By Nathan Tankus. Originally published at Notes on the Crises

I haven’t written in detail about the prospects of a congressional fiscal package since the beginning of August. Since we’re two weeks out from an election, this seems important to revisit. Long time readers will remember that I’ve been an aggressive advocate of large fiscal support to the economy so that there weren’t major income and financial impacts from having to quarantine. As the prospects of a new deal become more remote, I added my voice to the larger calls for a new package. I’ve outlined the damage that could be inflicted by not having a deal. I ended this run of articles with a piece in the Guardian warning against the terrible prospect of congress passing another fiscal deal. And especially not extending the supplemental unemployment insurance.

When it became clear we weren’t getting a fiscal package, I stepped back to analyze the “Fiscal Cliffication” of our economic policy. As I explained in that article, the Republican party has many political incentives not to pass a fiscal package. These hold especially if they strongly suspect Donald Trump will lose in November. Meanwhile, Democrats also have political incentives not to engage in a deal. I think that the political analysis in that piece holds up, and explains what has been going on for the past two and a half months. As I said then:

While this is disastrous for the country at large, the political incentives each party faces are going to lead to intensifying fiscal cliffs for the foreseeable future […] Without major and extreme change to our politics, we’re much more likely to see half-hearted and inadequate short-term extensions to the most minimal support to households and businesses, for as long as legislation requires inter-party cooperation.

Clearly, however, the politics of a new fiscal package have now evolved. It is beyond the scope of this piece to assess all the complex twists and turns of the negotiations. For that, you should be reading the excellent coverage by Jeff Stein at the Washington Post. The most important thing to understand is that the negotiations have not moved onto the main hurdle — Senate Republicans. While Democrats have been able to get the Trump administration to improve it’s offer in terms of dollar amounts, it’s not clear how meaningful that is without Senate Republicans participating. Negotiations have stalled at a back-and-forth between Trump, and House Democrats. House Speaker Pelosi’s stated position as of this writing is that she is not willing to accept the Trump administration’s proposed 1.8 trillion dollar offer. This offer includes another round of stimulus checks to every American, expanded unemployment insurance, and 300 billion for state and local governments.

Pelosi’s stated objections are firstly that the Trump administration is asking for too much discretion in allocating funding for coronavirus testing and secondly that they haven’t agreed to set terms on how state and local government support would be allocated. There are also a range of other issues where the terms and dollar amounts are not set, such as for childcare and a refundable tax credit for lower income Americans. She is also strongly objecting to the controversial idea of providing businesses a liability shield from coronavirus related lawsuits. This is a stated “red line” for Senate Majority Leader Mitch McConnell. While these issues are significant, it is not clear that they are worth holding up a package while millions of households are facing starvation and eviction.

This is especially true as the main leverage Democrats have is the looming election. An advantage which (obviously!) disappears once it is over, in just two weeks. Nonetheless, it is important to step back and remember House Speaker Pelosi’s stated goal in these negotiations — to get as big of a package as she can. Meanwhile, Republicans are looking to skimp on economic support. Her “messaging” bill was the 2.2 trillion dollar HEROES act. By contrast, Majority Senate Leader McConnell’s “messaging” bill is a minimal 500 billion (with no aid to state and local governments.) I could offer more detailed opinions on the complex politics surrounding these nearly lapsed negotiations, but I don’t really see that as my role. But they are important to understand for those who are keenly interested in our economic situation, as it stands today.

Let’s consider the lay of the land for Covid-struck America, after existing stimulus efforts. This will give us some idea of what hangs in the balance.

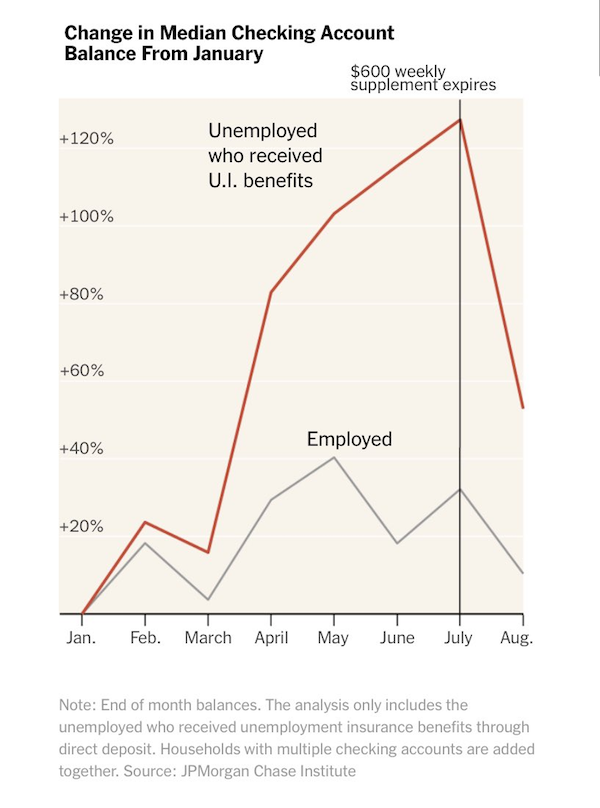

Overall sales didn’t instantly fall off after expiration, because the supplementary unemployment benefits were so large that they facilitated many receiving unemployment actually accumulating savings. There were also the 300 dollar FEMA payments that Trump authorized by executive order. These ran out in various states throughout September. The New York Times had some good reporting on a study based on JP Morgan bank accounts that showed the median checking account of those receiving direct deposits of unemployment benefits rose significantly early on, and then fell off significantly in August. The fall off in savings is probably less dramatic for the under- and unbanked receiving prepaid debit card balances or checks, with consequently larger drop-offs in spending when supplementary payments expired. A New York Federal Reserve survey from June showed similar results for the early part of the pandemic.

A similar story is told in the aggregate data. The saving rate peak coincided with the beginning of the stimulus check payments and supplemental unemployment benefits. As the stimulus checks were exhausted, the saving rate fell. It’s not possible to get a complete picture yet: we don’t have data for September, which will likely show larger declines. With the emergency FEMA payments declining, the desperation that has already racked millions of families is spreading — and so is the virus.

For now, the eviction wave I was most worried about in July seems to have been largely held off by the CDC eviction moratorium order. Though it’s hard to really tell how true that is given that we have no aggregate data on rental evictions, or homeowner foreclosures and evictions. Renters must submit a declaration to their landlord, which requires them to be aware of the CDC moratorium, to be able to go through the process. It also requires them to appear in court, and have proof that they submitted the declaration. This barrier makes this protection flimsier than it might seem after a glance at the moratorium order. Practically speaking, the “process servers” hired to supposedly deliver summons regularly lie about doing so, and are taken at their word by judges.

Even with successful recourse to the CDC moratorium, this moratorium doesn’t cancel rents. This means that we could get a spike of evictions January 1st. If the moratorium is extended, that still doesn’t deal with the looming threat of mass evictions in the longer term.

Which brings me to the major concern we face today. With each passing day, it becomes increasingly likely that there will not be any bill passed before the election in two weeks.

This would be an unqualified disaster. Without any passed legislation before the election, Democrats lose all leverage to push Senate Republicans to the table and the Trump administration will lose all interest in passing anything- especially if Trump loses.

This means we could possibly go until February 2021 before seeing another economic package. Worse, that package may even require a Democratic senate to become law. It’s possible that even that scenario is optimistic — it could then take a significant amount of time for Democrats to agree on a package among themselves. What happens to millions upon millions of people in that agonizing waiting period? A winter filled with a third wave of Coronavirus and no economic support to individuals is a recipe for absolute disaster — over 200,000 Americans have already died.

I hope I’m wrong — that a hasty deal will be struck, and that a fiscal package will become law in the short 15 days we have ahead of us. But I’m not optimistic.

If the government collapsed then most people would figure it out from there, including what is truly essential. Same at state and local level.

Check out what happens to systemic problems when government is de-valued, and disempowered here.

The title: From The Town That Went Feral: When a group of libertarians set about scrapping their local government, chaos descended. And then the bears moved in.

“If the government collapsed….”.

Military Junta, warlord, tribe, clan. Rule by the most violent.

Is that where you want to go?

Why do you think that the result of a government collapse would be dystopia? Science fiction writers and “mainstream” writers like Cormac McCarthy and Rudy Wurlitzer assume that mass violence and brutality will inevitably result from such a collapse. But where is the evidence to support this?

I have lived in three places which had no police – two in the US, one in Spain. Small rural towns, they were, and are, the most peaceful places imaginable.

Plus, in the United States – at least the west – one’s assumption is that one’s neighbour is armed to the teeth, which always mandates a degree of politeness and courtesy.

McCarthy’s entertaining dystopia novel The Road relies on a mysterious total absence of firearms in the Western US. Given that many of us have already been abandoned by the state, its collapse – and the fragmentation of the US into smaller, more viable statelets – doesn’t necessarily have to be violent mayhem. It might be. But it doesn’t have to be.

Unfortunately it isn’t a matter of who’s gun is bigger. It’s a matter of the continued functioning of services and supply lines, of at its most basic the folk who keep the sewage plants functioning, the milking plants running – needing power in the wires to do it – and to sit at a till in a supermarket all day depending on there still being police on the streets to protect them.

Your three most peaceful places imaginable were only able to be so because they could rely on a largely invisible net woven by the wider society beyond them to support them.

‘Natural law’ with respect to occupying land is that people who live somewhere, do not make trouble and are known by their neighbours will continue to live in that place. Likewise people who settle somewhere that hasn’t been occupied, live productively, don’t pollute or make a nuisance, and get along with their neighbours are unlikely to be prevented. It takes government power to make the property rights of far-away landlords factor into this equation.

The night-mare scenario is that the infrastructure for helping the destitute has collapsed while the infrastructure for preventing people from occupying their current dwellings and from settling on undeveloped lands remains intact, and hordes of homeless wind up being driven from encampment to encampment ‘Grapes of Wrath’ style.

Compared to that, government collapse would indeed appear much preferable.

We really take a lot for granted from a government. There is some essence of lawlessness where I live. The roads are largely privately owned. Where the neighbors agree to work together, the roads are well maintained. We each chip in a share (mostly) when it needs to be replaced. Where the neighbors don’t get along, and it only takes one or two rat bastards, the roads are not maintained and fall apart over a decade or two. Eventually you have a dirt road that services will not go down and a $400k repair bill to redo the whole thing. Everyone’s property value is cut in half.

The power of the state to tax or imprison removes this negativity. A polite “comply or else” is usually enough to get the rat bastards to participate as citizens. Without it, certain individuals go feral, and you can’t have a community anymore. It is not just everyone for himself. Certain things that must be shared will wither and die. They do not exist without the state.

Do either of the two bills McConnell says will pass the Senate in the next two or three days contain COVID liability protection for employers? I haven’t found a link to the text of either yet.

I do know that Alabama’s Republican governor, Kay Ivey, a lifelong party hack, has been making noise about calling a special session of the legislature to pass just such a bill. Guess some major donors are getting nervous. Is this happening in other states?

Krystal Ball reported on Rising this morning that the $500 million Repub bill is all about corporate liability protection with no money for ordinary people.

I thought I remembered reading that Trump killed the eviction moratorium, as of a week or so ago.

The article doesn’t address the widespread belief that Pelosi doesn’t want another package before the election for fear that it will help Trump at the polls. When Wolf Blitzer asked her repeatedly why she wouldn’t take Trump’s offered minimal bailout she melted down on camera in a widely distributed CNN segment.

Of course when an emergency arose in 2008 Pelosi was far more willing to step up and get the Dems to embrace the Bush bank bailout while many Republicans (including one of our SC congressmen) opposed on the grounds that government bailouts were not part of the capitalist bargain.

Pelosi’s CNN appearance was a PR disaster so perhaps she really will agree to some kind of deal in the next couple of days.

Don’t you love being used like a child stuck between two awful parents in divorce court?

+1.

I’m not sure the crime bosses in the democrat sindicate (and that would include Pelosi) are all that keen on a majority in the Senate. It would lay bare the farce that if only the horrid repug family weren’t there, the dem family could actually get something done.

That became very clear in 2008. They used their majorities to ensure minorities moving forward.

Those crime bosses just follow orders. Donors like reps in charge, what rich person doesn’t like tax cuts?

But dems must be there to keep progressives at bay bc all progressive policies are quite popular. Besides, those running dem administrations have the same policies, and are often the same people, as those running rep admins.

I think neither political party wants to be a ruling majority party. Actually legislating, which is a full time occupation, would threaten the gravy train. Easier to just pretend to work, keep getting the money, and keep their real bosses happy. The most active group in Congress are the Senate Republicans under Majority Leader Mitch McConnell because they want to fill all the judicial vacancies that accumulated in the past several Congresses. Senator McConnell has used the distraction of the stimulus negotiations to fill all those vacancies with oligarch and corporate approved judges without interference.

In my opinion, having worked in welfare services and done homelessness work at a public library, we’re not going to hear about the homelessness problem until it becomes recognizable to the Twitterati or politicians having to step over them on their way to the lobbyist’s party.

From what I understand in talking to old colleagues, evictions have already started in many places. Utility shutoffs are triggering properties getting condemned. Anecdotally, I am seeing a lot of people in strange places (walking on the highway, hanging around corner stores) wearing large backpacks and having “the look.”

Problem is that a lot of these people are not going to be tracked in any way. They don’t show up in statistics. They’re going to be living in cars or couch surfing. Economists just can’t track this kind of data with the tools we have now.

As Wolf Richter has pointed out, and as Nathan points out above, the Extend and Pretend policy on missed payments runs out at some point, which will then become a financial crisis.

I’m starting to see a lot of doubling up. As in, U-Haul trucks bringing the stuff belonging to people who are moving in with friends and relatives. And, in a nearby front yard, a travel trailer that appears to be here for the duration.

Interesting observation.

My mom pointed out that she’s seen that there’s a shortage of RV’s. At first she thought it was people doing their vacations out of RV’s, but increasingly, it’s also probably people who walked on their house but still had money to have a mobile home.

Hey, make sure there’s a post when we’re going to do a Chesco meetup, Slim. You know, sometime in 2025 when it’s safe…

Problem is that a lot of these people are not going to be tracked in any way. They don’t show up in statistics. They’re going to be living in cars or couch surfing. Economists just can’t track this kind of data with the tools we have now.

Feature, not a bug.

notabanker, this is true. On the other hand, I think there are a lot of ignorant economists who think that they have data on just about everything of importance and are myopic about the limitations of their view.

Seeing homeless tents in LA where I haven’t seen them in the decades before.

I’ve been shamefacedly stepping over or passing increasing numbers of homeless people for about three or four decades now. So, over half of my life, starting when homelessness was a rare thing indicative of drug addiction, mental illness, or extremely bad luck. Now that it is so *normal* even commonplace that not seeing some homeless people is strange, just when in God’s Name are the Very Serious People actually going to notice the growing millions of homeless Americans? Seriously? Do any of our elected representatives even care?

I think Pelosi’s interview with Wolf Blitzer says it all; what’s happening and what will hapen before the election. Pelosi is simply too imperious – amazed at the effrontery of Blitzer asking her how she will deal with a looming emergency that is uppermost on the minds of so many people – too imperious for her to shift gears from political strategy to averting a human catastrophe regardless of political calculus. From her own hubris, she ignores the potential for a huge political victory for Democrats (imagine if McConnell was presented with an agreement between the dems and the White House and then shot it down – a blood bath in the Senate elections would ensue), but Pelosi is way too far down the rabbit hole of her own infallibility to see it and/or she is content for the purposes of her own advantage with the balance of dems vs. repubs in House and Senate regardless of the damage to the pulbic.

https://thehill.com/hilltv/rising/521347-rising-october-16-2020

La fête c’est moi. (as Pelosi did not say.)

Now, Pelosi and Treasury Secretary Steven Mnuchin are back on the phone, and reportedly inching closer to an agreement.

But most House Democrats haven’t spoken out one way or another, in part because no House Democrat other than Pelosi knows what’s actually in the proposal.

https://theintercept.com/2020/10/16/nancy-pelosi-covid-stimulus-deal/

I was curious why CNN and ABC (usually staunch Democratic supporters) were being so critical towards Pelosi over the past few days in the interviews by Wolf and Stephanopoulos. I wonder how much of that has to do with the fact that the corporate banking world has billions of loans in forbearance held on their respective balance sheets and desperately need this government stimulus money to prevent those loans from being written off. Not to mention, most of these loans have been securitized into high yield products and are precariously sitting, waiting to blow up, in many 401Ks and pension fund portfolios. It’s all a fragile house of cards…

Good points. She’s so insulated with her ice cream she has no idea what’s going on in the gig economy… or doesn’t care… or the ones she listens to don’t care, or even oppose spending that could be better used for tax cuts… and maybe hasn’t got the bank memo.

IMO she’s got it now, but getting late in the day. Senate reps won’t oppose, but might drag their feet. Gotta see all the language… gotta iron out the differences between house and senate… and are all the dem blue dog senators on board with Pelosi? The ones not up for election? Ditto reps…

Opportunities for delay abound in dc…

plus reps really don’t want to bail out blue states.

You ‘ain’t seen nothin’ yet!

“The New York Fed said that 88% of the student-loan borrowers, including private-loan borrowers and Federal Family Education Loan borrowers, had a “scheduled payment of $0,” meaning that at least 88% of the student loans were in some form of forbearance. Until September 30. And then what?”

https://wolfstreet.com/2020/08/07/no-payment-no-problem-bizarre-new-world-of-consumer-debt/

Biden’s long and background history of supporting the

Student Loan Credit Card Industrial Debt Complex.

https://www.nationalreview.com/2008/08/senator-mbna-byron-york/

My wife and I can afford her student loan payments but we took advantage of the deferral through the end of the year to pay down a small car loan that had a higher interest rate. After that we will sock away the cash because, after all, this is a pandemic and cash is king.

At this point I cannot imagine student loan payments continuing. We are in a good position compared to most.

Howm many times do they have to say “compete with China” before people wake up and realize that means turning USA into a more abundant place for cheap labor?