Yves here. As you’ll see below, the jobs data is still grim and winter with no stimulus is coming.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

In October, there were 142.4 million employees on the payroll at “establishments” – businesses, non-profits, governments, etc., but not counting gig workers. That was up by 638,000 employees from the prior month, and still down by 10.1 million employees from February (152.5 million), based on surveys of these establishments by the Census Bureau, released by the Bureau of Labor Statisticsthis morning. At the low point in April, there had been 22.2 million fewer employees at these establishments than there had been in February. In other words, these establishments recovered 12.1 million of the 22.2 million lost jobs.

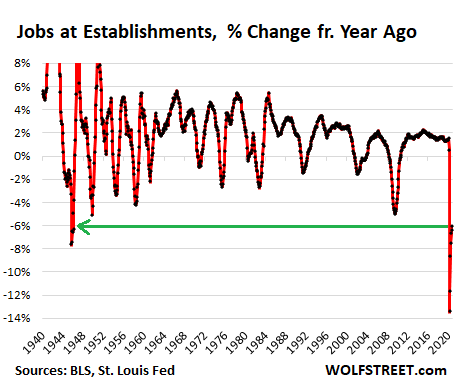

In percentage terms, employment in October at these establishments was still down 6.1% from a year ago. While this is a big improvement from the 13.4% plunge in April, it remains the steepest year-over-year drop in employment prior to the Pandemic since 1945:

I’m going to ignore the official “labor force” metric here because it is based on surveys of households, and if the respondents answer the questions in a specific way, they get surgically removed from the “labor force” though they still exist and would still work. You can see this as the labor force was down by 4 million people in October from February. These 4 million people still exist and would still work, but they answered in a specific way and got erased from the labor force.

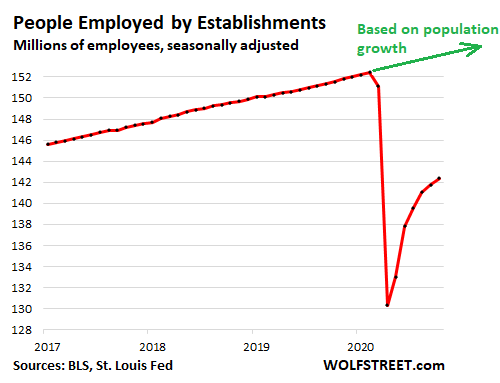

But wait… In the three years before the Pandemic, these establishments increased their staff at an average rate of about 177,000 employees per month. It was enough to absorb the growth in the working-age population that was interested in a job (not the official “labor force”).

And that growth in the working age population that would work has most likely continued at a similar rate during the eight months of the Pandemic as it had before the Pandemic. And the labor market will have to absorb them.

So not only does employment have to go back to where it was before the Pandemic, but it also has to make up for the growth in the working age population. This is a moving target. Note in the chart below, the slope of the line of employment at establishments before the Pandemic and where employment will have to go for it to catch up with the long-term trend.

Given the average monthly increase of 177,000 employees over the three pre-Pandemic years, the gain in jobs in October (+638,000) means that employment approached its long-term trend level (let’s call it the “approach speed”) by 461,000 jobs (638,000 minus 177,000):

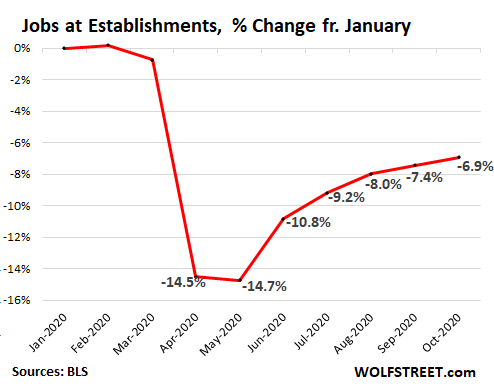

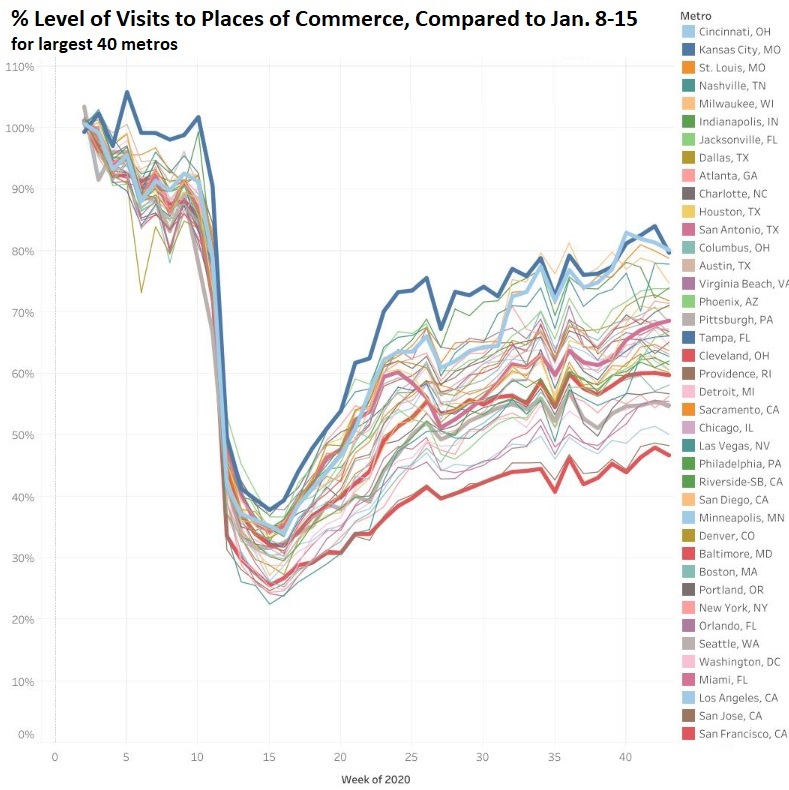

And this forms a pattern in the recovery that is being duplicated in many other data sets: After the initial plunge came the bounce, and the recovery continues but at a slowing pace and remains still very far from where activity levels had been. This can be seen in the two charts below: first jobs, and second a broad index of activity. Though the charts are very different, the slopes of their lines are very similar.

In October, the employment levels at establishments was still down 6.9% from January. Note the slowing recovery that is by a wide and historic margin below the January level:

And second, the very similarly shaped weekly index of how many people are going to “places of commerce” in the 40 largest metro areas in the US, based on cellphone GPS data. These places of commerce include offices, stores, malls, restaurants, hotels, movie theaters, airports, hospitals, other places of commerce and other points of interest. The index, released by the American Enterprise Institute, compares the number of visits on a weekly basis to the number of visits in the week ended January 15.

The top bold blue lines are Cincinnati and Kansas City (both at 80% of January level). The bottom bold red line is San Francisco (47% of January level). The bold lines in between represent San Antonio (69%), Baltimore (60%), and Seattle (55%). Click on the chart to enlarge it.

There are some aspects of this weirdest economy ever that are rocking and rolling, particularly retail sales, and particularly of durable goods that have spiked to record highs, triggering a boom in imports, in port activity, and in the transportation sector, amid rumors of capacity shortages ahead of the holidays, even as consumers themselves are super-gloomy about holiday spending. But retail is only a relatively small corner of the economy, and is not enough to make up for the still dismal performance of the other sectors.

Its hard for me to believe that there is any logical reason for the lack of coverage of this ACTUALLY HISTORIC level of unemployment other than the fact that the people who have been most harmed are restaurant, hotel, and in general lower paid people. And lower paid people don’t spend enough to interest advertisers…

I am a Recruiter for a third party logistics company. Despite the unprecedented unemployment, Warehouses are having a hard time finding workers. Most are offering sign on bonuses between $500.00 to $1,500.00. We offer full medical after 15 days of employment and a union job (Teamsters). These are 20.00/hr. jobs with OT. Even Amazon is offering Sign On Bonuses. Jobs are out there, but with schools still closed, people scared of the virus, and a possible round of stimulus on the horizon many are choosing to stay on the sidelines.

What city and state is this in?

the devil is in the details…are these warehouses in or near population centers? Graveyard shift? Must lift x lbs? Does your company have high turnover? Seasonal?

As to possible stimulus, ain’t gonna happen.There’s no political will and Bezos et al don’t want it because they’ll have to pay more to get people to show up.

Somewhat relevant…

https://www.theverge.com/2020/10/22/21529008/amazon-warehouse-injury-rates-classification-workers-compensation

Doesn’t surprise me. I used to work in an employment center getting jobs for people on welfare. Yes, picker packer type of warehouse jobs were out there, but people didn’t take them because the work did horrific things to your body. These were people desperate for a job, saying, “I’m sorry, but there’s no way I can do that. I would be wrecked.” Also, Amazon warehouses now have a reputation.

I live near the intersection of I81 and I78; lots of warehouses and lots of help wanted signs.

Funny the way our system works – need more workers? OFFER MORE MONEY.

I know people working in distribution centers. Managers are cutting hours as the expected volume is not materializing. 60% reduction in expected online sales is what managers are saying at the distro centers.

Some companies are now having Black Friday sales every Friday this month. An act of desperation.

A certain retailer has blacked out trucking company schedules to ship product. With online retail suffering from 40% returns requiring an enormous waste of resources. If it were not for tax law? Online retailing would be be practically destroyed.

Distro centers cutting back hours while companies are blacking out trucking company schedules. Two opposing forces.

Huge initial online sales will probably be announced. Stock prices will go up. Stock owners will line their pockets. While the losses will be quietly hidden. Tax law, thanks to 2017 Republican tax scam, will see those losses used as tax deductions out to 10 or more years resulting in corporate taxes being driven into negative rates.

Negative tax rates? Companies receive Federal tax rebates on paying $0 in taxes. Directly pickpocketing every US Citizen that pays taxes.

Losing has become winning in American Capitalism. If it were not for tax law and US taxpayer guaranteed handouts to corporations and Wall Street banks? Just about every major US corporation would be in bankruptcy court to hide assets.

States like Texas, indeed most Red States, who dominate the top 35 of Federal dependencies, would see their economies collapse without Federal handouts, jobs, grants, loans, paychecks.

Blue States reliant on the Financial sector and real estate would be almost mortally wounded. These are few, however.

Dow below 7000, S&P below 1000, etc.

The US is barely managing to hang onto a functioning economy by pumping dollars from taxpayers into the offshore bank accounts of investors, board members. Worh 25% of US stock markets owned by foreign investors. Including the Chinese government, owning US Treasuries. Also used to fund resource grabs by Chinese leadership and for PLA funding.

All because of neoliberal rentier economics and US business and political leaders of both parties being greedy. They can flee a collapsing US. The rest of us, cannot.

It’s interesting to game out what will happen with wide release of a Covid vaccine. I think it will be insane as cooped-up people want to do anything and everything. Now restaurants, malls (indoor and outdoor) will be understaffed but still have the dynamic of nobody who owns anything wants to pay labor crap* and thinks they can get away with it because people want jobs. Initially that will be true, but like I said everybody will be understaffed and if you offer no benefits then the flip side is you have no retention. Your good hires will be sucked up in a month by your competitors.

It will be a mess, but maybe a good one.

If we don’t have a Covid vaccine, well I don’t want to even think about, let alone speculate on, that.

*with governments mostly run by Republicans that certainly won’t increase the minimum wage/give free healthcare and those run by Democrats that will be afraid to because they are always afraid of what the Daddy Party will say about them

Will the “anything and everything” folks rack up a huge amount of consumer debt and drain savings? There could be a real boom-bust movement in the 5 or 6 months after a vaccine with everyone spending left and right until they realize they are out of money and in trouble, while the readjusted economy goes through a round of layoffs in the industries that did not survive.

President Biden, V.P. Harris and his entire cabinet, plus his side of the aisle must be the first to take the vaccine to reassure the American peope.

Just like Obama was the first to take a drink of Flint water.

No thanks, I will wait until the EU or somebody credible vouches for the vaccine.

If you observe that the virus has accelerated the long term trends of austerity and impoverishment of the most of the population, the US’s disastrous response to it makes a lot more sense. If the billionaire class wanted a more effective response, we would have had one, I think. The Democrats’ impotence and the Republicans’ intransigence in the second stimulus issue is the easiest example.

Destroying the last remaining super-power is high on economic globalists’ minds. Preventing the emergence of another super power is the issue.

What better way than to pit the last super power against the emerging super power? Financially and militarily.

There is not a monolithic conspiracy. Simple self interest among the billionaires controlling banks and corporations is enough to provide them with a common goal even as they fight each other as “frenemies”. They have a common enemy: the teeming masses. They view us as the greater threat than each other.

So true! There is no job creation.

Worse — many of the jobs created were created by small businesses. Many of those small businesses have closed their doors or hang on near the edge hoping for things to improve. When small businesses die the jobs they provided are gone and the jobs they might have created in the future are gone and their tombstones serve as warning to would be entrepreneurs who might have tried to start a new business.

It’s a hell of a thing when a business goes bankrupt. You take away all its got, and all its ever gonna have. You take away all the jobs it provided and all the jobs it might have created in the future. — to paraphrase a favorite movie

This isn’t really true. If airline goes bankrupt all those planes and pilots are still around. If a small restaurant closes (happens all the time), equipment gets sold and another biz can set up shop.

There are definitely problems when firms go bust. Best solution would have been for govt to pick up payroll. But outcomes not universally awful. Sometimes, as with airlines or exploitative small biz owners, new ownership might be better.

Gosh, you’re an upbeat commenter!

Alas, it seems to me that ‘creative destruction’ rarely results in reuse/ repurpose/ recycle, but rather in a pile of rusting junk. In our wasteful world, their successors find it cheaper and easier to begin from scratch.

It may sometimes be expedient for a man to heat the stove with his furniture. But he should not delude himself by believing that he has discovered a wonderful new method of heating his premises. (Mises)

Or….

COMMERCIAL BANKER …and the only way we can see this happening is liquidating the hangars and the planes. Can you people guarantee that?

INVESTMENT BANKER Guaranteed! No sweat. We already got the Bleezburg brothers lined up to build condos where the hangars are. We can lay off the planes with the Mexicans, who are dumb enough to buy ’em and Texas Air is drooling at my kneecaps to get the slots and the routes. What’s the problem? …. we got it all nailed right down to the typewriters….

Your man did his homework, Fox. You’re gonna have the shortest executive career since that Pope who got poisoned!

This is why, as dire as the pandemic is, lockdowns are a contentious issue: you are literally putting people out of work and taking their livelihoods away, especially for those who own small businesses.

It’s easy to be for a lockdown when you work from home, have a trust fund, or are comfortably retired.

However, if you have to work for a living and your job cannot be done remotely, you’re SOL if you business isn’t declared essential–you are simply out of work and at the mercy of whatever the government decides to provide as a safety, which here in the United States is not a whole lot.

You mean “Go die, you deplorable scum!”?

Plenty of people here have already commented on this, but watching the stimulus drama on Capitol Hill with the various interviews especially of Nancy, Chuck, and Mitch, reeeaaally beat into me the contempt, or worse the disinterest, they have for anyone outside their class. Worse, they act like petulant, ignorant children.

I wonder how many dreams and families their games have destroyed

The pandemic fits in nicely with the interests of the ruling class. It is clear that the world is running up hard against the “limits to growth” predicted in the 1970s by the Club of Rome precisely when inequality levels are at historic levels & rising. These limits have been greatly exacerbated by global warming, which was not fully understood at that time.

As has been clear for the past fifty years, the only “solution” to addressing these ecological and resource limits is a radical reduction in global energy and resource usage. This can only happen when there is an equitable sharing of the burden of change, with the largest cost borne by the ruling class.

So long as the top 20% control the vast majority of wealth and income (This applies also to the wealthier nations of the world in relation to the global south), the bottom 80% (the working class) is unlikely to accept the need for the radical conservation and restructuring to avoid ecological societal collapse.

Covid is creating even higher levels of inequality. The ruling class will blame the coming austerity for the bottom 80% on the pandemic, and use it as an excuse to attempt to maintain their lifestyles and control.

In the immortal words of Frederick Douglass, “Power concedes nothing without a demand. It never did and it never will. Find out just what any people will quietly submit to and you have found out the exact measure of injustice and wrong which will be imposed upon them, and these will continue till they are resisted with either words or blows, or with both. The limits of tyrants are prescribed by the endurance of those whom they oppress.”

The ruling class has been extraordinary successful in dividing working people to fight against each other rather than our uniting against the common enemy. The struggle today is for justice and peace and for the very future humanity.

Frederick Douglass spoke Wisdom to a different time. Power may concede nothing without a demand — but I hear no demands for less voiced. Populace does not seem to believe in less any more than our Power Elite does. The future promises poverty for all. That would eliminate inequality but no one accepts that reality whether rich or poor. We need to find ways to live with less that will not mean living a poor life. We need to learn new values.

I’m reminded of Marshall Sahlins’ words:

“The world’s most primitive people have few possessions, but they are not poor. Poverty is not a certain small amount of goods, nor is it just a relation between means and ends; above all it is a relation between people. Poverty is a social status. As such it is the invention of civilization.”

Stunning! You add this to the fact that the media will not show the mile long food lines, soup kitchens, and homeless that are growing daily, it’s as if a complete black out to keep the masses calm is at hand. I have been trying to keep my eyes peeled on Economic news, and keep seeing the term, “The Great Re-Set” being bandied about. A Re-Set for the Banks to unload all of their DEBT. That is a huge problem for me as WE the PEOPLE have been bailing them out again for months, before the Pandemic. There is also mention of a McKenzie Plan. I’m not quite sure what that is as of now, but intend to research it. I’m fairly new here, and unsure if I can include links. If not, I might just share the name of publication, and title of article in the more well known Economic/Money Reports, or Magazines in future comments. Thank you so much for all the information you share with all of us.

As the Rainbows say: Welcome Home.

I am not the greeter, but new once myself.

NC does have some Post Guidelines and I know our hosts like that you pay them some respect.

Links following their guidelines are accepted and the comment box you used has something just for that.

Use the heading bar across the page or drop down on your phone screen to get to those POLICIES.

Peruse the Links or Water Cooler to get a feel for what that looks like.

Oh–since ABOUT comes before POLICIES, I suggest you start with that.

Rod, thank you. Appreciate your welcome too!

Adding, welcome to the best commentariat on the web!

If there were a name for my theory regarding the past precedents, present, and our future, it would be Port Theory. In the introductory section I noted commerce centers and saw airports. Sea ports were not initially listed, though seaports do tend to have great airports. Just think of the cities you know by their airport identifiers. LGA, JFK and EWR are likely established in your mind.

Labor simply does not possess the mobility of capital and those who possess capital. I believe this makes much of the difference between 154 million working in the US and 190 working in the US.

When I was young and ever looking for a paycheck I needed no more than willingness for much of what was available. Those cities that are ports welcome the willing worker. Of course you will discount the effects of pot prohibition but you ought not, for in the early ’90s grew the piss test industry. It has been said that 25 million people in the US use or at that time used marijuana and you were made unemployable by piss tests from then on. Simply adding 25 million to 154 million gives you 179 million.

In my case, and my case exemplifies the ideal versatile American worker, I moved from aviation ground services to motion picture and television production. I had there a technical career as well as working as an actor as I even rose to Director of Photography. I ran a business in NYC. Safety first on tarmacs and movie sets is not theoretical.

It is a big deal that one state after the other has been legalizing marijuana. If it were to be federally legalized more people would be employable. The final say has to be said by the FAA, for if it is legal it has to be legal for aircraft captains same as is alcohol. The effects of edibles are longer lasting than smoke. I can tell you from my experiments on myself 24 hours from joint to joystick are safe, and even a stoned pilot is not near as dangerous as a drunk. Three days from eating a gram of hashish to flight plan and captain’s seat is certifiable as safe.

I am saying that what affects port employment positively or negatively matters a great deal. All you have to do to understand the impact on employment in the real economy that a prohibition of marijuana has come to mean since it was adopted as a folkway for so many of my American cohort. All you have to do is imagine if alcoholic drinks were still illegal. Think of all the bars closed again or restaurants that wouldn’t make it. That is a lot of people who are counted as employees.

Bad laws make for a bad society. I like to believe we can now fight back against those determined to privatize our Post Office, Parks, & Forests.

Sure enough we have today taken from our future 4 more years of a defender and part of the international oligarchy. In a couple few months we will have as our President a dinosaur. Biden, unlike Sanders, is expected do gradualism and bi partisanship over prohibition so much that the misery of dystopia started with the Nixon Drug War and all the surveillance it has led to will just continue.

Imagine a Federal Jobs Guarantee that excludes people whose piss is tainted by marijuana?

Thanks. Since over the past 50 years millions of words have been published about the prohibition that does fantastic damage to our society, and this is just more objection, & you probably know it already, & even wonder if it really fits here, I kinda apologize.

The end of the pandemic will cause debt growth to surge. 4% growth yry between q3 2021 to q2 2022.

Growth is dead.

How bad is it?

No one knows what real wealth creation is.

Where does it always go wrong?

“The Fate Of Empires and Search For Survival” Sir John Glubb

http://www.rexresearch.com/glubb/glubb-empire.pdf

The pivot point where the decline begins.

“There does not appear to be any doubt that money is the agent which causes the decline of this strong, brave and self-confident people. The decline in courage, enterprise and a sense of duty is, however, gradual.

………..

All these periods reveal the same characteristics. The immense wealth accumulated in the nation dazzles the onlookers. Enough of the ancient virtues of courage, energy and patriotism survive to enable the state successfully to defend its frontiers. But, beneath the surface, greed for money is gradually replacing duty and public service. Indeed the change might be summarised as being from service to selfishness.”

“But, beneath the surface, greed for money is gradually replacing duty and public service. Indeed the change might be summarised as being from service to selfishness.”

That sounds like the ideology we call “neoliberalism”.

Why is this so dangerous?

You have lost sight of where wealth creation actually occurs and are on a downward spiral.

The Americans hoped an entrepreneur would develop 5G in their garden shed, but it didn’t happen.

5G sounds a bit hard; there are loads of easy ways to make money.

Making money doing nothing.

What are the options?

Well, there are quite a few options available; we’ve got rent, dividends and interest and there is the globalisation favourite, capital gains on property.

You can make money without creating wealth and this is the easiest way to make money.

In 1984, for the first time in American history, “unearned” income exceeded “earned” income.

The American have lost sight of what real wealth creation is, and are just focussed on making money. You might as well do that in the easiest way possible.

Bankers can engage in an elaborate shell game that makes lots of money.

When you don’t know what real wealth creation is, or how banks work, you fall for the banker’s shell game.

Bankers make the most money when they are driving your economy towards a financial crisis.

On a BBC documentary, comparing 1929 to 2008, it said the last time US bankers made as much money as they did before 2008 was in the 1920s.

Bankers make the most money when they are driving your economy into a financial crisis.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

At 18 mins.

The bankers loaded the US economy up with their debt products until they got financial crises in 1929 and 2008.

As you head towards the financial crisis, the economy booms due to the money creation of bank loans.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

The financial crisis appears to come out of a clear blue sky when you use an economics that doesn’t consider debt, like neoclassical economics.

That’s what the banker’s shell game does to your economy.

Bankers are playing a shell game, which you can’t see if you don’t know how banks actually work like today’s policymakers.

Bank loans create money out of nothing.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Money and debt come into existence together and disappear together like matter and anti-matter.

It’s a shell game; you have to keep your eye on the money and the debt.

No one was looking at the debt building up in their economies as bankers played their shell game to make money.

At 25.30 mins you can see the super imposed private debt-to-GDP ratios.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

Private debt builds up in the economy until you get a financial crisis.

1929 – US

1991 – Japan

2008 – US, UK and Euro-zone

The PBoC saw the Chinese Minsky Moment coming and you can too by looking at the chart above.

We have been here before.

GDP was invented after they used neoclassical economics last time.

In the 1920s, the economy roared, the stock market soared and nearly everyone had been making lots of money.

In the 1930s, they were wondering what the hell had just happened as everything had appeared to be going so well in the 1920s and then it all just fell apart.

They needed a better measure to see what was really going on in the economy and came up with GDP.

In the 1930s, they pondered over where all that wealth had gone to in 1929 and realised inflating asset prices doesn’t create real wealth, they came up with the GDP measure to track real wealth creation in the economy.

The transfer of existing assets, like stocks and real estate, doesn’t create real wealth and therefore does not add to GDP. The real wealth creation in the economy is measured by GDP.

Real wealth creation involves real work producing new goods and services in the economy.

So all that transferring existing financial assets around doesn’t create wealth?

No it doesn’t, and now you are ready to start thinking about what is really going on there.

That’s the bankers playing their shell game.

What is the fundamental flaw in the free market theory of neoclassical economics?

The University of Chicago worked that out in the 1930s after last time.

Banks can inflate asset prices with the money they create from bank loans.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Henry Simons and Irving Fisher supported the Chicago Plan to take away the bankers ability to create money.

“Simons envisioned banks that would have a choice of two types of holdings: long-term bonds and cash. Simultaneously, they would hold increased reserves, up to 100%. Simons saw this as beneficial in that its ultimate consequences would be the prevention of “bank-financed inflation of securities and real estate” through the leveraged creation of secondary forms of money.”

https://www.newworldencyclopedia.org/entry/Henry_Calvert_Simons

Real estate lending was actually the biggest problem lending category leading to 1929.

Richard Vague had noticed real estate lending balloon from 5 trillion to 10 trillion from 2001 – 2007 and went back to look at the data before 1929.

Margin lending had inflated the US stock market to ridiculous levels.

This is what was going on last time and they had worked out the cause of the problem.

That’s the banker’s shell game.