Yves here. Just as with never-gonna-earn-a-dime dot-com darlings, we’ve underestimated how long over-eager investors, in this case lenders, would keep the shale play going in the US. We did at least, following the take of the Financial Times’ John Dizard, that the party would go on until the money punchbowl was removed.

It’s hard to see how shale companies can go on with super-cheap oil and gas as part of the new normal. As this story describes, while the President made all the right bailout noises, even cheap money can’t solve for this big a collapse in prices.

The fact that Wood Mackenzie is more downbeat than the predictably optimistic EIA is telling. They’ve regularly been the most bullish.

By Nick Cunningham, an independent journalist, covering oil and gas, energy and environmental policy, and international politics based in Portland, Oregon. Originally published at OilPrice

The Trump administration claims that the U.S. is “transitioning to greatness,” and that energy companies are going to see “massive gains.” U.S. Secretary of Energy Dan Brouillette says there is “stability” in the oil market, and that economic activity will “explode” on the other side of the pandemic. Thanks to the leadership of President @realDonaldTrump, the transition to greatness is well underway, and our economy along with our U.S. energy companies are going to see massive gains on the other side of this pandemic.

Thanks to the leadership of President @realDonaldTrump, the transition to greatness is well underway, and our economy along with our U.S. energy companies are going to see massive gains on the other side of this pandemic. pic.twitter.com/EZ2DFnlcUw

— Dan Brouillette (@SecBrouillette) May 12, 2020

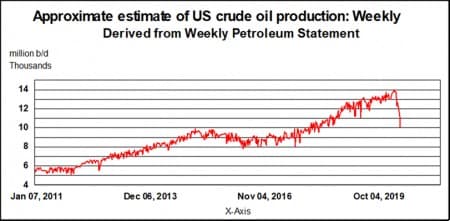

Meanwhile, back in reality, U.S. oil production continues to decline as drillers shut in wells and cut back spending. Output has already declined by 1.1 million barrels per day (mb/d), and more losses are likely. New data from Rystad Energy predicts U.S. oil production declines of roughly 2 mb/d by the end of June.

“Actual production cuts are probably larger and occur not only as a result of shut-ins, but also due to a natural decline from existing wells when new wells and drilling decline,” Rystad said in a statement.

Energy expert Philip Verleger, in an article for Energy Intelligence reports that the magnitude of output declines is much larger. His latest research shows that production as of May 10 is down by almost 4 million bpd from its peak as the below chart shows.

Source: PK Verleger LLC

To be sure, the U.S. government is doing quite a bit to try to bailout the oil industry. A new report finds that some 90 oil and gas companies will benefit from the Federal Reserve’s corporate bond buying program. The Trump administration is also quietly reversing environmental protections on the oil and gas industry.

But in the face of a historic meltdown in the oil market, even handouts from Uncle Sam won’t stop declines. The U.S. oil industry continues to idle drilling rigs at a tremendous clip, and the rig count is down by more than half in two months. “[W]e think that the last time there was so little drilling activity in the US was the 1860s during the first decade of the Pennsylvania oil boom,” Standard Chartered analysts said. The investment bank said that the contraction was notably acute in Oklahoma, where rigs fell to just 11 across the state, down 89 percent from the same period a year earlier.

The sharp decline in rigs, drilling and completion activity means that the steep decline rates endemic to shale drilling will overwhelm what little new production comes online. Standard Chartered said that if activity were to remain stuck at current levels, U.S. production in the five main shale basins would fall by 2.89 mb/d by the end of 2020.

Those declines would come on top of the output that has only been shut in temporarily. Standard Chartered envisions a “squashed-W pattern” for supply, in which temporarily idled output comes back online in a few months, but more structural declines continue thereafter.

The EIA, characteristically, is much more optimistic about the state of U.S. supply. The agency said on Tuesday that it only sees a 0.5 mb/d decline in oil production this year, compared to 2019 levels. Notably, Secretary of Energy Dan Brouillette says production will increase in the third and fourth quarters as the economy roars back.

Others aren’t so sunny. A report from Wood Mackenzie released on Wednesday says that oil demand will take years to recover.

“Production is falling sharply in the US, and some producers are reluctant to sell forward,” Commerzbank wrote in a note.

But while some oil drillers have hesitated to lock in hedges, others have decided that they can stomach hedges at extremely low prices, not because they can profit at such low levels, but likely only to guard against another meltdown. “The strike prices achieved in the latest surge of hedging have been low, these appear to be hedges designed to improve the probability of survival should market conditions deteriorate further,” analysts at Standard Chartered wrote in a report.

“Some of the hedges have been fixed at very low prices: one company has a USD 20.73/bbl WTI hedge for Q2, another has three-way collars for Q3 and Q4 with a floor of USD 25/bbl Brent,” Standard Chartered added.

The unease from some drillers regarding oil prices is understandable. The Secretary of Energy may predict “greatness” ahead, but others see a long, protracted economic recovery.

By Nick Cunningham of Oilprice.com

I had been watching EiA weekly oil production estimates and the decay in production observed so far seemed big but nothing as brutal as the PKVerleger estimate. In fact I was thinking that US oil production was more resilient that I could anticipate and this was at odds with data on rigs and inventories.. Good to see other estimates thank you.

I’d be interested in what regular commentator ‘rjs’ has to say, he keeps a very close eye on these figures.

I would guess that there will be a significant lag in figures, we won’t see the big picture for a few months. There is a lot of incentive among producers to be less than honest with declared output figures, as nobody wants to see their competitors benefit from higher prices if they make the first move to cut production.

I’ve more or less given up making predictions with shale production as I’ve been consistently wrong for a few years now, the industry has continued to grow long past it seemed to make any economic sense. But the one thing that seems likely is that if and when the decline occurs, it will be very rapid and severe due to the nature of fracking. A rapid reduction in investment in conventional output might not be obvious in output figures for a few years, but with fracking, once you stop injecting, the output drops are very rapid. I think we may be seeing the first stages of that process, which could lead to very dramatic falls in production later in the year.

You are right ! It didn’t make sense !

FRACKED Oil & Gas are high cost and can only be maintained in the competitive market by American Military constantly threatening lower cost producers!

Russia is calling American militaries put up or shut up!

Will this mean the whole world will tell America to stuff it !

America has used the extreem sanctions TOO MUCH TOO LONG!

At home America is clolapsing !

Industry can only survive in world trade or war with better than the other guys infrastructure !

America’s infrastructure is a very old paper tiger!

Go figure!.

Does anyone have a link to the 90 companies to get bailed out? The Guardian article in the post only names a few.

i don’t know how Verleger arrived at his estimates, but i suspect he’s on to something..

here’s how i’m opening my write-up on this week’s EIA report: US oil data from the US Energy Information Administration for the week ending May 8th indicated that because of a large jump in the amount of oil that went missing after it was either imported or reportedly produced, our commercial supplies of stored crude oil fell for the first time in 16 weeks

the problem is that our production, as reported, + our oil imports, + what was withdrawn from commercial storage was 931,000 barrels per day greater than our oil exports + what was added to the SPR + what oil our refineries used…so unless we have a big pipeline leak somewhere no one noticed, one or many of the EIA’s numbers were off by a net of nearly a million barrels per day..

Two days ago CORES released crude products consumption data for March 2020 in Spain and steep inter-annual declines in some products could be seen:

Fueloil: (about 11% of total oil product consumptiom): -37% (This is in line with previous months decline, a longer term trend).

Gasoline: (about 8-9% o.t.o.p.c.): -34%. (On the contrary, gasoline was increasing in previous months at a inter-ann pace of about 8% due to diesel to gasoline shift).

Diesel (about 60% t.o.p.c.): -8% (not so steep fall because heating diesel increases partly compensated transport diesel decreases).

Jet-oil: (about 10% t.o.p.c.): -44%. (Steep decay in flights starting on March 13th).

Oil Liquids & Gases (6-7% t.o.p.c.): +18%. Driven by heating gases increase overcompensating losses in transportation consumptiom.

Was there a followup on last week’s report that a fleet of oil tankers was already headed across the atlantic for the US from SA? Is all that oil parked in the Carribean? That’s as strange as a collapse in fracking just when the money is flowing like never before. Would they admit it if those fields ran dry? Add to that Trump’s latest insistence that we get out of the ME and pulling troops from Afghanistan. And the blow-up in Libya where nobody knows who’s on first or why. Vague reports that SA is losing control of its population. A Venezuelan Bay of Pigs. And China is getting uncharacteristically hostile. When they report that Chinese nationalists want to have it out with Taiwan are they really saying Chinese Nationalists want to have it out with the mainland? All reports are that China has her hands full with pandemic problems. Isn’t it a good time to start a nice little skirmish to take over Venezuela’s oil? The world’s economy might be cut in half but it still runs on oil.

Shale always seemed like a perilous short-term play that was destined to blow out. It could be viewed as a US strategy in the global oil market to defang some other players like KSA, the rest of OPEC and Russia while churning a lot of capital and shoring up some parts of the domestic economy. Get US in a more favorable position, at least in the short run, include a new enlightened and supportive approach in Riyadh, defuse some ME problems, again in the short run, and pray that it holds together long enough to reposition US industry, habits, financing and community cohesiveness. Oh, wait.