Yves here. Distress in commercial real estate is important not just in and of itself but also for its impact on long-term investors who’ve been active in these properties, such as pension funds and life insurers.

By Wolf Richter. Originally published at Wolf Street

Before the coronavirus, some segments of commercial real estate (CRE) were red hot, others were hanging in there or declining, and one sector, malls, has been in deep trouble since 2016, with prices plunging. Then came the lockdowns. Property prices in every CRE segment fell in April, even those that were red hot. And prices of mall properties got crushed.

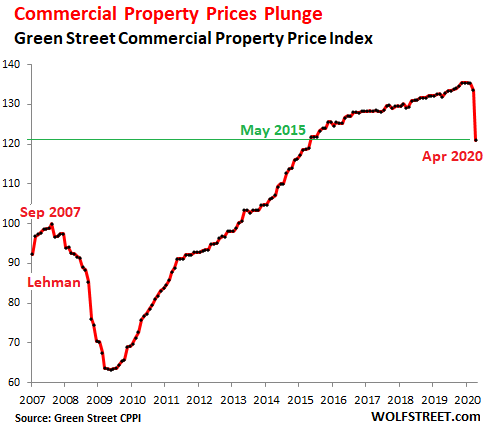

The overall Commercial Property Price Index (CPPI) by Green Street Advisors had peaked in the period of November 2019 through January 2020. In February and March, it ticked down. In April it plunged 9.4% from March, the second largest percent-drop in the data going back to the 1990s. The largest drop was 10.9% in October 2008, following the Lehman bankruptcy. Since the peak in January, the index has dropped 10.7% and is back where it had first been in May 2015:

There is sudden chaos in the industry, and the index designed to capture movements in near-real time has trouble capturing the massive month-to-month upheaval.

“The exact numbers are debatable, but property pricing is down about 10%,” said Peter Rothemund, Managing Director at Green Street Advisors, in the report. “Some property types, industrial for example, are probably faring better than that. Retail and lodging values are most likely doing worse.”

“There’s been plenty of examples of blown deals and people walking away from deposits, but the best way for us to get a sense of where things would clear these days is by talking with people in the marketplace — buyers, sellers, brokers,” he said.

During Financial Crisis 1, CRE prices collapsed nearly 40%, according to the Green Street CPPI, including in the middle the 10.9% cliff-dive in October 2008, following the Lehman bankruptcy. From the bottom in May 2009, the index more than doubled to the peak in January 2020. Now it’s back to May 2015 level.

Prices of Malls Collapse, All Commercial Real Estate Sectors Get Hit

The sub-index of the CPPI for malls collapsed by 20% in April from March, and is down 33% over the past 12 months. The index had peaked in 2016 and has since swooned by 45%. It’s by far the worst-performing sector of the CCPI.

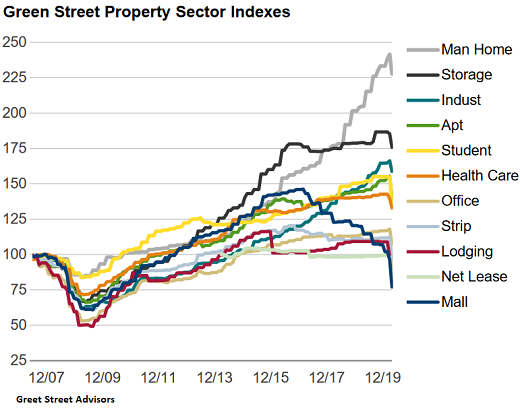

The other segments of the CPPI all dropped in April, but some dropped from record highs such as Manufactured Home Parks (trailer parks) and student housing. Lodging has been weak since 2015:

| CPPI Sectors | Index | %, Apr from Mar |

%, 3 months | % YoY |

| Mall | 77.0 | -20% | -25% | -33% |

| Strip Retail | 95.5 | -15% | -15% | -13% |

| Apartment | 140.1 | -10% | -8% | -3% |

| Office | 107.2 | -9% | -8% | -6% |

| Industrial | 158.8 | -5% | -4% | 7% |

| Health Care | 132.8 | -5% | -7% | -5% |

| Lodging | 91.4 | -7% | -16% | -16% |

| Manufactured Home Park | 227.7 | -6% | -2% | 11% |

| Net Lease | 90.0 | -8% | -9% | -9% |

| Self-Storage | 175.7 | -5% | -6% | -2% |

| Student Housing | 136.5 | -12% | -12% | -9% |

The chart by Green Street Advisors (below is a 13-year version of the 23-year chart) shows to what extent prices of some property types have shot higher in recent years, particularly Manufactured Home Park (top gray line) while prices of mall properties (dark blue line) have collapsed. Even Industrial (green line, 3rd from the top in April), which includes warehouses and fulfillment centers that were red-hot due to the surge in ecommerce, has dropped in April. No category was spared:

The Price Collapse of Mall Properties Will Continue Because Tenants Are Collapsing

Retail properties have been in a terrible mess for years, as their brick-and-mortar tenants succumbed one after the other to ecommerce. This has already wiped out categories such as CD and video stores, and it is wiping out the icons of American shopping: department stores and clothing stores, with some of the biggest chains having already gotten dismembered in bankruptcy court, including Sears Holdings. And even the survivors have shed tens of thousands of stores over the past three years, as “zombie malls” became a meme on the YouTube.

Now come the lockdowns, and the whole process that would have taken a few more years to play out is condensed into weeks and months. This is reflected in the 45% collapse of prices at mall properties since 2016, amplified by the 20% plunge in April.

The list of retailers now on the verge of filing for bankruptcy or having already filed since the lockdowns is getting longer by the day, as is the list of retailers that have announced permanent store closings since the lockdowns began.

This morning, Stage Stores [SSI], with over 700 stores, announced that it filed for Chapter 11 bankruptcy and plans to liquidate unless it can find a buyer.

Neiman Marcus, a luxury department store that last year still had 45 Neiman Marcus and Bergdorf Goodman stores and 24 Last Call stores, filed for bankruptcy last week, latest chapter in a long saga that now involves $5 billion in debt that resulted from a leveraged buyout in 2005 by private equity firms Warburg Pincus and TPG. They sold the retailer in 2013 to Ares Management and the Canada Pension Plan Investment Board (CPPIB) for $6 billion. Ares and CPPIB have been pummeling creditors with the threat of a bankruptcy filing since early 2017 in order to push them into a debt restructuring where they’d get a large haircut. Now they did.

J.C. Penney is preparing to file for bankruptcy as soon as this week and plans to permanently close about a quarter of its 850 or so stores, sources told Reuters last week. The company missed a $17-million debt payment last Thursday; its grace period expires this Tuesday and would trigger a default. It had already missed a $12-million debt payment on April 15; that grace period expires this Friday. J.C. Penney has long been on my list of bankruptcy candidates, causing me to write in July last year, I’m in Awe of How Long Zombies Like J.C. Penney Keep Getting New Money to Burn. But Bankruptcy Beckons .

Lord & Taylor, which has 38 department stores, said last week that it plans to liquidate its inventory once the lockdown allows it to reopen the stores as it will likely file for bankruptcy where it expects that its remaining assets will be liquidated.

J.Crew Group, which was subject to a leveraged buyout in 2011 by PE firms TPG and Leonard Green & Partners, filed for bankruptcy last week and hopes to avoid liquidation, after having come to an agreement with its creditors to reorganize its debts. Creditors will get 82% of the new company. These types of reorganizations lead to many stores being shuttered, and usually end up back in bankruptcy court for liquidation. Brick-and-mortar retailers are devilishly hard to restructure successfully.

Nordstrom, which has a thriving ecommerce business that was already over one-third of its total revenues before the lockdowns, announced last week that it is planning to shutter 16 of its stores.

It has been an intense litany that will continue. Tenants’ collapsing and disappearing one after the other without replacement has a pernicious impact on property prices. The whole CRE sector of mall properties will have to restructure, and much of it will have to be repurposed, and lenders and holders of commercial mortgage-backed securities will have to take their licks – but instead of having many years or even a decade to deal with it, hoping to get out of them before it happens, they’re caught up in it right now.

It just can’t catch a break: Friday after hours, United Airlines disclosed that it abandoned its junk-bond offering after investors balked. Shares fell. Read... It Gets Rough for US Airlines: Why Buffett Dumped His Airline Stocks Though There Was Blood on the Tarmac, Which Should Have Been a Buy Signal

Trying to imagine a future where the malls are now dead, a lot of the chain stores are gone, most windows are now boarded up where there use to be shopfronts, department stores are toast, etc. It seems that the whole economy will need a major restructuring and I suspect that there may be a lot of small mini-businesses popping up to fill the void locally that may not even have an actual store presence. They may operate in small markets and/or operate over the internet but local to their area. Hopefully local governments will try to encourage them.

In Austin, Texas, a number of the local iconic restaurants that have given the city a lot of its character have just announced that they will not be reopening. For those of you who know the area: Threadgills (this was a music venue where Janis Joplin got her start), Magnolia Cafe (west Austin location to close, the other will remain open), and Shady Grove (it really is a shady grove). Of course, the three of these had “pre-existing conditions” and would probably have closed anyway. For example, Magnolia Cafe’s owner mentioned that the closing location had been losing business for a number of years.

I remember all those locals in Austin with live music very well. It’s a pity.

I hadn’t notices Shady Grove was closing. With Threadgill’s gone where do I go for my meatloaf dinner with the rolls and the garlic cheese grits? (The owner of Threadgills was also getting really tired).

Much worse, I think are the signs that a lot of the little mom-and-pop places that made Austin Austin- restaurants, coffee houses do-it-yourself pottery studios and the like are closing and for sale. The people who made the place a paradise are growing old and tired and are ready to cash in.

The good news is that the outlaw ethos prevails: today I swam for miles along a shore covered with cypress trees (officially a no-no), one of the locals out near my country house has discovered that the nearby pasture is covered with psilocybin mushrooms and all the off-the-books construction people are as busy with off-the-books jobs as the local Mexicans are with the “Well, I know we were supposed to close” high-rise jobs. As usual, the young and the blue collar are getting screwed while the old and rich (like me) are doing fine.

Any chance some breadcrumbs could be left to that pasture…looks like a week of nice rains….

I abandoned Austin 6 years ago after almost 20 years there. What was once a decent and interesting place to live has become an insane rat race. The developers have run amok for 3 decades and wiped out a lot of the local flavor. Many iconic live music venues have struggled even after abandoning the high rent of downtown.

When I moved there in the 90s the gospel was “smart growth”; the city expected to avoid the fate of Houston and Dallas with significant investments in transit and infrastructure and affordable housing. But the developers held sway and defeated multiple initiatives so bye bye arty live music town hello high rent traffic clogged nightmare.

When I lived in Austin in the ’70s, it was fantastic. I went to ZZ Top’s First Annual Texas Size Rompin’ Stompin’ Barn Dance and Barbeque on Labor Day weekend 1974. Hot as hell that day. 80,000 strong at Memorial Stadium.

I attended a free concert at the World Armadillo Headquarters in July 1977 with headliner Moxy and opening act AC/DC. It was AC/DC’s first American concert.

I frequently went to Hippie Hollow on Lake Travis. Hippie Hollow was clothing optional 24/7. The drinking age in Texas at the time was eighteen years old. Party hardy time, my friend. But the main reason I moved there was that I needed an education, Longhorn style.

I’ve feared for a while now that the last few whiffs of homespun vibrancy that made Austin what it is may not survive the fallout from this current madness. There’s long been a push toward homogeneity with the explosion of mixed-use buildings and condos on every damn’d corner, along with those Californian’s and their cubist McMansions that pop up like mushrooms (not the fun kind) on double lots sandwiched between humble postwar blockhouses. No fun.

That said, I was in Dallas last weekend and I have to say — Austin still has some blood in it compared to that place.

Sad to hear about Threadgills; I knew the downtown location was already going away, but I didn’t realize the original location on Lamar was also shuttering. Magnolia was never great.

The malls are perfectly positioned to re-purpose their parking lots into drive-in theaters.

The US has had too much retail space for quite a while. The relentless focus on having the American consumer go into debt to maintain the world economy is probably about to come to an end. I suspect retail space is going to drop 25% or more over the next few years.

Restaurants, bars, and entertainment should bounce back but I think it will take at least two years. Few peopel will go in them for at least a year and then it will be a rough couple of years to get capital and get restarted. That is going to be a lot of jobs sidelined, especially in big cities.

Hopefully ,there will be more of a government and corporate focus on returning manufacturing to North America. That can probably absorb some of the big empty buildings for a while but will require a lot of refurbishing. A Sears, Penneys or Neiman Marcus may not be a bad structure to put a light manufacturing operation in.

Imagine the Halloween spookhouse you could put into a deserted mall!

No need to imagine

Though Rosedale was actually a fairly prosperous mall, pre-covid. In part because it has been flexible in making space for services and events as retail declines.

Retailers are tumbling like dominos this side of the Atlantic too – Oasis/Warehouse (mid market womens fashion) went into administration yesterday, and Office (shoes) are likely to follow suit. It seems significant to me that its the mid-market womens section thats hit hardest – anecdotally its my female friends who are most enthusiastic about online fast fashion, men I think like to see what they are buying. Fast fashion and upmarket brands still see ok for now.

The key thing of course is whether the owners of commercial property will accept reality and slash rents – many of those companes going down are perfectly viable if they don’t have pay inflated rates for well located properties. The alternative is to keep retail space empty for its notional value, or find alternative uses. As office and residential are likely to take a hit too, its hard to see alternative uses for either downtown properties or suburban malls. You can only have so many dollar/puund/euro shops.

One helpful policy of course would be stiff taxes on vacant property. Thats vital to stop investors sitting on boarded up outlets, waiting for another economic upturn.

My middle daughter does a sort of fast fashion, through thrift stores, particularly one about 15 minutes away by car. she can walk into this store and come out with a whole season of good quality fashionable clothes–way better quality than new cheap stuff. She has a good eye for suitability and quality. best of all, she can do alterations.

If I had the funds I would be buying commercial real estate.

Might be a little early yet …

(IMO) the only commercial real estate that will tread water for the foreseeable future are the ultra-prestige buildings, the top 10%. Older buildings (think Empire State Building), suburban buildings, etc. are going to get crushed.

Corona makes a good excuse to permanently cut headcount, push people into hot-swapping cubicles, etc.

The one area of real estate that will do well is warehouse space and server farm sites – both are in boom and are likely to benefit even more.

It will be a while before we see evidence of this, but I’ve a feeling that there will be a move away from big floor plate offices to older style buildings which can be subdivided into more individual units. There was already a move away from open plan (they were never as efficient as everyone thought, mostly because of noise levels). Its anyones guess now as to what will be preferred, but I suspect we’ll see a demand for smaller more self contained buildings with more traditional office layouts (i.e. shallow plan, lots of window access). This might, perversely, make older style offices more attractive.

The UK newspapers have recently reported a surge in demand for houses outside the traditional commuter zones – it seems a substantial number of people are already assuming that working from home will be the norm, especially for technical professionals.

Agreed. Somewhere in the 60 pages of the resurrection gospel of St Johnson is an injunction against hot desking. Those unlucky souls will now get to home desk instead, to their likely delight. And open plan is going to become individual or small group offices with a window. Old buildings rock.

Suburban office will do just fine. One to three flight walkups, lots of room, lots of parking.

The ongoing lockdown will be an extinction event for independent small retailers—-crushing rates in 2nd-tier strip malls and likely trickling its way up to the big regional malls—like when plankton die in the ocean, eventually the whales will starve too.

Was thinking about it during Mother’s Day as one could have no problems buying flowers at the grocery store or Mega-Lo Mart—-but all the local flower shops were shuttered. The lockdown is (arguably) unfair for independent florists but the powers that be (arguably) seem determined to whistle past the graveyard of local small businesses.

Wait a minute –

Does our dear leader have extensive real estate holdings ?

Any of it affected by retail losses ?

No, people are flocking to his golf courses and casinos.

Can Trump spell “zero”?

We’ll know when the US Supreme Court makes decision on the Trump tax filings case.

Of course there is no connection to him pushing Powell to lower rates.

Trump’s dream is to get zero or near zero rates for refinancing all his properties. As President that would be his Mission Accomplished. He is not stupid, poorly educated but not stupid – and street smart like the guy selling his “wares” on the street corner.

In my neck of the woods the town center was already dying as the small-shopfront traders were losing out to ecommerce and the superstores springing up on the town’s boundary. A cafe culture survived to service day-time office workers but even the bars and restaurants were dying unless they had that rare and expensive town-center facility, their own car-park. Otherwise visiting them meant using a half-deserted multi-story car-park – and paying for the privilege – and walking through hopefully empty streets to get there. An unpleasant experience better avoided.

This is a consequence of generations of anally-retentive town planners with their boxes for ‘retail’, their boxes for ‘commercial’, their boxes for ‘manufacturing’ and their boxes for ‘residential’ all neatly delineated by their felt pens.

My hope would be to see that all wiped away and life return to the town centers with apartments and town-houses in the main streets and where the malls once stood, supporting the bars, restaurants, theaters &tc. amongst them.

The question will be, at what standard of living will all this happen, 1940’s or even 1920’s?

Yes this is a consequence of decades of “City Planning” past its sell-by-date. Like other financial items, it’s takes us back to the early 1970s when it its conceptual flaws became apparent. Even urban neighborhoods were affected, negatively.

Robert Pippin’s thinking on civility brings us back to the need for Urban Villages, where people can interact informally, managing common needs without the needless complications of “Smart Cities” digital innovations.

Pippin’s book is The Persistence of Subjectivity.

Best solution for malls: multi-family residences over (or beside) retail. Please, flats, not “town homes” … too many stairs for the elderly.

This provides affordable housing (the lot is already paid for), and helps revive the commerce, admittedly on a smaller scale. Additional benefit: if they are dense enough such “lifestyle” centers provide transit ridership. This is a solution to a lot of the brick-and-mortar problems that’s already been tested, and has some market acceptance. At one time, Wikipedia said such centers had higher earnings per square foot than single-use sprawl centers. On the other hand, the architects proposing conventional shopping

Will we do it? We’re already plumbing the depths of horrible stupidity, so I have my doubts. Still, worth mentioning, as I see it.

https://www.syracuse.com/coronavirus/2020/05/fitch-downgrades-nearly-300m-in-bonds-on-destiny-usa.html

“Syracuse’s industrial development agency issued the bonds to finance and then refinance the Pyramid Cos.’ expansion of the shopping center, originally named Carousel Center, into the larger mall it now is. They consist of $82.6 million in bonds issued in 2007 and $209.4 million in bonds issued in 2016.

….

The bonds are just a portion of the debt on the highly leveraged mall. Pyramid also took out $430 million in mortgage loans on Destiny. Those loans, now part of commercial mortgage-backed securities, were recently transferred to a special servicer because they are in imminent danger of default, according to the Kroll Bond Rating Agency.”

Those retail stores that cater to the least wealthy, and most distressed- like Dollar General – are thriving in hard times. Stock is actually UP for 2020. The ones to go are the Dinostores, not adapted or adaptable to the present or the future realities.

I live in Jax, Florida. This Mother’s Day my wife and I saw multiple small restaurants and bar/restaurants filled to overflowing. Yes, it was that special day, but still, there is a pent up desire to go out to eat, to hang out in your local bar.

There was no social distancing and only the staff wore masks and gloves.

My wife and I did not go to any such venues. My point is, at least here locally, it appears those local venues who did not throw in the towel will be well attended. That may taper down, some will close, finally succumbing to the shutdown. But at least here in Florida, I think many will survive.

Malls have been tottering along for a long while now. Real estate in general has been overpriced in my view.

Notice how many chains are or were, under the control of private equity. PE appears to be a rapacious entity that is mostly destructive and seems to be as much an underlying problem as any shutdown. There is plenty of cheap money available.

I’m just trying to imagine what is happening with the American Dream Mall (originally Xanadu) in the Meadowlands, NJ. It’s construction dates to before the 2008 bubble – and it was supposed to open this year. Indoor ski slope, water park, etc.

Anyone have predictions for the housing market? Will there be foreclosures abound by 2021? I see houses still selling in my area.

I recall seeing a WSJ story that said prices are if anything higher now because people who don’t have to sell are pulling properties off the market, so those that have to buy (job move, divorce) are faced with less supply. Also as Bloomberg and the WSJ have pointed out, Mr. Market is expecting a V shaped recovery, which even they are pooh-poohing, so the buyers may be in sectors that they can tell themselves are insulated from the disease.

Last time around, there were so many defaults in some areas like Las Vegas that the bank servicers were holding off on foreclosures, since they didn’t want to have to manage all those properties with no buyers if they were to foreclose. Cheaper for them to keep non-paying homeowners in place. And in some states that toughened up on procedures, like NY, foreclosure takes a really long time.

So even though logically they ought to be up, weird dynamics could wind up dominating a lot of local markets.

I’m interested in buying a house in the Detroit metro area. I don’t see this area bouncing back like other cities. I’ve been looking for a house since late last year but now just waiting to see what happens in the next six months.