Yves here. The headline is a tad melodramatic but commodities prices can spike up when reserves are tight. We warned about aluminum being in short supply and that looks set to only get worse.

Note that copper, which we also flagged as under stress, will face more price pressure, a big issue for home construction, renovation, and auto manufacture.

By Alex Kimani, a veteran finance writer, investor, engineer and researcher for Safehaven.com. Originally published at OilPrice

- As tensions between Ukraine and Russia reach a boiling point, several key commodities could be impacted.

- Russia accounts for ~6% of global aluminum supply, and any sanctions against Moscow could result in a supply shock in an already-tight market.

- Oil and natural gas supplies are also likely to be strained if the situation worsens in Ukraine.

Escalating tensions in Eastern Europe over Russia’s looming invasion of Ukraine as well as prospects of sanctions against Russia are fueling fears of supply shocks in the commodity markets. After several weeks of joint military drills ended last week, Russia was supposed to start pulling back troops, but that is currently not happening, with as many as 190,000 Russian troops still camping out on Ukraine’s border and Belarus confirming that 30,000 of them would stay in the country indefinitely.

Last-ditch diplomacy doesn’t appear to be working either: in a bid to avert the biggest war in Europe since 1945, French President Emmanuel Macron took to the phone over the weekend and managed to arrange a meeting between Vladimir Putin and President Biden. However, the U.S. only agreed to the summit “in principle,” meaning it’s conditioned on Moscow holding off on an invasion. Russia appears to be continuing preparations for a full-scale assault on Ukraine, with president Biden’s administration warning that an invasion could happen any time now.

U.S. lawmakers have said they are devising the “mother of all sanctions”against Russia as a method of defending Ukraine that would be “crippling to [the Russian] economy.”

Here are 5 key commodities that are likely to be hardest hit if Russia invades Ukraine.

#1. Aluminum

Russia accounts for ~6% of global aluminum supply, and an escalation of tensions between Russia and Ukraine raises the likelihood of a supply shock in an already tight aluminum market.

According to the U.S. Geological Survey, Russia made roughly 3.7 million metric tons of aluminum in 2021, with world production of the metal amounting to about 68 million metric tons. Data by CIA World Factbookshows that China is the world’s biggest aluminum producer, making about 39 million metric tons in 2021, but Russia is also a large exporter of the commodity.

Aluminum prices have risen about 15% year to date, with prices near multiyear highs, but could still rise further. Jefferies analyst Christopher LaFemini says that even if geopolitical risks in Europe subside, aluminum prices probably would decline at first before rising again as the market deficit likely would persist.

Meanwhile, shares of one of the world’s largest aluminum producers Alcoa Corp. (NYSE:AA) have jumped 270% over the past year and 31.3% YTD. LaFemina has raised his price target to a Street-high $90 from $75, good for 15% upside, while reiterating his Buy recommendation on escalating fears that reduced supplies from Russia.

#2. Oil

Russia is an oil and gas powerhouse, with the country pumping about 9 million barrels of crude oil a day. In comparison, the U.S. pumps about 11.6 million barrels while global oil production runs to roughly ~96 million barrels per day.

Benchmark international crude oil prices are up about 20% year-to-date to trade near seven-year highs, with the oil markets facing supply headwinds.

OPEC+ has been setting a high bar for itself, boosting production quotas by 400kb/d each month since mid-2021. The group has consistently missed budgets, and there are signs that things are getting worse. The “OPEC 10,” countries within OPEC but excluding Venezuela, Libya and Iran, were budgeted to increase production by 254kb/d in January, with the remainder of the 400kb/d quota allocated to Russia and others. Official results released a few weeks ago indicate that OPEC 10 had increased production only 135kb/d, and now sits a full 748kb/d below self-imposed quota levels.

Outside of the core 10, Libyan and Venezuelan volumes fell while Iranian volumes increased. In total, the three countries saw volumes fall 33kb/d month on month. Meanwhile, Russian volumes for January increased 85kb/d, compared to the country’s budgeted 100kb/d increase.

In a break from recent history, there doesn’t appear to be a strong supply response to rising prices and declining inventories. When Chevron (NYSE:CVX) reported Q4 results two weeks ago, the company guided the street to flay YoY production in 2022. Exxon (NYSE:XOM) did the same, as did BP (NYSE:BP) and ConocoPhillips (NYSE:COP). Bakken producer Whiting (NYSE:WLL) announced they plan to increase capex 55% in 2022 and acquire assets to generate only ~3% production growth. Driller Nabors(NYSE:NBR) reported earnings Tuesday and indicated they don’t expect to add any rigs outside the US in Q1.

Veteran strategist David Roche has predicted that oil prices will “certainly” hit $120 a barrel, and the global economy will be “radically altered” if Russia invades Ukraine.

#3. Natural Gas

Russia is a leading producer of natural gas, pumping about 639 billion cubic meters of natural gas in 2021, or nearly 17% of global production of 3.854 trillion cubic meters as per BP data.

European natural gas prices have hit new highs after a pipeline that brings Russian gas to Germany switched flows to the east. Westward gas flows through the 2,607-mile-long Yamal-Europe pipeline, one of the major routes for Russian gas to Europe, have been gradually falling, a move the Kremlin says has no political implications.

Some western politicians contend that Russia is using its natural gas as a weapon in the political tussle tied to Ukraine, as well as delays in the certification of another controversial pipeline, Nord Stream 2. Russia, of course, has denied any connection.

In the event that Russia’s gas supplies to Europe dry up, U.S. gas producers are likely to step in to supply Europe with liquefied natural gas, which would imply a large increase in demand and potentially cause a quick reduction of domestic inventories of natural gas.

The United States is set to become the world’s biggest liquefied natural gas (LNG) exporter in the current year, surpassing Qatar and Australia over the course of the year once the new LNG liquefaction units, called trains, at Sabine Pass and Calcasieu Pass in Louisiana are placed in service by the end of the year.

Global LNG demand has hit record highs each year since 2015, thanks in large part to surging demand in China and the rest of Asia. Much of that global appetite has been steadily met by rising U.S. LNG exports, which have reached new records every year since 2016, a trend that appears set to continue.

#4. Copper USGS data shows that Russia produced 920,000 tonnes of refined copper in 2021, about 3.5% of the world total, out of which Nornickel produced 406,841 tonnes.

UMMC and Russian Copper Company are the other two major producers, with Asia and Europe being Russia’s key export markets.

Prices of green metals, including copper, are projected to reach historical peaks for an unprecedented, sustained period in a net-zero emissions scenario. Copper prices are sitting at all-time highs thanks to surging demand, especially in developed countries, with increasing usage in electric vehicles and wind farms, solar panels and the power grid, combined with tight supply.

Benchmark copper prices on the London Metal Exchange are currently sitting at $10,100 per ton, not far removed from its May 2021 all-time high of 10,724.50 per ton.

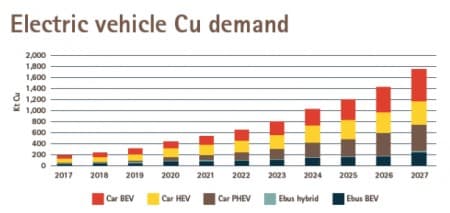

Copper is being billed as the new oil, with the ‘green’ shift in the post-COVID economy supporting higher demand for copper and other base metals since EVs use about 4x more copper than gasoline-powered vehicles. The International Copper Association estimates that the rapid rise of EVs will raise copper demand in EVs from 185,000 tonnes in 2017 to 1.74 million tonnes by 2027.

Source: International Copper Association

Copper is indispensable to infrastructure builders and is mainly used to make electric cables. In fact, copper is known for its uncanny ability to predict the health of the world economy.

Goldman Sachs estimates that copper demand will grow nearly 600%, to 5.4 million tons by 2030, thanks mainly to the green transition.

Another factor driving copper prices: Tightening supplies.

According to Goldman, the market could face an 8.2m ton supply gap by 2030, with new mine development being limited for the past decade as mining companies remain cautious about doubling down on new developments amid rising costs. Quite frequently, promising mines are located in locations that are difficult to access by large equipment. Further, as is common with many metals, developing copper mines requires long lead times, while environmental concerns make it increasingly difficult to acquire mining permits.

In a recent note, Goldman says that copper prices are poised to grow as demand outpaces supply since the concentrate market is very tight, particularly in China. The bank has a 3-month a 12-month price target of $11,500 per tonne.

Sanctions on Russia are likely to lead to even tighter supply and another short-term rally.

#5. Cobalt

According to data from the U.S. Geological Survey (USGS), Russia produced 7,600 tonnes of cobalt last year, more than 4% of the world total.

However, Russia was a distant second to the Democratic Republic of Congo which produced 120,000 tonnes. Nornickel (GMKN.MM) is the largest producer in Russia, selling 5,000 tonnes in 2021. Nornickel sells most of its output to Europe. Nornickel is also the world’s top producer of refined nickel, producing 193,006 tonnes in 2021 or about 7% of global mine production, estimated at 2.7 million tonnes. The company sells to global industrial consumers under long-term contracts.

After climbing more than 90% in 2021, mainly due to supply chain issues, cobalt prices are expected to stabilize in 2022, especially with EV makers like Tesla Inc. (NASDAQ:TSLA) and manufacturers in China popularizing lithium iron phosphate (LFP) battery chemistries.

In a recent note, S&P Global Platts said cobalt prices are set to fall 8.3% in 2022 as supply chain bottlenecks ease. Sanctions on Russia are, therefore, unlikely to have a major impact on cobalt prices.

You could probably add a few more commodities to that mix – namely wheat, corn, and sunflower oil. Russia and the Ukraine ‘reportedly account for around 29% of global wheat exports, 19% of world corn supplies, and 80% of world sunflower oil exports.’ There could be all sorts of supply disruptions here-

https://www.rt.com/business/550273-russia-ukraine-crisis-food-supply/

And as for #3 Natural gas, the author says that the US will step in and supply Europe with what they need – for a much higher price. That sounds great, fine, wonderful. They got the boats to transport that quantity of gas across the Atlantic? How about the infrastructure on the European end to turn that liquid back to gas? Who is gunna pay for it all?

Meanwhile, a Russian official suggested that Europeans will soon have to pay €2,000 ($2,200) per thousand cubic meters of natural gas. Maybe that is true but I can’t see the price dropping substantially for a very long time.

Potash (potassium fertilizer) should be #1 on the list, governments won’t collapse without copper or cobalt. Governments (like Egypt) could collapse w/rampant food inflation.

Add palladium along w/platinum (catalytic converters).

Back when palladium was much, much, much cheaper, my cousin and his wife got their wedding bands made of palladium. Now palladium is more expensive than gold!

nickel. everything from Tesla batteries to modern alloys all need nickel.

vanadium for aerospace.

almost every element that a White House staffer hasn’t thought about since high school chemistry can be affected somehow by Russia. Those elements are a necessity for anything that moves, grows food, or pushes electrons.

“There are decades where nothing happens; and there are weeks where decades happen,” as someone or other said. The global geopolitical order will look somewhat different by 2023.

[1] The Power of Siberia 1 pipeline began pumping gas from Russia to China in October, 2019. Power of Siberia 2 is supposed to come online this September. If things stay on schedule Russia will by this year’s end already be sending China maybe double the gas it now sends the EU.

[2] The Russian population’s sentiments never seem to figure in the West’s cartoon demonization of Putin. Nor that of its elite. Here ….

https://www.intellinews.com/polls-show-russian-public-opinion-united-on-ukraine-232551/?source=ukraine

‘Polling by the Levada Center shows that 50% of Russians believe that the US and Nato are responsible for tensions in the Donbas region, while only 4% feel that Russia is to blame.’

And this from the Carnegie Moscow Center ….

https://carnegiemoscow.org/commentary/86452

‘Those who believe that sanctions could prevent Russia from invading Ukraine or punish it for doing so need to understand that the most hawkish part of the Russian leadership is not opposed to Western sanctions against oligarchs, banks, companies, national debt, and so on. For the hawks, the ideal scenario would be a sovereign socioeconomic autarky, the end of ties with the West, the complete sovereignization of the elite, and the substitution of everything possible, even if that requires assistance from friendly China.’

[3] I expect this from Ambrose Pritchard-Evans in the DAILY TELEGRAPH will probably pop up in your links when they appear, but here it is now—

https://www.telegraph.co.uk/business/2022/02/22/vladimir-putin-controls-supply-chain-western-technology-bluffing/

Pritchard-Evans isn’t right about all his claims (e.g. re. titanium). But it gives pause for thought about the extraordinary ignorance and arrogance of the US, and the West more generally in following the US lead, that it’s triggered this confrontation when it’s holding a losing hand.

And here, from the horse’s ‘mouth,’as even the NYT belatedly circles around the uncomfortable reality that sanctions are likelier to hurt the West more than Russia —

https://www.nytimes.com/2022/02/21/business/economy/ukraine-russia-economy.html

What’s at Stake for the Global Economy as Conflict Looms in Ukraine

[4] Finally, all this isn’t even to get into the fact that for the next 18 months at least Russia has weapon systems a generation in advance of the US, for as much as that matters when both sides have massive nuclear arsenals.

And on that final point, it would probably also worth remembering that study from recent links, that claimed America’s vaunted missile defense is actually worth shit, and wouldn’t even suffice to protect from a North Korean attack, much less a Russian one.

respected ag market analyst Sue Martin sees big bullish moves in grains and softs. “…last year when Sue was on the show, she predicted in 2023, beans would be at $30. Corn would be at 18 and wheat would be somewhere 42 to 45. Do you still stand by these predictions or would you like to revise them?

Martin: I still stand by ’em. The wheat might take a little longer, you know, back in the 70s, you kind of walk through different markets, but I could see beans and corn this year into ’23. Corn could even take us into early ’24, depending on how we lay it out. Um, but I think, yeah, my glass half full, I have not changed my opinion one bit.”

restrictions of all kinds of trade from/on either of these countries could kick off these kinds of huge moves.

https://www.iowapbs.org/mtom/story/40069/market-plus-sue-martin

Is this talking about agribulk commodity industrial-feedstock corn? Is strictly human-consumption corn under different price pressures?

Is this a good time for suburbanites with lawns to begin thinking about growing some of their own culinary survival corn? What if they don’t want to dig up their lawns? What if they want to have their cake both ways and eat it too? Corn AND lawns?

Here is a video by someone who credibly appears to have worked out a way to grow corn plants spaced out in his lawn, using an old fashioned digging stick. Cornplants in the lawn and lawn all around the spaced-apart cornplants. Here is the link.

https://www.youtube.com/watch?v=6S-DD4RF7S4

Perhaps an ideal corn to do this with, for those who want to do it, might well be painted mountain which is supposed to tolerate poorer conditions than chemo-pampered industrial corn, and is supposed to be higher protein ( and maybe higher nutravitamineral-rich otherwise, too), and probably tastes better than chemo-pampered industrial corn.

And while the video-maker himself has not tried it, might someone else want to try a polebean seed or two right next to each cornplant in the lawn?

For reading about painted mountain corn and related survival subjects . . .

https://rockymountaincorn.com/blogs/the-rocky-mountain-corn-project

Russia controls like 90% of the world’s semiconductor grade neon, that’s a big one.

” Neon? For semiconductors?” . . . . I thought to myself . . .

So I found out this about neon for making semiconductors . . .

https://sst.semiconductor-digest.com/2016/03/chipmakers-seek-solution-to-neon-gas-supply-shortage/

If the shortage of importable neon becomes persistent or permanent, I should think we would be able to concentrate our own neon by mimicking whatever part of the steel-making process led to neon in the exhaust gas to begin with.

i always thought of Russia and Canada to be crucial for nickel…but Russia is now third behind Indonesia and the Philippines, and Canada has dropped to #6..

Many of the energy heavy commodities (including fertilisers, another key Russian export) are under heavy strain thanks to energy bottlenecks in China last year.

I’d add to the list above platinum, which is crucial for IC car production. I foresee an increase in catalytic converter thefts worldwide. Also, Russia is a key source for titanium.

One advantage the world has right now is that everyone was predicting commodity bottlenecks this year thanks to last years disruptions, so there are some changes already happening. Here in Ireland farming media has been full of advice for months to farmers in how to switch to less input heavy crops. I hope everyone likes peas, because there will be a glut of them next year.

The energy sector is more complex, because oil and gas is a less fungible product that people assume. It is Europe that will suffer if there is a gas crunch (although I suspect that a relatively mild and windy spring so far will help very significantly), but since LNG production is already at all time highs I don’t think a lot of switching around will take place. High energy costs are already affecting production decisions so I suspect we’ll see less industrial demand than expected. There is always an element of flex in production when manufacturers have reasonable warning of price spikes. I suspect that many energy intensive manufacturers have already planned in reduced production. This, of course, could lead to all sorts of unexpected shortages or price hikes.

One big issue nobody seems to talk about is the impact on aviation. I can only guess how airline fuel hedging strategies changed over covid. If they are lucky, they are well hedged for a year or so. If not, the ‘recovery’ in airline use will be hammered big time by surges in kerosene prices and travel worries over Europe. I’m quite happy about that. It will also slow down the return to the office as people simply won’t be able to afford their commute.

> I hope everyone likes peas, because there will be a glut of them next year.

Perhaps regenerative agriculture will get a boost in the current environment of high cost nitrogen fertilizer.

I’m planting clover (from inoculated seed) in the backyard garden this year. Should have done that long ago.

I wonder if there will be a shortage of Rhizobium inoculant for legumes.

Rhizobium inoculant can put more Rhizobacteria spores into immediate contact with developing legume roots than unassisted soil by itself can. But unassisted soil can do some Rhizobium inoculation of legume roots. Unassisted soil did that for millions of years, right up until the invention and deployment of Rhizobium inoculant.

And yes, if the right kinds of sanctions can force the price of Haber-Bosch nitrogen so high that mainstream farmers can either swallow their pride and adopt Gabe Brown/Garry Zimmer/etc. methods for biofixing their own free sky-nitrogen or go out of business and surrender their land to those who are not too proud to adopt the Brown/Zimmer/etc. methods; then that would be a good outcome of such sanctions.

The USSR used to be the only producer. During the Cold War, when Lockheed was building the SR-71 Blackbird, the CIA had to set up a front company to purchase the required titanium from the Soviets.

Russia seems to have gamed out anything the West can do to her, and even more cautious people like Putin have decided they now have a moral obligation to protect her people. The German Chancellor’s comment dismissing the genocide threat to Russian in Ukraine seems to have gotten attention in Russia and shows how ignorant the Chancellor and Germans are in their bubble of Western propaganda. I hope the Germans are prepared for a big dip in their standard of living and export competitiveness and loss of jobs. (Also I doubt Democrats of much of any clue how much this could damage their re-election by causing similar problem here in the US).

Putin’s TV address: “The main task of our decision [on recognizing independence] was to preserve and protect these lives. This is more important than all your threats”

Russian nationalist sites like The Saker believe Putin intends to include the entire 2 provinces of Doneska and Luhanska, even though the breakaway region holds less than 50% these. I disagree. IMO Russia will not use force to secure the whole of Doneska/Luhanska regions held by Ukraine, unless there is civil unrest such that is it clear the people in these Ukraine held areas want to join and will fight to do so.

I doubt if moral considerations play any role whatever in Putins thinking. This is all about protecting the Russian heartland and straightforward geopolitics. Russia wants the two breakaway provinces as buffer states, and will take whatever measures are needed to ensure this occurs. The Russian population there (who, lets not forget, where moved there deliberately to Russify the region) are just an excuse. If he can break up NATO while doing so, thats a win-win. He is being aided by the ineptness of the western response.

As for Germany, economically they’ll be fine. Its often forgotten that the German economy thrives in times of high energy prices. This is because its industry is extremely efficient and can win cost advantages over less efficient competitors (i.e. pretty much everyone). Germany is also a world leader in energy technology, so as the world scrambles to adjust to high energy prices, the likes of Siemens will be selling them what they need. Germany will, if needed, play the poodle, but will always – always – put its domestic industry first, and will always play a longer game than its western competitors. Any energy shortages will be absorbed by its citizens, not by its industry.

Perhaps, but Putin is but one voice amongst many. If you read accounts of other members of the security whatever it’s called in Russia that recommended recognizing Donbass, others wanted to go further by admitting Donbass into the Russian Federation. Moral passion seemed to be factor for many others even if not Putin.

As for you take on Germany, you might be correct But IMO you overestimate Germany’s circumstances as of the present.

I haven’t watched Putin’s speech but they say he was quite emotional and therefore a rarety for him. To be sure he hasn’t shown himself to be very touchie feelie in the past about, say, Chechnyans, but his rhetoric as a Russian patriot seems real. And his essential rationality seems more than real. If Ukraine is a buffer then perhaps we should ask why the Russians feel they need a buffer and why the region is such an obsession among the Anglos.

I don’t have patience for watching. Helmer (recall he was Carter’s press secretary) thought his delivery was very controlled except for some deliberate sighs but the text was very barbed at key points.

http://en.kremlin.ru/events/president/news/67828

Check out the Charlie Rose interview with Putin in 2015 (?). Insights into what he gets pationate about. I’ve been watching the more recent vieos of him and do see real flashes of what I take to be passion about some subjects.

If your analysis of German industrial energy efficiency is correct, then let us pray that energy prices go so high that industry is exterminated from China and all has to go to Germany to merely survive.

That is the best we can hope for in terms of achieving efficiency in a Forcey Free-Trade world order.

The west sought to exploint Russia after the fall of the USSR, it has worked to set up an economic system of exploitation and treat Russia as a colony for its expansion. Western media has regularly reported on NATO military ‘exercises’ on the Russian border to keep the threat at bay, it has never attempted to create a demilitarized zone or de escalate. US politicians were in Kiev 12 years ago demanding anti Russian politicians be elected (actively supporting fascists). The US puppet billionaire was so corrupt that he lost the last election, to be replace by a comedan

This is how we got here

One commodity which used to be a useful indicator in times of great stress (I remember the day Reagan was shot, the spot price gyrated about $150 up & down on all that glitters) hasn’t really done all that much, suggesting that either perhaps it doesn’t matter anymore, or nobody really believes that a substantial war is about to happen.

Alas, I was once thinking of buying gold when younger. But could never tell if it was not in fact gold-coated tungsten.

Alas? If you bought food or foodgrowing land, you would have been better off perhaps. Food will get you through times of no gold better than gold will get you through times of no food.

Nobody ever got the hell out of dodge and a bad situation with carrots.

Get the hell out of dodge? Where to?

In the future, everything will be one big Dodge. If we fall back to brute survivalism, people who spent their creative energy buying gold will be regarded as anti-social parasites whose survival is a threat to any survivalist community. Such people and their gold will be shunned and rejected, at the very least.

I remember reading once where Kurt Saxon, the self-styled inventor of “Survivalism” once recommended that any refugee trying to buy his way into a Survivalist Community with gold should be quietly taken off to the side somewhere and quietly killed, and his gold thrown off a cliff or into a swamp or a lake where it couldn’t be found and couldn’t hurt anybody.

In 1949 it got you out of China

In 1975 it got you out of Vietnam

In 1978 it got you out of Iran

Those are merely recent events, I could give you many more if you’d like.

Those events will be increasingly irrelevant as any guide in the coming ” no where to go to” future.

The world is a really big place, and who knows where the opportunities will arise?

Few would have thought of Portugal before the war as having such an outsized presence in WW2, for those seeking shelter from the storm.

Well, we have two different theories of what ultimate survival-wealth is.

In the long run, Darwin will decide which theory is right and which theory is wrong.

Gold has gone up a bit in the last several weeks, now around $1900, but its price is heavily “managed” by bullion banks in London and the USA. I think gold now has a lot of competition in the form of cryptocurrencies.

How many governments keep a strategic stockpile of cryptos?

Please keep in mind that you can not overestimate either the Hubris or the Stupidity of the Biden Administration.

It is truly impressive.

so….a practical question:

is now the time to break down the copper mine across the road?(big pile of window units and such that i’ve picked out of the dump, intercepted going to the dump, etc, over 25 years)

and what about the several aluminum mines?(piles of kids’ bicycle frames, similarly acquired) or the beercan graveyard(s)?( big boxes made of pallets and covered, filled by me and visitors and high school=> college age kids over many, many years)

(it’s a testament to my pallet engineering skills that i don’t have wind-blown beercans literally everywhere)

i’ve kept all this because i expected the prices to go up eventually—sort of a poor man’s gold hoard…but the nearest place to sell such scrap is still pricing as if everything’s fine out there in the world.

Amfortas, I think your beer can hoard is largely a waste of time. They are not a good source of metal for melting down because there’s lots of dross/oxides in the melt so you don’t get much usable metal out of them for the amount of effort/fuel to convert them to ingots. What you should collect are cast aluminum automobile wheels. Those are typically of the 356 casting alloy which has very good properties and there’s less surface area/weight compared to the cans. Cylinder heads are also often 356, but you’ve got the valve seats, studs/threaded inserts and often lots of grease to deal with as contaminants.

Foundry work can be an interesting hobby, and many people do it as a hobby for not a large money investment. But as with so many things, buying commercial foundry products (sands/binders, chemicals, ingots) vs DIY can make it easier to get sound castings.

the beer cans are more for selling: we’ve experimented with smelting them…made a small knife, using a steel cup crucible and a sand mold made from some of the more clay-ey frac sand from the hill to the north(an exposed strata of the more clay-laden bits can be dug where neighbor’s egress road cuts through). without more inputs(better mold sand, better crucible and dogs, etc) not worth it save in maximum doom.(the bicycle frames are much better, and i’ll likely save those)

but it’s easy to keep them out of the waste stream going to dump, thus lowering my cost…and so far, it’s easy to store them for a long, long time.

for almost 15 years, even that wasn’t worth the drive to the salvage place…but it’s getting there, now.(i’ve been noticing the return of can-people on the roadsides, from way out here all the way to san antonio—how’s that for an economic indicator?lol)

the copper and brass and bronze i accumulate: i think of it mostly as, like i said, a Mine…for doing things in the metal shop….but at current prices, even 70 miles to the salvage is well worth it. i’m torn between selling it(est.: $3k by weight, if i go to the trouble to clean it up)…hopefully at the top of the market(which we ain’t even close to yet)…or hanging on to it for the max doom i expect to be forthcoming with empire’s end.(a better/bigger crucible would be ideal, along with appropriate dogs/paraphernalia—stuff’s easy to work…especially for art stuff…and the “Mine” is out of the way and more or less organised)

all the iron and steel i’ll keep…i just need to organise it better. i’m fully set up for that, even if max doom and no grid or inputs(using homemade charcoal in the forge/furnace, etc).

boys are showing interest in blacksmithing and even wrought iron…mostly knives and swords…and i’ll encourage that as it warms up. lots of $ in swords, even primitive models, for to hang on walls of mancaves of the local elites. i send them wiki pages and pics of anglosaxon spearheads, gladiolii and all manner of such things.

it’s the aluminum that’s the potential eyesore(not yet), and price will decide when to crush and bag and run it up there.

and that’s my original question…buried in my excessive parentheticals: when does an aluminium shortage driven price work it’s way down to me?

i suspect that the salvage guys are holding back and arbitraging at the moment….pocketing the higher price i expect they’re getting, while still paying the can-people the lower prices(can-people are at the bottom of the power differential, after all)

i check weekly on-line(when i remember, what with the still current chaos of my life)