Jerri-Lynn here. This analysis of the dire conditions confronting airlines reinforces this post by Yves yesterday, Fliers Beware: Poor Mask Discipline Endemic Even Among Airline, Airport Staff, admonishing airlines and airports to get tough on practicing mask discipline, so as to help restore some passenger confidence that one won’t get sick by grabbing a flight.

For those who’ve yet to read it, I highly recommend Hubert Horan’s deep dive into the airline’s woes, Hubert Horan: What Will it Take to Save the Airlines?

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Delta Airlines came out with the mother of all revenue-warnings when it said in an SEC filing this morning that its revenues in the second quarter, ending June 30, would collapse by 90% compared to the second quarter last year.

In addition to the collapse of demand, it has “experienced significant ticket cancellations” (refunds are counted as negative revenues), and it has waved change fees, which used to be a big profit center, and it is giving out “other refunds,” and they all “have negatively affected our revenues and liquidity, and we expect such negative effects to continue.”

And it cannot predict the effects of this unpredictable future, not even the near-term effects. “The longer the pandemic persists, the more material the ultimate effects are likely to be,” Delta said. “It is likely that there will be future negative effects that we cannot presently predict, including near term effects.”

It added a slew of dismal data points and warnings, along with the hoops it has already jumped through and still needs to jump through to stay in business, including billions of dollars in help from the taxpayer. It was a doom-and-gloom report that not even a sworn doom-and-gloomer would have been able to imagine not too long ago.

Delta’s shares dropped 7.4% during regular hours, and another 7.0% after hours, to $29.40, after having already dropped 7.6% yesterday. It seems, some people knew yesterday what Delta would announce this morning. Over those two days combined, including after hours today, shares have plunged 20.3%.

Delta’s 90%-revenue collapse in Q2 came even as travel restrictions have begun “to ease,” it said.

In response to the collapse in demand, Delta has cut its capacity system-wide by 85%. As demand returns, it plans on rebuilding its flight schedule.

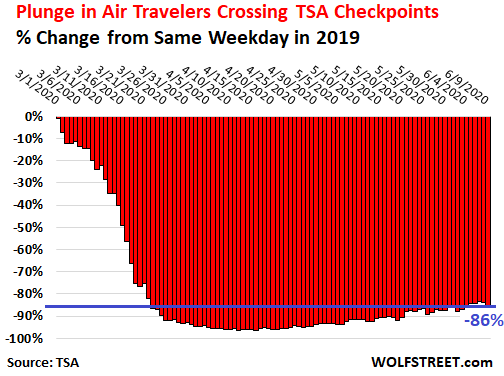

This is an industry-wide problem. According to the TSA, checkpoint screenings at US airports – a measure of how many people are getting on a plane – were still down 86.1% yesterday, compared to the same weekday last year. This has been inching up only in tiny increments. TSA checkpoint screenings over the Memorial Day weekend were down around 87%. During the worst days two months ago, screenings were down 95%:

Only a “Modest” Demand Recovery. And Some Demand Destruction Could Be “Permanent.”

Delta said that “we believe” that there will be a “modest continued demand recovery, particularly with domestic leisure travel beginning to return as states lift shelter-in-place orders.” But it expects international demand to “lag” domestic demand.

Demand issues could drag on as private and public sector employers have switched to work form home and are “otherwise dissuading or restricting air travel,” it said.

Conventions, conferences, big sporting events, concerts, and similar events “have been, and are continuing to be, cancelled, reducing the demand for both business air travel (which drives our most profitable ticket sales) and leisure air travel.”

And some demand destruction could be “permanent.” Delta said it cannot predict whether the pandemic “will result in permanent changes to our customers’ behavior,” such as “a permanent reduction in business travel as a result of increased usage of ‘virtual’ and ‘teleconferencing’ products and more broadly a general reluctance to travel by consumers.”

People May Be “Dissuaded From Flying…”

Delta lists some reasons that may dissuade people from getting on a plane, including:

- Wariness of airports and planes “where they may view the risk of contagion as increased”;

- Dislike of “enhanced COVID-19-related screening measures” at airports;

- “Concern that additional travel restrictions implemented between their departure and return may affect their ability to return to their homes.”

The Mad Scramble to Stanch the Cash Bleed.

Delta expects to reduce average daily cash outflow to about $40 million per day by June 30, down from about $100 million per day as of March 30. This reduction in cash outflow is a result of two factors:

- Having slashed operating expenses in Q2 by over 50%

- The “recent improvement in net sales,” in part due to the “stabilization in refund requests.”

It is already implementing or is considering other cost cuts, “such as deferral of nonessential maintenance, capital expenditure reductions, voluntary early retirement and opt-out programs, hiring freezes, facility closures, deferral of pension funding, and compensation reductions.”

Alas, yup, all these cuts “could also negatively affect our service to customers, revenues and results of operations.”

But hey, this is survival mode. The goal is to reduce the average daily cash bleed “to zero” by the end of the year, it said. To get there, it expects to cut costs further, and demand will have to pick up.

The Mad Scramble to Raise Cash.

Delta has raised “more than $10 billion” since early March, it said. At a burn-rate of $100 million a day, as was the case at the end of March, this would have lasted a little over three months. At the burn-rate of $40 million a day by June 30, the breathing room lengthens.

This “more than $10 billion” in cash came from these sources:

- $3.8 billion from taxpayers via the Payroll Support Program in the CARES Act. The package, when released in full, will be $5.4 billion: $1 billion in loans at an interest rate of 1% for five years; and $4.4 billion in warrants with a five-year term and an exercise price of $24.39 per share.

- $3.5 billion from issuing senior secured notes due 2027.

- $4.4 billion from two loan facilities.

There’s Still some “Unencumbered Collateral” Left.

Aircraft, “some engines,” and spare parts that have not yet been pledged as collateral amount to “$6-7 billion of unencumbered collateral” that could be used as collateral for more debt, to raise more cash.

Some of the “unencumbered” aircraft might also be sold and leased back. Since March 31, Delta has already raised $1.2 billion from such sale-leaseback transactions. These leases are a form of debt. Delta said it will classify them as “other noncurrent liabilities.” And they can get expensive. But hey, the only thing that matters at the moment is survival.

And it said that it still has borrowing capacity under its revolving credit facilities. The goal is to pile up as much cash as possible to get through this and worry about the mountain of debt later.

This Is the Most Unpredictable Future Ever.

“We are unable to predict how long these conditions will persist, what additional measures may be introduced by governments or private parties or what effect any such additional measures may have on air travel and our business,” Delta said.

“Furthermore, not only is the duration of the pandemic and future correlative combative measures at present unknown, the overall situation is extremely fluid, and it is impossible to predict the timing of future material changes in the situation,” it said.

“It therefore is impossible to predict whether any such unknown future developments will occur in the near, medium or long terms, and depending on the duration of the pandemic, such negative developments may occur over the entirety of the event,” it said.

Warren Buffett sold all his airline stocks, including his huge position in Delta in mid-March, when everything appeared to go to heck in a straight line. This was an unusual move for him: Blood was on the tarmac, and that would normally have been a buy-signal. But he dumped his shares.

For him, the entire equation for airlines changed. For him, this wasn’t a short-term blip followed by a steep V-shaped recovery, but a long-term structural issue that would leave the survivors burdened with so much debt and so many uncertainties that the flight path to the new normal, whatever that would be, would stretch over years for the lucky ones. And Delta today confirmed those fears.

Never let a good crisis go to waste. US production of crude steel, #4 in the world, plunged 32% in April. India’s production, normally #2, collapsed 64%. Read... Crude Steel Production: China Blows the Doors off Rest of the World During Pandemic After Already Huge Surge in 2019

One other negative factor that will hit some airlines – its already cost Ryanair a small fortune in Europe – is fuel hedging. Some airlines have expensively hedged on an assumption of gradually rising fuel prices over the next year or so. They will be paying out on these at precisely the time when their cash flow is critically constrained.

One industry to look out for is aircraft leasing – I would guess many airlines will be looking very closely at the fine print of leasing arrangements to see if they can hand the aircraft back cheaply. This could have terrible implications for Boeing if a flood of cheap nearly-new 737’s hit the market.

Incidentally, very quietly, the Japanese seem to be abandoning the Mitsubishi Spacejet. With the Sukhoi Superjet in huge trouble, this is one bright spot for Embraer – its pretty much the last manufacturer standing in the sub-737 regional market. Ironically, Boeing broke up its deal with Embraer at exactly the wrong time. The problems for Boeing just keep piling on. Airbus is in bad shape, but it looks like it will emerge stronger than any other aviation company, it will pretty much be the last one standing.

The big airlines seem desperate to pretend that this is just a blip, but I think its increasingly apparent that the aviation industry will face fundamental changes. Business/conference travel has been wiped out, for a few years at least. I think people will still want their regional 1-2 hour flights, but they will take significantly fewer of them. The big hubs will suffer most i think, people will avoid them if possible. I think the only segment of the market that might emerge relatively unscathed is the long distance point to point flight – people will still need to visit relatives, have a dream holiday, do essential business. The other growth area seems to be air freight. They are already looking into converting A380’s for freight.

Re fuel hedging, does this include an open-ended obligation to buy a certain amount of fuel at that price? If planes aren’t flying the price of fuel is surely a side issue.

I don’t think fuel price can be a side issue for airlines, moreover if the airplane seats are not packed with travellers. It compounds with all the trouble and if you cannot profit from the remainers of your shrinking business this is an existential risk.

Vlade explains it well. I meant a side issue in the sense that in my case, I have not put fuel in my car for ages because I have not used it so it is irrelevant to me what the actual current price is. My question was more whether the airlines were obliged to buy the fuel, even if they were not going to use it. Sorry if I was a bit unclear.

Thank you John. Your explanation was very clear and vlade’s answer clarifying. Mine was only to say that fuel cannot be a side issue in airlines IMO.

No, these are usualy cash-settled futures, based on the amount of fuel the airlines expected to need.

So if they need 10% of the fuel, but hedged it at price which is now say 3 time higher than spot, they will practically have to pay a lot for nothing.

Think about it this way. Say you are a mill, and need 100 tons of wheat. Instead of buying it all on open market, you buy it via futures, locking your price in. Under normal circumstances, this is great, you process your 100 tons, sell the flour, make money. If the price of wheat collapses, ah well, you could have made more money, but you know, it’s not the end of the world (this assumes, for the sake of the example, that the price of the flour won’t collapse too).

But what it your mill burns down and you have no use of the wheat? And the price of wheat collapsed, you have to either buy the 100 tons you’re obliged, or settle the market difference. Either way, you’re going to lose a ton of money at the worst time.

Thank you! That was a very helpful analogy.

Wait are you saying oil hedges will be a millstone around deltas neck?

Delta purchased an oil refinery in 2012 as it’s means to control fuel costs. They spent $100M to increase aviation fuel production. This adds a huge layer of complexity and risk beyond hedging. They had been looking for partners last year probably to mitigate the risk. It was a good move until it wasn’t.

While I recognize the significant economic impact the failure of airlines will have on many peoples’ lives, I cannot help feeling a bit of schadenfreude. The airlines have spent years making their customers’ lives worse in order to increase their profits and enrich their shareholders (and executives, certainly cannot forget them). Fees for everything, continued shrinking of space on planes making travel less and less comfortable, not to mention surly staff whose lives have also been immiserated by their bosses.

Now, airlines are in trouble and they need people to fly. And, while there are both financial and health reasons to avoid flying right now, it is hard not to think that a bit of goodwill from customers might help the situation. I doubt any of these companies will find that.

One issue that does not appear to be a problem in the United States, but is here in Europe, is refunds. Here, despite an EU law requiring refunds within 7 days if a flight is cancelled, airlines are simply refusing to provide them while lobbying the EU (with the support of national governments) to allow the airlines to provide only vouchers. At the same time, they are lying to customers claiming that they are “processing” refunds, which I doubted from the beginning, but now that over 90 days have passed since my first refund request I know is a lie.

At least here we have good train systems, which are more comfortable anyway.

Morpheus: Regarding your third paragraph. I was supposed to fly from Chicago to Turin via Munich on Lufthansa in early May. Lufthansa dawdled and finally canceled the flight about ten days before–but I was notified of the cancellation first through American Express and not directly.

Now, because I am in the U S of A, Lufthansa is pretending that I should simply re-book, within a certain time span, for a flight to leave before mid-2021. Am I getting any solid communications? No.

At least the EU is making noises about rules about refunds. The U S of A, where there truly no longer are any laws or regulations to rein in the powerful, is letting the airlines do whatever they want. Lufthansa is only too happy to deal with its U.S. businesss in a way that the German authorities should be highly skeptical of.

If the refund is a legal obligation that isn’t met, will the CC company reimburse? I know there’s a time limit for CC claims, but for a future service like a flight, does that count from purchase (perhaps 9 months earlier) or failure to deliver?

A lot of the budget airlines (in Europe, anyways) do not accept CC or surcharge. Also, the UK (for example) has a statutory minimum of GBP100 to reclaim, which may not be sufficient for a single traveller (would be for a family).

I don’t know about Amex, but for Mastercard and Visa, you have 120 days from the purchase for most chargebacks.

I am having the same problem with Norwegian airlines. They just cancelled my flight, and in fact have shut down all operations in San Francisco. That left me scrambling to buy more expensive tickets as I can’t shift the date of my flight.

They want me to take “Cash points” whatever the heck those are. And what use would they be if they don’t even operate in my area anymore? No thanks, I want my money back, and I told my CC company that they have failed to deliver the goods.

Let us not forget egregious levels of CO2 productIon. There is no interest in a greener airline fleet. Anything that brings this engine of destruction to a halt has to be a good thing.

My crocodile and me are beside ourselves with grief and sorrow. The tears keep flowing /s

We own a small free-standing purpose built (1996) 2 bedroom vacation rental in southwest Montana.

I built it with a cashed-out 401K when I was fed up with the ruse that is the stock market, and excessive executive pay.

Late Spring through Fall are our salad days. All bookings cancelled (understandably).

Between Covid, the airlines, VRBO and Air-B-n-B — Oh! The Pressure!

Luckily, no debt associated, overhead is stripped-down utilities and astronomical real property tax.

Could be worse.

Have not pulled the plug on the 20+ year old business and converted to workforce housing, always an option. Going to be a long road to ‘recovery’.

It looks like some airlines will have to shrink themselves to survive or even amalgamate. Get rid of older aircraft as they are not so fuel efficient and have higher maintenance costs. Cut orders for new aircraft, especially the Boeing 737 MAX as that is a hole in the ground about to happen. But the losses in personnel will be huge. Pilots simply won’t be able to get a job with a foreign airline now as this situation is everywhere though some might opt to rejoin the military. Stewardesses will probably have to leave the industry entirely but where will there be jobs that will suit their training? MacDonalds? No happy answers here.

The airlines are really the “Canaries” in this coal mine of ours.

Air travel is the apex of “normal” transportation. (We can ignore hyper-wealthy modes of travel, such as yachts and private jets. They are a special case.) It shows the results of two trends in today’s economies. One trend is the segregation and accumulation of wealth and the other is the shrinking of available work. The two work together to create a Hyper Robber Baron system.

In the Delta missive, they mention in passing that business travel is their most profitable class of booking. Given how much of the economy has been “streamlined” due to ‘shareholder equity’ issues, I am surprised that business travel hadn’t been ‘downsized,’ either through resources allocated to or number of flights scheduled previously. The Covid phenomenon may have been more of a trigger to begin a process the field was already overdue to experience.

Reverend

Surely you recall that flight attendants are there primarily for our safety (as they used to tell us in our briefings).

So they are over-skilled for fast food duties. Instead they should become our cities’ new generation of unarmed conflict resolution specialists – to replace the cops.

Complementary pretzels, with each family dispute!

This IS better than the old PD.

Who knows how the private jet companies are doing? Sales up? People forming co-ops to purchase, lease?

Given the semi-divine nature of the “myth of the rugged individualist” in our society, I would not expect much in the nature of co-operative ventures in the class of people who could become involved in such enterprises.

I think there’s more working against co-opts than just “rugged individualism”; e.g. what’s to prevent a successful one from being taken over via a leveraged buyout? Via loans from what is, in essence, a government-privileged counterfeiting cartel, aka “the banks”?

Or, if they are not taken over, what’s to prevent them from engaging in abusive practices themselves via “the banks”? Thereby becoming part of the problem?

See netjets.com

There is an interesting post over at Leeham News (a great source for aviation info and gossip).

It appears that the collapse of new aircraft engine orders is a bright spot for engine manufacturers, as they lose money on every engine shipped. Money is made in parts and maintenance. Sort of like ink jet printers and ink cartridges, my old employer.

(PW is Pratt Whitney, GTF is Geared TurboFan)

“PW loses money on each GTF it delivers. This is not unusual in a new engine program with any manufacturer. Because of steep discounts, sometimes up to 80%, it may take 10 years or more for an OEM to make money on the sales. ”

One more deranged business model…..

https://leehamnews.com/2020/06/08/pontifications-pratt-whitney-uses-covid-crisis-to-catch-up-on-gtf-fixes/

Financialization strikes again. Making things that do not result in any profitable gains … I bet there is some cheap Federal reserve money in Pratt and Whitney’s bank account.

I have the feeling that by the time the commercial airlines, or what is left of them, recover from COVID-19 and pandemic travel bans, the second law of thermodynamics will deliver the “double tap.”

Crude is dirt cheap now but all the oil majors are cutting back on Capex and exploration. Once the glut gets worked off we could see a huge spike in price, or it could simply go to zero as nobody is going to spend 10 barrels of oil to extract 9.

These dinosaurs need to die off in the name of climate change anyways.

FYI. Just average citizen who has had no impact to my income. I’ve looked around during this break and made major cuts to my spending, habits and “needs.” These are permanent on my part. I’ve been finding others have done the same. Recovery is going to have a new meaning going forward.