By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

The business of SPACs is setting stunning records. A SPAC (special-purpose acquisition company) is a “blank-check company” with no business activity that raises funds from investors via an IPO and will then attempt to use those funds to buy a startup company. For the startup company, getting acquired by a SPAC is an alternative to an IPO. There are fewer disclosures to make, compared to a standard IPO. For Wall Street, there are huge fees to be made. And insiders, including those that start the SPACs, make tons of money. So all the building blocks are in place.

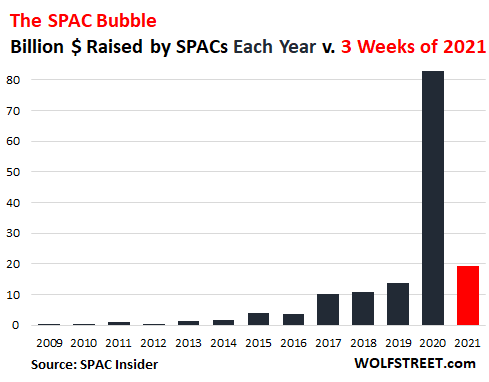

In 2020, an all-time record of $83 billion were raised by SPACs, six times as much as in 2019 ($13.6 billion), according to SPAC Insider’s data. This $83 billion was more than all of the funds that SPACs had raised in all prior years combined, according to Dealogic, and it blew by the $78 billion raised by standard IPOs in 2020, such as Airbnb’s IPO. Everyone and their dog was starting SPACs, from former Speaker of the House Paul Ryan to former NBA star Shaquille O’Neal, going after the hottest stories at the minute.

And in 2021, the SPAC mania accelerated further. “If you don’t have your own SPAC, you’re nobody,” Peter Atwater, founder of Financial Insyghts, told the Wall Street Journal. In the first three weeks of 2021, there have already been 67 SPACs, raising a total of $19 billion, more than in the entire year of 2019:

A special mix of market exuberance, blind confidence that this exuberance will last forever, and a total disdain for valuations are required to create this kind of situation.

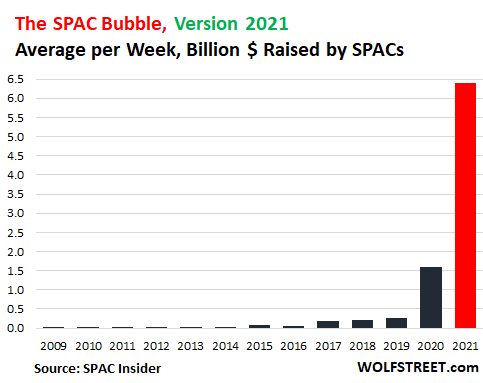

To see just how far this mania in SPACs has exploded this year, we can look at the dollars raised per week on average. Turns out, in 2021, $6.4 billion have been raised per week, compared to $1.6 billion per week in 2020. This is where we are so far:

There are currently 287 SPACs, sitting on roughly $90 billion in cash, that are now trying to chase down startups in the hottest sectors of the moment, from anything-EVs to telehealth.

IPO stocks skyrocket.

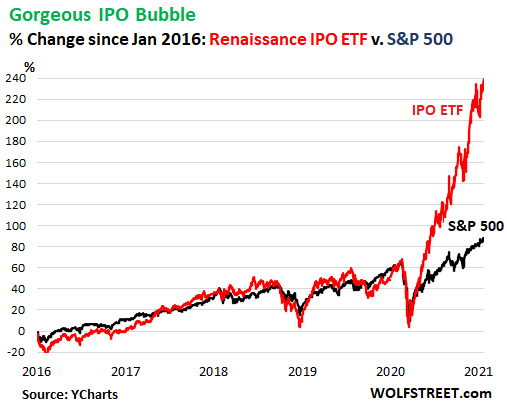

Stocks after they have gone public have skyrocketed since the March lows. The Renaissance IPO ETF [IPO], which tracks the Renaissance IPO Index, which includes the largest 80% of IPOs over the past two years, has soared by nearly 240% since March 18, totally blowing by and leaving in the dust the S&P 500 Index, which has soared 72% since the March low. This spike in the IPO index comes after it had spent the prior five years roughly on the same trajectory as the S&P 500 Index (data via YCharts):

Fees from SPACs and IPOs are a goldmine for Wall Street Banks.

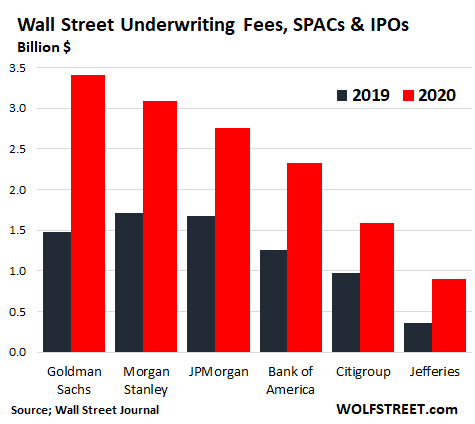

Banks have now reported their fourth quarter results, including the fees they earned from SPACs and IPOs. In 2020, the top six in equity underwriting fees – Goldman Sachs, Morgan Stanley, JPMorgan, Bank of America, Citigroup, and Jefferies – earned $14.1 billion in fees from SPACs and IPOs, according to the Wall Street Journal, up 89% from 2019:

So everyone is getting rich off this mania in SPACs and IPOs and is having a grand old time. And after everyone has gotten rich off the mania, and extracted fees and unloaded shares and had all the fun, there is then another thing: In prior manias of this type, the aftermath has been very unkind to investors that had made it all possible by buying these shares with that mix of exuberance, blind confidence that this exuberance will last forever, and a total disdain for valuations. Ah yes, this time it’s different, everyone is saying again – another sign that the zoo has gone nuts.

So everyone is getting rich off this mania in SPACs and IPOs and is having a grand old time. And after everyone has gotten rich off the mania, and extracted fees and unloaded shares and had all the fun, there is then another thing: In prior manias of this type, the aftermath has been very unkind to investors that had made it all possible by buying these shares with that mix of exuberance, blind confidence that this exuberance will last forever, and a total disdain for valuations. Ah yes, this time it’s different, everyone is saying again – another sign that the zoo has gone nuts.

Have you seen the latest SPAC? “For carrying-on an undertaking of great advantage but no-one to know what it is”

Nailed it, Mr. MacKay!

I am reminded of a droll WSJ piece from after the dotcom crash, riffing on a suitable memorial to what was then seen as the mother of all bubbles (ah, the naivete of youth!). The winner was:

A workspace vending machine:

– First the cokes were free

– Then they were subsidized

– Then they were full priced

– The moment they became part of the revenue plan (in hindsight) it was probably a sell signal…

I was just thinking that the shoeshine boy giving tips who (allegedly) was JFK Senior’s sell signal in 1929 would now have his own SPAC.

(Of course, SPAC for me will always be the Saratoga Performing Arts Center, where my family spent many a balmy summer evening a decade ago. *Sigh*, whatever happened to the America that built that?)

The insiders know this is ridiculous. They know it will collapse but there is a of money to be made before it does. And the rubes will be left holding the bag. Talk about stupid money – who actually invests in this stuff?

CalPERS?

SPACs sounds vaguely racist, but you go with the acronym that makes you money, ha ha.

Some liken Wall*Street to a casino-but it’s a bad evaluation, in that both customers & employees of houses of chance are given virtually no chance to cheat, and will be fully prosecuted should they do so, and get caught.

Can anyone address if there is direct relationship with SPACs, Opportunity Zones (land of OZ) and the large tax cut legislation?

Psst!

the “originally published @” link is busted:

it points here: https://wolfstreet.com/2020/12/18/who-holds-the-1-65-trillion-of-apartment-building-debt-amid-eviction-bans-and-plunging-occupancy-rates-at-high-rises/

should point here:

https://wolfstreet.com/2021/01/24/historic-mania-in-spacs-ipos-huge-fees-for-wall-street-banks-mega-paydays-for-insiders-disdain-for-valuations-blind-confidence-that-this-time-its-different/

HTH

This sounds like the South Park underpants gnome theory of making money, with other people’s money (OPM) being substituted for underpants.

Step 1: Collect OPM

Step 2: ????

Step 3: Profit!

Those other people aren’t going to like it much though.

Deals like this between SPACs and Blackstone seems like inside IPO’s?: https://finance.yahoo.com/news/foley-backed-spac-said-near-232611963.html

Anything named that is to be sold to whomever will buy it and pays in fees immediately makes sense to anyone who will receive the fees.

If it is like an IPO but can be a producer of fees with a lower bar

then great.

If it is a producer of a crisis that lowers the overall value of what is

generally valuable so much that it is clear the value of other financial

products will rise again while the thing like an IPO, an SPAC, disappears

then great, just great.

The is a very clear example of an ungoverned system. In this context the purpose of a governor is to prevent the system being governed from self destruction.

The image is a steam engine with the safety valve clamped shut.

We will know when the collapse is due when the unconnected are encouraged to place their money and future pensions into the funding of these mechanisms; that is when the SPACs become sold at the retail level – a few thousand will be the entry cost..

As to the timing, about the beginning of Kamela’s second term, the first being the rump part of Biden’s single term. That is about 4 years from now.