Yves here. Hubert Horan continues his chronicle of the deterioration of Uber’s finances. And you can only blame so much on the pandemic.

By Hubert Horan, who has 40 years of experience in the management and regulation of transportation companies (primarily airlines). Horan has no financial links with any urban car service industry competitors, investors or regulators, or any firms that work on behalf of industry participants

Last Thursday, Uber announced a full year 2020 GAAP loss of $6.8 billion with a GAAP net margin of (-60%). As discussed in the context of the mid-year results presented in Part 23, [1] Covid-19 significantly reduced Uber revenues, just as the pandemic has devasted dozens of other urban services and transport businesses.

The huge ($4.7 billion, 43%) year-over-year decline in Uber’s core car service revenue was partially offset by a 93% increase in delivery revenue, but the central story here remains unchanged. Uber’s rides business never had any hope of earning sustainable profits, even without the virus. The delivery volumes added have substantially worse margins and have done nothing to create a path to future profitability.

2020 losses would have been much worse but for massive cost cutting. Uber abandoned its entire “Advanced Technology Group” (robotcars, flying cars, etc.). Uber’s investments in new businesses had been the centerpiece of its long-term growth narrative but had no profit potential, Uber had to provide $400 million in funding to the startup that took it off its hands. [2] It also slashed expenditures not directly supporting its current car service and delivery operations. Research and Development spending was reduced by $2.6 billion (54%) and overall operating expense fell 30%.

Uber’s cash position declined by $5.4 billion, but thanks to the IPO and the massive funding investors provided previously, its balance sheet still reports $5.6 billion cash on hand. There have been multiple reports that Uber was attempting to sell some of its 15% stake in Didi Chuxing, the Chinese ridesharing firm, in order to raise additional cash.[3]

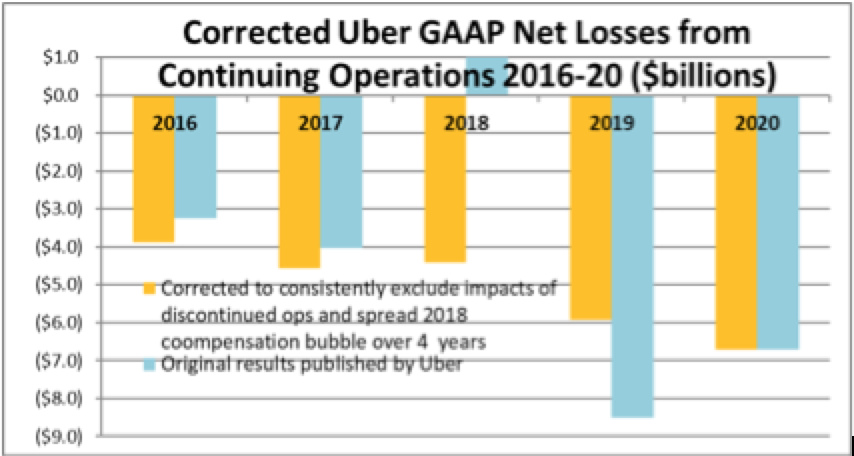

The exhibit below illustrates Uber’s losses over the last five years. The exhibit compares reported results with numbers adjusted to eliminate two major distortions in prior year results. These issues were documented in Part 22 of this series [4] and do not affect the newly published 2020 results.

Uber did not magically produce profits in 2018 amidst years of multi-billion dollar losses. Immediately prior to its IPO, Uber claimed that unmarketable securities it had received in return for abandoning massively unprofitable foreign markets were worth $4.5 billion, and improperly claimed that this asserted value was actually operating profit from ongoing Uber operations. After adjusting for this misstatement Uber has lost over $25 billion in the last five years

In accordance with GAAP rules it recorded $4.7 billion in stock-based compensation expense at the moment it vested (in the 2ndquarter of 2019), although these expenses were for work done over multiple years. The issue here is not the absolute level of expense, but the timing. Spreading these expenses over four years reduces Uber’s “official” 2019 loss from $8.5 billion to $5.9 billion while increasing prior losses.

While Uber’s “official” numbers suggest that the pandemic allowed Uber to reduce losses by 21% and had no impact on profit margins, a better accounting of historical performance shows margin deteriorated from (42%) in 2019 to (60%) in 2020 while losses increased by nearly a billion dollars.

Press coverage highlighted the bottom line $6.7 billion loss but continued to mislead readers about the viability of the business. It is not surprising that reporters who did not understand Uber’s major misstatements of 2018-19 results might misreport whether 2020 results were better or worse. It is less understandable why these stories not only emphasized volume metrics over profit measures but touted gross revenue (which includes the total cost of restaurant meals ordered and the total costs its drivers incur) over the actual revenue Uber earned. [5]

Stories highlighted the growth in food delivery (“food delivery has been a bright spot” [6]) without mentioning the cutthroat competitive conditions that produced sizeable negative margins or examining whether Uber has been able to improve its weak market share (37% after spending $2.6 billion to acquire Postmates [7]) or attempting to explain how Uber could eventually succeed in a delivery business where no one has ever produced sustainable profits.

Stories continued to push Uber’s narratives about how it was “taking a page from Amazon’s playbook” and that the growth of delivery meant “they’re actually stronger coming out of the pandemic than they were going in.” [8] None of the stories mentioned that Uber’s elimination of all businesses other than rides and deliveries directly contradicted longstanding claims that these investments would allow them to become “The Amazon of Transportation” and drive many years of Amazon-like profitable expansion. Instead of highlighting that Uber had abandoned the strategy that had been the centerpiece of its IPO prospectus, one story said that Uber had simply “shed some of its more fanciful pursuits.” [9]

As previous posts in this series have discussed, Uber projections use deliberately misleading metrics. Discussions of the overall company use a measure improperly called “EBITDA” which excludes lots of expenses other than interest, taxes, depreciation and amortization, such as the $4.7 billion in stock-based employee compensation. Discussions of rides, delivery and other business segments use an “Adjusted EBITDA” measure which excludes a wide range of other expenses including marketing incentives, Uber’s IT infrastructure and all general corporate support functions.

One can determine the real meaning of these mislabeled metrics if one examines the footnotes in Uber’s SEC filings, but Uber knows reporters for mainstream business publications will not do that. These reporters continue to tell readers that “Uber has said it expects to become profitable by that measure by year-end” since they do not understand the difference between “profitability” and “contribution after a large portion of actual operating expenses have been excluded.” Nor do any of these reporters make any attempt to explain how Uber might achieve the billions in P&L improvements needed to achieve even these badly flawed “profit” targets.

Unsurprisingly for a company that has never made a profit in twelve years and cannot explain how it ever could become profitable in the future, Uber’s stock value has increased nearly 90% in the last three months. Uber finally achieved its hoped for $90 billion IPO valuation last November and reached $112 billion after the news of its $6.7 billion 2020 loss was announced. The largest part of the stock runup occurred in November after Uber and other Silicon Valley companies dependent on extremely low “gig” labor costs successfully spent over $200 million to overturn California legislation and court decisions that granted employee rights to rideshare and delivery drivers. [10]

Press reports emphasized rational sounding (but highly implausible) explanations for the ongoing increase in Uber’s value—e.g. it was a “virus recovery play”, combining rides and delivery in a single company created huge value. None of the reports suggested that (as with companies like Gamestop) it was ludicrous to suggest that stock prices had any connection to marketplace reality, economic fundamentals or the efficient allocation of capital. No one in the business press suggested the possibility that $100 billion valuations could be manufactured out of thin air, or that the business press played a major role in promulgating the narratives used to manufacture those artificial valuations.

__________

[1] Can Uber Ever Deliver? Part Twenty-Three:Uber’s Already Hopelessly Unprofitable Economics Take A Major Coronavirus Hit, Naked Capitalism, August 10, 2010.

[2] Amir Efrati, Infighting, ‘Busywork,’ Missed Warnings: How Uber Wasted $2.5 Billion on Self-Driving Cars, The Information, September 28, 2020; Dan Primack, Kia Kokalitcheva, Uber in talks to sell air taxi business to Joby, Axios, Dec 2, 2020; Sam Abuelsamid,Aurora Acquires Uber’s Automated Driving Unit–And Uber’s Cash, Forbes, Dec 7, 2020; Cade Metz and Kate Conger, Uber, After Years of Trying, Is Handing Off Its Self-Driving Car Project, New York Times, Dec 7, 2020

[3] Pavel Alpeyev and Lizette Chapman, Uber to Seek Partial Sale of $6.3 Billion Didi Stake, Bloomberg, September 17, 2020. Uber had previously written down the value of its Didi stake from its originally claimed $8.2 billion value. A new report suggests Uber recently sold $207 million of Didi stock, but details have not been provided.

[4] These adjustments were documented in Can Uber Ever Deliver? Part Twenty-Two: Profits and Cash Flow Keep Deteriorating as Uber’s GAAP Losses Hit $8.5 Billion, Naked Capitalism February 7, 2020.

[5] Preetika Rana, Uber’s Food-Delivery Business, Cost Cuts Cushion Pandemic Hit, Wall Street Journal, Feb 10, 2021

[6]Kate Conger, Uber’s Food Delivery Business Nearly Matches Ride-Sharing, New York Times Feb 10, 2021

[7] Mike Isaac and Erin Griffith, Uber to Buy Postmates for $2.65 Billion, New York Times, July 5, 2020

[8] Claire Miller, Forget Ride Hailing. Uber Wants To Be Your One-Stop Shop For Everything, NPR, Feb 10, 2021

[9] Lizette Chapman ,Brody Ford , and Emily Chang, Uber CEO Sees Ride-Hailing Rebounding Faster Than Other Transit, Bloomberg, February 11, 2011

[10] Preetika Rana and Christine Mai-Duc, Inside Uber and DoorDash’s Push to Win the Most Expensive Ballot Race in California History, Wall Stret Journal, October 28, 2020

Selling dollars for pennies, what can go wrong?

At least the promoters of one aspect of the South Sea Bubble of 1720 were ‘up front’ about the prospects of their scheme by declaring that it was “For carrying-on an undertaking of great advantage but no-one to know what it is.”

Alas, Uber is all too transparent in it’s profligacy.

That supposedly ‘rational’ investors are putting money into Uber is an indication of the ‘escape from reality’ philosophy that underlies our ‘moderne’ economy.

Given Uber’s status as a stalking horse for deregulation of transportation and labor markets – witness their generous funding of even-more-serf-creating Proposition 22 in California – it may wind up being a net material positive for the investing class.

Perhaps the Uber’s of the world are simply there to increase aggregate profits for the ruling class, rather than Uber stockholders, a kind of evolutionary adaptation, whereby individual corporate profit is sacrificed in the interest of wider profits system-wide.

There’s some dispute as to whether group adaptation is an evolutionary fact. But it might well be true in capitalism, as you describe it.

Capitalism as an evolutionary phenomenon? Why not. I have always found economic anthropology a most revealing cut to the bone. There is a reason why it is rarely found in any course curriculum. May as well be the Piltdown Man. Capitalism is clearly an evolutionary dead-end since that is where it is inexorably leading us all. Certainly worthy of serious study. Perhaps we should engage the NGOs. ;-)

I was thinking, “evolutionary within the logic and practice of the system itself,” rather than “natural law universally applicable across millenia,” more figurative than literal, fwiw… but an interesting thought experiment, all the same.

Given Uber’s status as a stalking horse for deregulation of transportation and labor markets – witness their generous funding of even-more-serf-creating Proposition 22 in California – it may wind up being a net material positive for the investing class.

It’s not a merely ‘stalking horse’. Uber are a mercenary force paid by the go-ahead Technolords to destroy all laws and regulation in preparation for their libertarian promised land. As long as the Technolords believe in that, they will keep paying for Uber to deploy its precarious ‘contractors’. Wonder what benefits Eric Prince’s ‘contractors’ at Academi get?

Spot on. Uber’s purpose has been fulfilled.

Armies are often driven out of the cities they’ve conquered as nuisances once the defenders are defeated.

But sometimes it turns out that was just a battle, not the whole war.

These investors are rational.

They need to “buy low, sell high” their uber investment.

The Uber mirage lost its shine a while ago, yet the financial press continues to be dazzled by the rosy narrative coming out of its press relations department. It’s the same story with other wall street tech darlings outside the alphabet-facebook-amazon-Apple-Microsoft bubble, Spotify has to increasingly rely on the charms of the CEO selling a “on track to deliver a billion users” narrative to deflect concerns about mounting losses and no clear path to profitability. Netflix is resorting to amortizing increasingly large content spend in rather opaque ways to make the numbers look good while the spectre of studios pulling their licensed content off the platform to start their own streaming services continues to push the market towards fragmentation, to say nothing of driving up Netflix’s spend on own content aka Netflix Originals. To cement wall street’s parallel universe status, a feminist dating app called Bumble just debuted on the stock exchange at a $13bn valuation, as frothy an up cycle as you’ll ever see…

With all that cash on hand, Uber is free to continue its true mission. Undermine labor and small business while enriching elite insiders. No wonder so much good money has been thrown into it.

Um, you apparently missed that the cash Uber has is less than its losses last year. The cash flow was less negative than that only because Uber sold some operations. It can only burn so much furniture to keep its house warm.

Uber’s cash burn from operating activities last year was “only” -$2.75 billion. At that rate, they have about 2 years of runway. And heck, at Uber’s current valuation, raising more equity capital should be easy and cheap. So expect to see more of the DK alternate reality show for many more moons.

That’s not a free cash flow figure and you know that. Cash from operations doesn’t include changes in working capital and capital investments. If you are going to play this game you need to do it correctly and so far you haven’t.

When should we expect the Robinhood style short?

Wait! . . . wasn’t Robinhood one of the platforms from which a bunch of Reddit traders tried waging a Counter short?

I don’t know Yves. Tesla has persisted in tapping markets over and over again with a frothy stock market. Wolf Richter has pointed out that Tesla is a marginal automaker on scale, but yet it persists. Elon Musk admitted they were near bankruptcy and committed securities fraud saying the Saudis would take them private, and yet the roll on. I fail to see why Uber is any different in our current environment of low interest rates and Fed pumping.

Tesla actually makes money. Uber never will. That is a monster difference.

Not by selling cars but by selling pollution credits – a source of income that is rapidly declining as the other manufacturers start producing electric vehicles.

I’m not at all a Tesla fan but that’s apparently not the case. Basically Tesla could cut executive and manager comp if/when the credits go dry and remain in the black. And the tax credits were $1.6 billion v. $2.8 billion of free cash flow:

https://www.cnn.com/2021/01/31/investing/tesla-profitability/index.html

A few weeks ago I was relieved to see this article about how Spotify’s gamble on podcasting wasn’t looking all that promising. Unlike their long-term prospects, the material harms that these companies can cause are all too real.

Heh. From your link –

I listen to Joe Rogan on occasion and found that Spotify tried to jam about 8-10 minutes of ads in prior to the program (which is just 8-10 minutes of Rogan reading ad copy and trying to sound excited about it), which I found extremely annoying until I figured out I could just fast forward through all of them. If Spotify tries to force people into listening to the ads, I will just not listen at all.

I’m still listening to Rogan clips on YouTube. Works for me.

I read something similar recently outlining how the podcast acquisitions haven’t moved the needles that need moving ie. Funneling free subscribers into paid, reducing churn and attracting greater adspend. Also, the competitive landscape is becoming crowded with Apple and Amazon muscling in on the turf, and Soundcloud dusting itself off to have another shot at becoming a truly global player with wide appeal. Uber, Tesla, Spotify all have baked into their valuations the assumption that they’re going to be the dominant players in their spaces when the competitive dust settles. Even if that were to happen, we’ve seen throughout this series with Hubert that the economics matter because they point a path to a future with profit, or one without.

Tesla roused the giants from their slumber, and now the Germans and Japanese are on a war footing and allocating resources accordingly, and it’s going to take more than Musk’s penchant for hyerbole to win the ev market. Spotify has a running battle with artists demanding a bigger share of the revenues coming in, how they’re going to drive margin expansion in a cutthroat competitive landscape is anybody’s guess. Uber? Well, Hubert has said all that needs to be said on this one.

“I fear all we have done is to awaken a sleeping giant and fill him with a terrible resolve” –

Isoroku Yamamoto, Japanese Admiral, 1941.

History may not repeat itself but it does rhyme – attributed to Samuel Langhorn Clemens although no solid proof exists he said or wrote it.

How about all publicly traded companies have to report numbers using the old fashioned cash method, not accrual? Real money in, real money out – to reduce all the accounting wizardry that is so deceiving.

Neither method is ultimately better. It depends on the intent of the desired reporting. To dress up or to report the actual situation.

If anything, public access to the management reports used by the company’s own devision makers would probably prove more accurate.

This series is great, and will continue to prove prescient as the Uber ponzi-juggernaut shape-shifts its way into the annals of scam history. I was particularly impressed by the notes indicating that HH began this in 2010, until I realized that that was part 23, and probably just a typo. At some point this will be a book. I would like to see some of the more egregious toadies in the financial press named and shamed again, with an eye to making trading cards eventually.

HH writes above, “Unsurprisingly for a company that has never made a profit in twelve years and cannot explain how it ever could become profitable in the future, Uber’s stock value has increased nearly 90% in the last three months.”

From Bloomberg (2.15.2021)-

https://www.bloomberg.com/news/articles/2021-02-15/uber-ceo-promises-gig-workers-better-rights-ahead-of-eu-laws

“Uber Technologies Inc. Chief Executive Officer Dara Khosrowshahi said he was ‘ready to do more and go much further’ to improve social protections for so-called gig economy workers in Europe, but that new legislation was needed.”

Is the strategy something like: keep the big player-shareholders happy and as a bonus have a journo provide a positive spin on the possible move to launch a CA-Prop22 assuming the same tactics and results pan out in Europe ? Pass the popcorn.

The only way a business that always loses money makes sense is as a money laundering operation, for someone.

Uber Technologies Inc. Chief Executive Officer Dara Khosrowshahi said he was ‘ready to do more and go much further’ to improve social protections for so-called gig economy workers in Europe, but that new legislation was needed

Big words followed by an excuse to do nothing.

Uber was key in inventing a new employment category in the last election.

We still need the 2000-style melt-up before it comes crashing down and the new set of “Pets.com” candidates are taken down. Uber looks like a very, very likely candidate. Will local taxis make a comeback?

Yes, what is the future for taxis when Uber runs out of investor money ? And taxis now have apps, which increased their efficiency. The market for taxis before Uber was miniscule in comparison due to higher rates which covered vehicle costs and provided a reasonable income for drivers. One cannot sustain operation of a vehicle at Uber and Lyft rates which is why 97% of so called ” ride share ” drivers quit within a year. Repairs, auto depreciation and tax liability add up.