By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

So what happens to debt when borrowers stop making payments on their mortgage, credit card debt, auto loan, or student loan, and the lender puts the delinquent loan into forbearance or into a deferral program, and notes the loan as “current,” despite past-due payments, because there is no payment due this month since the loan is now in forbearance? Well, the algo of credit bureaus, such as Equifax, sees that the borrower who was delinquent has “cured” the delinquency and has become “current,” and it then raises the borrower’s credit score. A brave new world, but here we are.

Delinquent loan balances have plunged across all loan types, as these delinquent loans have been moved into forbearance or deferral programs, according to data from the New York Fed’s household credit report for the third quarter.

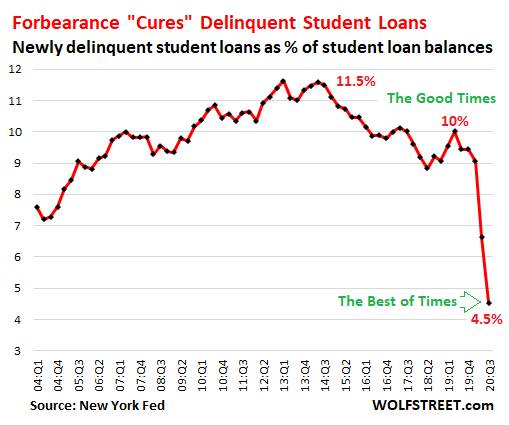

No Payment, no Problem for Student Loans.

The percentage of student loans that are 90 days past due plunged from 11% of total loan balances before the Pandemic to 6.5% in Q3 2020. And the percentage of newly delinquent student loans plunged from 9.4% of total loan balances before the Pandemic to 4.5%, by far the lowest in the data going back to 2004:

Student loan forbearance – the program also included 0% interest on outstanding balances and cessation of collection efforts – was originally scheduled to end on September 30 but has been extended through December 31. Now among student loan borrowers, the hope of student-loan forgiveness has turned into a feeling of near-certainty, and to heck with the idea of making payments even after the forbearance programs ends.

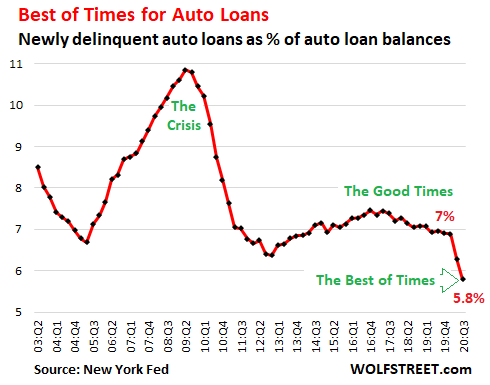

Best of Times for auto loans delinquencies.

Auto loans are not backed by the government, and the deferral and forbearance programs have been implemented by private-sector lenders and loan servicers. Newly delinquent auto loan balances dropped to 5.8% of total auto loan balances, the lowest in the data going back to 2003. Note the delinquencies of auto loans during the prior crisis, when they exploded into the double digits. But this crisis now is the Best of Times:

With auto loans there are two factors: Voluntary loan deferral programs by private-sector lenders and government cash sent to households.

In terms of lenders, for example, Ally Financial reported last summer that in its second quarter about 21% of its auto-loan customers were enrolled in its deferral programs where they would not have to make payments for 120 days. The programs ended on September 30. For its third quarter, Ally reported that 8% of the borrowers exiting its deferral programs were 30 days or more delinquent.

In terms of the government cash sent to households, this included the $1,200 per adult and $500 per child in stimulus checks, plus the extra unemployment benefits sent under federal programs, including the extra $600 a week through July, then the extra $300 a week starting in late August, plus the other special federal programs established under the CARES Act, including the Pandemic Unemployment Assistance (PUA) program that has been surrounded by fraud allegations. This government money helped many households keep their auto loans current.

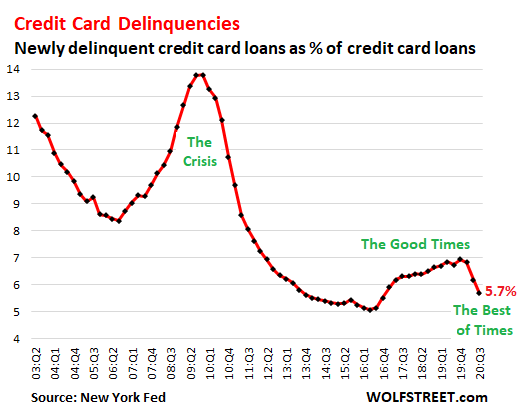

Credit card delinquencies also plunge.

In this era of deferral programs and government cash sent to households, newly delinquent credit card balances also dropped during the crisis, instead of surging, as they did during the last crisis. Credit card delinquencies had been on the rise since 2016, during the Good Times. Then the Pandemic and the unemployment crisis hit, and surprise, instead of spiking, newly delinquent credit card balances fell to 5.7% of total credit card balances, the lowest since 2016:

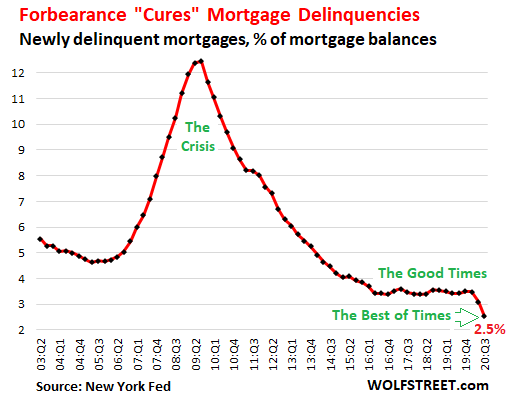

Forbearance pushes mortgage delinquencies to record low.

The government guarantees or insures the vast majority of residential mortgages issued in the US, and these mortgages became eligible for forbearance programs under government rules, which provide forbearance for six months, extendable for another six months, so in total for a year. These borrowers can live in their homes without making a payment for one year. When borrowers who have fallen behind on their mortgage enter forbearance, the lender can choose to mark the loan as “current.” This “cures” the delinquency though no catch-up mortgage payments have been made. Newly delinquent mortgages therefore dropped to a record low of 2.5%, despite the crisis:

Who are the Borrowers Seeking Forbearance?

The New York Fed looked into which borrowers relied on forbearance to deal with their mortgages and auto loans and found that borrowers that are now in forbearance had lower credit scores and higher outstanding balances in March before forbearance, than had non-forbearance borrowers:

- Auto-loan borrowers now in forbearance had an average credit score of 652 in March, compared to 693 of the non-forbearance borrowers.

- Mortgage borrowers now in forbearance had an average score of 708 in March, compared to 754 of non-forbearance borrowers.

- Forbearance participants had outstanding balances that were about 30% higher for both types of loans in March than those not participating in forbearance.

Confused Algos Raise Credit Score of Borrowers with Delinquent Loans in Forbearance.

The New York Fed found that for both types of loans, “troubled borrowers were far more likely to opt in to forbearances as evidenced by the higher delinquency rates of participants three months prior to the first forbearance month.”

But then, once the delinquent loans are in forbearance, lenders mark them as “current,” and the delinquency is “cured,” as seen in the charts above, which the New York Fed also noted.

And this curing of the delinquent balances by moving the loans into forbearance has a salubrious effect on the delinquent-but-not-delinquent borrowers’ credit scores.

The New York Fed found that, “On average, delinquent borrowers whose loans were converted to ‘current’ upon entry into forbearance saw an average 48-point increase in their credit scores (here, Equifax Risk Score 3.0).”

But for borrowers who were not delinquent when they entered forbearance, their credit score was unchanged.

Yup, the algos that Equifax and others use to arrive at their credit scores, and that lenders rely on when they extend new loans, got fooled, and these algos improved the credit scores of borrowers whose delinquent loans moved into forbearance while they did not change the credit scores of borrowers who were not delinquent. Just another distortion in the Weirdest Economy Ever, powered by government-sponsored loan deferments and government stimulus payments, where in the end no one really knows what’s going on anymore.

Cat seems out of the bag on this one. I don’t see how anyone can turn back on the student loan system at this point.

Two words: Debt jubilee.

Two words: Debt jubilee.

And a sentence: Debts that can’t be repaid won’t be.

Mentioning those words gets you in trouble over there.

Yup! That was the first thing that came to my mind when I read Wolf’s article! If not, all hell is going to break loose in a couple of months when the PTB decide they want their money!

John Michael Greer did a star chart/horoscope for the inauguration (if you care about such things). He said it was the most “malefic” [negative] chart he has ever seen. He said if Trump has any sense he will drop his lawsuits, get out of the way and think about 2024 if that is what he wants, because whoever is inaugurated is walking into a “buzzsaw”.

https://www.patreon.com/posts/us-presidential-44008577

Love it. Given the absolute failure of polling, I am willing to consider any datapoint at this time.

That includes whether the Moon is loosely in conjunction with Uranus. I am not going to make the obvious joke here.

from Greer (straying far from WolfStreet surely, but making sense of the world at this point requires an open mind):

“An addition, the Moon is loosely conjunct Mars and Uranus, two malefic planets whose very close conjunction will be examined a little further on. Moon conjunct Mars warns of quarrels, riots, fires, and bloodshed. A militant spirit is abroad in the country causing much unrest. The armed forces become a significant source of trouble for the government. Moon conjunct Uranus is unfavorable for Congress, predicting disorder, confusion, delay, unpopularity, and changes in laws and policies that have unexpected unfortunate effects. State and municipal officials will face serious challenges, and a rising tide of hostility against all those in authority is in process. These first troubles will thus be a harbinger of more serious problems to come.”

Agree! 100%. Plus, Michael Hudson has been telling us this for a couple of years now. His last book was written on that very subject.

More two words :

Clean slate.

Economic reset.

My expectations? The lenders and financial interests will be bailed out one way or the other like previously. Those with the debt will be ignored. If we couldn’t do debt write down for millions losing their homes a very tangible item hard to the same leaders do it for education.

not that I disagree, but your clean slate is someone else’s (and generally that person is a well fed fat cat) empty plate. I’ll believe it when I see it as it does not jibe with the standard operating procedures.

More to the point, here we have another concept that is being woefully mismeasured. (Another concept that, I believe, is woefully mismeasured is unemployment, although I think that is in large part because the media keep concentrating on U-3 when U-6 deserves as much attention, if not more.)

Statistics are supposed to illuminate the socio-economic situation of the population so that better policies can be designed through legislation. Wolf Richter here is making a powerful point: with faulty data, how can anyone tell what’s actually happening at the macro level?

The election we’re lugubriously exiting has all the historical significance of the Andropov, Chernenko succession.

The feedback mechanisms to the politburo are so corrupted by lower level functionaries gaming the systems for their own benefit that senior leadership can’t any longer tell WTF is going on.

Events are in charge and have been since the big Boston medical conference imported Covid 19. “Everything under heaven is in utter chaos, the situation is excellent.” Mao Zedong

I think the faulty data is widespread and it seems right to me you are correct, no one really knows whats going on.

In addition, imo, –a lot of looking away, also

with a big Trailer Park behind me and a low income apartment complex at the dead end of the street, there has been a noticeable( to me across from the stop sign) increase in car haulers after dark and real early morning.(you can hear diesals stop, move away and hit(or not) the speed humps lining the Park private road).

yesterday a black Toyota(not new looking) came out on the back of one as i was picking up the mail.

Auto loan defaults is a better bell-whether than most anything, imo (the loan and the legally required insurance–our state requires insurers who drop coverage for non payment report said drop within seven days and any driver having insurance suspended to relinquish their License Plates immediately or face “up to a 400$ fine for not maintaining coverage on a licensed vehicle”

So the burden-car payment and Insurance(full coverage required for any vehicle that has been financed) can be weighty.

https://www.titleloanser.com/stats/auto-loan-default-statistics/

As of the end of Q2 2019, the domestic subprime auto loan delinquency rate reached its largest 12-month increase since 2010, a bad financial time for the U.S., as the Great Recession just came to a close. Auto loan delinquencies at least 90 days overdue hit their highest rate in terms of the proportion of such long-overdue defaults to all outstanding auto loans since Q3 2009, just over a month after the

Great Recession ended. A further decline is likely in the domestic market’s future – at least on the long-term horizon, that is.

oh but(from the above)– Because of this fact – that long-term delinquency rates haven’t increased much from Jan. 2017 to Dec. 2018 – any current auto loan delinquency statistics you find touted by financial experts as supposed indicators of looming economic failure here in the U.S. are ungrounded and not based on valid statistics or ideologies.

When all else fails, accounting to the rescue!

If I didn’t do my personal accounting honestly, I’d be homeless.

Then how is it that “lenders” can defy economic reality?

Via government privilege seems the only answer.

Not that the entire population does not deserve a bailout (ala Steve Keen).

Yesterday, Fed Chair Powell said low interest rates benefits the poor and working folk.

With great minds pursuing innovative policies that which have never ever been tried before, we can’t fail, my friends.

That’s we have to block people like Judy Shelton from even coming near the Fed group-think bubble (not a gold bug but point being no new ideas or independent thinking or non group-think allowed).

One reason to save used to be the idea that you could garner interest on your money over time, which was quite the incentive. I remember my first savings account circa 1975 that paid a teenager 5 or 6% on a passbook, combined with the miracle of compound interest, why wouldn’t you want to ‘have money in the bank’?

There’s no reason to save these days as it might take 1,000 years to double your money and who has time for that, thus spend every last penny you have now.

And as far as interest rates go, a basic house in Los Angeles sold for $100k 40 years ago with onerous rates of nearly 20%. That same tired home is now worth $700k with interest rates near 2%, not really benefiting the poor and working folk.

And you’re absolutely correct regarding Shelton, yeah she’s a bit of a whack job, but must’ve struck terror in the heart of Fed darkness.

I greatly disagree.

The first rule of personal finance is to get a 3-6 month pad of expenses built up. That gives you so much more control over your relationships in the world. COVID hasn’t changed that.

That a large percentage of the population cannot or will not do that needs to be a “hair on fire” conversation.

Gold buggery is neither a new idea, nor independent thinking, nor non group-think (e.g. visit mises.org).

Otoh, ethical fiat creation (i.e. does not violate equal protection under the law) and use (accounts for all at the Central Bank itself) and no other privileges, explicit (e.g. deposit guarantees) or implicit (e.g. needlessly expensive fiat), for the banks is a new idea that’s never been tried despite claims about the so-called “Free Banking” era.

Probably true, but she doesn’t represent the Fed’s group think. That being the point, that all non Fed group must be eradicated.

Greenspan was a gold-bug too. Moreover, we persist with a gold-standard banking model so there’s an incentive for the Fed to “make fiat behave like gold” – what Greenspan said the Fed had learned to do.

For thousands of years the price per ounce really didn’t fluctuate all that much because no smart alec alchemist came up with a way to make as much as he or she wanted to, which is what is the situation is now with fiat currency, no limits.

The DEMAND for fiat is artificially suppressed in that only the banks may use it in account form and because of other privileges for private bank deposits such as government-provided deposit guarantees.

Or does only the SUPPLY of fiat matter?

Moreover, as long as fiat is generated in an ethical manner (e.g. an equal Citizen’s Dividend), price inflation should not matter much due to the elimination of non-ethical Cantillon effects.

Besides, it’s not likely that real economic growth should happen to match the average mining rate of gold (Gary North’s position) but that economic growth has been LIMITED by a stupid worship of shiny metals rather than ethics and justice.

Add to that that needlessly expensive fiat forces a reliance on private bank deposits that are lent into existence and cease to exist when repaid – hence the needless and dangerous boom-bust cycle.

I remember not so long ago the word ‘billion’ was almost forbidden, a large corporation might be sold for a few billion, wow!

I can talk in trillions now, ain’t no big thang.

Fiat has in no way, shape or form been suppressed.

I’m no bank toadie, just the son of a man who received his degree in economics from the University of Lausanne way back when, and he taught me oh so much.

Fiat has in no way, shape or form been suppressed.

I said the DEMAND for fiat has been suppressed and that’s undeniable.

And ironically, the SUPPLY of fiat has had to increase to counter the deflation inherent in a money supply (private bank deposits) that is lent, not spent, into existence as fiat can be.

Sorry, I have to give up as this conversation is headed nowhere, fast.

Till next time then.

When the Forebearance is lifted … Do the forebeared have to make up the missing payments in a certain time frame? like 12 months or 24 months? or are payments made up to the note before the note is due? or is the Note date pushed out?

Also – are their a whole bunch of admin expenses shoved into the pie? like inspections, attorneys fees, charges for the forebearance and etc.?

I used to work in subprime risk mgmt. A fav saying was “the best things in life are FEE!”

And now, how many of those ‘much improved‘ credit score owners are being plied by new pre-approved credit card offers arriving in their mail boxes just in time for Christmas?

The Fannie Mae mortgage forbearance program guidelines tells you to:

1. stop making your mortgage payments “because of COVID” (whatever that means). [What does this do to one’s credit rating?]

2. contact your servicer first, to see if anything can be worked out directly (lol)

3. get back into a position to be able to pay your mortgage normally (lol)

4. apply for Fannie Mae forbearance on missed payments, all credit hits resolved, “all anxieties tranquilized, all boredom amused.”

I sold my Fannie Mae stock in 2007 for around $60 a share when I realized the housing bubble was gonna bust, and since then the new & improved housing bubble has expanded greatly and Fannie Mae’s share price currently?

$1.95

Something is way out of kilter, no?

FWI just a heads-up, my impression is that many/most of the folks where this article came from, believe that existing bankruptcy laws work for student debt, and that’s all that’s needed to address the issue. Based on what I’ve seen here, many don’t agree with that. I don’t either.

Whatever is coming in the future, it won’t be nice and it won’t be pretty.