money with real value!

But hard to trade. Temples then managed grain reserves for their societies and kept ledgers to administer the flow into society across the year accoding to the political decisions of the priesthood about who deserved how much. Those ledger entries made “shekels” fungible, abstractly distributable in the modern sense of “money”.

Isn’t that a separate question?

Are some forms of money things?

Money doesn’t exist without a prior social agreement as to what it “is” and what it “is for”.

These two “iss” are a source of unending confusion.

The love of the first is is what Paul thought was the root of all evil. The “is for” is inherently social, which is to say political. The confusion between the two is what makes the systemic effects of money so exploitative of heuristic thinking: while money is a social agreement, it is a systemic agreement that doesn’t respond to social concerns, only agreed power relationships that can be reduced to the binary of the numeric relationships money represents.

Or more concisely, by the time you ask, “is money a thing” you have already agreed to the idea of money (fast, heuristic thinking) but are unclear about exactly what it is you’ve agreed to (slow, systemic concept with vast political implications).

Thanks.

So, money can be a thing.

And money exists not alone by itself, but among some humans (social or political). And not just can be, but can be used for.

And when you fall in love with what it is for, what money can be for…say, for power to hurt others, it is evil.

Still, money can be a thing.

As for agreement or social agreement, can money exist also as an imposition, a dictate, or a command? When or if Genghis Khan commands on pain of death that people should use his paper as money, that can’t be a social agreement, can it?

Money in my opinion is inherently a power relationship.

It is only sociably acceptable because of its coordinating effects in extended societies.

However coercive it is, and it is coercive, it confers advantages of scale on societies that accept it, and then tends to force itself on those that don’t.

It’s a social arrangement. Social since if there was only one person there would be no need for money. The sovereign makes the arrangements and you can go along or go to jail, as with many other arrangements.

And thing-money-things are things, but the money-things we use are just tokens. There are problems with our monetary system but thing-money doesn’t solve them. You can tell this from the fact that many of the problem makers have a thing for thing-money.

Money is not one or two things. Even in planned/socialist economies, money played a role in being a unit of account. It allows us to transfer information throughout the economy, and it allows firms to figure out (to an extent) if they are being efficient. Money is also not used to price many things that are destroying the world. The direct and indirect impacts of carbon emissions, or biodiversity, for example. It is many things, and it is also the root of many of our problems. Many things we should have to take into account when producing and buying things is invisible, not priced, and we don’t price those things because we use money to make most of our decisions. Public money creation allows public authorities to take non-market impacts into account in ways private finance in this economy cannot.

maybe in a sense. but its a social agreement that allows accounts to be settled. so it gains value in its liquidity and its use eventually becoming its own form of commodity as long the social aspect believes it is one. it gains more value then the underlying assets in some ways due to the liquidity it provides. i can buy tomatoes with money that i have from selling apples. but i might not be able to buy tomatoes with apples. i need to pay a premium to gain that liquidity.

this means the liquidity importance of money can become more important then any underlying “value” attached to it, especially during a crisis when debts need to be settled and people only want money. the larger the economy is leveraged the larger the cost attached to liquidity. which is no different to deflation.

Who would have guessed if the government was given a blank check they would abuse it. I’m shocked.

Money or MMT money is like a gladius (as mentioned in Gethsamane a long time ago).

“You live by the gladius…”

It can be either good or not so good.

the government isn’t given a “blank check”..it is a whole bunch of them ,or more like

the gov’t has a credit card with no fixed limit; which can be raised at will.

And there is no “paid in full” expectation… just a minimum amount due… i.e. the payments on the interest.. that in fact do come out of the federal budget… regardless of what MMT pretends.

The debt will still grow. the interest on that debt won’t stop being compounded.

and the marketing strategy is akin to telling the college freshman that the “card” is only to be used for emergencies…. like beer and pizza… and the occasional concert ticket… and the ride there… etc… just emergencies…

If you think of MMT as pretense, pray tell us when that ‘debt’ will be a burden? If you had a mortgage, but could print the means to repay it, when would that be a burden?

Remember the spending in excess of tax receipts is A: the dollar financial assets of the population (i.e. their savings), or B: National ‘debt’… just as your bank account is your asset, but the bank’s liability (debt). Advocating reducing national ‘debt’ is equivalent to stirring up a mob to go down to the bank and demand it reduce its debt. “But that would mean reducing the size of your accounts,” an honest bank manager might say. “We don’t care,” says the mob, “We hate the word ‘debt’…so reduce the size of our accounts!”

…not very sensible, if you ask me.

And read this.

You are stuck way down in the weeds. All that stuff you mentioned would only be relevant were i to have drunk the MMT kool-aid… But since I haven’t… I see no reason to assume any of those portrayals as real considerations.

The fact of me making my own money, and using it to pay all my debts would make sense, if I (the people of the USA) were to MAKE our own money…

The fed reserve act… has the banking industry do the majority of money creation at all levels… and the people and their “purse” allow the banks to make it as they create loans.. and they add it and the interest to our debt..

Back in the thirties , hundreds of economists and institutions worked out an alternative to this private banking model of the federal reserve. Nothing has changed in regards to ownership. And as recently as 2011, modified for today’s contexts, a new proposal was submitted in the congress. 112th congress HR2990 to do the same thing. End private creation of our money supply.

The green party has a platform called “greening the dollar”, which encompasses the three main things needed to reform our monetary system today.

And last summer , MMT leaders who were trying to influence the national green party platform, by accessing through some state green party groups. Were allowed to “prove” their assertions. In that, for a month, over a hundred panel members were shown the evidence each side could muster, as to the veracity of their claims… MMT fell flat. The party platform is as it was before.

Some people out there are on a better path… and it isn’t MMT.

MMT just pretends, theirs is an unbiased description… but it doesn’t hold water. and it is just allowing the powers that be now… to go forth .. unmolested.

“the government isn’t given a “blank check”..it is a whole bunch of them”

Fiat issuing governments actually create money by spending it and can spend whatever they want, including to pay for any interest they may have decided to provide for holders of their bonds.

“the gov’t has a credit card with no fixed limit; which can be raised at will.”

The limit on fiat spending by a fiscal sovereign (the US, UK, Japan, Sweden, Switzerland etc.: countries that issue their own currency) is what is available to purchase within the markets denominated in that currency. Ours has taken to purchasing bad corporate debt which it can do indefinitely until pitchforrks intervene by simply expanding it’s balance sheet and paying itself interest which cost it nothing.

“And there is no “paid in full” expectation… just a minimum amount due… i.e. the payments on the interest.. that in fact do come out of the federal budget… regardless of what MMT pretends.”

MMT doesn’t contest that the US pays itself interest, it contests that the US risks not being able to afford to pay itself interest: it is paying itself.

“The debt will still grow. the interest on that debt won’t stop being compounded.”

And the US government will continue to pay it with newly issued fiat.

“and the marketing strategy is akin to telling the college freshman that the “card” is only to be used for emergencies…. like beer and pizza… and the occasional concert ticket… and the ride there… etc… just emergencies…”

Should it try to purchase real things, it would encounter real world constraints like availability and location. We are already seeing that as our incompetent Federal Government outbids fiscally constrained State Governments for PPE for front line responders. Criminally stupid and counterproductive.

That idiots and sociopaths do stupid and self serving things with the tools at their disposal says only that they see utility to themselves in these tools. What to do with them is what this article is about. The authors propose we have all the tools we need to radically ameliorate many of our present difficulties. As best as I can tell, you are arguing that we shouldn’t do that because idiots are using those tools now.

That comment was “too off the cuff” to be too serious. It was a sort-of response to another , almost meaningless comment… It doesn’t really require the parsing of phrases…

Like many MMT analogies… it is just made up stuff.. not to be refuted.. or defended… it just was…

And I do not think “we ought not do what needs doing, because frauds are at the wheel”. I was meaning.. we ought NOT to allow an inaccurate portrayal of reality, when it comes to the federal debt.

If we (THE USA) the treasury, were creating our dollars… (without the debt, as it does not need to be created in the first place), then lets us move ahead.

But since we are allowing the banking industry, and THEIR “creation” ,the federal reserve; to make most of our money, and control our financial landscape in the distribution of that money, all while sticking the born and the unborn with the debt . We should proceed with caution.

First… get rid of the banks creation, and let the treasury create our money. debt free.

This is an old story at this point. 80 years ago… people already brought up the private banking houses roll in our economy. While so much has changed, the original sin. still lives.

Thanks for clarifying.

It seems people are not agreeing socially to this kind of money…less or no social agreement?

Excellent piece, thank you for posting it. It sums up nicely many thoughts I’ve had swarming in my head, with one major exception.

On a global industrial level, sovereign currencies interact with each other. As the US shifted to FIRE, others filled the gap in supplying the real economy of the world. At what point do those producers decide they are not selling their things for fiat money created on the whims of the FIRE sector?

This has always been my top question. At what point can the US no longer control things simply by controlling the institutions?

It is an amazing feat of narrative control. When will the rest of the world escape the currency monopoly? Lately it looks like the world is going deeper into USD hegemony. I don’t know the answer but my sense is that this monopoly completely distorts the US economy, like the Dutch disease but worse since the FIRE economy needs to skim wealth from other countries.

“Lately it looks like the world is going deeper into USD hegemony.”

I’m not so sure. There is some evidence that the world was cashing out of treasuries, and the run has been on the dollar itself, not the debt. Not a lot of transparency is provided into who is cashing out those treasuries and what they are doing with the cash. Also, the Fed created new alphabet soup to hand cash out directly in lieu of taking Treasuries.

If it were me, buying things of tangible value, like oil, when it’s at severely distressed prices, or pouring it into struggling EM countries for natural resources would be the play here. If opposing foreign interests were doing this while allied interests were busy covering fiat debt and derivative losses, it would be some cause for concern.

I’m no expert in any of this, and there are infinite possible triggers of chaos, but I also have some reason to believe I am entirely off base on the overarching concern the USD hegemony is facing some risk.

We can speculate on the domestic policy alternatives, and opposing viewpoints are important, but the direction is clear and it’s not going to change with this current regime. The real end game includes the global players, and the US is increasingly painting themselves in a corner with these policies:

“(In times past, this required warfare; today foreign debt is the main lever.)”

History may be getting ready to repeat.

To you and Pym of Nantucket I would really suggest reading Michael Hudson’s SuperImperialism book (it’s free download his website). It covers from the WW1 until 2000 and how the international banking and sovereign banking system worked and how the US went from being a creditor country dictating one set of rules to the world thru the IMF/World Bank etc to the benefit of the USA, to a debtor country during the Korean War and then dictated the opposite set rules and how it did this after going off the gold standard. It is a (long) fascinating read. First time in history a debtor country was able to set the rules and have continued to do so until this day.

“US govt debt became the international money used by central banks throughout the world s their means of settling mutual balances amongst themselves. America had come to rule not only by gold credit but by fiat credit” Pg 333

“Europe – now joined by Asia, by OPEC, and the worlds raw-material exporting countries, food deficit countries (euphemized as “developing countries”) – was willing to sacrifice its idea that international economic institutions should share the gains from international trade and investment equitabily, in order to avoid a restructuring” (the break up of the international economy which US govt officials were prepared to do back then)

As Pym suggests, the US dollar hegemony operates as monetary tribute to the US and the creditor countries feel the need to supply the US with their goods in return for Treasury notes otherwise they perceive their own economies will crash if they try to do something different.

Part 3 of the book looks at the time of going off the gold standard onwards when US become a debtor country and sustained it.

To read other people, like Paul Craig Roberts, on these cold war years it sounds more like the US, in an effort to create a functioning, capitalist global market, became the buyer of last resort. We bought up other countries’ surplus products but we didn’t sell them anything. We just gave them Treasuries to hold until there was something they wanted to buy from us. There were also concerns about depleting our natural strategic reserves, like oil, maybe minerals and we wanted to use other peoples’ instead. According to PCR the whole idea behind supply side economics was to dampen demand inflation here in the US to control the economy at an even pace. The problem TINA and supply side created was the destruction of US Labor and the offshoring of manufacturing in order to profiteer on cheap foreign labor. Our corporations got rich at the same time that the government spent all those Treasuries in exchange for goods. So it did balance out – but not in favor of society – and it was sovereign money, not private capital that achieved this wealth. Robert Rubin thought it was a great idea to continue on with this scheme and advised Clinton to “balance the budget” i.e. show a government surplus by cutting back on social spending; which further impoverished the middle class and society. We actually still created a lot of money but not much of it for good reasons. Making us look and feel like we really wasted it. Because we did.

Michael Hudson is a God That Walks The Planet!!!

MMT has been captured by wall street? what a surprise!! who could have seen that coming? the flaw in MMT all along has been the naive belief that it would result in more spending on good, progressive stuff such as free college, universal health care etc. why would MMT be less susceptible to capture by wall street and the military than anything else in this sociopathic economy? MMT supporters need to understand that a nation’s spending is based on it’s values, not the source of the money. implementation of MMT in the united states will buy bonuses for banksters, more f-35 aircraft, naval ships and, next up, space command. such are this country’s values. did anyone, ever really believe it would be otherwise?

As I understand it, the point of MMT is its descriptive power revealing as it does how fiat currencies operate (which is necessary to dispel all manner of errors that are hangovers from the gold standard and mercantilism).

What to DO with this correct understanding of fiat currency operations is a political decision, at which point the discussion ceases to be about “economics.” And the range of responses to “what should we do with this proper understanding?” is as wide as the political spectrum itself. Blaming MMT and its theorists for HOW their insights will be used is misguided, because their understanding does NOT constrain the political actors who will use it for whatever ends they see fit.

We move now from contesting whether or not the fisc intervenes directly into the economy (which is now clear that it always did) to cui bono — who benefits?

If you are a “progressive” (imagining for the sake of argument that we can agree on what that means) you need to agitate for, nay demand, that fiscal intervention be on behalf of public purpose. Just be mindful that other political actors will seek to bend fiscal intervention to their own “unprogressive” ends — viz. the oligarchy

Be mindful also that they fight hard and they fight dirty.

The scales of neoliberalism fall from our eyes — there are nothing BUT alternatives before us, and we bear the burden of choosing, unlike the childishness of our political representatives lo these past 40 years, who hid behind falsely constructed TINA excuses supposedly depoliticizing that which must always be political.

Hold your politicians to account for what they will now do with the fiscal power that is indisputably in their hands.

I’m done giving passes to the “but MMT is purely descriptive” crowd — there is also a political-economic brand of prescriptivism in play, as exemplified by the many, many, “under MMT, we could do this, that and the other without asking ‘how do we pay for it?'” threads and comments-discussions here on NC over the years. So when government money creation gets, in entirely predictable fashion, mis-used to bail out the Wall Street fraud cartels and support the Imperial Permawar State, sorry, you folks don’t get to weasel out by playing the “descriptive” card. My objection to the progressive MMT prescriptivists was always their naive assumption that a knight in shining armor, a “new FDR” if you will, would appear in Washington, override the entrenched financial/military interests and “use MMT for good”. Well, I’ve been watching DC for over 50 years now, and let me tell you, since at least the start of that time, “new FDRs” have been in direly short supply.

Bill Mitchell, at least, has always been clear that politicians can use an understanding of MMT for good or ill. Its special power for progressives is that it enables them to call bullshit on the ‘we can’t afford it’ gambit, forcing the bad guys to be more honest about why we can’t have nice things. Since the real reason is not a vote getter I expect some new lies will be tried before that happens.

The Sanders Presidency did envision values spending on Education and Healthcare. The Trump Presidency illustrates convenient abuse of Treasury power.

The idea that Biden is a decent human being and therefore is going to be pliant when it comes to acceptance of the ideals of the Sanders campaign that is to the electorate, is doubtful. Sanders and his supporters are repudiated. Biden has followed those who have a ring in his nose.

Abuse of MMT does not mean that it is wrong, anymore than it is wrong for the US to have a Treasury and financial system.

The alert here is that MMT has been adopted by those closest to the money for their benefit exclusively based on fantasy tax policies and misdirection.

The Sanders campaign did stand for values most closely associated with the values and goals created during the revolution that gave the continent’s population a citizenry and their own Treasury.

Fighting the parasitical pirates of that age is returned to us. Just because these pirates have private jets and wear suits when moving money to wherever X marks the spot doesn’t mean we ought mistake them for part of our civilization.

“The Sanders Presidency” — ITYM “The failed Sanders Candidacy”. And said failure cannot be laid entirely at te door of the esablishment-Dem corruptocracy — there was a large component of self-sabotage by Sanders, culminating in his final betrayal, in form of endorsing Joe frickin’ Biden. Even if one’s odds of winning have dwindled, that does not require one to stop telling truth to power. So please stop it with the what-coulda-shoulda-woulda-been mythologizing about the official Dem establishment sheepdog, Bernie Sanders.

Wall St. capturing the MMT money is a good example of the Cantillon Effect. Wall St. gets a bailout but you don’t.

“An 18th century French banker and philosopher named Richard Cantillon noticed an early version of this phenomenon in a book he wrote called ‘An Essay on Economic Theory.’ His basic theory was that who benefits when the state prints a bunch of money is based on the institutional setup of that state. In the 18th century, this meant that the closer you were to the king and the wealthy, the more you benefitted, and the further away you were, the more you were harmed. Money, in other words, is not neutral. This general observation, that money printing has distributional consequences that operate through the price system, is known as the “Cantillon Effect.”

https://mattstoller.substack.com/p/the-cantillon-effect-why-wall-street?

The heart of the distribution problem is the institutions we have for distributing the money. In Stoller’s words:

“To put it another way, why is the money meant for everyone only showing up in the stock market?

The reason is because money has to travel through institutions, and right now, the institutions for the powerful function well, and those for the rest of us are rickety and broken. So money gets to the rich first. Eventually, some money will get to the rest of us, but in the interim period before that money fully circulates, the wealthy can use their access to money to buy up physical or financial assets.”

The tbtf’s and Wall St. get money almost instantly. Small businesses have to use the rickety SBA/bank loan process, the newly unemployed have to use suddenly overwhelmed state unemployment offices.

“The institutions we have for distributing the money” are dysregulated.

In this sense our monetary arrangements are dysregulated like a body with metabolic syndrome — energy taken therein is preferably shunted away from productive tissue (organs, muscle, the brain and so on) and into adipose tissue.

MMT is an accounting view of the flow of funds, which leads to great insights

“Capturing MMT” would be like capturing Gravity or the Laws of Arithmetic

If one uses circuit analysis to describe a circuit has the circuit been captured?

Or has an understanding of its operation been reached?

MMT isn’t about “printing money,”a description that doesn’t imply anything about what happens to the money but accurately hints at hoarding and other speculative activity. MMT is about “spending money into creation,” which implies something that money is spent on, embodying the distribution/ allocation decisions Flora discusses.

“…embodying the distribution/ allocation decisions Flora discusses”

How money is distributed is not a part of MMT, that’s why MMT does not advocate taxing the rich to “pay for”. Taxing the rich is another argument separate from MMT

The distribution/allocation decisions are a part of public policy, not MMT

Just because someone can design a circuit to function poorly does not make circuit analysis “bad”

Just another example of hardly anyone being able to conceptualize anything beyond semantic reasoning.

Semantics ≠ logic, semantics is a cartoon conceptualization of reality

Yeah, but the problem is MMT relies on “semantics” almost entirely.

The whole edifice of MMT is semantics.

While I agree with MMT being described as “descriptive”; TO A POINT… and only to a point…. It is semantics that allow people to not see it as a tool to enable the current swindle that is happening to the citizens of the USA(and others I presume).. but in the case of the USA.

The semantics trap of MMT .The circuitous logic that is the lipstick on the pig…

Is how in its “circuit”, the federal reserve “is a public institution, doing a public service”.

Now in reality, the fed was created by banks. It s banks are owned through stock, which are owned by banks. the people who run it every day,every year, every decade, are bankers. They are part of an industry that , because of the law that created the fed. in 1913.. also allows banks to make money when they make loans. They operate in a world where they are allowed to backstop their own profession with anything it needs in any emergency. The proof of that is the current day, the SPV’s, QE, and other’s that cater to their industry. And the rats who live in their kitchens…. the financial services industry… AND the rest of the FIRE sector…

It is only the semantics of “we”… cause the fed ain’t “we”…. the fed is “them”… ” the “we” is who can go jump in a lake.

The semantics of a “public=private” institution…. like the fed.

the semantics of ” oversight”… by congress

the semantics of the national debt and the “money” used to satisfy the “interest” on that debt every year.

the semantics of why debt needs to be created in the first place.

the semantics of whose yachts, and penthouses are being bought with the proceeds of those annual debt ” accounting functions” and associated fees

the semantics enabling sociopaths into believing they are important contributors of society.

the semantics of “tax payments being burned.. destroyed…”

the semantics of “opportunity costs”… while people “feel” like a need is being addressed… “they won’t try to fix what ain’t broke”… which is why MMT is subversive… cause our system is broke… and the federal reserve act keeps it broken.

And it needs to be abandoned to adopt a better way. There are “better” ways for the citizens to use the treasury , as a real “public” creator of ALL US dollars…Debt free…

The Circuit described by MMT doesn’t address the major “short” in the system.It is a monkey wrench thrown in there by the creators… conveniently left out of the “diagram”

…which has zero to do with MMT

It’s like saying if I jump off a building my fate is gravity’s fault. Gravity made me do it.

Semantics is a problem of the semantic mind. Abstract thinking leaves semantics out completely.

The problem isn’t with MMT, it’s with those that aren’t capable of abstract thought.

Never mind that accounting is bog-simple, and MMT, an accounting view of the flow of funds, is so simple it repels the mind.

Also, accounting is ex-post. It’s a record of what has already happened.

Most people get caught up in anti-MMT thinking that has little or nothing to do with MMT.

Anyone using an MMT-centric analysis should be aware of all possible inputs, just like one analyzing an electrical circuit.

Blaming one’s own shortcomings on MMT is the same as blaming the messenger.

Ironically, at the end of the day, every transaction takes place in an MMT world, like it or not.

Using bullshit mythical constructs to save ourselves from ourselves has no chance of success beyond some randomized event

“Using Bullshit mythical constructs to save ourselves from ourselves has no chance of success beyond some randomized event.”

Yeah… that is true…. but the MMT mantra lives on in the minds of some… Probably because they fell victim to peoples use of semantics in framing their versions of what they perceive to be reality.

Actually , I hate to break it to you, but “money” isn’t a “force of nature”, It isn’t “a part of nature”… or anything “natural”, past the association with having been entirely made up by people. Just like the rules and practices at any given point in time.

Paulmeli, my reply meant for flora and Stoller was misplaced under yours. I agree with you. MMT is inherently about spending, not merely printing, which embodies the allocation. The circuit isn’t just a spigot; it routes the money by spending on /something/. The public policy aspect is embedded in MMT. Hence the “use and abuse.”

I would be interested in hearing what these authors think of the following idea:

as described in https://www.theamericanconservative.com/articles/forget-checks-how-about-giving-everyone-a-federal-reserve-account/

Not bad if you also made the Federal reserve a state corporation instead of its current ownership structure.

Yes, central banks were incorporated as private entities long ago. We now have a much finer definition of money. And sovereignty. We can see that private money, aka debt, is extractive, but without mutuality. If the extraction went both ways to keep a real balance things would not be this messed up. That’s why we have a legislature. We need new laws to reflect our growing sophistication when it comes to money. But with our congress of idiots, don’t bet on it.

Not all central banks are privately owned. Canada kept its bank state owned. I am sure other countries did too.

It’s definitely the way to go per the inherent right of citizens to use their Nation’s fiat – including in inherently risk-free account form – and not just depository institutions.

Once this is allowed then all other privileges for banks are on slippery slope and good-riddance too.

There is a missing closing bold HTML tag in the post

Seems many of these comments miss the simple truth MMT offers. Again MMT isnt a policy, its simply descriptive. From a progressive perspective, as Kelton constantly affirms, it offers policy space from the usual complaint about lack of money. I wish Bernie rebutted it when heckled about costs for his medicare for all. Anyways it seems quite simple to me. Getting mad that MMT might allow evil bankers to continually exploit the public purse doesnt refute its obvious truths. Unfortunately the political class that could use MMT’s factual claims to put to rest ideas about lack of money for social purposes and the consumer production sphere of our political economy arent stepping up. Instead they point out MMT might lead to oligarchy. DAA!! Democracy might not work so well in highly religious society’s that view their texts in a literal way. When given the chance to vote they vote in a theocracy that just takes their freedoms away. Same thing happens in an uninformed and propagandised society like our own. Given the chance they just vote for leaders that destroy their quality of life. Ignorance is bliss and so by the time they figure it out the house of cards falls in around them too fast to put back up.

“It’s purely descriptive” followed by “offers policy space” is a non sequitur. “Policy space” implies a degree of prescriptivism. Let’s stop it with the “purely descriptive” nonsense, already.

I’m not convinced this is rhetorically sound.

If a stated fact or description of an object or

phenomenon consequentially leads to numerous possibilities that can be actioned, it does not necessarily follow that the original fact was prescriptive.

To analogise (which is always fraught, I know): A hammer is an object with a handle and on the end of that handle, a weight culminating in a small, flat surface. That’s the descriptive account.

From a progressive perspective, it offers policy space to build a set of shelves.

Meanwhile, from a murderous perspective, it offers policy space to crack some skulls.

Of course, it does not follow that the hammer (or my descriptive account of it) was prescriptive one way or the other

(please forgive my self-indulgent silliness in the analogy).

NB while I am broadly supportive of and convinced by MMT, I’m not fully convinced by the ‘descriptive framework only’ claim for a different reason. Mitchell clearly states that the buffer stock Job Guarantee is an intrinsic part of MMT as developed by himself, Wray and Mosler (and whomever else). As a result, while MMT has considerable descriptive power, the ‘descriptive only’ contention has a whiff of motte-and-baileying about it. But one must be careful about where the ‘descriptive only’ contention is coming from – is this a first-hand contention by Mitchell et al, or is it coming second hand from MMT-adjacent commentators? (an answer to this question is beyond the scope of this comment – it’s morning here and I need some breakfast!)

I also read a piece recently – I think it was Mitchell’s blog but it might have been here? Explaining why the CARES bailout is not MMT compatible (again, giving the lie to ‘purely descriptive’). I’m not economically literate enough to comfortably paraphrase the argument but if I can relocate it I will post the link here.

when I wrote ‘motte-and-baileying’ above, I meant to attach this link

Bernie was commited to raising taxes and had disagreements with s. Kelton in the past over her insistence that we don’t need rich peoples money to fund govt expenditures.that’s one of the reasons he never openly ran as a mmt’er.

We need to tax the billionaires at the rates they were taxes in the 50s and 60s to reduce their increasing financial dominance of both the economy and politics, to reduce the growing oligarchy in the US.

Yes the tax rates of the 1960’s should be restored BUT NOT ON INCOME, which is wealth created. It should be on individual consumption, being all money received less money saved, which is wealth destroyed. With the added bonus that the cost of calculation of the amount to tax would be a small percent of the complicated determination of taxable income..

Didn’t the article convince you that income from “rents” is not real-economy wealth like income from goods and services production?

Instead fiat holdings, beyond a reasonable individual citizen limit, should be TAXED via negative interest as:

1) a payment for non-individual citizen or excessive use of a public utility.

2) a penalty to discourage money hoarding.

3) to preclude the misuse of fiat by banks and other large fiat users to drive the population into debt.

And we should be aware by now that wealth creation without regard to its just distribution is a recipe for widespread wealth destruction, i.e. it’s self defeating.

Totally agree. I think labour is a good example of this. When they are in control of the money – they usually (pre-Blair) spent only ways that made the economy grow – E.g. in the early 2000’s when knife crime was rife in London, the labour govt at the time introduced EMA to encourage low income household kids to continue to go to post-16 education and honestly knife crime all but disappeared because those jobless youth ended up going to university, they were too busy and didn’t have time to get into trouble. Now, they’ve all graduated and are the ppl working and taking all those holidays across Europe.

Compare that with when the coalition govt came and increased tuition, the effect was yes ppl still go to uni because the govt pays but now less and less people are moving out of their parents or home and finding it even more difficult to buy homes.

When we peel back all the intelligent talk, it all boils down to a simple fact I think, governments can in fact invent money, but how they spend that money will show whether they actually care about the citizenry or not.