By Jasmien De Winne, Head of Cooperation, Embassy of Belgium in Tanzania Affiliate Researcher, Department of Economics, Ghent University, and Gert Peersman Professor of Economics at the Department of Economics, Ghent University. Originally published at VoxEU.

The world is expected to see a significant rise in the frequency, duration, and intensity of extreme weather events. This column examines the macroeconomic effects of global food commodity price increases that are caused by global harvest and weather disruptions, and finds that the decline in economic activity is substantial and greater in advanced than in low-income countries. The findings suggest that the consequences of climate change for advanced countries may be greater than previously thought, and the strong rise in food prices since the outbreak of COVID-19 could seriously impede the recovery.

The Intergovernmental Panel on Climate Change (IPCC) projects a significant rise in the frequency, duration, and intensity of extreme weather events such as droughts, heatwaves and heavy rainfall (IPCC 2021). The direct local economic repercussions of such events are considered to be greater in low-income countries because these countries typically already have hotter climates, which implies that ecosystems are closer to their biophysical limits, and have less access to technology that can mitigate the consequences of extreme weather. Moreover, most low-income countries have very high shares of agriculture in economic activity, which is the most vulnerable sector to weather shocks (Nordhaus 2006, Dell et al. 2012, Noy 2012, Tol 2015, Cruz and Rossi-Hansberg 2021). Since poor countries have to bear the bulk of the climate change burden, it is often argued that this acts as a disincentive for rich economies to mitigate their greenhouse gas emissions (Althor et al. 2016).

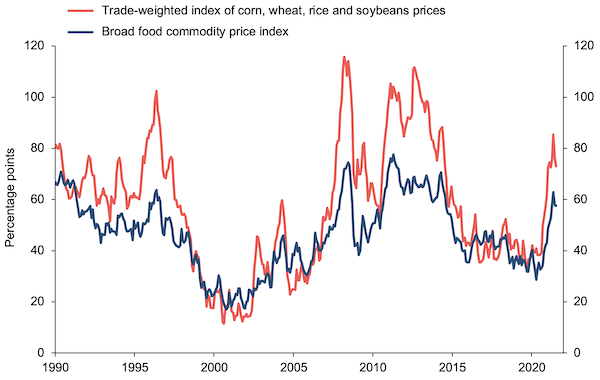

However, the rise in the frequency and intensity of severe weather events around the globe, as well as crop diseases and pests due to climate change, could also have an impact on the economic performance of countries that are not directly exposed to the extreme events through global agricultural production shortfalls and surges in food commodity prices. Specifically, since global production of the most important crops is concentrated in a small number of major producing regions that are vulnerable to extreme weather conditions, the IPCC projects greater risks of global food system disruptions and agricultural production shortfalls that trigger substantial rises in global food prices (IPCC 2019). Such food commodity market disruptions at the global level are not science fiction; extreme droughts in several major producing regions at the same time were, for example, the primary reason for the rise in the prices of the key staple food items in the second half of 2010 and summer of 2012 by 40% and 20%, respectively, which can be observed in Figure 1 (Barriopedro et al. 2011, De Winne and Peersman 2016). Studies conclude that an event that would have been called a 1-in-100 years extreme adverse global food production shock over the period 1951–2010 may become as frequent as 1-in-30 years before the middle of the century (Bailey et al. 2015).

Figure 1 Evolution of global real food commodity prices over time

Note: All prices are in US dollar and measured as 100 times the natural log of the index, deflated by US CPI. The broad food commodity price index is a trade-weighted average of benchmark prices for cereals, meat, seafood, vegetable oils, sugar, fruit, vegetables and dairy products. Data from the IMF.

Economic Consequences of Global Food Commodity Price Shocks

In De Winne and Peersman (2021a), we examine the impact of disruptions in global food commodity markets on the economic activity of 75 advanced and developing countries. For each country, we have estimated the effects of changes in global food commodity prices that were caused by harvest disruptions and by weather shocks that occurred in other regions of the world. The harvest disruptions are unanticipated shocks to the aggregate harvest volumes of the four most important staple food commodities: corn, wheat, rice, and soybeans. The weather shocks are deviations of agricultural-weighted global weather conditions (i.e. a quadratic in average temperature as well as total precipitation weighted by grid-level agricultural output and crop calendars) from their historical averages and long-term trend. For each country, we only look at shocks that occurred in other regions of the world to measure the macroeconomic effects via global food commodity markets rather than direct effects of extreme weather on local economic activity.

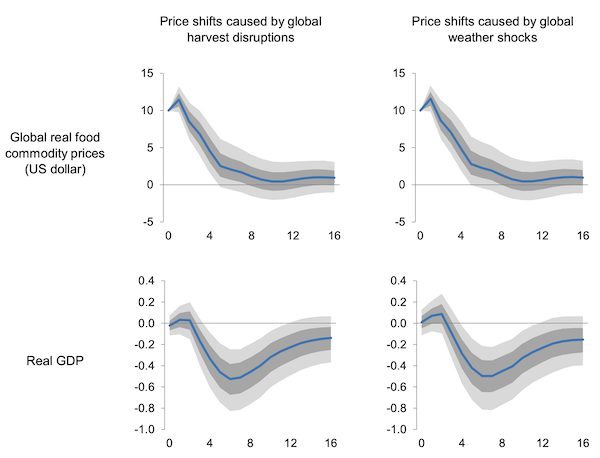

Figure 2 shows the average responses of economic activity in all 75 countries to a 10% increase in global food commodity prices caused by both types of shocks. The dynamic effects turn out to be very similar for both sources of food price shifts; that is, real GDP reaches a maximum decline of 0.53% after six quarters. This impact is considerable since extreme weather has triggered several price shifts of more than 10% and up to 30% in the past. The results also suggest that the strong rise of global food commodity prices in recent periods (see Figure 1) could impede the post-covid recovery.

Figure 2 Dynamic responses to a 10% increase in global food commodity prices

Note: the price shift is at period 0, while all other determinants are kept constant. Horizon of the responses (x-axis) is quarterly. 68 and 95% confidence intervals. The first column isolates, for each country, price changes that are caused by unfavorable harvest disruptions in other regions of the world, and the second column price changes caused by weather shocks in other regions of the world. Results are based on 75 advanced and developing countries, covering the period 1970Q1-2016Q4. Source: De Winne and Peersman (2021a).

We further find that several indicators of (expected) global economic activity decline as a consequence of the food commodity market disruptions, whereas consumer prices increase significantly. In related research, De Winne and Peersman (2016) and Peersman (forthcoming) show for the US and euro area, respectively, that food commodity price surges have an impact on food retail prices through the food production chain, but also trigger indirect inflationary effects via rising wages and exchange rate shifts. In addition, households do not only reduce food consumption – that is, there is even a much greater decline of durable consumption and investment. The latter is partly the consequence of the monetary policy response to stabilise the inflationary consequences. Overall, the macroeconomic effects turn out to be a multiple of the maximum impact implied by the share of food commodities in the consumer price index and household consumption.

Differences between Rich and Poor Countries

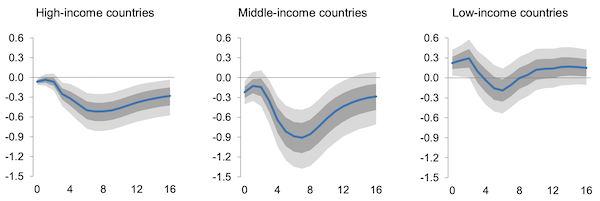

Figure 3 reveals that high- and middle-income countries are much more affected by global food commodity price shifts that are caused by harvest and/or weather shocks elsewhere. Real GDP in these two groups of countries declines by 0.52% and 0.91%, respectively, whereas the peak decline in low-income countries is only 0.19% and statistically insignificant.

Figure 3 Effects of global food commodity price increases in advanced versus poor countries

Note: Results for 10% price shifts caused by unfavourable harvest disruptions in other regions of the world. 68 and 95% confidence intervals. High-income countries are the top-tertile (top-25) of countries according to PPP-adjusted real GDP per capita over the period 2000-2015. Low-income countries are the bottom tertile (51-75) and middle-income countries are the remaining countries (26-50). Source: De Winne and Peersman (2021a).

The stronger effects in advanced economies are surprising, since the share of food (commodities) in household expenditures is much lower than in low-income countries. Moreover, since high-income countries typically have more effective government institutions, it is less likely that food price increases trigger conflicts that are detrimental for economic activity, such as food riots (De Winne and Peersman 2021b). Finally, advanced countries have better developed financial markets to absorb income shocks.

It turns, however, out that these favourable characteristics are offset by a number of less advantageous features. First, we find that the macroeconomic repercussions are weaker in countries that are net exporters of agricultural products, which can be explained by a favourable terms of trade effect. In addition, we document a more subdued decline of real GDP in countries that have higher shares of agriculture in economic activity, which is likely the consequence of the fact that these countries are more isolated from changes in global prices because more households are self-sufficiency farmers and a lot of agricultural products are traded on local markets only due to higher transportation costs in rural areas. Finally, we find weaker effects in countries that have lower shares of non-agricultural trade in GDP; that is, countries that are less integrated with the rest of the world via trade are also less sensitive to the global economic downturn caused by the rise in food commodity prices.

The favourable characteristics, which typically apply to low-income countries, can explain the weaker overall effects in low-income countries. In particular, once we control for these country characteristics in a panel regression, we find that the decline of economic activity becomes smaller when income per capita is higher.

Conclusion

There will be more frequent and greater downturns in economic activity compared to a ‘no climate change’ scenario through increases in global food commodity prices that are the consequence of extreme weather events in major agricultural production regions, such as droughts and heatwaves. In contrast to common perception (e.g. Financial Times 2021, Espitia et al. 2020), the macroeconomic repercussions of increases in global food prices are greater in advanced economies than in low-income countries. This suggests that the consequences of climate change on advanced countries may be greater than previously thought. This also implies that we need a more nuanced debate on the welfare effects of higher food prices, as earlier argued by Headey (2011) and Hertel and Rosch (2011).

Finally, swings in global food prices appear to be important for economic activity in many countries. The strong rise of global food commodity prices since the outbreak of COVID-19 could thus seriously impede the recovery.

So, this how reality will intrude on the carefully constructed fictions we call “markets”.

Our current “market” sustaining mechanisms of shoveling money by the ton to those who don’t need it while letting what paltry funds are fiscally allocated to the needy to go unspent will break down in the face of real resource price inflation.

It will be interesting to see how our betters choose to manage these real-world feedbacks, not easily subject to messaging.

get out of free trade. its a disaster, always has been, always will be. let the third world countries go back to their own production and agriculture. many of them used to be able to feed themselves.

this will help cut down on all of the emissions from shipping.

I agree. Every country should try to be self-sufficient and should ignore those countries coming in to create plantations of food for the empire countries while the servicing country has difficulty producing food self-sufficiency for itself. Take NAFTA which is set up to trade with a high-producing country and a middle-producing country and a low-producing country where incomes are not equal. The low income country can supply cheap labour to the high- and middle-income countries while the high-income country can put pressure on the middle-income country to give it a market share to increase its access to foreign markets. It would be better if each country had its own market for self sufficiency and whatever was surplus could be shared with the other countries but the country sharing should choose what products it wants to share without being threatened with tariffs or sanctions.

United Fruit and the marines are hard to ignore.

Perhaps we should go from “ignore” to ” crush, destroy and expel”. But that is hard for a little country like Guatemala to do when the private plantationeer has a powerful backer over the horizon.

This post views the world economy through a strange lens. Somehow worry about the economic repercussions of crop failures in crops like corn, wheat, rice, and soybeans seems misplaced. And measuring economic repercussions in terms of GDP is sure to minimize considerations of human desperation. The levels of abstraction visible through a lens of “shares of agriculture in economic activity” nicely avoids considerations of the shares of what crops compose regional agricultures. Low-income countries where globalization has specialized their agriculture to produce bananas, cocoa, coffee, avocados, flowers, …” for export, will have trouble telling their people to eat cake.

I especially like this sentence from the post: “Moreover, since high-income countries typically have more effective government institutions, it is less likely that food price increases trigger conflicts that are detrimental for economic activity, such as food riots.” I suppose food riots might be “detrimental for economic activity” but that is hardly the first or greatest concern that comes to my mind. If only I were an economist I might salve my concerns about Climate Chaos by worrying about GDP and conflicts that are detrimental for economic activity and similar abstractions.

You kind of knew it was going to go there when the first chart about disruption of food supply was bloody prices – not actual supplies, or harvests, or anything immediately relevant to the physical mechanisms that create food, but prices.

i’ve been watching global production stats for staple foods for years and they continue to rise with little fluctuation…whatever might be influencing prices, it’s not the planet’s ability to produce crops…

you might find some of the answers you seek here, a story which, by way of context, I found linked in this Bill Mitchell op-ed

FTA:”Studies conclude that an event that would have been called a 1-in-100 years extreme adverse global food production shock over the period 1951–2010 may become as frequent as 1-in-30 years before the middle of the century”

i reckon this is blissful delusion…it will happen with increasing frequency…and is likely to go hockey stick in short order, once it begins.

and this caveat, further down:”…The stronger effects in advanced economies are surprising, since the share of food (commodities) in household expenditures is much lower than in low-income countries. Moreover, since high-income countries typically have more effective government institutions, it is less likely that food price increases trigger conflicts that are detrimental for economic activity, such as food riots (De Winne and Peersman 2021b). Finally, advanced countries have better developed financial markets to absorb income shocks.”

what planet are we talking about, again?

as cynical as i feel about all this(Doom, she cried…)…it’s of the utmost importance.

as i said earlier, the milk truck didn’t come to our one town last week(tuesday is milk truck day)…and the town is out of milk.

In the big middle of Texas.

it’s closer than anyone likes to think.

add in my own anecdotes, over the last 2 years…about herbicidal manure, weird weather effecting just about every veggie crop i grow, and the ongoing (but better this year) multiyear grasshopper plague…and…it’s coming.

it’s not science fiction, like they say…but it’s much worse than all this academic obfuscatory twaddle can convey.

civilisation is on the edge, and there’s no wiggle room…because that didn’t funnel enough wealth upwards.

and…regarding our milk problem…i’ll be 53 next week…and it was in my lifetime that there were local dairies practically everywhere i went, from central texas to georgia(sticking to the blue highways(leatheatmoon)).

robust, like a field of weeds and grass and flowers…compared to the monocropped genetically homogenous corn or soy field

it will turn out that farming is a noble calling after all.

once the precarious cartel/monopoly system fails.

i’ll take yer labor for food.

it’s why we’re building a bunkhouse.

Your way with words is always compelling.

I am not sanguine.

Same here re the local dairies, and I didn’t even grow up in North America but rather in Hawai‘i. Unfathomable to think that the Islands were once home to 160 dairies.

https://www.civilbeat.org/2018/12/once-thriving-hawaii-dairy-industry-is-on-the-brink-of-extinction/

So many trends I used to think were just sad, I now view as plain evil.

caucus99percenter

When we moved to Salt Spring Island in 1980, there was a local dairy–on an island of about 5-6 thousand at the time. It was closed when the owners retired, because it no longer met the “new standards” of millions in sanitizing equipment. The same happened 15 years later when we were living in Nova Scotia–the closing of the small factory making the best yogurt I ever tasted because of new millionaire corporatized guidelines for production.

We kept goats when we lived on Salt Spring Island, and “gave” some of the milk to a friend and neighbour–in exchange for donations–whose biracial sons were lactose intolerant. Selling was illegal, you see. I’ve seen small slaughterhouses closed on both east and west coast, because of rules design specifically to close them in favour of trans-national mega operators, driving small farmers out of business; indeed, driving whole provinces out of business in animal husbandry. Our free-enterprise governments favoured the US model–gigantism.

Fortunately, push-back has eventually brought back some small animal slaughter and processing, and small farmers are getting together to build and run their own produce processing and delivery as well. Not nearly enough yet, but a beginning.

“leatheatmoon”? I do not understand.

sorry, fangers slower/clumsier than my noggin

William Least-Heat-Moon…referencing yet another book my mom regrets leaving laying around the house when i was a kid:

https://en.wikipedia.org/wiki/Blue_Highways

when my own epic crisis arrived, when i was 18-19, i remembered that book and hit the road.

it was only then that i discovered Kerouac, et alia.

I’m guessing least heat moon

Thanks, y’all.

some of the comments here, especially in reply to Amfortas, touch on the fact that although a country like the US should theoretically be food independent, it currently isn´t so much. Similar to the comment about all the dairy activity that has left Hawai’i or the milk lacking in the middle of Texas (are you in the cattle region? I’m in the Austin area myself) — my native rural Iowa and other similarly situated places have a lot of food deserts, right in the middle of what is supposedly the world’s ag heartland. Huge amounts of corn and soybeans are produced for processing, not for consumption. It’s the miracle of comparative advantage. When the plug gets yanked on the transportation network, they will be almost as bad off down on the farm as Manhattan will be, I fear.

Probably the least badly off areas will be those big towns and small cities which have a customer base willing to pay shinola prices for shinola food. That willingness to pay will support a rising number of minifarmers and microfarmers settling into a ring-zone around the shinola customer base town or city.

Also, if the suburbistans around and just beyond those towns and cities decide to devote themselves to intensive horticulture in their yards, that will enhance food-shock security in those towns and cities.

It is beginning to happen in my university city of Ann Arbor.

Maybe the scattered remnants of Occupy Wall Street could start Occupy the Food Supply and see where they can take it.

Occupy the Food Supply or Occupy Your Food or some other catchy title-of-intent.

People who can mormonize their food supply should start doing so, individually, at the family level, at the community level, etc. in a speedy and thorough way.

i don’t have the links to hand, but the Mormon Church used to maintain a pretty comprehensive, and free, website regarding all things Prepping…from canning to other food storage to digging a well and on and on.

very useful site, as i recall.

i used it back at the beginning as one of the models for my autarky doins—Amish are another bunch that are relatively on top of all that sort of thing…but they are less extroverted about it.

(although Lehmann Brothers has quality stuff along those lines…i got a few lanterns and a cast iron hand pump from them…and are friendly and a lot less introverted than the handful of Amish and Menonites I’ve known)

Sooner or later, the CVBB is gonna be hit with 130 degree temps judging from other instances of heat domes this summer, and most all of the dairies in Cali are here, and that’s not where you’d want to be in a CAFO lot, 4 legs not good.