Jerri-Lynn Here. I have been riveted to Justin Mikulka’s excellent coverage of fracking’s follies at DeSmogBlog, so I’m happy to post this piece on fracking in the Bakken. The boom has now gone bust and there’s no funding to clean up the damage, leaving the public to pick up the tab.

By Justin Mikulka, a freelance writer, audio and video producer living in Trumansburg, NY. Originally published at DeSmog Blog

More than a decade ago, fracking took off in the Bakken shale of North Dakota and Montana, but the oil rush that followed has resulted in major environmental damage, risky oil transportation without regulation, pipeline permitting issues, and failure to produce profits.

Now, after all of that, the Bakken oil field appears moving toward terminal decline, with the public poised to cover the bill to clean up the mess caused by its ill-fated boom.

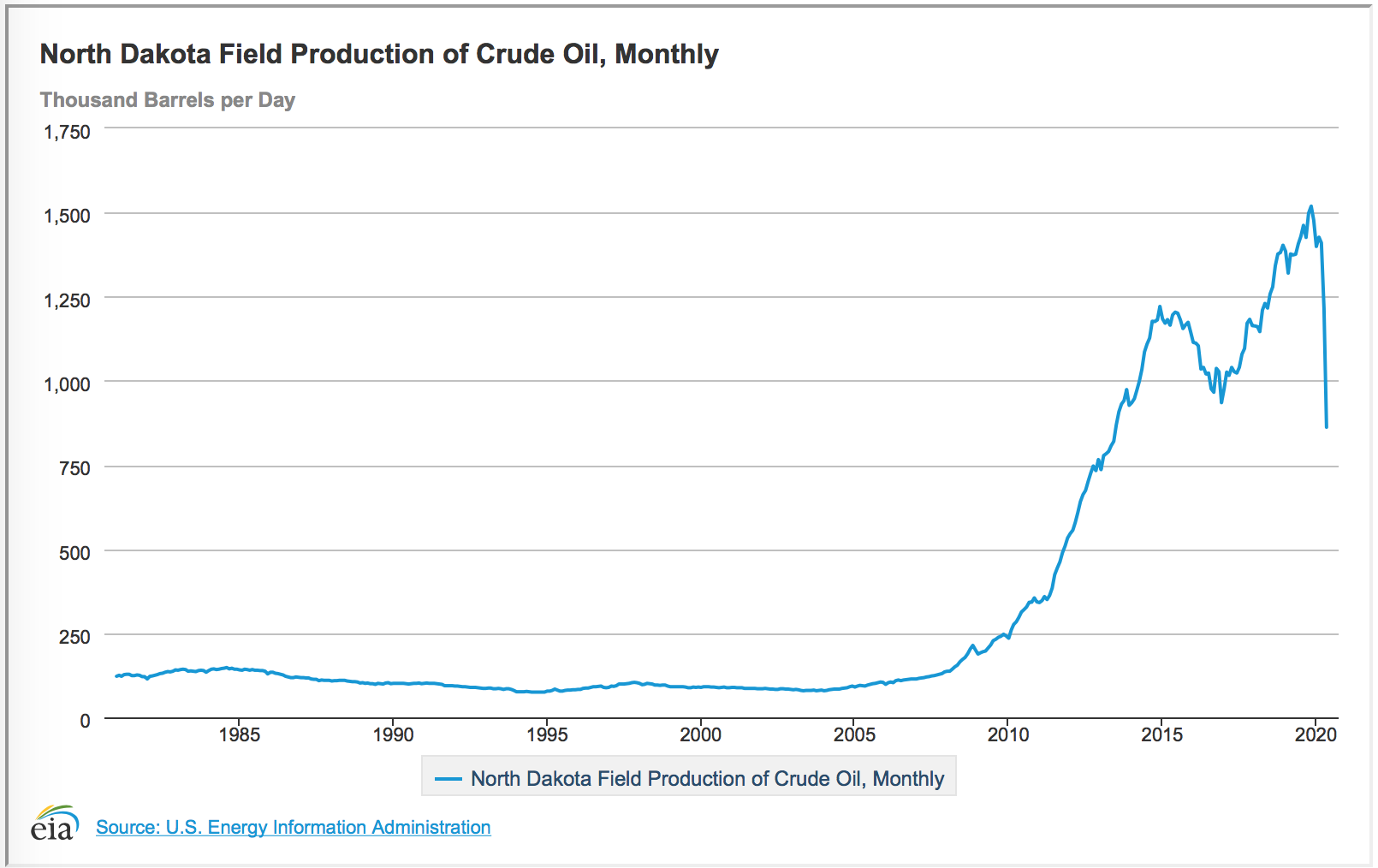

Historical Bakken oil production. Credit: Energy Information Administration

Historical Bakken oil production. Credit: Energy Information Administration

In 2008, the U.S. Geological Service (USGS) estimated that the Bakken region held between 3 and 4.3 billion barrels of “undiscovered, technically recoverable oil,” starting a modern-day oil rush.

This oil was technically recoverable due to the recent success with horizontal drilling and hydraulic fracturing (fracking) of oil and gas-rich shale, which allowed hydrocarbons trapped in the rock to be pumped out of reservoirs previously unreachable by conventional oil drilling technology.

The industry celebrated the discovery of oil in the middle of North America but realized it also posed a problem. A major oil boom requires infrastructure — such as housing for workers, facilities to process the oil and natural gas, and pipelines to carry the products to market — and the Bakken simply didn’t have such infrastructure. North Dakota is a long way from most U.S. refineries and deepwater ports. Its shale definitely held oil and gas, but the area was not prepared to deal with these hydrocarbons once they came out of the ground.

Most of the supporting infrastructure was never built — or was built haphazardly — resulting in risks to the public that include industry spills, air and water pollution, and dangerous trains carrying volatile oil out of the Bakken and through their communities. With industry insiders recently commenting that the Bakken region is likely past peak oil production, that infrastructure probably never will be built.

Meanwhile, the petro-friendly government of North Dakota has failed to regulate the industry when money was plentiful during the boom, leaving the state with a financial and environmental mess and no way to fund its cleanup during the bust.

Haste Makes Waste: Booms Move Faster Than Regulations

After the USGS announced the discovery of oil in the Bakken, the oil and gas industry moved fast, with both the industry and state and federal regulators ignoring whether what amounted to essentially new methods of extracting and transporting large amounts of oil called for new rules and protections.

The Bakken’s big increase in oil production quickly exceeded its existing pipeline capacity, leading producers to turn to trucks to move their oil out of the fields. But as the Globe and Mail reported in 2013, this stop-gap solution wasn’t working well: “The trucking frenzy was chewing up roads, driving accident rates to record highs and infuriating local residents.”

The industry could have restricted production until new pipelines and processing equipment were built but instead moved to rail as the next transportation option. High oil prices motivated drillers to get the oil out of the ground and to customers as fast as possible. Moving oil by rail was essentially unregulated and would not require the permits, large investment, or lead times required for pipelines, leading to the Bakken oil-by-rail boom.

Moving large amounts of this light volatile oil on trains had never been done before — but there was no new regulatory oversight of the process. Without proper oversight, the industry loaded the Bakken’s volatile oil into rail tank cars originally designed to carry products like corn oil. That’s despite the National Transportation Safety Board warning that these tank cars were not safe to move flammable liquids like Bakken crude oil.

The industry waved away these warnings. July 6, 2013 marked the first major derailment of a Bakken oil train, resulting in a massive explosion, 47 deaths, and the destruction of much of downtown Lac-Mégantic, Quebec. Bakken “bomb trains” (as train operators called them) continued to derail, creating large oil spills and often catching fire and burning for days. Regulators have still failed to address the known risks for oil trains in the U.S. and Canada.

Fracking for oil also resulted in large volumes of natural gas coming out of the same wells as the oil, further contributing to the financial troubles of shale producers. However, with no infrastructure in place to process or carry away that gas, the industry chose to either leave it mixed in with the oil loaded onto trains (making it more volatile and dangerous) or simply burn (flare) or release (vent) the potent greenhouse gas into the atmosphere.

More than a decade after the Bakken boom started, North Dakota was flaring 23 percent of the gas produced via fracking — making a mockery of the state’s flaring regulations. In July, The New York Times detailed the environmental devastation caused by flaring in the oil fields of Iraq, where they flare about half of the gas as opposed to the quarter of the gas that North Dakota has flared.

Also in July, researchers at the University of California, Los Angeles and University of Southern California published research that found pregnant women exposed to high levels of flaring at oil and gas production sites in Texas have 50 percent higher odds of premature birth when compared to mothers with no exposure to flaring.

Flare from an oil well in the Permian region of Texas. Credit: © 2020 Justin Hamel

Flare from an oil well in the Permian region of Texas. Credit: © 2020 Justin Hamel

Another major blindspot for the industry and regulators has been the radioactive waste produced during fracking. When the industry did finally acknowledge this issue in North Dakota, its first move was to try to relax regulations to make it easier to dump radioactive waste in landfills — a practice that is contaminating communities across the country.

In 2016, a study from Duke University found “thousands of oil and gas industry wastewater spills in North Dakota have caused ‘widespread’ contamination from radioactive materials…”

The fracking boom in North Dakota has resulted in widespread environmental damage and is worsening the climate crisis, given its high flaring levels, methane emissions, and, of course, production of oil and gas. As major Bakken producers go bankrupt and continue to lose money while the oil field goes bust, who will pay to clean up the mess?

Like most oil-producing states, North Dakota had the opportunity to require oil and gas producers to put up money in the form of bonding which would be designated to properly clean up and cap oil and gas wells once they were finished producing. Unfortunately, the state didn’t put that precaution in place, and now bankrupt companies are starting to walk away from their wells.

“It’s starting to become out of control, and we want to rein this in,” Bruce Hicks, Assistant Director of the North Dakota Oil and Gas Division, said last year about companies abandoning oil and gas wells.

The state recently decided to use $66 million in federal funds designated for coronavirus relief to begin cleaning up wells the oil industry has abandoned — costs that the industry should be covering, according to the law, but that are now shifted to the public.

The Bakken boom made a lot of money for a select few oil and gas executives and Wall Street financiers. But as the boom fades, taxpayers and nearby residents have to deal with the financial and environmental damage the industry will leave behind.

Bakken’s Best Days Are a Thing of the Past

As DeSmog reporting has revealed, shale producers have not been profitable for the past decade, even though they have drilled and fracked most of the best available shale oil deposits. While the prolific Permian region in Texas and New Mexico still has some of the best “tier one” core acreage for oil production left, that isn’t the case in the Bakken.

In June, oil and gas industry analysts at Wood MacKenzie highlighted this discrepancy in remaining core acreage between the Permian and the Bakken. According to Wood MacKenzie, the top quarter of remaining oil well inventory in the Permian would result in over 8,000 new wells. For the Bakken, however, the analysts put that number at 333 wells.

This difference is why John Hess, CEO of major Bakken producer Hess Corporation, predicted in January that Bakken production

North Dakota #oil #production fell in May by the largest amount ever, 350 thousand bo/d, to ~850 thousand bo/d.

Over 40% of the 16,000 horizontal #wells were completely shut-in for the month (the average utilization was 52%). The latest data is already available in our services. pic.twitter.com/e3BnH7Pd5J— ShaleProfile (@ShaleProfile) July 3, 2020

The drop in oil demand due to the pandemic has hit the industry as a whole, but the Bakken was already in decline, with the best producing wells a thing of the past well before the novel coronavirus reached U.S. shores.

In September 2019, The Wall Street Journal reported on the dismal outlook for Hess Corporation’s oil wells, noting last year: “This year’s wells generated an average of about 82,000 barrels of oil in their first five months, 12 percent below wells that began producing in 2018 and 16 percent below 2017 wells.”

Legal Reviews of Pipelines Potentially Causing Shutdowns

Even when the industry did try to construct oilfield infrastructure in the Bakken, its rush to build and manage pipelines hasn’t always worked out well. Legal challenges to two major Bakken pipelines, one old, one new, may shut down both of them soon.

The controversial Dakota Access pipeline (DAPL) is facing a potential shutdown after a judge ruled that the Army Corps of Engineers did not properly address oil spill risks and now must complete a full environmental review, which could result in a long-term shutdown of the pipeline while the Corps completes the study. Energy Transfer, DAPL‘s owner, appealed that ruling, and a subsequent court decision has allowed the pipeline to remain in operation while the legal battle over the environmental impact study continues.

At the same time, the Tesoro High Plains pipeline — in operation since 1953 — is facing a shutdown because it failed to renew an agreement with Mandan, Hidatsa, and Arikara Nation landowners on the Fort Berthold Indian Reservation, meaning the pipeline’s owner, Marathon, now is trespassing on that land.

These pipelines together ship more than one-third of the oil out of the Bakken, and if they are shut down, Bakken oil producers likely would turn to rail again to move their oil. However, rail is significantly more expensive than pipelines and not economically viable at current low oil prices.

However, at current production levels, existing pipelines (other than the two in question) and current long-term rail contracts can likely handle most of the Bakken’s oil production, especially as the region becomes less attractive to investors.

Stunning. DAPL customers told the Court that it would be the end of the world if the pipeline is shut down. The message to investors? No big deal. https://t.co/D5KUsKZep3

— Jan Hasselman (@JanHasselman) August 5, 2020

Energy consulting group ESAI Energy recently released a new report on U.S. pipelines, with analyst Elisabeth Murphy concluding, “An uncertain outcome for Dakota Access will have knock-on effects for the Bakken, such as capital being diverted to other basins that have better access to markets.”

The ESAI analysis also concludes that the Bakken will decline by approximately 270,000 barrels per day on an annual basis in 2020 and by a further 65,000 barrels per day in 2021.

With declining total production and new wells producing less than the past, Bakken producers are facing rising debts without the means to pay them back.

End of the Unconventional Bakken Boom

Oil produced by fracking is called “unconventional oil” due to the new technologies used to extract it from shale. However, it is unconventional in other ways as well. One, it has never been profitable. Another is a change in the boom-and-bust cycle, which has been a part of the oil industry since its inception in the U.S. in the 1850s.

Traditionally the boom-and-bust cycle for conventional oil production was tied to the price of oil. Low prices caused busts. This was true of the shale oil industry in 2014 when oil prices crashed. However, the industry returned to record production after that.

Screen shot of a marketing slogan for Bakken oil and gas development. Source: https://willistondevelopment.com

But it’s different this time. Unlike conventional oil fields, shale field production declines much more quickly. While shale producers could retreat to the top-producing acreage during the 2014 bust, most of that acreage is now gone.

The shale industry is faced with trying to come back from a historic downturn in which even the companies that don’t go bankrupt are saddled with crippling debts. That’s because for most of the past decade, shale companies borrowed more money than they made producing fracked oil and gas, to the tune of hundreds of billions of dollars.

All of the evidence strongly suggest that the Bakken is an oil field on the decline. Its best acreage has been depleted and the economics of the remaining acreage don’t pan out these days.

Reviewing the economics of the Bakken, investment site Seeking Alpha recently concluded that the “Bakken Will Never Be The Same Again.”

Seeking Alpha was purely commenting on the economics of oil production in the Bakken. However, the same could be said about the water, air, and land in the Bakken. Shale companies polluted the environment and are now walking away from the damage — leaving the cleanup bill to the public. It is a tried-and-true approach for industries in resource extraction. Privatize the profits and socialize the losses.

Hess Corporation CEO John Hess knows more about the economics of the Bakken than most people. In February Reuters reported, “Hess plans to use cash flow from the Bakken to invest in longer-term offshore investments.” A major Bakken producer is apparently no longer viewing the region as a good long-term investment.

From here, the outlook only gets worse for the Bakken.

Finally the Bakken play is proving to be transient in the worst possible way. How can we call this, pirate capitalism?

Its just normal resource extraction. The West is filled with old mines that were never properly abandoned, the East has coal mines (above and below ground) that are simply abandoned in place, old oil wells are all over the place and states like NY are spending public dollars to plug them. Some states (e.g. Michigan) are requiring firms that are still in existence to address old oil wells and drilling mud pits.

Existing companies can potentially be made to clean up their legacies through CERCLA. However, in many cases in the resource industry, the old firms are jsut allowed to go bankrupt and the assets are purchased which don’t trasnfer the old legacy problems unrelated to those assets to the new owners.

Much of the fracking industry has been smaller firms working leases. They were funded through junk bonds. Once the firm is out of business and the junk bonds are paid off or are worthless, then there is no there there to go after. North Dakota is going to be staring at a mess for decades probably relying on USEPA to hunt for PRPs to clean things up.

It could have been easily prevented by requiring bonding or letters of credit. That is an incentive to companies to clean things up as they go because, if they can clean it up for less than the face value fo the bond or letter of credit they can put the remainder in their pocket. Alternatively, they could have required some royalty money that gets put into a dedicated clean-up fund where the government does the clean-up across the board when industry leaves town. That can work unless the money is re-purposed by the government along the way which can happen (e.g. underfunded pension funds).

This is an international problem. Canada is spending a lot of federal money cleaning up old mining sites. Old mining sites create environmental issues in places like Australia, South Africa, Brazil etc.

South Africa, Johannesburg, District 9 Movie has pictures of the gold mine tailing, without one scrap of vegetation hundreds of meter high.

Q: Why, then are the Johannesburg Northern Suburbs the largest urban forest in the world?

A: The gold mine tailings are contaminated withe Cyanide. Cyanide used to extract the gold from the rock, and the rock was ground to powder.

The contaminated sand make a great base of paths – no weeds whatsoever.

The Bakken is almost just a blip on the resource extraction damage radar screen: https://www.ozarkradionews.com/nationalworld-news/us-mining-sites-dump-50m-gallons-of-fouled-wastewater-daily

As has been predicted for years, the very worst environmental impact from fracking is likely not from fracking operations – but from having countless thousands of badly capped frack wells littering the landscaped with no resources available to fix them. Ensuring a well is properly capped is reasonably simple when the well is completed – but it is horribly complicated and expensive if the well has been simply abandoned with a concrete plug (if even that) left over the void. This will be a climate nightmare for decades to come, never mind the implications for ground and surface water.

Quite simply, if any mining operation is not viable if it requires a full bond for restoration, it is being subsidised by the State. Fracking has been massively subsidised from the beginning, and the costs will only mount, even as the operators go off to destroy somewhere else. It really has been a catastrophe.

The rest of the world has been relatively lucky, in that the technology hasn’t proven very suitable for use elsewhere, mostly because few other places have the combination of geology, cash, and water resources that the US is ‘blessed’ with in that huge swathe from Texas up to Pennsylvania.

And the so-called restoration of the landscape will take decades to accomplish, if ever. Disturbing the plant communities with rolling vehicles detrimentally compacts the soil. Vegetation recovery is minimal on compacted roadways and drill sites. Like the flares seen in the nighttime from outer space the scars on the landscape will have out-sized implications.

The lack of bonding prerequisites for construction startup is a feature, not a bug. For the oil execs, priority is high personal compensation. For the local politicians, it’s Jobs, Jobs, Jobs (Even when the best ones will not be filled by locals.) Call it pirate Capitalsim or disaster capitalism, the losers are the unresponsive taxpayer.

Eco-terrorism aided and abetted by morally corrupt and ethically void public officials: a legacy of despoiled lands, poisoned life and accompanying misery.

Fury at this is a most healthy reaction.

The Permian Basin is also on the decline:

https://www.dallasnews.com/business/energy/2020/08/08/drilling-drops-to-15-year-low-in-permian-basin-and-other-us-oil-patches/

Though apparently el load in the area is still growing.

And here is a funny thing: US is working overtime to stop NordStream II – presumably to be able to sell its own LNG to the EU. But – as some of us have long suspected – soon, there’ll be no LNG to be had.

But this is not stopping Kinder Morgan from wanting to build yet another pipeline:

Willie Nelson and Paul Simon: Save Texas Hill Country and …

https://www.houstonchronicle.com/opinion/outlook/article/willie-nelson-paul-simon-save-texas-hill-country-15473470.php

yep. that’s about 50 miles south of me.

the people in frederickburg have been up in arms about it for at least 2 years, which is when the “Move The Pipeline” signs started popping up on the wineries and landed estates—-yeah…not exactly a grass roots resistance,lol. More about NIMBY…and “don’t harm my views”…and especially, “don’t mess with my property values”.

I’ve heard…but haven’t had the time or inclination to rummage around…that the pipeline is meanto to go right through Wimberly, Texas…and rather close to the famous, cypress laden, swimming hole there. That’s a terrible shame…because it really is a magical place, even with all the former hippies/now PMC karen types that own that whole part of the world, now.

(Wimberly…like Kerrville, further west…used to be a sort of outpost of austin’s weirdness, due to willie and waylon and jerry jeff, and the peculiar brand of “hippies” that Texas managed to produce(in this manner, I am like a ghost of Texas’ past). Now, such places are as “conservative” as they come, far right lunatics run and own everything, and the coppers are as bad as any big city if you don’t look like you belong. Kerrville even sports an 100 foot iron cross, looming over the town, on a prolly 300 foot hill….to ward of the Principalities.)

Delta Airlines bought an oil refinery. It didn’t go as planned.

That there would be irreparable damage was foreseeable and foreseen. The taxpayer will get shafted many times on this. In addition to bearing the brunt of polluted water and air, the physical and spiritual loss of land ruined for living and working, next the taxpayer will have to pony up for ‘professional remediation’, which will be handled corruptly, and then after enriching contractors and of course elected representatives, much of the damage cannot be undone.

About the post-Bakken landscape pollution . . . . who’ll clean it up?

Well . . . why clean it up? Do NOT clean it up. Let it remain as an object lesson of unregulated resource liquidation to begin with. If the whole area becomes uninhabitable, let it happen. Let that be a lesson to people who support an “oil industry” with their discretionary dollars and with their votes and with their hearts and minds.

The people who financed, managed and came in to work the oil and gas fields are gone. The people who were living in these towns and rural areas participated only slightly the oil boom and did not benefit from it. During the boom locals were priced out of housing and subject to the closures, debris, pollution and crime associated with the booms. Cleverly worded contracts saw that people on whose land fracking was done (especially Pennsylvania gas) didn’t receive royalties. The states took most of the oil tax revenues but the local counties and towns now have to pay to rebuild their roads and other infrastructure that were destroyed by the buildup. All these costs are in addition to those for securing the wells and restoring the land that is highlighted in this article. Should the long term residents should be punished again?

Fair points and good questions.

Were there ” ban fracking” movements in these places when it was becoming apparent what fracking did to the fracklands? If so, how did the rural people of these areas respond to the “ban fracking” movements?

I know that there are many reasons why a local town, county, whatever, even state, would not prevail in their fight against Big Corp+Govt (wait, isn’t that a definition of fascism?) drilling, pipelines, mining, fracking, or mountain-top removal for coal, wind farms, or kitty litter. But, 1.) the damage cannot be ‘cleaned up’, it can only be made presentable, ie covered up.

This is an Obama/Biden Administration legacy that was fueled by digital dollars injected by the Fed during the Great Recession plus deregulation which Donald Trump accelerated or will silently be maintained by Joe Biden.

What is the next boom, home delivery? Not likely, work at homers have already gone stir crazy. Losers looted Chicago Loop. Anarchists damaged Portland Police Union building. Public Health investment is needed to prevent hundreds of thousands of Americans dying from coronavirus.

The Bakken experience indicates that this is unlikely. Digital money will go to the next bubble scam only; unless, there is a revolt by the exploited.

People fantasize about a National Strike. There won’t be any National Strike.

Perhaps there could be a selectively targeted National Slowdown. Most people don’t have and will never have the money to give to kicks and causes. And most people don’t have and will never have the time to devote to kicks and causes. The only money most people have to “spare” is the money they have to spend on the survival necessities that only money will buy. And the only time most people have to “spare” might be the time needed to learn and figure out how to buy “this” thing inSTEAD of “that” thing , and buy from “this” supplier inSTEAD of “that” supplier, depending on which thing enriches the enemy MORE as against LESS, and which supplier is MORE dangerevilous as against LESS dangerevilous

In other words . . . within their own very narrow limits . . . people could practice some “leading the money around by the nose”.

So what kind of “buysupporting this” and “boycotting that” would degrade and attrit the enemy if a hundred million Americans were to do that kind of “buysupporting this” and “boycotting that”? One single person could start leading their own money around by the nose in just that way. And it is not that one person’s fault if a hundred million Americans do not all do likewise. It is their fault, not his/her fault.

Old news. Been there done that.

1964:

https://www.youtube.com/watch?v=qXbvpBI08vs&feature=youtu.be

Alberta is a sacrifice zone with thousands of “orphaned wells” sounds much better than abandoned. There is talk of slowly leaking the toxic lakes from the tarsands, (visible from space), into the Athabasca, mostly indigenous people down stream at Fort Chip. As for radioactive waste, Canada managed a single page “framework” policy paper about 20 years ago and nothing since. We do not have any regulations regarding nuclear waste. From the time when we helped with atomic bomb material until today, the regulatory body “Atomic Energy of Canada Ltd” was given along with 15 million to SNC Lavalin by the conservative Harper government. nothing from SNC why would there be?