Yves here. To add to Ilargi’s discussion on the long-standing, premature predictions of the death of the dollar:

1. If you look at not-much longer periods (pre-Brexit) the dollar was much weaker against the pound and the euro. So a modest retrace is noise.

2. The US cannot involuntarily default in its own currency. It can create too much inflation. With the massive deflationary impact of Covid-19, that’s not an imminent risk.

3. Being the reserve currency requires getting a lot of currency into foreign trade partners’ hands. That means running trade deficits, as in exporting jobs. China is mercantilist, and sees the point of trade as running a surplus, which is tantamount to importing jobs. So China is not willing to do what it would have to do to displace the dollar.

By Raúl Ilargi Meijer, editor of Automatic Earth. Originally published at Automatic Earth

It won’t come as a surprise to anyone that the first half of 2020 has brought, among many other things, renewed calls for the demise of the US dollar. It’s been pretty much a non-stop call for over a decade now, and longer. But this time, like all previous ones, I’m thinking: I don’t see it. I guess my first question is always: please explain why the dollar would collapse before the euro does.

For one thing, the dollar would have to collapse/default against one or more “entities”. The dollar is not like one of those highrises that collapse upon themselves. It will have to default or collapse against something(s) else. Since it is the world reserve currency, that means there would have to be a replacement reserve currency. Yes, that could also be for example gold or SDR’s, or even a basket of currencies, and something like that may happen eventually, but it doesn’t appear in the cards in the short run.

There are really only two candidates for the role, and neither looks at all fit to play it. The euro may have some ambitions in that direction, but it has far too many problems still. The yuan/renminbi certainly has such ambitions, but the Communist party refuses to let it get on stage to show what it’s got. As I recently wrote:

The main sticking point for Beijing is a conundrum it cannot solve. The CCP wants to have BOTH a global currency AND total control over that currency. It will have to choose between the two, and cannot make up its mind. So it pretends it doesn’t have to choose. Sure, there has been some advancement for the yuan, but I bet most of that is on the back of the Belt and Road (BRI), and that will turn out to be one of the main victims of the coronavirus. The BRI is China’s very clever way of exporting its overproduction, but potential buyers have other things on their mind today.

Meanwhile, even with that, the yuan is used in only 1.8% of cross-currency payments. [..] The sudden, and rushed, take-over of Hong Kong with the new security law will not help China’s plans to be accepted internationally. [..] The world’s large investors will not put their money into something that Xi Jinping can declare devalued by 50% on a rainy morning when he sees fit. He will have to cede that kind of control.

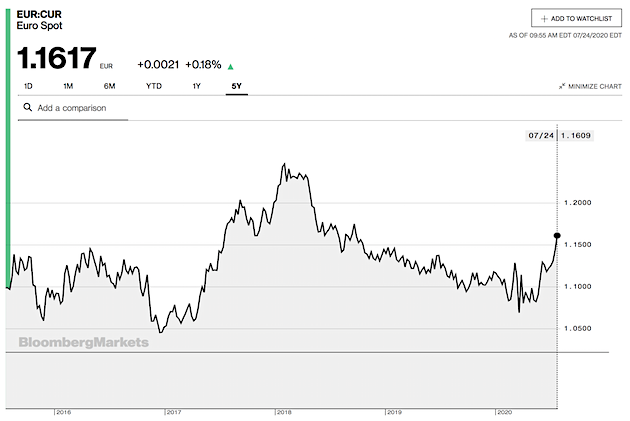

The euro has made some gains vs the USD recently, going from 1.07 to 1.16 or so, but that means very little once you look at the broader picture. Moreover, the reason the financial press provides for -much of- those gains, which is that the EU supposedly showed “unity” in its recent Recovery Fund talks, is bollocks.

If it showed one thing, it was a lack of unity. That’s why these were the longest talks they ever had. And if this had not been Angela Merkel’s last hurrah, they might not have agreed at all. They paid off the Frugal Four to the tune of hundreds of millions, and that’s how they got a deal. Horse traders.

A simple screenshot from Bloomberg of the USD vs EUR over the last five years makes clear why the recent changes are no big deal. (All BBG screenshots are from July 24 just before 10 AM EDT and all cover a 5 year period.)

A reserve currency has two roles: being the currency that most international trade is conducted in, and -closely related- being the currency that countries hold most as foreign exchange (FX) reserves. After WWII, the US dollar became the most important currency for trade more or less by default, a position that it greatly strengthened with the petrodollar.

A 2015 SWIFT paper provides details about the US dollar’s share of international trade:

The US dollar prevails as the dominant international trade currency, with a 51.9% share of the value of international currency usage in 2014. The euro is second, with a 30.5% share of the total value. The British pound is third, with a 5.4% share of the total value, followed by Asian currencies such as the Japanese yen and the Chinese yuan.

That’s from five years ago, but things won’t have changed much. The system is complex and inert, it has a very strong resistance against large and sudden changes. (Do note that the euro’s share of international trade is substantially skewed because it includes payments between countries that use the euro as their currency, plus those EU countries that don’t -yet-). Single market, international trade.

And then there’s the dollar’s FX role.

In September 2019, Eswar Prasad at Brookings reported that the dollar’s share of global FX reserves remains around 65%.

The drop from 66 percent in 2015 to 62 percent in 2018, is probably a statistical artifact related to changes in the reporting of reserves. Compared with 2007, however, the dollar’s share of global FX reserves has declined by 2 percentage points while the euro’s share is down 6 percentage points. Over this period, the Japanese yen’s share has risen by 2 percentage points, while other less prominent reserve currencies have increased their total share by 4 percentage points. The renminbi, which was not an official reserve currency in 2007, now accounts for 2 percent of global FX reserves. [..] .. the euro has stumbled, the renminbi has stalled, and dollar supremacy remains unchallenged.

[..] In July 2019, China’s total official reserve assets amounted to just over $3.2 trillion, of which $3.1 trillion (97 percent of the total) was held in the form of FX reserves. Gold holdings amounted to about $89 billion [..] Coming amid rising trade tensions with the U.S., the 5 percent increase in China’s gold stock and the 24 percent increase in the value of its official gold holdings during 2019 have been interpreted as a sign of China’s attempting to diversify its reserve holdings away from U.S. dollars.

If this interpretation was indeed correct, China has a long way to go. Gold now accounts for 3 percent of China’s gross international reserves. From a global financial market perspective, and especially relative to its overall international reserves, the $18 billion increase in the value of China’s gold reserves during 2019 is trivial; it barely registers as a shift in the composition of China’s overall reserves.

Assuming that China still holds 58 percent of its FX reserves in dollar-denominated assets, the value of those assets in July 2019 was $1.8 trillion. So, the value of its gold reserves, $94 billion, is a mere one twentieth of that of China’s dollar-denominated reserves.

With the euro and yuan out of the way as potential reserve currency candidates, we can take a look at gold. Senior commenter Dr.D at the Automatic Earth recently wrote: “As advertised, the US$ is defaulting. What? Where? US$ has been cut in half compared to Silver in 3 months. US$ has been cut in half compared to BTC in 3 months. US$ has been cut in half compared to Gold in 4 years.

Like many people talking about a USD demise, perhaps that’s too much of a dollar-centric view and conclusion. Surely gold and silver can rise vs the USD without announcing an imminent collapse of the latter. And since precious metals tend to go up in times of uncertainty, and COVID has brought shovels full of just that, you would expect them to rise.

Therefore you would have to also look at how they do vs for example the euro, before concluding anything. Note: I didn’t include Bitcoin because it’s too new and volatile. Makes me think of the Lindy Effect, often cited by Nassim Taleb, the idea that the older something is, the longer it’s likely to be around in the future.

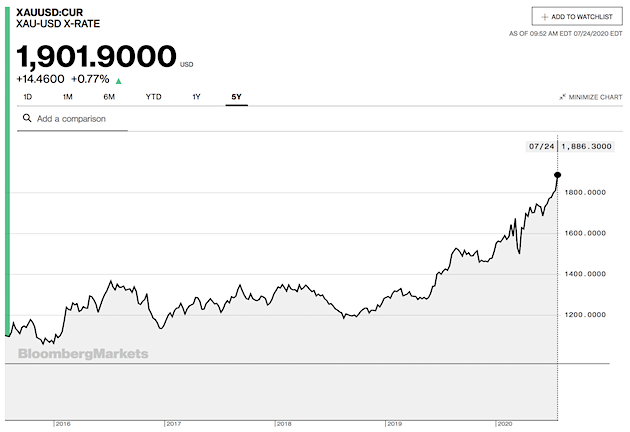

Here are a few more Bloomberg screenshots. And yes, gold has done well vs the USD in, say, the past two years, no doubt.

But gold has pretty much followed the exact same pattern vs the euro:

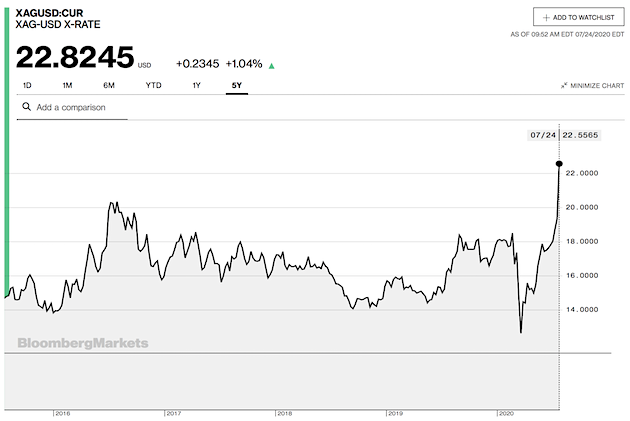

Silver has done even better, more recently, vs the USD, though compared to where it was in 2016 it’s not that big a step (barely more than 10%):

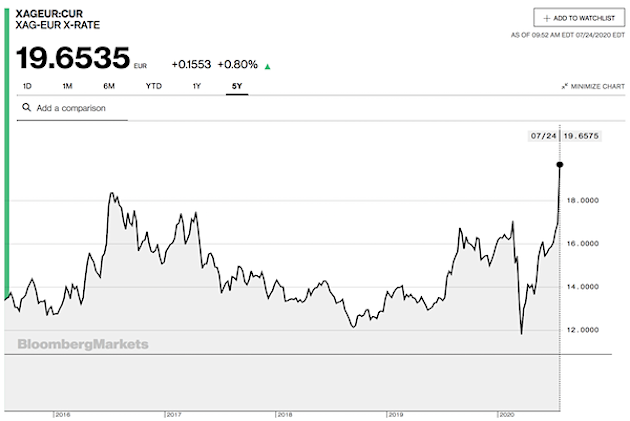

And the pattern of silver vs the euro is so similar it’s almost eery.

I don’t see anything there that would make me think the dollar is collapsing, no more than the euro is. What I see is gold and silver rising. People move into precious metals, perceived as safe havens; they always do when the world is in turmoil. And don’t forget there are trillions in additional recent central bank money sloshing around that have to move somewhere.

As for the changes of the USD vs the euro: we’ve already seen that they are not exceptional. Losing a few percent vs the euro will not collapse the dollar.

Also, there’s something missing in the discussion as far as I’ve seen: the option that it’s the US itself that wants a lower dollar at this point in time, and actively works to get it lower. A strong dollar works for a strong economy, but not for one weakened by a pandemic and an acrimonious political climate.

But the US has borrowed so much money!, you say. Yes, but so have Europe, and Japan, and China, everyone has who could.

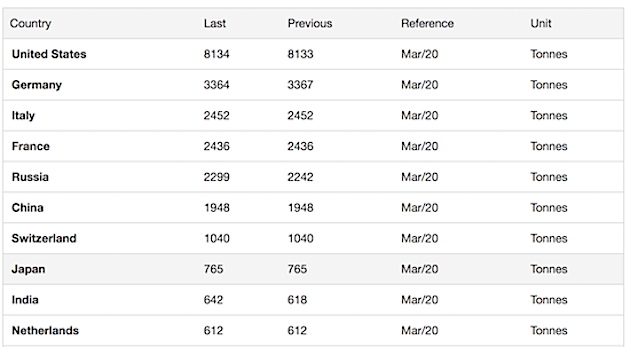

A little more about gold, since some are clamoring for a return to the gold standard. Which is not likely, because too many parties would resist, either for ideological or practical reasons. But say you would consider it, then you would as one of the first things you do, look at gold reserves. Here are the top ten gold holding countries per March 2020, as assembled by TradingEconomics.com:

Note: Britain is not there, because “Between 1999 and 2002 the Treasury sold 401 tonnes of gold – out of its 715-tonne holding – at an average price of $275 an ounce, generating about $3.5bn during the period.” (BBC). Gold is at $1,900 today. Nuff said.

The US gold reserves are so large it would appear to give them an unfair advantage if a gold standard were considered. Same as they have in the current set-up. Then again, if you insert population numbers into the equation, Germany, Italy, Switzerland, even the Netherlands, have more in relative terms. Question is: where does that leave all the others?

Long story short: I don’t see a US dollar default or collapse in the near future. But by all means enlighten me.

Good post. Last ones out of the gold (exchange) standard got crushed, this time the first one in would get crushed as everyone else printed free money and exchanged it for the new hard (gold) currency. The other factoid is that 2 of 3 dollars exists outside the U.S., outside the control (or even the knowledge of) The Fed. So since the Fed decided to buy *yet more* debt to support the dollar their top purchases have been: German automaker bonds. Some softening of the famous “it’s our currency but it’s your problem” line.

The Fed recently told U.S. banks that Treasuries purchases will no longer impair their regulatory capital. They’ve crossed the monetization Rubicon and are now recruiting the strength of the U.S. banking system in their efforts to keep the lights on. To have an actual currency war though they need a much weaker dollar, but I’m sure that would pass quickly with the installation of The Biden. It would be straight back to Total China Lovin’ (Hunter is the king!) and globalist kumbayas all around.

And just to correct a misconception: gold stays the same, that’s what it does best, courtesy of Mother Nature. Bank currencies devalue against it.

I would hardly call going from ~$670 at crisis bottom to ~$1900 now or in between, retracing from $1900 in the post GFC hyperinflation hype to <$1100, as "staying the same."

I think what he means is that physical bar of gold is always the same physical bar of gold, but can have different value in fiat currencies.

TBH, don’t see a point of that, that applies to a lot of other things (like the most-useless-compute-use aka BitCoin).

What he’s really saying is that the REAL purchasing power of gold remains constant, which is false but a tenet of faith of the gold-worshiping Austrians.

The foundation of that myth is that supposedly, by mere co-incidence (or supposed but un-warranted* Divine Intervention), the average mining rate of gold and average real economic growth rate both equal about 2% per year.

It’s more likely to me that, at least during the years of the Gold Standard, that real economic growth was LIMITED by the average mining rate of gold.

*Since the God of the Bible is no gold-bug, to put it mildly, but for economic justice.

Expressing my point exactly, a troy ounce is still a troy ounce as the amount of bank currencies required to obtain it increased. They lost exchange value against it.

And on the “purchasing power myth”, in Rome the cost of a top-quality men’s outfit (toga, sandals, belt) was one ounce. Today in 2020 $1950 (one ounce) would buy you…a top-quality men’s outfit. In Cordoba in the 11th century the price of a top-end house was 25 ounces…same as today. These examples abound.

The minimum wage in 1965 was $1.25 per hour, or five silver quarters. Today the face value of those five quarters is, of course, $1.25. But the silver value is +/- $21.00. Which many would say would be a handsome and justified minimum wage today. If the purpose of money is to store labor so it can be transported across space and time…then the government-declared face value was not able to reliably store labor, whereas the precious metal was. My theory is that money that took no labor to create cannot reliably store labor over time. But I suppose it depends what you think “money” is, I think it should be something that can *extinguish* a debt, not just pass a debt to someone else, like debt-based bank currencies do. Those are called “credit”.

Fiat SHOULD lose value over time. Otherwise we reward (or at least don’t penalize) risk-free hoarding of it and that’s a recipe for economic stagnation, not progress.

And who should care if the dollar is only worth $.03 of its 1914 value so long as real incomes are greater than then?

There are serious problems with how and for whom fiat is created and who may use it but needlessly expensive fiat is a scam.

I think it should be something that can *extinguish* a debt, not just pass a debt to someone else, like debt-based bank currencies do. OpenThePodBayDoorsHAL

Fiat does extinguish private debts. And since a monetary sovereign can, in principle, create fiat at ZERO or even NEGATIVE interest rates, it doesn’t make sense to consider fiat creation as public debt creation.

I don’t believe for a moment that gold stays the same. It’s value is mostly fiat just like the dollar. It has some limited utility, yes, but that is only enough to account for a tiny fraction of its cost. Apart from perhaps Indian cultural hoarding, and limited utility as a door stop, there is little reason to believe gold should be worth much more than say silver or copper. There is no absolute store of value.

IDK.

(cocks his ear at an unseasonable owl hooting)

statements like this :” The system is complex and inert, it has a very strong resistance against large and sudden changes. ”

…are treated far too incidentally for my whiskers.

it works—–until it doesn’t.

things….even great big solid things…change abruptly sometimes.

and big, solid things sometimes are not all that solid.

the supporting evidence…while convincing…are reliant on quite a few assumptions.

as if the fed can…just sort of naturally, and by right…prop up as it sees fit.

it ain’t a thunderstorm.

it’s a human built system, and assumptions are only as good as they prove out, each time the experiment is run.

To paraphrase a wonderful analogy i saw on NC,” gilding the roof while the foundation and walls rot is all well and good, if you’re stupid”

I can think of maybe as many as fifty million people…as well as what?…25 million maybe fixin to be run off?….who might want to have a say in things.

I think I agree with Yves’s view about things holding together. Because the system is complex and inert. I’ll never understand the mysticism of gold, but never mind my own mental block. What strikes me here is that the entire global financial system is so slow to “implode” you’d think it was under some reasonably benevolent control. In fact I think it is. That’s the good news. One thing I noticed above is the mention of a certain obligation of reserve currency sovereignty not just to itself but to the world. So we can’t, as China does, devalue our currency by 50% to stop deflation in its tracks. Yet, on the other hand, we can fork over trillions in a pandemic – it’s all in how the accounting is set up over many decades. I’m assuming. And it does all come down to trust and track record. So this puts neoliberalism in the docket – it must manage to change its ways or be replaced. 2020 is a fitting year to become the crossroads. The thing that made and keeps America financially powerful and trusted is not, however, it’s accounting – it’s how we govern and how strong our economy is. And that has recently come under scrutiny. Because “strength” is based on those with the least income. And their wellbeing. That seems to be the compass – if I can be a little optimistic – globally. We’ll see how Congress responds in the next week. They could blow it all to high heaven. And it would not surprise me if they did. There is a frightening number of elected twits in that assembly.

And also a pandemic serves to sink all boats. So everything is relative.

The global role of the dollar does not seem separate from the global influence of the us military and other expressions of us hard and so-called soft power. If the us military (incl intel agencies, etc) did not pressure any foreigners, how different would the international financial situation be? I think a lot.

A lot of concern about the US dollar seems tied to a recognition that the us empire is crumbling, or in other words its international influence is fading. As control of the reserve currency is a major mechanism of control (ie with its ability to sanction countries and individuals), how strong are the underlying power dynamics that enable the status quo to continue? What are those power dynamics?

Any discussion of the dollar that doesn’t mention the threat or actual use of violence misses the picture, and knowledge of these dynamics can only be inferred from tea-leaf reading in the news, since the honest truth is not broadcast. My spidy sense is the us leadership is not competent to run its own country and is mismanaging the empire (see for example, encouraging a deep cooperation between Russia and China rather than sowing division). I don’t know when the empire will crumble dramatically, but I bet the most valuable information indicating near-term collapse (as that time approaches) will not be in charts comparing currency values.

Thank goodness for Ilargi. At times like this, there’s so much guff written about so much by so many who have little understanding of their chosen subjects. Or, alternatively, are paid by the word to write tripe to a particular specification.

This is probably a familiar topic to Naked Capitalism readers, but it can’t be reiterated and presented in the contexts of the day, such as COVID-19 impacts, often enough. Whatever the crisis of the day is, it’s usually taken as an excuse to trot out age-old nonsense like deficit terrorism and “governments running out of money”. I should start a drinking game — in my version, you get a double shot for “Weimar Republic”.

For some reason which I can’t quite recall, I skimmed my way through ZeroHedge the other day. Oh, my word. It was as bad as ever. No, I take that back, it was worse. All the gold bugs and hard money types were back in all their splendour. It’s like when they hooked Frankenstein’s monster up to the power supply — something which should have died decades ago has got a whole new lease of life.

I have a couple of problems with your last paragraph, Clive.

First, and you are hardly alone in this, I find the Zero-Hedge bashing to be problematic, as it is an aggregative site, and does occasionally feature very good articles from excellent sources. Yes, plenty of hyperbole and doom and gloom, as well, but I really don’t see the point of painting it with such a broad, and arguably inaccurate brush.

Secondly, your condescending attitude towards “gold bugs and hard money types” suggests a misunderstanding of the reasons that many people choose to hold physical gold. Most hold it as a hedge against dubious Central Bank policies, and have been emphatically proven to have been correct (or wise, if you prefer), over the past 20 years, given the plummeting relative values of major fiat currencies. Since 2000, when Central Banks began print with reckless abandon, the value of the following currencies have all dropped ~85% or more when measured in gold: USD, GBP, EUR, CAD, JPY, SEK, AUD. Others, such as ARS and VEF have lost virtually all their value.

Eighty-five percent in 20 years, and you speak of “gold bugs” derisively?

Why do you think that gold is at all-time highs in most currencies? Do you imagine that it is simply an inflated, commodity equivalent of Tesla? Or is it, as many believe, potentially very valuable insurance that has been tested and proven successful over millennium?

Here is a quote from Jim Grant from a recent interview. Note that Grant has been widely respected in financial circles for decades, as the publisher of his Interest Rate Observer newsletter.

It is perfectly reasonable to engage “hard money types” in arguments about the merits of MMT, and whether or not an ‘anchor’ is (again) needed in order to constrain runaway government spending and central bank malpractice. But lumping them into the same category, and dismissing them en masse as something to be derided, is, in my view, a deviation from your usual, well thought out comments.

This assertion that the “price” or “value” of gold is somehow determined by only the purest and most noble of human endeavours and behaviours is completely false. For one thing, gold is a go-to vehicle for money laundering and concealing the proceeds of crime — the levels of corruption in the supply chain, the dealers and the refineries is legion. Big cases do come to light and get progressed to prosecutions https://www.bbc.co.uk/news/uk-50194681 but these are the tip of an iceberg. Tesla stock, to use your example, is many things, and the company is in my opinion and the opinion of many here at Naked Capitalism too a load of junk. But the trading in the stock is done via an exchange, so everyone can see the clearing price and, within the disclosure thresholds set by the relevant regulator of the exchange, who is holding the stock, who is shorting it, what the volumes traded are and so on. And even the useless SEC took action against Musk for market-misleading statements. That’s way, way better than you get in the gold “market”. While Tesla itself might be a fraud (or at least overhyped), trading is Tesla stock isn’t easy to use as a method for fraudulent money transmission.

Way too often, gold fans confuse bad investments (like Tesla) with fiat issuance. The concept of fiat issuance is the same for both currencies and stock, but the two aren’t the same things at all. Then they make another category error and believe that, because gold isn’t a fiat issuance, it can’t be any part of fraudulent activities. Oh yes, it can.

ZeroHedge is constantly running stories trying to ramp prices of both gold and, especially, silver. It gives to me the impression that it is — or it would be, if it were securities we were talking about here — trying to perpetrate a fraud or, at best, manipulate a market. The regulatory authorities can do nothing about this, because gold isn’t a security. You might as well try to accuse me (and prove) that I’m manipulating the price of a cake I’ve baked and am offering slices for sale on a street market stall. My theoretical cake, like the market for gold, is outside of the control of the regulatory bodies. I can sell it for the price that I can con people into thinking it’s worth.

And as for price discovery, which is essential for determining what something — be it gold or fiat currency — is worth, have you ever tried to buy or sell physical gold in anything other than trivial quantities (i.e. above say $10,000)? Aside from the issues with transportation and getting insurance on shipping, in the EU you will face a raft (and I do mean a raft) of Anti-Money Laundering checks and declaration requirements. If you trade in gold, you’re responsible for your own compliance. If you use a currency, the financial institution is responsible. I can send, for instance, $100,000 or more fairly painlessly and I can trade in and out of paper stocks in much the same way. There is zero spread on currency transactions (apart from any fee for making the transfer) and in a liquid stock market the spreads on publicly traded stocks is pretty tight. Have you seen the spreads on gold trading? You’ve lost maybe 5% of your money just buying the stuff and taking it home with you. And if you’ll read the marketing blurb in the link I’ve put there, you’ll notice the hidden gotchas for their low commission and spreads: the storage costs and insurance. I never want to hear a gold fan complain again about negative interests rates. Not when they’re paying 0.5% p.a. just to have someone store it for them.

Finally, the most compelling evidence for the hokum that is “gold is a better store of value than all those nasty old fiat currencies which are waiting — just waiting I tell you! — to be debased by their issuers” I can merely point to Japan. As is well known, the Bank of Japan has expanded the monetary base relentlessly for the past 20 (now nearly 30) years. They’ve practically given up now, but for the first decade or two, the hyperinflationistas were determined to assert that soon, really really soon, now, Japan would succumb to an inflationary spiral. Let us, then look at a currency pair that pits those crazy spendaholic Japanese against the fiscal puritanism of the euro (subject to endless fretting from Germany and the other “frugal” members) determined to hold an entire continent to ransom against backward notions of how fiat currencies work. I present to you 23 years (this is the longest continuous series I can find online, back to the introduction of the €) of Yen “disaster”: https://www.macrotrends.net/2554/euro-japanese-yen-exchange-rate-historical-chart

It is, as you can see, right back where it started. So much for central bank (or government) induced hyperinflation.

Why would you begin your response with such a straw man? Did I, or anyone, including those posting on ZH, ever suggest such a thing? That’s a rhetorical question.

The fact that there is some corruption associated with the physical gold market is irrelevant to its market value, or utility. That’s an enforcement issue, as is drug money in the form of bundles of USD being legitimized through banks.

Say what? Fraud? Manipulation? What are you on about? What laws prevent commercial websites that have clear disclaimers from being sympathetic with certain investment strategies over others? ZH’s disclaimer begins with this:

As for this:

The answer yes, I have. And if one uses companies that specialize in such transactions, in Switzerland, to use an obvious example, the process is extremely simple. There are no transportation concerns, unless one chooses to buy and hold the metal themselves. The companies and banks in Switzerland are acutely aware of the compliance issues, and follow the guidelines carefully. There are tax and storage issues to consider, but you exaggerate the latter, and continue to misconstrue why many people hold physical gold.

Your references to hyperinflation are also straw men. Yes, there are commissions on purchases, and storage fees, but, to draw from my previous post, what part of an 85% devaluation do you fail to understand? It doesn’t matter that Japan hasn’t suffered from hyperinflation – its currency has lost ~85% of its purchasing power relative to gold over the past 20 years. Would commissions and 0.5% p.a storage costs have reduced the value of the choice to own gold over JPY (or any of those currencies) by anything other than a trivial degree?

How is a JPY/EUR chart relevant to the value of gold relative to those currencies? If you wish to argue that someone living, say, in Argentina, might have been better off holding USD than gold over a given period of time, I might well agree with you. But we’re discussing gold as a store of value, and particularly in contrast to major currencies when they are being rapidly degraded.

There are nuances that we would likely agree on (e.g. it can be difficult for people, depending on where they live, to buy, sell and hold gold; timing is very important in gold ownership, etc.), but the central fact remains that gold is by far the longest standing, best performing preserver of liquid, and widely accepted wealth that the world has ever known.

As a final note, you did not address what may have been my primary criticism of your initial post, namely painting those who see the value in gold ownership with a single brush. No one would ever suggest that Jim Grant is a “gold bug”, yet he is, by expressing his opinions, publicly promoting its ownership at the moment. Why? For the same basic reasons that many of the “gold bugs” on ZH do so.

ZeroHedge is about as pure as the driven slush. Its founder, Daniel Ivandjiiski, was barred for insider trading https://www.finra.org/media-center/news-releases/2008/finra-bars-two-registered-representatives-insider-trading and of course it portrays itself as a “news and information site”. That is how it can have a liability shield and also a get-out-of-jail-free card for not giving investment advice. No, it’s not a fee-based advice or analytical service. But it does, most assuredly, advise its readers what to buy: gold and silver (amongst other commodities trades). If one chooses to take one’s opinions from convicted insider dealers and buys something on their say-so then all I can say is that you can’t be too surprised if they aren’t exactly honest brokers and may be up to something that doesn’t entirely coincide with your best interests.

The argument that you can overcome holding physical gold as an asset class’ problems by brokerage storage undermines the claim for the store of value. The value which is being stored is only as strong as your claim on the physical assets of any company. If the broker or storage house turns out to not have the gold at all (a popular scam, incidentally) or is merely insolvent for another reason then you’re left to pursue a claim on the residual assets with no more rights than any other unsecured creditor. That’s bad enough if you have to do it in your domestic court system. Try doing that in a cross-border litigation if you want a real trip to the pain locker (not to mention the costs of mounting such an action). Of course, the reason people resort to non-physical gold holding is because of the costs and hassles of holding physical gold in the first place. Which eminently proves my point. If holding physical gold as an insurance against currency debasement was such a no-brainer, there wouldn’t be a market for non-physical gold service providers.

I used currency devaluations to prove that there is no documented example of any industrialised nation which borrows in its own currency suffering anything like a significant debasement which could reasonably be called hyperinflation in a hundred years. A Japanese citizen can purchase exactly the same amount of food, oil, manufactured goods, consumer durables and pretty much anything you’d care to mention for their Yen (and the same can be said for a euro member country citizen or a US resident) as they could 20 years ago. There has simply been no significant inflation as a result of monetary expansion.

You point out that if you cherry-pick your timings, you can, like any commodity speculation, make money. But you can equally well lose money, too. Gold has historically had bouts of appreciation but also has had plenty of stupendous crashes: 22% in 1997, 28% in 2013, and it lost a third of its value between 1988 and 1992 https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart — I’m sorry, but I fail to see how any “safe investment” or “store of value” definition can extend to something which can knock your net worth down by twenty to thirty percent in 12 months.

If you want to take a punt on speculation in commodities, be my guest. But please don’t try to convince anyone you are doing anything other than playing the market. Sometimes indeed you can play the market and win. But equally often, it’s the market which plays you. And if you want stock tips (or investment chit chat) then I could equally well sit here and say people should “invest” in, say, UK residential real estate*. It’s performance has made gold look like a chocolate tea pot in the past 10 years. And at least you can live in a house. And you don’t have to hope it really does exist somewhere in a Swiss safe storage facility.

* no, I really wouldn’t actually; it’s due for a huge correction — the same can be said of gold,

I continue to be amazed at how you choose to argue this matter. ZH is an aggregative site, and as such, hosts views expressed by a wide variety of people from around the world. That would include Wolf Richter, whose excellent work, as you well know, appears fairly regularly on this very site.

And you want to argue that it is somehow dangerous to read the site because its owner was once convicted of insider trading? Presumably you would be very comfortable following the advice of the CEOs of J.P. Morgan or Goldman Sachs, as neither of them have personally been convicted of such crimes, at least yet.

News Flash: most economic websites have agendas! And the vast majority of readers are very aware of the fact, and do not slavishly follow whatever perceived investment advice may be present.

While it true that there is some counterparty risk when gold is not held directly by the owner, such risks can be mitigated significantly by careful research and choice of storage. I am not aware of a single case of gold held in a segregated account in a major independent Swiss storage facility having gone missing. Of course banks are more risky, but that is a tangent that we needn’t pursue.

If one does choose to the hold the gold oneself, then the transport costs would easily be offset by the elimination of storage fees. We would agree that there are other risks, though.

On one hand you argue (correctly) that it dangerous to own gold without holding it physically, yet at the same time you argue that the mere existence of markets for paper gold somehow prove your point? The only point that they prove is that many people choose convenience over safety, and are therefore exposed to greater risk of not receiving the expected return (or, possibly, anything) when it comes time to sell.

No one ever said that it was a “no-brainer”, or suggested that it is simple to buy, hold, and sell gold. But if your argument is that, well, yes, gold typically does perform well against fiat currencies during economic crises, but practically speaking, it is very complicated for the average person to take advantage of the fact, then why don’t you just come out and say it?

Say what? Set aside the loaded word “hyperinflation” – we’re not discussing that. And cut your time-frame in half. Every major fiat currency has lost over 90% of its value vs. gold since 1971. The USD, GBP, AUD, and CAD have lost 98-99%.

The question of purchasing power, e.g. comparing what one could have purchased 20 years ago in various currencies is tangential, but what did a good suit, or an average car cost in 1970 vs. today? A house? A month’s rent? A gallon of gasoline? Etc.

Your point about cherry-picking is only half correct. I did not do so in the usual sense, as 20 years ago was precisely when the CBs (outside of Japan) really began to become reckless, so it is a natural starting point to use. 1971 would be another, and gold has outperformed the DOW since then. Of course timing is important in the near to medium term, and gold has had its ups and downs in the market, but stock markets have been every bit as volatile over the past 20 years.

With fiat currencies being debased as wildly as they are today, the likelihood that gold wouldn’t perform well was infinitesimal. And that is why the topic is of particular interest to me, as preserving wealth is likely to prove much more challenging –and important – than during less turbulent times.

To summarise, then, where we broadly agree:

1) ZeroHedge has an agenda. That agenda is to boost gold and silver prices.

2) ZeroHedge’s agenda is advanced by a known convicted insider trader who has used privileged information to mislead people for personal gain.

3) Physical gold has storage, insurance, transportation and transaction costs far exceeding those of fiat currencies.

4) Non-physical gold has counter-party risks. You cannot insure against these risks.

5) Physical gold is somewhat illiquid in large amounts (above $10,000) and the illiquidity grows with the size of the trade (either buy or sell side).

6) Both physical and non-physical gold is a speculative investment that can potentially either boost your net worth by 30% a year or wipe it out by the same amount.

7) Both physical and non-physical gold are, as asset classes, amenable to being boosted by government and central bank support for assets (just like stocks, fine art, real estate and so on).

So why not buy baseball cards? At least they’re easier to carry. Or tulip bulbs for that matter?

And let me introduce a final point:

8) What government and central banks can give’eth to asset prices, central banks and government can take’eth away again. They can put a floor under or increase the value of their chosen favoured asset classes (e.g. residential real estate, stocks etc.) They can decline to put a floor under asset classes that displease them (e.g. crypto currencies, gold etc.) and let other asset prices increase faster thus depressing their relative value to the asset classes they smile upon. The government and central banks can also introduce a tax on or other disincentives to hold particular asset classes. They can insist, on pain of fines or jail time, you settle these taxes in their chosen fiat currency.

In the end, like it or not, they win. The people behind ZeroHedge are many things. But stupid isn’t one of them. They know how this game is played. They know how it is always going to end. They are simply luring in another bevy of new fools. They lure the fools in by telling them how clever they are to have found this “new” “secret” “knowledge”.

The only predictable thing about gold is, in terms of a store of value, that there’s always a group of speculators who, by the luck of good timing, get in at the bottom of whatever slump has just proceeded the rally de jour. Out, then, they all come, eager to tell the world about how canny they’ve been in spotting this fatal flaw in the global financial system, one that buying gold is a way to circumvent and even exploit. This time really is different. And equally predictable is that, like the warmth of a summer’s day gives way to a cold winter’s chill, come the equally inevitable slump (that has never failed to arrive) and follows the rally, like between 2012 and 2020, you don’t hear a peep out of them.

I wish that you would stick to facts, and argue the salient ones.

1) Unsubstantiated speculation. The “agenda” of ZH is to make money. There is zero evidence that the owner gives a rat’s ass about whether gold goes up or down in value. He wants eyeballs and revenues, and gets them.

2) See above. I assume that the owner does indeed influence the editorial choices, but gold and silver are but one of a very wide variety of topics that are covered.

3) Agree to an extent, but when put into the context of their relative values over certain times periods, notably economic crises to which CBs react recklessly, those costs are marginalized to an extreme degree.

4) Non-physical gold does create counter-party risks, but in the case of segregated storage you absolutely can insure against them. There may, however, be extreme exceptions (e.g. war) under which the storage entity is relieved of responsibility.

5) Physical gold, as mentioned previously, is not illiquid in larger amounts if one uses a legitimate broker. In times of crises, in fact, there is no collateral that is easier to liquidate! That is precisely why early in both the 2008 crises and the one currently unfolding, gold dropped in value briefly before heading inexorably skyward.

6) Yes, we agree that it is speculative as an “investment”, just like stocks, bonds, or any other asset class. And like those other assets, the degree to which it is speculative rests largely on the entry and exit points. But some gold owners view it much more as insurance, and are quite willing to hold it themselves over long periods, having confidence that it will perform much better than fiat currencies over time. Others, like myself, own it primarily when CBs behavior becomes especially reckless, and serious dangers are perceived in other markets as a result.

7) Agreed! And this is one of the nuances that we would be better served discussing.

C’mon, Clive. That’s not even worthy of a response.

8) I agree with your first paragraph, and that it does present a danger to many of those holding gold. But the objection is too broad, and I’ll explain why. Switzerland (yet again) is, for a variety of reasons, probably the least likely country to impose punitive sanctions on gold ownership. There are no taxes on the sale of bullion, and the chances of the Swiss changing that to any significant degree are indeed very small. So, if one were, for example, to be a tax resident of a country which allows such residents to be taxed on capital gains held outside of the country based on the laws of the country in which they are sold, then the risk would be almost fully mitigated.

As to your last point, the fact is that there are countless people, including, in some cases, otherwise impoverished people in India, who has saved in gold over long periods of time, even generations, and whose wealth has increased markedly as a result.

Over shorter durations, the risk of volatility does increase, and we agree that timing takes on greater importance. But this is true of other asset classes, as well. Try selling a commercial building in NYC today for close to what it was worth eight months ago!

Finally, given the extreme CB response to a problem that they quite obviously can’t fix by creating additional mountains of debt, I’ll be happy to go on record as saying that there won’t likely be any significant slump in gold value for at least a couple of years to come. Having said that, though, as I am very aware of the danger of riding an ‘overshoot’ too long, I do expect to trade a good portion of my holdings for useful property, and possibly (then) depressed securities, in the not too distant future.

Thanks for engaging.

If ZeroHedge isn’t concerned about the gold price, then you’d see articles on how gold is a bad investment, has a lot of drawbacks as an asset class and shouldn’t be a part of a retail investment portfolio. I have never seen even one such article in over ten year’s reading of it (although I don’t read it often it has to be said). Therefore the publisher must have an incentive to see more so-called investors buy gold. Even if they don’t sit on various trades or derivations of other people’s trades and profit directly, they encourage, through their advertising sales and revenues, gold ownership promoting services. So as an absolute minimum their editorial policy is about writing articles to garner ad revenue. That’s not journalism. It’s product placement, which can’t be whitewashed as mere “editorial policy”.

I have looked for any mainstream insurance carrier which will quote for a gold broker / storage facility which will indemnify against fraud and / or insolvency. Catastrophic loss and theft is fine, it’s the same as any safe storage box. But insurance for anything other than those risks? I can’t find anyone with a standard product. You’d need specialist cover. I’d love to see a quote and the policy documents for that. That would tell me exactly what insurance offer I’m getting (and any conditions or exclusions). Oh, and of course, the bit I’m really interested in: the price of the premium. I can then add that to the cost for holding gold, which never seems to stop finding new things to add to the total.

You dodged my illiquidity problem with the hardware of finding the “right” broker. I can guarantee you that if I sold my house, let’s say it was for £1M, and insisted on gold as a payment both the buyer and I would find our transaction costs would be way higher than using currency. The buyer would have to obtain a large amount of bullion — this would cost them, in terms of the purchase price, more than buying a couple of oz and would need notice given to even the “right” broker to ensure they had the gold available for shipping. The shipping and insurance on it would be an extra cost. And if I kept the physical gold in my possession for any length of time, I’d have the cost of insuring it too. We both know that, in that sort of transaction, we’d use a bank and currency like everyone else does. If transacting in a high-value-movement-of-funds way, gold is completely impractical. You’d have to trade in and out of gold and currency. If anything other than a tiny handful of transactions were done that way, the float of free gold would quickly run dry. Your “right” broker will have a finite limit on how much float they have available at short notice. Go above that, and you’ll get discouraged either through the pricing mechanism, the waiting time for your order to be fulfilled or, even, that the “right” broker refuses — as they are perfectly entitled to do — to do business with you.

I’m sorry that my jibe about baseball cards was deemed “unworthy” of a response. Because it is the most pertinent point in all that I raised. Perhaps that’s why it was ignored — because it hit too close to the nerve. Yes, buying gold is exactly like buying baseball cards. Or Rembrandts, if we want to be a bit higher class about it.

In the wealth management industry, this asset class even has a name — “zero yield assets” or “unproductive investments” or similar. Things you buy that don’t earn a return but you hope to get some asset appreciation on. You can make-believe to yourself that maybe because more people buy gold than buy baseball cards, or fine wine or jewellery that somehow it gets elevated to a higher level of sophistication and kudos. But it is exactly the same investment strategy. Gold simply has a better image (and this is where the likes of ZeroHedge and the PR they supply comes in) than, say, the captain of the Titanic’s chamberpot, brought back from the deep. But it isn’t the slightest bit different to that.

So, I think we can safely conclude — as your last paragraphs infer — gold is just nothing more than common-or-garden variety speculation on non-income producing assets. Perhaps with some added spicy sauce of vague libertarian notions thrown in to give it some piquancy. ZeroHedge does that last ingredient a lot. Nothing wrong with that, of course, it’s good harmless fun. If a little tawdry. Providing you don’t mind nursing losses if they hit you.

But it’s not and never will be anything more than that.

Clive, your view of ZH is distorted, though I am not sure why. Of the last 20 articles posted on ZH, two were gold-related, and one was entitled: Gartman: “I’m Getting Out Of Gold”. That’s 10% of the content, for those keeping score.

Now, you may cry “small sample!”, but the fact is that gold (or PMs) is just one of many, many topics that ZH covers on a daily basis, and your suggestion that they never feature negative views on gold was disproven just a few hours ago.

So, let’s forget about ZH, as it is a distraction from the topic at hand in any case.

I apparently didn’t make myself clear on the insurance issue. What I meant is that well-established vaults (e.g. Loomis, etc.) provide insurance when used for storage. Third-party insurance would, of course, be more expensive and complicated.

That isn’t a liquidity problem, it’s a transaction problem. If you want to sell your house for the equivalent of £1m worth of gold, take the cash (or a bit more to cover transaction costs) and buy the gold – problem solved. When I talk about liquidity, I’m referring to the ability to either sell bullion for any major fiat currency, or use it as pristine collateral, anytime, including under the most stressful economic conditions. One can then use whatever currency one desires to transact normal business.

I wish that I could end on a much different, and more positive note, as I find most of your contributions to NC to be very thoughtful, but it frankly boggles my mind that you continue to spout such nonsense.

As I’m nothing if not thorough, I read the ZeroHedge article you referred to as being anti-gold. It turned out to be nothing of the sort. It soon enough veered into using the Gartman interview as a reason to “buy the dips”.

As desperate times call for desperate measures, I’ll quote directly from ZeroHedge:

Me again. At which point I had to stop reading for the sake of my own sanity, I did skim the rest of the piece, it was waffling on as they usually do about various charts and trends and “the fundamentals”.

Now, if you are willing to in a comment here blatantly state a complete falsehood — that ZeroHedge ran an anti-gold article when the article was actually pro-gold buying as an “investment strategy” then there is little point in a debate. You have verifiably been willing to just make stuff up. ZeroHedge was up to its old tricks, as usual. And you claimed the opposite.

No-one is going to stop you from buying physical gold or, as you have, handing over real currency so you can look at an entry on a web app that claims to be showing an account which denotes that the operator of the website is holding some gold for you, somewhere, that you are entitled to call your own and may, if you requested it, actually turn into real physical gold if you asked them to send some to you (for a fee). I’ve heard people look at worse things on the internet.

But in terms of an asset, what you own (or hope that you own) is exactly the same as heavier, shinier baseball cards. They return no yield. They cannot settle a debt to the state. Their value derived from their scarcity value. Their worth is what a Greater Fool might pay you for it. If that’s the sort of “investment” you want to make, be my guest. But I think you’d be better off with the Titanic captain’s chamber pot. At least you can a) see it and b) put it, as a last resort, to some practical use.

Not that Clive needs any help, but to add to his cataloguing of your intellectual dishonesty, two articles out of 20 for a site that depicts itself as a general finance, economics, and sometimes even political site is extremely heavy coverage. We don’t devote remotely that much attention to favorite hobby horses like CalPERS and private equity.

This visualization show how inconsequential gold is compared to other investible assets.

https://www.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization-2020/

It’s way way way way less than the 1/10th coverage it’s gotten in ZH recently, even assuming every article was about investments, as opposed also covering, say, the latest Fed announcement or unemployment report.

Clive –

The article that I referenced was a mixed bag, though there were several negative views on gold’s near-term prospects included.

In another recent article on gold, which probably would have been a better example for me to have used, Michael Every of Rabobank rains on gold’s current parade, and concludes that:

The ZH editors added nothing whatsoever to the article, allowing it to stand as a clear example of a negative article on gold. Here’s the link to the article:

https://www.zerohedge.com/markets/rabobank-yes-gold-soaring-here-what-goldbugs-are-missing

Nice try but it still doesn’t cut the mustard. The article was in passing an at-best-neutral commentary on gold’s current appreciation — as the headline said “gold is soaring” — and it certainly had more than a hint of gold boosting about it, you didn’t even need to get past the second paragraph before you might have had good cause to exclaim out loud, as I did, “ahh… there it is”:

What part of that was in any way anti-gold? It flat out claims that if you buy gold now at $2,000 you might well make a 50% return or even a 150% return. In what universe is an article which features exhortations that gold is going to go up significantly in value is anti-gold?

But that’s not really what the article was about anyway. It was primarily about the Gold Standard. I really don’t know why I’m having to sully the comparative island of sense and respectability that is Naked Capitalism with repeating this kind of nonsense, but merely as an explanation of what ZeroHedge was doing running that piece, the Gold Standard (or, rather, being anti- the Gold Standard) is one of the Holy Writs of libertarianism. ZeroHedge, for whom its other purpose of which apart from constantly ramping gold is being a libertarian’s comfort food (they must consume it with the same relish as I do a slice of cake) runs libertarian tropes such as this one under various guises. For the ZeroHedge editor, a piece which combined both gold price appreciation and dissing the Gold Standard must have been a dream come true.

For those who like a good laugh, they can read up on exactly why libertarians despise the Gold Standard (short version, and really, you don’t want the long version, believe me) is that any form of government currency issuance (even if gold-backed) is an example of state oppression. The long version is covered here. Brave souls who made it to the end of that article will note that — apparently — what’s needed isn’t the Gold Standard. It’s… wait for it… Bitcoin!

Did I mention that, when it’s not trying to talk up the price of gold, or trotting out libertarian nonsense, ZeroHedge is constantly plugging that other scam, Bitcoin? I’ll say this for it, it’s certainly consistent.

But anyways, I’m still waiting for a ZeroHedge article to be cited which says anything like “gold is rubbish, you should sell it immediately, and don’t even think about buying it”. Or even “here’s a few things to think carefully about before buying gold”. The one you linked to certainly wasn’t it.

Do you actually read those things before you link to them as “evidence”? If so, when you read the words “there seems no stopping it” in an article about the gold price, what did you take those words to mean? Where did you learn English to come up with an understanding that this article was any kind of cautionary tale about the price of gold or gold as an asset class?

Clive, I freely admitted at the outset of our discussion that ZH is a gold advocate, and have never attempted to deny it. What articles like both of the above underscore is that they do, at least occasionally, present some alternative investment perspectives, which you have suggested are absent.

I am well aware that the second article was largely about the gold standard, but that is a topic which fascinates many of the very “gold bugs”, a fair percentage of whom actually advocate some type of return to. So when you dismiss the article because it isn’t a comprehensive rebuke of gold, it is arguably disingenuous.

Furthermore, after the quote that you presented, you said:

yet the quote that you excerpted was followed directly by this:

So the answer to your question is that Every’s clear rebuke of the likelihood of a return to a gold standard is very much “anti-gold”. The fact that he accepted that gold may be well set-up to increase further in value over the near-term does not make it a “pro-gold” article, as he is simply observing current trends.

More broadly speaking, it doesn’t matter if there are any articles that might meet your stringent criteria as qualifying as “anti-gold”, as we have never disagreed about ZH’s essential stance. The question of gold’s utility as a preserver of wealth, and/or insurance against CB malpractice are the points that we should have been focussed on all along.

And, finally, given that gold:

– is classified as a Tier 1 asset

– has been used successfully as money and/or for wealth preservation for thousands of years

– is easily divisible and never degrades

– is hoarded by the very central banks which often claim to have no use for it

– is listed first on the ECBs asset ledger on its financial statement

reveals the absurdity of your claims that it is not the slightest bit different from baseball cards, fine wine, jewelry, and tulip bulbs.

The article was a boosting gold’s prospects as an investment because it referred to price increases in gold recently, prophesised that these would not only be maintained but would even go up and didn’t refute any of it. If an article refers to an event and doesn’t claim that the event is being misreported or pour cold water on it, the article is reinforcing and amplifying the event. Otherwise, it would directly criticise it. So the ZeroHedge article (which you cited as being “evidence” ZeroHedge runs the occasional anti-gold article) was, then, not anti-gold as an asset class at all, was it? It was as you conclude anti-Gold Standard.

The BIS reclassification of gold as a Level 1 asset (after it declined to do so in 2013) says nothing at all about gold as an asset class. It merely reflects that the present-day liquidity of the gold market (and it should be noted, this only applies to physical gold as held by a central bank or at a commercial bank in a 100% i.e. haircut-free sovereign state which is a much narrower category than just any old gold, located anywhere it might happen to be) is deemed to be sufficiently liquid so as to meet the BIS HQLA criteria.

Gold as an asset (within the asset class of non-productive assets) is obviously more liquid than baseball cards, fine wine, jewellery, and tulip bulbs (and the captain of the Titanic’s chamberpot, although I should strictly speaking label this as “collectables”). But it is exactly the same as these things. It is an example of a “non-income producing asset”. There’s nothing wrong as I’ve said previously with having an investment approach which features non-income producing assets, if that’s what you fancy. But until you can show where gold produces an income (or the hope of a coupon) — which of course you can’t — then it is an absolute fact that, as an investment, gold is a non-income producing asset. It is, therefore, the same as a tulip bulb.

What you seem to be insisting on doing is taking a classification for something, let’s say a red vase and, because you don’t like, for some reason, the association with a description of that item, trying to deny that the item has that particular characteristic. You don’t like the colour red, so you deny the vase you own is red. Gold has no use outside of a few specialist industrial purposes. It generates no yield. It incurs costs (or a holding risk, if not insured against) just by sitting there, doing nothing. It is, unarguably, a non-income producing asset, just like hundreds of different sorts of non-income producing assets. They are all the same. Gold isn’t anything special, it is just another sort of non-income producing asset. But you keep on denying an obviously red thing isn’t red. And trying to make out that an obviously non-income producing asset is something that it isn’t, but is, rather, something uniquely different.

Thank you for your measured response. Let’s belatedly set ZH aside. It’s not a site that I am inclined to defend, and I’m sorry that we spent so much time and energy on the topic, especially given that it was tangential.

I have never suggested that gold was income producing, but the fact that it has that one characteristic in common with baseball cards, tulips, and used lawn-mowers, etc., doesn’t mean that it is, in any meaningful sense, an analogous asset or investment. Had you merely wished to assert that it is non incoming producing, I would have basically agreed, and we could have moved on. But you said this:

which is not all the same.

Along the same lines, in your above post, you say:

Setting aside that technically, it can and does produce a yield when leased in the wholesale gold market, what your quote above, and others that I have highlighted suggest, is that gold confers no advantages over other non-income producing assets, which is patently untrue, as you yourself have now admitted.

We have agreed that there are complications, costs and risks associated with physical gold ownership, and that there are other risks associated with paper proxies. We agree that gold is essentially non-incoming producing. We agree that the market performance of gold can be volatile over shorter durations, and that therefore investing in it can be risky.

That’s all good, as far as it goes. But you apparently disagree with my fundamental assertions relating to gold’s utility as it relates to wealth preservation vs fiat currencies, and especially during times of extraordinary stresses on financial systems. Or, put another way, you essentially dismiss its use as insurance against dubious central bank policies, and the instability that such policies often foment. Surely you wouldn’t suggest that anyone buy tulips or set of baseball cards as insurance, but gold has performed remarkably well over an extraordinarily long period of time under those very conditions.

I have provided clear examples of gold’s performance vs. fiat currencies, which you have not refuted, and could easily provide more. The timeframes chosen, which was your one objection, were perfectly reasonable, as gold began to float freely after the Nixon shock, and the major central banks (outside of Japan) began their serial bubble-blowing, radical balance sheet expansions ~20 years ago. To object on the basis of gold having had down years during both of those periods (i.e. having been volatile) is to miss the forest for the trees.

The very reason that so many mainstream investors and hedge fund managers are suddenly talking up gold, when they couldn’t have cared less about it for the past few years, is precisely because the metal is performing as it typically does when confidence in central banks and flat currencies wane.

If you are tired of the debate, and prefer not to respond, no worries.

There is a reason why some investors are psychologically poorly suited to a self-managed approach to investment decisioning. You’ve demonstrated many, if not all, of the behavioural traits which those seeking to invest their wealth should watch out for and try to correct and, if they can’t correct them themselves, have a fund manager do that job instead.

As the SEC notes in their advisory on this subject:

There’s nothing wrong with using the platform that Naked Capitalism provides to its readers to discuss this- or that- investment approach or particular asset class with other readers. But that can’t in any way denote anything other than a particular personal opinion. No investment asset class is a guaranteed Sure Thing. So the very most a reasonable commenter can do is say something along the lines of “I personally like this investment approach, it’s something I believe readers might want to consider”. And leave it at that. Otherwise, what is it you’re trying to accomplish?

Many self-directed investors succumb to the known problems of trying to determine one’s own investment strategy. You’re exhibiting pretty much all of them. From the SEC’s note, lets take each in turn:

Underdiversifying — you have mentioned one asset class alone in this discussion. You have had ample opportunity to outline both the advantageousness of gold as part of a portfolio and its many disadvantages. And to advise how you have to, in any portfolio, balance weaknesses in one asset class with comparative strengths from another. But you’ve resisted every attempt I’ve made to provide such a counterbalance. I can only conclude, you’re suffering from a adherence to a strategy for investment which is intolerant of a healthy degree of diversification.

Trading frequently You don’t say why now you’re suddenly talking about gold as an asset apart from the increase in price recently. If you’d said six months or a year ago (I assume you’re a regular reader) to buy gold as part of a long-term buy-and-hold investment strategy, that would be one thing. But by making it a topic now you give the impression that you should try to play the market and get in at the first hint of a price rise. Presumably, you have to also then try to get out before a price fall, as gold has no income potential. Before, again, trying to get in ahead of the next price rise. This is a very risky investment strategy because no-one can say what is the right time to either buy or sell.

Following the herd The attempts to now handwave away ZeroHedge’s gold boosting antics (which you did repeatedly until it was obvious how biased a source of information ZeroHesdge is) is classic herd mentality. Lots of people on ZeroHedge like gold. I criticised ZeroHedge. You criticised me for criticising ZerohHedge. This was because you’re following a herd and, by criticising the herd, I’m criticising you by inference. Gold, being a non-income producing asset, is entirely dependent on herd mentality buying. Unless people who hold gold as an asset plan to die without ever having to sell it (unlikely, and even if they do, their beneficiaries may well want to sell their inheritance for cash, if they don’t share the fondness for the stuff) then, at some point, they’ll have to sell — to meet retirement living expenses etc. which can’t be settled in anything other than currency. So gold needs, as an asset class, to find a continuous increase in willing buyers just to absorb ongoing unavoidable selling of current refined gold (let alone new gold which is being produced). It is for this reason that the gold owning herd reacts so strongly to any criticism of the herd.

Favoring the familiar Many of your claims as to the superiority of gold as an asset class are based on it being a known quantity. The history of gold, the numbers of people who hold gold, gold as a non-income producing asset being more identifiable than a typical piece of fine art and so on. So you have to be on alert to this being a factor in why anyone would choose to own it. If gold’s history etc. wasn’t there, would anyone suddenly decide it was a good thing to own? If the answer to that question of asset class fundamentals is “probably not” then that tells you a lot about how much gold, as an asset class, depends on familiarity with it. The SEC’s guidence note points out the pitfalls of falling for something, just because it’s something you’ve heard of before.

Succumbing to optimism, short-term thinking, and overconfidence (self-attribution bias) As I have evidenced, the recent (and indeed, longer history) of gold as an asset is chock-a-block with price rises and crashes. But with each rise, there is a group who emerge to point out how it’s risen in price but completely ignore the well-documented history of price corrections. You have consistently failed to acknowledge the steep falls in gold’s price through its cyclicality. If you don’t acknowledge a negative thing, you’re exhibiting optimism bias, right there.

While I think our commenter Tinky is a lost cause, I would urge readers to think not once, not twice but a hundred times before embracing gold (and non-income producing assets in general) as part of any investment strategy for any wealth they’re lucky enough to have acquired. And you can see from this thread, once you’ve convinced yourself you’ve stumbled across some magical answer to how to protect your wealth, there’s nothing (having become a prisoner of your own biases and self-selecting fact-sets) you’ll let come in the way of letting go of your idealism.

It’s easy to confuse the value of something by using price, it happens all the time…

This picture speaks volumes, as those lucky enough to turn paper into karats got to miss out on the Great Leap Forward, Great Famine, Cultural Revolution et al.

https://www.art.com/products/p11790363-sa-i1424969/henri-cartier-bresson-gold-distribution-shanghai-china-1949.htm

The same thing happened in South Vietnam in 1975 and Iran in 1978-79.

How do you think new arrival Iranians to LA were able to buy up sizable chunks of the tony westside and other areas?

Quite frankly, reverting to a gold standard is the surest way to sink the economy. We’d be in the same shoes as Greece in 2008, huge debts and no way to devalue them because we do not have monetary sovereignty. We’d be looking at decades of austerity. Likewise bitcoin, the international unit of electricity waste, is not a solution either.

Russia, China, and Iran have been arranging to manage their trade outside the dollar. It might not be hard to extend this system to other countries. Russia has amassed a large gold reserve. What happens if China decides to sanction the U.S.?

China’s economy dies?

China is, via its exports, way more dependent on the US than vice versa.

It’s the “if you owe the bank 100k, the bank owes you. If you owe the bank 100bln, you owe the bank” in the export space. The exporters like to present themselves as morally superior, but in reality, it’s the other side that often holds the power – because the exporters cannot force them to start importing (with a few notable exceptions).

I doubt the Chinese economy will die, simply because they have the industries and production, not the United States. I also doubt the Chinese want to rock the boat too much, because the current situation favors them so strongly, although their policy of “strategic patience” seems to be over.

China’s exports are about 40% of its GDP IIRC. A large chunk (10% IIRC, but I could be wrong here) is to the US directly or indirectly (mostly via Japan).

If China was to sanction US, it would pretty much have to ban most of its exports (probably only leaving Russia, Iran, South Korea, and a few African countries left, rest would happily re-export to the US). That would mean huge unemployment.

The CCP legitimacy stands entirely on “visible material improvement”, i.e. people getting better. There would be zero popular support at the moment for the unemployment and similar sacrifice in China requiring it to stop its exports.

China’s major problem is that ex rare earths (which is really Inner Mongolia TBH) it has almost no mineral natural resources. It’s probably one of the poorest natural-resoures countries on per-capita basis (Japan is in a similar situation, but I think it’s somewhat better). Which means it has to import it all. Which means it has to export to afford them. Which means that export sanctions are a very large economic hit.

China is well aware of its strategic weakness here, hence the whole New Silk Road, forays into Africa etc. The only problem now is that Xi is now often overplaying his hand, and instead of using soft power (which China was deploying very sucessfully ten years ago), is reverting towards what looks like arrogant imperialistic strongman (not comparable to the US, granted, but way way from the soft power it used to exercise. The US is still in a class of its own there). And it’s hurting it.

Unless China imports its raw materials from America, sanctions or other economic warfare are not necessarily going to interrupt its supplies. American-style sanctions may not be right for China, but there might be alternatives suitable to China’s strengths and weaknesses. China might want to orient its production toward serving its own public.

It still has the problem it needs to export to import the raw materials. And there’s a limited market for its goods outside its current export markets – there’s a reason why most of its stuff goes to the US, the EU etc..

More importantly: they require USD in order to trade, CNY is fine for internal use. It’s a currency based on housing, whereas the USD is increasingly a currency based on the stock market.

Globally the liabilities side of the ledger can no longer store value against the cost of goods and services. We’ve reached the event horizon where time preference equals zero. Put differently, you can no longer get paid for extending credit. So the CBs are moving to the asset side of the ledger. The Swiss central bank is a top 10 owner of AAPL shares. The Japanese CB owns 80% of all Japanese equity ETF assets. And stuck in the CARES Act: power-of-attorney from the NY Fed to Blackrock to purchase assets. With the US taxpayer fronting up a cool $454 billion in “first-loss” equity, that then gets leveraged 10X. The language is clear: purchases can include equities.

In March it took exactly 11 trading days of stock market declines for the US Treasury market to “cease functioning” (which is what the Fed minutes stated). This scared the bejesus out of them. So hi ho hi ho it’s off to work we go…towards asset-based money. Because debt-based money can no longer do the job.

They have exactly three choices (if they want to extend and pretend that is). 1. Grow their way out of the debt. 2. Everybody gets a haircut. 3. Inflate their way out. So: the correct move would be to devalue the USD against gold 50%. The rest of the complex would reprice, re-liquifying the system, and we’d be back off to the races. The wrong races, mind you, but they have made their (and our) beds.

Uncle Sam slaps down $500 billion and factories pop up like wild flowers. First 5 years will be all boondoggles and crappy products, but eventually the institutional know-how will return.

Or we could just threaten to make the sun go away…

One would hope so, but the level of ineptitude and corruption makes me wonder the the U.S. is up to it. So far, the record has not been inspiring. If the billionaires wealth were threatened, I wonder how long it would take them to move their wealth elsewhere?

One important reason for those non-dollar deals was to shield iran from the U.S. sanctions. The second reason was publicity.

China helped out iran, iran is now on step further in chinas cobweb, and that’s it (that Iran was going to China was unavoidable anyway, given that the U.S. policy against Iran is terminally stupid). In the total balance these deals don’t matter.

Extending these deals to other countries depends on:

(1) countries willing to break with the U.S. and going over to china (which might be a bit controversial, as china is not necessarily the better empire).

(2) china wanting to export money (doesn’t look as it does).

(3) the renminbi being freely convertible (it still isn’t). Nobody does like having money he can’t use as he pleases.

On 1), what motive do countries have to stick to the U.S.? What is in it for them (or at least their rulers, who may admittedly have different interests)? The U.S. is now sanctioning countries like Germany that don’t follow their orders. Schroeder recently called this an act of war. Some countries may become neutral, and others join the “axis of resistance”.

An interesting article but I do have reservations. I am sure that if you went into the literature from a over hundred years ago that there would be articles talking about the stranglehold that the British Pound has on international trade. Times change. Dollar is king at the moment but countries are learning to work their way around it as Washington demands supervision of all dollar transactions. Actually it is a truism that the only stable thing in life is change. And if this sounds unlikely, just remember that the world economy at the moment has substantial differences to the one that existed merely six months ago.

But where he said ‘The US gold reserves are so large it would appear to give them an unfair advantage’, well, my eyebrows are still lost in my hairline. The last time that the gold at Fort Knox itself was checked was back long before disco died – back in ’74. There was a visit in 2017 by Treasury Secretary Steven Mnuchin, Senate Majority Leader Mitch McConnell, R-Ky.; U.S. Rep. Brett Guthrie, R-Ky.; and Kentucky’s Republican governor, Matt Bevin. They all took a look and said yep, its all there and we all know that these are honest men all. But as the Scotsman said – ‘I ha mah doots!’

Thank you for the most sensible take (yet) on this thread. It is the height of naïveté to accept the 8k ton claim when the U.S. Government has refused any serious audit for a half-century.

Re The Rev Kev: I think what happened to the British pound actually illustrates what the author is describing. Britain went through two world wars, was devastated by the second one, and the US which was largely unscathed, was ready to take its place as the economic hegemon and provider of the world currency. It’s hard to see what could quickly displace the US under current circumstances. Obviously cataclysmic war or environmental collapse could, but then the few survivors would be too busy digging grubs out of the ground to eat to worry about currency.

With respect to gold, you could well be right, but who knows really? (good luck with the eyebrows!)

In contrast, with this pandemic the EU is relatively unscathed, whereas the USA is pretty much scathed.

As far as deflation, I’m not seeing it yet, what I’m seeing at the grocery store is more inflation – smaller packaging, higher prices etc. Of course this is just anecdotal.