Yves here. In addition to Wolf’s caveats about the possible less than upstanding reasons for a spike in the number of new businesses, keep in mind that 90% of new businesses fail in the first three years. So while this is good news about the potential for recovery, don’t underestimate the amount of attrition.

Although I did not follow new business formation in the old normal, my recollection is one of the reasons for the high propensity to failure was that a lot of the new businesses were restaurants, which are more difficult propositions than talented chefs might believe. Needless to say, they aren’t a major category now. Instead, retail dominates. With America having had an extremely high level of retail space per capita among major economies, it remains to be seen if enough thinning of that herd has taken place.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

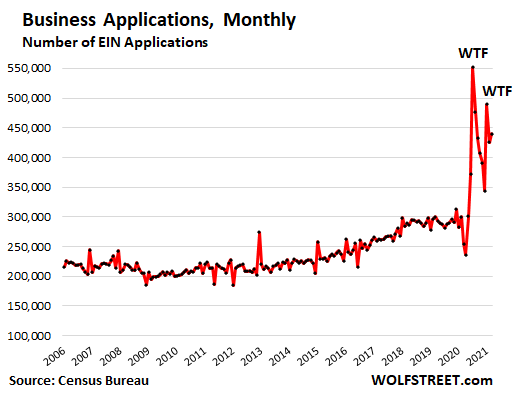

The historic over-night explosion of layoffs last spring, the tsunami of free money from the government for people and businesses alike, whether they needed it or not, whether they were fraudulent or not, and people’s reactions to that free money have upended all kinds of economic dynamics. And the double-spike in applications to start new businesses is one of them.

The 440,165 applications filed in March with the IRS for an “Employer Identification Number” (EIN) were up 47% from February 2020, the last month before the Pandemic. In Q1, applications jumped by 62% from a year ago. In July last year, business applications had nearly doubled year-over-year, producing a historic spike that faded through December, then re-spiked in January for a double-WTF moment – and we’ll get into potential reasons in a moment.

This data from the Census Bureau is not based on surveys, but on actual applications by new businesses for a federal EIN, with which the IRS tracks businesses for tax purposes.

Excluded are EIN applications that are not related to typical business formations, such as EIN applications “for tax liens, estates, trusts, or certain financial filings, applications with no state-county geocodes, applications from certain agricultural, public entities, and applications in certain industries (e.g. private households, civic and social organizations).”

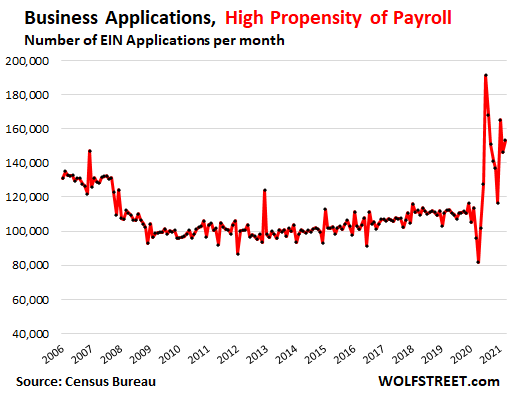

The Job-Creating Machines

From the information in the EIN application, the Census Bureau estimates which businesses have a “high propensity” of having a significant payroll (“High-Propensity Business Applications” or HBA) and might therefore become job-creating machines.

In March, there were 153,186 applications that the Census Bureau deemed to be HBAs, up 35% from February last year. In Q1, HBA applications jumped by 47% in Q1 compared to last year. That massive spike last July faded through December, but then applications re-spiked in January. Note that it took this spike to get to and surpass the number of applications before the Financial Crisis:

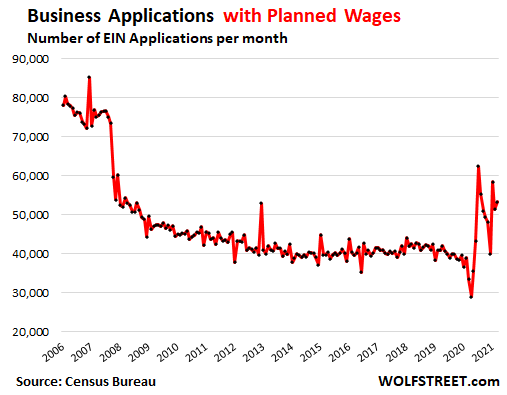

The Real Job-Creating Machines

Within the HBAs are the “Business Applications with Planned Wages” (WBA). These are businesses that already have a planned date for paying wages. They have hired people and have funding in place and are ready to pay wages and grow their payroll and become significant employers.

In March, 53,213 business applications of this type were filed, up 37% from February last year. The Q1 total was up by 50% compared to Q1 last year. But note that even the huge spike in July didn’t bring applications by these job creating machines back to levels that prevailed before the Financial Crisis:

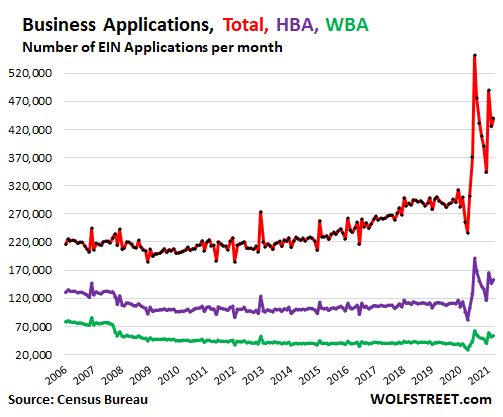

Most of the Applications Are by Businesses with a Low Propensity to Create Jobs

The chart below of total business applications (red), high-propensity business applications (purple), and business applications with planned wages (green), all on the same scale, shows the reality that most business applications are for businesses that won’t have a significant payroll. They might employ the owner and eventually maybe a few other people, and often enough, they remain one-man or one-woman shops throughout their existence. That’s a great way to go, but they essentially create just one job:

Retail Trade Dominates.

Brick-and-mortar retail took a horrendous beating during the lockdowns, as large retailers that sold food and everything else, such as Walmart and Costco, were allowed to stay open, while retailers that didn’t sell food had to close. These retailers that had to close had already been beaten down before the Pandemic by the competition from ecommerce. Many big-box stores filed for bankruptcy. Little shops went quietly, walking away from their lease, maybe working out a deal with the landlord, and then closing the shop.

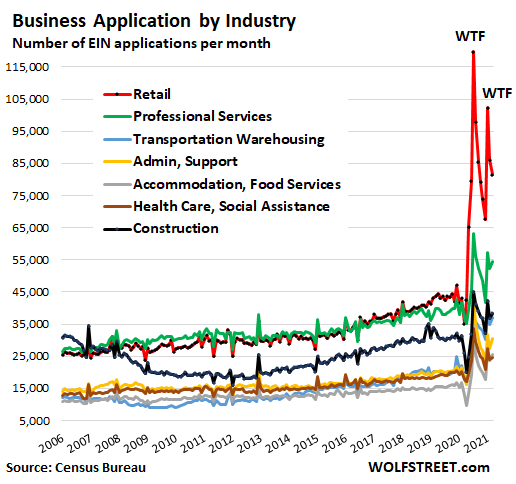

But online sales boomed, and business applications in the retail trade – likely by people planning to ride the boom in online sales – experienced a historic spike. At the peak in July, there were 120,000 applications by businesses in the retail trade, or 22% of all applications during that month, and triple the number of applications before the pandemic.

In March, business applications in the retail trade, at 81,469, where still roughly double the levels in 2019 (red line in the chart below). Nothing else came close. This is interesting because in the years before, retail trade applications ran roughly on the same level as professional services applications (green line), but then during the Pandemic just blew through the ceiling. Also note that all categories have that double spike:

The chart above shows the top seven industries, by number of business applications in March, plus the increase from 2019:

- Retail (red): 81,469, nearly double from 2019

- Professionally services (green): 54,385, +38% from 2019

- Construction (black): 38,312, +16%

- Transportation & warehousing (light blue): 37,092, +83% Many are trying to ride the red-hot ecommerce boom with its final-mile delivery requirements, and the boom in deliveries of food and meals.

- Administration and support (yellow): 30,480, +50%

- Accommodation and food services (gray): 25,540, +66%

- Health Care and Social Assistance (brown): 24,674, +33%

Entrepreneurs Try To Make a Go of It.

There are many legitimate and exciting reasons for a surge in business applications during the unemployment crisis, including that people had time, and some extra cash from the government to finally chase after their dream and strike out on their own and start a company. I know several people who’ve done exactly that, and that’s exciting and wonderful to see.

Anything having to do with the internet – whether retail or delivery or posting YouTube videos and making money from ads – would naturally be a primary target during the lockdowns. And lots of people did that. This type of fired-up entrepreneurial energy is one of the best things to come out of this crisis.

But There’s Another Side

I don’t remember anything that has ever drawn so much fraud to itself, like an industrial magnet attracting ferrous scrap metal, as the federal government programs to support the unemployed and struggling businesses.

When it comes to this twin-spike in business applications, the forgivable Payroll Protection Program (PPP) loans and Economic Injury Disaster loans come to mind immediately – especially since the spike into July, and then the renewed spike this year, are timed with the two PPP generations.

Businesses that applied for the PPP loans had to submit documentation of wages paid over specified periods. The first-generation PPP program ended on August 8, 2020. The second-generation PPP program started this year and remains open.

The dates were structured so that it would be impossible by honest people to create a business entity after the announcement, pay wages for long enough to qualify for a PPP loan, and then apply for a PPP loan. Applicants had to submit historical wage documentation to the lenders whose job it was to check all this out.

What we now know is that these PPP loan applications were rife with misstatements and fraud. Fintech companies have plowed into PPP loans with reckless abandon. A Bloomberg analysis in October found that Fintech outfits were connected to 75% of the PPP fraud cases alleged by the US Justice Department at the time, though they only arranged 15% of the number of total loans.

Once fraud by the borrower is involved, it no longer matters what the original requirements were because they’re being bypassed by the fraudster to begin with.

The Project On Government Oversight (POGO) reported today: “The Justice Department has brought criminal charges against at least 209 individuals in 119 cases related to Paycheck Protection Program (PPP) fraud since banks and other lenders began processing loan applications on behalf of the Small Business Administration on April 3, 2020. And these cases are just the beginning.”

POGO’s analysis of the first batch of PPP fraud cases found that in at least:

- 107 of the cases, accused individuals allegedly falsified payroll documentation to justify either getting a loan or getting a bigger loan then they were eligible for;

- 93 of the cases, accused individuals allegedly created fake tax documents used for verifying details in loan applications;

- 41 of the cases, accused individuals allegedly created bogus companies to get loans;

- 28 of the cases, accused individuals allegedly used defunct companies to get loans;

- 20 of the cases, accused individuals used stolen identities or aliases while applying for loans;

- 12 of the cases, accused individuals allegedly falsified ownership of existing legitimate businesses;

- 28 of the cases, accused individuals also obtained Economic Injury Disaster loans (some of these individuals have been accused of fraudulently obtaining these loans as well).

So on one hand, this spike in EIN applications is the result of an exciting surge in entrepreneurial energy by a large number of people striking out on their own and getting their ducks in a row to start a new business, which is wonderful to see. On the other hand, this spike appears to include large-scale and systematic efforts at fraud, the extent of which – beyond some titillating nuggets emerging from investigations – we may never be able to fully fathom.

Could legitimately be dead people. Keep in mind that when one settles an estate which has any meaningful assets to be distributed an EIN could be required.

@JIG

April 17, 2021 at 7:30 am

——-

An EIN is required in such circumstances. However, the statistics above specifically exclude estates, trusts, and other non-business entities.

“Excluded are EIN applications that are not related to typical business formations, such as EIN applications “for tax liens, estates, trusts, or certain financial filings, applications with no state-county geocodes, applications from certain agricultural, public entities, and applications in certain industries (e.g. private households, civic and social organizations).”

Being a sole proprietor who participated in the PPP program both times, my personal experience was that I needed to produce three years of tax returns, schedule “A”, s etc.

I am grateful for the micro-loans (micro-business drives out micro-loans!) which have kept our family in our home and the one creditor mortgage company at bay. So far.

The bank received origination fees, has commercial underwriting loan departments and staff to review and comply with guidelines. While there will be borrowers and banks committing fraud, the potential for the fraud insinuated as widespread might be a bit exaggerated.

Sole proprietorship is a challenge. Jobs are going away with AI and automation.

Perhaps Americans see the writing on the wall, and realize that it’s time to boot-strap.

My counsel to anyone who asks (small circle!) is that the job should involve your personal hand’s-on labor, that cannot be out-sourced or automated/ digitized. Think house painter, plumber, locksmith, mechanic.

7.9 billion souls scrapping to exist. Sooo relieved Jaime Diamon, Elon, Xi, Bezos and the Davosmen are lazer-focused on it with their deep altruism.

The Great Reset in action. The Elect and the Damned. And I know which category we fit into. Look up how serfdrom got started in late Rome. We’re there.

Or sharecropping in the South after the American Civil War.

https://www.randomlengthsnews.com/archives/2020/09/17/prop-22-the-great-wage-theft

FTA, which was pre prop 22 and discussed how the gig economy dumps risk on workers…

“”As with port truckers, their condition could well be described as “sharecropping on wheels”: doing piecework with the illusion of ownership and the reality of political powerlessness, along with limited earnings and the possibility of going into debt.””

I wonder how much of this is actual retail vs. drop ship dreams spread by hucksters. Likely no more successful than traditional brick and mortar retail, but probably less expensive to unwind at failure time.

I know of a business owner friend who got 600k PPP loan.

He told me he didnt need it but the bank told him that if he used it for payroll it will be forgiven, so he took it.

His business was better than ever, he was going to pay his workers no matter what so the loan was a gift.

He used the money to buy real estate.

Sending money to people indiscriminately was the biggest theft ever perpetrated on the american taxpayer.

History will look at these period as the time of excesses.

The Catholic church scored a cool $1.4 billion preying on the PPP, and lookie here @ all the houses of worship in Cali pulling down between $150k to $350k ‘loans’. Whadarya, a business or an add for tithing front?

https://www.cnn.com/projects/ppp-business-loans/states/ca?page=518&limit=50

My wife sees the waste, too.

Targeted support is more efficient. But it’s slower and requires an army of bureaucrats to monitor the handouts. So first you have to staff up, train them, etc, so greater efficiency increases costs. But it’s also much, much slower, and meanwhile the economy was in danger of full stop because of crash in demand.

So some money went to people who didn’t need it, and this led to a great deal of buying, much of it on imports still clogging ports. On the plus side, we have so far avoided depression.

And remember; Gov is not gonna run out of either money or keystrokes. And better to err on the side of too much vs too little, remember there’s a wide consensus among economists that too little was spent in 2008.

And regarding inflation… yes, it’s rising, but slowly and likely IMO temporary because of excess demand, which will go away as soon as the economy can grow without handouts.

Targeted support is not more efficient. It is more efficient to support everyone and take back via tax from those who didn’t really need the support.

Its strange there is no category for manufacturing. Say someone decided to make COVID masks, hired some seamstresses and sold them over the internet. There are hundreds of such masks for sale on Ebay, for example. This new business would be categorized as Retail?

@RickV

April 17, 2021 at 4:30 pm

——-

There is a manufacturing category in the EIN statistics as well as several other categories not mentioned by Wolf. I think he picked only the ones that showed the biggest spikes.

IIRC, there are 13 or 14 categories on the EIN application.

I wonder how may were simply online retail. For example, Etsy Shops. Alot of people invested about 2k or so in their hobby or side interest and tried to get some online cash during the first part of the pandemic when lock downs were more strict and stores were actually closed.