As readers of this site know well, retailers, particularly department stores, were in distress even before coronavirus hit, and private equity was a big, and arguably dominant, reason why. Contrary to the mythology that some captured business journalists would like to sell you, many of the companies fell victim to private equity leverage and fee extraction far more than competition from e-commerce. The list of casualties is long: Toys’R’Us. Mattress Firm. Payless Cashways. Sports Authority. Barneys. Fairway.

Now even some of the walking wounded like Neiman Marcus have filed for bankruptcy. Macys has been on the death watch for a while. Now many companies are arm-wrestling with landlords for rent holidays. And for many if not most retailers, the rent burden is the direct result of the tender ministrations of private equity.

To add to the fun, the bagholders, um, buyers of the real estate formerly owned by retailers but routinely sold at high prices due to inflated leases devised by the private equity overlords, are now looking at a world of hurt. Even though being an owner or investor of commercial real estate in the US is suddenly an unattractive proposition, large footprint retail space, whether in malls, urban centers, or suburbs now looks like an albatross.

The new wrinkle, which we’ll discuss shortly, is that a major real estate investor, Brookfield Properties, has announced that it is launching a $5 billion retail bailout fund. While struggling stores are desperate for any lifeline, one has to wonder if Brookfield, like too many investors, is anticipating a relatively quick recovery. While, as we’ll see below, there’s also an element of self-interest in its opportunism, this looks an awful lot like Merrill’s “catch a falling safe” January 2007 acquisition of subprime originator First Franklin.

A 2019 study by the Center for Popular Democracy found that 10 of the 14 large retail bankruptcies since 2012 occurred under private equity ownership. This report also found that private equity purchases of retailers resulted in 1.3 million lost jobs.

Analysts of these bankruptcies point out how high debt service levels denied these retailers the ability to invest in e-commerce strategies. Even worse in case like Fairway, the new private equity overlords took niche operators that were successful in their home bases and embarked on bone-headed brick-and-mortar expansion plans.

Even though retailers would be in perilous condition due to temporary closures and considerable uncertainty about how much traffic will return once restrictions are eased, private equity strategies made them much less likely to survive shocks, above all, engaging in real estate asset stripping. We first wrote about this practice in 2014, based on the work of Eileen Appelbaum and Rosemary Batt:

For instance, one way that private equity overlords enrich themselves at the expense of the businesses they acquire is by taking real estate owned by the company, spinning it out into another entity (owned by the PE fund and to be monetized subsequently) and having the former owner make lease payments to its new landlord.

The problem with this approach is usually twofold. First the businesses that chose to own their own real estate did so for good reason. They were typically seasonal businesses, like retailers, or low margin businesses particularly vulnerable to the business cycle, like low-end restaurants. Owning their own property reduced their fixed costs, making them better able to ride out bad times.

To make this picture worse, the PE firms typically “sell” the real estate at an inflated price, which justifies saddling the operating business with high lease payments, making the financial risk to the company even higher. Of course, those potentially unsustainable rents make the real estate company look more valuable to prospective investors than it probably is.

Here are the key elements of the Brookfield rescue scheme, courtesy the Wall Street Journal:

Mall owner Brookfield Asset Management Inc. plans to devote $5 billion to shoring up retailers hit by the coronavirus pandemic, a bet on a beaten-down sector that could also help keep its rent payments rolling in.

The initiative will be aimed at taking noncontrolling stakes in retail businesses with prepandemic revenue of $250 million or more whose sales have plummeted as stores have been forced to close and consumers have remained on lockdown.

The Canadian investment giant said it plans to finance the program using money from its balance sheet and existing funds and investment strategies. It may also raise additional institutional capital for the program….

Being a tenant of Brookfield won’t be a requirement for investment, according to people familiar with the matter. Still, providing rescue financing for retailers could be a roundabout way for Brookfield to inject capital into its malls whose rent rolls have been battered during the pandemic. Shares of Brookfield Property REIT Inc., which had fallen by nearly half from the beginning of March through Wednesday’s close, climbed by more than 6% after the Journal reported on the plans…

Brookfield is hardly the only investor looking for opportunities amid the current economic carnage. Firms, including Silver Lake and Apollo Global Management Inc., have invested billions of dollars in the weeks since the pandemic began. Others, such as private-equity giant Blackstone Group Inc., have taken a more cautious approach based on the belief that the economic recovery will be gradual.

The Financial Times, reporting on the same story, sounded a cautionary note:

There was another reminder of the pressure that the shutdown of stores is causing for landlords on Thursday when Washington Prime, owner of about 100 retail properties across the US, warned there would be a “substantial doubt” about its ability to continue as a going concern unless it secured relief from its creditors.

The real estate investment trust disclosed it had collected only about 30 per cent of rents it was owed for April because of the Covid-19 crisis. Bankruptcies last year of the retailers Charlotte Russe, Gymboree, and Payless ShoeSource further hurt its rental income.

The pink paper’s readers were also skeptical. For instance:

WinnerWinterChineseDinner

Just delaying the inevitable…

Short commercial real estate

TheSadTruth

This looks like the very definition of throwing “good money after bad” … but I applaud them. Better they look the money than the taxpayer. Anyone stupid enough to be invested in a fund specialising in retail commercial property deserves to be parted from their capital.

Dr.plantain

Bravo! For actually spending their own money to bail out the companies in hot waters. This is how it should be done.

Then again retail is a dying horse.

While there may indeed be some viable retailers that can be salvaged at beaten-down prices, at this stage, it looks like too many investors have been conditioned by the Greenspan-Bernanke-Yellen put. But the central bank isn’t positioned to act as a social safety net provider, and this Administration, primarily by virtue of temperament, but also in part due to crippled operational capacity, won’t step in either.

Thus while lockdown-crazed extroverts may be eager to get out, it’s not clear how much of that impulse will go to safe and not retail-spend oriented activities like going to parks and beaches versus going to malls and restaurants. And with many white-collar businesses having managed to get buy with stay-at-home workers and Zoom conferences, the odds are high they’ll keep a lot of employees working out of their homes, due both to worker preferences and the cost and inconvenience of making the offices safer. That means fewer commuters and less lunchtime spending near city centers.

And the raw impact of 16% and rising headline unemployment on many businesses and on the habits of those who are relatively unscathed by the crisis is going to severely dent spending.

We described a few days back why ending the lockdowns was unlikely to result in anything dimly approaching a return to the old normal. Even in Dublin, where the local economy seems likely to benefit from Ireland doing a fine job of containing coronavirus, plus an influx of finance jobs due to Brexit, PlutoniumKun was struck by how sentiment seems out of line even allowing for arguably better fundamentals going forward than in the US:

I had a work online meeting this morning when I casually mentioned that the property market is dead for at least 5 years. I thought it was kind of obvious, but I was surprised at…. the fact that none of my colleagues seemed to agree. The consensus was ‘oh, its certainly a blow, but I think investment will start to flow back in before the end of the year….’. I kept silent. I hope the property industry is similarly clueless, because at least this will keep construction workers in a job for the rest of the year at least.

Just to take one narrow sector, commercial property. Even if all goes to plan with controlling the virus, nearly every business will be seeking to cut its rent costs severely. There is simply no way that retail or restaurants/bars can pay rents at 2019 levels for the foreseeable future. Even those companies that are doing well (and there are plenty of them) this year will be trying to cut back on office space as so many workers are based at home. Warehouse space is maybe the only sector that might – might – be ok. This will lead to huge pressure to reduce rents, and this, as [Richard] Murphy points out, will massively undermine the balance sheets of pretty much every bank, financial institution and pension fund throughout the world. This issue alone will be enormously difficult to address.

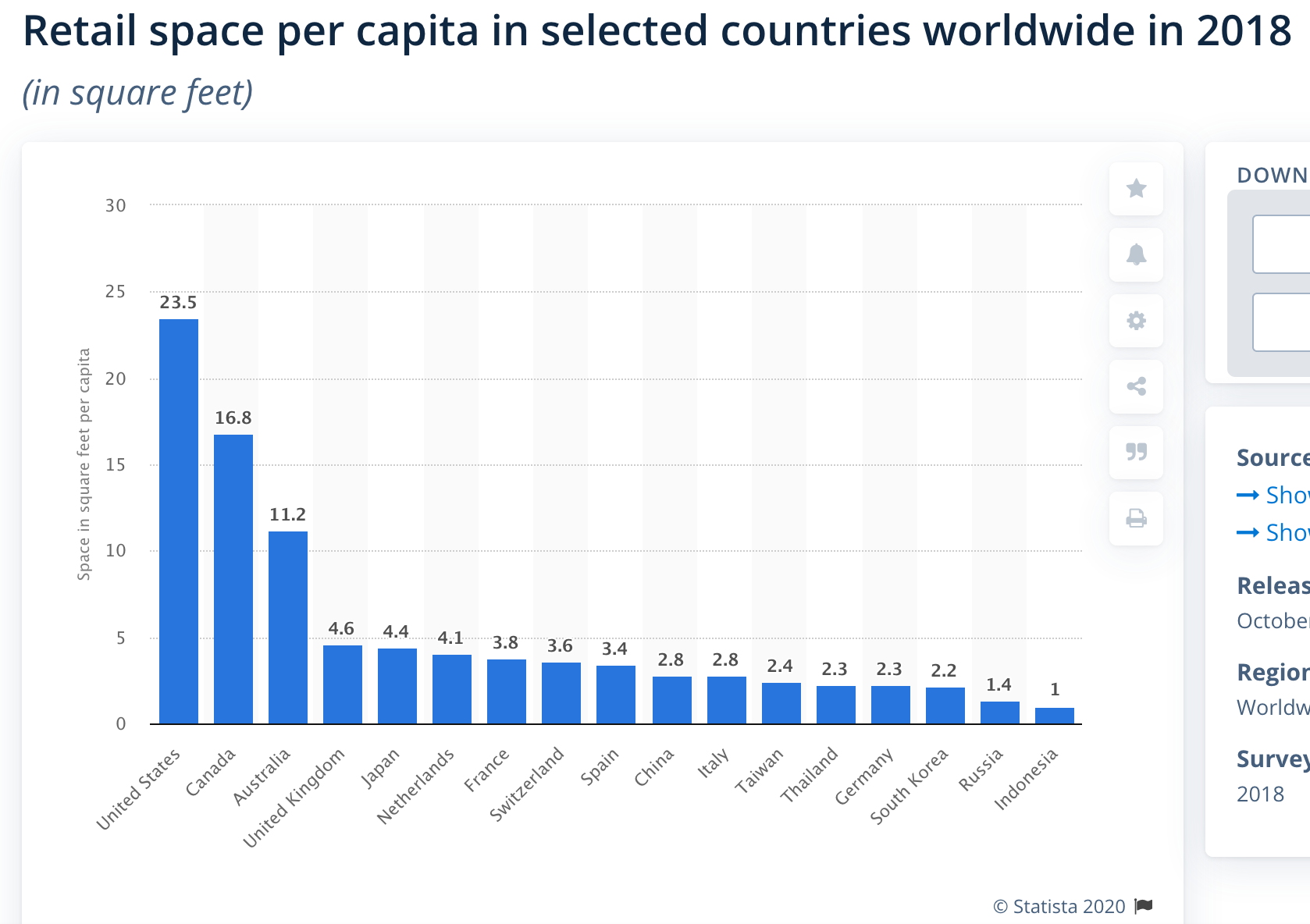

And the US has long been “overstored”. A client who’d take a flier in retail in the early 1990s pointed out how the US had far more square footage per capita than any other county, and that hasn’t changed:

In other words, this vast retail space overhang confirms Richard Murphy’s argument that landlords should be first in line to take a bullet to save the economy:

We need to be prioritising work at present.

And we need to keep trade alive.

At the same time we also need to preserve the operational aspects of banking, as best we are able, because we cannot survive without it: those systems are the plumbing on which the economy runs. And because we have done no real banking reforms since 2008 that may yet require nationalisation of the whole banking sector fails as the property market collapses, and with it all the collateral on which banks have relied for around 85% of their loan books.

But I stress, even if we are concerned that the property sector might collapse that is not a reason to priorities the interests of landlords. They have to be at the bottom of the pile for support right now. In other words, the government has everything the wrong way round.

There are practical reasons for this. As I have said since this crisis began, even if every landlord fails now, the properties that they own will still be there: in other words, even if their financial capital disappears, their physical capital does not. What that means is that the economy can survive the failure of landlords more than it can survive anything else because whatever happens to the current owners of these properties they will still exist. We cannot say that of any other part of the economy.

Retailers understand the significance of the rent issue, even if policy proposals aren’t going far enough. From Worth:

Gianfranco Sorrentino is the president of Gruppo Italiano, a trade organization devoted to bringing artisanal Italian products to American restaurants and retail stores….

In a recent phone call, he explained, “The rule of thumb is that the rent should be 5 to 8 percent of gross revenue. Labor is around 38 percent and food, 28 percent; the rest is general overhead and profit. While it may seem that the rent is not a large percentage, in fact, it is, because, to a large degree, everything else is flexible in the sense that demand can dictate costs. Moving forward, rent flexibility has to be the future of all retail as the coronavirus has turned the world upside down.”…

With all of this in mind, the only way forward that I can see is to share the rent risk with the landlords. This means that there will be no fixed rents going forward. Rents will be based on revenue. This idea will fast forward the price discovery mechanism of rent negotiations. Those often took weeks or months. Landlords will, in essence, be silent partners. If the recovery is slow, the rent will be low; if it is robust, so will the payments to the landlords.

Why would any property owner agree to this? Because if they don’t, they may have absolutely no revenue at all. Their restaurants and stores will be boarded up, they will default on mortgage payments and taxes. By the way, both of these will also need to be renegotiated. If they aren’t, defaults will multiply, and banks and cities will both be owning a lot of property…that neither wants to own.

This problem wind up being complex when you factor in that the huge excess of retail square footage in the US. We already had dying malls as a symptom thanks in no small part to private equity increasing the mortality level of retailers, and now the coronacrash. And a mall operator as new savior of retail is not going to see rent-reduction as a meaningful part of the solution.

For some definition of “their own money”. Might Brookfield’s sudden largess have anything to do with the $10 trillion the Fed just plopped on the table to buoy asset prices? Not to mention ZIRP/NIRP and the promise of oodles more QE.

The net effect of the radical restructuring of the US economy wrought by these latest bailouts is writ large in Brookfield’s actions. Giant players with dominant/monopoly positions will take their free money from the Fed and promptly hoover up stakes in smaller players. The resulting M&A party will result in the usual post-fiesta disaster scene: mass layoffs, higher prices and poorer services.

Furthermore, the FT readers are thrilled that the private sector is taking over what should be the public purview, which seems to be the signature dish of this round of crisis response.

It’s boggling that all this can happen on the heels of a mass political movement purportedly championing the public sector, worker’s rights and the crushing of oligopoly. A cynic might even think it was all just hot air.

Finally some real numbers

“In a recent phone call, he explained, “The rule of thumb is that the rent should be 5 to 8 percent of gross revenue. Labor is around 38 percent and food, 28 percent; the rest is general overhead and profit. While it may seem that the rent is not a large percentage, in fact, it is, because, to a large degree, everything else is flexible in the sense that demand can dictate costs. Moving forward, rent flexibility has to be the future of all retail as the coronavirus has turned the world upside down.”…”

We note that a common complaint of US manufacturers is that labor costs are too high and that to compete a move to a lower wage rate environment is necessary.

If we were to ask what the labor quotient for a given operation actually is there might be a better understanding of business.

The flexible rent proposition is one that already exists in limited circumstances. I have a friend who used to work in real estate for biotechs. The real estate they built up and leased is in some of the hottest most expensive markets in the world. Kendall Square in Cambridge is where everybody has/had to be and that comes at tremendous cost. But all those workers need places for meals, coffee breaks, and after work drinks. Leisure businesses like this could never afford the square footage rates the biotechs were paying. So my friends company offered up ground floor locations for these businesses with the rent being an agreed upon percentage of gross profits. This would seem to be critical in all markets going forward.

I would make another suggestion that property owners should be held to a standard of upkeep or investment in cities or risk having their property seized. One local example of why I think this should happen is Lynn, MA. It is situated on the water, just north of the extremely hot Cambridge/Boston market. It’s serviced by a commuter train and a nearby Blue Line MBTA train service. The downtown property is controlled by a handful of rentiers that likely right off costs while doing nothing with the property, hoping for a big pay day. To my mind their greed stagnates the vitality of the city. Better to turn the property over to housing and more community based resources than let it sit idle for decades. Or at least make the property owners pay their share to maintain the city and the improvements the rentiers need to recognize the value of their property.

That sounds like henry george’s “land tax” idea he was writing about in the 1870’s/1880’s…

keeping land…costs money…. .. better to get people to “live” on it…

the people with a lot of vacant land pay the burden of the taxes for the community….

The general public will need to be shown, not told. Maybe one solution involves pitching a new television series about the adventures of a private equity analyst.

Visualize an episode unfolding with some compelling graphs that show pre- and post-funding activities like dividends, exec comp and such while building toward the layoff numbers. Overlay that with a few vignettes about shifting healthcare and other items that were previously called benefits, and be sure to spice up with a few viral transmission opportunities.

In the show, and in the world, individuals at first won’t notice that much the impacts due to various types of social and media isolation. Once those impacts become a little more concrete, and have more of an emotional hook, there is more likelihood of exponential growth of viewership and of interaction among those viewers.

Now, any candidates for the leading and supporting roles and for location scouting?

The old depreciation gig that PE uses to strip assets from the business proper while paying much lower taxes due to that depreciation scheme. The higher the PE firm can jack the cost of property (to itself) the larger the depreciation expense offset in taxes

So maybe attach the property tax bill to the actual owners- say the banks or PE firms – same for forclosed properties or short sale – let the banks continue to pay tax without recourse to the ousted owners.

I would expect speculative lending to dry up / – Also cut that depreciation tax and allow actual maintainence and improvement costs to be deducted (none or limit admin costs – they are gamed also).

Here are a couple of retail data points from Central New York:

Sales tax revenue plummets 30% in Onondaga County, and could get worse

Fitch downgrades nearly $300M in bonds on Destiny USA

Destiny USA is a ~2.4 million square foot albatross mall that was built in the 1990s and greatly expanded in the mid-2000s — in the heart of the rustbelt and in a city with some of the highest poverty rates in the US. They do not pay property taxes and PILOT payments are dedicated to improvements in the mall area. They also got tens of millions from NYS for laying asphalt over polluted grounds under a guise of “brownfield remediation”.

Wonder if CalPers is a bondholder?

Hey Yves- great post, but up top you wrote Brookwood instead of Brookfield :)

fixed it. Thanks!

I agree that rents will change because of the crisis. My rule of thumb would be that rents should be no less than 10% of gross. This assumes that there are other substantial advertising investments being made by the business of anywhere from 5 to 15%. Some retail locations are so perfect that there is no need for any advertising and so the rents would be higher because there is no need to advertise. Also it must be remembered that in major metropolitan areas property taxes are an enormous part of landlord costs. The problem is that the city taxing bodies have so squandered and misspent this revenue stream that many cities retail areas are looking terrible, not because landlords are not paying taxes, rather because cities are moving the revenue streams elsewhere; corporate subsidies, TIF districts, high salaries, overly generous pensions.

I don’t know about you guys, it might just be my age, but where ever I look, in every business or governmental category I am seeing all the wrong decisions being made for all the wrong reasons. It’s as if all the lessons learned in every discipline for the pas 70 years are being thrown out the window. Oh well… what the hell…let the grifting continue!!!

So is Private Equity just capitalism’s own private liquidation authority? Plunder is still the business model, right?

If we are headed for a general debt-depreciation, I don’t think that the Fed can prop up these commercial assets forever. But of course the smart money will figure it out and escape before le deluge. Online shopping and less disposable income have been undermining commercial property for decades all the while the relentless asset bubble has been increasing their so-called value. I’m wondering if the prevalence of balloon-mortgages has also been boosting the value. If that is the case then the greater fools are finally being identified. Balloons could be the next sub-prime.

It is with some embarrassment that I note the Canada Pension Plan has blood on its hands where the Neiman Marcus bankruptcy is concerned, via its private equity arm. The prat responsible, mind, has long since fled for greener pastures at BlackRock …

https://www.theglobeandmail.com/business/article-neiman-marcuss-bankruptcy-filing-wipes-out-canada-pension-plans/