Yves here. The fact that the rise in headline inflation is largely due to car prices and gas is striking.

By NewDealdemocrat. Originally published at Angry Bear

Let me start my take on this month’s inflation report with my concluding remarks last month: “this is not a big deal if it only lasts another month or two. But if the trend continues longer than that, it will begin to impact consumer spending, and it will get the Fed’s attention.”

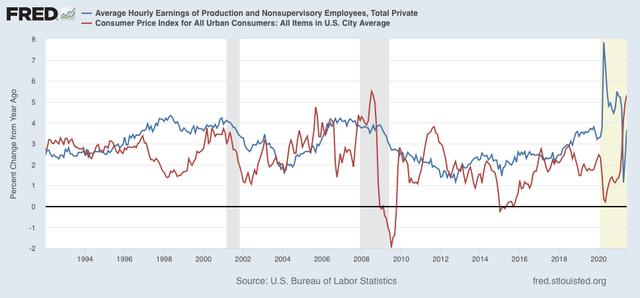

Well, it has definitely lasted another month. In spades. The 0.9% increase in June was the highest since June 2008’s 1.0% increase (driven by $4+ gas).(red in the graph below) More importantly, the 5.3% YoY increase is also the highest since summer 2008, and well in excess of the YoY average wage increase for nonsupervisory workers of 3.7% (blue):

This is going to get the Fed’s attention. They may not even wait another month.

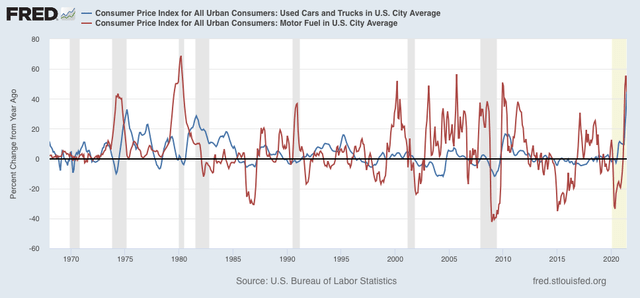

Be that as it may, the primary driver of this inflation is not wage increases, it is first and foremost a supply bottleneck in the production of new cars, which is driving insane demand for used cars (blue in the graph below), the prices of which are up 45.2% YoY. Secondarily it is the demand driven increase in gas usage, which has caused those prices to increase 44.8% YoY (red):

The spike in prices in used cars alone is responsible for about 1/3 of the total increase in prices last month. Used car prices, which are about 3.2% of the total weighting in the inflation index, rose 10.8% in just the past month! That nets out to over 0.3% of the total inflation number being just used cars.

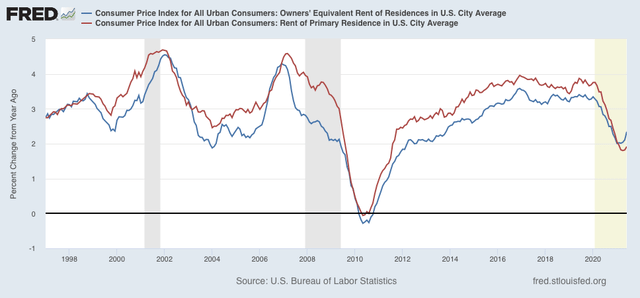

On the other hand, rent continues to be somnolent (as is “owners’ equivalent rent,” which is how the Census Bureau tries to measure house prices):

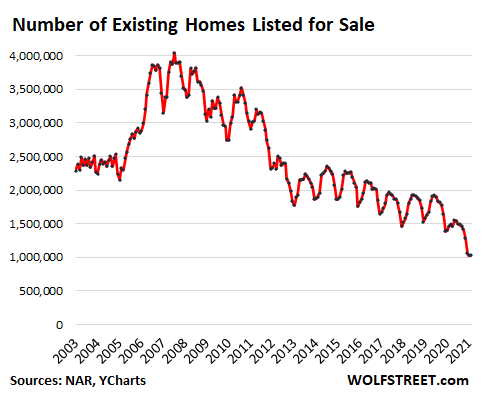

By the way, ultimately the house price spike has been driven by the fact that during the pandemic last year, existing homes placed on the market (which are about 90% of the typical housing market) declined precipitously compared with the typical year:

I expect both house prices and gas prices to work themselves out. Not only have home sales declined, but I expect most of the houses that were going to be placed on the market in 2020 to go to market over the next 12 to 24 months. This surge in existing home inventory is going to drive house prices down. Similarly, the travel bug from being cooped up at home during the pandemic is going to pass as well.

That leaves motor vehicles. As I wrote last month, I have no special insight into vehicle part supply chains, and in particular microchips, which have been fingered as a primary shortage.

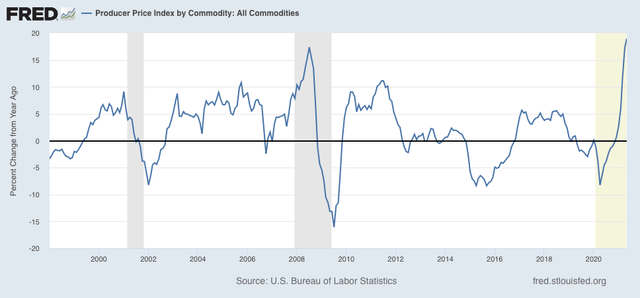

But, hypothetically, would the Fed raising rates do anything about that shortage? The answer seems a pretty clear “NO,” so why deliberately slow down the rest of the economy to deal with a bottleneck that is beyond their control?Beyond that, as I wrote last month, there have been a number of 10%+ spikes in commodity prices in the past several decades that were brief in nature and worked themselves out without causing a recession:

Ironically, the only way I can see the Fed “helping out” with inflation, is in the area of their “blind spot” – actual house prices. If they were to raise rates just enough to trigger an increase in mortgage rates of 0.5%-0.75%, which would serve to cool down the housing market in a very substantial way without necessarily causing the economy as a whole to stall.

Inflation indexes that include car rental prices, airfare, and insurance premiums should be taken out behind the barn and shot.

Let alone, that the Fed’s target is 2% inflation per year, and looking at those charts, they still have plenty of catching up to do for the last decade.

But creditors, and their friends in the press, never complain that inflation is under target, while assets are pumping. Especially when inflation is the de facto wealth tax of the “free market.”

I’m still waiting for the Fed to make up for the inflation overshoot of the 1970s…we remain well above our 2% target for the long-term. That’s too much of the regressive “inflation tax” for my taste.

It’s not just cars. I had to replace a washer last month and didn’t want to wait six months for a Maytag (about $900), so I bought a Speed Queen for $1,745.

in the bizarro world of the ivory tower, you have zero inflation as the Speed Queen, being commercial-grade, is $800 better than a retail-grade Maytag.

So you got what you paid for and the Fed sees nothing wrong with the world.

And top-loading washers v. front loaders deserve a whole post by itself

Wow. I bought a Speed Queen washer about five years ago and it was $600 including shipping. At least you are getting a reliable machine; mine has not had any problems. My neighbor got a lemon Maytag clothes washer at about the time that I bought my Speed Queen, and then she got a lemon Fisher & Paykel.

I think that if I were looking at $1,745 I would get a washboard and a tub.

A friend of mine makes six figures as an appliance repair man. Hard, hard work, but people need help with these machines.

Just a general comment from the other side of the Atlantic here is that I think there are still deflationary forces out there. A friend of mine was downtown shopping for herself and her kids clothes for the summer this weekend and she commented on how pleasantly surprised she was at how cheap everything was. Shops are obviously still trying to run down stock.

I have noticed thought that the price of eating out has gone up significantly, which I assume comes from restaurants trying to keep some sort of profit margin up (there is still outdoor dining only permitted here). I had a funny moment yesterday when I chatted with a local cafe owner I’m friendly with. She was telling me about an Italian place that she loved that has a great pannini – ‘but its 7 euro, so expensive!’ she said. She then looked a little embarrassed when she realised that she’d said that having just charged me 9 euro for a sandwich (I didn’t mind, it was delicious and it was sit down, not take-out).

Chinese domestic demand is still well below expectations (the huge nominal growth in GNP is still infrastructure focused) there is lots of spare capacity so it will not be a source of inflation – I suspect the same applies to all the export based economies in Asia which are all still trying hard to keep their factories going while doing little or nothing to stimulate their own consumer demands (i.e. give some money to regular people).

It is the same here with food and dining. I have to watch my costs closely so I see this more quickly than others. I feel the inflation was happening even a bit before the pandemic, as I mentioned to friends that I cloud not get a lunch for under $8 anywhere. Now I find that is $10. At least you do not have to deal with tipping as well. I have also noticed that tip jars (and the POS tip prompts) are everywhere now, and many in places where they should not be.

To me the car prices increases might be from more people having to live in them,. :)

I wonder about all the people who bought 100 shares of google for 8,500 ten years ago and now have $250,000 in”savings.” (Not that I’m bitter.) They might regard that as a lot of money and start spending it. And China’s new Silk Road is probably being paid for with US dollars. It sounds like regular inflation to me.

Will It draw the Fed’s attention? Maybe. The primary driver of this inflation may not be wage increases, but you can bet that there are more than a few people that will try to make it out to be so. And therefore, the way to dampen down this blip in inflation would be to take measures to tamp down wages. Having a situation where the plebs are refusing to work for the offered dog food or are just quitting en mass because of a combination of poor wages & poor conditions is not to be tolerated. And a rising inflation would be as good excuse as any other to worsen worker conditions. I’m sure that Larry Summers would agree with me.

From here it seems as if the wages have actually been increased via the stimulus spending.

Noticeably pawn shop inventory appears to be down, sale prices for used vehicles are quite steep ( try to buy a used PU truck), raw land prices are up.

Now that I’m permanently work from home, the used car/gas price increase is interesting. Since I no longer commute, any COLA keeping up with inflation gets banked.

Inflation is going to tax people who aren’t in white collar jobs like mine the hardest.

I am a little surprised at the durability of the “we’re out of chips, can’t make cars” story. There is a lot of semiconductor capacity out there, and there must be absolutely excruciating pressure on the normal channels to produce product.

Here’s a clip from a May 26 article on the shortage:

“The world biggest contract chip manufacturer, TSMC’s chairman Mark Liu was present at the annual general assembly of the Taiwan Semiconductor Industry Association as the chairman of the organization and told reporters, “We believe currently the total production capacity is still bigger than real market demand”, as quoted by the Nikkei Asia Review.”

And the link is here.

I believe if housing were put back into CPI as it once was, the FED would see reality – that it has far exceeded it’s “inflation” “target” and that inflation is in fact out of control and far over target and has been for some time.

Other factors not just it’s error in removing housing as a cost of living also suppress CPI below reality.

Also most inflation is in asset prices thus inflation is a transfer of wealth from non asset holder to asset holders. If the Fed actually cared about inflation, it would find a way to included stock market prices into the mix.

Yes housing, food, rent, fuel, and then my SS might be much improved.

Indeed. It seems to me that incorporating the Case-Schiller Index into the CPI would be a great improvement. While data on the repeat sales of single-family homes is somewhat limited, single-family homes are what families are typically looking for. The Gov sees housing not as a consumption need like food and clothing, but as a unit of wealth like stocks and bonds. So, when you buy a house (uh…get a mortgage) you have moved from the masses of the great unwashed to being a Standard American of the Wealth Accumulation Class. Congratulations and enjoy the asset bubble!

Or as credit gets cheaper force capital gains tax rates higher. That might do wonders for bubbles (as a starter)

I’m wondering about the coming supply chain shocks for food. Meat is still an issue due to accelerated buying then meat packing plants hit by COVID, and the China swine virus cull.

And I’m sure food is still impacted by all the shipping/transport bottlenecks.

Now there is drought in US and Brazil. coffee prices are already up. Worry about wheat and soy supplies.

I would assume that tapping the strategic petroleum reserve would tamper down the spike in fuel costs, although that’s obviously outside of the Fed’s domain.

I had an annoying conversation with a friend about this inflation since she read an article that said people on Social Security might get a big bump in COLA because of it. First, it really will just keeps cost in place so it is not like I am getting a reward or anything. And second, there is NO WAY they will allow a 6% in COLA on SS beneficiaries. They will weasel out of it somehow…

But now it has me thinking that it could act as sort of a infinitesimal stimulus.

Here’s a less optimistic view on inflation that I tend to side with a bit more than the “transitory” mindset:

https://wolfstreet.com/2021/07/15/this-temporary-inflation-is-turning-into-an-inflation-spiral/

One way to think about this might be: If you’re a CEO of a company right now, do you raise prices?

I think we should take out of the index the car and gas prices, people are working from home after all and dont need them.

Eventually if we factor out of the index all items rising in price, inflation will be quite low.

Krugman says there is no risk of inflation, I am not going to believe my lying eyes.

a bit off topic, but used car inflation is setting up many for future failure.

to get affordable cars, some ?/many? are forced to get higher mileage vehicles by neccesity. many models can easily last 2-300,000 miles with prudent maintenance, but many can’t. (and that is not counting those who stretch the budget for a car payment and have little left for an unexpcted repair)

and given borrowing, undoubtedly some will have negative equity on their loans.

will nor be a pretty sight, and i am not holding my breath for the media to cover it

Price of oil still looks to be inversely correlating with the strength of the dollar: https://fred.stlouisfed.org/graph/?g=Frpl

US dollar is getting weaker compared to other currencies since beginnning of this year. So the price of oil has gone up.

– Which suggests that our central bank is behind the other central banks when it comes to putting some limits on their respective punch bowls.

– Or it suggests that the stimulus spending in the US has resulted in consumer debt binging. Or debt binging by those closest to the Fed Gov feeding trough. I don’t believe that’s the case.

– Or it suggests the expectation that stimuls spending in the US will result in consumer debt binging. Perhaps, but then the 10Y yield is going down the last few months, which suggests the bond market doesn’t like what it’s seeing inflation-wise.

other than gasoline prices, which are 45.1% higher year over year, these are the items that are moving prices:

Among core line items, the price index for car and truck rental, which has now risen 87.7% from a year ago, the price index for used car and trucks, which is now up 45.2% from a year ago, the price index for vehicle insurance, which is up 11.3% year over year, the price index for airline fares, which is up 24.6% since last June, the price index for other intercity transportation, which is up 13.3% over the same span, the price index for men’s pants and shorts, which is still up 11.1% from a year ago, the price index for women’s dresses, which has risen by 15.5% over the past year, the price index for jewelry, which is now up 12.3% from a year ago, the price index for lodging away from home including at hotels and motels, which has now risen 16.9% in the past year, the price index for domestic services, which has risen 10.6% year over year, the price index for moving, storage, freight expense, which is up by 17.3% over the last 12 months, the price index for sewing machines, fabric and supplies, which has risen 13.3% year over year, the price index for laundry equipment, which is up 29.4% from last June, and the price index for living room, kitchen, and dining room furniture, which is up 10.8% year over year, have all seen prices rise by more than 10% over the past year, while the price index for telephone hardware, calculators, and other consumer information items, which is now down by 17.8% since last June, is the only core line item to have decreased in price by a double digit magnitude over that one year span….