Yves here. We see the US and UK making broadly similar mistakes. Both adopted super low interest rates and persisted with them, when prior to the dot-bomb era, the Fed’s pattern had been to drop rates only for a quarter and then start moving them back up. QE among other things was a tool to extend central bank influence to longer maturities, although the device of focusing on quantities was bizarre. As Marshall Auerback and others pointed out, you can control prices and quantities, but not both. So it was never clear how much interest rate impact QE had.

Monetarism-fixated central bank orthodoxy has also not come to grips with the fact that interest rates are a blunt and asymmetrical tool. Putting money on sale does not do much to stimulate the economy. It gooses asset prices and benefits leveraged speculators, like private equity, real estate developers, and banks. But jacking up rates can and does constrain financial activity, since businesses plan assuming certain funding costs and increasing them can lead them to cut back. Rising interest rates also directly signals a bearish outlook, another reason for commercial interests to exercise caution.

And it goes without saying that central banks are not in a position to address the current inflation, which is driven primarily by energy and automobile prices. But if they crush demand, they’ll kill inflation…along with a hell of a lot of bystanders.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

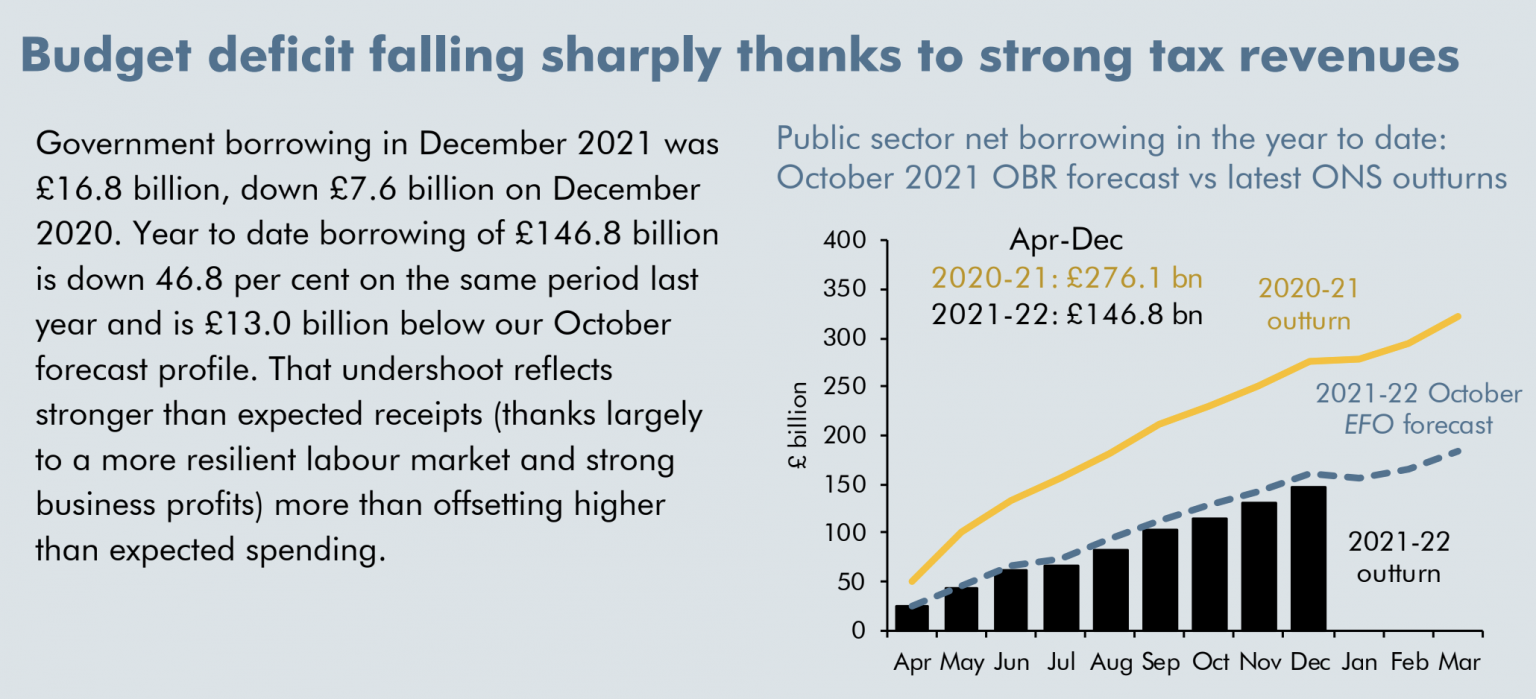

The Office for Budget Responsibility published this commentary this week:

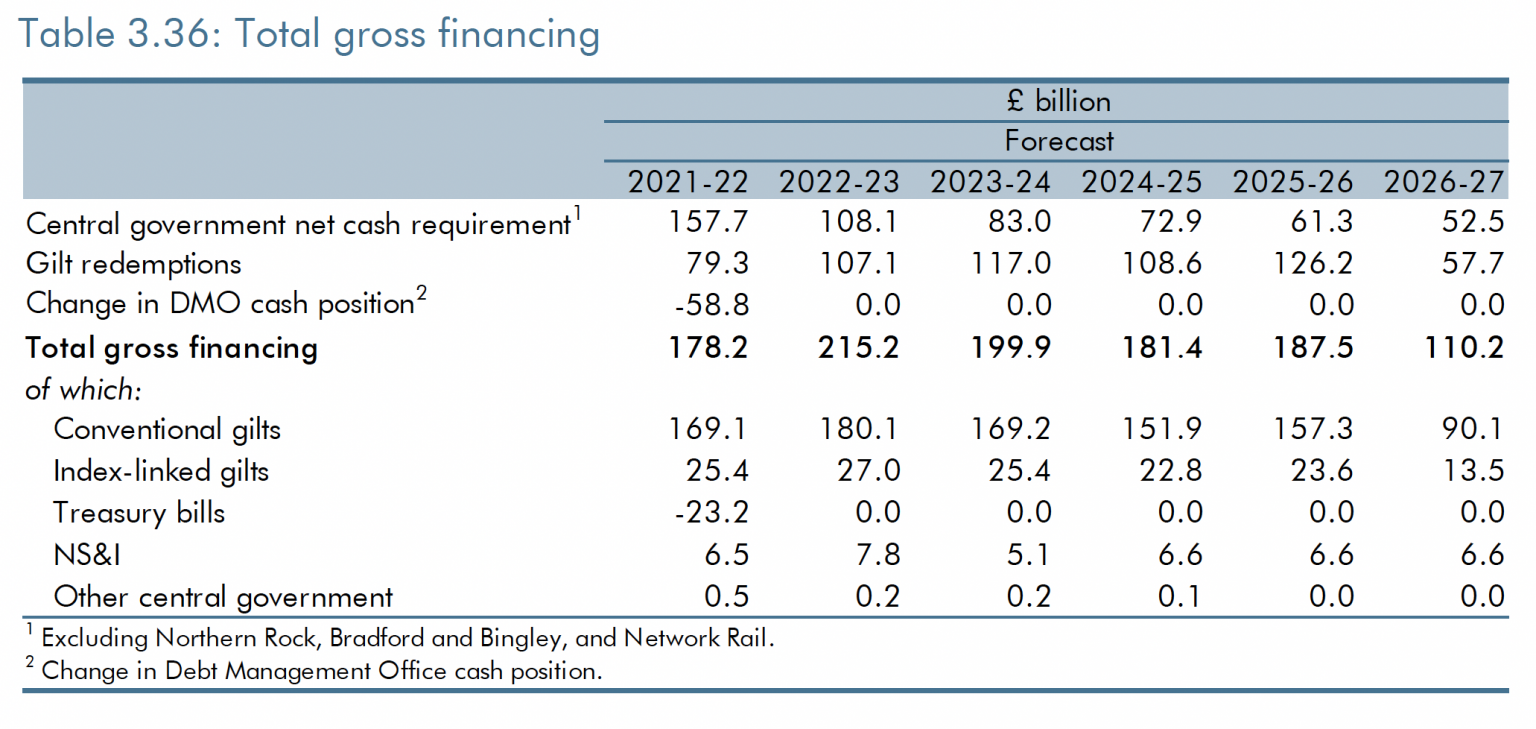

This needs to be out in the context of its borrowing forecasts made last October:

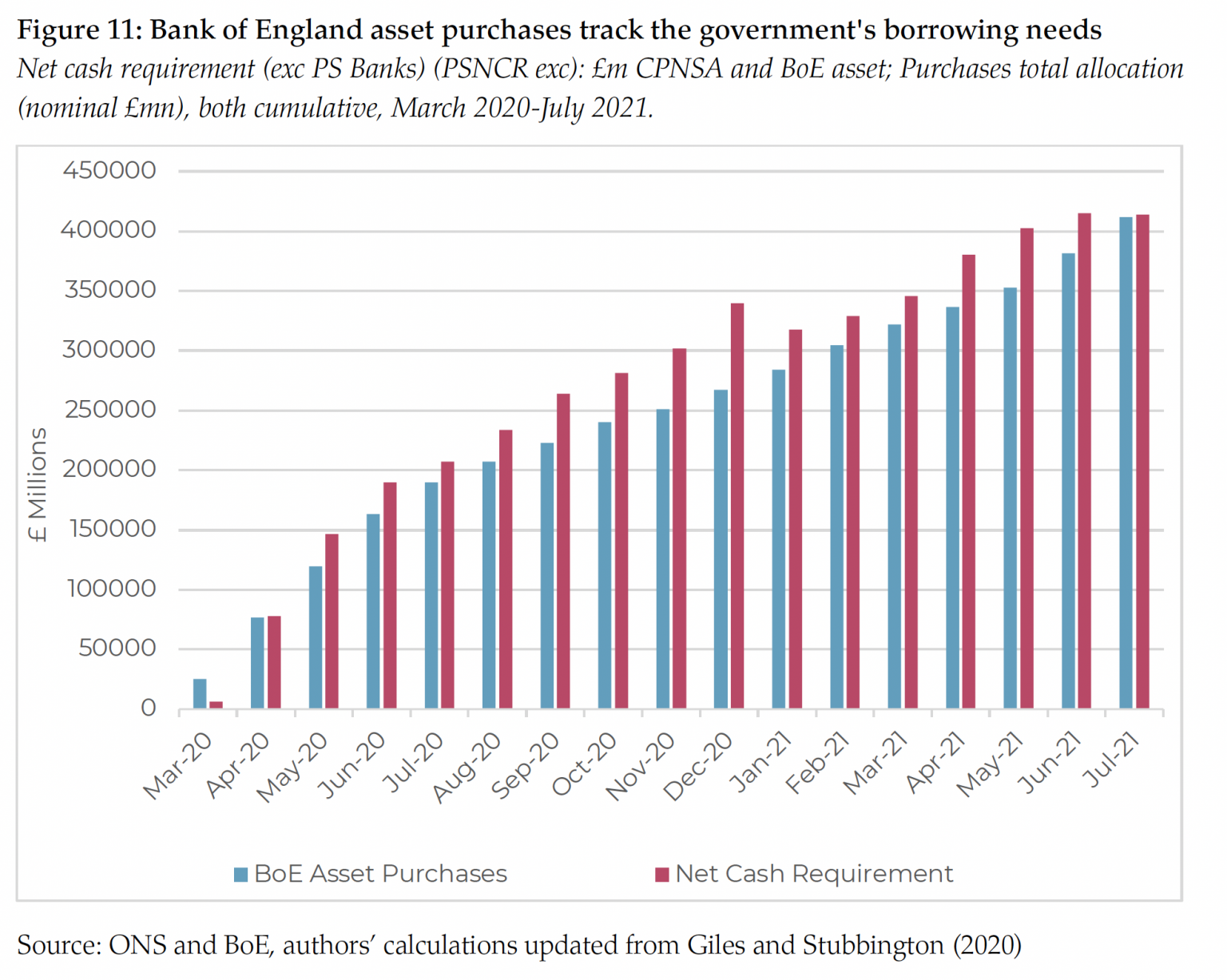

That also needs to be set in the context of a recent report from the New Economics Foundation that showed that quantitative easing has been funding government deficits whatever the Bank of England would like to claim:

Now let’s extrapolate a little.

The QE programme has come to an end. The total government cash requirement is to be funded by financial markets. And, in addition, QE may begin to be unwound. This means that the Bank of England will not repurchase gilts when those it owns are redeemed. It owns 33% of all gilts right now.

What this means is, broadly speaking (and all the figures are estimates, so broadly speaking is good enough) that in 2022/23 the financial markets will have to fund £100 billion of gilt purchases and at the same time the Bank of England will withdraw over £35 million from that market. That means there will be a cash call on U.K. financial markets of around £140 billion when over the last two years there has been none, in effect.

This is a seismic change to funding. More than 6% of UK GDP is going to be required by government to be withdrawn from effective money supply. What are the consequences?

Candidly, who knows?

We can be sure that the policy is deliberately designed to push down government bond prices by increasing the number of gilts available to the market. The result will be increasing interest rates. That much is predictable.

It is also predictable that without a change in policy more than £100 billion is going to be withdrawn from financial markets over the following few years.

Apart from increasing interest rates no one can be sure what the consequence of this is. But, given that QE was always intended to push investor funds into riskier assets, and this has clearly happened, what we can reasonably expect is a reversal of this trend. There will be sales of riskier assets. In fact, those sales could be significant. The £140 billion required in the coming year has to come from somewhere within the financial system, and they do not create the money to fund this.

What this might mean is three things. First, there will be net selling markets in riskier assets.

Second, net selling markets reduce prices at the margin.

Third, markets are valued at marginal prices, meaning that the overall sense of well-being amongst those with assets will fall.

Which assets are likely to fall in value? Gilts will, of course. But so too will shares. Corporate bonds will also fall as interest rates rose. And most likely house prices will too as the stimulus has also ended there.

Summarise this, and the massive reversal of economic policy that the end of QE, rising interest rates, and QE reversal simultaneously represent look likely to create a significant fall in assets values, across the board in the UK, with the US looking likely to do much the same.

Corporate profits will fall as a result as pension deficits rise. Real investment will fall in the economy.

But what else happens? In effect, liquidity dries up. Because prices in markets are expected to fall no one wants to buy. So prices fall again. Or, alternatively, markets freeze. Both create chaotic situations. And given the intense financialisation of the UK economy, the result could be chaotic.

There could be banking crises, e.g. because of property price falls, or a stock exchange crash, or a loss of confidence simply leading to an economic downturn.

QE was done in the UK with the aim of inflating asset prices. That was always the wrong thing to do. There was always the better alternative of Green or People’s QE. But QE was done. And now the intention is to reverse it, rapidly. My point is a simple one. Bad as QE was, unwinding it rapidly could be worse and this government and the Bank of England seem unaware of that, which is really quite worrying.

Late in the week on CNBC the talk was not whether the FED increases their targeted short term four times, but if they could or should do more. I heard a comment that the 2yr UST had increased since late November.

Commenting on conditions of the US economy and effectively jawboning market participants will accomplish some tightening. But reducing the balance sheet of the FED is a broadly complex problem. Stock market volatility should not deter the Fed from action.

If a company does not know or failed to predict market rates would be higher, well I gotta wonder which rock one has been under.

Western economies have been living on carried forward leveraged consumption since the days of hair metal. QE allowed them to keep the concert going despite the crowd going home. Through two decades of QE (including japan) we’ve inflated asset prices at the expense of our productive capacity. While covid May have tumbled the house of cards, it was still a house of cards. We are now sitting on piles of cash but have no capital.

Over the years I’ve read a lot of well meaning and intelligent people on this site advocate for MMT, I think they failed to realize that those in charge of our economy believed in MMT before there was even a name for it. QE is almost the endpoint and unbound expression of the logic that undergirds MMT. But whereas the implication with MMT is the use of sovereign debt for the purpose of increasing the productive capacity and wellbeing of society. We used it to for guns, toys and candy. If CPI is running at 7% you can bet the farm that inflation in the real world is in double digits. The system constraints have been reached and breached. We seem to have blown the largest bubble in history, the Dollar Bubble.

The reversal of this disastrous policy, QT, may cause major pain to the “economy” in so far as the economy is now largely composed of the facade of asset prices(fire) and the consumption those allow(services). But the “pain” was/is inevitable, a consequence of decisions made long before the Fed bought its first MBS, and the pain is happening now to millions. Implementing QE will simply mean those asset holding segments of the population will feel some of that.

There was not a single MMT economist that I’m aware of who was in favour or QE. In fact the entire theoretical rationale for the policy was rooted in loanable funds theory / monetarism and now that the chickens have come home to roost you have the gall to rewrite history and call it the “unbound expression of the logic that undergirds MMT” rather than the unbound expression of the logic of the neo-classical monetarists who actually implemented and supported the policy. You’re wrong that the people in charge believed in MMT before there was a name for it but they certainly understood that they were no longer working with a 19th C gold standard. Retreating to the nostrums of the 19th century gold standard, Andrew Mellon style (he of the famous quote “liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. Purge the rottenness out of the system. High costs of living and high living will come down. … enterprising people will pick up the wrecks from less competent people.”) will be even more disastrous today than it was during the Great Depression.

The official textbook of MMT, Macroeconomics by Mitchell, Wray and Watts, spends a considerable amount of time debunking the idea that QE would ever work. So (as usual) the accusation that MMT is behind some bankrupt policy is just false. Now all that’s left is for Dftbs to say “Thanks for pointing out my mistake.” Unfortunately that’s not too likely.

Adam I do agree that what MMTers wanted in their text book and their definition of what “works” is different from what QE was meant to do. And I’m certainly sorry I can’t express that clearly enough. My limitations as a post writer. So you have my apologies.

But outside of the platonic ideals within a text book, non-MMTers who haven’t read any theory used the mechanisms of sovereign debt and sovereign currency (which exist a priori of MMT) to do something that “worked” for them. IMO economics is a political philosophy which informs material choices, and so the people in charge don’t care what you call it, they just did what suited them.

If you are under the crusader’s sword do you care what it says in the Bible?

I get it. The MM Theoreticians are simply operating within the parameters of their profession. They want to persuade other people in their profession. If they appear to be blind to the actual operations of those in control of the actual levers of power and money, then they are entirely in the mainstream of the Economics profession. Economists have been doing this they buried Veblen.

When the Plutocrat Boutique Bank carries on operations by any other name that are parallel to, or in harmony with MMT, why would Kelton, Wray & Co. be expected to see the rhyme? The Greenspan put was a real thing and a big hammer. Now the big hammer has given way to the twin 10 lb. sledges of QE and back door re-po…unwieldy things indeed. I am curious to see what the free-money geniuses come up with in the face of the next cataclysm. I’m just sure it won’t be rent control. Let’s hope the MMTers catch up.

Thanks for this — I was similarly disturbed by that careless association of QE with MMT. Just another straw man for the “burn the heretics” bonfire.

I think we are looking at three things here, distinguished by who gets the fresh pixel bucks:

1) MMT, the government uses the money to buy things for the country it thinks the country needs.

2) QE, the government uses the money to support and inflate asset prices.

3) Peoples’ QE: The government gives much of the money directly to the people via a guaranteed annual income, refundable child credit, etc. (as well as buying things on their behalf, like national health insurance).

So, I’d agree with dftbs that the three are roughly similar, with the exception of the proposed beneficiaries.

Narratives are seldom why. You could ask Ben Bernanke how QE works, cos he was at the wheel when it was first implemented. But I suspect the real reason is the classic, “you don’t think about draining the swamp when your up to your @ss in alligators”.

Banks matter. How could you help banks which didnt have enough equity to carry their balance sheets without causing a collapse in asset markets.

If “those in charge of our economy believed in MMT before there was even a name for it” then the why would they bother with QE at all, since US bonds are cash equivalent with an interest premium? For that matter why would they even continue to print bonds?

If slave masters believed in their inherent superiority why would they bother with chains?

I’m not saying they understood what MMT was and kept it a secret. Newton was referenced across the comments earlier and I think the example fits. He elucidated the theory of gravity, but wasn’t the first guy to have an apple fall on his head. Similarly they used the mechanics which MMT identifies as being available for the greater good to do something not so good like QE and the generation of leveraged consumption that came before it.

Also US bonds are a cash equivalent only within the confines of the US monetary domain (vassals included). Geopolitics matter more and more these days.

I suppose this is accurate and not realizing if it was mentioned here but doesn’t the most ardent proponents of MMT recognize its application is useful only after fiscal authorities adhere to spending constraints and nonexistent negative real interest rates in an inflationary environment?

Enter crypto, the pure expression of consuming future productive capacity to produce present growth based on pure speculation, without the need for any underlying asset.

I suspect the root causes of these challenges come from the Fed becoming too political in recent decades – too responsive to market participants and media pressure – and the near-abandonment of fiscal policy tools.

This may be why the Fed always seems to be behind the curve. They have to wait until the markets’ “Overton window” shifts to the point at which a particular policy goal becomes tenable. And if Congress can’t touch fiscal policy, all eyes go to the Fed, which becomes even more cautious about doing anything rash given the extra scrutiny.

For example, the inflationary pressures have been obvious for more than 18 months if you happen to buy your own groceries and scrutinize your spending, but if you are someone who must wait for 9 months for the data to show up in the official data – a lagging indicator if ever there was one – then it may be hard to form a consensus that something must be done.

I doubt being stuck in the Washington bubble helps matters. The number of policymakers who buy their own groceries or shop at a hardware store is probably close to zero.

“I doubt being stuck in the Washington bubble helps matters. The number of policymakers who buy their own groceries or shop at a hardware store is probably close to zero.”

Yes. And the number of policymakers who have benefited from QE- and ZIP-boosted returns on their sizeable stock holdings (and other financial assets) probably approaches 100%. Alas, fewer than 50% of ordinary citizens own any stocks. Not even in their retirements accounts.

I’m not convinced that ending QE and ZIRP will fully address the inflation issues we’re seeing today. But I am firmly convinced it would help address the stupendous levels of income (and wealth) inequality that plague this country. That reason alone is enough to justify ending QE and ZIRP. The money-printing for the wealthy really needs to stop.

The money-printing for the wealthy really needs to stop. But only combined with compensatory money-printing for the non-wealthy. Otherwise we’re back to “liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. Purge the rottenness out of the system. High costs of living and high living will come down. … enterprising people will pick up the wrecks from less competent people.” with ensuing Great Depression.

I’m of the view that in capitalist systems periodic “depressions” are necessary, and indeed desirable. Over time capitalist economies become infested with excess that rots from the inside. Just as one might need to purge their intestinal track in order to alleviate bloat, constipation, etc…capitalist systems need to be purged from time to time. We are at that time. Perhaps an economic depression is inevitable and we ought to let it happen. A few billionaires jumping out skyscraper windows isn’t necessarily a bad thing.

In the depression bankers did jump out of windows. But 25% lost their jobs, kinda nasty side effect.

QE can be done by sending equal checks to everybody when there’s insufficient demand and unemployment spikes, which congress did do during Covid. Maybe in our system we should reserve such actions for congress, granted we’re so divided a few people could throw sand in the gears.

“QE can be done by sending equal checks to everybody when there’s insufficient demand and unemployment spikes.”

I’ve had similar thoughts. Trying to boost the economy by shoving money into the financial sector has worked poorly. Pretty much only Wall Street and the banksters have experienced clear benefits. A small fraction of the dollars actually reached the public. And similarly, injecting dollars through government spending on dubious programs is of little value, as they typically benefit government contractors more than individual citizens.

If you simply want dollars to reach the public, then send the money directly to the public. Don’t use middle-men.

DO NOT MISLEAD READERS. You have just made clear you don’t understand QE. So please do not talk about it again until you bone up further.

It is a violation of our written site Policies. You are breaking our overarching rule:

“Sending checks” is not and never was QE.

QE is a central bank buying bonds. It is an asset swap.

You are both talking about direct fiscal spending. That has to go through Congress. It’s a budgetary action.

The problem with that is that it’s not the billionaires who suffer during Capitalism’s periodic crashes/pullbacks.

In the 19th century there was a “panic” (as they called depressions back then) every 20 years or so, and the classical economists of the time thought nothing could or should be done about it so the view that “depressions are necessary” has a long & visible history. Sure a few millionaires who didn’t see the writing on the wall lost their shirt but the story of that time was the rise of the robber barons and the entrenchment of oligarchy, not the purging of rot that you seem to imagine. This was also the time of “dark satanic mills” and the “communist manifesto” because who bar the ultra-rich would want to live in a capitalist economy that required a once-a-generation collapse. I can’t even imagine how much more severe the results of such a policy would be today given how much the nature of society has changed – revolutionary conditions in 5 years or less if I had to place a bet.

The prescriptions of those neoclassical economists regarding the business cycle were the medical equivalent of bloodletting.

Not interested in a return to that nonsense, thanks.

depression isn’t billionaires jumping out of skyscrapers, it’s workers starving to death in the streets

During the last Great Depression, wasn’t it wiped-out speculators and traders who jumped out of windows? Billionaire-nevergonnabes maybe, but surely not actual billionaires and millionaires?

I agree.

I’d be interested to see an analysis showing how much of the money supply growth created by ZIRP/QE leaks out though foreign exchange (ie trade deficit).

That would seem to me to be an important driver of inflation/disinflation to the extent that the US economy decouples from low cost – or perhaps more accurately formerly low cost – Asian countries, and as the effects of rising labor costs or labor shortages (some COVID-driven) take hold.

There are a lot of variables that interact with each other in complex, highly dynamic ways and I am skeptical anyone really has a handle on it.

China has behaved like any sensible would-be monopolist, selling below cost (worker safety, environment, supressed consumer spending) and having driven pretty much everyone out of manufacturing, is now free to raise prices.

And of course, closing entire cities to *protect* their citizens (What an absurd idea /s) has also lead to a lot of long lead times and inflationary impacts as well.

So now the Fed finds that prices are going up (they are slightly late to that realization), and so are going to raise rates. It’s the only tool they have.

Tho I’d be fascinated to learn in what theoretical framework higher interest rates will increase the production of semiconductors and meat.

I guess we will see.

Theoretical framework? :)

For semiconductors, how about more military aid to Taiwan, and for meat, pressure the Brazilian government to push Chinese agribusiness out of the Amazon (for “environmental” reasons) and push that business to ADM?

And how is that supposed to help? The semiconductor shortage is not a military problem, it’s a supply and demand problem. The pandemic has increased the demand of semiconductors far beyond the most optimistic estimates, and building up production capacity takes billions of dollars, years, and a extremely specialised labour.

Additional new foundries are being built everywhere, but it take years to see the increase in productive capacity. As it turns out, building semiconductors is an extremely complex and laborious process, far far beyond any other massively produced good.

A cynicism deficiency. More military aid to Taiwan, means more Arizona and Texas-located Taiwan Semi fabrication investments. It does take years and hundreds of billions, so if you want to extort them you should start now!

Why is closing a city to protect its inhabitants from runaway covid an absurd idea? Has it proven not to work in China so far?

… facade of asset prices (fire)…

FIRE sector, leading to inevitable fire-sale. :/

I try to simply.

Broadly speaking, QE is basically government spending not authorized by Congress in the usual manor as was probably intended by the Constitution.

QE is now so large it has little to do if anything with funding government solvency or normal, traditional Treasury funding. Instead, it is now all about benefiting the rich of which the folks at the Federal Reserve are part of. This unauthorized government spending directly and intentionally benefits upper income asset owners and harms those of lesser means, in a way being a redistribution of wealth to the wealthy and away from the working class. This spending is not a perfectly efficient way to benefit the very wealthy and does spill over to the not super wealthy. Yet it is so large and comes with so few constraints, it has proven to be a very easy way for the elites to make themselves wealthy at others expense.

This is partly because a handful of very wealthy folks with enormous conflict of interests, are able to spend at a split second notice limitless trillions amounts of unauthorized government spending to directly and indirectly benefit themselves and their friends.

I have trouble regarding QE as an economic policy. It was a sweet give away dressed up to look like a policy. A giveaway to the people who matter, arranged for the benefit of the people who matter, and by the people who really matter — as in people who wield some political power over and in the u.s. government. Now that all the players have made their inside deals it’s time for a game of equity markets up-and-down to liven things up for the next round and keep things interesting for the inside traders who like their action fast.

Self-dealing U. S. A.

Its keystone and acme is the Fed through its bank-owned arm, the N. Y. Fed.

Could somebody start a campaign of public service television ads? As Sanders helpfully pushed the slogan that Wall St.’s business model is fraud, the phrase is, the Fed, the self-dealing Wall St. (banks).

No, that is 100% false. Do not misinform readers.

QE is NOT net fiscal spending. If it were, we would not have had secular stagnation and near zero inflation.

QE is an inefficient way of lowering interest rates further out the yield curve. Targeting interest rates would work much better but OMG that would be too Communist to directly control prices.

QE is an asset swap, period. The Fed buys bonds from investors (which increases their price and lowers the interest rate). The investors get cash. But they didn’t want the cash, they just wanted to take advantage of the Fed’s bid. So they buy another financial asset.

Forgive me OnceWereVirologist, I don’t mean to say that people who support MMT supported QE. I agree that the end goals of both are drastically different, I thought I said as much. But I think we are confusing the illusion of economics as a science and the reality of that field as one of political philosophy(sophistry) and material choices.

With respects to the former, MMT is a valid empirical observation, I do think it’s a good descriptive analysis of the capacity and constraints of post-industrial economies of sovereign nations up to the near present day. In the latter regard MMT ignores that the ruling political classes have acted as “MMTers” since before there was such a named theory. You may say they were neo-classicals, monetarists, neo-Libs, etc. They may have droned on about us not being able to spend money on social goods because “we can’t afford it”. But they directed public spending on the priorities which suited them, with no regard to the cost, implicitly understanding the most import conceit of MMT: You can always payback debt you owe in sovereign currency you issue.

QE was the largest such initiative, the public balance sheet was wholly directed to the purpose of propping up asset prices(debt), very literally producing money out of thin air, all the while our political classes (to this very day) tell us we can’t afford the most basic functions of government during a Pandemic!

MMTers would argue that they would’ve used the public balance sheet for a greater public good, I would reply that Mr. Winchester has no say on how his rifles are used. And now, we have reached the limits defined by MMT. We can always pay back our sovereign debt in our sovereign currency, but the purchasing power of that currency is limited by our productive capacity. With no regard to increasing that productive capacity, inflation will rear its ugly head. So here we are.

Now those in charge have to try to defend that purchasing power because their temporal political power is thus denominated. QT will cause pain, but that pain was inevitable. You can’t keep piling band-aids on top of each other at one point they have to be ripped off.

Okay, fair enough. “Reagan proved deficits don’t matter” [Dick Cheney] it is…

Dear Ma’am or Sir,

This is not a true analogy. Mr. Winchester *invented* that thing, and it had limited uses — can’t build schools with it, can’t provide health care with it, can’t repair bridges with it, can’t provide child or elder care with it. Money, OTOH, can be made into just about anything.

The MMT’ers didn’t invent anything. They merely described what was really happening with sovereign currency, ie, one unmoored from a commodity — I think of them as round earthers. Oh, BTW, individual banks, at least here in Canada, are sovereign currency issuers, too! They don’t need reserves to lend against anymore, so their keystrokes make up (considered phrase) the $$ you pay for your house with! Problem, when you pay back that mortgage, *you* can’t make up dollars from keystrokes, you have to earn them. Nice racket, eh? But I digress. To blame MMT for BadThings happening from QE and other irresponsible, evil uses of sovereign currency is more like blaming Isaac Newton for that rock from that ballista hitting your city wall.

Mao would disagree with your characterization of the limited capacity of Winchester’s invention. But yes you are spot on about MMT being a description (a very accurate one) of the real world system MMTers observed, not an “invention”. I agree they can’t be blamed for the same dynamics that undergird their theory being used to do something nefarious like QE.

As to private banks being sovereign currency issuers, RBC, TD, Scotia, CIBC, BMO or Nations issue debt in CAD or their foreign subsidiaries in their domiciled foreign currency(usd, euro, aud not a lot of yen on those balance sheets I think), but not “RBC bucks”, at least not yet. They create money in so far as their client liability is an asset on their sheet. But if the client doesn’t fulfill their obligation they can’t create money to make themselves whole. A sovereign can internally monetize their own debt the way the Fed does with the Treasury. The constraint here being inflation.

Not true. How many of these neo-classicals, monetarists, neo-Libs who were supposedly implicit MMTers lost money trying to short Japanese bonds in the last 30 years. The list is long and includes most of the big names in finance. This despite supposedly implicitly understanding that a sovereign can always pay back debt issued in its own sovereign currency. I didn’t see much evidence of understanding in the political class either back in 2008 when they all went mad for austerity. The fact of the matter is that interest rates were cut to zero and below back then on entirely neoclassical/monetarist principles. And even if there were such a thing as “implicit MMTers” so what ? Unrestrained oligarchies govern to enrich themselves no matter their ideology. The only way to change that is to replace them with people who won’t abuse the public balance sheet. Finding people (i.e. explicit MMTers) who don’t hide their ideology behind non-empirical economic myth-making would be a good start with that.

You’ve summed it up quite well. MMTers cannot control how the money they want to create and funnel into certain causes. It will almost always be used to enrich the rich and undeserving. The only difference between QE and MMT policy is that one is monetary (no Congressional approval) and the other is fiscal. Both will result in inflation because too much money will chase too few goods/services.

> “The only difference between QE and MMT policy is that one is monetary (no Congressional approval) and the other is fiscal.”

Ummm … No.

Firstly MMT is not a set of policies or a regime. MMT, as Bill Mitchell says, is “the lens” (via YouTube) by which a prescriptive understanding of how money actually works for nation-state sovereign issuers of their own currencies can be achieved.

How money gets to “certain causes” is a matter of political will, not macroeconomic school of thought. Like Bill said in the video, MMT is neither “left” nor “right” from the perspective of a “political spectrum”.

> “Both will result in inflation because too much money will chase too few goods/services.”

As I reminded another commenter recently, QE did not create the inflation we have now. In fact, for almost a decade after QE started, central banks all over the world were struggling to “get it up” – inflation, that is (via The Guardian). Where were you then? What is your explanation for years of QE not causing greater inflation? Were the QE billions not enough chasing money? Were there too many goods? Asset inflation, yes. Broad CPI inflation, no.

Since someone mentioned Wray’s book earlier, I will endorse it and also remind people that he basically blogged the outline of what he planned the book to be at neweconomicperspectives.org under the MMT Primer section. It’s an invaluable resource for those who really want to understand #MMT but can’t get the book.

Cheers.

This is the purest of sophistry. QE was neoclassical/monetarist policy and has led to a whole pile of negative effects, including maybe the inflation the US is seeing now***. MMTers recommended different policies post-2008 and if mismanaged those too could also lead to inflation. Therefore the fact that neoclassical/monetarist mismanagement of the economy has led to an inflation crisis and MMT mismanagement in an alternative universe could theoretically also lead to an inflation crisis means that both are really the same thing. Does that logic make even the tiniest lick of sense. To make an analogy, mismanagement of any diet you can imagine – vegan, pritiken, palaeolithic – could lead to serious illness. It does not then follow that all diets are equally dangerous and all their advocates indistinguishable.

*** (Though to be honest I think I think US inflation has a lot more to do with US-specific legalized oligarchical corruption, price-gouging, and monopolization. Japan after all tried the super-sized version of QE and their inflation rate is still scraping along below 1%.)

Ya, Keynesianism is basically old school MMT to my understanding, and it’s how we got out of the great depression into what are often considered the good old days. MMT is sort of ill defined in my mind, but I think that I have learned a lot learning about it.

So, what policy path might lead to a reversion to a (less) mean that strips the froth out of the rich sh!ts’ and looters’ accounts without breaking the bank for the rest of us? And who will advocate for that policy path?

The bubble riders are already ladling out the Bernays Sauce ™ that peddles the notion that “we all have to bear the pain,” meaning of course that the workers and disabled will have to starve to protect the looted “wealth” created by the QE that the FIRE overlords ignited…

“Calling Dr. Hudson and Dr. Keaton to the red emergency phone!”

I think the conceit of Richard Murphy’s post was that QT is going to be painful. I would agree, but there are no pleasant paths. They all entail destroying the consumption and living standards of the American (Western) populace, either through persistent QE that keeps inflation going or through QT that crushes leveraged consumption. Everything coming will hurt just and unjust alike. If there were Bolsheviks around perhaps, but the American people are the most housebroken in the history of humanity.

We could just tax the rich and use that money to backstop the negative side effects of eliminating QE. Losing your job isnt the end of the world if theres robust unemployment insurance and universal healthcare. Maybe the governent even steps in and hires those people to build infrastructure and parks ala FDR

By all means tax the rich — just don’t do so under the illusion that you need to do so for revenue purposes. You need to do so in order to prevent them from buying the government.

I completely agree with you about unemployment and healthcare — Medicare for all and a Federal Job Guarantee are the answers.

In the recent interview of Michael Hudson by The Saker, Andrei asks, “Andrei: The Fed overprinted dollars and that there is now no way to get these dollars back out of circulation, thus is there is a high chance of stagflation in the USA by this summer?” (my bold).

I jumped out of my chair yelling, “Dollars are extinguished by taxation!” The Prof was following another tack, but that is true, isn’t it? And it could be targeted in such a way as to hit only the uber-wealthy and spare (in so far as is possible) the 99%. Tax assets over some number of $$, tax income, tax realized capital gains. Call it de-billionaireing. Govt* might take over (nationalize) ‘uge tracts o’ housing, which would reduce* housing costs. If govt were to resell housing, priority could be given to democratic coops (well-vetted) and individual owners. No sales to private companies. It could even be means-tested, which would keep a lot of Demos happy and busy!

I don’t have the chops to track what would happen in the various sectors, so is this a very bad idea?

*a real government of, by, and for the people. Not likely, I know. Remind me again, why can’t we have nice things?

I really enjoyed that Saker/Hudson interview! I think you’re right about “taxation”, but since most of the wealth is “unrealized” this would in essence be wealth seizure. If I remember correctly our gracious hosts shared a link a few months back with what I thought was a very coherent plan to tax the leveraged consumption of the super wealthy by taxing their loans and adding the interest to their asset cost basis.

The real problem as you allude to is not the lack of “policy proposals” but the ability to get any of them done within the confines of the American polity (no gov for the people). Any sensible path forward will be met by massive resistance. And the coercive power of the state, down to the local level, is presently aligned against any such policies. It’s likely that resistance would be more violent than it already is.

IMO 2016 and 2020 elections should disabuse people of the likelihood of even the mildest illusion of hope in our gangster system. There are no American Lenins and really, we are more likely to get an American Pinochet (we’ve had a few, no?) than another FDR.

Seems like the government should be able to deflate an asset it inflated with QE, without there being a taking.

An impure world does not offer any pure solutions to the power-low and the near-powerless. So perhaps we might try finding and settling for impure interim solutions which allow us to raise our own and eachothers’ brute physical survival chances in the meantime.

The more personal food/water/indoor heat/ indoor cold/ etc. that people can grow or produce directly instead of needing to buy with money, the less money such people will need for those aspects of their brute-physical short term and/or medium term survival. And just because we the near-powerless cannot produce all our own means of survival outside the moneyconomy does not mean that we can not produce any of it at all. If we can produce any of the means of survival outside the moneyconomy , we should go right ahead and do so.

We might possibly buy ourselves enough time and survival to be able to address these moneyconomic issues eventually someday maybe.

We won’t ever know if we don’t even try.

What you are seeking requires revolution, and likely lots of blood on the streets. Acts of Congress and policy “tweaks” will never get you where you want to go.

Perhaps. I’m no advocate for revolution; but if anyone in 2022 America sincerely thinks they can vote their way to progress, they’re either in Bellevue or on their way to kickboxing class and margaritas.

> So, what policy path might lead to a reversion to a (less) mean that strips the froth out of the rich sh!ts’ and looters’ accounts without breaking the bank for the rest of us?

You are asking for perfection. Let er rip. Some peasants are going to die so the rich suffer a paper cut. Its a class war and Captain Greed’s class is winning.

My belief, since everything is like Calpers, is that the pecuniary interest of Jerome preclude any disturbance to the stawk and financial markets since there is the probability of a multi deca million dollar hole opening up in Jerome’s stawk portfolio when things go sideways. The guy will print as many trillions as needed to prevent that.

Not perfection at all. Granted, overindulgent lifestyles and consumption will perforce get lopped, but how many ‘Merkans really are over the top, consumption-wise? Tax policy is exactly that, tax POLICY. Choices are made, folks, and of course dollars (even deflated ones) speak louder in the current stanza of “democracy, the epic” than mopevotes. But that does not have to be the case.

And squillionaires have in the past been forced to accede to heavy taxation and haircuts (including down to the neckline), if only to protect their ill-gotten positions against the angry mobs. The legitimacy of government in the US and elsewhere is getting dissolved — and Pelosi and Mitch and Jerome will be dead sooner than most of us, so change in a healthy direction is not precluded…

To say that everything is like Calpers is to give up and settle for life under the Overclass on the Overclass’s current terms.

Everything is not like Calpers. Fedco Seeds is not like Calpers. Johnny’s Selected Seeds is not like Calpers. There might be a few other things which are not like Calpers. Just because most things are like Calpers does not mean that every single thing is like Calpers.

Every single not-like-Calpers thing which currently exists might be considered a kind of FOS ( Forward Of Survival ) for surviving in Calpers World and for maybe even launching guerilla raids against particular vulnerable Calpers World targets.

When I said “Forward Of Survival” I meant ” Fortress Of Survival”.

But maybe some FOSs can also be FOBs . . . Forward Operating Bases within the Calpers Occupation Zone.

The US has an annual trade deficit heading toward the trillion dollar per year neighborhood. That means a large outflow of US dollars; normally that would mean a fall in the American currency but it has been balanced out by the purchase of American assets like real estate, stocks and debt – which has also led to asset bubbles. A huge factor in keeping this merry-go-round turning has been the governments running very large fiscal deficits, Trump added $8 trillion in deficit spending during his term and Biden adding $1.4 trillion since October of 2021.

Winding down QE runs the risk of deflating the asset bubbles and the country not attracting funds for their continued purchase. That would lead to a fall in the USD and real inflation. I could see the Fed talking big about interest rate increases and then doing little. When the economy is running on a lot of hot air, turning off the pumps isn’t much of an option.

> I could see the Fed talking big about interest rate increases and then doing little

Yep–thats what they did in the summer of 2019 and immediately stopped when the economy was ever so slightly effected

Purely anecdotal, fixed rent for 4 years, owner is cashing out, market rents are now 62% higher. Luckily I inherited a small income stream that covers that jump, but I’m still pissed. What about those who don’t have such bumps? The Fed is on a program of inflating the debt away come hell or high water until and unless the peasants revolt. It’s not what they say, its what they do. They are only jawboning increases. If it were not for a loved one I would soon be a Californian exporting his inflation to other relatively cheaper RE areas.

You can’t lock down most of the world for two years and not expect ill economic effects, even if it was justified. Monetary policy can help, but only within certain limits. We’ve reached a point where the only real decision left to make is who will feel the most pain and the manner in which it will be applied. Will a recession be induced by the fed raising rates, ending QE, and reducing its balance sheet? Will they press on with QE end up like Japan, and also inflate a good chunk of the average person’s (retirees in particular) wealth in the process. Yves is correct to say that not all of this inflation is strictly the result of monetary policy, COVID has wreaked havoc on supply chains and less is being produced, simple as that.

I know it’s a gross oversimplification, but certain groups get hurt more by a recession than inflation. Inflation tends to hurt younger people less, since they have less wealth to inflate away and as lot of years left to earn money (assuming wages eventually rise to keep pace with said inflation at some point in the future) and hurt older people more (less years to earn money, if they even still are, or chipping away at retirement savings). Obviously it’s more complicated than that, most retirees have some degree of savings in the stock market and a rout there hurts them too. Inflation is bad for everyone on some level. You get the point. There’s not much in the way of good options, even less that anyone currently in power here will find politically acceptable.

“Most retirees have some degree of savings in the stock market.) Got any authority for that? Maybe half, all at the upper bounds of the wealth distribution. https://www.financialsamurai.com/what-percent-of-americans-own-stocks/ And most of those holdings are through 401ks, and are pretty small dollars.

POLICY can provide a real safety net, ensuring at least basic needs are met, including adoption of national health care and such fripperies as writing off all student loans. Which would inject a lot of strength and resilience into the political economy. Doable, if the will exists.

How to build the power to get to that point is the question…

“There’s not much in the way of good options, even less that anyone currently in power here will find politically acceptable.”

As John Kenneth Galbraith wrote so eloquently: “To incise a bubble so that it subsides slowly is a task of no small delicacy.”

Can’t wait for house prices to crash. Serves every bloody idiot who did buy to let right

Fundamentally, the problems QE was intended to solve was cause by people on Wall St doing bad things. We never put anybody in jail, didn’t change the rules enough to stop it, and didn’t even force out the people in charge.

Instead we just gave them more money. TRILLIONS.

Richard Murphy is channeling Loanable Funds Theory, one of the justifications for fiscal austerity. This theory involves a total misunderstanding of how interest rates are set and was debunked years ago by MMters. It is possible QE had a slight impact in lowering interest rates at the long end, but generally speaking interest rates are set by central banks and all other actors adjust their rates accordingly.

Reversing QE should have the same impact QE did, very little. It may even be economically stimulative in that more interest income will accrue to the private sector rather than go to central banks. The danger is it will be accompanied by less fiscal stimulus, even austerity. Then the result would be to slow the economy to very negative effect for most people.

iirc we’ve had a similar discussion here about a decade ago. At the time I asked why can’t the Fed buy muni bonds? The answer was “The Fed can buy anything it wants to buy.” It’s a solution waiting for a consensus. Since this is a democracy (in nothing but name – but still it seems it has that aspiration) maybe Bernie would send a letter to the Fed asking who votes for what and why. And why, exactly, doesn’t the Fed consider society to be the most important of its obligations?