Yves here. This post reproduced below strikes me as more than a little weird. I hope those who have a better grasp of the French Revolution and the post revolutionary-period than my now-not-entirely-reliable-memories from having studied that era in college, can comment and likely make corrections.

This post gives very peculiar impression that state building in post-revolutionary France was a bottom-up process, and depended on the building up of coercive power at the département level. It completely ignores that a, if not the, major source of funding for France in the early decades after 1790 was seizure of Catholic Church property and its sources of income. Talleyrand, then Bishop of Autun, read out the decree announcing the land grab. He was excommunicated. But clerics were put the state’s payroll.

Land reform played a significant role in growth. The areas that had more Church land to sell to private concerns showed higher growth through until the effects of the productivity gains leveled off. From the Journal of Law and Economics in 2021:

This study exploits the confiscation and auctioning off of Catholic Church property that occurred during the French Revolution to assess the role played by transaction costs in delaying the reallocation of property rights in the aftermath of fundamental institutional reform. French districts with a greater proportion of land redistributed during the Revolution experienced higher levels of agricultural productivity in 1841 and 1852, more investment in irrigation, and more efficient land use. We trace these increases in productivity to an increase in land inequality associated with the Revolution-era auction process. We also show how the benefits associated with the head start given to districts with more church land initially, and thus greater land redistribution by auction during the Revolution, dissipated over the course of the 19th century as other districts gradually overcame the transaction costs associated with reallocating feudal system property rights.

I also wonder how Napoleon raised and funded his armies when the départements are presented as not always fully functioning government entities as of then. The piece does make a passing reference to capitals paying higher conscription levies.

By Cédric Chambru, Post-doctoral Researcher in Economic History, University of Zurich; Emeric Henry, Professor of Economics, Sciences Po; and Benjamin Marx, Assistant Professor of Economics, Sciences Po. Originally published at VoxEU

Effective states can raise taxes and armies, enforce laws, and produce public goods, but how these functions are built over time is not well understood. This column studies the administrative reform initiated by the French Revolution, one of history’s most ambitious state-building experiments, to shed light on the sequence of steps needed to build effective states. Cities chosen as local administrative centres initially invested in the state’s capacity to extract resources from citizens. These cities may not have grown in the short run, but the investments eventually delivered payoffs in terms of public goods, which stimulated long-run growth.

State capacity is essential for economic development (Besley and Persson 2011, Besley et al. 2021). However, this fundamental insight of political economy involves a paradox: strong states have a unique ability to coerce their population and to collect taxes from citizens, which can also undermine economic growth. In the worst-case scenario, the coercive apparatus of the state can fall into the hands of corrupt elites and threaten the existence of markets and democracy.

Using evidence from Colombia, Acemoglu et al. (2016) warn us of the dangers of putting military objectives above all others in weak-state settings. At the same time, if the state fails to enforce law and order, other actors might step in to create sophisticated administrations in its place (Sanchez de la Sierra 2017, 2020). Historical examples illustrate the importance of early investments in coercive capacity. The young Roman Republic raised large numbers of conscripts to ensure its survival and expansion. In Ming dynasty China, a substantial share of the population belonged to ‘military households’ required to supply soldiers to the state. Recent work in low-income settings has focused on helping weak states develop fiscal capacity.

Across the board, the ability of states to raise taxes and defend their borders seems essential to their long-term success. Yet, policymakers often grapple with the problem of how to trigger the complex process of building the different functions of the state.

In our recent paper (Chambru et al. 2021), we exploit one of history’s most ambitious state-building experiments, the administrative reform initiated by the French Revolution, to shed light on the sequence of steps needed to build effective states. In February 1790, France’s Constituent Assembly overhauled the administration of the kingdom. In response to widespread grievances about administrative complexity, the Assembly established new centres to concentrate local administrative functions. The main achievement of the 1790 reform was to divide the territory into 83 homogeneous units known as départements. Citizens would never be more than a day of travel away from the nearest local capital, where all administrative services would be available. This state-building enterprise, solidified after 1800 by Napoleon, has largely survived to the present day.

One original feature of the reform allows us to establish a causal link between the reallocation of administrative presence across space and subsequent economic outcomes. Facing pressure from local representatives, in about a third of French departments, the Assembly did not determine which city should become the new local capital. Instead, it decided that the capital would rotate across multiple cities.

Unsurprisingly, this compromise solution was not viable, and French parliamentarians soon began to call these ‘wandering administrations’ a ‘ridiculous and expensive’ solution. In September 1791, the Assembly abolished rotations and ordered the local administration to remain where it was. We show that this generated exogenous variation in the allocation of capital status, and we use this setting to compare the cities that were ultimately chosen (capital cities) to the ones that were initially considered (other candidate cities).

Despite having similar economic potential before the Revolution, capitals diverged dramatically from other candidate cities over the long run. By the end of the 19th century, the population of capitals was 40% larger than that of comparable candidate cities. Civil servants and their families accounted for about a third of this difference. This demographic divergence, which continued in the 20th century, is consistent with a large literature showing that public investments and market agglomeration forces promote economic growth around centres of administrative power.

What happened in the immediate aftermath of the reform, however, is equally intriguing. In the short run, capitals did not grow faster than comparable candidate cities. Instead, the capitals concentrated investments in coercive capacity, which enabled France to fund and fight a series of external wars. By 1815, France’s new local capitals and their periphery were substantially more likely to have established their cadastre, a type of land-registration system aiming to facilitate land taxation. Moreover, capitals also paid a heavier tribute to military conscription in Napoleon’s armies after 1802.

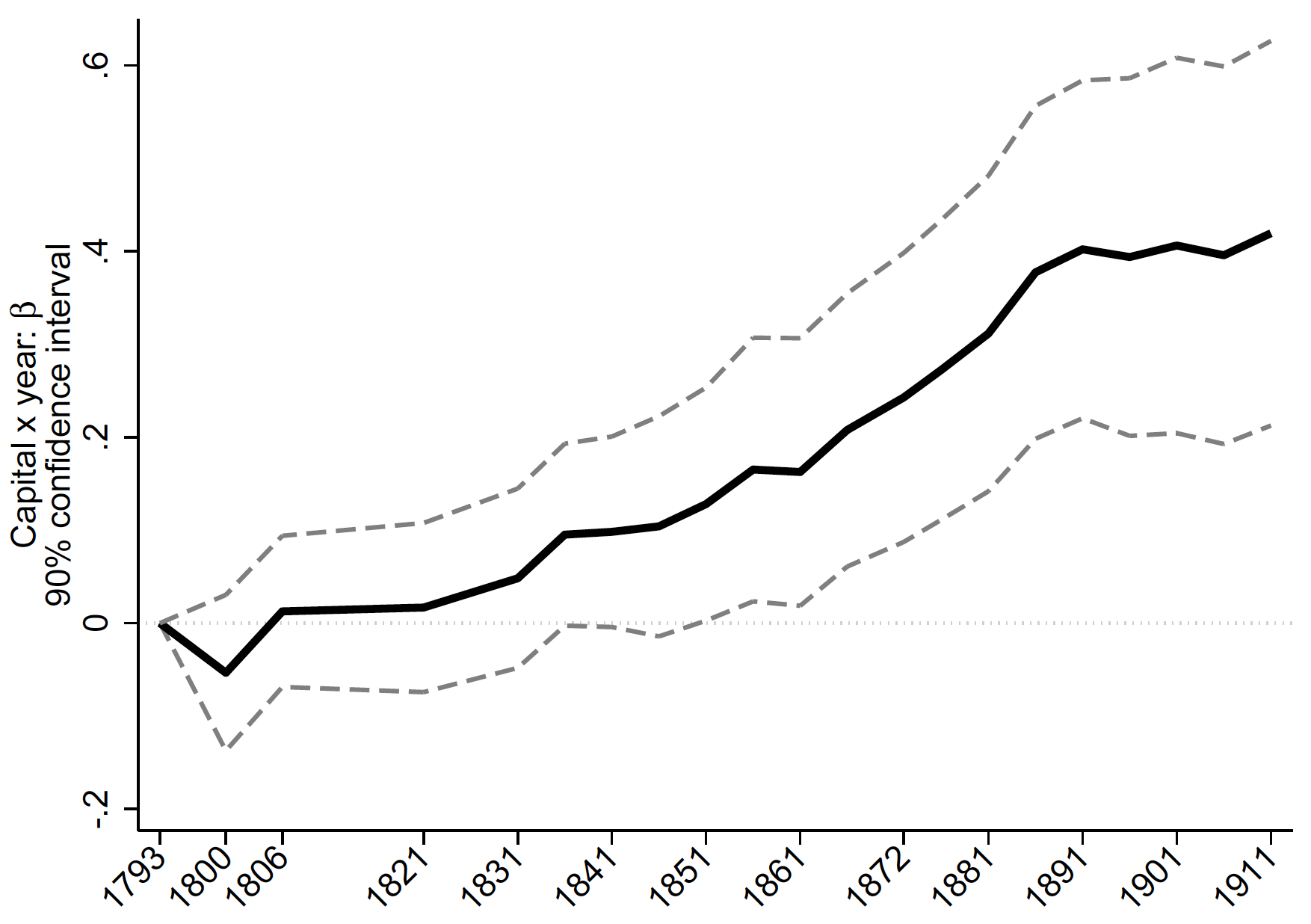

We represent the dynamic evolution of population in Figure 1, where we plot the causal effect of the administrative reform on the population of capitals over time. Two striking facts emerge. First, the ‘winners’ of the administrative reform – the cities chosen as capitals – diverge markedly from competing cities in the long run. Second, this effect only materialises after several decades. We view this initial phase as the period during which investments are made to build the extractive capacity of the state. Only later does this increased capacity translate into a higher provision of public goods.

Figure 1 Population growth of capital cities compared to candidate cities

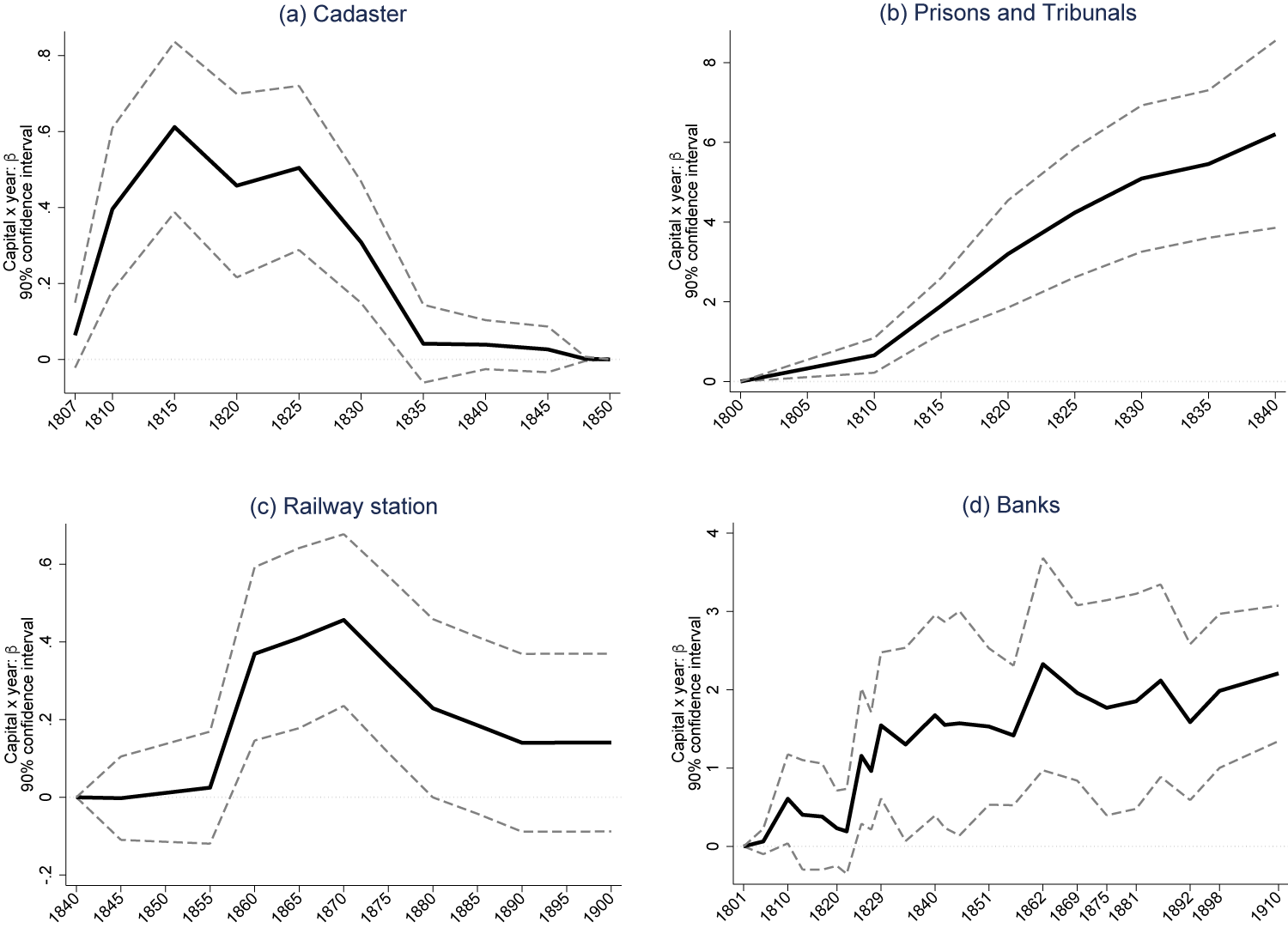

Figure 2 illustrates the successive steps of state-building, which can explain the long-term success of capitals and their periphery. Panel (a) shows the dynamic build-up of extractive capacity: capital cities establish their cadastre before other candidate cities. Panel (b) shows capitals investing in enforcement capacity, in the form of tribunals and prisons. Investments in the coercive capacity of the local administration might have made capitals less attractive for firms and citizens initially. Over time, however, these investments allow the local state to deliver local public goods. Panel (c) shows that capital cities obtain a railway station earlier than other candidate cities.

Figure 2 Growth in public and private goods of capital cities compared to candidate cities

Eventually, these investments in public goods and infrastructure stimulate private sector growth, as shown in panel (d), where we look at the number of local banks. We observe a similar pattern for other economic outcomes, such as innovation. In the late 19th century and the 20th century, the capitals and their periphery have grown faster in economic and demographic terms: the dynamic process of state-building paid off.

France’s state-building experiment illustrates that it takes time and patience for effective states to rise. Early investments in the state’s ability to extract resources require upfront efforts that may be costly for the local population. The dividends from such investments, while substantial in the long term, may not become apparent for several decades. These delayed benefits make the task of building effective states, which remains a key issue in many parts of the world, all the more challenging.

See original post for references

I would argue that the same applies to Henry VIII’s England leaving the Catholic Church and confiscating their assets.

Thank you, Matthew. There’s a great book just published on that and with some elegant maps and prints.

Many books? Which do you recommend?

Precisely.

I have to say I don’t understand this at all. I’m not sure what the argument is.

To begin with, there was a state in France already in 1789. It was one of the best organised in Europe (OK, not a great distinction) but suffered from a chronic inability to raise money. So there was no “state-building” in the ordinary sense of the term, but rather a whole set of ambitious modernising reforms. I’m not sure either why they say that: “Effective states can raise taxes and armies, enforce laws, and produce public goods, but how these functions are built over time is not well understood,” when there are libraries full of books on state formation and development. Perhaps economists just don’t read them. I don’t understand either why states which are capable of “coercion” (which in this sense means developing a police and prisons service) and collecting taxes should risk “undermining economic growth”, at least outside market economics textbooks.

The whole basis of comparison in the article is the contrast between cities which became the capitals of departments and those that looked, for a very brief time, as though they might. This strikes me as a pretty fragile distinction to build a general theory upon. It ignores the fact that capitals were often sited in cities and towns that were already wealthy, strategically placed (on rivers, close to natural resources) or had historical roles in administration. As I recall, the arguments of the period were often about which town or city had the best claim to these assets, so you often got a high level of continuity. Thus, the departmental capital of the Marne was quickly decided to be Charleville-Mézières, not because it was the largest town in the department but because it was the historical seat of the Dukes of Champagne. And once the capitals were settled, and attracted a professional middle class, then most of them flourished, and people moved there. The graphs all stop a hundred years or more ago, by the way, and figures for population growth would look very different now, in an age of de-industrialisation, even though the capitals have not changed.

There’s a lot more to argue with but this will do.

There is indeed a lot more to argue with.

France may have looked like one country on the map but there was a great deal of legal and administrative fragmentation under the ancien regime, mainly due to the huge number of local and regional privileges. Even something seemingly as simple as the gabelle (salt tax) was assessed and levied in half-a-dozen different ways depending on which part of the kingdom you lived in. In fact, it was this jungle growth of privileges which was largely responsible for the monarchy’s “chronic inability to raise money”.

The article about post-revolutionary economic development also raises some questions. First, the auction of Church lands mainly benefited well-to-do peasants and affluent local bourgeoisie. After all, who else could afford to buy the lands in the first place? And people who could afford that could also afford to engage in productive investments later on. Much later on, since the overall economic impact of the Revolution was to set development back by a quarter-century. Second, there may be a very simple reason why military conscription was more effective in local administrative capitals than elsewhere. It was easier for the local authorities to get their hands on conscripts in towns than in the countryside where draft evaders could easily take to the hills.

Right. The authors seem hesitant to cite those whom they claim to have not shed sufficient light on this. I’m not that familiar with social history, but at Michigan and then at Columbia this was what Chuck Tilly and his coworkers burrowed into for decades. (Here’s a sample from 1975.) I think most of them were initially drawn by an interest in revolutionary processes and then were, quite naturally, pulled into thinking about state capacity. And they did spend quite a bit of time on France.

Thank you, Yves.

I am glad that NC has addressed this and hope that David, a former UK civil servant and now resident in France, chimes in.

I contend that the build-up of the French state goes back further and further study should include the likes of Mazarin and Colbert, sponsor of glass manufacturer St Gobain and colonial ventures, in the 17th century, if not a century back. This build-up extended to the colonies.

Younger sons of the aristocracy were dispatched to the colonies as civil servants, known locally as intendants. Some took up concessions on offer, 600 arpents for nobles and 300 arpents for commoners. Some of these concessions remain in the hands of descendants, but are incorporated. One of the 18th century buildings in Port-Louis, Mauritius, is the Intendance. Some of these descendants have also inherited titles from senior lines in metropolitan France. The business of government was slowly professionalised.

Over the 16th century, the link between a title and territory was severed, a means of preventing apanages like Burgundy from becoming regional powers that threatened royal authority. The departements that were created in 1790 were first proposed in the late 17th century, partly as means of weakening the parlements and local nobility, and to make governance more efficient. That also led to innovation and investment, e.g. Riquet’s construction of the Canal du Midi.

The growth of the professional civil service and provision of a career for sons at a loose end led to improvements in infrastructure and economy, something that accelerated under Napoleons I and III, vide the Duc de Morny and his business empire, including the new resort of Deauville, under his half brother Napoleon III.

It took a long time for trickle-down prosperity (trickle down democracy) to establish itself. Faster around established cities and therefore commercial centers. None of this is very surprising. Or revolutionary to us. But it is interesting to think about the similarities between modern oligarchic rentier economies and old feudal rentier economies. Unless they evolve they cannot survive. Not because they are inherently unjust but because they can no longer extract payments from the rest of the population. I see this as almost synonymous with our current disregard of the necessity for demand in a market society. If demand falters you definitely need more prisons, more coercion. Hence our turbo-neo-liberal economy and globalization. As well as our most recent hallucination – Ukraine. But that’s the last phase, imo, because there is no mechanism to feed the beast after some critical mass of wealth has been extracted. And the earth is polluted. And the people are disgusted. Another interesting topic is the mechanism itself. Money. I keep thinking that the age of human obsession with money is over. We now have much bigger problems to address.

” Money. I keep thinking that the age of human obsession with money is over. ” Interesting observation, Susan T.O. Image of urbane ex-hedge fund quant, proclaiming with dismissive hand wave, oozed into my mind: “Oh, money. Been there, done that!”

Money takes the place of community. Retirement funds, so we don’t die, alone, on the street. We die, alone, in a $10,000 per day ICU.

Money confers power. We no longer have to gain and prove our wisdom, our craftsmanship, our ability to lead by example. We funnel wads of cash to politicians who then do our bidding.

We have dredged the ‘working in self-interest’ lie until it is bone-dry. Maybe time to dust off the ‘working for the common good’ approach.

“We,” the inchoate singular-plural, have a big problem with that “working for the common good,” which I would sum up in the phrase “You first.”

“We die, alone, in a $10,000 per day ICU.”

Wow, that is cheap compared to nursing home care.

David Graeber says states are always ambiguous–alternating between an extortion racket and a utopian project. People seldom die for an extortion racket (although mafiosi might disagree).

Graeber certainly documents (in Debt: The First 5,000 Years) that no economic markets are possible without states. “Magic money” predates states, but economic money is another story.

The statement that “the age of human obsession with money is over” ignores the prevalence of “Midas disease”–more of an epidemic than COVID in my experience. I met a retiree who said the ecological ideas I expressed would make his 401K less valuable…but, as reluctant as I am to support elder poverty, having a bunch of stock certificates, or a pile of dollar bills, does nothing for people of any age if there’s nothing to buy.

Midas disease is also called “The fallacy of misplaced concreteness” — going to a restaurant and devouring the paper menu rather than the food. Mistaking symbols for the real thing is one of the unintended consequences of sophisticated symbol systems. I’d suggest the prohibition of idolatry (worshipping the symbol rather than the god) is rooted in that bit of human nature.

Anyway, the age to come, at least for those who survive, may indeed be less materialistic, or less ambitiously money-oriented, but I’d bet as long as we have symbols of wealth (money) we’ll have Midas…

Incidentally, I’ll add that Graeber’s latest and last (The Dawn of Everything) has a very different story of the origin of states, noting that what constitutes a state is very difficult to define in the first place.

The State probably comes about out of necessity – survival – organization has few choices, just like individuals. The choice the State makes is a mandate to control people symbolically (your term and it rings so true) as a conduit for money. A bond as good as blood becomes as good as gold, and etc. States issue money like they construe legal codes. They create Negative Liberty. And my disconnect with Graeber was over his claim that “debt is money” because debt is really negative money. Maybe all just to maintain some standard of civility, like parents bribing their kids. My eternal confusion over “money” is that now “the unintended consequences of sophisticated symbol systems” obfuscates our priorities. They get lost in translation. As sovereigns, we come together with pure credit. Money is credit not because it gets paid back with interest but because it accomplishes something far more valuable than the credit it requires. We’d be off and running if the world realized that money is not an obstacle to our goals. Sorry, raving here as usual.

“I also wonder how Napoleon raised and funded his armies when the départements are presented as not always fully functioning government entities as of then.”

Napoleon founded the Bank of France in 1800 and gave it a monopoly on money creation and complete control over the management of state debt. That wasn’t enough to finance his ambitions so he put other banking houses out of business. They complied with his request to cease operations as it was backed up by tens of thousands of bayonets. I suspect there wasn’t anybody who said “no” to Napoleon when he was winning military victories.

The most famous bank that ceased operations due to the French Emperor’s request was the Bank of Saint-George in Genoa. It was the Goldman Sachs of it’s day, if Goldman had a standing army, collected taxes, or even governed territory on behalf of the state.

Maybe it isn’t anything like a modern Wall Street bank and we should probably be grateful for that. Going back to the good old days when you were forced to fight your landlord’s wars doesn’t sound like fun.

” Effective states can raise taxes and armies, enforce laws and produce public goods but how these functions are built over time are not well understood.”

You can say that again!!

On a deeper theoretical level we seem to be tussling with issues of structure and its relationship to individual subjectivity/volition and agency. Structures, like the State, seem to often end up reified ( viewed as ontologically independent of individual subjective volitions) or similarly ideas rather than structures can be reified and solely symbolic forces are viewed as what supposedly cause social change.

People like Charles Tilly in “Coercion, Capital and European States,” have argued that no one designed the principal components of national states. He sees Treasuries, courts, central administration and so on as usually formed inadvertently as byproducts to carry out immediate tasks, especially the creation and support of armed forces/war. He goes on to say that it is all too easy to treat the formation of states as a type of engineering, with Kings and their ministers as the designing engineers.

The tendency to begin with the State as a single actor tends to reduce to a single point a complex and contingent set of relationships in an attempt to impute a unitary interest, rationale, capacity or action to the state entity.

Wasn’t a big part of Robespierre’s downfall his attempt to found a new religion: The Cult of the Supreme Being. The French Revolutionaries didn’t seem too keen on giving religion any power.

It remains a mystery–so Fruet and Ozouf argue in the seminal work, The Critical Dictionary of the French Revolution–precisely why Robespierre ‘fell’. One reason for this mystery was the fact that he was brought down by his former collaborators…..who quickly wanted to cover their connections with Robespierre, and his faction.

Personally, I would argue it is less, perhaps much less, that Robespierre wanted ‘to found a new religion’, though he made moves in this direction, as he wanted to stop the brutal treatment of Catholics outside of Paris. Particularly so in the Vendee and specifically in Lyon. The purge was encouraging general chaos, Civil War, foreign intervention in France and undercutting the creation of the Nation State.

Two further comments on the general subject: linguistic differences should be noted between Paris and the rest of France. They were dramatic. Two, as to how Napoleon raised money, at least in his very beginning (Italian Campaign) and at the end of his reign, attention should be paid to the looting of art in the territories he conquered. The haul was stupendous and engendered much resentment. That, ultimately, came back to haunt the French Empire.

I regret that I have little to add but this old chestnut of Charles Tilly’s:

“War made the state, and the state made war.”

This is a perfect example of anti-science, namely cherry picking data to support a theory. That some of the data may not relevant or even factual never troubles such theorists, any more than all the data which does not support their theory.

The elephant in this room is the French state. With the possible exception of Japan, no other democratic country is more “top down” and still is. This has been true since the 17th century. The different regimes and constitutions since 1789 have had almost no visible effect on this extreme centralisation.

Today’s Enarchs have more economic power than the dhurch and nobility of the ancien régime. They are considerably better educated. So they have engineered a system that provides the necessities of life to everyone. Around half the inhabitants get little or nothing more, but enough to ensure the indefinite continuation of their power.

Now semi-retired, I have lived and worked in France with few interruptions since 1961.

Leading up to the revolution, the finance minister Turgot abolished forced labor and implemented a land tax, the original “single” tax. The landowners fought back and Turgot was dumped in 1776.