By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Rental markets in the US are shifting in a massive way, with some of the most expensive cities, cities across the oil patch, college-focused cities, and tech and education hubs such as Boston booking sharp year-over-year rent declines. But 60 of the top 100 rental markets booked rent increases, and 23 of them booked double-digit increases.

San Francisco, the Most Expensive Market, Skids Hard.

The median asking rent in San Francisco for one-bedroom apartments dropped again 2.4% in July from June, to $3,200. This brings the two-month decline to 4.8% and the 12-month decline to 11.8%. From the peak in June 2019 – which had barely eked past the prior record of October 2015 – the median asking rent has now plunged 14.0%. That’s a lot, very fast.

For two-bedroom apartments, the median asking rent dropped 3.0% in July from June, to $4,210, bringing the two-month decline to 4.8% and the 12-month decline to 12.1%. Since the peak in October 2015, the median asking rent for 2-BR apartments has now dropped 15.8%.

In terms of 1-BR apartments, this makes San Francisco the third-fastest dropping rental market among the top 100 rental markets in the US on a year-over-year basis, behind Syracuse, NY (-15.5%), and Madison, WI (-11.7%), but ahead of oil-patch cities Irving, TX (-9.6%) and Laredo, TX (-9.6%).

In terms of 2-BR apartments, San Francisco’s rents fell faster on a year-over-year basis than any other city.

Despite these declines, San Francisco remains the most expensive city to rent in, among the top 100 rental markets in the US, according to Zumper’s Rent Report. But in terms of ZIP codes, San Francisco doesn’t have the most expensive ones; there are some in Manhattan and in Los Angeles that are even more expensive.

Rents in San Francisco hat hit a ceiling in October 2015 and then spiraled down by close to 10% over the next year-and-a-half before the Trump bump kicked in and rents rose again. 2-BR rents never got back to their October peak, but 1-BR rent did briefly eke past it in June last year. Now the Trump bump has totally unwound, plus some, in just a few months.

What Are “Median Asking Rents?”

Median asking rent means that half of the asking rents are higher, and half are lower. “Asking rent” is the advertised rent. This is a measure of the current market, like the price tag in a store that can be changed to attract shoppers. Asking rent is not a measure of what tenants are currently paying on their existing leases or under rent control.

These rents are for apartments in apartment buildings, including new construction but do not include rents of single-family houses, condos-for-rent, rooms, efficiency apartments, and apartments with three or more bedrooms. The data is collected by Zumper from over 1 million active listings, including from Multiple Listings Service (MLS), in the 100 largest markets.

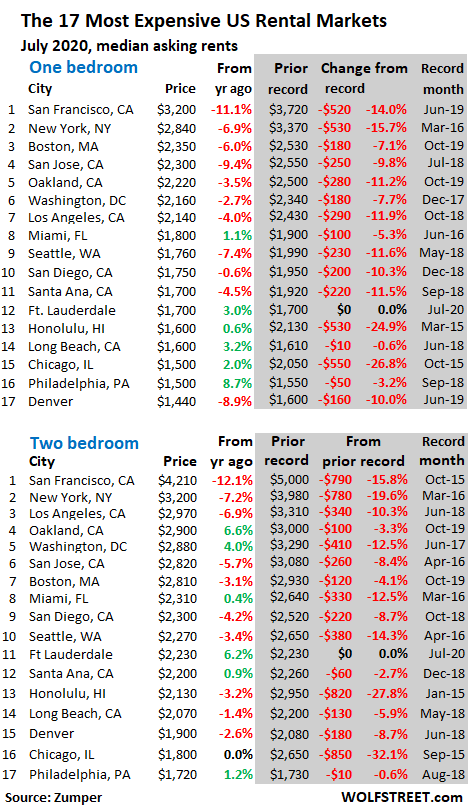

Red Ink in the 17 Most Expensive Rental Markets.

The table of the 17 most expensive major rental markets by median asking rents shows July rent, the change from July a year ago, and, in the shaded area, peak rent and change from the peak. The “declines from peak” are led by Chicago and Honolulu in the range of -25% to -32%, though they seem to have found a bottom recently. Numerous cities – including some of the formerly hottest markets – are have booked double-digit declines from their peaks. But Ft. Lauderdale set new records:

The 35 Cities with declines in 1-BR rents.

The table below shows the 35 cities among the top 100 rental markets with year-over-year rent declines in July for 1-BR apartments, led by college town Syracuse, NY, Madison, WI, and San Francisco. In addition to Silicon Valley’s San Jose and some other unicorn-startup-bubble hubs with a large university presence, such as Boston, there are a bunch of cities on this list that are in the hard-hit oil patch in Texas, Oklahoma, and Louisiana, with Texas being the epicenter of oil-and-gas company bankruptcy filings, and also being represented by seven entries on this list:

| Decliners | 1-BR | Y/Y % | |

| 1 | Syracuse, NY | $820 | -15.5% |

| 2 | Madison, WI | $1,060 | -11.7% |

| 3 | San Francisco, CA | $3,200 | -11.1% |

| 4 | Irving, TX | $1,030 | -9.6% |

| 5 | Laredo, TX | $750 | -9.6% |

| 6 | San Jose, CA | $2,300 | -9.4% |

| 7 | Denver, CO | $1,440 | -8.9% |

| 8 | Aurora, CO | $1,090 | -8.4% |

| 9 | Seattle, WA | $1,760 | -7.4% |

| 10 | New York, NY | $2,840 | -6.9% |

| 11 | Providence, RI | $1,400 | -6.7% |

| 12 | Charlotte, NC | $1,240 | -6.1% |

| 13 | Tulsa, OK | $620 | -6.1% |

| 14 | Boston, MA | $2,350 | -6.0% |

| 15 | Fort Worth, TX | $1,090 | -6.0% |

| 16 | Anaheim, CA | $1,650 | -4.6% |

| 17 | Orlando, FL | $1,240 | -4.6% |

| 18 | Santa Ana, CA | $1,700 | -4.5% |

| 19 | Virginia Beach, VA | $1,050 | -4.5% |

| 20 | Louisville, KY | $860 | -4.4% |

| 21 | Los Angeles, CA | $2,140 | -4.0% |

| 22 | Raleigh, NC | $1,040 | -3.7% |

| 23 | Salt Lake City, UT | $1,030 | -3.7% |

| 24 | Oakland, CA | $2,220 | -3.5% |

| 25 | Houston, TX | $1,110 | -3.5% |

| 26 | Pittsburgh, PA | $1,050 | -2.8% |

| 27 | Washington, DC | $2,160 | -2.7% |

| 28 | Spokane, WA | $830 | -2.4% |

| 29 | Corpus Christi, TX | $830 | -2.4% |

| 30 | New Orleans, LA | $1,400 | -2.1% |

| 31 | Durham, NC | $1,090 | -1.8% |

| 32 | Plano, TX | $1,150 | -1.7% |

| 33 | San Antonio, TX | $880 | -1.1% |

| 34 | Scottsdale, AZ | $1,420 | -0.7% |

| 35 | Minneapolis, MN | $1,390 | -0.7% |

The 35 Cities with the Biggest Rent Increases in 1-BR Rents.

In total, there were 60 cities with increases in 1-BR rents – compared to 35 cities with declines. So you can see where this is going: In aggregate, averaged out across the US, rents are rising. The table below shows the 35 cities with the biggest rent increases. The smallest increase among those 35 cities was 5.8% (Atlanta). In 23 cities, rents increased by the double digits. In 10 of them, rents increased by 15% or more! None of these 15-percenters are expensive rental markets, compared to San Francisco:

| Biggest Gainers | 1-BR | Y/Y % | |

| 1 | Cleveland, OH | $940 | 16.0% |

| 2 | Indianapolis, IN | $870 | 16.0% |

| 3 | Columbus, OH | $810 | 15.7% |

| 4 | St Petersburg, FL | $1,270 | 15.5% |

| 5 | Reno, NV | $1,050 | 15.4% |

| 6 | Chattanooga, TN | $900 | 15.4% |

| 7 | Cincinnati, OH | $900 | 15.4% |

| 8 | Baltimore, MD | $1,360 | 15.3% |

| 9 | St Louis, MO | $910 | 15.2% |

| 10 | Norfolk, VA | $920 | 15.0% |

| 11 | Lincoln, NE | $770 | 14.9% |

| 12 | Detroit, MI | $700 | 14.8% |

| 13 | Rochester, NY | $960 | 14.3% |

| 14 | Chesapeake, VA | $1,130 | 14.1% |

| 15 | Memphis, TN | $830 | 13.7% |

| 16 | Bakersfield, CA | $830 | 13.7% |

| 17 | Des Moines, IA | $920 | 13.6% |

| 18 | Newark, NJ | $1,290 | 12.2% |

| 19 | Boise, ID | $1,070 | 11.5% |

| 20 | Nashville, TN | $1,300 | 11.1% |

| 21 | Akron, OH | $610 | 10.9% |

| 22 | Sacramento, CA | $1,430 | 10.0% |

| 23 | Fresno, CA | $1,100 | 10.0% |

| 24 | Wichita, KS | $670 | 9.8% |

| 25 | Philadelphia, PA | $1,500 | 8.7% |

| 26 | Oklahoma City, OK | $750 | 8.7% |

| 27 | Arlington, TX | $890 | 8.5% |

| 28 | Gilbert, AZ | $1,310 | 8.3% |

| 29 | Tucson, AZ | $700 | 7.7% |

| 30 | Richmond, VA | $1,150 | 7.5% |

| 31 | Colorado Springs, CO | $1,000 | 7.5% |

| 32 | Winston Salem, NC | $820 | 6.5% |

| 33 | El Paso, TX | $690 | 6.2% |

| 34 | Buffalo, NY | $1,050 | 6.1% |

| 35 | Atlanta, GA | $1,470 | 5.8% |

The Big Shift.

This is still very early in the game, so to speak – the game being the consequences of the large-scale move to work-from-home which allows people to live anywhere for now, historic unemployment – over 30 million people are claiming state or federal unemployment insurance – and the oil-and-gas bust that has been washing over the producing regions. In addition, the unicorn-startup bubble already burst last year; and the Pandemic came on top of it.

So part of what we’re seeing is people leaving some expensive markets and moving to cheaper markets, maybe moving back home, or whatever, either because they lost their jobs or because they’re allowed to work from anywhere.

For renters in markets where rents are increasing 5% or 10% or 15% a year, this is going to get tough. In this environment, wages are unlikely to explode higher at this rate, even for the lucky ones who’re still working. Which leaves me wondering: How long can those rent increases in those markets be sustained? As along as the stimulus money keeps flowing?

Top 100 Rental Markets, Most Expensive to Least Expensive.

San Francisco tops the list; at the bottom are Tulsa, OK, and Akron, OH. The median asking rent in San Francisco – despite the sharp declines – is still over five times as expensive as in Akron and Tulsa.

The table shows 1-BR and 2-BR median asking rents. The cities are in order of the dollar-amount of 1-BR rents. You can search the list via the search box in your browser (if your smartphone clips this 6-column table on the right, hold your device in landscape position):

| City | 1-BR | Y/Y % | 2-BR | Y/Y % | |

| 1 | San Francisco, CA | $3,200 | -11.1% | $4,210 | -12.1% |

| 2 | New York, NY | $2,840 | -6.9% | $3,200 | -7.2% |

| 3 | Boston, MA | $2,350 | -6.0% | $2,810 | -3.1% |

| 4 | San Jose, CA | $2,300 | -9.4% | $2,820 | -5.7% |

| 5 | Oakland, CA | $2,220 | -3.5% | $2,900 | 6.6% |

| 6 | Washington, DC | $2,160 | -2.7% | $2,880 | 4.0% |

| 7 | Los Angeles, CA | $2,140 | -4.0% | $2,970 | -6.9% |

| 8 | Miami, FL | $1,800 | 1.1% | $2,310 | 0.4% |

| 9 | Seattle, WA | $1,760 | -7.4% | $2,270 | -3.4% |

| 10 | San Diego, CA | $1,750 | 0.0% | $2,300 | -4.2% |

| 11 | Fort Lauderdale, FL | $1,700 | 3.0% | $2,230 | 6.2% |

| 11 | Santa Ana, CA | $1,700 | -4.5% | $2,200 | 0.9% |

| 13 | Anaheim, CA | $1,650 | -4.6% | $2,000 | -10.3% |

| 14 | Long Beach, CA | $1,600 | 3.2% | $2,070 | -1.4% |

| 14 | Honolulu, HI | $1,600 | 0.6% | $2,130 | -3.2% |

| 16 | Chicago, IL | $1,500 | 2.0% | $1,800 | 0.0% |

| 16 | Philadelphia, PA | $1,500 | 8.7% | $1,720 | 1.2% |

| 18 | Atlanta, GA | $1,470 | 5.8% | $1,890 | 8.0% |

| 19 | Denver, CO | $1,440 | -8.9% | $1,900 | -2.6% |

| 20 | Sacramento, CA | $1,430 | 10.0% | $1,660 | 10.7% |

| 21 | Scottsdale, AZ | $1,420 | -0.7% | $1,900 | -5.5% |

| 22 | New Orleans, LA | $1,400 | -2.1% | $1,650 | 7.8% |

| 22 | Portland, OR | $1,400 | 3.7% | $1,750 | 2.9% |

| 22 | Providence, RI | $1,400 | -6.7% | $1,680 | 6.3% |

| 25 | Minneapolis, MN | $1,390 | -0.7% | $1,910 | 6.1% |

| 26 | Baltimore, MD | $1,360 | 15.3% | $1,620 | 14.1% |

| 27 | Gilbert, AZ | $1,310 | 8.3% | $1,520 | 3.4% |

| 28 | Nashville, TN | $1,300 | 11.1% | $1,410 | 4.4% |

| 29 | Newark, NJ | $1,290 | 12.2% | $1,740 | 16.0% |

| 30 | St Petersburg, FL | $1,270 | 15.5% | $1,630 | 5.2% |

| 30 | Austin, TX | $1,270 | 5.8% | $1,570 | 1.9% |

| 32 | Chandler, AZ | $1,260 | 4.1% | $1,440 | -1.4% |

| 33 | Dallas, TX | $1,250 | 1.6% | $1,700 | 0.0% |

| 34 | Charlotte, NC | $1,240 | -6.1% | $1,420 | 0.0% |

| 34 | Orlando, FL | $1,240 | -4.6% | $1,440 | -2.0% |

| 36 | Henderson, NV | $1,180 | 4.4% | $1,350 | 0.0% |

| 36 | Tampa, FL | $1,180 | 4.4% | $1,380 | 4.5% |

| 38 | Richmond, VA | $1,150 | 7.5% | $1,370 | 11.4% |

| 38 | Plano, TX | $1,150 | -1.7% | $1,550 | -4.9% |

| 40 | Chesapeake, VA | $1,130 | 14.1% | $1,250 | 2.5% |

| 41 | Houston, TX | $1,110 | -3.5% | $1,360 | -2.9% |

| 42 | Fresno, CA | $1,100 | 10.0% | $1,300 | 14.0% |

| 43 | Durham, NC | $1,090 | -1.8% | $1,250 | -1.6% |

| 43 | Aurora, CO | $1,090 | -8.4% | $1,370 | -8.7% |

| 43 | Fort Worth, TX | $1,090 | -6.0% | $1,350 | 3.8% |

| 46 | Boise, ID | $1,070 | 11.5% | $1,180 | 7.3% |

| 47 | Madison, WI | $1,060 | -11.7% | $1,320 | 0.0% |

| 48 | Phoenix, AZ | $1,050 | 5.0% | $1,290 | 3.2% |

| 48 | Reno, NV | $1,050 | 15.4% | $1,360 | 3.8% |

| 48 | Virginia Beach, VA | $1,050 | -4.5% | $1,260 | 2.4% |

| 48 | Pittsburgh, PA | $1,050 | -2.8% | $1,350 | 3.8% |

| 48 | Buffalo, NY | $1,050 | 6.1% | $1,350 | 14.4% |

| 53 | Raleigh, NC | $1,040 | -3.7% | $1,220 | 1.7% |

| 54 | Salt Lake City, UT | $1,030 | -3.7% | $1,280 | -6.6% |

| 54 | Irving, TX | $1,030 | -9.6% | $1,410 | -6.0% |

| 56 | Colorado Springs, CO | $1,000 | 7.5% | $1,300 | 8.3% |

| 56 | Las Vegas, NV | $1,000 | 1.0% | $1,250 | 8.7% |

| 58 | Milwaukee, WI | $990 | 2.1% | $1,130 | 10.8% |

| 59 | Anchorage, AK | $980 | 5.4% | $1,200 | 4.3% |

| 60 | Kansas City, MO | $960 | 1.1% | $1,160 | 8.4% |

| 60 | Mesa, AZ | $960 | 5.5% | $1,200 | 3.4% |

| 60 | Rochester, NY | $960 | 14.3% | $1,130 | 15.3% |

| 63 | Cleveland, OH | $940 | 16.0% | $1,000 | 14.9% |

| 64 | Jacksonville, FL | $930 | 1.1% | $1,100 | 4.8% |

| 65 | Norfolk, VA | $920 | 15.0% | $1,100 | 2.8% |

| 65 | Des Moines, IA | $920 | 13.6% | $990 | 15.1% |

| 67 | St Louis, MO | $910 | 15.2% | $1,280 | 11.3% |

| 68 | Chattanooga, TN | $900 | 15.4% | $1,030 | 15.7% |

| 68 | Cincinnati, OH | $900 | 15.4% | $1,200 | 7.1% |

| 70 | Arlington, TX | $890 | 8.5% | $1,180 | 8.3% |

| 71 | San Antonio, TX | $880 | -1.1% | $1,100 | 0.0% |

| 72 | Glendale, AZ | $870 | 1.2% | $1,100 | 0.0% |

| 72 | Indianapolis, IN | $870 | 16.0% | $930 | 14.8% |

| 74 | Louisville, KY | $860 | -4.4% | $960 | 0.0% |

| 75 | Omaha, NE | $840 | 1.2% | $1,040 | -1.0% |

| 76 | Memphis, TN | $830 | 13.7% | $880 | 8.6% |

| 76 | Spokane, WA | $830 | -2.4% | $1,050 | 5.0% |

| 76 | Baton Rouge, LA | $830 | 1.2% | $910 | 0.0% |

| 76 | Corpus Christi, TX | $830 | -2.4% | $1,060 | -0.9% |

| 76 | Bakersfield, CA | $830 | 13.7% | $1,030 | 14.4% |

| 81 | Winston Salem, NC | $820 | 6.5% | $900 | 8.4% |

| 81 | Knoxville, TN | $820 | 2.5% | $990 | 10.0% |

| 81 | Syracuse, NY | $820 | -15.5% | $1,050 | 0.0% |

| 84 | Columbus, OH | $810 | 15.7% | $1,050 | -4.5% |

| 85 | Tallahassee, FL | $790 | 3.9% | $910 | 3.4% |

| 85 | Augusta, GA | $790 | 5.3% | $880 | 6.0% |

| 87 | Lincoln, NE | $770 | 14.9% | $940 | 5.6% |

| 88 | Lexington, KY | $750 | 0.0% | $940 | -4.1% |

| 88 | Oklahoma City, OK | $750 | 8.7% | $900 | 1.1% |

| 88 | Laredo, TX | $750 | -9.6% | $880 | 0.0% |

| 91 | Greensboro, NC | $740 | 1.4% | $850 | 0.0% |

| 92 | Albuquerque, NM | $730 | 4.3% | $940 | 10.6% |

| 93 | Tucson, AZ | $700 | 7.7% | $900 | 1.1% |

| 93 | Detroit, MI | $700 | 14.8% | $800 | 15.9% |

| 95 | El Paso, TX | $690 | 6.2% | $800 | 1.3% |

| 96 | Wichita, KS | $670 | 9.8% | $720 | -4.0% |

| 97 | Shreveport, LA | $650 | 0.0% | $800 | 14.3% |

| 97 | Lubbock, TX | $650 | 3.2% | $810 | 1.3% |

| 99 | Tulsa, OK | $620 | -6.1% | $820 | 1.2% |

| 100 | Akron, OH | $610 | 10.9% | $720 | 1.4% |

Hah! Thanks!! By some odd coinkeydink….this is precisely the data I was thinking about digging in to this morning! :)

Me too! But I was expecting more than a 10% drop in big bubble cities.

I don’t think these figures reflect free months, waived broker fees (both of which I’ve seen advertised more in Boston), and above all, flexible lease terms whereas in many markets getting anything less than 12 months before March 2020 was impossible.

Last week I emailed someone on Craigslist who wants to sublet their own apartment in Cambridge/Boston. I asked, how long a term do you want? And she replied with, how long do you want? She mentioned no one wants to lease for 12 months right now because of all the uncertainty. The pro landlords and property managers won’t be so candid, so I think serious researchers need to dig a little deeper and talk to non-pros.

Meanwhile, the Boston Globe is publishing landlord propaganda in their real estate section claiming that rents are not expected to decrease.

I can’t imagine paying what SF wants for rent. Most I’ve ever paid was $1500 a month for a 1 bed and bath in DC, and I considered that exorbitant. The void in leadership on this issue, in a Democrat stronghold, is part of reason why I can’t trust Democrats on other issues.

Our cities have been controlled by Democratic machines for decades. They have certainly been subject to the forces of the national economy, but they have also shaped it. And that’s the case across much of the west. I’m not the first person to note that Tony Blair, Bill Clinton, and Barack Obama were in many ways much better salesman-exponents of neoliberalism, for reasons both subtle and unsubtle, than Maggie Thatcher and Ronald Reagan could ever have been. The Good Cop, Bad Cop routine of the Ds and Rs should have had us all rebelling long ago.

The state and municipal governments here in California have pretty much ignored the problem at least partially due to developers, landowners, and corruption. It should be said that there is rampant NIMBYism. When the already inadequate sum of money is allocated, it seems to mostly disappear into salaries and building contractors instead of, you know, being used to build housing.

The housing crisis is a perpetual grift now in which money is spent to create the appearance doing something. This is an example of Lambert’s never let a crisis go to waste. It’s been going on for more than thirty years and I don’t expect anything much to change.

Yeah, from what I’ve seen the NIMBYism seems to be what ultimately drives this. The government in my city in Southern California seemed to really try to increase housing density a couple of years ago with a long-term plan that I thought at a glance made sense, only to have homeowners fight the plan tooth and nail. Signs sprung out in front of many single-family homes advocating for people to fight and reject the plan. So the city leadership eventually gave in and modified the plan to mostly just increase the density in areas that were already fairly dense and leave most single-family home areas alone. Essentially a failure due to NIMBYism.

Unemployment in Memphis is up to 11.9%. In the metro area, it is boom times for warehouse/distribution. Amazon has built 4 major centers here. DHL has expanded. Interstate 269 was completed last year and connects with large intermodal logistics hub. Within the city, lots of apartments/condos coming online in downtown and midtown. They look not to be filling up fast. Houses in suburbs seem to be moving quick. Automobile traffic is still light within city as well. Office workers still working from home.

Newark, NJ $1,290 12.2% $1,740 16.0%

That raised an eyebrow. Granted, there’s been some gentrification…

That screams civic corruption to me. I saw Newark, NJ at ground level in some of the best neighborhoods just last year — before Corona. I am an old white guy and when I wear my black hoodie and my special smile I look like an escaped mental case. No one bothered me but I read misery and unhappiness in the faces I saw on the streets. There were as many panhandlers there as there are near Penn. Station in NYC. The police presence was more palpable than the presence of pedestrians. Sirens and flashing red lights were heavy in the area near Newark Penn. Station. Some were ambulances racing to the county hospital a little more than a mile up the road … but a lot weren’t. When I went shopping at a Shoprite Supermarket in town, the store was crowded and felt unfriendly. I was there on several Sundays spread through the year and the other shoppers seemed especially tired, irritable, angry. [In making that assessment I watched the interactions between other shoppers, between other shoppers and store employees and between store employees. No one was particularly unpleasant or unfriendly to me.]

Booker can pound sand. I need to find out who is in the City Government in Newark, NJ now so I can add them to my ‘naughty’ list — unless I find good reasons not to add their names.

Renters are in trouble, but so are many home owners. How many of the rentals cleared as renters are shoved to the pavement will be filled by home owners pushed out of their homes? How much more unemployment is still to come? Cities and State Governments are in trouble and consequently so are their employees. Teachers at all levels may join the unemployed if the in-person school openings fail and on-line school is declared a ‘success’. I think rents are in for a roller coaster ride as things settle out, assuming they will. Many smaller private landlords aren’t sitting too pretty either as vacancies rise, costs increase, and their mortgage is still due every month. But large investment firms are flush and the Fed is pushing money at them as homes and apartments come onto the market at bargain prices. A few large investment firms, holding a large share of the rental homes and apartments, and lunching together from time-to-time on a strictly ‘non-business’ friendly basis, might have deep enough pockets … running over with Fed cash … to enable them to continue acquiring the market while holding out for the rents and prices they believe best reflect the Market.

I am ready to make a move much further to the back country, but I have no idea when the time might be right — to avoid Corona — and to avoid paying more for rent than seems right to me.

It ain’t over til it’s over.

I don’t think ‘moving to the back country’ will necessarily avoid Corona. You’ll just get it and be alone.

I am not planning to move to avoid Corona. I want to move to a small city famous for its dedication to very special material I have grown to love — glass. I am also moving because where I presently live is within a foot or two of sea level and also much too near several large metropolitan areas. I am moving to escape the craziness when the shit hits the fan and locate near where there are a few silos of feed corn, and where I might own enough land of my own to grow a few potatoes and beans.

I don’t believe Corona is either the last or the worst critter we will need to deal with — and I agree moving to back country is not a solution. That is why I wear masks, read the very boring medical literature, and take avoiding critters as a personal matter since our public health system has proven no reliable bulwark.

Love the Corning Glass Museum. If you haven’t been, it’s a must.

I was more concerned that given Covid, many people living with roommates would rush to get their own apartments. I am sure that is happening, but is apparently being outweighed by all the people who are just broke.

The drop in rents in Syracuse is not surprising at all. In recent years there have been a huge increase in “luxury student apartments” at SU Hill. Really massive places with hundreds of apartments, going for $1200 a month per bedroom. To make matters worse, the out of town developers have gotten 10 year property tax breaks. Meanwhile in the traditional student housing neighborhoods (older multi family housing stock), there are “for rent” everywhere. Local politicians and fixers get paid.

With COVID and the discouragement of Chinese students, there is a huge glut of student housing. “Investors” and slumlords will take a well deserved hit.

This is in a city where almost 40% of the population is below the poverty level.

Same thing’s happening here in Tucson. Party towers looming in the distance and more under construction.

And I can’t help thinking that they were a great real estate investment idea before the Time of COVID. Nowadays, not so much.

The bad decisions will continue until you let the bust happen, just saying.

“With COVID and the discouragement of Chinese students, there is a huge glut of student housing. “Investors” and slumlords will take a well deserved hit.”

Speaking as the owner of some low income housing, all I can see is the stuff is getting bought like crazy. I sold my 15 unit building to another buyer and I am probably gonna have to move up market to find something to buy. The market in the suburbs is crazy tight.

Holy crap. San Francisco rents are twice the price of Honolulu? How do people live there?

The Honolulu numbers don’t look out of line with historical norms, but I note they have fallen a lot from the peak. I was going to blame this on Covid but I see they are actually slightly up year on year, so it’s not that. Hawaii has been hit very hard by Covid since the tourism sector is essentially dead, so I’d expect those numbers to fall further.

The whole San Francisco Bay Area is like that. The whole state of California is a reflection of the Bay Area or Los Angeles as well. All the jobs were in the metropolitan areas and pretty much nothing elsewhere. The cost of housing in the job deprived rural areas was/is also higher than much of country.

As how to live here… it interesting. Almost my entire life there has been the housing crisis; every year it gets tighter especially as it always seems to increase faster than wages increasing. And many people do fall off. There is at least 140,000 Californians homeless. San Francisco has 15,000 itself in a population of 880,000, which is not quite two percent of the city.

SF native here. The tech industry has killed off much of the counter culture in the city. Landlords appeal to the programmers who make 140k on average. Common folk are left adrift. Affordable housing policy here has not done nearly enough here by allowing a measly 15-20% of affordable units in a market rate high rise tower that charges 3500 per month. I’m tempted to support Singapore like housing where the government owns the lion share of housing to keep rents low.

This whole affair has been weird, been suspicious of real estate since about late 2015. We were overdue for another massive correction. What’s most odd is that I’m hearing from some local realtors that they’ve been having their best seasons sellin’ homes in Charlotte. I guess it’s still considered a ‘cheap’ city to move to. Meanwhile investors are planning a get together to prepare for the pre-foreclosure sales.

I’ve watched homes grow in price from around 150-200k five years ago and now some of the new homes being built in my neighborhood are nearing 1,000,000$. It’s not healthy, it’s not the housing we need. Let’s see how much they are worth in five years…

Same thing here in TX.

They keep telling me this is different than 2008 because that was involved a lot of mortgages being given to people who couldn’t pay them. And yet, what do we have now…massive numbers of people unemployed and missing housing payments. What’s the difference, exactly, or why do people seem to think the end result will be different? It makes little sense to me.

I’m also in Texas. The story in 2008 was that Texas prices did not get as out of control as in other parts of the country, so things did not need to crash here. On the ground here, 2008 did not really seem to bring any kind of correction. It only paused the run-up for a few years, which then resumed with increased vigor. Prices here are as out of whack in regard to incomes as in most other overpriced areas. Housing moves slowly, and the effects from this crash haven’t even begun to be felt yet. Everything with regard to the economy and covid is Wile E. Coyote hanging in midair after having just run off the cliff. The plummet has to come at some point.

Same here in Denver. In my neighborhood I saw one interesting and kind of cute little house bought by an investor of some sort, become a rental and allowed to decline. Then it was demolished and a monstrosity of a duplex was built with each side selling for just shy of $1 million. I pass by it nearly every day and I saw that place go up. Cheap materials used all around. If it lasts 15 years without needing major work I will be amazed.

If I were to buy now there is no way I could afford my neighborhood. Gentrification is making my home value skyrocket, but my neighborhood is losing its personality as diversified and interesting and degenerating into merely chi-chi.

Here in South Carolina there is a very hot housing market (Zillow). A personal anecdote; I live in a median proced housing subdivision and my neighbor 2 doors down just sold his home for 20% more than it was supposedly worth just last year. It sold in 6 days. Building new homes is going like gangbusters here in Columbia. Unemployment is down to 7.5%. I notice quite a few small businesses closed around town and we have had quite a few restaurant permanent closings. Our governor has opened everything back up, including large scale venues with no statewide mask requirements. Of course, our COVID infection rate is skyrocketing. The county I live in is as of today has almost a 1900 per 100k infection rate. The percent positive of tests seems to be trending downward in recent days though, down to 15.2% as of 8/2. The biggest topic of conversation is whether there will be sports played this fall, in particularly the USC-Clemson game. Our Sen Lindsey Graham even weighed in on the matter. Whether public schools should open for classes or not does appear to be the second hottest topic.