Yves here. This article contends that higher interest rates will dampen private equity returns and new commitments, although that could work to the detriment of smaller firms. I’m not completely convinced of the latter, given the strong push many investors are making to promote ESG goals, and that minority/women owned firms are not big fish.

The article is disappointing in its failure to acknowledge the existence and guesstimates of the magnitude of hidden fees in talking about the potential for limited partners to push for a better net deal for themselves. As we’ve pointed out many times, Oxford professor Ludovic Phalippou estimated total private equity fees and costs at 7% per year, which CalPERS confirmed in a private equity workshop in November 2015. Much higher valuations could translate into a somewhat lower take, but still markedly over 5% on average. By contrast, this article mentions only management fees of 1.5% to 2.0%.1

The piece also ignores the fact that private equity investors do very little negotiating of the limited partnership agreement, above all on fees, since limited partners often don’t have congruent interests and believe they face anti-trust issues if they were able to agree among themselves and band together. Instead, they focus their negotiations on side letters.

This article finally fails to mention the important SEC push for vastly increased disclosure of fees and conflicts of interest.

By Victoria Ivashina, Lovett-Learned Professor of Finance and Head of the Finance Unit, Harvard Business School. Originally published at VoxEU

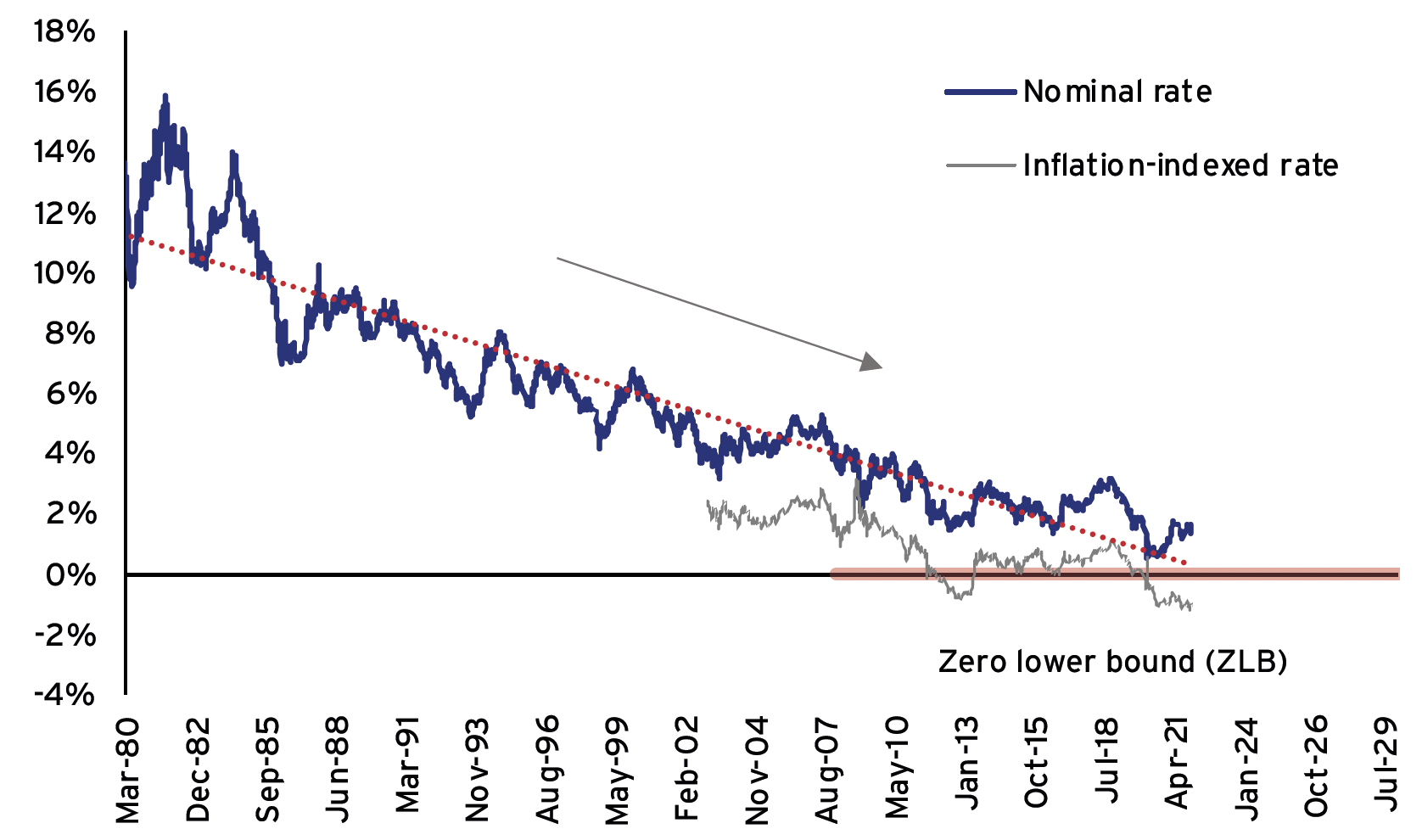

As interest rates shift from a decades-long decline to hovering at the zero lower bound and potentially increasing significantly, the private equity industry will face new pressures. The inflow of capital to the asset class will decelerate, leading to an increased scrutiny of costs and an opportunity to shift bargaining power to limited partners. The first LTI Report argues that while the private equity industry has made promising steps towards innovation to preserve momentum, the adverse macroeconomic pressures will likely still prevail, affecting the industry’s growth and, subsequently, its cost structure, which remains a controversial subject.

Private equity is a unique form of long-term capital that plays a significant economic role. As such, it is pivotal to understand how developments in the private equity industry interact with macroeconomic trends and monetary policy. We know the flow of capital to private equity and its performance are highly cyclical (e.g. Axelson et al. 2013). But there is analysis of the industry’s interaction with longer-term trends. In particular, the expansion of long-term alternative asset managers in the past four decades coincided with the secular decline in interest rates (Bean 2015). This has been an important tailwind for the industry’s growth, as debt markets were becoming increasingly cheaper and institutional investors were searching for ways to offset the shrinking yields on their fixed-income portfolios. In the first report in a new series from the Long-Term Investors think tank at the University of Torino (LTI@UniTO) and CEPR, I look at what we should we expect as this pressure dissipates (Ivashina 2022).

Donwload When the Tailwind Stops: The Private Equity Industry in the New Interest Rate Environment, LTI Report 1, here.

The Changing Environment

In 2021, the private equity industry’s fundraising leaped to a new record level. Given that that interest rates have been at zero for over a decade now, at a first glance, it might seem that this stagnation at zero has not been consequential to the industry’s dynamic. However, unlike other financial segments, the relationship between the demand for private equity asset class and the interest rate environment is not contemporaneous. This is partly due to constrained access to funds, long-dated holding periods, and illiquidity. In addition, investors entering and exiting the alternatives space is not exactly a spontaneous or isolated decision; it takes significant time and resources to develop the necessary knowledge and relationships.

The history of limited partners’ capital flow to private equity is best understood as a set of overlapping waves jumpstarted by just a handful of significant strategic shifts in allocations of institutional investors, with each of these waves taking over a decade to fully unravel.1 The latest wave began in response to the near-zero rate environment that surrounded the global Financial Crisis (GFC) and recovery period. It led to a significant structural revision in the allocation of alternatives for pension funds and other investors. This is the shift that still feeds the fundraising success of the last few years.

Figure 1 10-year US Treasury constant maturity rate, 1980-2021

Source: Compiled from https://fred.stlouisfed.org.

While the timing of the rise in interest rates is uncertain, it is abundantly clear that the nominal rate either will continue lingering close to its zero lower bound or will begin to increase (see Figure 1).2 A significant rise in rates would be the most damning scenario for private equity. This would most likely result in limited partners scaling down their allocations to private equity and becoming more selective with funds, which would have several implications:

- First, the illiquid and long-term nature of the private equity asset class, significant dispersion in returns across funds, as well as bilateral and relationship-driven fundraising, creates scarcity in access to individual funds, giving private equity funds the bargaining power when splitting the returns. As the industry’s growth deaccelerates, the pendulum of bargaining power will start to shift to limited partners, but more permanently than what we saw during the GFC.

- Second, we will see larger scrutiny of the cost structure and the industry’s value-add. Put simply, it is an expensive asset class, with the net returns to limited partners lacking consistency in beating public benchmarks (e.g. Harris et al. 2014).3 A central tension is large funds’ management fees, which typically run at 1.5% to 2% of committed capital already in the first five years of the fund life.4 This structure is lucrative for managers but underscores the disconnect between the private equity firm’s income stream and its fund performance, especially for large funds.

- Third, such pressures would make new and smaller funds particularly vulnerable. The proliferation of new funds, especially generalists’ funds, in the past decade was partly explained by the strength of capital flow and investment managers’ desire to capture a more significant share of fund economics. These funds have a higher embedded cost structure. Larger funds, therefore, have more room to compress the fees and have a higher ability to experiment in the investment space. All this gives larger-scale firms a better chance to withstand adverse pressures, resulting in market consolidation.

- Finally, calls for increased transparency across the industry are growing. There have been recent legislative proposals to regulate the industry, particularly regarding fee transparency. If significant progress is achieved on the disclosure of fees and expenses, it will likely accentuate negative pressures that are emanating from the new interest rates environment.

If we are in a ‘hockey stick’ scenario and rates will continue to linger around zero (as they have done since 2008), the consequences are unlikely to be as pronounce, but astonishing growth of the industry of the past decade is deemed to fade. At its core are portfolio allocation decisions of pension funds and other large limited partners; it all starts with target allocations across different asset classes, given their projected performance. Returns on fixed income cannot contract further, and the scale for limited partners’ investing in private equity has already been reached. We would expect growth to be in line with the limited partners’ assets growth. Once again, such deceleration in capital would likely bring the industry’s risk-return profile and its cost structure into the spotlight. Thus, whether rates rise or they stay consistently low, the consequences are very similar. What is different is the horizon over which these pressures will materialise.

Industry Reinvention

This new interest rate environment will also put pressure on the industry to innovate to maintain momentum. Perhaps the most exciting of such trends, the one that stretches the frontiers of private equity investment opportunities, is the lengthening of the investment (holding) horizon. One way or another, movement towards a seven- or ten-year holding period for individual deals would be a significant transformation for the industry. While we tend to associate private equity with patient, long-term capital, the reality is that the industry is almost entirely focused on the five-year holding horizon. That is five years to exit, which means that the growth and/or turnaround results need to clearly show in about four years. It is easy to see that the needs and opportunities for sophisticated active management far surpass those initiatives that can show results in four years.

Can this trend take off at a significant scale? Not so fast. The problem is limited information and, relatedly, weak governance that comes with illiquidity. Mandatory exits provide a clear window into the performance of a fund. If the holding horizon becomes longer, the misalignment of incentives between limited and general partners can be amplified. Differed compensation for investment professionals helps. First, it creates a problem since ‘carry’, which is already removed far into the future, is being pushed even farther. Second, it does not resolve the problem of gambling for resurrection or just shirking (while charging a fee) when things do not go as planned. In sum, the extension of the investment horizon is the trend with the largest growth potential, but it is unlikely to become the new normal in the near future.

The second significant trend that could offset the pressures of a fading macroeconomic tailwind is growth of the investor base. The idea is simple: if capital flow from one client is slowing down, complement it with a new one. The problem is that the untapped territory is retail, and historically fundraising has been very costly and time consuming, even for big cheques. It is not yet clear how the industry could fully democratise fundraising (while also avoiding significant increases in regulation). But a significant step in that direction is the entry of US defined contribution pension plans to the private asset class.

Conclusions

Due to the nature of the private equity asset class, its growth follows a unique trajectory. This trajectory cannot be understood unless we think about long, overlapping cycles. Where we stand today, adverse macroeconomic pressures for the industry are evident and likely to be persistent. Although some interesting experimentation is taking place in the industry, as of this moment, none of the benign trends appears to have sufficient capacity to offset the tampering of the capital push into alternatives. What is in question is not the industry’s existence but its growth, and with it, the sustainability of the current cost structure. For limited partners, this represents the opportunity to seize bargaining power in how rents are split between private equity firms and their investors, and the resilience of high fees – despite growth in fund size and compression in returns – is what is at stake.

But this should not be taken for granted. The impact of the slow capital inflow is likely to disproportionately affect smaller and younger funds. Larger funds will likely continue receiving substantial fund inflow, especially as the industry consolidates. Without an informed approach and coordination among limited partners, we might see the exit of smaller private equity firms but the cost structure for large firms stay the same. Proactive coordination efforts among limited partners will be necessary to converge to a new cost structure with a better alignment of private equity incentives.

See original post for references

___

1 Phalippou pointed out how using nominal management fee levels is misleading. That 1.5% to 2.0% is of committed capital. But on average, PE funds are using only about half of their commitment level over the first five years. That makes the effective management fee level double that of the nominal fees.

Readers of this column may be interested to read our response to a Department of Work and Pensions consultation on the potential exemption of performance fees from the charge cap that applies to DC pension funds. That consultation is misleading titled “enabling investment in productive finance” – this is part of a government initiative to steer pension assets into their favoured projects – the whole thing has been accompanied by a series of boosterish reports which do not bear close scrutiny – With Gary Gensler having reported average fees of 1.73% ad valorem (all too often on committed not invested capital) and 20.3% performance fees, it is clear that the room for a painful experience is substantial – and that is before any effects due to the end of the secular declines in interest rates.

https://www.longfinance.net/publications/professional-articles/response-dwp-consultation-enabling-investment-productive-finance/

The penultimate paragraph informs re conclusions, including

…that to offset the tampering of the capital push into alternatives…

I always suspected that there was action behind the scenes, and that the efficient market had some unseen forces at work.

Perhaps the markets are channeling their inner Chuck Prince, late of Citi? He opined that when the music is playing you have to dance. With that much capital to deploy, maybe the new trend will be in virtual jukeboxes? /s

Anecdotally, I think the updated edition to the “keep dancing” quote from Prince is the TINA method. There is No Alternative. Where do you allocate investment funds, and attempt to do so more or less efficiently?

I suppose the trend will be into avenues and sectors that NC has covered in previous months. Health providers, dental and orthodontist* providers, late life care / retirement, and vet services. Set up taxable / advantageous franchises within each state and let the fee raising commence. Anecdotes about private equity ownership of retiree facilities exist.

*New tact by a private equity owned dental office. Sir or madam, would you like to also keep your teeth or just have them industrially cleaned? Ha ha

Once you have seen the Stockholm Syndrome of investment managers at an institution like CalPERS you will comprehend that the mindset of paying higher fees to large firms is seen by them as a way to increase the illusory IRR that falsely gooses their “benchmarks” and “funded” status — mainly for bonus calculation purposes.

Academic pieces such as this one are so quaint; actual “market forces”are meaningless to the investors of Other Peoples’ Money.

Private equity attaining cruising speed long term? Who writes this stuff? With possible higher percentage rates come longer horizons… but how to convince retail investors to pony up for a much longer torture and fleecing? Well, PE will just have to “innovate” to maintain momentum because attracting retail investors is just so very expensive! And besides almost all the people with too much loose change have already been tapped out. So the question has naturally turned to find a socialized answer. “How to democratize (PE) without regulation?” Without regulation? Are they serious? Democratize? And voila! “The US defined contribution pension plans (officially make their entry) to the private asset class.” Oh, good. Now it’s official.