Yves here. Wolf Richter meets Michael Hudson in decrying how high rents are a big drain on the economy, more broadly defined than landlords.

But I’d like to know if the traffic has gotten any better. The last time I was there, pre-Covid, it was close to impossible to get around the city during the business day (unlike NYC which was not terrible for cars and also has the usually-faster-for-north-south-trips option of the subway). Honestly, unless you could walk to work or were near BART stops, I wasn’t sure how the locals functioned.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

San Francisco has long lamented its “Housing Crisis,” a phenomenon where housing – whether rented or owned – is so ludicrously expensive that middle-class workers, even if there are two in the household, can no longer afford to live in San Francisco, or have to spend so much of their income on housing that they’re effectively poor in every other aspect, and cannot spend money on other things.

So now the market is responding to this phenomenon: More people are leaving, fewer people are coming in, vacancies are surging, and rents are sagging, amid a massive churn by tenants who move to similar apartments for a lot less and get “three months free,” or who chase after the “free upgrade” to nicer apartments.

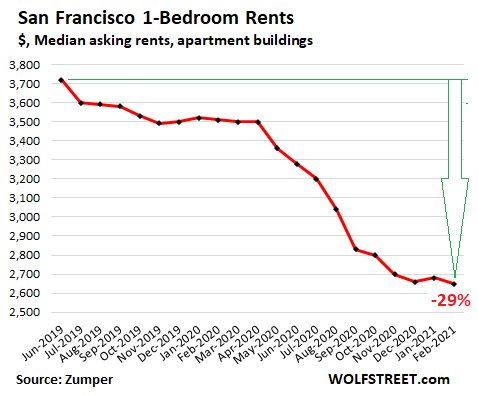

The breath-taking downward spiral of the median asking rent of one-bedroom apartments continued in February, dropping to $2,650 a month, the lowest in years, down 24% from a year ago and down 29% from June 2019:

Despite this drop, San Francisco remains the most expensive major rental market in the US, according to data from Zumper.

The median two-bedroom asking rent in San Francisco, at $3,500 in February, is down 24% from a year ago and down 30% from the peak in October 2015, when it was $5,000. Which is just nuts when you think about it. “Median” means half the asking rents are higher, and half the asking rents are lower. This is the middle, amid small-ish apartments, not glorious luxury.

Following that peak in October 2015, rents began to correct, dropping by over 10%. Then the Trump-bump set in after the 2016 election, and rents rose again. One-bedroom rents eked past the old record and set a new high in June 2019. Two-bedroom rents got close in June 2019, but did not quite set a new high, and have now plunged 30% from their October 2015 high.

And that’s a good thing for the city and for the “Housing Crisis” and for businesses – the lucky ones that are still hanging on and those that haven’t left yet. The market is in the process of correcting a mega-problem that the City has had: housing was too damn expensive, and was driving a lot of people and businesses out, and was killing local businesses.

I understand that property owners – landlords and homeowners both – want property prices to only surge. Because it’s just money, and getting rich off this surge is the name of the game.

But then out of the other side of their mouth, in a deafening hypocrisy, they bemoan in a politically correct manner the “Housing Crisis” and they lobby for taxpayers or developers to subsidize a few “affordable” housing units.

Housing costs are a leech on the economy. What people spend on rent and mortgage payments in San Francisco cannot be spent on other things – the lucky ones that can even afford to live in San Francisco and haven’t been driven out yet by high costs.

Local businesses suffocate if locals don’t have money to spend. Sure, you can rely on hordes of tourists to come in and drop loads of money. But as we have seen, tourism can be fickle, and bleeding tourists dry doesn’t create a vibrant city but a tourist trap.

Local businesses are already being suffocated by landlords that have raised their rents into the stratosphere when the 10-year lease came up for renewal. Before the Pandemic, shuttered stores along the commercial strips and in neighborhoods were already an eyesore. Now they’re a pandemic in their own right.

Small businesses with thin margins, such as retailers and restaurants and some service establishments, cannot survive if their costs, such as rents, keep getting jacked up while their customers are squeezed by housing costs. This is a toxic combination – and it has been visible in San Francisco long before the Pandemic.

And forget the once thriving community of artists and musicians with notoriously uneven incomes that have long ago abandoned the City.

Small businesses have trouble hiring because the people who work in kitchens and shops cannot afford to live in the city. $20 an hour in San Francisco is very tough to get by on. But businesses cannot pay higher wages – unless they’re serving the very high end of the market – because their potential customers are squeezed dry by housing costs and cannot spend the money to sustain those businesses.

Then there’s the exodus of bigger businesses that has been going on for years. High housing costs – and the high salaries they require – and high office rents are among the primary reasons. It’s just money. The list is long. And let’s not blame the Pandemic: among the pre-Pandemic departures are Charles Schwab moving its headquarters to Texas and Macy’s shutting down the headquarters of macys.com, Product and Digital Revenue, and Technology. This trend just accelerated during the Pandemic.

You get the idea: Money spent on housing goes to Wall Street, banks, investors, mega landlords and their investors, and small mom-and-pop landlords, from where it goes to the banks, Wall Street, and their investors. Housing has been completely financialized and every aspect has been turned into a global financial asset class.

Sure, some work is done to repair and maintain the rental properties from time to time – replacing a roof, painting, etc. – which boosts the local economy a little. But there’s not a lot of it, and the workers live elsewhere and car-pool into the City because they cannot afford to live in the City, and so they won’t spend their money in the city, except for a sandwich if they forgot to bring their lunch. And sure, high housing costs are generating some local tax revenues – but at what cost?

The solution is to let the market correct this bizarre phenomenon of rents (and more broadly, housing costs) strangulating the City. The Federal Reserve could help by ending its asset purchases and by raising short-term interest rates at tad. This would speed up that process of curing the City of the Housing Crisis.

Sure, some big landlords might walk away from the properties and let the lenders have the collateral. And some small landlords might too. But lenders and investors got paid to take those risks, and they pocketed the income from interest and fees for years, so it would be their turn to eat the losses. They will eventually sell the properties, and the new landlords with a lower cost base can make those properties work with lower rents. And tenants would have more money to spend on other things in the City.

Once housing costs become reasonable, some folks will come back, and new folks will arrive, and businesses can hire and thrive, instead of having to pack up and leave or shut down, and just maybe a new vibrancy might emerge. And that’s of course when the next boom will start in San Francisco’s boom-and-bust cycles, along with all the ultimately self-defeating housing craziness…. OK, I give up.

The massive Pandemic shifts that triggered plunging rents in the most expensive cities and surging rents in cheaper cities are still on display. Read… Exodus from Big Expensive Cities Running out of Steam? Maybe. But Rents in San Francisco & Los Angeles Hit New Multiyear Low

I work for an SF based company and agree completely with Yves sentiment. The streets are choked with traffic. I took a shuttle van to the airport on my last trip and it took over an hour to get on the highway from Chinatown during peak rush hour.

It is an incredibly walkable city and Bart is a decent way to get around, but I don’t know how people justify the high cost of living.

How many were ‘gig’ workers in your traffic-jam? Should have rolled down your window and compared depreciated assets…

Excellent article.

There is good reason both Uber and Lyft were born in SF. San Francisco’s public transportation systems, BART and Muni, are not sufficient. Traditional taxi service does not cover all areas of the city and is expensive. Given the high cost of housing, it’s no wonder cheap alternatives became so popular. Those streets in the city are choked with Uber and Lyft drivers. Throw in Door Dash and Amazon, both regular and flex, and you have a perfect storm.

Compare this to a city like Amsterdam, where public transportation is accessible, safe, efficient, affordable and very popular. And, of course, like most European cities, it is bike friendly.

An old acquaintance just told me his daughter, an engineer at Google, has relocated from SF to Lake Tahoe. And that migration and the stress it will put on those cities is worthy of analysis of the unacknowledged and unaddressed externalities that result.

I disagree with your making the consumer into a driving force – “There is good reason” according to a shopper, but you’re choosing that protagonist and lens instead of another one. I disagree with the standard you are setting. Yeah, the users of products have a priority system and they like things for reasons. They are often bad reasons. If you then say “it’s no wonder, everything worked out to fulfill a demand,” you’re pandering to a point of view.

The intrinsic features about getting around SF like the hills and compact distances (I’ve lived here a long time) were around way before 2009. People worked out different approaches at different times, before the smartphone. There’s a certain attitude towards privatization, or public-private partnerships which is a product of one period and not another. That is part of what went in to particular rollouts of products for problems. Otherwise it wouldn’t be done a certain way, and what it means for narratives would follow, not lead. Low prices are made of precarious work and a dishonest deployment of 1099. Why was it like that in around 2009? Robert Reich referred to people who had been laid off in the crisis as “involuntary entrepreneurs.” That is part of where your cheap alternatives originated. Once they did originate it became possible to say, this is so perfect for the buyer’s needs, it’s so natural.

The shopper is sometimes a big infantilized baby, blinkered and you shouldn’t foreground their crude, surface perspective and stop there. Not necessarily deliberately but you assist the companies who would like to push that dazzled, superficial world and mask out the structural things.

Uber and Lyft succeeded because people were willing to pay for an alternative to existing options and local government did nothing to stop them or invest in improving public transportation.

Observing this doesn’t not make me a supporter or these companies or the broader gig economy that is designed to push all risk and external costs to the worker. The lie that this was good for worker has always been just that, a lie. I won’t use Uber or Lyft or Door Dash, but I know plenty of people who do because it is cheap and easy.

It is as if Henry Ford’s dictum that in order to sell his cars to his workers he had to pay them enough in wages to afford them has been turned on its head.

And don’t use the excuse that people just figured it out prior to 2009. When I worked in the city in the early 2000’s, I used BART and if you worked late into the night you could call for a taxi. At least BART is still available, but life in SF has degraded significantly since then. Like it or not, many people avoid public transportation now because of the inescapable human misery they would see on the trains and in the stations.

> It is as if Henry Ford’s dictum that in order to sell his cars to his workers he had to pay them enough in wages to afford them has been turned on its head.

With respect to Uber and Lyft, yes. In order to sell their rides they charge half the cost of providing the ride. The Nimtz fleet sized losses are a testament to that.

Modern capitalism. Money is speech. Losses don’t matter when you are dictating laws..

And adding to Otis’s very relevant reply on this somewhat recent “gig” transportation economy situation:

It was also due to the SF Taxi Commission’s terrible graft and mismanagement that artificially restricted the number of available medallions from around a total number of 750 or so in the Willie Brown (ballots in the bay) era , to still less than 1500 in the Gavin Newsom (Mayor as a career advancement) period. Taxi service in SF was so bad – if were old, lived anywhere beyond the immediate downtown corridor, wanted to use a payment other than cash, or simple attempted to call or schedule one to pick you up most anywhere in the city that would never show up.

This egregious SF Taxi situation went on until the advent of Lyft/Uber – which initially was just responding to a critical transportation crisis that the Taxi Commission – as well as all of the city politicians and their assorted cronies greatly befitting from this highly corrupt Taxi Commission Cosa Nostra. It was only after the SFTC was near collapse (from the serious competition that Lyft/Uber provided) that they finally recognized that their little rigged “gig” was up, and they would have to drastically change their whole corrupt game if they wanted to survive. But…as we see today in SF, Taxis are but a shell of what they once were – with many cabbie drivers also ‘moonlighting’ for Lyft/Uber to try and make ends meet.

A classic story of how a longtime dominant business organization – completely indifferent and non-responsive to a cities rapidly growing transportation realities – eventually fall to a new dominant type of a business cosa nostra (Lyft/Uber..etc). If, or when the city of SF finally figures out that the overall best and most lasting solution to getting around a rather small 7×7 square mile area is to have a similar type of public transportation system that already successfully exists in Tokyo, Amsterdam, Paris..etc..

What the shopper/customer did happens last. It succeeded? How do you lose 6.8 billion dollars and succeed? Leaving Hubert aside, if I go with your claim that it succeeded, you’re mistaken in saying “because” of shoppers willing to pay. It succeeded because of the climate and environment that funds it regardless of whether or not it makes any money, because of a particular state of ERISA and laws like that, because of the pipeline from retirement to institutional limited partners to certain kinds of pilot projects, sometimes with certain ideology baked in. It succeeded because of a certain state of unionization, it succeeded because of 2008 unemployment creating people who took an IC role, maybe for want of a job. It succeeded because as you said, governments did nothing to stop it. It succeeded because of the think tanks and neoliberal idea sprawl, from one end hammering unions with the agency-fee ideas and suits, and from the other end inculcating workers with IC ideas (peers.org), and from another end hammering mandatory arbitration clauses, and…

So all of this is about 95% of the backstory. And then you have some shoppers, who say “neat stuff for me!” and press a button. They’re acted upon, Otis! The structure has already been churning for a while by the time the shopper acts, and has already set a tenor that is baked in to their choices. When you say in effect, “well what do you expect someone to do, transit used to be viable and isn’t now,” it’s nonsense. You’re conflating the nasty social values, the worker lie, with the pragmatic use value of transportation and saying the nasty social values are just how it is now – and oh well – because the transportation made itself indispensible when other kinds went downhill. You’re picking an emphasis on the shopper over the nasty social values, when an alternative is possible called emphasizing the nasty social values over the shopper.

There’s lots of public transit in San Francisco, map of the bus lines:

https://www.sfmta.com/maps/muni-system-map-except-during-covid-19

Growing up in the city I rode buses from seven years old through high school and have witnessed the sad decline of the city.

Here’s why rational people drive:

Transit is spoiled by public policy at the local level. Thugs terrorize certain bus lines.

“San Francisco Muni drivers went to their bosses seeking protection from assaults. What they got in return are plans for a three-year, $3 million program to train workers in “incident de-escalation” and “implicit bias” when dealing with agitated passengers.”

https://www.sfchronicle.com/bayarea/philmatier/article/Muni-drivers-protection-assaults-sensitivity-train-13546049.php

The mentally ill and homeless often sleep and sometime relieve themself on buses or BART, attacking other passengers, all things that the police do nothing about, and which the district attorney, a Massachusetts transplant, will not prosecute.

No sane parent dares allow their child to ride the bus by themselves, which means that the 90% of children assigned to schools outside their neighborhoods by the ongoing and ever changing integration and diversity policies from the school board, have to be driven back and forth, two round trips per day, adding large numbers of cars to the road.

The Municipal Railway, once the pride of the city is now a hotbed of corruption and poor maintenance. All corrupt politics are local.

Good clarification. It is not so much that they systems are not there, but that they are degraded to the point where a significant percentage of the population avoids them. That failure lays squarely at the door of the political class.

Public transport is not particularly affordable in Amsterdam.. that’s why they have to give free transport to all children, students, and recipients of social security. When I still commuted to the office 5x/week, I paid more on public transport than I did on housing, and I was only making my way from suburb to city center. Despite this, I was still paying about 40% of what a tourist would pay for the same ticket. It was literally more expensive than Uber Black, which makes no sense at all.

The cycling infrastructure does set the standard though.

Some simple math –

$2650 x12 = $31,800.00 annual rent for a one bedroom apartment.

$15/hr x 40 hrs x 52 weeks = $31,200.00 annual salary (before taxes!) for someone working full time at $15 per hour.

Rents need to drop a lot more before they’ll be affordable to the vast majority of the working class.

High rents in SF are not an act of God, nor are they due to a rapid increase in jobs. It took until 2013 for SF to have the same number of jobs that existed at the peak of the dot com boom in 2001, although there’s been growth since then.

What’s needed is an environment in which greedy developers will respond to sharply higher rents by building lots of new housing, just like they do in places like Denver, Phoenix, Atlanta, and Dallas. The restrictions on new development combined with extractions, most especially requiring market rate developers to provide deeply subsidized housing units for a fortunate few forces the remaining units to be sold or rented for even higher prices.

The obvious direction is to reduce government imposed costs on the development of market rate housing, and to fund affordable (meaning mostly middle class units by any other community’s standards) through heavy taxation of new housing space (say $100-200/sq. ft.) as well as an annual tax (say $1-2/sq. ft.) on existing offices. When there’s an imbalance between jobs and housing, the logical path is to tax buildings that allow additional jobs and to reduce the taxation on the production of new housing.

What’s needed is an environment in which greedy developers will respond to sharply higher rents by building lots of new housing, just like they do in places like Denver, Phoenix, Atlanta, and Dallas.

So you’re saying that greed is good then?

No. I’m saying that real estate developers are motivated by the hope of profits from the time and money they invest in a project (duh). As yourself why rents in such unprogressive communities like Dallas come down as those “greedy” developers rush in to take advantage of market rents higher than what it costs to bring new dwelling units on line. In ever progressive San Francisco, development restrictions make it impossible for investors to do just that, as city officials pile on more and more costs and restrictions in the name of social justice. Ask yourself, just which community has the truly progressive policies when it comes to keeping housing costs at a more affordable level?

yes, motivate their greed and get a good outcome.

I say raise rates to 6% and that’ll crush all of them speculating banksters and rents will go down, for sure. Also, I don’t see rents ex pandemic going down anywhere.

Don’t fight the fed…

This was my response to yesterday’s Housing and American Dram article. Yes – basic tenants protections are good, and on an individual level – year over year limits on rent increases are great. But on a macro level, what seems like common sense policy can result in stratospheric market rate rent prices and increased homeless/people living out of their cars

There’s obviously a middle ground. But its necessary to discuss both the cost and benefit of the government interference which is all to often missing

You can watch this story of one guy’s attempts to build:

https://www.youtube.com/watch?v=ExgxwKnH8y4

Only really big developers can afford the costs associated with trying to develop anything (and the bribes). By pure chance I found out that there had been a building plan from 1965 for 22 blocks of homes to be built up near Candlestick Park. It was to be landfilled up in height. This guy had a deed for land underwater. It costs taxes (tho not much) but is literally inaccessible with no plan.

Considering SF has lost 49% of its small businesses in the last year, I’m not sure what its prospects are for the future. Don’t get me wrong, the geography of the bay area is amazing, but the stupidity of “magical thinking” politicians makes this place closer to hell.

..but…but, Wolf…my balloon mortgage…what about my balloon! My five years are almost up, and I gotta pay it off and move on to the bigger balloon. You don’t understand how this works. I gotta sell this building for a lot more than I bought it for. I thought that we all understood that! The next guy gives me my nice capital gain which I roll into my next balloon tax-free. Your chart…your chart is, like…I don’t know…un-American! That is not how this real-estate business works…don’t you understand? I’m…I’m providing housing for people. This is like…like a public service almost. People need housing…and what about my balloon?!

Having spent 45+years here, first in SF, then Oaktown, now Berkeley, it’s been “interesting” to see the makeup of the city change. But then it surely was a far different place 45 years before I arrived, prior to all the soldiers shipping out to the Pacific War and deciding to investigate moving here when they returned.

The traffic became much more snarled when uber and lyft took over the streets, many operators seemingly “commuting” in from outlying areas along with workers (Modesto, Sacto etc.) and often appearing to not know their surroundings. (A friend in Boston has noted a similar effect there). A positive result of the pandemic has been a noticeable decrease in car traffic other than at commute times, especially less goober/lifter operators with their stopping in the middle of the street to pick up/deliver fares and whose gps devices don’t seem to provide clear directions as they halt mid-intersection to calculate which way to move. As writer above noted, the lunch delivery drivers have filled in some of the space freed up by lack of demand for the (v.c. subsidized) hire car services.

There is a dense network of bus lines in SF, however the service is chronically underfunded as in most cities, with riders packed like sardines much of the day on heavily utilized routes. Apparently not a social good be paid for from public funds, like health care. Still, I much prefer to use transit and my feet on forays to the city. It’s a very walk friendly place, good exercise provided by the hills, no snow, no 115 degree summer days etc.

While appropriate for the Fed to cease subsidizing the r.e. market with nearly free money, the odds of that happening seem about as likely as the tax code being simplified. Too many people becoming wealthy with things as they are, lots of lobbyists employed “saving jobs.”

Born at 7th & Bush. (St. Francis Hospital, Downtown). Life was definitely different then than now. Most folks lived in apartments or in the tight-lot homes in the Avenues around Golden Gate Park out to the Fleishhacker Zoo (near Lake Merced). Muni rail and electric buses got you around just fine until the post-war boom and the freeway construction that opened up the East Bay and South S.F. suburbs.

When single car traffic bloomed the usual (but unobtrusive in 1960) act of momentary double parking became a form of local traffic gridlock. Today, as noted, the Uber/Lyft/services along with UPS/FedEx trucks parked in traffic lanes makes City traffic flow unworkable.

San Francisco is still the most beautiful city in the US for panorama, vista, architecture, public places, and proximity to stunning natural wonder (Point Reyes) for VISITORS. Residing there is difficult.

There is no such intersection as 7th and Bush.

Your right. The intersection is Hyde & Bush. The hospital address is 900 Hyde st. It’s been 70+ years since my mom was in the delivery room; must have confused my decadal existance within my recollection.

The City remains the most beautiful City in the USA.

Cheers.

St. Francis Hospital is located at 900 Hyde. 7th St. segues into Leavenworth which meets Bush at the corner where the hospital campus is.

7th Street is south of the slot, ie Market St. It was the lower class area cf, Nob Hillish where St. Francis was (though Catholic, so lower class). It is your typical world class city, endlessly snobbish.

I never took a Lift or Uber in Boston, which I avoided doing anyway whenever possible, that had any idea how to navigate the city without the app, as near as I could tell.

QE protects the porfitsof top end of town only.

A rising tide floats the twig before the boat.

Traffic? Just because it could take an hour to get to the Golden Gate and longer to the Bay Bridge from work in the Financial? I’d just read or listen to the radio depending on whether I drove or took the bus. Got a lot of reading done.The housing crisis has been ongoing since about 1980. Nineteen fricking eighty. So, while I am glad about the drop in rents, it is still too high to actually live there. Really, the entire Bay Area is just too expensive. It is just all variations on the San Francisco theme. But nothing every really happens except bloviations from the entire Bay Area political establishment with the very occasional low income housing or aid. It’s always “look at all this money we spent and all our hard work!” but the money and the “work” never does much except appearing real good in the news or get a handful of people good housing. But there seems to be happy governmental and NGO employees.

I use to go into the city for shopping, but really what is left after all the small shops are gone? Since the quarantine, I have been trapped at home and haven’t been in the city, but the place was emptying out even before then. Going to the western or southern end of Market has been depressing for years as you go from the Financial to Skidrow South and I swear the dead zone, like a rotting limb, has been crawling up Market to the Financial for decades too with a desperate rearguard action by the city government to stop it. They have merely slowed it.

Most of the Bay, at least the picturesque parts, have been reduced to facades pretending to be what the whole Bay Area community used to be. But like what people have been saying about New York, there is no there there. Unless you are a tourist.

Much like the Rust Belt without the beauty and the tourists, which is a connection I just made.

I recall that one of the metrics that Krugman looked at in relation to the housing bubble that burst resulting in the GFC was the price/rent ratio, and the disconnect between prices and rents being indicative of the asset price bubble as the prices skyrocketed while rents remained flat-ish.

It seems San Francisco housing prices have continued to rise against this backdrop of decreasing rents. Does that not indicate a painful adjustment coming to the asset prices in the city through foreclosures, short-sales, etc? Or perhaps people are convincing themselves that all of this is just temporary?

A boom can last for years with no obvious cause. California is always having or just getting over a housing boom.

Every ten to twenty years it’s splat, but property owners always refuse to adjust their prices because it’s “the Bay Area” or “LA.” Add that in the past the servants of the Tech Lords always get relatively better pay then the local peasants and that the out of area wealthy people are always buying or investing in housing in those areas.

So, the prices are really sticky going down and remarkably fast going up. Each burst bubble that I can remember has always ended with a new plateau higher than the last even adjusting for inflation.

It has been a lifelong squeeze for renters and home buyers rather like those increasing weights that interrogators would put on their victims. Sometime the interrogated died.

Perhaps a better metaphor is millions of people and organizations being forced to swim in place with more weights being added every year. You can see the future. You know that more weights will be added. All you can do keep going yet year hoping that the added weight this time will not drag you down. And every year there are more people at the bottom of the pool. People that you can see.

A few tens of millions of Californians over forty years have enjoyed this adventure, but nothing changes except the different amounts added each time. And each time more people drown. Some people are making bank destroying the lives of millions of people in just one state. But we don’t talk about that.

When the cost go down to fifty percent then I will be excited. The rent will be down to what I paid in 1995. It would almost affordable.

I live in SF. How do people justify the cost of living? Opportunity. The last startup I worked for was bought by a big tech company and I just decided to not work for awhile, it’s nice. You meet people here who can help / hire you. It’s an exciting hub for tech. There are plenty of dumb ideas but some smart ones. For startups, it’s the VC community plus the tech talent.

As for the ragging on Muni, it’s overdone. Muni is basically fine. The problem with the homeless is the collapse of the working class economy and that problem is horrible and everywhere. SF shows American capitalism at its worst AND best.

I think after the pandemic some folks will come back but the hysteria of the past is hopefully over. What the post office change of address forms show is that plenty of people have moved out, yes – but they’ve moved to California counties, most in the Bay Area. They are ready to come back, or maybe find an outlying house with yard where they can commute a couple days a week. They are staying the region because Silicon Valley is a thing.

I have a friend who is an artist who just found a big studio bedroom apartment in a good neighborhood for $1250 (rent controlled). Overall the city may be a better place to live after this is all over.

How much would said ‘rent-controlled’ apartment uncontrolled be? That is the question, and the point I believe.