Lambert here: They call it an investment vehicle because it’s designed to drive off with your money.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

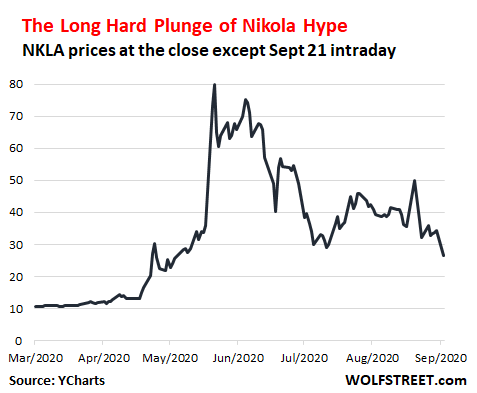

Shares of the electric truck maker Nikola that hasn’t made a single truck — not even a working prototype that uses its own technology — started trading on June 4, 2020, through a reverse merger with special-purpose acquisition company (SPAC) VectoIQ Holdings – the boom in SPACs being another phenomenon that shows how nuts this market has gotten. By June 9, Nikola’s market capitalization had vaulted to $29 billion as day-trader fans were going nuts over it, trying to get rich quick on this supernatural phenomenon.

Then the collapse began, the collapse in every aspect, including the collapse of hype.

This morning, the company announced in an astounding SEC filing that CEO and founder Trevor Milton, who is immersed in fraud allegations, was out, and the way it was done, namely effective yesterday, September 20, suggests that this was an orchestrated firing over the weekend, dressed up as “voluntary.” Some excerpts from the SEC filing:

The Executive hereby voluntarily hands over and otherwise relinquishes, and the Company accepts his relinquishment of, his position as Executive Chairman of the Company and all positions as an employee and officer of the Company and its subsidiaries (the “Company Group”), and his position as a Director on the Board and a director of any of the Company’s subsidiaries, including all committees thereof effective as of the Effective Date and without the need for any other action.

There are some minor claw-back provisions in the filing:

To help preserve capital and assist the Company in retaining world-class talent to succeed the Executive, the Executive hereby relinquishes each of the following:

(i) 100% of the 4,859,000 performance-based stock units (the “PSUs”) granted to the Executive on August 21, 2020,

(ii) any right or claim to enter into a two-year consulting agreement with an annual fee of $10,000,000 and

(iii) any other right and entitlement that the Executive may have or claim pursuant to the Employment Arrangement, except as set forth in this Agreement.

Milton was forced to announce his departure in the social media:

Following the Effective Date, the Executive will promptly revise the Executive’s employment status on social media, including LinkedIn and other social media sites so that the Executive is no longer identified as holding any position with the Company or serving on the Board.

Milton has to get approval before posting anything on the social media about the company:

Prior to using any social media site, blog or other online platform to make any statements regarding the Company Group or any of their respective employees or directors (a “Statement”), the Executive agrees to consult with the Executive’s counsel and the Company’s Chief Legal Officer as may be reasonably necessary to determine that the Statement complies with the Executive’s obligations to the Company.

And this is what Milton did this morning, when he tweeted – presumably with approval of said Chief Legal Officer: “I will be cheering from the sidelines with you. Your greatest fan.”

Nikola’s shares [NKLA] are currently down 22%, at $26.59, with plenty of true believers still thinking that this is a buy. Shares are down 65% from their closing high of $79.73, and down 70% from their intraday high of $93.99:

On September 10, Nikola got hammered by detailed allegations of short-seller Hindenburg Research that the company was “an intricate fraud built on dozens of lies over the course of its Founder and Executive Chairman Trevor Milton’s career.” In explaining its short position on the stock, Hindenburg Research summarized: “We have never seen this level of deception at a public company, especially of this size.”

Then Monday last week, Bloomberg, citing sources, reported that the SEC was examining Nikola “to assess the merits” of the fraud allegations of Hindenburg Research.

Milton had responded to the allegations with some tweets, that made things only worse. The company, still on Monday, came out with a rebuttal, that didn’t help matters either.

The deal with GM, announced on September 8 – though the media and Wall Street analysts oohed and aahed over it and caused the shares of both companies to soar briefly – raised red flags about the Nikola’s so-called industry-leading core technology upon which all the hype had been built, namely its battery and fuel cell technology that were supposed to power its trucks.

In the deal with GM, however, it was revealed that GM’s own Hydrotec fuel cell technology and Ultium battery systems would power Nikola’s Badger pickup trucks, not Nikola’s technology, which raised further doubts about the validity of Nikola’s technology breakthrough claims.

Not only would GM provide the core technology for those trucks, Nikola also disclosed that GM would “engineer, validate, homologate and build the Nikola Badger for both the battery electric vehicle and fuel cell electric vehicle variants as part of the in-kind services.”

So that leaves just the name that GM was apparently interested in and the hype surrounding Nikola. And true to form, following the announcement of the partnership, GM’s shares jumped 10%. This morning, GM’s shares are down 7%, and below where they’d been before the announcements. And it’s uncertain what remains of the value of Nikola’s tainted name. What is certain is that this whole entire Nikola phenomenon was only possible in a market gone willfully blind and nuts.

Selling classic cars during the Pandemic is hard – and even harder at the high end. Affordable Classics rise, American Muscle Cars fall, Ferraris flat, after big drops earlier this year. Beautiful machines all of them. Read… Asset Class of Vintage Cars During the Pandemic: Sales at High End on Ice, After Steep Price Drops Earlier in the Year

It sure didn’t help when it was learned that their infamous truck ad was performed by rolling the semi tractor downhill under only the force of gravity.

I have to say, however, that is probably the most efficient energy source.

Gravity: It’s the Law

Just put big tires in back and small ones in front – problem solved!

I read some comments elsewhere speculating that in addition to the hype, GM is after additional EV tax credits. Something about it being a different company opens up a full quota of tax credits which was desirable as GM has exhausted theirs.

Don’t know enough about these tax credits to know whether this makes any sense, but, if true, it could explain why GM invested in a company with no working product or battery / drivetrain/ engineering / production capacity (as GM says they will do this part)

there are some credits that apply to companies that actually end up being ‘sold’ to others to cover those companies own fossil fuel usage (Tesla being an example). doesnt really mean selling the vehicle. though i wonder how that works when GM builds the NIKOLA vehicles.

I am a long term investor in EV and battery space.

While clear that NKLA was not investable (no IP, no moat, dubious leadership, no demonstrable product…all of which covered by numerous high quality YouTube analysis), the interesting piece is “why did Blackstone and other in-the-loop players get on board?”

Why did GM follow? Why did Bosch follow?

There is a missing piece to this.

Speculation: battery EV has caught TPTB by surprise, especially oil & gas. There is increasingly an understanding that fossil fuels are going into a decline and losing the transport car and truck market to EVs over time is coming faster than anyone guessed (see Europe). Hydrogen is a byproduct of refining fossil fuels. Ergo H is backed as alternative to EV. Logistically H leaks everywhere and there is no infrastructure in place. Was NKLA part of a plan to combat the EV? Burning H is an adaptation to burning FF. So lots of big Companies would be happy to transition to being part of H move.

Do not know, but there is motivation, money, politics, and history to support that this is at least possible.

Blackstone would have been key to this strategy.

I think your questions are rather good but I don’t understand the speculation. Why NKLA would be a tool to combat EV? Also the rush for H2, as I see it, is for H2 from renewables, not FF, at least for what I’ve seen in European H2 projects.

He called the company Nikola, as in Mr. Tesla’s first name?!? How unoriginal. Better grifters please.

Right? For all of Musk’s antics, he at least has a car you can see driving down the street!

Nikola Tesla.

A breakthrough scientist who discovered among other things, alternating electric current, which enabled transportation of electric energy over great lengths.

Edison could transport electric (DC) energy 2 or 3 miles, Tesla could transport his (AC), over a hundred miles. That is what enabled the architecture of modern electric supply grids, worldwide, and avoided the necessity of every conurbation having to have its own electric generation plant right in the middle of it.

For a genius like Tesla to have his name raped by these two sh#&£*sters, is just sad.

>100% of the 4,859,000 performance-based stock units (the “PSUs”) granted to the Executive on August 21, 2020,

Of course there is no way of figuring out what that means in actual $$s but I would gladly trade my “fortune” for it. Glass floor…

Having been a “second waver” in several startups, what I can tell you is that those “stocks” are pretty much an Alice-In-Wonderland thing, where they mean “just what we say they mean, nothing more, nothing less”.

One company I was “granted” like 3% of the total, something like 1500 options out of 50k. In like two years there were suddenly 1.2 million stock options, and I had gotten an additional for my hard work something like another 750.

What a joke that was. I made the second startup simply pay me properly.

Milton should be charged with fraud. He already cashed out tens of millions from Nikola. Mary Bara should resign. How could she allow GM enter an agreement with such a scam operation as Nikola?

“Lambert here: They call it an investment vehicle because it’s designed to drive off with your money.”

Drum roll and Mic drop.

http://instantrimshot.com/

I prefer free odds on the point.