The Wall Street Journal describes tonight how the line between two tiers of the Covid economy isn’t as tidy as many might think. It isn’t just hourly workers in service businesses like restaurants and hotels who are seeing smaller or even no paycheck. High income professionals are also in distress due to having relatively high level of borrowings which makes them vulnerable to declines in income.

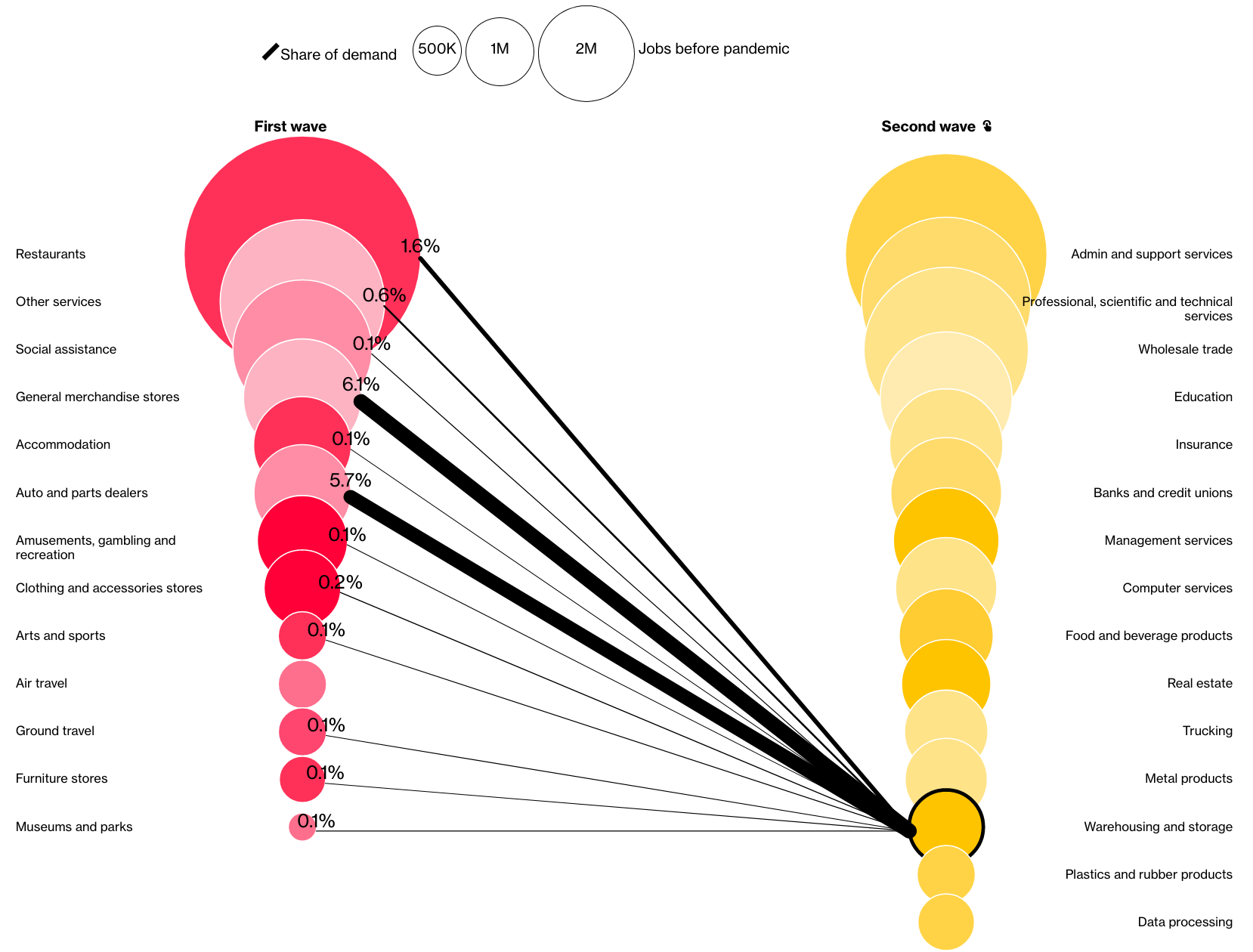

We warned early on, as did a Bloomberg story in June, that layoffs would increase higher up the job ladder as it became more evident that Covid-19 damage was not just severe but long-lived. From the Bloomberg account (note the chart is interactive, so go to the original story if you’d like to play with it):

The pandemic isn’t finished with the U.S. labor market, threatening a second wave of job cuts—this time among white-collar workers.

Close to 6 million jobs are potentially on the line, according to Bloomberg Economics. That includes higher-paid supervisors in sectors where frontline workers were hit first, such as restaurants and hotels. It also includes the knock on-effects to connected industries such as professional services, finance and real estate.

And the Bloomberg analysis found that these “second wave” losses would have a disproportionate impact:

While not as high in number as the initial wave of layoffs, the second round will still pack a sizable economic punch, as it will include middle-class Americans who drive discretionary spending, a major growth engine.

An additional issue, which this article does not address directly, is that work both at the high end and the low end has become specialized. When manufacturing was much more important to the economy, employers expected to train new hires, although they would often require a basic level of mathematical and reading skills. Today, even fast food outlets prefer to hire front line and managerial personnel with industry experience. In The Predator State, Jamie Galbraith argued that having a society invest heavily in conferring advanced degrees was not a plus. The cost of that education, in terms of the resources involves as well as the student foregoing wages in order to earn the degree, is high. Yet by investing in that training, those students have chosen to limit their career opportunities, which may not be a good bet in the long haul. If employment contracts in your field and you are one of the ones who winds up earning less or losing a job entirely, the immediately available replacement is usually at a much much lower skill level, where to add insult to injury, employers will worry that the displaced professional is overqualified and won’t stick around long. And getting established in a new field takes time and often involves spending on new training….and that self-reinvention process may not work.

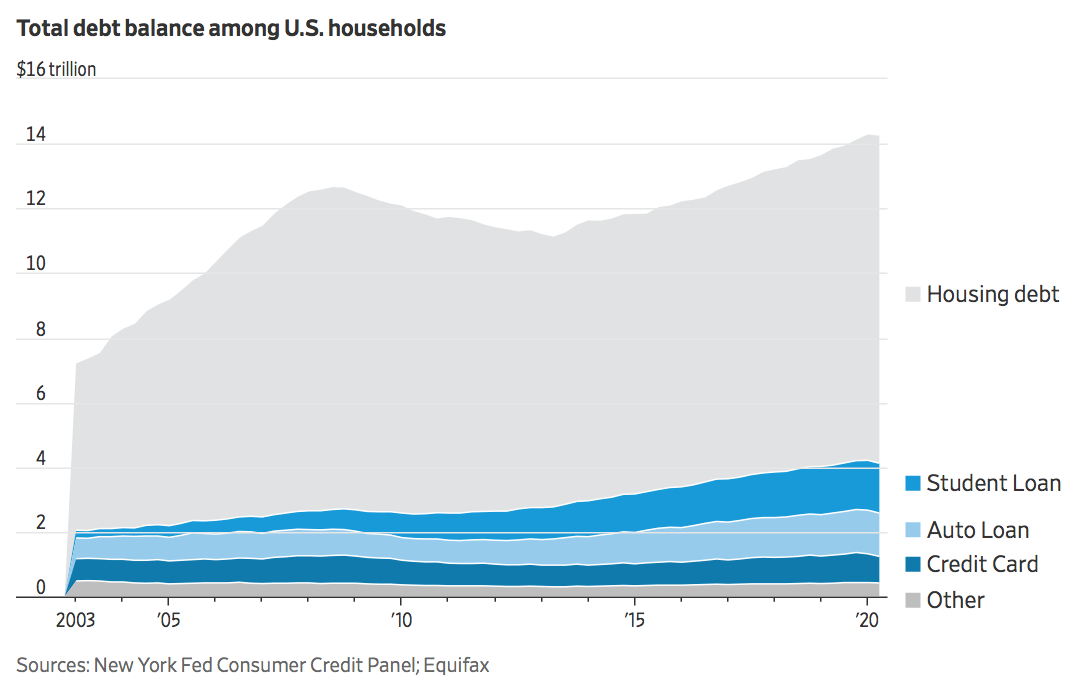

Richard Vague in particular has been inveighing on the dangers of private debt, particularly household debt. Even so, the data in the Wall Street Journal article is sobering:

American families with nonhousing debt making over $98,018 a year in pre-tax income owed an average of nearly $92,000 of such debt in 2016. That’s up 32% from 2004, adjusted for inflation, according to an analysis of Federal Reserve data by the Employee Benefit Research Institute, a nonpartisan nonprofit research group.

Average nonhousing debt owed by families making $52,655 to $98,018 rose about 33% over the 12 years to $33,378.

The article points out that overall credit card debt declined after the onset of Covid. The $600 a week unemployment supplement provided enough income support, combined with the fall in spending due to limitations on activities that some were able to pay down debt. But averages conceal subpopulation. Again from the Journal’s story:

The coronavirus has spared few industries and expanded unemployment benefits designed to replace the average American income didn’t cover all the lost pay of higher-earning workers, especially in or near expensive cities. The extra $600 weekly payments expired in July, putting them even further behind.

“What I see happening here is a core assault on successful college-educated families, which are the new breed of middle-class American families,” said Anthony Carnevale, director of the Georgetown University Center on Education and the Workforce. “There’s a professional workforce that’s getting slammed.”

Roughly six months into the pandemic, many lenders that let borrowers skip monthly payments now expect to get paid again. They have set aside billions of dollars to cover potential losses on soured consumer loans—an acknowledgment that America’s decadelong debt binge has come to an end…

Unemployment for the arts, design, media, sports and entertainment was 12.7% in August, more than triple its year-earlier level. In education, it more than doubled to 10.2%. Sales and office unemployment was 7.8% in August, up from 3.8% in August 2019.

Architects and engineers, who earn $1,826 in average weekly pretax income, well above the $1,389 average among full-time wage and salaried workers, have seen unemployment rise to 3.7% from 0.8% a year earlier. Unemployment for computer and math occupations, which earn $1,919 a week on average, more than tripled to 4.6%.

It could get worse. “The pain so far in the economy has largely been at the lower end of the pay scale,” said Discover Financial Services Chief Executive Roger Hochschild, adding that many of “the white-collar layoffs are still to come.”

And overall demand for higher-paid professionals is softening as lower-paid jobs are coming off their lows:

By some measures, the outlook for higher-earning workers appears worse than during the 2008 financial crisis. In August, about 3.3 million people age 25 and over with bachelor’s degrees or higher were unemployed, up from 1.2 million in February, according to the Bureau of Labor Statistics. During the last downturn, that number peaked at about 2.2 million.

Postings for jobs with salaries over $100,000 were down 19% in August from April, while postings for all other salary categories increased, according to job-search site ZipRecruiter Inc….

Many people who have jobs are struggling with pay cuts. As of August, 17 million workers were getting paid less due to the pandemic, said Mark Zandi, chief economist at Moody’s Analytics. Some 9.5 million took pay cuts; the remaining 7.5 million are working fewer hours, he said.

The Journal presents anecdotes, and some families were carrying such high debt levels that they were vulnerable to any bad development, such as a New York couple earning $175,000 annually with monthly debt payments of $9,000. But others didn’t have crazy fixed costs when the downdraft hit:

Terri Smith, 64, said her job analyzing legal expenses for her employer was eliminated in a round of cost-cutting. Even with the extra $600 a week, unemployment didn’t cover her lost earnings, and she is now down to $285 after tax in weekly unemployment benefits.

The monthly mortgage payment on her Charlotte, N.C., home is $1,550, she said. Her car payment is $550. Health insurance costs $600 a month, and a recent hospital visit cost $7,500 in out-of-pocket expenses. She has dipped into savings to keep up with bills and is thinking about withdrawing from her 401(k) or signing up for loan-deferment programs until she can find a job.

“I don’t have a plan. It’s very dire,” she said. “I’m getting very nervous.”

Needless to say, the disconnect in Versailles, um, Washington, is striking. The longer relief is delayed, the more lasting damage will occur.

Yes, the over-specialisation is a big problem. But TBH, it’s closely related to the “lean and mean” idea of the corporate machine, that you’d cut down cost – by hiring the “precise” cog. My take on it always was that generally cutting costs (slash and burn) was easy, but reducing costs (so that you have a good company still) was extremely hard. And, no matter of cutting costs ever increased revenues (which is hard too) – but that’s often where you need more than a narrow specialist, as it requires innovation.

Hiring the specialists also often gets ridiculous. I have seen IT ads that ask for 10 years of experience in a product that didn’t exist 5 years ago.

Very much agreed and in a world where most jobs are in services the outcome will usually be the crapification of the service being offered. We have become too used to notice that.

yup. hyperspecialisation has always bothered me…but i’m somewhat biased, i guess…my models are my grandads who were generalists par excellant, and could “cracker rig” just about anything with some baling wire and some trash.

my brother, the pmc sales person at a global “enterprise” software corp, periodically puts out feelers for another job…hopefully with fewer shark people.

he recognises that his skillset transfers easily to almost anywhere…but many of the shark people he works with have crawfished themselves so far into the mudbank that they would have to start all over at the bottom if they got laid off.

he says this applies to maybe half of them where he works.

it would seem that this wouldn’t comport well with the “move fast and break things” ethos.

perhaps that ethos is only for the upper levels….and maybe that uncertainty and hyperspecialisation contributes to the shark like behaviour in such places.

whatever, talking to brother about such things always makes me happy that i’m a poor yeoman farmer guy.

My family were definately the post-ww2 make-do austerity types… kept small pieces of string etc. Result of that is I rarely buy anything for the veg garden, but always find and make something good enough. Then there are the people who buy the green painted bamboo canes at Home Depot to support a plant, when actually anything thin and long will do.

I’ve long thought hyper-specialization has helped migrate (at least fear of) precarity up the income ladder. If you are a highly specialized person making six figures in an arcane role – and the bigger the organization the more roles grow arcane – you know in your gut that you’d be hard pressed to do as well elsewhere. Throw in healthcare tied to your job, and this is hardly a prescription for doing anything other than “crawfishing into the mudbank” for most in the organization. To do otherwise, you must be either uncommonly fearless, or backed by wealth that makes your job unnecessary.

Separately, the income. I always despair when some right-wing friends of my talk how the poor people don’t know how to manage money, and end up in never-ending loop of debt.

I have known way too many “rich” people, who had negative net worth. Which actually requires way worse money management skills, because the margin of error for poor to slip into the debt trap is trivial, often none – just one bad-luck event. With rich, it often takes effort, or spectacularly bad luck.

Then you have the richer people perceiving themselves as ‘better’ than poorer people. Not necessarily. They just have more money.

All not good. Just wait til the state and local governments have to start cutting. It’s going to get really ugly, really fast.

So the US Senate is REALLY going to let the whole country go down the tubes after giving Wall St and billionaires $3T? AMAZING.

Between 2008 -2011, according to a working paper by the Levy Institute it’s estimated that the Federal Reserve provided $29,000,000,000,000.00 to bail out the financial system. $3 trillion is certainly no trifling sum, but in comparison it sounds like they’re low balling. I’m sure they’ll catch up though. I’ll bet they’re working on it as I write this comment.

“So the US Senate is REALLY going to let the whole country go down the tubes after giving Wall St and billionaires $3T? AMAZING.”

They have so many distractions going, the usual suspects will get away with a bigger heist than the last crisis. Everything is Trump’s fault or BLM’s fault, etc. Get it?

The paragraph that starts with An additional issue… and ends with …that re-invention process may not work is a MUST read and must be understood in full so as to be aware of how sick has become the labour market since decades ago. A lot of people, as I have experienced myself, have found that re-education is very frequently a downward ladder and re-educated professionals are usually disliked as employers may be wary of people that, among other things, have gone through experiences that might turn the red light of uncritical obedience on.

+1

Re-education and education are a lot about warehousing people (keeping people busy and away from the job-market). The warehousing might have been a viable short-term fix but the short-term is over and a longer term solution has to be found.

As far as I can tell the way forward is to start sharing the jobs that are worth doing.

The interpretation of this saying:

https://www.usingenglish.com/reference/idioms/devil+finds+work+for+idle+hands.html

might need to be changed or at least tweaked a little. Not to get too religious about it but surely some BS jobs are more likely to be devil-work than the opposite?

“Idle hands are the devil’s workshop.”

New version:

“Idle hands are the devil’s debt-interest taking opportunity.”

Yes. Career changes, more than brief time off for family, illness, just to live, asking overly perceptive questions in an interview re: things like work environment and business philosophy, being known to be supportive of Bernie Sanders. All marks against ones “character” in PMC world in my experience.

It’s worse than that now for a lot of jobs though. Say you got sick and fell behind on some debts and your credit score is low (making you highly motivated to get and keep a job, even a less than ideal one). Say goodbye to interviews.

So you get desperate and take a job in fast food or poor-person retail (e.g. dollar store). To put than on resume and not get interviewed because that makes you automatically a loser in PMC world, or to not and be deemed a loser because 1 year gap. Tough choices.

And this with a literally top-tier academic record, having performed excellently at every job you’ve actually been given the opportunity to do, and having caused zero ethical breaches or workplace drama.

Thing is, most of your peers at the top flight college have parents worth millions. For some reason, no amount of time off or poor work performance or poor grades or unethical behavior counts against them at all. Quite the mystery.

To add to your list, care-giver also results in the side eye.

Add clerk to the list

That sure sounds grim.

Aren’t there any places left in the labor market where employers are just hungry for decent workers, and will accept these very minor flaws?

Ever see “Wages Of Fear?”

Will this signal increasing support for debt forgiveness?

The long article from the other day about debt-forgiveness….

I found the gist of that long long article to be: We can’t provide meaningful aid to everyone so we’ll need to choose who will get this meaningful aid.

Few, if any, people are free from bias and if I were to guess the authors of that piece have friends and family who are overindebted but no friends or family who are homeless and/or coming from real poverty. Might the authors of that piece possibly be biased based on their environment?

I’d say that there might be more signals now for support of debt-forgiveness but only from certain sources and those sources might not be representative of what the majority wants and needs.

No solution is perfect, every solution will be unfair in some way to some people. The debt-forgiveness is in my opinion yet another way of sitting in judgment of people and deciding who is worthy of help. A universal aid might not be sufficient for all but at the very least it does not divide the population into the groups of the worthy and the deplorables.

+1,000,000

Richard Vague’s plea for debt forgiveness was a continuing reminder of how valuable is NC. (Seriously, one the best to appear on this website. Please read if you haven’t already)

Exactly spot on… and a reminder that there’s an alternative to continuing the beatings in hopes it’ll improve morale.

Ya, and we are supposed to have a debt forgiveness program. It’s called bankruptcy, and to my understanding we had the best system in the world. Borrowing a bunch of money and not paying it back isn’t supposed to be the dominant strategy, but it isn’t supposed to leave you in bondage either. Lose most of your assets (INCLUDING your 20,000 acre ranch in Texas…) and get a clean slate. You keep your reasonable house to live in, and the tools you need to work.

Beyond that, IMO everyone should get baseline health care and a UBI, and pretty much there you go, no big moral hazards, lenders have to be careful.

It already has been done – for the mega corporations!

I didn’t know that. Are you talking about the rescue of banks? This was not debt forgiveness. On the contrary the rescue helped keep debt well, alive and ever growing.

The pandemic has exposed all of the multitude of problems in the US such as poor healthcare, inadequate social safety net, political corruption, ineffective education systems (lack of critical thinking skills), and a over reliance upon household debt. When will the government step up to the plate and use its power to create demand? If things don’t change then I fear we are headed towards another Great Depression.

I can’t imagine what it would be like to have that much non-housing debt. People have to be a bit more frugal. I am constantly surprised by the new 50k+ huge trucks that I see on the road around here. I don’t understand how people can spend that much on a truck! The fact that trucks have gotten bigger and more expensive is nonsensical. I guess that I’m getting old but I remember when you could buy a new 4wd truck for under 20k. How much of the price increase has been due to normal inflation vs. price gouging? IIRC, auto makers can make as much or more in finance charges as they do in regular profit margin.

As a matter of fact, a lot of carmakers last years made more in finance deals than car margins. I’ve often seen it was cheaper to buy on 0% finance than cash-on-the-table deals. I suspect there’s some accounting magic going behind that that beefs the profits.

The fed has been successful in inflating asset prices such as housing. You have to wonder if the low interest rates have also greatly inflated auto prices and other consumer goods that require financing. Heaven forbid that they reduce interest rates on student loans. That would really increase higher education prices!

I believe that Wall Street has almost completely taken over the economy. They are perfectly happy having us plebes pay large portions of our income in interest charges. I try to avoid giving any money to them.

Well, there is inflation price, price gouging, and actual improvements. Most of them unnecessary imo, and funded with cheap debt for sure, but a lot of these 70k trucks are pretty amazing if you are into trucks. The old 20k trucks didn’t have 600 horsepower engines with exhaust cleaner than the air coming in the intake and decent fuel economy, cameras all over for situational awareness, comfy seats and huge towing capacity. Which rarely gets used, but since the government in its infinite wisdom regulates cars into being noncompetative, people substitute trucks. I have a small car and an old truck, but I do get jealous sometimes. I barely have A/C in the car, and the truck doesn’t.

It may also be related to the concept of “key workers” that the virus has done so much to elucidate. It was pointed out in France that, when Carlos Ghosn was on his tragi-comic run from the authorities, Renault continued to function normally, whilst a strike by low-paid assembly-line workers in Romania, for example, would have brought the company to a halt. The virus is demonstrating just how many pointless “bullshit jobs” in the late-lamented D Graeber’s phrase, there actually are, in all areas. From being a passport to anything, an MBA may increasingly be a passport to nothing, as there are fewer and fewer Executive Vice-Presidents in Charge of Financial Manoeuvres that Aren’t, Strictly Speaking, Illegal to aspire to.

And it’s aspiration that is at the bottom of this. We live in a society where the best-paid jobs, that attract the greediest people, are generally not worth doing for their own sake, but only for the money. Conspicuous expenditure is thus a way of compensating for the knowledge that what you do is of no practical value, and may even be positively harmful, and whatever salary you earn, you’ll spend it all on trying to give some kind of meaning to your life. My heart goes out to such people.

Executive Vice-Presidents in Charge of Financial Manoeuvres that Aren’t, Strictly Speaking, Illegal

David, I am stealing that lovely phrase.

Debt for most is a big problem. As long as work is steady debt seems is OK. When work slows dow debt is like an anchor. I blame huge debt on artificially low interest rates. It encourages people to bower to maintain their life style. People also are living day to day, not saving for the future or an emergency. We now have an emergency and many aren’t prepared to be able to pay their bills . As this slowdown drags out things will only get worse. The near future looks bleak for many. Unfortunately too many can’t manage their money. They have been convinced to over consume. Money is spent on things people could get along without. As an example look at what people spend on cell phone service. Instead of a relatively inexpensive plan, I pay $14 per month for cell service, people buy the most expensive plan. It’s made worse by every family member having their own cell phone. The same is true with many other things. Entertainment, transportation eating out all add up to big expenses , paid for many times with credit. Low interest rates along with propaganda to buy unnecessary things have created this problem.

Cell phone service… is that stand alone or bundled?

Here, 35 USD per month is the lowest price for plain old cell phone service we can find. (3G with no frills.) Also, when bundled with ‘whatever plus service’ the cell phone service charge does not go down!

Total Wireless has a stand alone plan that’s $25/month. It’s unlimited talk/text/data, the data being 1 GB at high speeds then throttled. They have data add-ons that never expire, so you can spend $10 to add 5 GB high speed data which is there until you use it. Total Wireless runs on Verizon.

Redpocketmobile is what we have, ambrit. Their low-end plan is $10 mo per line. If you run out of minutes you can top up with 100 min for $2. It ain’t fancy — and was a tad difficult to set up for me because not being a ‘phone person’ I didn’t know the terms and stuff and had to self-edumacate a bit — but it works fine. No shops, you buy online and they send you the SIM card. Ten bucks, man! No complaints!

Hi Ambrit,

Have you looked at Consumer Cellular’s service? They contract with some of the large service providers and offer some of the least expensive plans I’ve seen. When I wasn’t using any data service, I think I was paying around $15/month for a limited number of minutes. I think I am paying around $30 now, including taxes, and I get a certain number of talk time minutes bundled with some data and texting service. The nice thing is if you choose a plan that has limits that are lower than what you use in a particular month, CS will automatically roll you into the plan that fits rather than charge you a ridiculous penalty fee for excess minutes/data. There are also no contracts. I’ve been completely happy with them – been with them for about 8 or so years.

Their website seems to be down right now, but it might be worth your while to check them out if you haven’t already.

https://consumercellular.com/

Its called a standard of living – and when wages have been stagnate for a long time, and when employement participation rates have been low – and when everybody (aided by a corrupted lending /financial system) jacks up the cost of housing (rental and ownership), and when everybody pays more for food, and when everybody pays more for healthcare (aided by a corrupted lending /financial system)

I would say your standard of living goes down or you borrow from the assets (that have inflated) for those thing which one can not get on along without – shelter food, health.

And on top of it – we are paying for Social security and un-enployment comp and a never ending variety of imposts and hidden taxes. Those taxes should be aimed at those who increase the cost of living and doing business – the fire sector and wall street gambling and stock buy backs and the list goes on regarding the parasites.

It does not matter where you are – it is a standard of living – cost of living to get by with basics is your start line but- the poverty levelhas not moved forever and a lot more people are in poverty now than the official stats would show

One should ask why we spend twice or more on healthare than the rest of the world and with worse outcomes, why we pay more for cell phone services and internet services per megabyte or gigabyte and be as a nation behind in technology implementation – why is San Fran real estate so expensive that it crushes the standard of living for everyone in that city.

Coronavirus Economic Distress Hitting Indebted Professionals

Hurray! Now maybe they’ll be less judgmental of other people and consider that it’s the system* that’s at fault.

*i.e. a government-privileged usury cartel with its attendant power to drive people and companies into debt.

“Her car payment is $550”

Seriously?

I thought the same. Why does a 64 year old woman even have a mortgage, let alone a car payment. What is she thinking??? She is very close to retirement age and should quickly and sharply reduce her debt.

cars wear out, and people move. often, they downsize. even if they don’t downsize, they move to an area with a lower cost of living on their pension, and still may need a mortgage to cover the house.

not everyone made enough money during their working years to be debt-free.

but let’s blame individual choices, again. that always works.

It might make no sense to blame individual choices for structural problems, but this woman is an individual example and so when assessing her situation it makes perfect sense to pinpoint certain choices as lousy.

That is almost exactly the amount of the average car payment on a new car in the US. The average used payment is $390.

Depends on the conditions of the car loan. Some are at zero percent interest for quite a few years. I was shocked by the $7,500 out of pocket for health care at a hospital. Yikes!

That $7500 is actually below the usual expense for an emergency room visit. Healthcare is the BIG rip-off in the US.

Obviously, it’s all her fault. And, BTW, what does her being a woman have to do with it?

It was work but I found the the Sanctimonious Professional reply section of NC. “Why does a 64 year old woman even have a mortgage…”. Come now.

Thanks for good overview. So if professionals join the great unwashed in impoverishment does that mean we will finally get a leftie Dem party again? Or does what happened to Sanders–arguably a middle class appealing candidate–bode otherwise?

“crawfishing into the mudbank”

Describes middle to upper-middle tier at CalPERS succinctly.

The Vietnam War stopped when the Elite were affected. You need to be an untouchable Govt employee taking no economic risk to get indebted now. Curtis Ishii, who gets a $418,600 CALPERS pension, can take on lots of debt and not worry. CALPERS and CALSTRS employees and pensioners would be the last to starve as long as Newscum can tax us.

Geoffrey Race (author of War Comes to Long An) learned Vietnamese on the boat over to his assignment during that war, then interviewed the population in Vietnam rather than huddling in his “strategic hamlet.”

What does that book tell us? Answer: the Vietnamese knew full well that as long as the indebtedness to the oligarchy installed by French colonialism continued, they would be unable to have any social mobility. That’s why they fought a far-better-armed American presence to a standstill.

Oddly enough, Americans were willing to give the Japanese and Germans a debt jubilee after World War II. Why not such a thing for one of our allies, like Vietnam? Perversity? Anti-Commie-sentiment trumps all? Who knows?

Meanwhile, Steve Keen predicted the Great Recession based on the unsustainable private sector debt load that preceded it. The U.S. private sector is even more indebted now!…

Fortunately we’ve figured out MMT for the oligarchs. ?

And, a hearty guffaw was heard from my direction

i’m seeing a lot of help-wanted signs – more than before the pandemic…every place from fast food joints and groceries to factories and other businesses on a two mile stretch of road in a rural Ohio rust belt town…two companies even rented billboards to pitch to potential employees…