Given the resentment in many quarters of the US towards government employees, particularly those with decent pensions, you’d think cities and states would recognize that having them enjoy lavish, private-equity-paid travel was not only terrible optics but also smacks of corruption. But instead, the prevailing attitude seems to be that as long as the travel bills aren’t being paid directly by the government, the unseemly plushness of these junkets conveniently falls outside official travel policies.

A recent expose by the Philadelphia Inquirer does a fine job of documenting the extent and cost of private equity related travel by the investment team at the Pennsylvania School Employees Retirement System, or PSERS. The article makes clear that PSERS employees did not book these trips, nor did the pension system pay for them directly. These charges were made to the various private equity funds in which PSERS invests. While PSERS bore only a small fraction of the cost of this travel, it was also paying for other investors’ travel costs.

However, the significance isn’t just the lack of propriety of having state employees travel in a style well beyond normal state travel allowances, as well as what these workers would be able to pay personally. The trips to a large degree are unnecessary, save to advance the interests of the general partner, to the detriment of investors like PSERS.

These jaunts keep the private equity staff regularly in personal contact with the private equity firms, when as limited partners, they have zero say over investments (we’ll turn later to the role of the toothless-by-design “advisory committees”). These trips serve as marketing and relationship-building for the general partner coming out of the investors’ hides. They also keep public pension employees busy doing fake oversight at the expense of real oversight, which they can do better at their desks, reading the limited partnership agreements and the various documents from the fund managers to understand if they are complying or not.

PSERS disclosed its travel expenses…but its accounts would include only trips that paid for by PSERS. For private equity, the charges are nearly all ones later reimbursed by various private equity funds. However, they do not include travel booked and paid for by the private equity funds. So taxpayers have only a partial view. Fron the Inquirer:

For many years, the fund’s spending on travel has been secret to the public. Under pressure from reformers on the board, the pension plan produced its first breakdown of 2019 travel late last year. Reports for 2017 and 2018 were only made available in March.

The staffers in PSERS’ investment shop are paid somewhat like their counterparts in private high finance. James Grossman, the chief investment officer who has worked for PSERS for nearly 25 years, is the highest-paid employee in state government, making $485,000 yearly. His deputy is paid $399,000. The average salary in the unit is about $190,000.

Grossman and most of his staff are often on the road. Their most frequent destination has been New York, followed by London, then Boston. Philadelphia was the fourth most listed destination.

Itineraries have included Dublin, Edinburgh, Lisbon, Macau, Madrid, Saudi Arabia, Singapore, Seoul, and Stockholm. They have gone to meetings in such American hot spots as Beverly Hills, Orlando, and Park City, Utah, along with dozens of other U.S. cities.

In a microcosm of the sorry state of private equity fees and costs, where no private limited partner knows their true investment costs because many are hidden from by being charged to portfolio companies, rather than at the fund level, PSERS couldn’t be bothered to tally its travels cost. From the article:

At a PSERS meeting last spring, another board member, Nathan Mains, said regarding travel: “We really don’t have a sense of what some of our funds or managers or others have actually spent.”

Grossman replied: “That is correct.”

The Inquirer points out that there are many gaps because the general partners blew off PSERS’ information request:

[Spokesperson Steve] Esack had said earlier that “100% of vendors” had replied to queries about the trips. Asked about the hundreds of blank responses, he wrote Friday: “These are the records the managers provided.”

So we are to believe that private equity firms that are acting as stewards of hundreds of millions to billions of dollars don’t keep their books well enough to be able to substantiate travel charges? Esack’s lame comment shows the position that the limited partners have put themselves in: they’ve locked up their money and can’t even get adequate disclosure of how it is being spent. That produces results like:

Of the almost 500 trips, 80 have fares listed as zero, including four flights to London, as well as flights to Beijing, Hong Kong, and Zurich.

Even more trips had nothing listed for hotel costs. One was a trip that investment chief Grossman made in the summer of 2018 to Jeddah in Saudi Arabia. The report says his airfare was $7,015 but lists his hotel bill as zero.

The article points out that the PSERS investment office regularly violates state travel policies, which require employees on Commonwealth business to hew to Federal guidelines for airfare and lodging. Eight PSERS officers have been granted waivers from this policy.

PSERS defends the travel costs by saying staff traveled business class and the fares were typically refundable and sometimes bought at the last minute.

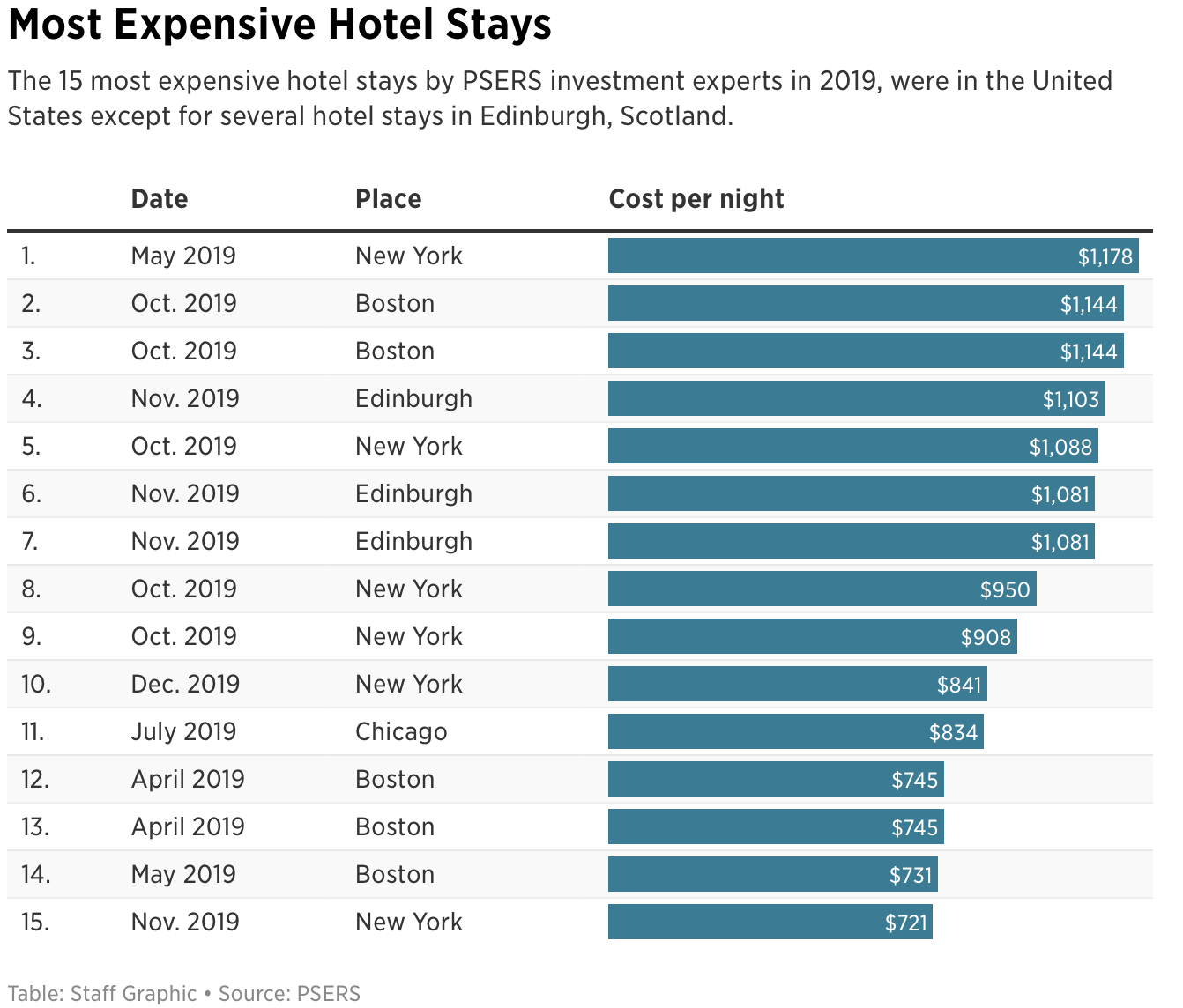

My issue isn’t with the cost of the flights but their necessity, and with the hotel costs. Public servants should be staying in Westin/Marriott level rooms. These prices are consistent with five star hotels, like the Four Seasons or St. Regis in New York City.

PSERS’ defense of the trips is absurd if you understand the role of limited partners. Here’s the agency’s justification:

“PSERS has been a global investor for decades,” its spokesperson, Steve Esack, said in a statement. “Its investment team must be willing to travel in order to properly perform their fiduciary duty of monitoring existing investments or conducting due diligence on prospective investments.”

“PSERS investment staff works during these flights to prepare for their meetings,” the statement also said. This sentence was underlined.

“Staff worked on the plane.” Come on. For starters, flights from the East Coast to Europe are almost always overnight. Are we supposed to believe they arrived bleary eyed and tried to function on no sleep?

But let’s unpack the more troubling but less obvious howler: that the travel is “to properly perform their fiduciary duty of monitoring existing investments or conducting due diligence on prospective investments.” Just because the staff may actually believe that does not make it so.

Bluntly: “What about ‘limited partner’ don’t you understand?” Limited partners contractually have absolutely no say about how private equity investments are made and managed and when they are sold. They are along for the ride. There’s no point in “monitoring” beyond reviewing investment returns. In fact, they are paying the general partners to do that! On top of the management fee, which is the compensation to the general partner to buy attractive businesses and oversee them, nearly all general partners double-dip by charging a “monitoring fee” directly to portfolio companies.1

But here’s a section that ought to trigger readers, but won’t:

The task before them is to check on fund investments. So, for instance, when Luke Jacobs, a PSERS private-equity manager, flew to London on March 4, 2019, for a round-trip fare of $13,025, he attended annual meetings for two funds of Apax Partners, called Apax Digital and Apax Europe VII. PSERS has put more than $300 million into the two Apax funds.

This is one of the two main types of meetings a limited partner like PSERS will attend. One is the annual meeting for the funds. These are incredibly lavish productions where the general partner has well-oiled talks about how great the fund is, as well as top-tier entertainment, with the very best food and wine you can serve in a conference setting. For instance, from a 2016 post:

Another routine form of private equity rent extraction is how they get the fund investors, who are fiduciaries, to pay for lavish annual conferences which for the biggest funds includes big ticket entertainment like Elton John:

#EltonJohn — TPG CEO Conference Phoenix AZ pic.twitter.com/gQWqkpPEwO

— Doug Curling (@shakadoug) October 19, 2016

And for the still skeptical, another source has confirmed that Elton John performed at the TPG conference. And as is typical in limited partnership agreements, investors are on the hook for the costs of “meetings” and this show, as part of a limited partner event, was on their nickel.

The second type is the meeting of the advisory committee, which is subset of the limited partners, chosen by the general partner. This is a fig leaf to support the fiction that limited partners have some checks on the general partner. Certain matters, most importantly waivers of conflicts of interest, require the approval of the advisory committee.

However, the general partner, who controls who sits on the advisory committee, takes great care to include enough “friendlies” so as to assure that the general partner will never lose a vote (these are often respectable-seeming players like the JP Morgan private equity fund of fund. No fund of funds will ever cross a general partner; they need to preserve access to as many funds as possible).

Nevertheless, general partners also like to avoid controversy, since the “non friendlies” minority (who don’t even recognize that the advisory board is stacked) typically includes investors who have stature. Having them vote against the general partner on any more often than rarely not only means an influential investor might not participate in the next fund, but even worse, their opposition might become the talk of the next big industry conference.

What is the most economically significant matter that regularly comes up before advisory committees? Waiving the conflict of interest for the general partners to pay themselves M&A and financing fees. This amounts to double charging the portfolio companies, since the general partners engage investment bankers to do the work. You’ve probably seen psychological research that has found that a gift as minor as a can of soda will predispose the recipient to a request made by the giver. It psychologically would seem churlish to say no to general partners who’ve arranged for travel and accommodations that vastly more luxurious than what public employees are allowed or what these staffers could afford in their private lives.

Mind you, the limited partners are so bought captured that they don’t even exploit the power of these extremely valuable transaction fee waivers, which are indefensible from a fiduciary duty perspective, to trade for better disclosure: “We’ll give you the waiver only if you and any agents and affiliates account fully for all the fees and costs you incur pursuant to this waiver.”

And the proof of the pudding is that the PSERS approach to monitoring has delivered remarkably sub-par investment performance:

The pension plan has invested heavily in private equity, betting on enterprises not available on the stock market. These deals have prompted criticism for high fees and middling performance. Fund reports show such investments lagging behind its U.S. stock buys for the last decade. Last year, its private-equity portfolio fell 4.2% in value while its public stocks rose 3.2%.

The pro-accountability board members are upset, and for the right reasons. Again from the Inquirer:

“It’s hard to imagine how any person, much less a state employee, hired to serve the public, is even permitted to spend more than $10,000 for airfare, or thousands of dollars in hotel costs for a single trip,” [State Senator Katie] Muth said in a statement

“But what’s more important here is that the Wall Street money managers flying investment office staff to Paris and Hong Kong are the same ones turning around and asking for huge, shady contracts to manage public money,” she said.

Now in fairness, PSERS has made co-investments, in which it invested along side a general partner but (typically) paid no or reduced management fees. The general partner most often offers the opportunity to investors in the fund, but it will sometimes solicit an outside investors for political reasons, such as CalPERS or CalSTRS because the business has California regulatory issues.

However, it seems very unlikely that any controversial high-cost trips would have involved co-investments. First, a PSERS does not have employees that know how to do due diligence on companies. So even if they were to visit the offices of a potential investment, they wouldn’t know how to conduct an inquiry.

Second, PSERS would not tag along with a general partner while it was doing due diligence. The average middle market company gets dozens of bids. There would be no assurance that the general partner would wind up the buyer.2

Third, PSERS made only small co-investments. In 2019, through mid December, the agency had committed $1.47 billion to 2019 “vintage” funds, while as through mid October, it had made $153 million in co-investments, of an average size of $19 million. Even if you take this run rate and project it through mid December, you get $185 million in co-investments. Not shabby, but also not worth incurring much if any travel costs since staff doesn’t know what questions to ask.

Some contacts in private equity say the Inquirer piece has rattled quite a few funds. Let’s hope so. Even though this is far from the biggest transparency failing in private equity, it’s one people understand. You pry the door open where you find a crack.

____

1 Oxford professor Ludovic Phalippou, who has read many monitoring agreements, calls them “money for nothing.” From a 2014 post:

The wee problem is that when you look at these agreements, it’s clear no business would enter into this arrangement. While the portfolio company has an unambiguous obligation to make payments to the private equity firm, the private equity firm is under no obligation to do anything to justify getting these fees. I’m not making this up, as this highly engaging video called “Money for Nothing” by Professor Ludovic Phalippou of Oxford attests. The entire video is worth watching, and the critical section starts at 8:00

Here is his translation of the services agreement:

I may do some work from time to time

I do some work, only if I feel like it. Subjective translation: I won’t do anything.

I’ll get [in this case] at least $30 million a year irrespective of how much I decide to work. Subjective translation: I won’t do anything and get $30 million a year for it.

If I do decide to do something, I’ll charge you extra

I can stop charging when I get out (or not), but if I do I get all the money I was supposed to receive from that point up until 2018.

“Junket”

noun: junket; plural noun: junkets

Informal

an extravagant trip or celebration, in particular one enjoyed by a government official at public expense.

eg “the latest row over PSERS investment team junkets”

Verb informal

verb: junket; 3rd person present: junkets; past tense: junketed; past participle: junketed; gerund or present participle: junketing

attend or go on a trip or celebration at public expense.

eg “the PSERS investment team junketed off to Arizona for an Elton John concert last week”

Many years ago I worked in the intersection between public sector regulators and consultancy in the UK on both sides of the table at various times. The two companies I worked for had a reasonable level of integrity with this (or maybe you could say they were naïve), but I saw plenty of other ways that private sector companies could use a myriad of means to give junkets to public sector employees or elected representatives, and it almost always worked in terms of getting (sometimes subtle, sometimes not so subtle) favoritism when decisions were made.

It became clear that no level of fudged rules worked to stop this. Only an absolute and unambiguous ban on taking anything direct, or indirect, or very indirect, from the private sector worked in ensuring the barrier in decision making worked. Most public authorities did this, those that didn’t became notorious for how easy it was to bypass the rules. In my experience, public servants welcomed this, as there was nothing for honest ones (the majority) more frustrating than to see bosses, colleagues, or elected representatives taking advantage of paid jollies (as they were called) or other forms of freebies.

It’s not just government bodies. You sometimes see these bans in savvy private sector companies. I saw this in a Fortune 500 company, an indirect client (I was in the weird consulting role of acting as a project manager for a hermetic, unusually competent client on a new business they were seeking to launch. In the end they decided it wouldn’t work despite the very nice profits on my gig; it took too much customization, and that meant partner time, which was a very limited resource). They wouldn’t even let me buy a cup of coffee.

It reminds me of when I was trying to order a particular bike part from my local bike shop. After repeated orders and requests over many months, it never showed up. I thought at first it was my local shops fault and tried ordering direct from the supplier. They didn’t even to reply to my emails.

After all this I eventually went in to cancel the order in the shop. The two guys behind the counter sympathized, saying this company was notorious for being uncooperative. ‘So why the hell do shops sign up as authorized dealers with them? I asked. The two of them just laughed and replied ‘You’ve obviously never been to one of their Christmas parties!’.

Thank you, Susan and PK.

Until the pandemic, Cannes hosted the annual property and finance conference, MIPIM. This is / was a bit before the May film festival.

Local government officials from around the world, but especially Western Europe and North America, are wined and dined by unscrupulous bankers, property developers and professional services firms.

In addition to the gastronomic delights, glamazons were brought in huge numbers to provide personal services. One year, mid teens, it got so bad, that the organisers were asked by local police not to be so obvious and to stagger the arrival of the glamazons. Also, attendees were expecting to be entertained by a French beauty, but there weren’t enough to go around and some had to make do with someone not francophone.

Over this century, as education became a business / commodity, university delegations were invited. This is how British universities and a Parisian institution were conned into lavish developments and debts running into hundreds and billions of pounds. That is before the interest rate and currency swaps and derivatives kicked in.

Still, someone had fun in the south of France sun.

One of my contacts who was a board member at a public pension fund described a dinner hosted by a private equity fund widely seen as scuzzy. He is also married. He was seated between two extremely attractive women. I don’t recall if either affected any investment expertise. They were, however, physically aggressive. He didn’t drink any alcohol and got out of there as quickly as he could. I doubt that was a typical response.

The flip side is that the long-standing joke at CalPERS is that the price of a $100 million commitment is a steak dinner.

Thank you, Yves.

I can imagine some desperation for business kicking in.

DB allowed such expenses to be declared, but UBS could / would not.

‘One year, mid teens, it got so bad…’

I hope that you did not mean that literally, Colonel.

Thank you, Rev.

The middle of the last decade :-).

A bit of background on this world in London. There’s a class system. At elite / banker list level, escorts can be split into quarters, nurses, teachers, other professionals and others / often full timers.

My mother was a public school teacher in PA. After she retired, she became a PSERS beneficiary.

Late in her life, I gained power of attorney so I could manage her affairs. While I did this, I had to interact with PSERS. Never did I ever have a problem dealing with them. Ever.

Without disclosing specific figures, I can say that my mother had an adequate, but not generous, pension. I also remember her saying that the money to fund that pension came out of every paycheck.

If she was alive today, I think she’d be livid.

Excellent reporting, Yves, as ever.

I worked for a government owned fund manager at one point and we were not allowed to accept anything, even a sandwich, without filling in a gift form and anything in value over £15 had to be refused or donated to the company and the value paid in personally. We used to pay for every lunch – co-investors and consultants loved us.

One quibble, the comment about diligence could have a non-disingenuous interpretation (“PSERS has been a global investor for decades,” its spokesperson, Steve Esack, said in a statement. “Its investment team must be willing to travel in order to properly perform their fiduciary duty of monitoring existing investments or conducting due diligence on prospective investments.”). It may be referring to PSERS evaluating its existing or prospective LP positions, rather than underlying portfolio assets. I have not read through to the Inquirer article: if the original is clearer on this point, it would repay to hoist a different / additional quote out.

That is the point I address. PSERS can’t go and visit portfolio companies. No general partner would stand for that. LPs do not have any rights to get information about portfolio companies beyond what is specified in the LPA (see our Document Trove for some samples) and what the GP in his munificence deigns to provide. So what they do get comes from the GP, via various disclosures (way way way way short of comprehensive) and via GP happy talk at various meetings. They will showcase investee management of companies they really like to talk about at their annual shindigs.

The LPs flatter themselves that they can judge the cohesiveness of a firm by coming to the highly staged annual meeting and other invites. This is lunacy.

As for evaluating new GPs, there’s no value in visiting the GP at his offices. Please tell me what information they could gain. Sales ability and interpersonal skills aren’t highly correlated with investment skills (see Michael Burry for one of many examples).

Prospective investors would do vastly better to understand fund performance. 77% of the funds can cut their numbers so as to claim to be top quartile. IRR is a poor, misleading metric. Doing the heavy lifting of getting past GP/PE consultant-serving investment nostrums would benefit them much more than spending face time with GPs.

But if they did that, they’d have to confront that the fund would do better on a risk-adjusted basis to buy a couple of indexes of small cap equities. They could lever that if they wanted a closer approximation of PE risk/reward. But were they do do that, they would do themselves out of jobs. So the current drill preserves their employment.

The other way to go would be to bring PE in house. That’s a many-year commitment but public pension funds are stable enough institutions to be able to see that through. That would not result in PE staff career suicide, unlike advocating small cap equities in place of PE.

I was in agreement that they are not visiting portfolio cos.

I also agree that they can get the returns data, albeit presented by the GP, and would be better squeezing insight out of that, assuming any has been accidentally left in.

I was thinking more of process nd compliance d.d. First time investors in a new GP have the leverage to demand physical evidence that the internal processes claimed in the fund PPM exist and are followed, as the price of their money. So, file sampling on the investment papers, portfolio management accounts etc. Established GPs can refuse to deal on these terms but first time and second time funds cannot. And when pulling up the drains, you learn something about the owner of the house too…..

Having said that, PSERS seems a nobidy-got-fired-for-buying-IBM place, as you noted, so probably not many first time funds….

No, first time investors do not have leverage. We haven’t been in an environment where it has been hard to raise funds since the early 1990s. PE is seen as a velvet rope business, the GPs decide who to invite in.

And the LPs don’t do serious due diligence. They hire firms like Hamilton Lane, who as we have shown’ just cut and paste GP marketing materials and call that due diligence. LPs seem clueless that nearly all of the fund consultants also run fund of funds, which are more profitable than the consultant business. And as fund of fund managers they are always super nice to GPs. Any thought of tough LP questions will be discouraged.

This casual corruption is a rot that has spread deeply in the pension system that I depend upon, CalPERS.

Imagine the drudgery of working crunching numbers in the Investment Office of a pension fund situated in a baking-hot backwater such as Sacramento, working for “leadership” incapable of so much as opening a spreadsheet, let alone understanding it. These wasteful junkets become the only thing that makes life worthwhile — and so “everybody does it.” The Board, the executives, and the high-level flunkies. Those who don’t aspire to attend.

I’ve suffered through enough conferences to consider even four-star hotels to be as appealing as Alcatraz, but the love of these places by petty bureaucrats appears to be as limitless as it is limitlessly corrupting. The numbers are obfuscated by all concerned so that everyone can pretend that they aren’t dragging down returns — but drag down returns is the only thing that they do.