Yves here. Some experts as well as readers have pointed out the pollution cost of mining the materials needed to produce electric vehicles and wind turbines. A few have gone further and highlighted supply constraints for lithium. This article takes a broader look at the prospective demand for key metals as more countries and concerns adopt net-zero emissions plans.

By Lukas Boer, Research Associate, DIW Berlin and PhD candidate, Humboldt-Universität zu Berlin; Andrea Pescatori, Economist, IMF; Martin Stuermer, Senior Research Economist, Federal Reserve Bank of Dallas; and Nico Valckx, Senior Economist, Global Financial Stability Analysis Division, IMF. Originally published at VoxEU

Low greenhouse gas technologies require more metals than their fossil fuel-based counterparts. This column estimates supply elasticities and pins down the price impact of the energy transition on the metals markets. The results show that prices for copper, nickel, cobalt, and lithium could reach historical peaks for an unprecedented, sustained period in a net zero emissions scenario. The total value of production could rise more than four-fold for the period 2021-2040, rivaling the total value of crude oil production.

To limit climate change, countries and firms are increasingly pledging to reduce carbon dioxide (CO2) emissions. Reaching this goal could substantially boost demand for metals like copper, nickel, cobalt, and lithium. Low-greenhouse-gas technologies – including renewable energy, electric vehicles, hydrogen, and carbon capture – require more metals than their fossil-fuel-based counterparts (World Bank 2020, International Energy Agency 2021a, 2021b).

If metal demand ramps up and supply is slow to react, a multiyear price rally may follow – possibly derailing or delaying the energy transition. To shed light on the issue, our new paper (Boer et al. 2021), together with the related IMF World Economic Outlook’s Commodity Special Feature (IMF 2021) introduce ‘energy transition’ metals, estimates price elasticity of supply, and presents price scenarios for major metals. We also provide estimates for revenues and identify which countries may benefit.

Soaring Demand for Energy Transition Metals

Our analysis focuses on copper, nickel, cobalt, and lithium. These metals are considered as the most important metals that are highly affected by the energy transition (World Bank 2020, International Energy Agency 2021b). Copper and nickel are well-established metals that have been traded for more than a century on metal exchanges. They are used broadly across the economy and across low carbon technologies. Cobalt and lithium, instead, are minor but rising metals. They started being traded on metal exchanges in the 2010s and have gained in popularity, mainly because they are used in batteries.

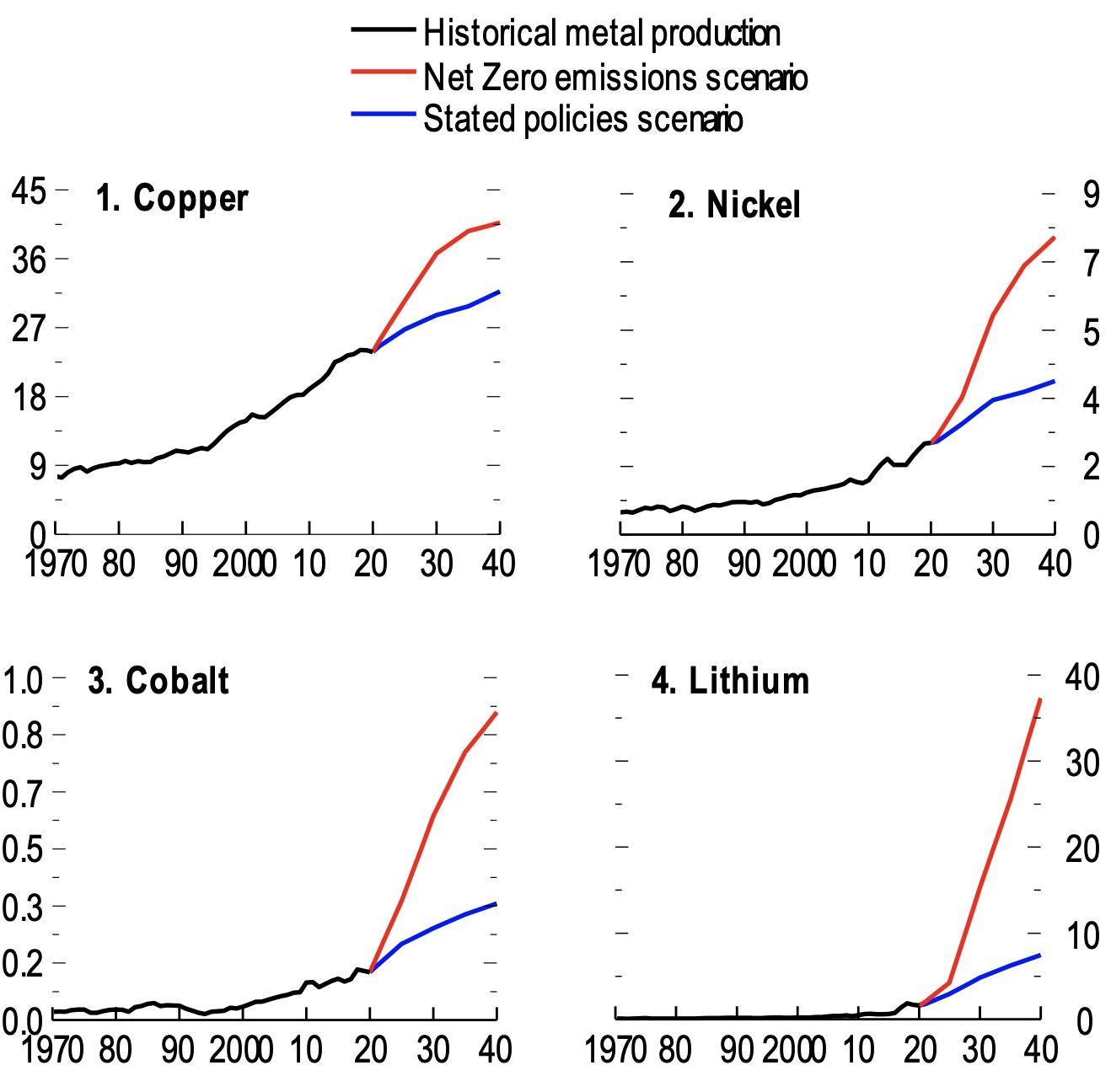

Figure 1 Historical metal production and IEA energy transition scenarios (million metric tonnes)

Sources: IEA; Schwerhoff and Stuermer (2020); US Geological Survey; IMF staff calculations.

Note: Copper and nickel refer to refined production, while cobalt and lithium refer to mine production.

A fast-paced transition that is consistent with the ‘net zero’ scenario of the International Energy Agency (IEA), implies soaring demand for metals over the next decade (see Figure 1). In this scenario, the total consumption of lithium (Li) and cobalt (C) rises by a factor of more than six, driven by clean energy demand (mostly batteries). Similarly, copper (Cu) shows a twofold increase and nickel (Ni) a fourfold increase in total consumption (including demand unrelated to clean energy). In contrast, the increase in metals consumption is much more modest in the IEA’s ‘stated policies’ scenario (a slow-paced energy transition scenario that is inconsistent with climate goals).

How Elastic Is the Supply of Metals in the Long Run?

While metals demand could soar, the supply of metals typically reacts slowly to price signals. This depends, in part, on production methods. Copper, nickel, and cobalt are extracted in mines, which often require capital intensive investment and take as long as 19 years to construct. In contrast, lithium is often extracted from mineral springs and brine as salty water is pumped from the earth. As such, lead times to open new production facilities are shorter.

To estimate supply elasticities at different horizons, separate structural vector autoregressive (VAR) models and data are used for each metals market, including global economic activity, metals output, and real prices from 1879 to 2020 (where available). VAR models are a standard way to model commodity markets (Kilian 2009, Baumeister and Hamilton 2019, Stuermer 2018, Jacks and Stuermer 2020).

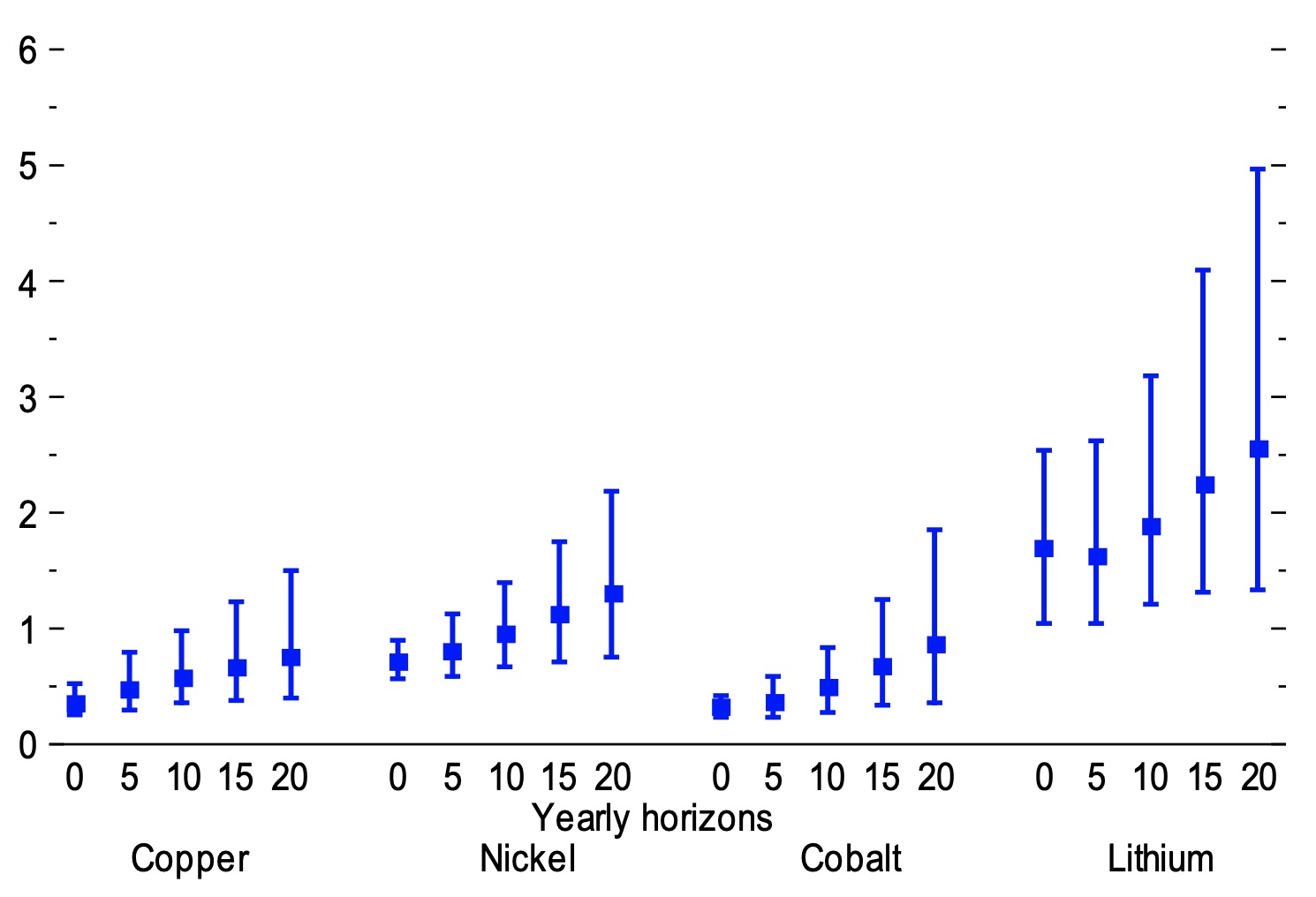

Results suggest that supply is quite inelastic over the short term but more elastic over the long term (Figure 2). A demand-induced positive price shock of 10% increases the same-year output of copper by 3.5%, nickel 7.1%, cobalt 3.2%, and lithium 16.9%. After 20 years, the same price shock raises the output of copper by 7.5%, nickel 13%, cobalt 8.6%, and lithium 25.5%.

Figure 2 Supply elasticities for selected metals

Sources: Schwerhoff and Stuermer (2020); US Geological Survey; IMF staff calculations.

Note: Supply elasticities are the ratio of the change in price and output from horizon 0 to 20 years, derived from metal-specific demand shocks. Lower and uppoer bounds are the 16th and 84th percentiles, respectively. See online appendix 1.SF.1 for methodology..

Identifying Metal-Specific Demand Shocks Analog to the Energy Transition

We propose an anchor variable as a new way to identify shocks in our structural VAR models. This variable helps us disentangle metal-specific demand shocks (such as the energy transition)from aggregate demand shocks. We do so by assuming that while a positive aggregate demand shock will lift both the metal and cotton prices, the metal-specific demand shock has no initial impact on the cotton price. We are agnostic on its impact on aggregate activity. In addition, we employ zero sign and narrative sign restrictions.

The above identification strategy allows us to construct structural price scenarios following Antolin-Diaz et al. (2021). We pin down a series of exogenously and metal-specific demand-driven price shocks that incentivise the production path needed for the energy transition in the different IEA scenarios. A price path implied by these shocks is then derived.

Metal Prices Could Reach Historic Peaks for an Unprecedented Sustained Period

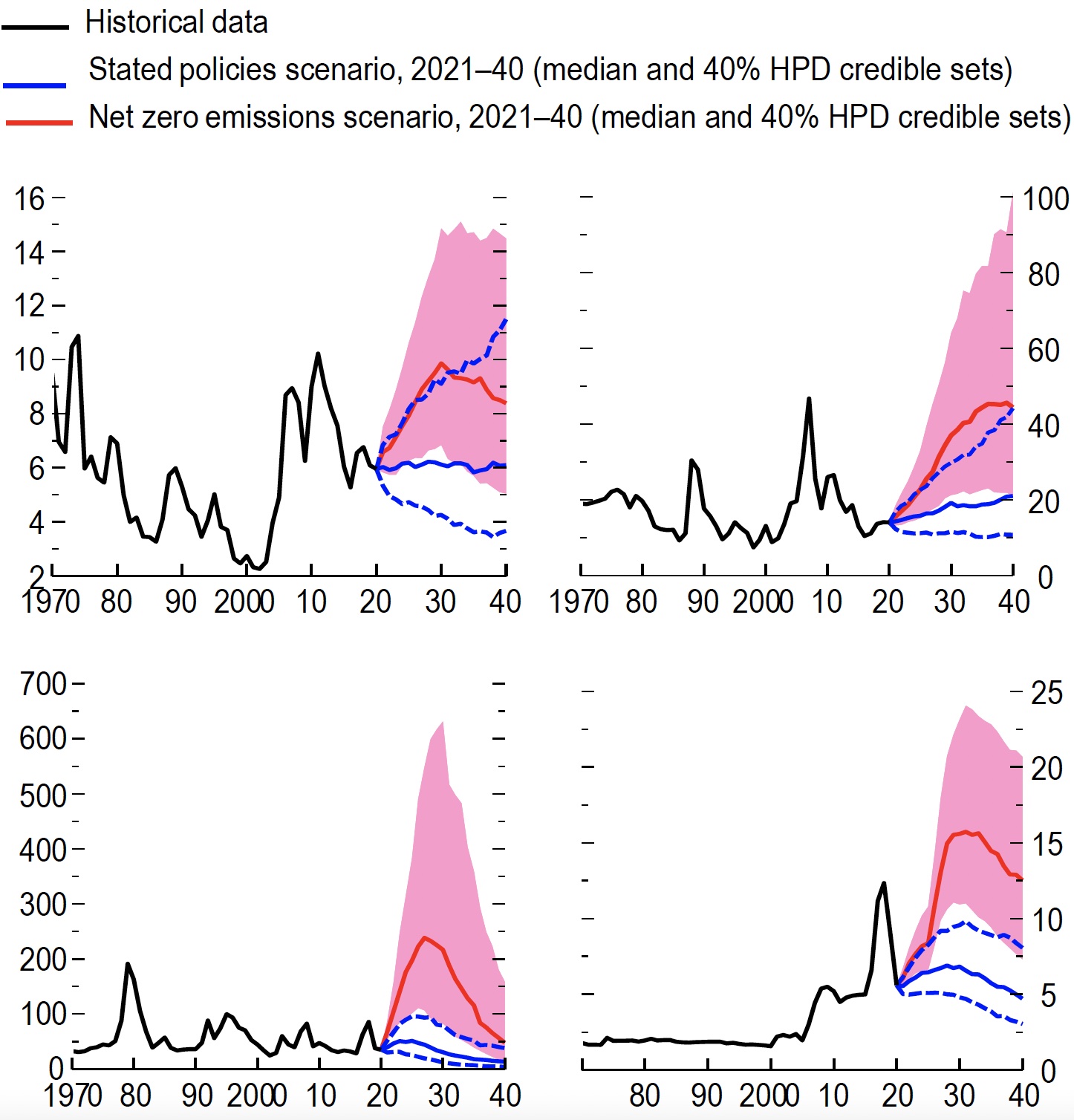

The four metals are potential bottlenecks for the energy transition. Inflation-adjusted metal prices would reach peaks similar to historical ones but for an unprecedented sustained period of roughly a decade in the IEA’s net zero emissions scenario (Figure 3). This would imply that real prices of nickel, cobalt and lithium would persistently rise several hundred percent from 2020 levels, while the copper price would increase more than 60%. In the IEA’s stated policy scenario, real prices would broadly stay in the range of the 2020 average.

Figure 3 Price scenarios for the stated policies scenario and the net zero emissions scenario (thousands of 2020 US dollars a metric tonne)

Sources: International Energy Agency; Schwerhoff and Stuermer (2020); US Bureau of Labor Statistics; US Geological Survey; IMF staff calculations.

Notes: HPD = highest posterior density. Note: Prices were adjusted for inflation using the US Consumer Price Inflation Index. The scenarios are based on a metal-specific demand shock. See Online Annex 1.SF.1 for the data descriptions and methodology.

Prices peak mostly around 2030 for two reasons. First, the steep rises in demand are frontloaded in the net zero emissions scenario. Unlike fossil-fuel-based energy production, renewable energy production uses metals up front – for example, to build wind turbines. Second, the price boom induces a supply reaction, reducing market tightness after 2030.

Potential Value of Metal Production Could Rival Crude Oil

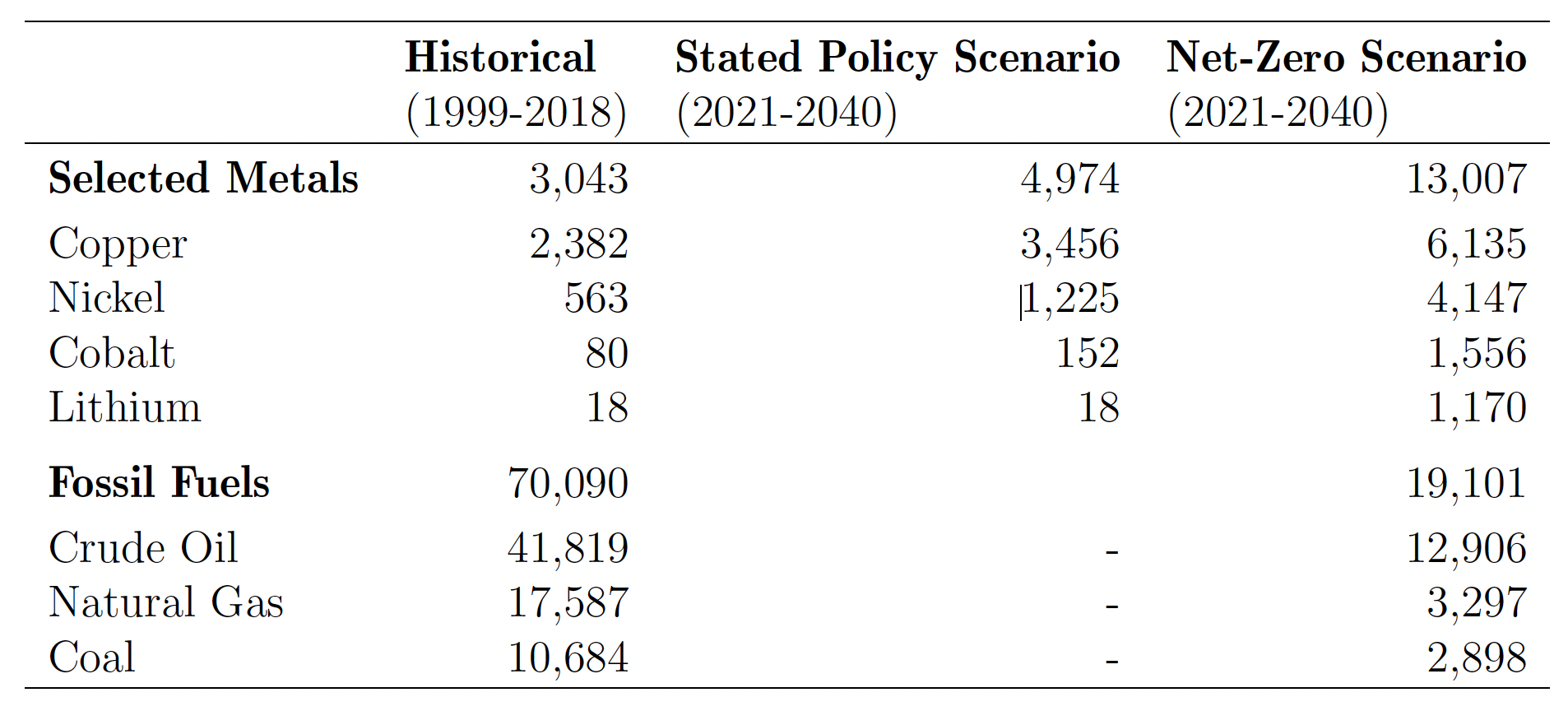

In the net zero emissions scenario, the demand boom could lead to a more than fourfold increase in the value of metals production – totaling $13 trillion accumulated over the next two decades for the four metals alone. This could rival the estimated value of oil production in a net zero emissions scenario over that same period (see Table 1). This would make the four metals macro-relevant for inflation, trade, and output, and provide significant windfalls to commodity producers.

Table 1 Estimated cumulated real revenue for the global production of selected energy transition metals, 2021-40 (billions of 2020 US dollars)

Sources: International Energy Agency; IMF staff calculations.

Sources: International Energy Agency; IMF staff calculations.

Note: For 2021-2040, prices of $30 a barrel for oil, $1.50 a million British thermal units for natural gas, and $40 a metric tonne for coal are assumed.

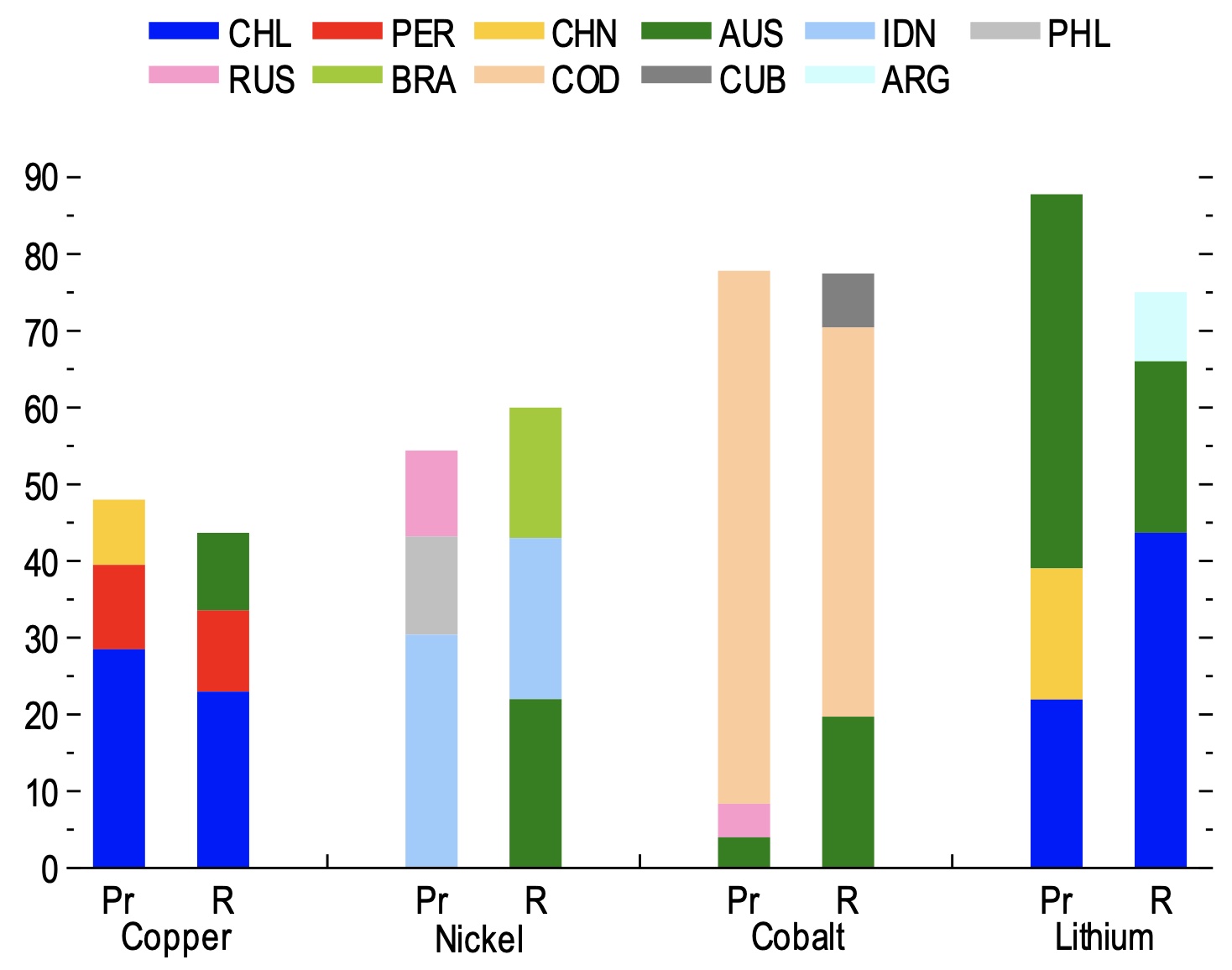

The supply of metals is quite concentrated, implying that a few top producers may stand to benefit. In most cases, countries that have the largest production have the highest level of reserves and are therefore likely to be prospective producers. The Democratic Republic of the Congo, for example, accounts for about 70% of global cobalt output and 50% of reserves (Figure 4). Other countries that stand out in production and reserves include Australia (for lithium, cobalt, and nickel); Chile (for copper and lithium); and, to lesser extent, Peru, Russia, Indonesia, and South Africa.

Figure 4 Top three countries by share of global production and reserves for selected metals (percentage points)

Sources: US Geological Survey; IMF staff calculations.

Note: Data labels in the figure use International Organization for Standardization (IOS) country codes. Pr = production; r = reserves.

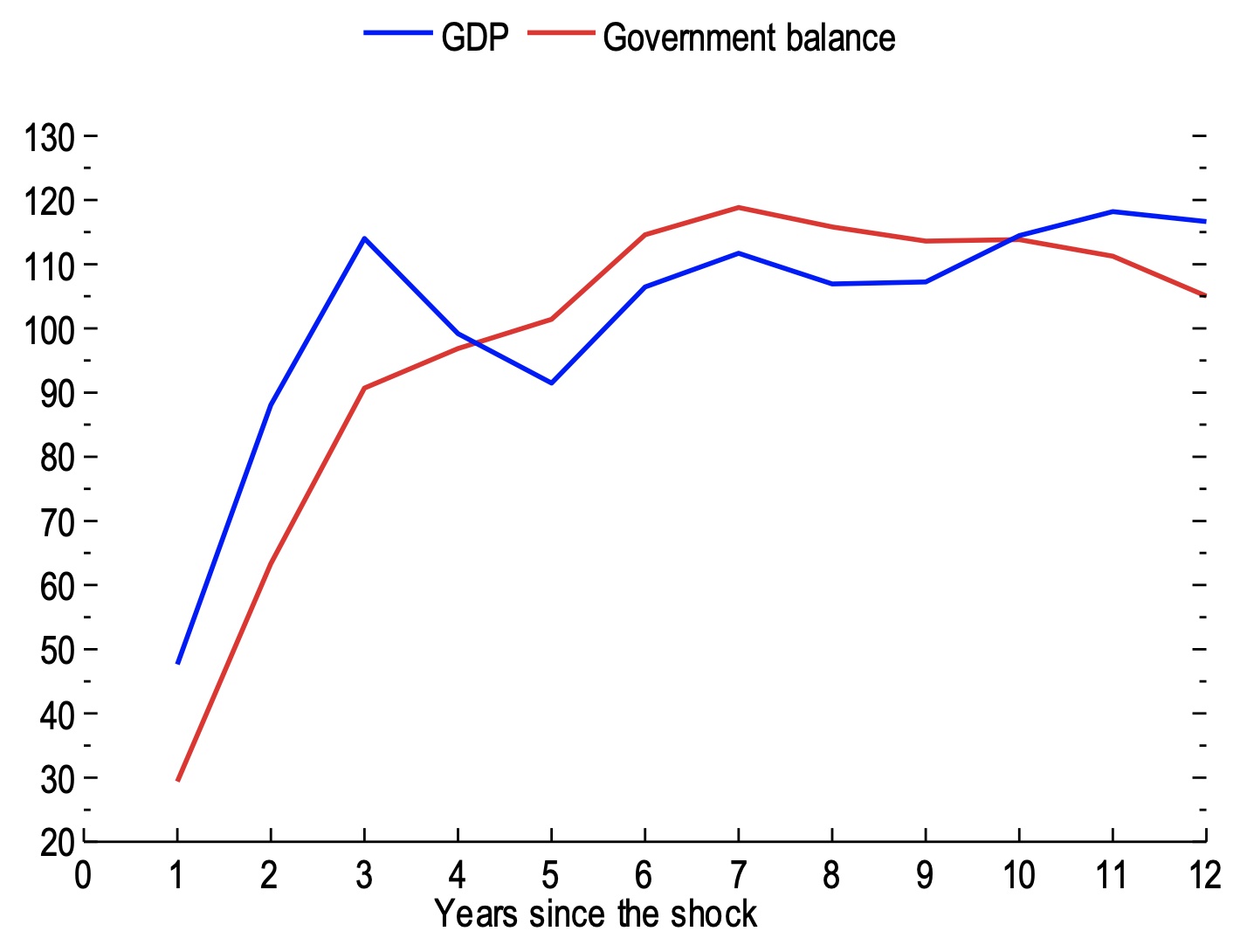

A long-lasting metals commodity price boom could translate into substantial macroeconomic gains, especially for metals exporters. In fact, a 10% persistent increase in the Commodity Research Bureau (CRB) metal price index adds an estimated extra two-thirds of a percentage point of real GDP growth for metals exporters relative to importers (see Figure 5). The estimated improvement of metal exporters’ fiscal balance is of a similar magnitude. These estimates are derived from generalised impulse responses of a panel VAR model that includes each country’s real GDP growth rate, government balance-to-GDP ratio, current account-to-GDP ratio, and the CRB’s real metal price index (year-on-year growth rate), together with global GDP growth and annual changes in real oil prices as additional control variables.

Figure 5 Impact of metal price shocks on exporters (basis points)

Source: IMF calculations.

Note: The figure shows panel vector autoregression generalised impulse reponses following Persaran and Shin (1998) for the differences in GDP growth and the general government balance-to-GDP ratio of the 15 largest importers for a one standard deviation shock to metal prices (about 15%).

Policies To Reduce Uncertainty

High uncertainty surrounds the demand scenarios. First, technological change is hard to predict. Second, the speed and direction of the energy transition depend on policy decisions.

High policy uncertainty is detrimental as it may hinder mining investment and increase the chances that high metal prices will derail or delay the energy transition.

A credible, globally coordinated climate policy; high environmental, social, labour, and governance standards; and reduced trade barriers and export restrictions would allow markets to operate efficiently. This would direct investment to sufficiently expand metal supply, thereby avoiding unnecessarily increasing the cost of low-carbon technologies and supporting the clean energy transition.

Finally, an international institution with a mandate covering metals – analogous to the IEA for energy and the Food and Agricultural Organization for agricultural goods – could play a pivotal role in data dissemination and analysis, industry standards, and international cooperation.

See original post for references

Not like “ha-HAW” funny an’at; but Amy Goodman’s COP-26 hoedown had folks from Bolivia, who’d actually been invited (!) rightfully concerned of how we’d ALREADY coup’d foreign nations for lithium, copper, cobalt… and Afghanistan will soon be China’s BFF. And NONE of her folks dared to mention that we’d crossed into groovy GREEN Imperialism?

Afghanistan as a BFF for resources? Talk about supply chain. How about NONE. Mines must be dug, train trakcs must be laid, thoudands of miles, across harsh conditioons to get it out and get it to the PRC. Afghans are not friendly towards others stealing their resources, culture, whatever. What effects will 250,000 Chinese people imported to labor to do the backbreaking jobs, taking jobs from Afghans who have no interest in allowing them to do so? I think there will need to be 100,000 PLA troops to feed and equip to “protect them, etc. Lotsa luck, CCP

The one big question mark over all analyses like this is that they make extrapolations from existing technology. But EV tech is changing with remarkable speed. It seems quite likely that by the middle of this decade the lithium ion battery will be overtaken by solid state or lithium sulphur technology (in EV’s at least) – these require a very different subset of minerals (fortunately, both use far less rare earths). It is highly unlikely that the lithium ion battery will be used in large scale storage – there are much cheaper and simpler alternatives coming on-stream.

The potential bottlenecks in production are very well known in the industry, which is precisely why there has been an enormous effort put into identifying alternatives. If I was a commodity investor, I’d hedge my bets very carefully when it comes to anticipating future demand. If I was into bets, I would anticipate that magnesium will become a key bottleneck, as it is a very important part of lightweight structures (in aluminium and titanium alloys), and these will be very important in the future in sustainable transport tech. The lighter a structure, the less energy you need to move it.

“I would anticipate that magnesium will become a key bottleneck”

Why? Due to the current lack of awareness of a likely increase in demand and current under-investment? It’s widely available in seawater, saline seas, and terrestrial brines. In fact it’s problematic for lithium brine extraction. Too much Mg in a brine reservoir can kill a prospect. It impedes extraction of Li2CO3. You can’t avoid it in claystone Li deposits either, however I do not know if it is a metallurgical constraint in these.

Magnesium is very common, but so is lithium. The problem is scaling up production in the timescale required (same as with any mineral). With minerals, its rarely a case of whether they are common or not, the question is whether the industry has planned output correctly to meet demand. And there is a particular problem when the dynamic in the manufacturing side is moving far faster than the mineral production side. Everyone has been piling into lithium and (where possible) rare earths. Its entirely possible that the mining industry will have made the wrong bets.

Having spent time in, and more time as an investor in, the metal and mining industry much of what you say is important and correct. Critically, supply responses are very slow for number of reasons.

New mines take roughly 10+ years to find, prove out, engineer, permit, etc. Second, the Industry knows that these are very long-lived assets and each company has a view on the sustainable price at which it will invest in a new mine. Also, there just aren’t very many large, undeveloped ore bodies to develop in places one would want to do so.

As to existing capacity, at the margin most mines can increase ore production if the price justify the cost by digging lower quality ores. In fact, there are a number of mines that were slated for closure that still operate due to high prices.

If the price is high enough the supply will be there.

At the margin there is some substitution that can take place — e.g., Al for Cu in electrical applications, or PVC for copper in plumbing.

Many of these get swamped when financial players get involved and run the prices up in commodity markets — masking what is really happening.

Can you point to an example where “EV tech is changing with remarkable speed” this is measurably true? If that were the case car costs would have plummeted just the last year, they haven’t, or range measurably increasing in terms of miles/lbs of batteries required.

Fwiw I’m more plugged into the rooftop solar sphere professionally. And many of the “gains” in the last couple of years have just been to make panels bigger, not increase efficiency or kw/sf.

There may be an inbuilt bias going on here in regards to the quantity of metals required to keep our civilization running. I would also postulate that this intense demand for metals will also lead to mining them from the sea floor after a time. I am going to assume that the amount of metals required as talked about here are for our present way of life which is a steadily expanding capitalist economy. But I am going out on a limb and say that after centuries of a constantly expanding world economy, that we are reaching the point where this is not only slowly grinding to a halt, but that we will in fact transition into a world economy that will be steadily decreasing in size. It is almost inconceivable this but it won’t make it less true. Call it a response to our limits to growth moment. Come to think of it, this whole push to metals as talked about in this article to ‘transition’ the present economy may be nothing less that a desperate attempt to try to make sure that our present life does not change at all. But seriously, there is such a thing as being more efficient using the metals that we do have rather than just dig for more.

The main thrust of this article is correct, metals supply will be in deficit and prices will go up. One overlooked material is battery quality graphite which is by weight, the largest single component of a BEV Li Ion battery. Anode graphite is exclusively processed in China, with only one North American source (Noveau Monde Graphite NYSE: NMG) coming on stream in 2023, the year that graphite demand exceeds supply.

One major source of hand-wringing/concern trolling is the environmental costs of metals mining. A recent Dallas Morning News article (https://climatecrocks.com/2021/10/24/clean-energy-mining-footprint-tiny-compared-to-fossil-fuels/) went into the reasons that metals mining is a vast improvement on fossil fuel mining. One major reason is that coal is mined and used once. Lithium or rare earth metal is used in devices that generate energy for many years. ALL renewable metals (Lithium, copper, cobalt, graphite) mining intensity is quoted as 3% of coal. Also, once mined and used, battery minerals are recyclable to a very high degree so they will see multiple use cycles from the same mining. Two graphite companies (Talga Resources, NMG) are building highly efficient mines with electric mining tech (not diesel) and taking advantage of efficient rail transportation (not fossil fuel shipping). There is every reason to be optimistic on mining as a much better option than fossil fuel energy, but humans have to regulate and that is not a great thing to rely on.

Finally, battery manufacturers did not invest $3 trillion in battery plant manufacturing to see it go obsolete by 2025. Speculative tech that works in a lab is a LONG way from production ready. A process has to be developed that is cheaper. The product has to be better. Most in the business of making batteries overwhelming think that Lithium Ion batteries will be built for decades. Quantum Scape, which is the “leader” in Li metal anode (solid state) does not project mass production until the end of this decade. Analysis of QS’s info indicates that their batteries may not be cheaper than the current batteries which are reducing in cost and improving in performance in the typical ways that occur when production reaches massive scale. By the time QS’s solid state battery is “here”, it may be more expensive and lower performing than Lithium Ion. Some industry experts think that solid state may be useful for aviation or similar markets. Tesla and Chinese BEV makers are using Lithium Iron Phosphate (LFP) batteries now. The reason is that technology advances have made them competitive with NMC (Nickel-Mangenese-Cobalt Oxide) batteries in BEV use. Iron is a cheap cathode material that sidesteps more expensive Nickel. Nickel EV batteries will be used for semi trucks and premium high performance cars, according to Tesla.

Biden administration is making moves to secure a strategic supply of metals. This will also push up prices as the US Government acquires stockpiles.

Mining produces a local and regional pollution footprint, where fossil fuel extraction produces local, regional, and global footprints.

Extraction is extraction- there’s no free lunch- but understanding what the pollution is and how it affects the environment actually matters.

Mining produces far less of a global impact than fossil fuel extraction, and I find it frustrating that this goes unrecognized by environmentalists.

Copper 90%, Tin 10% – are the main 2 constituents of bronze, although it can vary depending on it’s purpose & aluminium, zinc & manganese can be used to replace tin. Not a major thing but it will drive up the prices in foundries that use it. They also use a lot of silicone rubber imported from China which has presently risen in price by around 30%. The alloy is also used for bushings & bearings, in musical instruments & medals, while due to it’s resistance to corrosion it is ideal for many nautical applications.

Presently for a pretty simple lifesize bronze statue weighing about 250 kg, here in Ireland foundry costs would be around 20 – 25,000 Euro just for the finished cast – maybe lower elsewhere as the 2 foundries ( except wise sculptor owned, myself not included ) over here are pretty expensive, both in ROI & charge the same rates. It is perhaps just as well that for many reasons I am getting out of that line of work after my next commission when I finally get the go ahead to start the damned thing.

An open access cold shower on the renewable energy transition, including but going beyond just raw material constraints: https://www.mdpi.com/1996-1073/14/15/4508/pdf (Co-author Rees is the originator of the ecological footprint concept.)

Abstract:

We add to the emerging body of literature highlighting cracks in the foundation of the mainstream energy transition narrative. We offer a tripartite analysis that re-characterizes the climate crisis within its broader context of ecological overshoot, highlights numerous collectively fatal problems with so-called renewable energy technologies, and suggests alternative solutions that entail a contraction of the human enterprise. This analysis makes clear that the pat notion of “affordable clean energy” views the world through a narrow keyhole that is blind to innumerable economic, ecological, and social costs. These undesirable “externalities” can no longer be ignored. To achieve sustainability and salvage civilization, society must embark on a planned, cooperative descent from an extreme state of overshoot in just a decade or two. While it might be easier for the proverbial camel to pass through the eye of a needle than for global society to succeed in this endeavor, history is replete with stellar achievements that have arisen only from a dogged pursuit of the seemingly impossible.

I read the study you linked. Many errors. I concur with several takeaways such as population overshoot is the primary cause, and FF consumption during the production of solar panels and windmills needs to be taken into account. However, there is considerable research on the life cycle energy cost/watt of renewable energy tech and it shows that these technologies are sustainable. The study’s point is correct in that an overall carbon budget that took into account the carbon cost of a RE transition is not being used with any rigor in any of the political discussions. But….

– Recycling of batteries and solar panels is a thing already and will scale as the metals get more expensive, and more importantly, more panels and batteries are available for recycling

– Mining can be done sustainably, but the regulations requiring it need to be put in place

– Cost of PV has gone down and is not “rising”.

– Battery technology improvements do not come at the cost of another parameter, batteries are getting better and cheaper

– EV Trucks are moving from prototype to production (they are not “impossible”)

– “Big Picture Sanity Check” ignores what is possible during mass mobilization (e.g. WW2). This is a matter of political will not capacity, but concur that there is no political will (see COP 26 pathetic process)

– The only replacement for coal is charcoal from wood (really?)

Overall, the main factor has to be the inability of humans to make these kinds of changes. The barrier is not primarily technological, it is human. Old business models, old political alliances, and old habits have to be overturned. We have a long way to go until a RE transition can happen.

“Mining can be done sustainably”

“Sustainably” means replenishing,which is not how mining works.

How’s it population overshoot when such a small percentage of people on the planet account for the majority of pollutants and energy consumption?

I did a back of the envelope calculation of the impact of the decline in metal prices on the cost in $/kW for Tesla’s EV batteries. As getting $/kW below $100 is the quoted Holy Grail.

Between 2010 and 2020 I estimate that the metal price decline reduced the $/kW by 32%. Okay this is not perfect, but order of magnitude and directionally correct. Even if it’s 20%, if the metal prices rise then the increase has to be offset with other efficiencies, which is getting asymptotically harder.

Conclusion, for EVs to acheive cost parity with an ICE at acquisition is likely to get harder.

How much less energy could we use and still have a comfortable-enough okay lifestyle? That should be explored and pursued. The less energy we need, the less renewable energy we will have to harvest, and the less special metals we will need to harvest it with.

Electric cars and trucks on any scale is a first world issue, and I’m not sure its the right way too go. 75% +of the planet doesn’t have the electric infrastructure to do electric even if they had the money to buy the vehicles, which they don’t. This is actually a opening for E fuels. The world already ships oil, gas, diesel, kerosine, jet A to most countries because they either don’t have oil or don’t have the processing to refine it. The infrastructure is already in place for the use and distribution of liquid FF.

So its a question: Do you try and replace all the worlds vehicles, generators, motorbikes, boats, planes etc or do you replace the fuel that powers all those vehicles/uses? There are many ways to think about the efficiency of such a idea. You have straight in vs out efficiency, then you have time: ie how long would it take to replace 1 billion vehicles and is that on a time frame that works for climate change, and I can offer up a lot of other takes on the all of the above idea.

One common thread in all the “solutions” to climate emergency is mostly they are all very narrow, even this conversation all hinges on converting everything to electric cars with batteries. As long as we look in that narrow idea we are even more screwed.

Just like people completely po po hydrogen, the reality is that the energy density of hydrogen vs current batteries is hundreds of times better. Also you can fill a tank in minutes in stead of hours. Its why long haul trucks are going with this vs battery. Oh and don’t get me started on new batteries such as 1.2+ mega watt hour truck batteries and that they will fill in minutes, where is the power grid to do that? Filling a 1.2mWh battery in 10 minutes like you can fill a truck fuel tank now, or a hydrogen take will need 7.2MW per charger and the current batteries can’t take that C Rate. You are talking a huge grid to do that. Even the tsela super chargers are supposedly 100kw ( 100,000 watts), except if more than one charges at the same time they all ramp down because there isn’t enough KW going to that charging station.

E fuels require mostly just electricity and water, then you have a liquid drop in replacement for liquid hydrocarbons that any truck, car, motorbike, or airplane can burn like normal. And they can be mixed in so its seamless. Production is from electricity so make more electricity, I don’t care: coal with CCS sure, generation 4 nuclear sure, wind, solar, geothermal sure sure sure.

I’m just trying to point out the all of the above energy revolution has lots of options and is not limited to some wealthy muppets idea of pushing heavy electric cars that accelerate fast vs a small super efficient car such as the VW XL1

When I think of radical conservation, those are the things I think of.

The title is a bit problematical on first principles; can’t have one without the other.

James Howard Kunstler cites Joseph Tainter frequently, “overinvestments in complexity with diminishing marginal returns” Sinking our collective energy/metal reserves into personal EV infrastructure is building a cathedral to commemorate post-war suburban America; it is not a progressive vision. It is a capitalists collective delusion.

But I guess since we are all stuck in this delusion, don’t forget to stack silver. At some point we will find it much more suited for PVs than coinage. Luckily it’s widely available today in both forms.

No oil no mining, no mining no metals.