Yves here. I really wish Elon Musk was not as successful as he is in getting so much media attention that he can’t be avoided unless you limit your Web surfing to non-stop cat videos. So as much as part of me does not want to add to his clippings file, this debunking is a welcome relief.

By Tim O’Reilly, the founder and CEO of O’Reilly Media Inc. His original business plan was simply “interesting work for interesting people,” and that’s worked out pretty well. He publishes books, runs conferences, invests in early-stage startups, urges companies to create more value than they capture, and tries to change the world by spreading and amplifying the knowledge of innovators. Twitter: @timoreilly. Originally published at Evonomics

At one point early this year, Elon Musk briefly became the richest person in the world. After a 750% increase in Tesla’s stock market value added over $180 billion to his fortune, he briefly had a net worth of over $200 billion. It’s now back down to “only” $155 billion.

Understanding how our economy produced a result like this—what is good about it and what is dangerous—is crucial to any effort to address the wild inequality that threatens to tear our society apart.

The Betting Economy Versus the Operating Economy

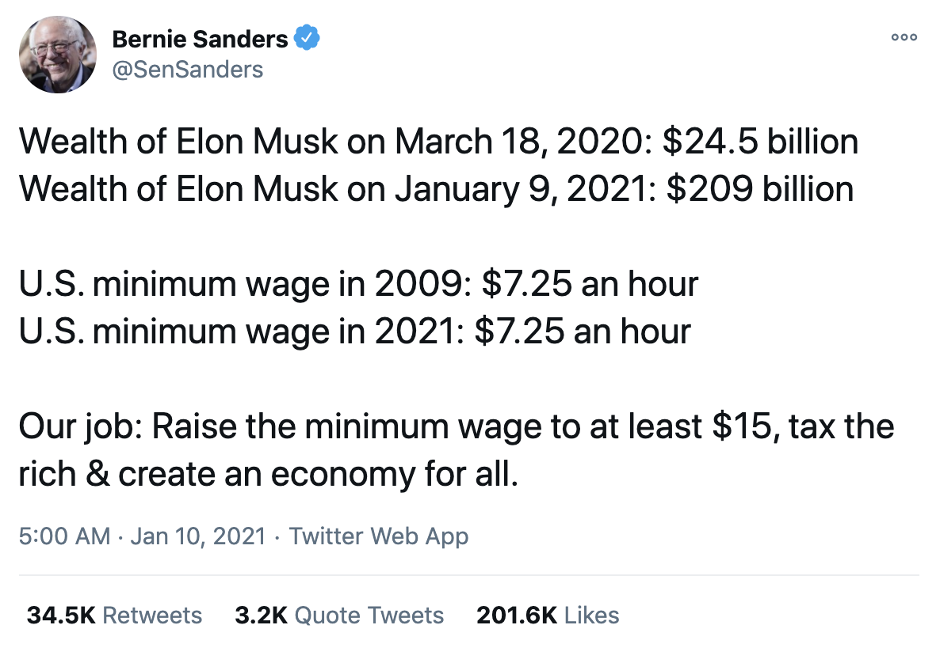

In response to the news of Musk’s surging fortune, Bernie Sanders tweeted:

Bernie was right that a $7.25 minimum wage is an outrage to human decency. If the minimum wage had kept up with increases in productivity since 1979, it would be over $24 by now, putting a two-worker family into the middle class. But Bernie was wrong to imply that Musk’s wealth increase was at the expense of Tesla’s workers. The median Tesla worker makes considerably more than the median American worker.

Elon Musk’s wealth doesn’t come from him hoarding Tesla’s extractive profits, like a robber baron of old. For most of its existence, Tesla had no profits at all. It became profitable only last year. But even in 2020, Tesla’s profits of $721 million on $31.5 billion in revenue were small—only slightly more than 2% of sales, a bit less than those of the average grocery chain, the least profitable major industry segment in America.

No, Musk won the lottery, or more precisely, the stock market beauty contest. In theory, the price of a stock reflects a company’s value as an ongoing source of profit and cash flow. In practice, it is subject to wild booms and busts that are unrelated to the underlying economics of the businesses that shares of stock are meant to represent.

Why is Musk so rich? The answer tells us something profound about our economy: he is wealthy because people are betting on him. But unlike a bet in a lottery or at a racetrack, in the vast betting economy of the stock market, people can cash out their winnings before the race has ended.

This is one of the biggest unacknowledged drivers of inequality in America, the reason why one segment of our society prospered so much during the pandemic while the other languished.

What Are the Odds?

If the stock market is like a horse race where people can cash out their bets while the race is still being run, what does it mean for the race to finish? For an entrepreneur or an early-stage investor, an IPO is a kind of finish, the point where they can sell previously illiquid shares on to others. An acquisition or a shutdown, either of which puts an end to a company’s independent existence, is another kind of ending. But it is also useful to think of the end of the race as the point in time at which the stream of company profits will have repaid the investment.

Since ownership of public companies is spread across tens of thousands of people and institutions, it’s easier to understand this point by imagining a small private company with one owner, say, a home construction business or a storage facility or a car wash. If it cost $1 million to buy the business, and it delivered $100,000 of profit a year, the investment would be repaid in 10 years. If it delivered $50,000 in profit, it would take 20. And of course, those future earnings would need to be discounted at some rate, since a dollar received 20 years from now is not worth as much as a dollar received today. This same approach works, in theory, for large public companies. Each share is a claim on a fractional share of the company’s future profits and the present value that people put on that profit stream.

This is, of course, a radical oversimplification. There are many more sophisticated ways to value companies, their assets, and their prospects for future streams of profits. But what I’ve described above is one of the oldest, the easiest to understand, and the most clarifying. It is called the price/earnings ratio, or simply the P/E ratio. It’s the ratio between the price of a single share of stock and the company’s earnings per share (its profits divided by the number of shares outstanding.) What the P/E ratio gives, in effect, is a measure of how many years of current profits it would take to pay back the investment.

The rate of growth also plays a role in a company’s valuation. For example, imagine a business with $100 million in revenue with a 10% profit margin, earning $10 million a year. How much it is worth to own that asset depends how fast it is growing and what stage of its lifecycle it is in when you bought it. If you were lucky enough to own that business when it had only $1 million in revenue and, say, $50,000 in profits, you would now be earning 200x as much as you were when you made your original investment. If a company grows to hundreds of billions in revenue and tens of billions in profits, as Apple, Microsoft, Facebook, and Google have done, even a small investment early on that is held for the long haul can make its lucky owner into a billionaire. Tesla might be one of these companies, but if so, the opportunity to buy its future is long past because it is already so highly valued. The P/E ratio helps you to understand the magnitude of the bet you are making at today’s prices.

The average P/E ratio of the S&P 500 has varied over time as “the market” (the aggregate opinion of all investors) goes from bullish about the future to bearish, either about specific stocks or about the market as a whole. Over the past 70 years, the ratio has ranged from a low of 7.22 in 1950 to almost 45 today. (A note of warning: it was only 17 on the eve of the Great Depression.)

What today’s P/E ratio of 44.8 means that, on average, the 500 companies that make up the S&P 500 are valued at about 45 years’ worth of present earnings. Most companies in the index are worth less, and some far more. In today’s overheated market, it is often the case that the more certain the outcome the less valuable a company is considered to be. For example, despite their enormous profits and huge cash hoards, Apple, Google, and Facebook have ratios much lower than you might expect: about 30 for Apple, 34 for Google, and 28 for Facebook. Tesla at the moment of Elon Musk’s peak wealth? 1,396.

Let that sink in. You’d have had to wait almost 1,400 years to get your money back if you’d bought Tesla stock this past January and simply relied on taking home a share of its profits. Tesla’s more recent quarterly earnings are a bit higher, and its stock price quite a bit lower, so now you’d only have to wait about 600 years.

Of course, it’s certainly possible that Tesla will so dominate the auto industry and related energy opportunities that its revenues could grow from its current $28 billion to hundreds of billions with a proportional increase in profits. But as Rob Arnott, Lillian Wu, and Bradford Cornell point out in their analysis “Big Market Delusion: Electric Vehicles,” electric vehicle companies are already valued at roughly the same amount as the entire rest of the auto industry despite their small revenues and profits and despite the likelihood of more, rather than less, competition in future. Barring some revolution in the fundamental economics of the business, current investors are likely paying now for the equivalent of hundreds of years of future profits.

So why do investors do this? Simply put: because they believe that they will be able to sell this stock to someone else at an even higher price. In times where betting predominates in financial markets, what a company is actually worth by any intrinsic measure seems to have no more meaning than the actual value of tulips during the 17th century Dutch “tulip mania.” As the history of such moments teaches, eventually the bubble does pop.

This betting economy, within reason, is a good thing. Speculative investment in the future gives us new products and services, new drugs, new foods, more efficiency and productivity, and a rising standard of living. Tesla has kickstarted a new gold rush in renewable energy, and given the climate crisis, that is vitally important. A betting fever can be a useful collective fiction, like money itself (the value ascribed to pieces of paper issued by governments) or the wild enthusiasm that led to the buildout of railroads, steel mills, or the internet. As economist Carlota Perez has noted, bubbles are a natural part of the cycle by which revolutionary new technologies are adopted.

Sometimes, though, the betting system goes off the rails. Tesla’s payback may take centuries, but it is the forerunner of a necessary industrial transformation. But what about the payback on companies such as WeWork? How about Clubhouse? Silicon Valley is awash in companies that have persuaded investors to value them at billions despite no profits, no working business model, and no pathway to profitability. Their destiny, like WeWork’s or Katerra’s, is to go bankrupt.

John Maynard Keynes, the economist whose idea that it was essential to invest in the demand side of the economy and not just the supply side helped bring the world out of the Great Depression, wrote in his General Theory of Employment, Interest and Money, “Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.”

In recent decades, we have seen the entire economy lurch from one whirlpool of speculation to another. And as at the gambling table, each lurch represents a tremendous transfer of wealth from the losers to the winners. The dot-com bust. The subprime mortgage meltdown. Today’s Silicon Valley “unicorn” bubble. The failures to deliver on their promises by WeWork, Katerra, and their like are just the start of yet another bubble popping.

Why This Matters

Those at the gaming table can, for the most part, afford to lose. They are disproportionately wealthy. Nearly 52% of stock market value is held by the top 1% of Americans, with another 35% of total market value held by the next 9%. The bottom 50% hold only 0.7% of stock market wealth.

Bubbles, though, are only an extreme example of a set of dynamics that shape our economy far more widely than we commonly understand. The leverage provided by the betting economy drives us inevitably toward a monoculture of big companies. The local bookstore trying to compete with Amazon, the local cab company competing with Uber, the neighborhood dry cleaner, shopkeeper, accountant, fitness studio owner, or any other local, privately held business gets exactly $1 for every dollar of profit it earns. Meanwhile, a dollar of Tesla profit turns into $600 of stock market value; a dollar of Amazon profit turns into $67 of stock market value; a dollar of Google profit turns into $34, and so on. A company and its owners can extract massive amounts of value despite having no profits—value that can be withdrawn by those who own shares—essentially getting something for nothing.

And that, it turns out, is also one underappreciated reason why in the modern economy, the rich get richer and the poor get poorer. Rich and poor are actually living in two different economies, which operate by different rules. Most ordinary people live in a world where a dollar is a dollar. Most rich people live in a world of what financial pundit Jerry Goodman, writing under the pseudonym Adam Smith, called “supermoney,” where assets have been “financialized” (that is, able to participate in the betting economy) and are valued today as if they were already delivering the decades worth of future earnings that are reflected in their stock price.

Whether you are an hourly worker or a small business owner, you live in the dollar economy. If you’re a Wall Street investor, an executive at a public company compensated with stock grants or options, a venture capitalist, or an entrepreneur lucky enough to win, place, or show in the financial market horse race, you live in the supermoney economy. You get a huge interest-free loan from the future.

Elon Musk has built not one but two world-changing companies (Tesla and SpaceX.) He clearly deserves to be wealthy. As does Jeff Bezos, who quickly regained his title as the world’s wealthiest person. Bill Gates, Steve Jobs, Larry Page and Sergey Brin, Mark Zuckerberg, and many other billionaires changed our world and have been paid handsomely for it.

But how much is too much? When Bernie Sanders said that billionaires shouldn’t exist, Mark Zuckerberg agreed, saying, “On some level, no one deserves to have that much money.” He added, “I think if you do something that’s good, you get rewarded. But I do think some of the wealth that can be accumulated is unreasonable.” Silicon Valley was founded by individuals for whom hundreds of millions provided plenty of incentive! The notion that entrepreneurs will stop innovating if they aren’t rewarded with billions is a pernicious fantasy.

“Deserve” is more of a value judgment than I would want to make, but yes, there is definitely a difference between an actual innovator and someone who made a lot of money as a hedge fund manager, etc. At least Musk, Bezos, etc. are using some of their wealth to try to advance commercial space technologies that may benefit society generally. The billionaires (or faux billionaire grifters) who cause the most harm are not linked to innovation.

If you think Elon isn’t a grifter, I suggest listening to the multi-part series about him on the True Anon podcast. He’s much, much more of a con-man than an “innovator.”

At least in part is not the con (or”business model”) the ability to access the government trough (being subsidized with public funds) to finance r&d etc? Chomsky’s “pentagon system” re the internet or the iPhone in which every bit of technology was paid for with “taxpayer money” and the technology privatized to be sold back to us a second time. Ditto about 90% of big pharma’s most important drugs, big ag, on and on, now including education via charter schools and vouchers. Other more recent examples include AI, driverless cars, space travel etc. Socialize the costs, privatize the profits. The biggest American neoliberal lie is that communist China is a state run economy while ours is a free market economy. As the writer states, financialization and speculation beget monopoly and bigness ain’t free for those living in the “dollar economy”.

I was going to recommend this as well. Benefiting society has never been a concern of his.

Agree! Much more of a con-man than an “innovator.”

Please elaborate on how society is supposed to benefit from Musk and Bezos going to space. Knowing Bezos, all we’ll ever get is probably more advanced “spying” gadgets. Musk’s “self driving” tech has killed quite a few people gullible enough to trust his claim that the technology works. If that’s a preview of his upcoming “innovations”, then I think society is better off without them.

https://www.nbcnews.com/news/us-news/crash-victim-had-posted-videos-riding-tesla-autopilot-n1267510

He isn’t Superman – but he is Homelander

https://twitter.com/electroncomm/status/1357691004371955713?s=21

While it is true that Musk’s wealth didn’t explode because his Tesla salary is extractive of Tesla employees, but Tesla’s stock price didn’t move up 750% because all other stocks declined it jumped in part because of all the money sloshing around in financial markets. Where did that money come from? Sure some from unspent covid stimulus, but mostly from the top 1%-5% who do collected billions in extractive salaries and bonuses from their workers. So in the end Musk’s big jump in wealth did indirectly come from the exploitation of workers.

How much of the money being gambled in the stock market is imaginary money invented by the FedResBank ( and other such?)to buy “assets” with? And then injected into the stock market economy?

Why is he selling his RE portfolio is another question … because land … they don’t make it anymore thingy …

Publicity, anything to keep people talking about him

From a investment perspective this means, in most cases, a need[cry] for liquidity and a heightened PR salvo to keep the unwashed churn rolling over or experience a personal Minsky moment …

When the CIA is your godfather, all things are possible.

Getting something for nothing

The great sore spot in our modern commercial life is found on the speculative side. Under present laws, which foster and encourage speculation, business life is largely a gamble, and to “get something for nothing” is too often considered the keynote to “success”. The great fortunes of today are nearly all speculative fortunes; and the ambitious young man just starting out in life thinks far less of producing or rendering service than he does of “putting it over” on the other fellow. This may seem a broad statement to some: but thirty years of business life in the heart of American commercial activity convinces me that it is absolutely true.

If, however, the speculative incentive in modern commercial life were eliminated, and no man could become rich or successful unless he gave “value received” and rendered service for service, then indeed a profound change would have been brought in our whole commercial system, and it would be a change which no honest man would regret.- John Moody, Wall Street Publisher, and President of Moody’s Investors’ Service. Dated 1924

You want to know the real reason Musk plans to go to Mars?

.

.

.

.

He plans to corner the supply of red kryptonite

~~~~~~~~~~~~~~~~~

I’ve mentioned it previously, but Musk bears a lot of resemblance to the ‘Match King’, Ivar Kreuger-who also had his finger in a lot of pies. They both sport odd first names as an added bonus.

Kreuger committed suicide @ 52 when his schemes unraveled, Musk is now 50.

https://en.wikipedia.org/wiki/Ivar_Kreuger

If I’m not mistaken, Tesla has never made profit from manufacturing cars. They are only in the black because of carbon credits (i.e. taxpayer money). Of course Nancy Pelosi owns $1 million worth of Tesla stock options.

Oh yes. And get this, they’ve been selling carbon credits (ZEV credits, I believe they’re called) for vehicles that have been pre-ordered but not manufactured yet. Pretty good scam, if you can pull it off…and as Michael points out, with the proper connections, all things are possible.

‘Elon Musk has built not one but two world-changing companies (Tesla and SpaceX.) He clearly deserves to be wealthy. As does Jeff Bezos, who quickly regained his title as the world’s wealthiest person. Bill Gates, Steve Jobs, Larry Page and Sergey Brin, Mark Zuckerberg, and many other billionaires changed our world and have been paid handsomely for it.’

Seriously? The author believes this? He may say that they changed the world have been paid handsomely for it but I think that the truth of the matter is that it is the world that has paid handsomely for their “success.” Sorry but if you took the whole lot of them out the back and shot them, the stock market would have a wobble – and then the world would move on. People see their billions but when I see those names, I see different things. I see slave/worker conditions, monopolies running riot, the surveillance state, the death of privacy, starving African farmers, a borked pandemic response, dysfunctional & cruel personalities and the conversion of democracies into oligarchies. Other people’s mileage may vary.

Who knows what Tim O’Reilly believes? He’s stating a belief that’s so widely held it’s barely debatable.

But both Tesla and SpaceX are products of government subsidies, products that these subsidies are supposed to produce. If it hadn’t been Musk, it would have been somebody else. But Musk has done a superb job of branding and promoting so that he and those two company names are now the holy trinity of the coming techno-libertarian utopia. Fake it til you make it.

To be fair I believe that he only said that they deserve to be wealthy to the tune of a few hundred millions at most. That is still a lot of cash, but Musk and Gates and Bezos did do some useful stuff een though they also did a lot f terrible stuff.

He objects to the hundreds of billions which in fact are the cause of the problem. one $ one vote.

You can have Gates and maybe Bezos but not Musk. I suspect we’d be a lot farther down the EV road if that maniac hadn’t chosen to grab all the subsidies and make it all about him. Imagine where we could be with competent management and reasonable business plans.

Musk and Tesla are becoming an obstacle in the fight against global warming – if they haven’t already become one. The difficulty of supplying enough batteries to electrify the nation’s transportation sector has already been documented on this site and elsewhere. Yet Tesla, unlike Ford, VW and Hyundai, continues to oppose incorporating vehicle-to-building technology in its cars. Because it sells PowerWalls?

Tesla’s sale of grid-scale batteries is slightly more defensible. But not much. There is a plethora of gravity-based technologies waiting to be developed as soon as we give up the notion that existential problems can not be addressed until someone figure out how to make a lot of money.

Just putting this link here with some background about Tim O’Reilly, author of the above piece.

https://thebaffler.com/salvos/the-meme-hustler

Not sure O’Reilly has the right word. Is it valid to describe buying Telsa stock as betting, like you might on pro sports games? Are the massive long-term interventions from the FED that affecting many stocks prices going to end? What about the government green-energy subsidies that keep companies like Tesla afloat? And, iiuc, since Tesla is an S&P 500 stock, huge sums in private savings must to be spent buying their stock by linked funds. We can’t afford to let this bubble burst so it feels more like a state-backed pyramid scheme than legit betting to me.

Now I want to reread Evgeny Morozov’s 2013 Baffler salvo “The Meme Hustler: Tim O’Reilly’s crazy talk”

https://thebaffler.com/salvos/the-meme-hustler

You called it a “state-backed pyramid scheme”. That’s a pretty apt description. I like it. Between QE (where new money is pretty much directly injected into financial markets) and ZIRP (where new money is lent out at ultra-cheap rates, to mostly land in financial markets), it seems pretty obvious that the Federal Reserve has contributed to our current stock market bubble.

Pyramid schemes normally burst when the supply of new investors (or more accurately, investors with new money) dries up. But with the Fed maintaining ultra-liquid conditions, the money never runs out.

I am glad to see mention of the two realms of money above, although it needs to be developed more. By ”two realms of money” I mean the fact that there is an economy in which money is based on labor and the things that labor produces, which we could call the ”real” or ”poor people’s” economy, and on the other hand an economy in which various parties seemingly create money at will, the ”rich people’s” or ”funny money” economy. The two kinds of money measure things differently and the economies attached to them behave differently. As a result, seemingly simple terms like ”one dollar” are actually rather ambiguous, and become more so as we go up the economic food chain. Of the heroes listed here some (as probably everyone knows) have actually been pathologically destructive; their profession is most accurately described as ”grifter” or ”con artist”. But regardless, their antics are energized by the torrents of funny money which the financial system produces at their behest, a practice which (most of) the rest of us seem to condone and even applaud.

Elon and Tesla are a parallel project for the oil/ICE car duopoly.

As this dominant post WWII market maker is in full retreat after finally facing Peak Oil (consider fracking like the current Afghan retreat, for the oil/car industry) Exxon/Toyota have put up last-ditch efforts to avoid switching over to EVs, so that they can sell the last of their inventory, which is under the hood or still in the ground. Hybrids are also a big part of this controlled retreat, says Toyota, who are lobbying the Biden administration to slow down their efforts to switch over to EVs.

With the massive funds of dark-pooled money out there, Tesla’s stock price is artificially propped up as he conducts the most genius of his latest moves to retard the advance of EVs – linking their development with the concept of self-driving cars.

My father and his engineering firm were at the forefront of LIDAR back in the Reagan 80’s when he worked for a defense contractor on the ‘Star Wars’ program and the promise of purple-crayon shielded safety from Russian ICBMs were foisted on us by the Pentagon. Retired now, I told him what Musk was doing with LIDAR and his cars. He thought for a second and said it will never work, unless you get 100k worth of hardware, drive no more than 25mph and NEVER drive in the snow.

EVs should be simple and cheap, not larded with a 100k worth of electronics and hardware – see the upcoming Apple car.

As long as Musk is the vanguard of EV technology, EVs will continue to be the playthings of the rich. What Exxon / Toyota pays for – a showman, grifter and master distractor.

Yes self driving hype is just a way to extract $ from idiot investors. Would only work without any human drivers on the motorway. Tesla is addressing transportation like Apple addresses phones and (once upon a time) computers … pay more for a fancier package that the average user does nothing worthwhile with. I do admire Musk for his spacex efforts. They are the only ones who can get a few of us off this rock before this pathetic civilization tanks from climate and peak oil/water wars, to drop our descendents into hundreds of years of energy starved darkness and die-off. Will access to space mitigate that? No, everything is futile, but it can’t hurt which is more than you can say about Amazon etc.

“If you’re a Wall Street investor, an executive at a public company compensated with stock grants or options, a venture capitalist, or an entrepreneur lucky enough to win, place, or show in the financial market horse race, you live in the supermoney economy. You get a huge interest-free loan from the future….”

Some bigger players are getting a damn near interest free loan now to get the interest-free loan from the future.

Isn’t this like pulling up the ladder you used so that future generations can’t use it?

The Musks and Bezoses burn down the ladder for non-rich people of their own generation. They will always extend a ladder to any younger Musks and Bezoses of the future generation if they feel they recognize such.

And then those newer Musks and Bezoses of the future generations will burn down all the ladders for the non-rich majority of their own future generation.

And etc. and etc. and round and round. And anyone who buys anything from Musk or Bezos supports this process.

Siloing things like speculator/operator is a trope in its own right. Tulipmania contrasted from something else is a trope. How and why do these different kinds of things transition into another kind at a business entity that is already partway along? That’s kind of compelling, right? Bill Black and Philip Mirowski have both mentioned entities that start out “as seemingly reasonable projects” and only get into wonky accounting/control fraud when their backs are to the wall. Zuboff said that after the dotcom crash, Page & Brin had big problems with their investors and had to “think of something” in the context of a “state of emergency.” And that’s when they got into the Google equivalent of more speculative and less real-economy, exploiting the users’ attention and kicking off a huge and perverse speculation on the users’ behavior.

The “good” businesses are also subject to an engine that makes them often decide to perversify partway through. Competition has a coercive quality and in some cases, the things that they do to stay in business involve changing along the big betting/operating dichotomy. Typically when this happens the name on the marquee is identical and they don’t advertise that they have become radically different on the inside. I think boards of directors are known for firing idealistic founders quite a bit? And they institute a change of direction once they have. Distressed firms have to be bought by PE. It looks like the same Toys’R’Us or Guitar Center on the outside but has changed drastically on the inside. Once we know this, we should no longer put a halo around the ordinary businesses in the “before” state either. How small is too small to pervert their mom-and-popness? I’m taking exception with the siloed category of “proper businesses” from O’Reilly but also from a ton of people (main street/wall street, betting economy/operating economy, bubbles on enterprise/enterprise on bubbles, ordinary money/funny money) because the good guys are also a walking deathtrap in that we have no idea what kind of pressure they are under to pervert or whether they did it yesterday. Any of them can say “our backs are to the wall and we must move” and the person on the street has no way of knowing which ones are and which ones aren’t. Other than endogenous, trial and error which takes time and sacrifices the early people. (Not “early adopters”, just whoever happened to stumble into a newly PE-owned retailer, three days after the unpublicized switch that is about to take a 180-degree turn on aspects of “fair” or “good” business we think are solid, like safety, workers’ conditions, product quality, store policies…)

Equity/leverage…

Moritz/Schwarzman…

https://www.nakedcapitalism.com/2017/02/private-equity-slugfest-managing-partner-sequoia-slams-blackstone-chief-steve-schwarzman-new-york-times-op-ed.html

David McWilliams calls the kind of speculation that leads to “valuations” like those of Tesla “the greater gobshite economy.”

I do take issue with the author’s characterization of money’s value as a form of collective delusion. In that case it’s more of a collective expectation that the state will continue to exercise its monopoly of the legitimate use of force to uphold its laws and continue to collect its taxes, fees and fines which are what give its currency value — which is to say, Chartalism.

Yves here. I really wish Elon Musk was not as successful as he is in getting so much media attention that he can’t be avoided unless you limit your Web surfing to non-stop cat videos

You say that as if watching cat videos non stop was a bad thing. Everything I learned worth learning I learned from cat videos…

Sure, now go find that mainstream auto manufacturer who had the foresight to start doing electric vehicles (Toyota pretty much solely–and arguably successfully–with the Prius)…and the segment of the public who would pay elevated prices to own one. It certainly wasn’t Mr & Mr’s Smith, who would rather have their ginormous pickup trucks and SUVs.

Elon Musk, for all his eccentricities, has made a great contribution to humanity.

From an 8/13/2021 article in Barron’s “Boeings Spaceship Problems Show Just How Amazing Musk’s SpaceX Is”:

“Boeing continues to work on valve problems that delayed the launch of its Starliner space capsule.” and later: “The SpaceX success seems even more impressive considering that SpaceX’s Dragon capsule sits atop SpaceX rockets with engines built by SpaceX. The Boeing Starliner capsule sits atop a United Launch Alliance, or ULA, rocket. Some of the engines are made in Russia, while others come from suppliers such as Aerojet Rocketdyne (AJRD).”

Also, I do not own Tesla stock, but I do own a Tesla Model 3 and agree completely with a Chinese supplier of out sourced Tesla parts in China who said the company is 5 years ahead of the competition.

I say give credit where credit is due.

Yves, this article, tho solid, did not go into the cult that surrounds musk (and thus helps to pump the stock). I was disappointed that the article finalizes by saying Musk deserves his wealth, given the history of how he acquired the company, chased away good talent, has committed fraud in several ways.

The stock is pumped by this cult that thinks he can do no wrong, he’s doing things different, he’s going to drive all the other automakers out of business (the future value of the company mentioned in the article), and that he’s some sort of genius. The only genius i see is he took the internet stock bubble concept of Priceline.com (no earnings, everything internet will be worth billions, pump the stock, sell it, walk away with billions while it collapses) & transferred that to these real world businesses. It’s all fraud. But have you talked to any of these cultists? I bet there are some in the comments section actually, as they will do anything to defend him as some sort of god.

I spent an hour arguing with 2 of them on twitter last week. They argued his cyber truck is going to be amazing and will take down Ford. I argued that the truck will never be built, that when Ford announces a new vehicle, the vehicle actually gets built, the company can answer questions about the vehicle, can give demonstrations, can show the press the vehicle, on and on. While Tesla introduces the cyber truck, then 1 year later says “it may go thru a complete redesign before being released”. This led to an argument about financials where they said one quarter of profits by the company shows they will bring down the Big 3. I threw every financial number at them, showing how profitable and strong Ford’s balance sheet is, while they argued 1 quarter of Tesla earnings means $3,000 a share stock price. (Earnings partially built on energy credit sales).

I could go on (endless examples of securities fraud..). But how can we expect the stock price of Tesla to return to normal when these cultists will revolt? They will claim the govt is making war against Tesla & Elon’s vision for the future. Plus many of these are San Fransisco elites. They aren’t trailer park poor ppl. They have some political power. Elon has made himself Too Big to Fail. In some way, I will admit genius there. But, just with the banks, we cannot have companies (or people) that are too big to fail.

I’ll contend that the delay of the cyber truck is a result of the realization within Tesla that there was no way that the truck could be built and marketed for the price established by Ford with the EV-F150 as a bogey. Even if you grant Tesla a cost advantage for production of the drive train and batteries, the sheer volume that Ford sell F150’s, nearly 790000 in 2020 means they have a huge purchasing advantage on common parts. Plus that swoopy cyber truck body work, looks awfully expensive to produce.