Yves here. New technologies aren’t necessarily “winner take all” but the benefits are concentrated.

By Nicholas Bloom, Professor of Economics, Stanford University; Tarek Alexander Hassan, Associate Professor of Economics, Boston University; Aakash Kalyani, PhD student, Boston University; Josh Lerner, Jacob H. Schiff Professor and Chair of the Entrepreneurial Management unit, Harvard University; and Ahmed Tahoun, Associate Professor, London Business School. Originally published at the Institute for New Economic Thinking website

Rising inequality has focused attention on the benefits of new technologies. Do these accrue primarily to inventors, early investors, and highly skilled users, or to society more widely as their adoption generates employment growth? This paper aims to trace out the impact of 20 new technologies on employment of low and high skilled workers around the birthplace of the technology and across the US.

Policymakers are also focused on the location of technology, with growing competition between nations and regions to attract nascent industries and technologies. Whether payments to attract professors specializing in artificial intelligence and biotechnology researchers, the construction of facilities to house new firms, or matching funds provided by angel or venture capital investors, governments have sought to establish an early presence in promising industries.

In undertaking these initiatives, policymakers have been attracted by the success of technology clusters such as Silicon Valley, Herzliya, Shanghai, and Shenzhen. The success of the Boston area in biotechnology illustrates the positive dynamics that can occur. The initial wave of start-ups spinning out of Harvard and MIT in the 1980s and 1990s resulted in a number of significant enterprises, such as Biogen, Genzyme (now part of Sanofi), and Vertex Pharmaceuticals. The region has continued to attract new entrants, raising almost $5 billion dollars in venture capital in 2018 alone. Finally, the presence of academic institutions and younger firms have attracted investments in major research facilities by established firms from elsewhere, such as Novartis, Pfizer, and Takeda. Between 2010 and 2018, the Massachusetts biopharmaceutical sector grew from 55 to 74 thousand jobs.

But despite the many billions of dollars devoted annually to the attraction of infant industries, these policies have attracted relatively little systemic attention from economists. Motivating the policy interventions by governments are two propositions. The first is that public interventions will effectively enhance the presence of an emerging industry in a given region; the second, that this initial activity will yield long-run impacts for the region. Our INET working paperexamines the second of these claims.

To do so, we study the evolution of twenty new technologies in the United States from 2002 to 2020. We develop a methodology for systematically identifying two-word phrases, or “bigrams,” associated with a new technology. We then look for documents linked to these new technologies, including U.S. patents, earning calls from publicly listed firms, and job announcements in the Burning Glass database. This evidence allows us to assess the impact of these technologies along a dimension of crucial importance to policymakers: employment. In particular, we examine the evolution of the number, location, and quality of new jobs associated with these new technologies.

The key results of our analysis are as follows:

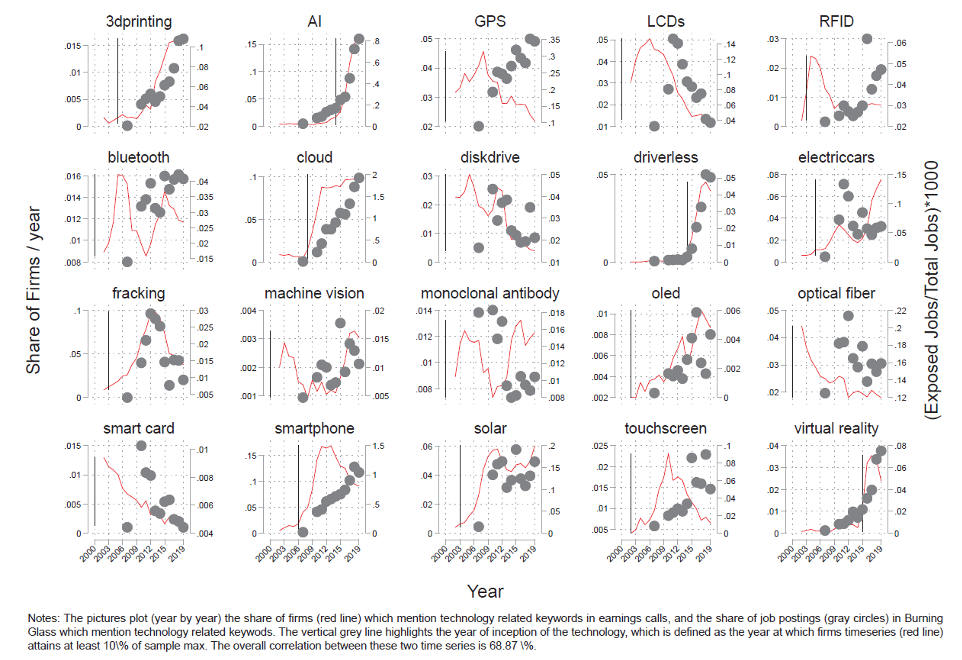

Earnings call mentions and hiring announcements linked to the new technologies rise in parallel over time. See Figure 1

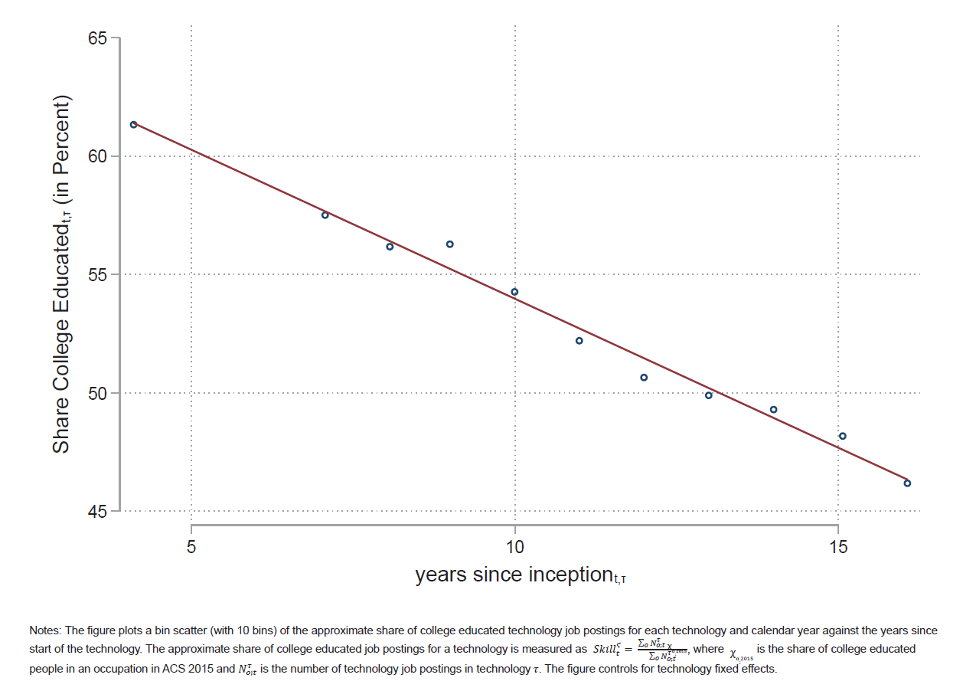

While initial hiring is focused on high-skilled jobs, over time the mean skill level in new positions associated with the technologies declines sharply, which we term a “skill-broadening” effect. See Figure 2

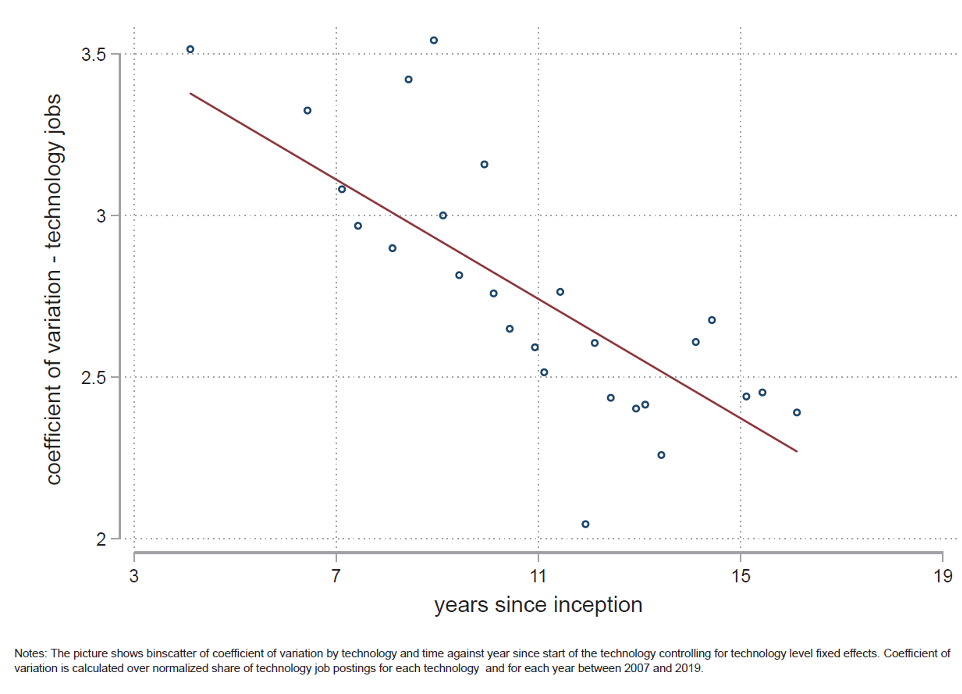

New hiring in new technologies increases its geographic footprint over time, becoming less concentrated, which we dub “region broadening.” See Figure 3

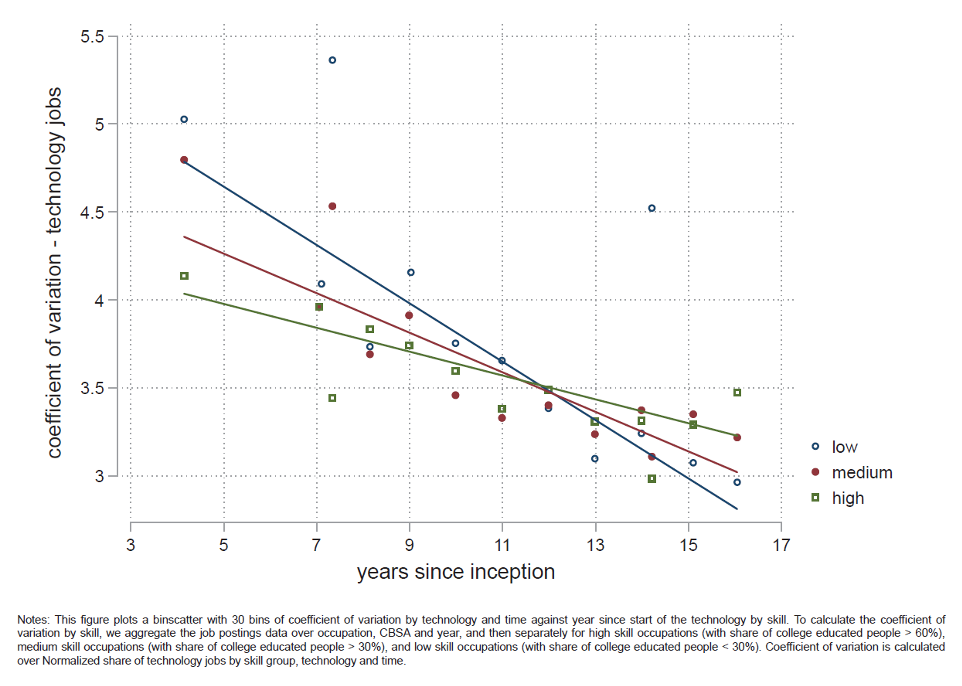

The initial geographic hub retains an important advantage that persists over time. This pattern is particularly pronounced among high skill jobs. See Figure 4

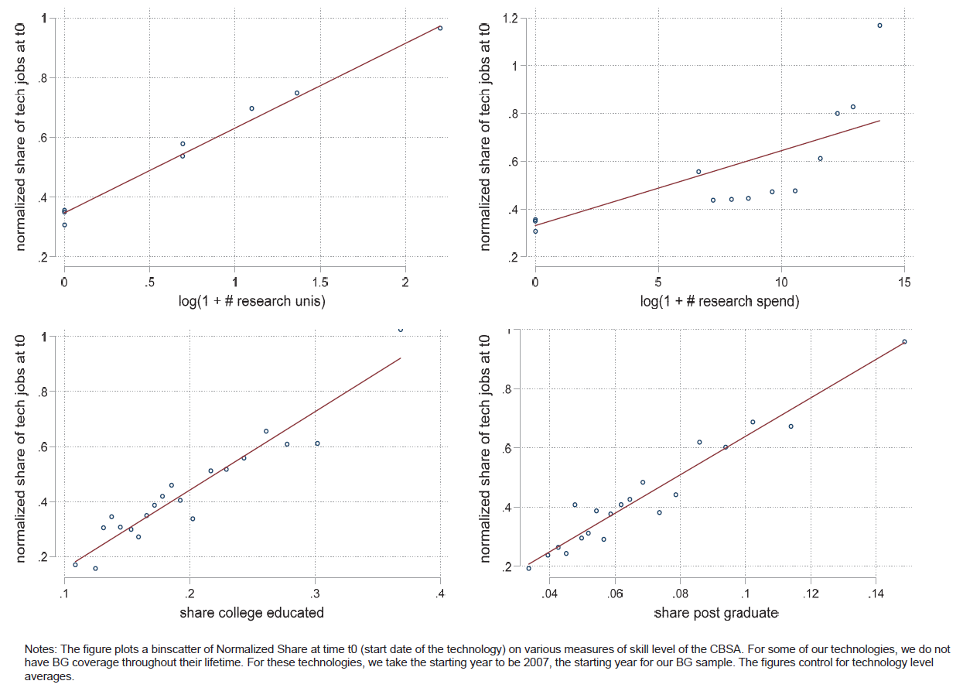

Hubs are most likely to arise around universities and areas with more educated populations. See Figure 5

Our work thus suggests a strong advantage for areas that were associated with the earliest activity in a technology. Despite the skill- and region-broadening effects alluded to above, not only does a disproportionate share of new employment continue to locate there, but especially the most desirable high-skilled positions.

Figure 1 – Technology Exposure in Earnings Calls and Job Postings

Figure 2 – Share of college educated by year since start of technology

Figure 3 – Coefficient of variation by year since start of technology

Figure 4 – Coefficient of Variation by year since start of technology by skill

Figure 5 – Technology jobs vs local skill composition

Here’s another interesting paper found from evgeny morozov’s latest project https://the-syllabus.com/ – Technology as Ideology in Urban Governance –

https://www.tandfonline.com/doi/abs/10.1080/24694452.2019.1660139?journalCode=raag21

This seems to hark back to ‘cluster analyses’ of the 1950’s and 1960’s. Back then the big interest of development economics was the benefits of clustering high productivity uses in geographical areas to encourage local multiplier effects. Sometimes it involved universities as well (this is why the UK has so many big universities in out of the way parts of Wales and northern England). The Italians tried to cluster high energy use developments in the south. In Ireland, they attempted to merge lots of small FDI projects in related areas in similar geographical areas. This was based on years of research by geographers on clustering and ‘first mover’ effects.

It fell out of favour over the years because most attempts to manage clustering impacts were expensive failures. It takes a lot of effort to really get clusters going, and there seems a mysterious ‘secret sauce’ that nobody has yet quite identified as to why some take off, and others don’t. I suspect its a mix of being the first entrant (why, for example, silicon valley? It has nothing particularly special that other regions lack), along with a certain element of randomness.

Having said that, with sufficient effort and scale of intervention, it can be done. The Chinese have certainly done it with a rigorous approach to mixing infrastructural investment, educational establishment, and sometimes just brute force. The South Koreans likewise through sheer force of will turned remote farmland into major industrial hubs, even when there was nothing but a political reason for their existence (Daeju, being one example). But the developing world is littered with failed expensive attempts to do the same thing.

Intriguing macro analysis in the piece, and great comments, PK and others. These macro trends are well worth pondering! Especially in conjunction with the FT graphic Lambert has posted elsewhere showing which sectors and firms have gained in 2020 in spite of Covid.

Matt Stoller (who’s very on point these days on many topics) recently flagged a great blog post by David Rosenthal The Death of Corporate Research Labs which seems germane here. Rosenthal in turn quotes extensively from this 2019 paper.

A few highlights (again, please read the originals):

1. Research in corporations is difficult to manage profitably. Research projects have long horizons and few intermediate milestones that are meaningful to non-experts. Companies have increasingly concluded that they can do better by sourcing knowledge from outside.

2. Historically, many large labs were set up partly because antitrust pressures constrained large firms’ ability to grow through mergers and acquisitions. In the 1930s, if a leading firm wanted to grow, it needed to develop new markets. The more relaxed antitrust environment in the 1980s, however, changed this status quo.

3. The past three decades have been marked by a growing division of labor between universities focusing on research and large corporations focusing on development. Knowledge produced by universities is not often in a form that can be readily digested and turned into new goods and services. University research has tended to be curiosity-driven rather than mission-focused.

4. Corporate labs work on general purpose technologies that benefit their product space. Bell Labs had a connection to the market, and thereby to real problems. Corporate labs are also multi-disciplinary and have more resources. Large corporate labs may generate significant external benefits to society and the broader economy.

5. Mismanagement of leading firms and their labs can sometimes be a blessing in disguise. Nvidia was started by a group of frustrated Sun engineers.

I wondered what 20 new technologies in the United States from 2002 to 2020 we had benefitted from. The list of technologies listed in Figure 1 is most curious and something of a sorry list. Many of these technologies are neither especially new nor especially technical or characteristic of what could be classed as US technology. Some received considerable support from the US Government — GPS, RFID, AI, virtual reality — something fairly important that the analysis does not appear to take into account. Indeed, almost all these new technologies received substantial though indirect Government support — consider petroleum subsidies and fracking or the on-again-off-again tax write-offs and credits for solar. Some of the technologies are little more than minor improvements on existing technologies. Others of these technologies are straightforward improvements to existing technology often taking advantage of improvements in packaging and package density thanks to Moore’s law – diskdrive, smart card, smartphone, machine vision. Such newness as optical fiber, or solar might claim seems less ‘new’ than incremental improvements to an existing technology. I am not sure how LCDs and oled fit into a picture of US technology — most of their development has not been done in the US since the last Century. I have trouble thinking of bluetooth as a ‘technology’. It’s just a commercial radio protocol. The touchscreen, driverless [vehicles], electric cars are less technologies than marketing approaches, efforts to pry money from dreamy investors, or cover for another intent — like the hype on electric cars as a cover for greatly increased sales of other vehicles. That leaves 3D Printing, fracking, and the cloud along with monoclonal antibodies. I don’t know much about monoclonal antibodies and cannot assess their newness or importance as technology. I don’t know what to make of 3D printing. It seems promising at a nano-scale but that still seems to be a technology tied to an academic materials lab. Many of the 3D printers at other scales are simple improvements and extensions of x-y-z platforms — already well along their development as desktop printers and CNC machines. I have trouble thinking of fracking as a new technology, and I began my career in computers working on a local IBM HASP-run ‘cloud’ over fifty years ago.

Looking over the 20 new technologies studied in this research I less than marvel at learning “… a disproportionate share of new employment continue to locate there[areas that were associated with the earliest activity in a technology], but especially the most desirable high-skilled positions.” I do marvel at what seems a sorry list of new technologies from the last twenty years that were identified as worthy of economic study.

Why Silicon Valley?

It may surprise some to know that the Silicon Valley area has been associated with electronics for over a hundred years.

For example:

The “audion” vacuum tube invented by electronics inventor Lee de Forest (“Father of Radio”) in 1906 and his development of the 3-element triode vacuum tube the following year started the Golden Age of Vacuum Tubery. There is an “Electronics Research Laboratory” marker at 913 Emerson St., Palo Alto, CA

The television pioneer, Philo Farnsworth, also had his research laboratory at 202 Green Street in San Francisco (1927).

Hewlett-Packard started in the area in 1939 (Hewlett and Packard both went to Stanford) and their electronics firm predated the transistor.

But probably the reason Silicon Valley became the center was due to the decision of William Shockley (raised in Palo Alto) to establish Shockley Semiconductor Laboratory in 1956 in Mountain View, CA to be near his ailing mother.

https://en.wikipedia.org/wiki/William_Shockley

From accounts I read and lectures I have attended, Shockley was an abrasive and terrible manager, but he hired talented individuals such as Robert Noyce and Gordon Moore (Intel founders).

The “Traitorous Eight” left Shockley’s employ and originated many of the Silicon Valley Companies.

from https://en.wikipedia.org/wiki/Traitorous_eight

“A group of about thirty colleagues who had met on and off since 1956 met again at Stanford in 2002 to reminisce about their time with Shockley and his central role in sparking the information technology revolution. The group’s organizer said, “Shockley is the man who brought silicon to Silicon Valley”

Short summary may be that Silicon Valley was started by an unsuccessful, Nobel Prize winning entrepreneur, with an eye for talent, who wanted to be close to his ailing mother.

Government planning does not seem to be much of a factor in the creation of Silicon Valley..

Why Silicon Valley?

No non-competes. Firms that aren’t dynamic enough losing their employees. Engineers moving from firm to firm, spreading knowledge.

That doesn’t reward the originator, but it does speed up and create many parallel attempts to bring a technology to market.

Who benefits?

The same people who’ve benefited from every ‘next big thing’ for the last forty years.

Rich folks otherwise worthless kids.