In responding to a Public Records Act lawsuit filed by a former board member over violations of transparency statutes, CalPERS is attempting a new variant of the classic legal strategies in litigation: “If you have the facts on your side, pound the facts; if you have the law on your side, pound the law; if you have neither the facts nor the law, pound the table.”

As we’ll explain, CalPERS is pounding the table in the guise of pounding on facts. And the reason for trying to fight a Public Records Act suit on facts, when they are nearly always argued on legal issues, is to force a trial. Going to trial is the course of maximum delay, which not only defers embarrassment but is very likely to push a court decision out beyond the early fall board elections. And it also forces Jelincic to lay out more dough in pursuing this case. Even though successful plaintiffs in Public Records Act cases are entitled to the award of legal fees (and this includes if the other side coughs up the records before a court rules), they still have to feed their counsel during the process.

Mind you, absent getting a very government-deferential judge or winning a war of attrition against Jelincic, the odds of CalPERS winning are slim. Yet CalPERS thinks it’s perfectly fine to waste beneficiary dollars to make the litigation costs as high as possible to defend its flagrant abuse of California’s open government laws.

We have embedded the filing by plaintiff and former board member JJ Jelincic at the end of this post, along with CalPERS’ response.

Background

Jelincic is challenging CalPERS’ dubious denials of two different Public Records Act requests he made. One focuses on impermissible secret board discussions shortly after Chief Investment Officer Ben Meng’s sudden resignation last August. The filing not only calls for these records to be made public but also demands that board members be released to discuss all the matters that CalPERS impermissibly covered in the August “closed session”. The second involves CalPERS’ continuing efforts to hide records showing how it overvalued real estate investments by $583 million. Yet CalPERS not only has said nary a peep about bogus valuations are larger than the total amount it was slotted to invest in a mothballed solo development project, 301 Capitol Mall, but it continues to publish balance sheets that include the inflated results.

We predicted that CalPERS would be be even more inclined than usual to fight these Public Records Act requests because the filing seeks remedies beyond release of the records. First, it requests that CalPERS be found to have violated the Bagley-Keene Open Meeting Act. Second, to the extent that the judge rules that the board discussed items in closed session that should have been agendized for and deliberated in open session, the suit asks that board members be permitted to disclose the contents of those particular discussions in public. Third, the filing calls on the court to require that CalPERS make video and audio recordings of all closed sessions and keep them for five years (this is something that CalPERS currently does but this obligation is meant to shut the door to “the dog ate my disk” pretenses down the road.)

The last two requirements are particularly deadly. If the CalPERS board is exposed to having all of its cozy, illegal private chats later made public by having board members freed to discuss them, they would have to expose more of their decision-making to public oversight and feedback. The more the media sees of what actually goes on, not only will more dirt be exposed, but so too will be the cronyistic, diseased relationship of the staff to the board. As we’ve chronicled over the years, the board is captured by staff and bizarrely views asking even basic questions as destructive to CalPERS image. If that’s actually correct, that staff and the board are so utterly incompetent that they can’t handle simple queries, it’s concrete evidence that CalPERS is horrifically badly run and needs a big shake-up.

CalPERS Poison Letter Followed by Presumptuous Filing

CalPERS tried an initial high-handed gambit by writing Jelincic’s accomplished attorney, Michael Risher, and bizarrely demanded he drop the case. We argued that this letter was a major own goal because CalPERS made admissions against interest in it. If you missed this post when it appeared and have time for it now, I suggest you give it a look, since Risher’s retort makes for gratifying reading.

The CalPERS response to Jelincic’s filing is similarly presumptuous.1 The form is unusual but not unheard of.2 Rather than provide a well-written, accessible argument, CalPERS gives a series of denials that are not self contained, followed by terse and not credible affirmative defenses.

See how the fact fight begins:

CALPERS generally denies each and every allegation of JELINCIC’s Petition/Complaint, except verified paragraphs 4, 6-8, 15-16, 32, 50-51, 55-57, 62, 64, 68, 70-74, which CALPERS specifically addresses below.

This form of presentation is extremely discourteous to the judge, since it forces him to flip back and forth from CalPERS’ answer to the relevant sections of Jelincic’s Writ of Mandate, and then make sense of the CalPERS’ comment. This approach suggests CalPERS isn’t interested in winning but in simply making the process as difficult as possible. As we explained above, that does serve to extend the timetable and force Jelincic and his lawyer to burn more cycles.

Another problem with CalPERS “Deny deny deny” approach is that the giant fund denies things that are obviously true, again suggesting CalPERS could care less what the judge thinks. We’ll pick a few examples because there are so many that doing this well would be tedious, which is the point.

For instance, CalPERS denies everything up through Paragraph 4. Just look at Paragraph 1:

The California Public Employee Retirement System (CalPERS) manages hundreds of billions of dollars of public money for California retirees and their families. California law requires that it comply with a number of transparency laws, including laws that apply only to CalPERS. And,

given the immense amounts of public money at stake, compliance with these laws is critical.

The last sentence is an apple pie and motherhood statement that CalPERS as a matter of good form ought to agree with, but does fall short of being a fact. However, read the first two sentences again.

CalPERS doesn’t manage huge amounts of money? Seriously? So let’s dissolve them now and give all that dough to CalSTRS, since they’ve just disavowed their role.

Now one can make a hyper-technical argument that the formulation needs to refer to administration of trust assets, but CalPERS itself regularly describes what it does in terms similar to the ones in the Writ of Mandate.

And how is the second sentence, that CalPERS must comply with California transparency laws not true? CalPERS obviously has to adhere to the Bagley-Keene Open Meetings Act; that’s why it provides meeting notices, publishes agendas and posts public meeting documents on its site. CalPERS further admitted rule by Bagley-Keene by having filed a regulation, as required, to limit public comments to three minutes. CalPERS has similarly admitted by its behavior that it is subject to the Public Records Act, otherwise it would blow off all request rather than engage in arm-wrestles over them. And CalPERS has lost and settled Public Records Act suits and been forced to cough up documents.

Similarly, the effort to deny that CalPERS has laws that apply only to CalPERS, and include transparency requirement, is absurd. CalPERS has it own 1348 page statute, the Public Employees Retirement Law. However, the germane transparency provision to the Jelincic filing is aCalPERS/CalSTRS specific Government Code provision.

CalPERS will presumably attempt to argue that the secret discussion of the suddenly departed Chief Investment Officer was kosher because it fell under a provision that allows personnel discussions to be relegated to closed session. But see paragraph 22 in the Jelincic filing:

22. Government Code § 11126(a)(1) allows public bodies to hold closed sessions to discuss a range of topics relating to personnel matters. However, this provision does not apply to discussions relating to the CalPERS CIO, which are expressly governed by a more-specific subdivision, § 11126(g)(1). This subdivision applies only to the CEOs and CIOs of CalPERS and of the Teacher’s Retirement Board. As relevant here, this statute allows the Board to meeting in closed session only “when considering matters pertaining to the recruitment or removal of the Chief Investment Officer of … the Public Employees’ Retirement System.” Id. § 11126(g)(1).

An ex-CIO that already removed himself isn’t entitled to personnel protections. Any discussion of the Meng apparent self-defenestration had to be held in open session.

Now CalPERS might again be attempting another hyper-technical argument, that the provision invoked in the Writ of Mandate applies to both CalPERS and CalSTRS, not just CalPERS. And I don’t have the time to plod through the PERL to see if and where it sets a higher disclosure standard than for other state agencies. But I would not bet against something being there.

Of course, CalPERS also denies Paragraph 22, with no explanation.

Just to give another of the pervasive examples of bad faith, CalPERS also denies that Betty Yee wrote a letter to the board, upset about the board having been kept in the dark about CalPERS investigating Meng’s conflict of interest and giving him a pass. This is Paragraph 30, which CalPERS denies:

30. Five days later, California State Controller and Board member Betty Yee wrote to Board President Henry Jones, raising concerns that Mr. Meng had violated conflict-of-interest laws.

This letter noted her deep disappointment “in the actions of former Chief Investment Officer

(CIO) Ben Meng and what appears to be a blatant disregard of conflict-of-interest laws and

policies.” Controller Yee requested an immediate special meeting to hear about and discuss

“potential violation of laws, adequacy of existing policies, safeguards that could prevent a recurrence of the situation, and the Chief Executive Officer’s oversight and implementation of

policies and safeguards.” A copy of this letter is attached to this Petition as Exhibit A.

Huh? How is this possibly not true?

Put it another way, it’s hard to see how CalPERS gets around its own bad admissions, which are a matter of public record. None other than CEO Marcie Frost said in a beneficiary meeting that she believed all of the concerns that Betty Yee had raised in the aforementioned letter had been addressed in the closed session. Covering all that terrain would go well beyond the meeting notice, which was all the board was permitted to discuss in private.

As for the real estate asset valuations, CalPERS lost a Public Records Act case over a real estate investment where the judge ruled that real estate was not a fancy-dancy alternative investment, even if made though a limited partnership, and therefore could not benefit from the higher secrecy protections granted to alternative investments.

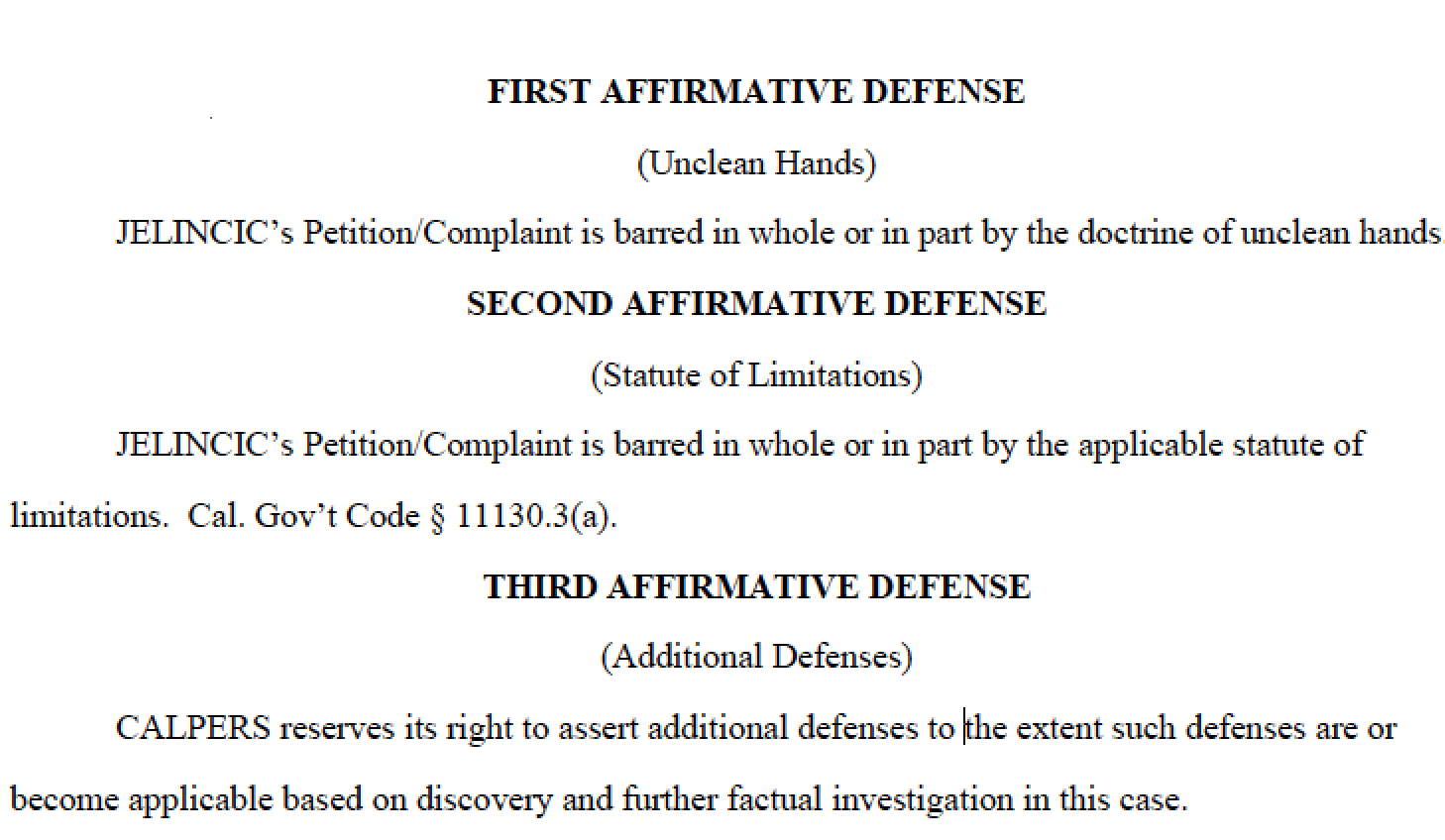

Rather than continue to belabor what is now obvious, let us turn to the affirmative defenses:

Just to make sure there is no misunderstanding, here is the California doctrine of unclean hands, courtesy Brown & Charonneau:

A plaintiff’s claim to recover under a quantum meruit theory is governed by principles of equity. Mains v. City Title Ins. Co. (1949) 34 Cal.2d 580, 586. In accordance with the maxim that no one can take advantage of his or her own wrong, those who seek the aid of equity must come into court in good faith. Samuelson v. Ingraham (1969) 272 Cal.App.2d 804. Any unconscionable conduct that relates to the transaction may give rise to the defense of unclean hands and bar relief. Id; Aguayo v. Amaro (2013) 213 Cal.App.4 1102, 1110 [any conduct that violates conscience, good faith or other equitable standards of conduct is sufficient to invoke the doctrine of unclean hands].

So how can Jelincic possibly have unclean hands? How could he possibly have been in a position to persuade Henry Jones to allow such wide of the meeting notice discussions to happen in the closed session at issue? And it’s not as if Jones is permissive; he quickly shut down objections over process by Betty Yee and Margaret Brown during the brief open session before the closed session. And how could Jelincic, as a board member who didn’t have an active staff role, possibly have had anything to do with the particularly of real estate writedowns (as if that were some sort of bad act on top of it?).

The second affirmative defenses is even more bizarre. California does have strict time limits on writs of mandates that seek to overturn government actions. You can’t implement new programs or laws if they might be overturned well down the road. Here’s the relevant section:

§ 11130.3. (a) Any interested person may commence an action by mandamus, injunction, or declaratory relief for the purpose of obtaining a judicial determination that an action taken by a state body in violation of Section 11123 or 11125 is null and void under this section. Any action seeking such a judicial determination shall be commenced within 90 days from the date the action was taken. Nothing in this section shall be construed to prevent a state body from curing or correcting an action challenged pursuant to this section.

Again, no where in his Writ of Mandate does Jelincic attempt to have declared null and void.

One has if this is an admission that when the transcript for the closed session is disclosed, that it will show that the board took a vote. That would be yet another closed violation, since the board is required to report out any vote taken in closed session immediately after. So CalPERS may be trying to falsely depict Jelincic as wanting to upend an improperly secret board action when Jelincic has pleaded no such thing.

The third affirmative defense is a lame effort to get Jelincic to rack up expenses by dealing with spurious discovery demands, presumably based on bogus unclean hands theories. I can’t imagine any savvy or fair minded judge would go for that.

And remember, CalPERS administers the pensions of California judges, so they are not likely to view shenanigans like covering up real estate losses with equanimity.

____

1 The text is identical to the filed version.

2 A filing like this is also most often seen as a supplemental document, to make crystal clear where the parties disagree, as opposed to the main and sole submission.

00 2021.03.08 filed JJJ v. CalPERS complaint and exhibs00 2021.04.28 CalPERS FINAL Answer

And so the game goes on while retirees pay the bill.

Can the judge throw the book at Calpers and tell them that this doc amounts to a contempt of court (in the “disrespectful” sense)? And/or similar “misuse of process” things?

Being by nature a helpful sort of guy, I have been giving serious thought how CalPERS could bail itself out of the hole that they have dug for themselves. Having deemed shovels to be of insufficient utility, I see that they are now going full excavator. They seemed determined to take this to court as they figure that it will cost Jelincic more, even if a judge is probably going to award him costs. I suppose that as far as the CalPERS Board is concerned, that is not a problem as it is not exactly going to come out of their own pockets. But I hope that they have spent as much money building up their legal department as they have their pr department.

So here is the thing. It goes to Court and CalPERS argues their case that they actually don’t have to follow the law because reasons. Now at this point a judge may wake up and say to themself that ‘Hey, my pension is tied up with these yahoos!’ At that point they might start calculating the legal costs of the case in front of them and wonder if that CaLPERS screws their pension up as badly as they are this court case, that they might spend their twilight years eating out of a tin of cat food out on Q Street somewhere. I hope that CalPERS has taken this into consideration.

So I have a solution. Take it to ‘Judge Judy’. No seriously. They might stand a better chance there. Maybe get themselves some good TV publicity and we all know that any publicity is always good, right? Of course this idea could backfire-

https://www.youtube.com/watch?v=ICZa2764LJI (4:21 mins)

um…

https://images.app.goo.gl/a5qTdZ38Kd9pd3keA

I think you might need a bigger bucket on that thing…

“The Ever Given will remain anchored in the Great Bitter Lake after an Egyptian court upheld a previous ruling on Tuesday preventing the ship from leaving the country. The court’s decision came from the city of Ismailia, the same court that initially approved the seizing of the vessel”

The Judge is the key, and it’s California.

There’s a lot of money and power involved, lots of quiet conversations taking place and in all likelihood once we know who the Judge is we’ll know the outcome.

Attorney General Bonta should be back from vacation reasonably soon and I’m sure he’ll seek the sage advice of his predecessor about getting involved.

As soon as he can find the time.

My thoughts, too. Mr. Jelincic is challenging deep pockets with political ties. I hope he wins.

Thanks to NC for continued reporting on CalPERS, pensions, and PE.

California Judges have their own pension fund. It is far less funded than CalPERS. I think I learned that from Mr. Jelincic himself.

Thank you again for being at the forefront of protecting Californians (and all people) from the looting class.

CalPERS administers the judges’ pension plans.

And I think you misunderstood Jelincic. The judges’ plans are very well funded. CalPERS’ stance prior to this suit it they don’t wan the judiciary thinking badly of them.

More detail. There is one plan that is technically severely underfunded but that’s because it is set up as pay as you go, not defined benefit. The defined benefit plans are super well funded (recall the main CalPERS funds are at about 70% funded). So CalPERS is taking exceptionally good care of the plans where the judges could consider CalPERS to have a role in its funded status. Specifically:

Judges Retirement System for judges appointed or elected before 11/9/94 is pay as you go and funded at 0.4%

Judges Retirement System II for judges appointed or elected on or after 11/9/94 is funded at 99.4%. The Legislative Retirement System for Senators and Members of the Assembly (first elected prior to November 7, 1990), Constitutional Officers (first elected prior to December 31, 2012), and Legislative Statutory Officers (first appointed prior to December 31, 2012).is funded at 116.8%

The unclean hands defense is very weird. So, they are saying that because Jelincic was on the board and technically participated in the illegal behavior, that Jelincic can’t sue for the board to correct the illegal behavior because that would let Jelincic somehow benefit from said illegal behavior when ti would seem that if the whole board at the time is accountable for said illegal behavior Jelincic is actually self-incriminating, and thus gets no benefit.

Are they arguing to rename themselves the CalPERS Borg? ( ‘He has been assimilated!’ ) / ;)

So all I want to know is this . . . presuming a bad actor at calPERS, a ‘person’ of flesh and blood has been responsible, are they liable? E.g. can calPERS claw back or otherwise go after their ass for money and damages when they lose?

—

Inquiring minds

No, the board members and key execs have fiduciary duty insurance….provided by CalPERS! Clearly illegal under CA law as we explained, not that anyone cares:

https://www.nakedcapitalism.com/2018/11/calpers-self-dealing-board-staff-grift-calpers-expense-via-grossly-underpriced-liability-waiver-fiduciary-self-insurance-policy-invalid-face-due-lack-reserves.html

This whole thing brought the Monty Python argument sketch to mind.

But of course he could be arguing in his spare time. :)

Follow the money…