Yves here. The fact that the Fed isn’t giving financiers as much in the way of new juice doesn’t change the fact that it threw open the floodgates last month.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

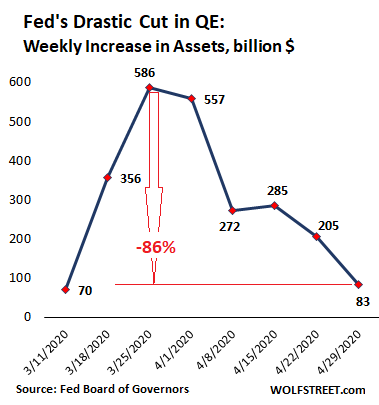

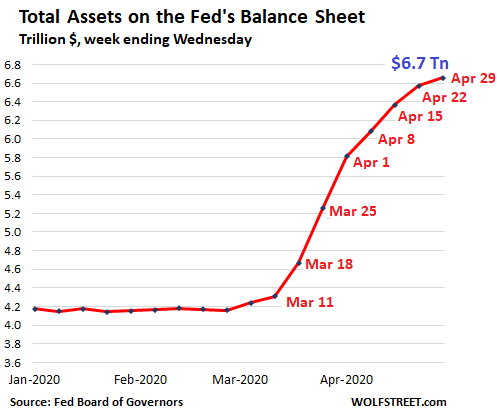

Total assets on the Fed’s balance sheet rose by only $83 billion during the week ending April 29, to $6.656 trillion. That $83 billion was the smallest weekly increase since this show started on March 15, and down by 86% from peak-bailout in the week ended March 25. This chart shows the weekly increases of total assets on Fed’s balance sheet:

The Fed is thereby following its playbook laid out over the past two years in various Fed-head talks that it would front-load the bailout-QE during the next crisis, and that, after the initial blast, it would then cut back these asset purchases when no longer needed, rather than let them drag out for years.

On January 1, the balance sheet stopped expanding as the Fed’s repo market bailout had ended. However, in late February, all heck was breaking loose, and the Fed first increased its repo offerings and then on March 15, started massively throwing freshly created money at the markets, peaking with $586 billion in the single week ended March 25.

But since then, the Fed has slashed its weekly increases in assets, which shows up in the flattening curve of the Fed’s total assets in 2020:

The Fed cut its purchases of Treasury securities. The balance of its mortgage-backed securities (MBS) actually fell. Repurchase agreements (repos) have fallen into disuse. Lending to Special Purpose Vehicles (SPVs) has not gone anywhere in five weeks. And foreign central bank liquidity swaps, after spiking in the first two weeks, only rose modestly, with most of the increase coming from the Bank of Japan, which is by far the largest user of those swaps.

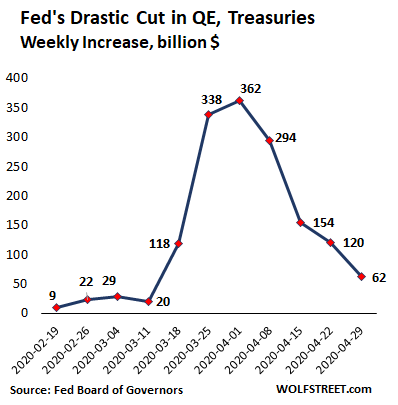

Purchases of Treasury securities get slashed.

The Fed added only $62 billion of Treasury securities to its balance sheet during the week, the smallest amount since this show began, down 83% from the $362 billion during peak-Wall-Street-helicopter-money. This chart shows the weekly increases of Treasury securities on the Fed’s balance sheet:

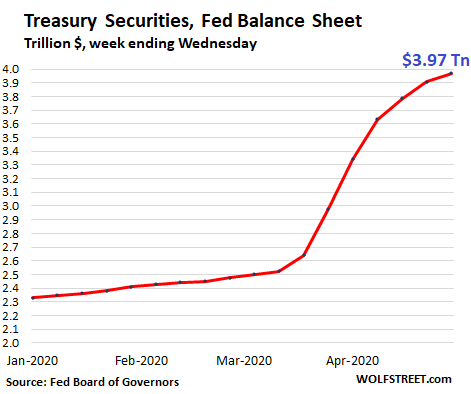

The chart below shows this effect: The curve of Treasury securities has been flattening over the past few weeks, after the massive frontloading of purchases in March. The total is now $3.97 trillion:

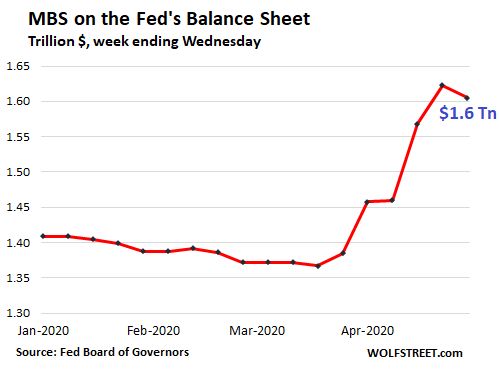

MBS purchases and balances fell.

The Fed has drastically cut its purchases of mortgage-backed securities over the past five weeks, as reported by the New York Fed transaction summary (net purchases, for the weeks ended):

- $157 billion (Mar 25)

- $145 billion (Apr 1)

- $109 billion (Apr 8)

- $58 billion (Apr 15)

- $56 billion (Apr 22)

- $38.5 billion (Apr 29)

MBS trades take weeks to settle. All of the $38.5 billion in MBS the Fed bought this week will settle in May. Since the Fed books the MBS trades only after they settle, the balance sheet lags by some time the actual trades.

In addition, if the Fed buys no MBS at all, the MBS on its balance sheet will decline due to the pass-through principal payments that all holders of MBS receive as the underlying mortgages are paid down or are paid off. There is currently a boom in mortgage refinancing underway, which creates a torrent of these pass-through principal payments. Just to keep its MBS at a steady level, the Fed would need to buy a significant amount of MBS.

This combination of drastically lower purchases, the erratic settlement dates, and the torrent of pass-through principal payments caused the balance of MBS on the Fed’s balance sheet to fall by $18 billion, to $1.6 trillion:

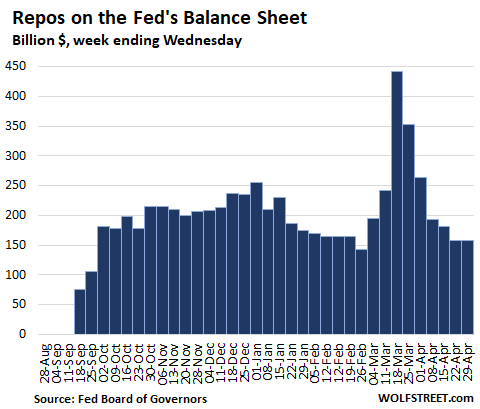

Repos fall into disuse.

In recent weeks, there has been no demand for the repurchase agreements the Fed offers in the repo market. The repo market itself is running as it normally does, a multi-trillion-dollar affair on a daily basis. But the Fed’s repos are only being nibbled on every now and then. What’s left on the Fed’s balance sheet are several term-repos from weeks ago. Repos are in-and-out transactions. When repos mature, the Fed gets its cash back, the counterparty gets its securities back, and the repo balance for that entry goes to zero.

There are $158 billion in repos left on the balance sheet. I’ve dug up most of them. Over the next two months, they will all mature and roll off the balance sheet:

- From April 29: $2.0 billion, 1-day

- From April 13: $14.5 billion, 28-day

- From April 6: $6.3 billion, 28-day

- From April 3: $1 billion, 84-day

- From March 20: $31.2 billion, 84-day

- From March 13: $17.0 billion, 84-day

- From March 12: $78.4 billion, 84 day

Total repo balance, at $158 million, is down 64% from the peak ($442 billion):

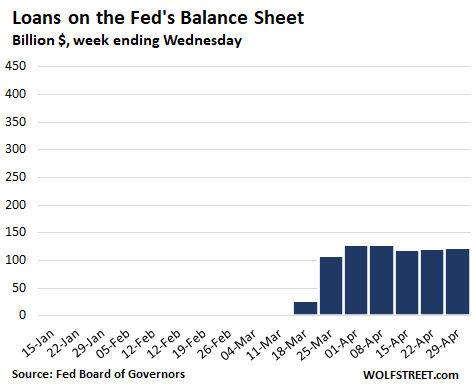

“Loans” to SPVs & Primary Dealers went nowhere in five weeks.

The Fed’s alphabet soup of bailout programs are in effect loans to Special Purpose Vehicles (SPVs) that the Fed has set up in conjunction with the US Treasury Department, and to its Primary Dealers (the big broker-dealers and banks the Fed does business with). The Fed in essence lends to them, and they can buy whatever the Fed directs them to buy or lend to entities the Fed directs them to lend to.

This scheme is a way to get around the limits imposed on the Fed by the Federal Reserve Act. Congress could stop these schemes but applauds them.

When the Fed announced the first batch of its alphabet soup of bailout programs, “loans” on its balance sheet ballooned. But over the five weeks since then, they have remained essentially flat at around $122 billion:

The Fed shows these loans by category:

Primary credit: fell to $32 billion, from $34 billion last week and from $43 billion three weeks ago. This SPV was expanded to be able to buy some “fallen angel” junk bonds. But the balance has dropped since the expansion and the Fed hasn’t bought any fallen-angel junk bonds. Some of the positions have unwound, and the SPV paid the associated loans back to the Fed.

Secondary credit: $0. Designed to purchase corporate bonds, bond ETFs, and even junk-bond ETFs. None were purchased.

Seasonal credit: $0

Primary Dealer Credit Facility: fell to $25 billion, from $36 billion two weeks earlier. Amounts the Fed lent to primary dealers to buy stuff with. After the initial burst, some of the positions have been unwound, and the loans were paid back.

Money Market Mutual Fund Liquidity Facility: fell to $46 billion,from $49 billion last week, and from $53 billion three weeks ago. This SPV bought corporate paper and other short-term assets to bail out money-market funds. After the initial burst, the positions have started to unwind, and the SPV paid back some of the loans.

Paycheck Protection Program Liquidity Facility: Jumped to $19billion from $8 billion. This is where the Fed lends to the SPV to buy from the banks the government-guaranteed loans they have issued to “small businesses” (hahahaha) under the PPP program. This SPV does nothing for small businesses. It just takes some loans off the books of the banks after they’ve extracted their fees for processing the PPP loans.

These loans show that the Fed has not done any of the things with SPVs and Primary Dealers over the past five weeks that the markets were drooling and raving about – they didn’t buy junk bonds, ETFs, or stocks. The markets just haven’t figured it out yet.

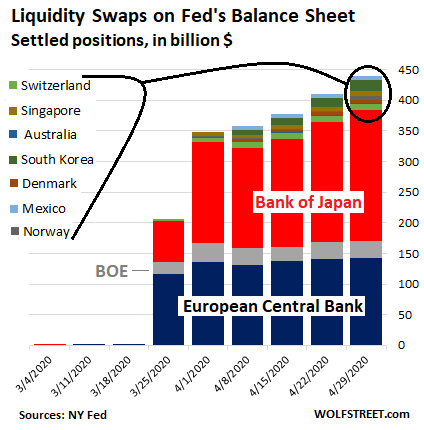

Central Bank Liquidity Swaps.

The Bank of Japan is by far the biggest user of the Fed’s “dollar liquidity swap lines.” Swaps with the BOJ surged by $18 billion from the prior week to $214 billion and now account for 49% of the total swaps on the Fed’s balance sheet.

The ECB is the second largest user of the swap lines, with balance of $142 billion, 32% of the total. The Bank of England is far behind with $28 billion.

The Fed also has opened swap lines with the central banks of Canada, Australia, New Zealand, Sweden, Denmark, Norway, Switzerland, Singapore, South Korea, Brazil, and Mexico. There are no swaps with the central banks of Canada, Brazil, New Zealand, and Sweden. And the remaining central banks are small fry (see chart below).

With these swaps – maturities of either 7 days or 84 days – the Fed lends newly created dollars to another central bank, against domestic currency posted at the Fed as collateral. The exchange rate is the market rate at the time of the contract. When the swaps mature, the Fed gets its dollars back, and the other central bank gets its own currency back.

The combined amount of those swaps – the country data is released by the New York Fed – increased by $29 billion from the prior week to $439 billion.

If…

Since March 11, the Fed has printed $2.34 trillion to inflate asset prices, restart the chase for yield to where investors would lend to companies with deep-junk credit ratings, already too much debt, and business models that have run aground. It did so to bail out asset holders and Wall Street.

If the Fed had spread that $2.34 trillion equally over the 130 million households in the US, each household would have received $18,031. For many households, this would have gone a long way to helping them through the crisis. But this was helicopter money for Wall Street.

In addition to logistical difficulties of selling a home in the era of social distancing, there is the explosion of a historic unemployment crisis. Read... Mortgage Forbearance Balloons, Home Sales Plunge

Reduced to $83 Billion a week? That is what they paid out in QE per month, 2011-2014. The swelling of the Fed balance sheet already exceeds the height of the Great Recession, yes?

Meanwhile, as a self-employed remodeler running my own business, I still haven’t seen a personal stimulus check, and the IRS seems indifferent to my repeated queries, so I am not expecting to see it soon if ever, even though it would be quite helpful now. As for unemployment, work trickling in keeps me from filing, even as that income is not anything like sufficient to pay bills.

I had to wait ten years after 2008 before that ongoing helicopter bailout of Wall Street “trickled” down to become my $30,000/yr gross….

Welcome to the “Rugged Individualist” socio-economic status group. We are a very long way away from a Jeffersonian “Yeoman Farmer” societal ethos.

We haven’t seen a cheque yet either, and we are most definitely “on the radar screen” due to filing income tax statements every year and receiving Social Security payments now that we are “retired.”

With all of this largess being lavished on the upper tiers of the wealth spectrum, we now begin to see signs of the return of the “Austerity” argument. Plainly, this austerity is meant for we lower depths denizens. When the Elites finally show their hand and suggest some form of Social Security curtailment, all in the service of “Fiscal Responsibility,” there will be all h— to pay. Not the elder cohorts per se, but the younger cohorts will act because their primary reason for supporting the status quo will be seen to be snatched away from them. Why play by the rules when doing so has no eventual pay off? Deferred gratification is all well and good, when there is some gratification to be anticipated after the deferral period has elapsed. We are training an entire set of generations to behave like sociopaths. What sort of society can function under that set of conditions? A Slave owning society.

Interesting times.

Even the Boomers might get vocal if the masters start using too much austericide while still giving themselves the evil socialism. At least we aren’t yet at the point where reformers start having unforeseen health problems or child porn is being found on their computer.

MMT for the best, “Austrian Economics” for the rest.

The one person in our family who had to wait for the stimulus check was the only person who filed their 2019 tax return. If you filed a 2019 tax return it appears they have to complete every aspect of processing it, even after sending your refund out, before it gets processed for the stimulus check.

Out stimulus check arrived, literally, days after e-filing our 2019 tax return in early April.

Isn’t this just the first wave…a quick liquidity shot to keep the patient stable? I expect that the solvency shot will come in a couple of months when 1st quarter losses appear on corporate reports. Then corporate bonds, bond ETFs and junk bonds will begin their desperate search for a floor and the SPIVs will kick in with a vengeance. Please, just don’t call these leading titans of the economy zombies.

A million in Banjamins weighs 22 pounds, and a helicopter just can’t carry that much, so i’d propose we repurpose those Boeing 737 MAX planes sitting around gathering dust to use as ‘crop dusters’.

Nah, that would only be if the government wanted the possibility of regular people grabbing the money. Nah, to prevent that they give it straight to banks who then ‘lend’ it out at a profit for the banks. You know, to prevent anybody who isn’t already a millionaire from getting any. Otherwise it would be ‘welfare’ or, *gasp*, SOCIALISM, and we can’t have either of those things because they’re doubleplusungoodthink.

Get ready to wait for it to ‘trickle down’ into the real economy. I’ll bet $5 on ‘never’.

We need to create a new department within Treasury – the Department for Direct Fiscal Spending. And within this new department we need to coordinate industrial planning, infrastructure, labor, small business, etc. Treasury is no longer the prerogative of finance and financiers. Why? Because they have no connection to reality. They are like some godawful abstract painting.

Abstract artists are mindful of the outcome of their intentions….Treasury, not so much.

I worry that Treasury is it’s own little citadel. Run by and for the rich for no other reason than to become richer. I’m not saying this cannot change but to change we need “organs of state”, as the communists would say. And I’m not saying we should all be communists. Capitalism can serve us well if we begin to control it. You’re right, art is like money: it’s value depends on what the artist accomplishes with it.

That’s the thing. Who can control capitalism but capitalists? Perhaps capitalism would serve us well without them, but such a thing has not been invented yet. Remember, we tried democratic socialism, but that was tossed in the garbage at the first sign of trouble, and is now basically extinct.

From my point of view (via Marx), if the rich aren’t getting richer than capitalism kicks the bucket. And at this point, amidst the pandemic, it is plain to see who they are willing to sacrifice to keep the ball rolling (in other words, pretty much everyone who earns a paycheck for a living).

So, I would like to be proven wrong. If capitalism can be tamed, so to speak, what is it that could possibly make capitalism serve us rather than them?

I think capitalism has eaten itself and finding itself to be hard to digest, is now vomiting as a result.

I know that picture Su, its four square meters of board painted completely black, done by that chain-smoking chap and sold to a finance company (who else) for millions. Its filling wall space in a low-level gallery now with a bench in front where you can sit and marvel at it.

Given our forebears’ fears of those who control a government-central bank-Wall Street-corporate cartel and the evidence from the aftermath of the GFC and the latest episodes of trillions of dollars in corporate stock buybacks funded with debt, maybe I’m naive or suffering from Stockholm Syndrome. But have come to think the Fed views its primary mandate as protecting the banks and major creditors in the financial system from debt default and to inject money into our deregulated debt-based monetary system, never mind the creditors’ deeply flawed underwriting practices. This is being done to protect the nation’s depository and payments system from the creditors recklessly negligent speculative behavior for private financial gain. Clearly it’s long past time to reinstate the Glass-Steagall Act that separated the depository and payments system from speculative finance, but this is the role of our legislators and not the Fed.

The elevation of asset prices that has so benefited a narrow segment of wealthy citizens so disproportionately may largely be a by-product of this policy, not its primary intent. It has become self evident that monetary policy by itself is of little efficacy in terms of boosting the real economy, and that the so called “Wealth Effect” is essentially a bankrupt hypothesis as we watch money flow into rising asset prices that in turn provide collateral support for the debt.

Unfortunately, all roads lead to highly problematic social outcomes as the majority of citizens see a relatively small group benefiting from these policies while they and their families suffer economically from wage suppression in different forms and heavy debt loads, whether direct or indirect, and food shortages reportedly begin to surface in the wake of the current pandemic. Not unmindful that this comment is being written on May Day.

Actually, the fed is really only allowed to deal wit hthe big banks etc. The Federal government austerity fiscal philosophy over the couple of past decades (unless it si for war or tax cuts for the wealthy, in which case there are no limits) means that everybody assumes its the Fed’s job to save the economy, instead of just balancing inflation and unemplyment per their mandates. Since the Fed can’t send checks to people on Main Street, they focus on pumping up asset prices and maintaining liquidity.

I do not think it is optimum policy but I also think the Fed would like Congress to step up more on the fiscal front so the Fed doesn’t have to be as activist. They have seriously pushed the envelope on their mandates in the GFC and continued now. i think some of the fiscal stimulus in this go around from Congress means that the Fed has been able to pull back a bit.

However, the US has designed so many complex dysfunctional government systems at the federal and state level that it is taking quite a while for the helicopters to get off the ground to deliver money. Florida deliberately structured their unemployment system to make it difficult to apply and amazingly enough are struggling to give unemployment to their residents which also means the infamous $600/week of federal money is not being infused into the system. NYS has been much more efficicent on that front (not perfect, but much better).

The economics of globalisation has always had an Achilles’ heel.

In the US, the 1920s roared with debt based consumption and speculation until it all tipped over into the debt deflation of the Great Depression. No one realised the problems that were building up in the economy as they used an economics that doesn’t look at private debt, neoclassical economics.

Not considering private debt is the Achilles’ heel of neoclassical economics.

The FED does the best it can with an economics that doesn’t consider debt, which really isn’t very good at all.

Greenspan and Bernanke can’t see the problems building before 2008.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

At 18 mins.

(When you use neoclassical economics that doesn’t consider debt, the economy runs on debt and then crashes in a Minsky Moment, 1929 and 2008.)

No one can work out what caused 2008, and afterwards and they attribute it to a “black swan”.

Janet Yellen is not going to be looking at that debt overhang after 2008 and so she can’t work out why inflation isn’t coming back. It’s called a balance sheet recession Janet, you know, like Japan since 1991.

Jerome Powell is not looking at the debt overhang after 2008 and so thinks the US economy is fixed and raises interest rates. Raising interest rates with all that debt in the economy will soon cause a downturn and there is no way he will get anywhere near normalising rates.

Japan knows all about the balance sheet recession.

Richard Koo had studied what had happened in Japan and knew the same would happen in the West after 2008. He explains the processes at work in the Japanese economy since the 1990s, which are at now at work throughout the global economy.

https://www.youtube.com/watch?v=8YTyJzmiHGk

Debt repayments to banks destroy money, this is the problem.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

They saved the banks, but left the debt in place.

The banks were ready to lend, but there were too few borrowers.

The QE couldn’t get into the real economy, but it could get into financial markets.

The gap between economic fundamentals and the US stock market widened to 1929 levels (before recent correction).

1920’s was the end of a era that began in 1830 as growth from the industrial revolution ended, which destroyed the British Empire’s reserve currency status. It was the end of a era. Using that as a example is irrelevant.

Fact is, debt is debt. Capitalism can’t grow without it, but needs a high enough multiplier to stay in business. That is the problem. It takes insane amounts of debt to grow. None of your points seem to adjust too that fact.

Capitalism can’t grow unless it is actually investing in being productive. None of the debt held is being used to invest in anything real. They are used to buy more stocks and other near useless stuff.

People are drowning in it because they need to survive. Companies are not using their nearly free money(debt) for research, factories, training or anything but bonuses and dividends. The former are literally dying while the later is dancing on piles of paper and clouds of electrons not realizing that that makes their paper and electrons worth anything and creates stuff to buy either for living or luxury is going away.

Should we count the $1.5-ish trillion in Treasury increase as inflating asset prices in the face of the $2 trillion CARES Act?

Instead of saying “If the Fed had spread that $2.34 trillion equally over the 130 million households in the US” shouldn’t we be saying “If Congress had spread the $2 trillion CARES Act equally over the 130 million households in the US”?

Congress on that day of the big corporate bailout deal, except for Massey, is a complete joke. Trump calling him out on his principled stance was the exclamation point. Bi-partisan den of thieves in service to their corporate masters and Wall Street.

Meanwhile what about the folks with no money, no jobs, can’t pay the rent, don’t have enough to eat? Are they supposed to go die because markets? I’ve about had my fill of the callous bastards in Washington.

I posted this comment to the original Wolf Street version of the article:

“Thanks for the update, Wolf. No yuuge amounts of added helicopter money needed this month since markets been on a sugar high the whole time. As soon as the crack addicts realize that a miracle cure for the pandemic is not in fact going to be available next week and start selling off again, that balance sheet will resume ballooning. Fed, as result of the post-GFC “there are no limits to what we can do” mindset, has lost all inhibitions – they will literally print a GDP-multiple of helicopter money to throw at the stock indices, if that’s what thy think it takes. Their only measure of “the economy” is the indices, and operationally, their only mandate is keeping those numbers in bubble mode, to be able to point to them and say, ‘See? Prosperity!'”

10 years of building up “capital” isn’t quite enough, once the next stages follow.

The banks get theirs first, to drive arbitrary density until they can’t. The private corporations get their turn next if republicans are in charge. The public corporations get theirs second if the democrats are in charge. Working people lose to inflation either way and are wiped out periodically on credit reload. That’s a mature empire, with no natural stock to exploit. The empire has to move, but has no new foundation short of much better education and productive operational leverage.

Operational leverage is the ac driver which leads to relative electronic vs. physical in general circulation. If you understand that kernel and local position, you can open a much more effective risk-free to physical, short-term lending window. The rest of the curve follows. And if you really wanted to, you could open a local hub.

If you know what I mean.

Yup, so “smart money” so smart that it was blindsided by covid-19 has been given a nice interval to recover then set their shorts. Now we poor slobs in 401K’s can watch this crash again. Rinse and repeat.

The article must add the $9 Trillion pumped into Wall Street through the overnight Repo market since September 17th, 2019

If you look, fintech and the resulting S&P leadership behavior hasn’t changed one iota. If you look, the response to the virus really has nothing to do with a virus. If you then go back and look for the real financial trigger, you will see the call on the USD as fintech was going in for the final kill of physical cash.

Turns out cash equivalents are not cash equivalents in the short term interbank.

If you have great physical cash circulation in your community “bank” or bank, you are in the catbird seat, that is if you control your own data instead of handing it over to FIS.

You could easily arbitrage credit spreads in favor of your community, creating a real loan market, and employ the tellers for feedback. Problem solved.

If that was the problem anyone was trying to solve.