Many readers, but likely not as many in the general population, will recall that the vogue for city living is a fairly recent phenomenon. In most of the post-war era in the US, the ideal was suburban living, the single family home with a yard so children had a place to play. After all, everyone was supposed to marry and have 2.3 kids. Cities were places where young people got experience and older men worked to support their families.

Large cities fell into disfavor in the 1970 as they came to be seen as hotbeds of crime and “white flight” became widespread. The exodus further eroded strained tax bases.

We’ll focus on New York City as the canary in the coal mine for what is coming for other cities if Covid-19 isn’t tamed by say mid 2021, particularly since commentators are already worrying about fiscal-crisis-level damage to the Big Apple. For instance, Wolf Richter has a piece documenting how San Francisco’s financial district has become a ghost town which we’ll discuss briefly. Heavily tourism-dependent towns are also due to take worse hits than similar-sized brethren.

The Wall Street Journal has a new story tonight on how employers are facing worker revolts about bringing them back to offices, which does not bode well for the recovery of urban centers. Key sections:

This summer, executives at health-care-technology firm Epic Systems announced a plan: Most of the 9,500 employees at its 1,000-acre campus in Wisconsin would be expected back in the office in September.

The company, like many others, says its employees do their best work when they can collaborate in the same space. But blowback to the mandate was swift. Employees expressed fears about safety and spreading the new coronavirus. Local health officials questioned the move. So Epic joined legions of other companies making late-in-the-game changes to office-reopening plans, saying this month that staffers could work from home at least through the new year….

Expecting the virus to be under control by Labor Day, many employers had hoped to bring white-collar workers back to the office next month. But as cases rose in dozens of states throughout the summer, major school districts settled on remote or hybrid instruction, complicating the picture for working parents. Some employers have already scuttled plans to force office workers back so soon.

They include some of the country’s biggest companies. In an August survey of 15 major employers that collectively employ about 2.6 million people, 57% said they had decided to postpone their back-to-work plans because of recent increases in Covid-19 cases. Nearly half said they were putting in additional safety measures for when they reopen, such as redesigned workspaces and temperature checks.

Only one respondent said the summer surge of infections hadn’t affected its timeline or plans for bringing workers back.

In the 1970s period of revulsion about cities, New York City was the sickest:

I spend the summer in New York City in 1980 and moved there in 1981. It was grimy. There were a lot of petty robberies, but if you lived in at least an OK neighborhood and didn’t go to risky areas in the late evening, personal safety wasn’t a real risk. But even then, it was the place to be for so many lines of work: dance, theater, visual arts, advertising, publishing, finance, law. It was also a magnet for top journalists and medical professionals. But I ran into people even as late as the mid-1980s who had nearly had their businesses fail during the fiscal crisis and still seemed traumatized when the topic came up. They had little confidence in the resurgence of prosperity then.

As I’ve recounted, New York City’s population of the city rose not just due to growth of jobs but also the increased tendency of mid and upper income workers to bring up their children in the city. And the long-term plan for New York City, of it becoming a bedroom community for the wealthy and professionals, was coming to fruition (if you were a fan of sort of thing) via formerly commercial neighborhoods like Soho and Tribeca becoming playgrounds for the affluent, and Harlem and areas colonized by artists gentrifying.

Another chapter in this “progression” was New York, along with other “world cities” becoming a place where the super-wealthy would buy apartments as investments. They were often kept vacant or little used. New York hadn’t gone as far as, say, Fulham Road near Sloane Square, in terms of looking like it had been hit by a neutron bomb. But some buildings like the former Plaza Hotel, converted into condos, even had articles written about how creepily empty they were.

Now this has all gone splat. High end real estate prices are cracking as the city’s budget becomes a black hole, assuring coming deep and painful cuts in services. The press was already reporting that rats were becoming bolder due to restaurants no longer producing anywhere near their former level of throw-away food, in combination with the city sanitation services having already cut back on their schedules.

The first adverse development was underway before Covid-19 hit, that of the super-rich cooling on New York City. Some of that was due to increases in mansion taxes and transfer taxes on very high end properties. I imagine another chilling effect came from an initiative to disallow corporations to buy properties without disclosing who the owners were; that followed a New York Times expose on some of the corporate-owned units in the Time Warner Center, which found some could not be traced at all and others had decidedly seedy (as in crime connected) shareholders. The threat was to make real estate sellers subject to “know your customer” type requirements, not just banks.

On top of that, lots of new apartment buildings designed for the top wealthy had just come on the market. From the Wall Street Journal over the weekend, Covid-19 Pounds New York Real Estate Worse Than 9/11, Financial Crash:

The Covid-19 crisis has delivered a stunning gut-punch to the New York City luxury real-estate market, applying downward pressure at a rate that surpasses both the 2008 financial crisis and the period immediately following the 9/11 terrorist attacks.

In the West Chelsea district, a recently built ultra high-end boutique condominium known as the Getty slashed prices for its remaining units by as much as 46%. One full-floor, four-bedroom apartment at the Peter Marino-designed building was lowered to $10.475 million from $19.5 million….

The crisis comes at a time when sales and prices in the luxury market were already under pressure. “It’s not like New York City is all of a sudden on sale. New York has been on sale for the past 24 months,” said Tal Alexander, a luxury agent with Douglas Elliman. “Sellers who are motivated and want to do deals need to add on another layer of discount.”….

New listings were down by 21%, while new listings priced at $4 million and above were down by almost 35%. For luxury homes sold in the second quarter, prices were also down by about 11%, according to a report by Douglas Elliman….

Agents said the greatest discounts are in new developments, where developers with stacks of inventory need to move product to meet loan repayment deadlines. “Any developer who broke ground after 2016 in Manhattan is going to be lucky to get most of his equity out,” Mr. Korolik said.

The flip side is this is way way way short of the distress during the fiscal crisis or even the much-shorter-lived bottom of the nasty 1991-1992 recession. Then some co-ops were sold for $1 plus proof of enough income to cover the maintenance. There were so many buildings seized by the city, mainly in Harlem, that it also created a homesteading program: the city would let someone take over a house if they could show they had plans for fixing it plus the skills and funds needed for the repairs.

Or as Kurt Andersen, founder of Spy Magazine, said in an interview in the New York Times:

I know people who are trying to buy and sell real-estate right now and I haven’t heard that you can suddenly get a one-bedroom apartment for $200,000.

But things look set to get worse before they get better. From yet another Wall Street Journal piece, this one today on the New York City budget crisis:

New York City faces a $9 billion deficit over the next two years, high levels of unemployment and the prospect of laying off 22,000 government workers if new revenue or savings aren’t found in the coming weeks.

The growing economic crisis, brought on by the coronavirus pandemic, has alarmed New York Gov. Andrew Cuomo so much that he recently asserted greater control over a panel overseeing the finances of the nation’s largest city…

Mr. Cuomo, a Democrat, has grown concerned about the direction of the city budget, state Budget Director Robert Mujica said in an interview.

The city had to cut billions to balance its latest budget, but it still has major funding challenges.

Local officials have called on Congress to approve a relief package for the city, but talks about a bill are ongoing. As a backstop, New York City Mayor Bill de Blasio asked state lawmakers for authorization to borrow up to $5 billion to fund operating costs. Democrats who control the state Senate objected, and the request hasn’t been granted.

“A lot of the same things that occurred in 1975 are reoccurring,” [state Budget Director] Mr. [Robert] Mujica said. “And if that’s the case, and the city’s going to be in a level of fiscal distress, we want to know early.”

Axios confirms the downbeat take:

Where it stands: A throwdown between Mayor Bill de Blasio and the city’s unions over New York’s massive municipal budget deficit could make matters much worse.

-

De Blasio has appealed to Albany and Washington for relief, but so far is hearing, “Talk to the hand.”

-

He’s threatened to fire 22,000 city employees unless unions agree to trim $1 billion in labor costs.

-

Meanwhile, trash is piling upin city parks, the city’s EMS union chief says that “people will die” if first responders are cut, and New York’s teachers have threatened a sickoutto protest de Blasio’s plan to open schools on Sept. 10.

And there are plenty of signs of trouble:

“Until the pandemic struck the city, La Jornada food pantry used to hand out groceries to roughly 1,000 families a week. Now, the number tops 10,000. . .Across the five boroughs, the hungry is in the hundreds of thousands, the Food Bank of New York estimates.”

— Jennifer Taub (@jentaub) August 23, 2020

And collapsing confidence in Mayor DiBlasio:

Parents in New York City are ‘Baffled’ that @NYCMayor has no plan to test all entering schools https://t.co/CmbcrTgDvA @UFT

— Brian Gibbons (@BrianUFT) August 22, 2020

And although it is only one opinion, developers tend to be bullish. From CNBC, New York City may take a decade to recover from coronavirus pandemic, says developer Don Peebles:

“I think New York will ultimately come back. It’ll come back differently. It’ll be a different place, and it will be much more affordable,” said [Don] Peebles, CEO of privately held Peebles Corp., which has a corporate office in lower Manhattan.

He added on “The Exchange,” “I think it’s going to take New York about a decade or so to dig out of this. Maybe longer. But it’s not going to be soon.”

Peebles said he foresees challenges ahead for New York City in attracting and maintaining new residents and businesses going forward. Among them is the strength of other U.S. cities, especially in places with a more tax-friendly environment, he said.

I hate to sound like a Republican but the New York City corporation tax is a big disincentive. And there is an unincorporated business tax too.

While New York City’s tsuris gets a lot of coverage, it is not alone. As we mentioned, Wolf Richter has a photo essay of San Francisco. From the set up:

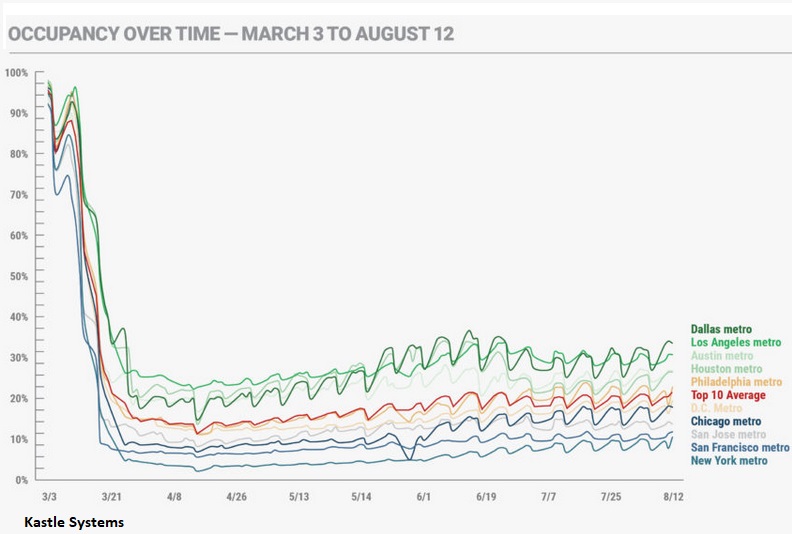

The data of how work-from-home impacts office patterns in a city like San Francisco are grim. According to Kastle Systems – which provides access systems for 3,600 buildings and 41,000 businesses in 47 states, and therefore has a large sample of how many people are entering offices during the Pandemic – office occupancy in San Francisco was still only at 13.6% of where it had been at the beginning of March, meaning it was still down by 86.4%, just above New York City:

And some of his images, taken at the AM rush hour on August 18:

On Columbus Street, looking at the intersection with Montgomery Street, with the Transamerica Pyramid in the background. I’m standing in the middle of the street to take this photo. Why? Because I can:

…..On Montgomery, getting closer to Clay Street:

…..Intersection of Montgomery and California, another main drag, so to speak. The cable car rails have been unused since March, cables turned off. Looking south on Montgomery, across California:

If you have time, I suggest you look through all of Wolf’s images. They look an awful lot like Midtown when I was there in July.

These cities will all limp through. But how long it takes and how much they change is very much an open question.

As I noted in the last posting, I think the impacts are going to be highly regionally specific – urban life is far more deeply ingrained in continental Europe and Asia than in the America’s, where there has always been more room to spread and an infrastructure that allows/encourages it. Although I suspect that the situation in the UK may be more like the US. A general antipathy to cities seems to be quite an anglophone problem, despite Britain having historically being one of the most urbanised nations on earth for much of its history.

There is a view expressed by some urban economists that in the longer run, this type of clear out is healthy. Cities are generally enormously resilient (there are historical exceptions), and major downturns simply makes them more affordable, and the presence of infrastructure and history will mean a new generation will move in once prices drop low enough. It may take a decade or more, but in the longer term a new generation of urbanites will inhabit areas abandoned by investors and banks, just as they’ve frequently moved into long abandoned industrial areas (not always of course, but there are plenty of success stories). I think a peculiarity of the US (maybe Australian/NZ too) situation is that the tax and infrastructure investment system has a particularly nasty pro-cyclical impact on urban finances. This leads to more investment in the desirable ex-urbs, which may prevent the natural flow back to the city.

Those photos of abandoned downtown areas remind me of the Sundays I’ve spent walking and cycling around the financial districts in London and New York and elsewhere – Sunday morning is always the best time to gawk at the architecture of those places undisturbed. But of course if its like that 24/7, then very quickly companies will cut their losses and move somewhere cheaper.

Having said all this, we can never forget why cities exist, and why so many companies are willing to spend huge sums on urban office rental when they could get something a fraction of the price in a small town somewhere. Cities are highly productive. They make highly efficient use of historic infrastructural investment (this is why ‘new’ cities rarely work), and there is a very close relationship between urban size/density/ and innovation. Having lots of people in similar fields of work mingle together is very productive, this is why clustering has happened throughout history and why major cities are so very resilient. The original reason for London, Paris, Beijing, New York, etc., to be where they are (and the size they are) has long since disappeared – but they still grow and thrive for very good reasons.

Dublin’s equivalent, the docklands area, where Google/FB and the banks, etc., are based has a similarly empty feel. Even though the city still officially has a shortage of residential space, many blocks seem visibly empty, with no lights on at night. Its very eerie. The only activity is construction, which is still going at more or less full blast. I’ve heard rumours that most of the big companies have ordered foreign work-from-home staff to return to Dublin before the end of the year, even if they are not to attend the office. It’s something to do with tax liabilities (i.e. if they don’t reside in Ireland, they can no longer be considered domestic employees), but I don’t know the details. But this has caused some consternation among staff apparently, and may have an impact on residential demand.

There has also been a lot of activity as people get used to working from home. My spare room is now occupied by a friend who found her previous set up sharing unbearable, and so she needed a transition space for a few weeks. My nephew and his gf is looking for a larger (2-bedroom) apartment in the city as he and his gf are working from home all the time and can’t share the same room as an office and focus on work apparently. So there is lots of activity as people adjust, without any obvious end result. I’ve heard many stories of people looking to move permanently to rural areas, although I suspect that most of those plans won’t come to fruition for all sorts of reasons, not least the inadequacy of rural broadband.

The theory is that urbanization drives innovation, but is that true? Are there studies to back it up?

Because it seems to me that cities, places like LA, weren’t set up for innovation, they grew around manufacturing and shipping. Deep water ports like in New Orleans are what built the city, not the financial district innovating new ways to cut up and redistribute loans. The recency of “downtowns” being places where you sit in an office is all new. And when I look at my local downtown and see the companies (mostly FIRE), I’m not seeing innovation. I’m seeing rent seeking.

It seems to me that as manufacturing has gone overseas, American cities have become centers of consumption, not production. LA lost its manufacturing in the 70s and 80s. It has never become the boom town that it was.

There are mountains of research papers on the topic, there was huge interest in it within geography and economics circles in the post war years (it drove many of the fashionable development theories of the time), and there are plenty of more up to date papers on it. Quite simply, there is a long established relationship between density (or more specifically, the number of interractions an individual will have during a day) and productivity and innovation. Its years since I read up on the subject in detail, but I’m not aware of any significant amount of research contradicting these assumptions.

I’m not sure if it’s entirely true that big cities are the largest innovators.

Here, they show patents per square kilometer. Noteworthy is that the top contenders include places like Boulder, CO (not really that dense), and smaller cities like Trenton, NJ and Ann Arbor, MI:

https://www.theatlantic.com/business/archive/2010/09/the-density-of-innovation/62576/

The driver of innovation is the speed of communication and its quality.

If you look back at history you will find that there were surges whenever means of transport or communications technology advanced.

One of the biggest boons to innovation was the advent of the steamship. Letters and papers could travel faster between continents and cities.

If so, then would the quality of internet connection be far more important?

All the more reason to breakup companies like Comcast, if not outright nationalize them.

That’s a case for better internet than say, density. It’s likely that Internet technology will continue to advance in terms of bandwidth (say if optic fibre was widely rolled out in a state owned ISP)?

I am not so sure. The studies I remember didn’t just refer to communication as the “exchange of ideas” but the infrastructure to act on those ideas. Say I need a unique part built for prototype or even limited production. In a place like New York, its a near certainty (or was) that there was some one who could make it. With industrialization, this is no longer the case, even IF you have the internet to facilitate more “communication.”

A case in point, a friend of mine was trying to manufacture RF probes – good ones. (I own one – it’s like a little piece of gold on the end of a coax.) At its heart it needs a tiny little mettle barrel with specific RF properties. He looked from coast to coast and found only 1 manufacture who had the chops to make it with any sort of quality. When it got bought out and shut down (its operations were moved to Mexico) the importation costs suddenly became prohibitive and he could no longer make the probes.

The theme of a lot of the research on innovation has been on the importance of “clusters”. This typically means a large number of similar firms in a small area. The firms can switch between competition and cooperation and the employees have a much more liquid labour market and therefore have confidence in developing specialised skills. Some of the most dynamic clusters occur in densely population but non-metropolitan regions, for example in southern Germany and Northern Italy. LA is one aerospace cluster and entertainment cluster(f***?)).

NYC and London are currently FIRE clusters (+ parasite clusters of legal and advertising) but once upon a time, so were Genoa and Augsburg (the Fuggers)…

The manufacturing infrastructure in the UK Midlands for the F1 racing teams is another example. Say you need a special gear made over the weekend fabricated from a special steel with a special heat treating. It is no problem in that area.

If you were in Nebraska, forget it. I used to subscribe to the brit magazine RaceCar. The adverts for the various custom fabricators were incredible.

Those are all college towns. Universities are the denser areas in those municipalities. Check out Strong Towns – the excellent research they do on urban planning and density. Simply put, what’s underground is more important than what’s above ground and it acts as clock in many ways as to how long aging infrastructure has and the monies to pay for it.

I think I needed to know the buzzwords before I started to really research this, thank you, PK. Unfortunately that article is behind a paywall, I wanted to see their methodology. You’re right, there’s plenty of research out there.

This was an interesting article that I think you’ll like. https://www.bloomberg.com/news/articles/2019-12-02/innovation-doesn-t-happen-only-in-urban-clusters

One thing that this article points out is our definition of innovation, because creativity and sustainability aren’t always put into these equations.

I just wonder if it’s less a function of living in a city and more that you have X good ideas per Y of people and cities appear to be places where innovation happens because your Y is localized.

But hey, I’m not an economist, just an interested observer.

well given the disparity in internet speed in urban/suburban and rural, its probably the same. in some urban/suburban cities you can get 1gb speed, while rural has trouble getting to 10mb, not even 1/10 of the top speed available. some of that is because the population density is so low, leading to much higher costs vs revenue to fund the infrastructure. while the latest greatest cell speed may solve some of the cost vs revenue to pay for the infrastructure, the population density wont help.

and while the much lower cost of living in rural, also comes with much fewer opportunities to work, leading to almost complete exodus of the kids as they look for work or education, neither is available. now its possible that with covid and remote schooling education could be better, but then there is still the problem of using that education

I would disagree that being in one location adds to productivity or even to collaboration.

In my experience, being in one space does the following.

1. Encourage cube conversations about why the bosses are idiots

2. Create distractions when your trying to get something done

3. Breed unnecessary meetings

4. Exhaust people trying to get to and from the job

The big difference between now and the past….BROADBAND SPEEDS

OMG, DanP66, you just described every office job I ever had. And, just because I can, I’m going to add this story from the Arizona Slim file:

Years ago, while I was a low-level worker bee in the groves of academe, I was discussing my boss with my mother. I was telling Mom, a classroom teacher, that my boss’s job consisted of going to meetings.

To which my mother replied, “That’s not a job. It’s a sentence.”

DanP66 and Arizona Slim, yes! Back in the day working for large law firms, the utilization of time was a joke, in my opinion. The wasted time made me crazy. People would saunter into offices to “chat.” I worked through lunch and left 15 minutes early to get home to kids. I was deemed “unfriendly.” As soon as a few of us established our own firm, I worked from home when possible. Much more productive! Maybe that’s what people are finding in certain occupations. (That said, when it comes to law, it’s imperative that courts be operating.)

In may past life as a design engineer, it would be impossible to work from home. So much of my job was “Come here and look at what this stupid thing is doing!”

That’s why the people researching the Toyota process were so clear on never, never, NEVER separating design and manufacturing. You need that intimate interaction.

When imagining NYC’s future (where I lived from 1977 to 1992) one must remember that though not mentioned here there are well known additional issues that may make its cyclical renaissance from covid different and unpredictable from past recovery patterns. Specifically rising sea levels, environmental collapse and enormous delayed infrastructure renewal. Can we continue to assume that these long denied and ignored issues will not have a significant impact?

And then even beyond these problems is the conundrum Y Varoufakis posted on a few days ago, the decoupling of the finance economy from the real economy leaving the post industrial capitalist world in new territory. These are formidable problems that probably should be considered when using past experience to prognosticate on the future of our brave new world.

Specifically rising sea levels, environmental collapse and enormous delayed infrastructure renewal.

Can’t lose sight of the big background looming…

Just an anecdote from outside the US. I had two colleagues who worked in NYC in the last 20 years, both vowed never again. Both are currently working in China, Shanghai region, and have found it a much better experience than NYC, one even went back to China after a brief stint back in the UK.

The finance and real economies will reconnect when the central banks stop printing money to inflate the capital markets, or cease to exist due to political repercussions of their money printing. Y Varoufakis knows this, but it makes a better political narrative not to mention it.

Philip

“I think the impacts are going to be highly regionally specific – urban life is far more deeply ingrained in continental Europe and Asia than in the America’s, where there has always been more room to spread and an infrastructure that allows/encourages it.”

Asia and Europe are older cultures. But, judging from the political rifts, the urban life is starting to be more ingrained in the USA. How “deep” any exodus back to burbs or rural areas will be may be different now.

I guess I’m trying to say that it takes time for urban life to really develop a “new breed” of sorts. Well, about to find out for sure.

San Francisco is going to see a much harder time than New York. Its budget went from $6B to $12B from 2008 to 2020, thanks in large part for the tech windfall (by my estimates 40% of that was absorbed in wages and benefits by the city bureaucracy). Now, all the people who blamed tech for the city’s woes (as if the housing crisis did not go back to at least the 80s) are going to get what they want: Tech is leaving the city in droves, as are tech workers.

When the budget shrinks back to 2008 levels (which were historically high, despite the impending recession), there will be open warfare between the various special interests that currently feed at the trough. I don’t expect actual residents’ needs will feature highly, as they don’t today either.

And here is one quick and dirty solution to the problems that cities like New York and London on have. Where it says here ‘…New York, along with other “world cities” becoming a place where the super-wealthy would buy apartments as investments. They were often kept vacant or little used.‘ pass an ordinance that says that unless those empty apartments are being taken by long-term tenants, then they have to be sold at market value within a short time-period.

It does not matter if the super-wealthy try to pass them around between dummy companies as the key will be that there has to be long-term tenants in them with long-term meaning at least a year or more. And these places will have to be checked on to make sure that this happens as in Trust But Verify.

But we all know that this will not be done as nobody will do this to the elite so Mayor Bill de Blasio will just continue to cut city-workers and make other cuts which will make the city even less attractive to live in thus driving more people away that would have saved the city.

Ouch. The pictures look like Oslo on days where no one needed to be there – eerily empty, like you’re an extra in an “after the Catastrophe” movie.

On the other hand, while I get the nostalgia for the past, maybe big cities need to shrink, and perhaps betting on stratospheric real estate prices is not a sustainable policy.

I watched a documentary about NYC and the peoples dependance on food pantries. I don’t remember the exact number but over 50% of the residents of NYC depend on food banks for one or more of their meals.

What’s the name of the documentary?

The acoustics for a lone saxophone player on an empty Montgomery street is something I will never forget. Couple blocks further down towards Market on the right is the sweet spot.

Nothin’ shakin’ on Shakedown Street. Used to be the heart of town.

Don’t tell me this town ain’t got no heart. You just gotta poke around.

So does this mean I’ll be able to afford a place in the Outer Richmond (SF) someday?

My friend’s grandson works for the San Francisco office of a major law firm. The young lawyer was told he can work from anywhere in the country where he feels safe from Covid as the firm has no intention of reopening its downtown office until at least next summer.

Well gosh, this just warms my heart. The financial districts becoming flyover country. High-end RE prices slashed 46%! How do you spell haircut? I got one in ’08 and I still don’t like it. I love the smell of detritus in the, well, I just love it. And I’m not bitter. I’m not!

Hum de dum de dum, Change is in the air, la de da de da.

Ditto from this corner of the boonies.

No offense to ordinary New Yorkers and finance industry bystanders but karma is a bitch. NYC recovered in the ’80s and ’90s on the backs of the rest of America as Wall Street hollowed out our already declining industrial base. Then in 2008 further hollowing via an outrageous big bank bailout. One could even go so far as to say that our politics and social dysfunction will only improve once these chickens come home to roost. It’s the money power that is wrecking us and NYC is money power ground zero.

Plus Covid is exposing the degree to which all this herding together may no longer be necessary. It may be time for the big cities to experience the cyber age creative destruction.that is threatening the heartland. And once they disperse to said heartland they may discover that it’s not quite as scary as they think.

Scary no

Boring yes

Except it’s not that financiers that will be damaged. It’s all the working people that will be left aside now that financiers don’t find them useful. Just like they did to flyover states.

Seems like Covid was just the excuse the powerful needed to take the remaining silverware off the table. Rich get richer and poor get poorer. Starting to think it’s a law of physics.

Karma is only a bitch if it hits the right people without hitting any bystanders along the way.

Otherwise Karma is a blind drunk and a fool.

I think Billy Joel wrote a song about this…

https://www.youtube.com/watch?v=Az1FSLfZxH4

I may be off here but,

I recall reading that cities were thriving places able to efficiently put infrustructure, modern conviniences, and resources at the disposal of its residents. Throughout history, cities developed that were able to grow and expand – but always, and forever, the special interests, politicians and realtors were always looking for ways to skim the communities improvements and, increases of value thus rendered, into private hands. A tax system that taxes improvements on a lot of property will tend to prevent those improvements from being done. Why be taxed on a 1 billion dollar real estate developement on a block of property when an existing 100 million property on a block is taxed at 1/10 and is older and in need of much more public services.

Why is it that a realtor is always happy when existing building stock appreciates —- more money at the sale

Equally adaptable to the USA as it is the ECB – I recomend

Michael Hudson and all his books –

Michael Hudson Financial Predators v. Labor, Industry and Democracy

August 2, 2012

By Michael

A little exerpt

“By starving the economy of the funds to increase employment and output – while backing banks that have spent the past generation inflating real estate prices and the financial bubble – ECB policy has promoted asset price inflation for housing, living costs and hence employment costs. This hardly is a recommendation for leaving it with the central planning power it is seeking to impose austerity to squeeze out debt payments for its past irresponsible credit policy.

Something has to give. If debts are not written down – and indeed, written off – then economies will have to use their surplus to pay past creditors and their heirs rather than invest in economic growth and raising living standards. The financial plan is to dismantle government social spending and infrastructure investment, privatizing this – on credit, building heavy debt servicing charges into the prices of public services now provided at subsidized rates or freely, paid for by a combination of progressive income and wealth taxation and new government money creation. The effect will be to increase the national price structure, while making creditors and privatizers rich even as the overall economy shrinks.

A political and ideological coup d’état is replacing democracy with financial oligarchy, transferring government power to banks and bondholders. The new policy is not for governments to tax the wealthy but to borrow from them – at interest, which is to be paid by taxing labor, consumers and industry all the more. To proceed down this path would reverse Europe’s Enlightenment and the past three centuries of economics. It is called classical economics – and even “free market economics” – but it is a travesty to impose this policy in the name of the patron saints of classical political economy. The Physiocrats, Adam Smith, John Stuart Mill, Wilhelm Roscher, Friedrich List and Progressive Era reformers urged just the opposite path of what now is being taken, and indeed which the world seemed to be following until World War I and for a few decades after World War II.”

The problem began over a century ago when neoclassical economics and marginalism (the labor theory of value instead became subjective marginal utility) were born. The vested interests, being threatened to defend their unearned gains, began an academic campaign to conflate (largely via John Bates Clark) land and capital as factors of production – the classical economists were precise in differentiating economic land as its own unique factor i.e. humans contribute no labor to making (economic) land, it is the community that creates its value; all the classical economists agreed on socializing rent so as to free the people from the free lunch of ‘owning’ titles of privilege to natural opportunity. New York has largely been one giant real estate value maximization effort ever since, the Al Smith Act of 1921 being a brief attempt at equalizing the land’s value for its residents.

The Assassination of New York by Robert Fitch –

https://archive.org/details/assassinationofn00fitc/page/n9/mode/2up

Yes indeed – thanks for that

What is “economic” land versus “non-economic” land or “un-economic” land?

What moves a measured or at least measurable square area of land from out of the “non” economic bucket or the “un” economic bucket and into the “economic” bucket?

There are real problems which the article highlights, but the flip side is: cities and states are being paid to borrow money. 30 yr munis are yielding 1.3 percent! Adjusting for inflation thats akin to investors giving cities 115$ dollars now only to be paid back 100 in purchasing power over the life of the loan.

I normally abhor politicians who borrow from the future for the now, but in this case–I think there’s a clear solution to all these budget woes. The Fed has been cleaning up Congresses’ unwillingness to govern for awhile now (albeit with a lot of not necessarily positive side effects), and this is just another example

I was in NYC a week for a coin show every December from 1978 to around 1985, and being an Angeleno I couldn’t believe what a gawdawful mess it was compared to LA. I remember one drive from Fort Lee across the GW Bridge counting carcasses of cars on the way to midtown Manhattan, and 1/2 of the area around the periphery of Central Park seemed a strict no go zone, while the other half seemed where the money was, just startling to my young adult mind.

W/o Wall*Street, the Big Apple would’ve more closely resembled a rust bucket city such as Cleveland, but financial chicanery brought it back from the brink, only to fall into the abyss again.

LA at the time had scads of light industry and an auto plant, now it has the Kardsahians.

So… NYC is still ahead? :)

I moved there in 1991, there were fiscal issues then as well, crack was very much a problem, but like Yves said, as long as you were smart, you were fine.

The value proposition for cities is severely damaged currently. All of those elevators, and the part-time residents. I lived recently in Austin in one of the big condos downtown – only 3 of the 8 apartments on my floor had year-round residents. I only heard noise outside the elevator a few times in a year; it was weird. I feel for the great musicians living there, they’re adapting but at a fraction of the income. How long can they can hang on in what is a very expensive city?

We are accustomed to government action to bail out markets – the response was so swift this time I’m still reeling from the whiplash. But urban RE prices in a pandemic might have to wait.

Sir Walter Scott comes to mind “Oh what a tangled web we weave, when first we practice to deceive!”

I’m waiting to see what happens to all those balloon mortgages. If the Fed operates efficiently under it’s new design I suppose that I will continue to wait.

Another facet to consider is that automation will be slowly removing the need to have low income workers within a bus ride distance from their place of employment. The city still has the advantage of keeping messy humans off the farm land, which is very important in the long term if we expect to see key farmland devalued by rising sea levels.

There are lots of dystopian outcomes one can imagine, with many of them already in full swing as population monitoring and continuous surveillance show no sign of slowing – cites are a great place to optimize surveillance. If a historical hump in the need for human labour has passed, the folks pushing for depopulation have some scary but valid points. I’m pretty sure I do not like that end point as a goal but not sure if it repels me because of how I grew up and my own bias.

There will certainly be a need for city infrastructure for a few generations. The trick will be keeping them livable if their ability to generate tax is dropping. Surely there is room for government to see the use of such concentrated living infrastructure that isn’t a Snake Pliskenesque horror show.

This post covers Manhattan but what is happening in the other boroughs? The Federal unemployment supplement has expired along with the rent moratorium. What is happening to the small businesses in the boroughs? What is happening to the small landlords? What about the many people who were employed in the service industries? I cannot get past feeling the scene is set but the drama hasn’t started yet.

Unfortunately, Manhattan is better observed. And it is Manhattan, and not the other boroughs, that in the old normal the monster influx of commuters and associated spending. People in the other boroughs largely depend on Manhattan, either directly by working there or indirectly by having businesses that cater to locals who to a significant degree work in Manhattan.

Thanks. My daughter is in Brooklyn. From what I hear from her I get the impression a lot of the small businesses there are trying to hang on waiting to see what happens next — but they aren’t earning any where near the income they had before. I think she may have a hard time finding a new roommate and I can’t figure out what she thinks she will do if she can’t find work at one of the restaurants, bars, or small shops. Until the Corona pandemic settles I don’t think she wants to risk work serving the public. But until the Corona pandemic settles I’m not sure I want her working as a bartender or waitress.

We were just discussing the challenge of working in teams on a call today. A logistical challenge is quarantining if there is a suspected or proven infection when testing often takes 5+ days to come back. The quarantine daisy chain then impacts entire teams and their families.

White collar workers are easier to have at home so this is much less of an impact. So there is fear on the part of the workers, testing and quarantine issues, and the general unwillingness of many of the bosses themselves to come into work.

I think this fall is when the cost of inadequate federal focus on testing is going to really come into play as an economic factor.

Meanwhile, the US economy has viewed frontline, migrant, and meatpacking workers as disposable, so it is not surprising that this is the sector where many fo the cases and deaths have been.

Carmageddon is the best possible outcome for when the lockdowns are lifted. A Mother of all Gridlocks so total and comprehensive as to become an “immovable object” for several days or maybe a whole week would force the Big City inhabitants to finally decide just how much they REALLY value mass transit, and just how much they are really willing to pay, and also to give up and go without, in order to have mass transit.

It will take the Mother of all Gridlocks to force urbanites to do the final and ultimate thinking involved in making some real civic life choice decisions.

I am more interested in what will to mid-tier cities and suburbs when more of the wealthy move out of their expensive cities to destroy and drive up prices elsewhere. Will people in those cities and towns be priced out? Will there be a reversal again where more poor people move into the cities and wealthy people see the value in having a house with a back yard in the suburbs in the decade ahead?