Yves here. Despite all of the braying about our current recovery, there’s still plenty of individuals and households who are badly squeezed. In a nod to William Gibson, the expansion may be here, but it sure isn’t evenly distributed. Rising rents versus not so rising incomes is one example.

But it’s also worth noting that not everywhere is seeing rising rents.

By Wolf Richter. Originally published at Wolf Street

How have on-time rent collections been doing in this era of spiking rents? Across the 100 largest markets in the US, in multifamily buildings the median asking rent for one-bedroom apartments jumped by 12% year-over-year. The median asking rent for two-bedroom rents jumped by 14%. In 34 cities, asking rents spiked by 15% to 28% year-over-year.

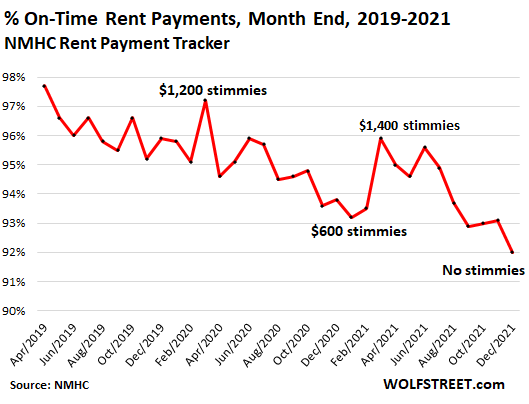

Turns out, there is a perplexing deterioration of on-time rent payments that started in mid-2019 and has continued through the end of 2021, interrupted only by the months when the big stimulus checks – not the little one – went out that allowed more households to make timely rent payments.

Only 92% of renter households had made their rent payment for December by the end of December, the lowest percentage since April 2019, down from 93.8% in December 2020, and down from 95.9% in December 2019.

What stands out is the down-trend over those 33 months, interrupted by the months when the big stimulus checks poured into household coffers.

What also stands out is that the $600 stimmies that went out at the end of December 2020 and in January 2021 didn’t cut it, in terms of rents. They were likely used to deal with the credit-card hangover from holiday essentials.

Most of the eviction bans have now ended, but rent-and-landlord-support programs by various government entities to deal with the eviction bans, and the end of eviction bans, are still going on. This came on top of the now-ended flows of free money via extra unemployment benefits, PPP loans, stimulus checks, and other programs.

This data is based on actual rent collections from 11.8 million market-rate apartments in multifamily buildings (not single-family rentals) that are managed by corporate landlords. These apartments house about one quarter of the total 44 million renter households in the US.

This special pandemic-era rent-collection tracker was provided by the National Multifamily Housing Council (NMHC), based on data from companies that sell property-management software to larger landlords. This rent collection data does not include mom-and-pop operations, single-family rentals, subsidized affordable units, privatized military housing units, and student housing.

“While the tracker is intended to serve as an indicator of resident financial challenges, it is also intended to track the recovery as well, including the effectiveness of government stimulus and subsidies,” the NMHC said. But the trend has been worsening.

Many of these apartments are in expensive urban centers, offer glitzy amenities, and cater to young people with good incomes and to empty-nesters with good incomes, following an apartment-tower construction boom in those areas. So tenants are not necessarily the down-trodden.

Massive Rent Increases Anyone?

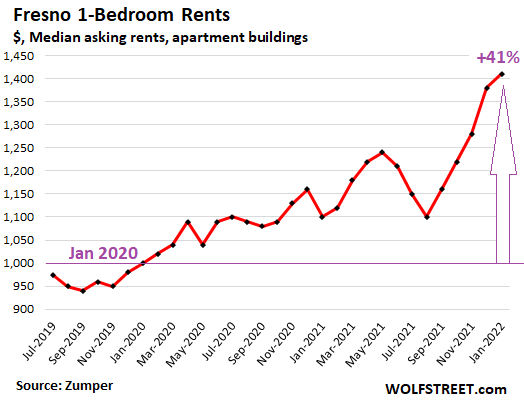

This rent collection trend comes amid a massive surge in market rents in many cities. Across the 100 largest markets in the US, in multifamily buildings – many of them managed by the very landlords in the above rent collection data – the median asking rent for one-bedroom apartments jumped by 12% year-over-year. In 34 cities, asking rents spiked by 15% to 28% year-over-year.

Those are massive increases. A 20% increase of a $2,000 rent payment means the household must come up with $400 per month more just to spend on rent.

Some of them are big expensive cities, such as Boston, Miami, Austin, and New York. Others are in smaller cities with much lower rents where renters now get raked over the coals.

The whole list of those cities and their rent increases are in my open letter to Powell: Dear Mr. Fed Chair Powell Sir, Rents Are Blowing Out and People are Hurting. The winner was Fresno, CA, where the media asking rent for 1-BR apartments spiked by 28% year-over-year, and by 41% in two years:

Could there be a relationship between these stunning rent increases and the deteriorating timeliness of rent payments across the universe of 11.8 million renters in apartment buildings?

Lacking data to prove it, my gut tells me that when rents are raised this sharply, and when rents already constitute a large part of the household budget, then there are going to be issues. These rent increases cannot just be brushed aside. Even in households where pay went up 6%, a 20% rent increase is a tough nut to crack. And a larger portion of tenants appear to be falling behind.

Fresno??

Last time I was in Town, it just didn’t seem the place for high end , luxury laden apartment ‘homes’ complexes.

I mean it was nice and all, and we had a good breakfast after a night at the Motel 6(dogs). But $900 to $1,400?

Seriously. Fresno?? Where they are soon to have NO WATER AT ALL?

How dare they price-gouge in a place like that?

I was a world history buff from the time I learned how to read. The one thing I learned about and dread is a full scale, nationwide bloody revolution, possibly much worse than 1789 France. That tsunami pattern is forming; this corporate renter ripoff pattern is a big part of it. That sea wave will come to shore and it won’t be pretty either!

In 2008, Memphis was single family residential was 60% owner occupied, 40% rental. From 2000 to 2005, we were the foreclosure capitol of America, then the rest of the country caught up with us. Today, single family residential is close to 65% rental, 35% owner occupied. My street was all owner occupied as of 5 or 6 years ago, now there are 5 rental properties. Investors paid way over market value for them. Multifamily residential here has seen a boom in only a couple areas of city, the midtown area and parts of downtown. Way to many apartments and condos have been built for the market. While Tennessee has seen many people move to the state, those people didn’t come to Memphis. Population has been flat for 20 years. Much of this multifamily construction have been suspected money laundering or malinvestment of people with cheap money to spend, in the end the ravenous purchase of single family and over construction of multifamily (oversupply still hasnt caused a decline in rents yet) has driven up rents in a city that has had a desperate need of affordable housing for decades. While we don’t have tent cities like other larger cities, homelessness is increasing and begging is common on many street corners. Social fabric is frayed. Schools and the student body themselves are a mess. Memphis has always been a hot mess because of multi generational poverty, a logistics based economy and sitting in the center of the Mississippi delta. To add insult to injury, the publicly owned utility has been neglected and poorly run. Ice storm from 10 days ago still had 7,000 households without power as of yesterday. I lost a hot water heater to it. Public so angry at it there is a push to privatize the utility and use the money to bury the electrical grid, which they say will cost $2.9 billion. If we sell the utility, we will get higher rates and I am pretty sure the power lines will still not get buried. Higher rents and higher utilities. Just what a poor city needs. Thank you Federal Reserve.

Thanks for that local perspective.

what I do not get is how this is possible. who are the tenants for these more expensive apartments? what are current vacancy rates? why aren’t landlords going broke from raising rents and not being able to collect? I mean, I was wondering about these things before covid, and now I am bewildered, so grateful to anyone who can throw light on this subject.

I’ve lived in 3-bedroom apartments the last 7 years or so – Puget Sound area, not a bad neighborhood…but not fancy new luxury apt complexes by any means – and while at the beginning of that stretch (after a year goes by, leases expire, rent goes up) i think I saw more of the expected “young couple with a kid or 2 driving shabbier car moves out, young couple with no kids driving new car moves in” (with maybe the 3rd bedroom turned into a computer or extra room)

Now during ‘lease-end/rent-rises-again’ times I am mostly seeing “young couple with 2 kids and shabbier car moves out, 3 couples all driving shabby cars move in” i.e., as long as people are friendly enuff to share a bedroom, the rent gets split smaller even more ways”

Dunno about laws regarding max occupancy but i assume it must be something like ‘max 2 peeps per bedroom’ or similar. Although, I wouldn’t expect apt mgmt to care too awfully much if that definition gets ‘stretched’ from time to time, as long as noone complains and rent gets paid on time.

>>>Although, I wouldn’t expect apt mgmt to care too awfully much if that definition gets ‘stretched’ from time to time, as long as noone complains and rent gets paid on time.

Yes, and it can be a lifesaver when one is poor, but Americans usually have a two limit maximum per bedroom. In boom times when undocumented immigrants pour into the area, the very large number of single men, plus occasional family blows past that limit in a house or apartment. I cannot blame anyone as poverty is the driver in such situations, and as the saying goes, needs must do as the devil drives; it just that having cars and people to such a number that finding parking or using the laundromat can be almost impossible. When six cars are in the driveway, plus some lined up one the street of a small house… nobody wants to live in such a crowded environment, but are forced to just to have shelter. Some landlords do like making the money and it does not matter if the economy is good or bad, they will keep raising the rents beyond reason or sanity.

People in the Bay Area keep saying it can’t get any higher or the increases must slow down at least for forty years. I think the costs have gotten so high compared to the rest of the country, the increases have been nil, or rarely, there have been decreases, but the rent is still so damn high. I haven’t had the absolute need to check prices for a while (thank you family!), but really, over a thousand for a room or two thousand for a studio is not unknown. I mean looking at Birmingham with the average first of thirteen hundred and a low of nine hundred in the past year, are prices I haven’t seen for about two decades.

However, with the prices in the rest of the country, I am guessing the landlords are cracking the bones to get to the marrow, having eaten everything else of the nation’s body. And they can keep cracking those bones longer than most people can survive. Damn ghouls.

I think this is much ado about nothing. Moneymen seeking rents bought massively during the downturn and naturally, promptly raised rents to improve their returns as otherwise, there’s no way to really make money on a scale to which they are accustomed. Thing is, nothing goes straight up (or straight down) and with the next recession, I expect there will be a price-reset. After all, moneymen expect their holdings to remain leased and when they’re not, then the usual move is to lower the rent until the property it is occupied by a good tenant. In the process, they’ll seek better opportunities and credit worthy purchasers will have a boon as they unload properties. But these things take time to work out and this pandemic is an usual happening. So all I am saying is I believe we will, as usual, eventually see a reversal to the mean regarding both rent and rental property ownership (although in the meantime, I expect there to be a lot of pain).

Evicted by Matthew Desmond is a how-to manual for slumlords. It says that asking for rents higher than the typical tenant can pay is useful because those in arrears generally loose all tenant rights and can be easily evicted, thus can’t complain if the building isn’t being maintained properly. And then future income can be attached even if they have nothing now since, who knows, they might get married someday or inherit something.

Land gives so much more than the rent. It gives position and influence and political power, to say nothing of the game.

—Anthony Trollope’s Archdeacon Grantly in The Last Chronicle of Barset (1932, 178)

> The Last Chronicle of Barset

Oh my, one more book to read (though 1932 must be the edition, not the date of publication).

Yes indeed! The Barcester Chronicles have been on my bucket list of “must be read” books for too long.

But the problem is that here in the UK we appear to be living through them, en route to the full-on re-creation of the world of Charles Dickens.

But hey! It’s what the people have voted for this past 45 years or so.

When I was in Boston, in Cambridge they’d just finished a dozen or whatever story residential tower in Central Square across from the fire station. Starting rent was like $2900 for a studio. This was in 2019 I believe, prior to the pandemic.

Kind of insane, eh?

It’s hard to imagine who can afford such things.

Wealthy students and people working in tech, finance, and legal. Biotech keeps booming and those are high salary positions. Plenty of people in metro Boston to fill those units.

Oh I have no doubt. It’s only a short stop to Kendall Square and Pharma Ally, and Pfizer is actually right there in Central Sq I think? Not to mention Google and Amazon right in Kendall. Still, not much housing for teachers, police, firefighters, and the working class that kept all those bars and restaurants up and running for the tech kids. Even much of Somerville was insane by the time I moved.

> Still, not much housing for teachers, police, firefighters, and the working class that kept all those bars and restaurants up and running for the tech kids.

I think this is the real reason for late/missed rental payments. Wages arent keeping up with inflation. Tough to get too mad at the Fed for this (although driving up housing prices certainly didnt help). We need policy finally written for the middle class’ benefit

I did my postdoc in Boston and lived in Watertown because most of Boston/cambridhe was so expensive. Watertown is no longer the deal it once was either.

Land gives so much more than the rent. It gives position and influence and political power, to say nothing of the game.

—Anthony Trollope’s Archdeacon Grantly in The Last Chronicle of

Barset (1932, 178)

Equal rights for renters? Hah…

When a supermarket in a bad neighborhood with “relaxed” enforcement sees pilferage go from 2% to 5% they raise the prices to compensate for the pilferage while a store in a “good” (low pilferage, high enforcement) neighborhood sees 1% pilferage that doesn’t rise. Supermarkets work on a low mark-up model; I’ve heard that 10% gross profit is not unusual. So in the bad neighborhood the pilferage cuts the gross profit in half while in the good neighborhood the pilferage cuts the margin by 10%. To make up for this difference, the market in the bad neighborhood raises prices by 10% and in the good neighborhood the prices go up by 1%. This leads to demonstrations and bad publicity for “discrimination”. So the company closes the store in the bad neighborhood. Profits go up and so do the number of articles about a “food desert”.

The basic economics apply to housing. The federal government “mandated” no evictions but refused to compensate the landlords. Renters, not unreasonably said: “Why should I pay my rent if they can’t throw me out?”. So landlords, also quite reasonably, raised the rents to cover the non-payment, increased security deposits to reduce the number of potential deadbeats and, more interestingly, priced in the uncertainty created by this government action.

Welcome to the NYC rental market after the “emergency” rent controls during WW II were extended for 50 years. In 1974 I got a $68/month rent controlled fifth floor walk-up on 33rd between 2nd and 3rd. The “renter of record” was an urn of ashes on the mantle. I got the apartment from her “nephew”. I guess that made me her grand-nephew.

And why would anyone invest in building new rental property if the government can say “Oh, there’s an emergency so you don’t have to pay rent this month”? I live in a student housing neighborhood near the University of Texas. No deadbeats; rich parents; guaranteed turnover. More than half of the US multi-unit rental investment in the last 10 years have gone into student housing, which is ridiculous but understandable. So we get 18 story student housing buildings with pools on the roof and gyms facing out from the 14th floor and no investment in low-to-moderate income housing. The money flows to a safe, predictable market not controlled by Presidential Decrees (ie Executive Orders). And notice that Birmingham is down while Fresno is up 40% curtest of migrants from the Frisco Bay, the land of Liberal NIMBY and forever rent control.

Policies have predictable but undiscussed consequences. The policies cause the consequences and no amount of post-hoc finger-pointing will change that reality.

> More than half of the US multi-unit rental investment in the last 10 years have gone into student housing

Interesting! Do you have a link?

From this room, I can see a cluster of high-rise student apartment towers. They were constructed west of the University of Arizona campus in the past few years.

On one hand, they’re ugly and expensive. On the other hand, my neighbors and I view them as giant vacuum cleaners that have pulled students away from this area. Quite frankly, we aren’t sorry to see them go. As neighbors, they were noisy and inconsiderate.

Oh, you should see the Coliseum, Spaniard!

There was a boom of student housing at UCF that seemed to have recently come online back around ~2013-14 or thereabouts. And you wouldn’t even recognize UF anymore these days, if you went to school there in the early 2000s.

That said, I can’t substantial the claim, although I know I’ve read some about it in the not that distance past, but it was pre-pandemic and I’ve forgotten most of the outrages of that era now.

In reply to Lambert. I was heavily involved in the issue two years ago and read the figure in one of the four national magazines and had it confirmed by a second article.

Now when I look up the numbers from outside sources the number seems suspect. The best number I can find for dollar volume is about 5.8 – 7.3 billion dollars/year for student housing. The best report I found on “alternative Realestate” is https://www.cbre.us/research-and-reports/2020-US-Real-Estate-Market-Outlook-Alternatives. While 280,000 multifamily units were being built for roughly 50 billion/year. It appears that new student beds/year is ~50,000.

So either I misread the report, they were talking about the number of beds/bedrooms, or they were playing with numbers. But clearly the 50% is wrong. The real number looks more like 10-12%

I do not deny that some businesses have been destroyed by outside theft, but just as with prison drug trafficking usually is usually done by the prison guards themselves, most shrinkage comes from the people working for the business. Have anyone ever been to a supermarket in one of “those areas?” I have, a lot, and it is amazing the difference between two different stores of the same chain, merely a very few miles apart. The worst of everything from product to employees, understaffed, dirty, and disorganized. Stores, banks, hospitals, whatever. And most of the people, as in everywhere, are honest and just trying to get what they need to survive.

More on topic, we can discuss the details details, but I think that we can agree that the cost of everything especially rent has been rising faster than income for decades. Pointing to just the peanuts getting stolen, while true by itself, is ignoring the growing impossibility of growing numbers of Americans just to survive. This while the tippy top gets trillions of dollars just about shoved into their gaping maws like Mommy and Daddy birds shove it into the little chicks.

We have tended to think of ourselves as just a fabulous country. That may have been true fifty years ago if you squinted real hard. But now it’s okay to throw whole families onto the streets because reasons. I am always hearing what we cannot do and very often seeing what little is done going into the pockets of grifters. Someone’s third cousin’s best friend’s girlfriend get a job Kamala like getting six figure sinecure instead of the money going into government services like public toilets or creating housing.

Vienna has affordable housing for everyone that apparently almost everyone of all classes want to live in an ongoing project starting right after the First World War; looks like their secret is a goal of very good, affordable housing for the upper classes downwards, for everybody, with very reduced rents for the poor and working classes, and not building cheaply and maintaining poorly for the lowest classes. They have been doing this for a century, but it would be only modestly profitable for the builders with the way the Viennese do things.

Make it something anyone would like and then they will come. We all know that modern American public housing means building garbage and then not maintaining it, while shoving the poorest, most desperate people into them. Who would want to live with that? But no, it must be all the poors fault that they live in bad housing. May I suggest reading about buying homes on contract and the real estate industry’s practice of block busting, which was common in the United States, but especially so in places like Chicago and Detroit. Working and middle class people of all kinds lost billions with a b.

The more I read American history, the more I understand that much of it, like racism, Wokeism, Appalachian poverty, the Indian Wars, Neoliberalism, and so on, much of the Cold War, heck Jim Crow itself, is a number of interlocking grifts. Get rich by stealing and killing anyone troublesome. This was a cause for lynching. Any black business owner (and a few whites) who was too successful and a threat to the local elites’ businesses got hung after some BS accusations of being too friendly with the white women or something.

It’s been under or never reported, but apparently much of the theft started AFTER the companies laid off their security people. Here’s one example:

Before Recent Wave of Train Cargo Thefts, Union Pacific Laid Off Unspecified Number of Its Railroad Police Force

https://www.msn.com/en-us/news/us/before-recent-wave-of-train-cargo-thefts-union-pacific-laid-off-unspecified-number-of-its-railroad-police-force/ar-AASWvJE

I’m not saying theft isn’t up, I think laid off and hungry people is up too. For all we know, the people taking goods from the trains WERE the security guards at one time.

But here’s even larger theft, from 2017:

Employers steal billions from workers’ paychecks each year

https://www.epi.org/publication/employers-steal-billions-from-workers-paychecks-each-year/

Wage theft is WAY LARGER than what’s disappearing from stores, but it’s hardly ever reported by the MSM.

Sorry, this post is a little off topic, but Dave In Austin mentioned the store theft.

Lets not forget the tax advantages given to rentals and multi units residential — in the form of depreciation and your tenant’s rentals including the invisible property taxes they pay as a pass through to landlord and on to the taxing authority.

If you the investor or landlord play the numbers you will have an advantage over the homeowner or prospective homeowner in ability to pay a higher price bye-in because your tax advantages allow a larger income stream on a product that is a required survival need (shelter). If you are building a multi unit residential.. you get tax breaks etc. for building it…jawbs and future taxing authority revenue streams which can be lent to the taxing authority at compound interest …which make those elected officials so happy by increasing their greese to get re-elected. Meanwhile, al that jaw boning about the affordable housing this new build creates gets overplayed and under deployed …because greed and the mechanical advantage achieved through taxing changes, grift, greed and legalized gambling in the fundamental human survival needs.

It should be remembered however, the evolutionary process by which monkeys made men of themselves was considerably slower than the reverse process.

Legal Gambling

The gloom is fading from the real estate situation. More nibbles during the last few weeks than the last three years. If January brings us good rains, this next year will open the door to the sunshine – a case of rain bringing the sun.

It is to be hoped, however, that there will never be another boom. The crash of the boom of 1923 was due to the same causes that wrecked the wall street stock market. People sold what they did not own. They made a payment down in the hope of getting the property off their hands before it began to burn. Real estate fell into the hands of sharp-shooting gamblers who had no interest in land. To them it was just a pile of blue chips on a roulette wheel. -Anon-1920’s

Once people lose their last grip on the ladder and fall into the bottomless pit of homelessness, they rapidly lose the attributes of “employability”. I think Clinton and Biden attempted to postpone the shantytowns and tent cities by tripling our prison population with their “crime bill”, possibly to take up the slack from NAFTA, etc., globalizations. But now what? We’re stuck between a Trump and a hard place. Why can’t we get an FDR when we need one? Oh, yeah, our votes can’t compete with oligarchic corruption. 0h, well, Herb Stein said it best: “If something cannot go on forever, it will stop.”

>>But it’s also worth noting that not everywhere is seeing rising rents.

I hope I am not imposing or breaking a ton of site rules by asking this, but do you recommend Birmingham for refugees from expensive cities? If any other commentariati can chime in with their recommendations, that would be nice.

I don’t know how much longer I can take Boston. It is a shadow of what it was pre-pandemic which was a shadow of what it was pre-gentrification, but somehow more expensive than ever.

I don’t know, all the cool kids are in the Seaport these days, if insane rents, no subway, and only the Trader Joe’s is your scene… I do miss wandering around North End though.

How could anyone suggest that the Silver Line isn’t a subway? I mean, a bus is a subway if you stick it underground, right? /s

Atrios is always harping on Philly, but outside of “major” cities and capitals, there are places like:

https://en.m.wikipedia.org/wiki/Roanoke,_Virginia

Then you aren’t that far from VPISU and JMU which will bring in more exotic stuff. There should be a short line going in to connect you to the crescent and northeast amtrak. There is a bus now. I’ve never been there beyond day trips and the circus when I was small, but I always liked it. I think most Virginia independent cities are nice or have nice, affordable areas if you are looking for a retirement from greater Boston. I would stay away from the more highway driven monstrosities like Charlotte.

I don’t know the prices, but I like Portsmouth, NH.

And the Salem Red Sox are there.

Is there any correlation between the percent of rent increase in various cities with the number of foreclosure/evictions that occurred in those cities as a result of the 2008 crash?

Couple of things I didn’t see mentioned:

1. Child tax credits—The last one went out on December 15, I believe. Which brings us to:

2. Lower tax refunds. Since the child tax credits were really an advance payment for the child tax credits that people usually receive in February, March, or April, those low-bracket taxpayers are discovering that their annual windfall from Uncle Sugar is not coming this year.

3. Student loans—-supposed to start back up in May.

For many young families, they probably started the pandemic with student loans and no monthly tax credits. The tax credits and student loan payment freeze could have put an extra $1,000 in their pockets every month, depending on number of children and amount of student loan payment, and then people also got the stimulus payments! Having gotten used to having that extra money each month, the pain is going to be substantial when it all goes away—-especially when the timing of it going away coincides with higher prices and rents.

We are rediscovering how capitalism actually works and the opposing interests of the three groups within the capitalist system.

What was classical economics like?

There were three groups in the capitalist system in Ricardo’s world (and there still are).

Workers / Employees

Capitalists / Employers

Rentiers / Landowners / Landlords / other skimmers, who are just skimming out of the system, not contributing to its success

The unproductive group exists at the top of society, not the bottom.

Later on we did bolt on a benefit system to help others that were struggling lower down the scale.

Identifying the unproductive group at the top of society didn’t go down too well.

They needed a new economics to hide the discoveries of the classical economists, neoclassical economics.

The equation puts the rentiers back into the picture, who had been removed by the early neoclassical economists.

Disposable income = wages – (taxes + the cost of living)

Employees want more disposable income

Employers want to maximise profit by keeping wages as low as possible

The rentiers gains push up the cost of living.

Governments push up taxes to gain more revenue

In fact there are four groups, if you include the Government.

Chinese policymakers didn’t have the equation.

The dynamics of the capitalist system were a bit of a mystery.

Davos 2019 – The Chinese have now realised high housing costs eat into consumer spending and they wanted to increase internal consumption.

https://www.youtube.com/watch?v=MNBcIFu-_V0

They let real estate rip and have now realised why that wasn’t a good idea.

The equation makes it so easy.

Disposable income = wages – (taxes + the cost of living)

The cost of living term goes up with increased housing costs.

The disposable income term goes down.

They didn’t have the equation, they used neoclassical economics.

The Chinese had to learn the hard way and it took years, but they got there in the end.

They have let the cost of living rise, and they want to increase internal consumption.

Disposable income = wages – (taxes + the cost of living)

It’s a double whammy on wages.

China isn’t as competitive as it used to be.

China has become more expensive and developed Eastern economies are off-shoring to places like Vietnam, Bangladesh and the Philippines.

Customer?