We are featuring an important new article by Richard Ennis, the co-founder of the first professional investment consultancy, EnnisKrupp, and editor of the Financial Analysts Journal. As we’ll explain shortly, Ennis continues with his criticism of fundamental flaws in the orthodox, and pretty much pervasive, approach large investors use for structuring and managing their portfolios. Ennis, who is unusually well-qualified to make an assessment, deems this strategy to be inherently flawed and describes what he views as superior approach.

We’ve embedded his paper at the end of this post and encourage you to read it in full.

While we are very much taken with Ennis’ critique, we have to confess to be less keen about his remedy. It is likely to reduce expenditures on chasing returns, but we are skeptical that large investors can generate alpha, particularly collectively.

By way of background, the prestigious Journal of Portfolio Management published another devastating piece by Ennis earlier this year, which we also encourage you to read. From our summary of its major findings:

We are embedding an important new study by Richard Ennis, in the authoritative Journal of Portfolio Management,1 on the performance of 46 public pension funds, including CalPERS, as well as of educational endowments.

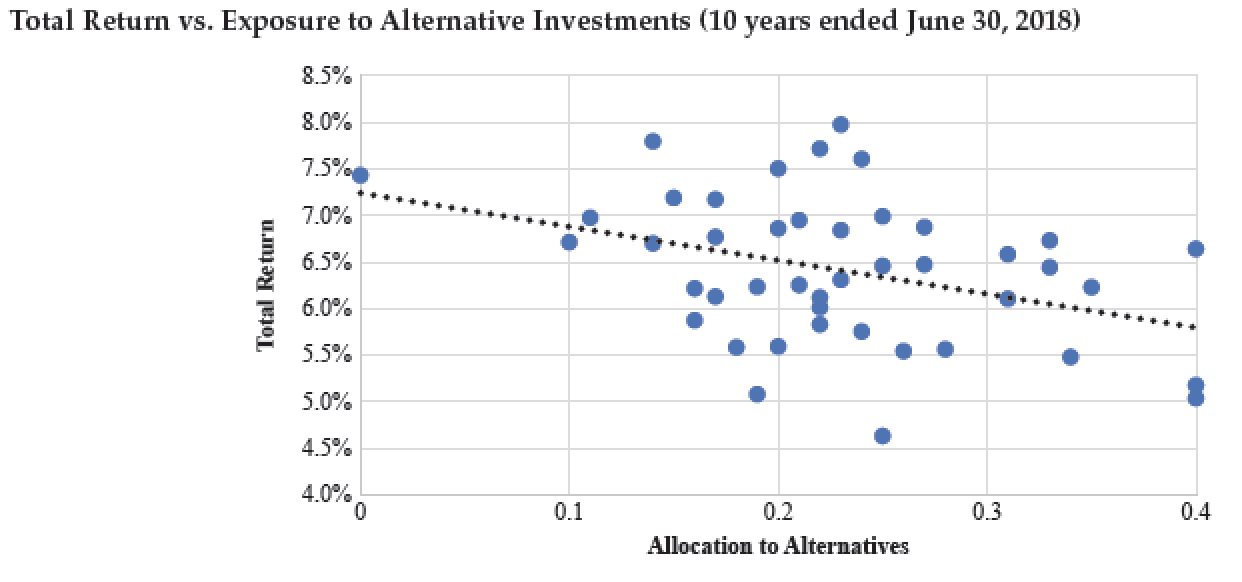

Ennis’ conclusions are damning. Both the pension funds and the endowments generated negative alpha, meaning their investment programs destroyed value compared to purely passive investing.

Educational endowments did even worse than public pension funds due to their higher commitment level to “alternative” investments like private equity and real estate. Ennis explains that these types of investments merely resulted in “overdiversification.” Since 2009, they have become so highly correlated with stock and bond markets that they have not added value to investment portfolios. From the article:

Alternative investments ceased to be diversifiers in the 2000s and have become a significant drag on institutional fund performance. Public pension funds underperformed passive investment by 1.0% a year over a recent decade…

For a decade [starting in 2009], stock and bond indexes have captured the return-variability characteristics of alternative investments in composites of institutional funds, for all intents and purposes. Alternative investments did not have a meaningful effect. The finding that the correlation between funds with significant alts exposure and marketable securities benchmarks is near perfect runs counter to the popular notion that the return properties of alts differ materially from those of stocks and bonds. That, after all, is an oft-cited reason for incorporating alternative investments in institutional portfolios. As we see here, however, alt returns simply blend into broad market returns in the context of standard portfolio analysis in the latter decade.

Needless to say, this finding also shows the folly of CalPERS’ plan to pile on risk by investing even more in private equity and plunge into private debt.

As the extract above indicates, Ennis found the median cost of the mismanagement by the 46 public pension funds as roughly 1% per year. CalPERS is a standout in the “negative value added” category, ranking 43 out of 46, with a “negative alpha” of 2.36%. This is a particularly appalling scoring, since CalPERS has far and away the largest and best paid investment office of any US public pension fund. But is this outcome partly result of CalPERS paying its investment team for merely showing up? The investment office staff perversely receives performance bonuses for merely almosthitting their benchmarks, which means achieving what CalPERS has defined as “market” performance. As we’ll discuss soon, Ennis describes how those benchmarks are self-serving and more favorable than using simple, broad stock and bond market proxies.2

Ennis explains that the public pension fund underperformance appears to be explained almost entirely by higher investment costs.

Back to the current post. In his latest article, Ennis further develops and substantiates his “overdiversification” thesis:

Trustees of public pension funds and large endowments in the U.S. are in a bind. With the help of staff, consultants, asset managers, assorted pundits and a media chorus, they have rationalized the division of their portfolios into as many as a dozen different sub-portfolios, commonly known as asset classes. Additionally, they behave as if they believe they can beat the market with 100 or more asset managers, which they compensate to the tune of 1-2% of the value of their assets each year. None of this is working for them, and certainly it is not working for the stakeholders of these funds. Ennis (2020) found that public pension funds collectively have underperformed passive investment by 1.0% per year and large endowments by 1.6% per year. It is time for fiduciaries to recognize that they have not merely been unlucky. Rather, their strategy has failed them.

CalPERS fits this picture, with roughly 100 managers in its private equity program alone.

Ennis points out that most of the so-called asset classes aren’t, since they don’t offer diversification beyond holding stocks and bonds.1 Instead, these other “asset classes” are “alternative investments” like private equity, venture capital, hedge funds, and real estate. Ennis explains that these are active strategies and investors are seeking to generate alpha.

The problem is that they once did and now don’t. The “Golden Age” of alternative investments was from 1994 to 2008. It would probably have overloaded the article to elaborate, but the vintage years 1994 through 1999 were spectacular for private equity, due largely to the wipeout that had come in the late 1980s and early 1990s. The losses were so widespread that the leveraged buyout industry felt compelled to distance itself from them by rebranding its activities as “private equity”. The years of disfavor meant that there had been a big falloff in buying private companies, as well as less competition for spinoffs of corporate divisions, creating buying opportunities. And “leveraged buyouts” had been tarnished badly enough that it took a few years of success for the money to start rolling back in in a big way.

The lifespan of this trend got a boost from the dot-bomb era, when Greenspan kept real interest rates negative for a then-unprecedented nine quarters. Investors, particularly long-term investors, started reaching for return, and private equity and hedge funds were among the preferred targets. More money pursuing these approaches initially bid up the assets they invested in.

So while the Ennis analysis is persuasive, I’m less taken with his prescription. It’s clearly an improvement from the status quo; my concern is that he oversells it in an effort to overcome institutional inertia. From his abstract:

We propose an alternative approach that employs just two asset classes: a versatile Passive Core and a flexible, efficient Active Portfolio. The Active Portfolio is where the action takes place. Here there are no asset-class silos to be filled and diversified; silos merely serve as constraints in selecting the most promising investments. The proposed approach maximizes freedom of choice, while enabling the investor to reconcile (1) the need for diversification, (2) scarce mispricing opportunities and (3) cost.

So far, so good. Ennis is quite serious about the Passive Core and tells investors with $1 billion or more that they should be spending no more than 1 basis point on this component of their strategy.

The problem I have is with the Active Portfolio. Ennis urges investors to go forth and seek alpha. I don’t see how this can realistically be done even on a single investor basis in an environment of financial repression, aka super low interest rates resulting in nosebleed valuation levels everywhere you look. You have historical situations where investors have effectively done what Ennis preaches without publicizing it widely. For instance, the success of the Yale endowment was based largely on making outsized bets on Chinese venture capital plays in the early and mid 2000s, due to making use of alumni connections, so they got currency appreciation, very strong fundamental growth, plus a strong record of making astute bets on particular companies.

Ennis first mistakenly believes that there is persistence in alternative investment top quartile performance. As we’ve been writing for at least the last 5 years, this hasn’t been true in private equity since the mid 2000s. It may still be true for a thin slice of top venture capital firms, but even they don’t necessarily let investors benefit. For instance, Sequoia’s flagship fund reportedly is a persistent top performer. But investors in the Sequoia flagship fund are required to invest in its doggier European and Asian funds, dragging down overall returns.

Ennis secondly believes in a terribly hostile environment, it is nevertheless possible to find superstars. Good luck with that. We addressed this fallacy back in 2014. You can substitute “alternative investments” for “private equity” and come to the same conclusion:

When you boil it down, this graph illustrates the ugly truth of investing in private equity: it’s not attractive unless you can outrun most of your peers investing in the asset class.

Rather than question the logic of investing in private equity at all, everyone in the industry has convinced themselves that it is reasonable to believe that they can be the Warren Buffett of private equity. The investment consultants go through the shooting-fish-in-a-barrel exercise of convincing their institutional clients that each of them is prettier, smarter, and more charming than average, and therefore capable of achieving sparking results. Needless to say, flattery is an easy sell….

Fundamentally, this is an intellectually dishonest exercise, and diametrically opposed to the way many public pension funds construct other parts of their investment portfolios. With public equity in particular, it’s almost certain that a significant majority of U.S. pension fund assets are invested in index funds. That’s because pension funds have recognized that, collectively, they cannot do better than average, and that after paying active management fees, actively managed public equity portfolios typically perform worse than the market average.

So it’s not as if these investors are so clueless that they can’t grasp the point that all of them cannot achieve above average results, let alone significantly above average results. Instead, with private equity, there is a desperate desire to be in the asset class for reasons that probably reflect a combination of intellectual capture by the PE managers, political corruption in legislatures that control public fund board appointees, and the need to have a strategy that could conceivably solve the pension underfunding problem over time.

Ennis recommends getting an advantage by hiring an experienced Chief Investment Officer who will in turn hire well-paid, in-house “scouts” to find superior investment managers. At least this gets rid of reliance on overpriced consultants. However, per the discussion above, there’s no evidence these super-managers who consistently outperform exist. Moreover, if they did, the first place they’d go to work is for a family office, where they would have better pay opportunities and less bureaucracy than working for an institutional investor (the exception would be a prestigious endowment, where success could be a stepping stone to launching one’s own fund).

In other words, Ennis appeared to lack the strength of his convictions to follow where his data led: to tell institutional investors to give up on the chasing alpha game, determine the level of risk they wanted to assume, and construct the cheapest indexing strategy possible consistent with that. Now there may be a role for opportunism, but it takes the discipline to sit around doing nothing until there’s blood in the streets, and then jump in and take big risks. Ironically, this was one of departed CalPERS CIO Ben Meng’s few sound ideas, but given his lack of experience running money, it’s not clear he had the temperament to execute it well.

____

1 One could argue that before the crisis, hedge funds offered a return profile not that much correlated with stocks. We pointed out at the time that hedge fund manager were even conceding that they weren’t generating alpha but instead “alternative beta”. We noted then that there was no justification for paying “2 and 20” merely for differentiated return profiles; you could create it vastly cheaper via other means.

00 Richard Ennis Standard Model Critique 1.0

It’s funny the state most associated with gambling doesn’t gamble (that much) with it’s pension fund. From 2016

What Does Nevada’s $35 Billion Fund Manager Do All Day? Nothing

From 2020 Nevada Pension Returns It looks like the evil blood suckers have managed to get their hands on some of the loot though (boo).

— and we can see the underformance of the alternative assets in the real vs actual allocation

As of June 30, the actual allocation was 42% domestic equities, 27.4% domestic fixed income, 18.9% international equities, 5.7% private equity, 4.5% private real estate and 1.5% cash.

The target allocation is 42% domestic equities, 28% domestic fixed income, 18% international equities, and 6% each private equity and private real estate.

I read this as “insider trading” opportunities. Even passive funds can’t beat those returns.

Perhaps the wiser folks here can give an answer to this quasi dilemma:

How can we expect active asset managers to outperform the market less their fees, if, in the aggregate, because of their collective size, they are to a good approximation the market?

On the other hand, if the market were almost entirely passive, would this allow for potentially substantial opportunities for scalping? (E.g. plausible to bid aggressively or ‘front-run’ Tesla before its joining the S&P 500.)

Not every investment is efficiently captured in some passive index or easily accessible market. There’s nothing principled against the idea that active managers can find good investments beyond indices.

I used to live in an apartment building that was owned by an insurance company, and before that, in one owned by a pension fund. At work, I recently designed machinery that got (from what I heard) funded through some leaseback or mortgage construction with a pension fund.

These are investments of some millions a piece, that might well, in aggregate, be a better investment than a passive index – for an investor who understands the particular niche markets well.

By definition, the set of active managers cannot “beat” the market – alpha is only defined with respect to some beta (benchmark) and alpha therefore must be zero sum. If a manager has positive alpha, it’s because he is taking it from someone else. So we need to find the winning active managers and avoid the losers…

When I worked for OConnor in the 90s one of the partners said that you should always try to identify who you are taking it from. Back then, it was easy to scrape nickels and dimes from large asset managers as they did not hide their activity very well. One manager, rhymes with “Oppenheimer”, used to do major rebalances over a week. If we discovered on Monday what was happening, Tuesday to thursday were frontrunning/scalping days. In effect, we drove their transaction costs up and acted as an intermediary/market maker for a fee. I was hardpressed to see what value we were delivering for the fee… but hey, we exploit people because we can, not because it’s right.

Now, there are a lot of things to buy and sell and not all of them are exchange-traded nor included in benchmarks.

And there are real premia offered for taking on certain kinds of risks, such that illiquid longer term investments typically paid (on average…) higher return than something liquid. Term structure of bonds illustrates this with easily priced things.

Hence investing in timber or farmland, private businesses, real estate.

And there are “premia” available via quirks in tax laws…

Thus there is some reason to believe that returns can be generated that have maybe a better return/risk profile than purely passive.

But most of these have limited capacity. At $100B there just isn’t a lot of ability to move the needle.

If the market for equities was almost entirely passive, where is the reward for fundamental analysis? How do prices get “discovered”?

changing rant a little

“Hedge fund” is not an investment class, it’s a description of the compensation scheme.

Let’s say that you should get paid tiny amounts for delivering beta (it does take some small effort to actually place funds into investments but it’s not hard) and large amounts for delivering alpha (hard to do and hard to rely upon, but worth paying for). As an investor, I really can’t know whether my 5% was composed of alpha or beta. I won’t have visibility into manager’s risk profile (a 5% nearly risk free return is great but 5% generated by getting lucky on short volatility plays is maybe not so good…). As a manager, I want to generate returns, but I also like getting paid 20% for delivering beta, which I can buy for 0.01%

There are a lot of people getting paid good fees from sources with agency problems. I.e. CalPERS and staff are not truly at risk from paying retail fees for a wholesale product, the beneficiaries are, yet they have very little visibility nor oversight. Fiduciaries… don’t seem to exist anymore. Most high fee things are not by themselves bad, it’s just that there is a consistent drag on return which compounds over time to an almost certain underperformance.

I will assert with a high degree of confidence that investing skill exists (I make my current fees by identifying skilled managers in multimanager shops and building portfolios to extract maximum alpha from manager skill…). I will define “skill” as having a likelihood of outperforming a passive benchmark.

Most managers with skill capture nearly all the value for themselves, not their investors.

In liquid, exchange traded or vanilla OTC markets, skill can only be exploited to some size as costs of implementation are somewhat more than linear in the size of trading.

So most skilled managers stablize at a particular size and generally all of their capacity is owned by Steve Cohen, Izzy Englander or Ken Griffin (or a few other such guys…)

Outside of this group, skill exists, at small scale, and a large investor simply can’t afford the due diligence costs to identify and participate.

Big fan of Ennis and overall he is on the right track – too much friction in terms of fees spent chasing low likelihood of outperformance.

There are fair returns to be earned from fair risks (i.e. beta) and beyond that you can only win by earning economic rent exploiting a monopoly in information (or maybe skill… e.g. Rafa Nadal has a monopoly on his set of skills…)

Thank you for such a detailed explanation how success is possible for some people within markets and how local or specific knowledge can aid such efforts. Of course all the players think they are going to win and I can’t pick a winner to save my life. It doesn’t seem most pensions can either.

If the market for equities was almost entirely passive, where is the reward for fundamental analysis? How do prices get “discovered”? – I’ve thought about this one and offer my best guess – Real Estate, most buildings aren’t sold every year, so if most investments were passive only a few would change hands and you would be left to value companies by comparing companies with the 1% of “active” buy/sells – and as a passive investor, I’ll offer this thought – I’m not interested in the short term, my passive investment is a bet that the sum of publicly traded companies / widgets will return profits over the longer term. In short I am betting that all those people going to work are adding (aggregated) value and not destroying it.

I do worry that public companies are destroying value/capital and that my passive investments are being subtly eaten by private companies and markets that I can’t invest in – but for it to be more than that I have to believe private market money is doing something differently. So far it looks like the only thing it is doing better is enriching the managers.

Its a long time since I read the details, but this seems to be turning back to the advice of JM Keynes in his model for the Cambridge Kings College Endowment (which I understand is considered the most successful long term investment model thats been studied over an extended period). I suppose you could summarise it by saying just KISS (keep it simple, stupid).

One aspect I’d be curious about is his suggestion about recruiting specialist investment staff. Back in the 1980’s when I was briefly studying this stuff, I knew two institutional property investors – both worked for pension funds. They had one job only for their entire careers – building up one or two large land banks within the property market they were most familiar with. Essentially, their job over the years was to work with local government to gradually build up prime land banks out of fragmented holdings (the local governments were useful as they would have eminent domain powers), with the aim over a 10-20 timescale to build up an area that could be turned into a major redevelopment of the type that was so fashionable up to the 1980’s. Essentially, urban mixed use malls. The theory was that only pension funds had the time scale and resources to wait for a long period of time before the land could be developed – but once they did, this laidback could then be turned into a very lucrative long term investment project worth multiples of the original investment (as one large block is far more valuable to developers than many fragmented holdings). This type of project seems to have fallen out of favour with institutions – I wonder though if anyone has really assessed whether they were actually a better approach than the type of indirect investment that became favoured from the 1980’s onward.

One problem is that local land deals can be corrupt as hell. You need people who know the ins and outs of a local market, down to whose cousins’ husband’s business partner has a ‘mate’ in the council, or you get snookered. But if you have people who are deep enough to know that, you have to worry that they aren’t themselves cousins or mates of some property developer.

Now if capitalism were two directional it would be simple – make money both coming and going. But short selling isn’t long term. Ikea has just announced its new business plan to buyback, recycle, refurbish and resell their old furniture. That kinda makes sense. It’s a way of looking at what the GND might employ in some cases. Forbes once said, in a former life, that “there’s cash in all that trash.” There is. It will come down to a question of government policy. Because everything else has; why not? There’s an enormous amount of money to be invested and pension funds are obviously not doing it right. They must make short term gains just to keep from going in the red. And that kind of desperation is policy driven. We should change all that. Go long term, go green, recycle, repair, refurbish and blahblabla. Profits will be smaller but steadier. Then the problem to solve is how to shore up the pension funds in the interim. And that solution can only come from the government. Until pension funds can fix their budgets they will need help from the government. It’s just crazy for them to think they can profiteer their way out of this trap. And the fastest way to get over this problem is to start incentivizing the new economy. No?

This is a step in the right direction, but why not take it further and ask why these public fiduciaries are even chasing unicorns in the first place?

The entire GAAP principle of “full funding” must be re-examined in the realm of public sector pensions and endowments. Governments are in no danger of being wound-up or acquired like private employers are, and their pension endowments will always have ever-growing wage-inflated inflows from current employees.

If you eliminate the massive grift overhead of alpha, and let savings benefit from compound interest, shouldn’t long-term beta provide enough in returns along with current contributions to pay benefits after the 25-40 year career of most government workers?

It seems like the “full-funding” mantra is nothing but a Shock Doctrine sales scam being run to panic public fiduciaries into opening their trust funds to looters.

Compound interest doesn’t really exist anymore, does it? Conservative investments pay less than inflation expectations. I can understand why pension funds are looking for better expectations than that. I can also understand why they want something different from just more stocks. The stock market is a weird beast, it’s mighty uncomfortable to have everything riding on that.

Of course, just because you want something, doesn’t mean you can have it.. A lot of the alternatives just seem to be the stock market in disguise, with more looting

Finding a barrel full of fish can’t be counted on to happen every day.

And counting chickens before the eggs are laid is somewhat worse that counting them before they’re hatched.

Ok, to be more clear;

WRT the barrel full of fish, you can only loot the commons until there is no commons left, you can only loot target companies until there are no targets left.

WRT unlaid eggs, the dot com bubble was caused by selling products and services that were entirely feasible, but either did not exist as of yet, or you didn’t have the ability to deliver.

So, the problem is much more simple than most folks are able to understand, those ‘alternative investments’ opportunities have become more and more scarce, for the purposes of this discussion, might as well not exist.

My old College, Queens’, is literally the poor neighbour to King’s (but richer in beauty, beyond that show-off chapel…). The College estates are basically some farms in the fens and a shoe shop in Essex. A lot of the little we have was invested in distressed funds. With an 100 year horizon, these bets have paid off well. Allegedly – I have not seen the books because as an incorporation by letters patent from 1449, it is not obliged to file accounts….

More generally, why are pension funds investing in traded assets at all? They do not need capital liquidity unless they are in run-off. They need cash flows. Surely the discussion should be about how much to invest in free cash flow businesses and how much in speculative cash sinks (venture capital, woodland, real estate development, turnarounds)? Tradable status should be secondary, especially as markets are usually misprinted. Business with free cash flow are hard to fake, absent fraud. There are risks such as financing risk and business model risk – don’t buy leveraged or dying businesses – but why pay for liquidity? And why pay two and twenty, externally? Hire these people internally on similar packages.

While accepting that one swallow doth not a summer make I hath a personal anecdote.

KiwiSaver is an NZ scheme designed to encourage New Zealanders to build up funds over their working lives in order to supplement the barely sufficient state pension. Most financial institutions here offer them along the usual choices of higher-risk ‘growth’, moderate-risk ‘balanced’, low-risk ‘conservative &etc, but with substantially lower fees than usual.

My wife and I a few years ago split our investments 50/50 between a personal ‘buy-and-hold’ portfolio – entirely in NZ50 equities – and KiwiSaver Accounts split 50/50 between growth and balanced funds. And unlike our private portfolio the Kiwisaver accounts are more diversified internationally and thus also reflect currency movements.

At the start of the 2019-2020 fiscal year here (April 1 – March 31) our managed KiwiSaver accounts amounted to 51.28% of our invrestments. At the end of the year – at about the low point of the covid-induced nose-dive – our KiwiSaver accounts amounted to 53.42%.

Now 6 months into 2020 and after a spectacular recovery on the exchanges our KiwiSaver funds amount to 55% of the total.

So even after fees our managed pension funds have outperformed a solid buy-and-hold portfolio by a respectable amount.

And over the whole 18-month period including the Covid crash of March our total capital increased 13.3%. So

I can’t complain.

Your anecdote for a ton of reasons isn’t applicable to the paper, starting with being for institutional investors, not retail investors like you. The reason for Kiwisaver doing better is likely more diversification (your private portfolio is wildly underdiversified)

I think Richard and you are right in saying big funds ought to allocate the majority of their capital to a maximally diversified portfolio of very low-cost risk premia products.

Then if the fund believes it can access alpha, then it can allocate and arrange to only pay performance fees. As you point out, persistence is the key metric here.

Alpha is some sort of mispricing or inefficiency. It can come from “asset strategies” – undervalued or over-valued assets (if there is a way to short) that are held for longer periods. Or from “trading strategies” that buy and sell to exploit shorter-term mispricings (albeit often with capacity limitations). It is worth noting that there is some public good from investment into alpha in terms of bringing prices closer to fundamentals.

So many problems in investment stem from inappropriate attempts to scale something up beyond reasonable limits. Mike Milken’s original pitch on fallen-angel junk bonds made perfect sense. But then we ran out of junk bonds. So, to satisfy the stimulated demand, we encouraged crappy companies to issue crappy bonds – which, having no connection to the original research, did as well as you’d expect. For junk bonds, think mortgages, hedge funds, private equity, venture capital…

AKA: Too much money chasing too few investments.

Another “benefit” (sarc) of FED policy. They keep buying safe investment vehicles and forcing pension funds and savers into more risky things, which then get priced high and return less… More risk less return

OK – there’s gotta be some key something I did wrong.

Shouldn’t the 100 million ++ working stiffs of the country be paying into funds which fund community infrastructure investments, and, which will then fund their golden years?

background – I’m 60, I was cook in Boston and in Alaska on fishing etc boats, I went back to school & got a math B.A. in ’97 at U.W. Seattle & finagled myself into a support job during the dot.bomb in Redmond WA. Dot.bomb blows up & I’m on the street & I try this high school math teacher thing, starting in 2003. Part of high school math life is stuff like polynomials and geometric sequences and compound interest and Pe^rt.

Piddling around, I put together this little unit on how you get fucked out of 10 cents an hour and … hmmmm. Ooops! I worded and presented that a lot differently!

Suppose you’re a ‘regular’ kinda working stiff getting paid for 40 hours a week for 52 weeks a year. How many hours of pay is that in a year. [2080] Suppose you get a 10 cent an hour raise, how many dimes is that – like the dime I just threw on the floor that all of you ignored? [bring out 1/2 gallon clear glass growler with 2080 dimes in it.] Suppose you get 4% interest on that $208 for the next 30 years, how much is that? [math math math, peel out some Bens & Grants & Jacksons to supplement the 2080 dimes in hte growler.]

Fast forward some math – suppose you want to save that 10 cents an hour, every year for the next 30 years, and you’re gonna get 4% a year? [Thanks, Stewart Precalculus, 4th Edition, 2002? or so]. This could be a 30 degree polynomial! or a geometric series sum! Or … let’s fart around with Stewart’s subsection on annuities & plug and chug and … $11,600 could be yours in 30 years! [NO 11 grand in cash made it to school for this part!]

BTW – remember PEMDAS ? What if that dime was a buck, or ten bucks?

BTW – what is the present value of that $1,160,000 +/- if you saved 10 bucks an hour for 30 years? [Thanks Stewart!]

I’ve tried extending things by looking at the size of the gov’t bond markets & most high school kids just don’t have the schema in their young lives to make much sense of things at this level.

Any-hoo —– why is all this money NEVER paid to the community members who created the wealth such that the community is NOT begging the powerful for table scraps to invest in the community’s well being?

Just kidding! Thieving scum are the reason that model doesn’t happen, BUT,

have I just invented the perpetual motion machine? There has to be a flaw, other than thieving scum, in my back of the envelope high school math fantasy?

thanks for any insights,

rmm.