By Lambert Strether of Corrente

Patient readers, this is an open thread and I must now go on to eviscerate Ron Klain. Such was not my intent, but a series of minor logistical issues due to the time change interfered, like me sleeping very badly. I’ll make it up to you tomorrow. –lambert strether

Contact information for plants: Readers, feel free to contact me at lambert [UNDERSCORE] strether [DOT] corrente [AT] yahoo [DOT] com, to (a) find out how to send me a check if you are allergic to PayPal and (b) to find out how to send me images of plants. Vegetables are fine! Fungi and coral are deemed to be honorary plants! If you want your handle to appear as a credit, please place it at the start of your mail in parentheses: (thus). Otherwise, I will anonymize by using your initials. See the previous Water Cooler (with plant) here. Today’s plant (TH):

TH writes: “I went for a walk at a park in Irvine (Kenneth Mason park), hoping to spy the golden eagle someone I met while photographing the Monarchs earlier this month had mentioned. I didn’t spot the eagle, and the smaller birds weren’t being cooperative, but the lighting on the sugar sumac and bees contented me.”

Readers: Water Cooler is a standalone entity not covered by the recently concluded and — thank you! — successful annual NC fundraiser. So if you see a link you especially like, or an item you wouldn’t see anywhere else, please do not hesitate to express your appreciation in tangible form. Remember, a tip jar is for tipping! Regular positive feedback both makes me feel good and lets me know I’m on the right track with coverage. When I get no donations for five or ten days I get worried. More tangibly, a constant trickle of donations helps me with expenses, and I factor in that trickle when setting fundraising goals:

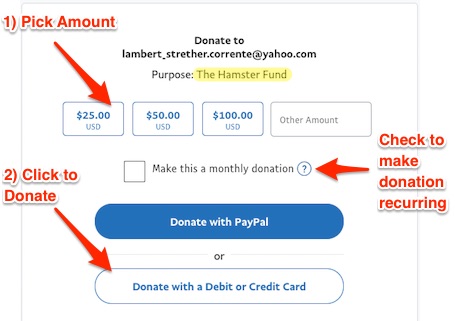

Here is the screen that will appear, which I have helpfully annotated.

If you hate PayPal, you can email me at lambert [UNDERSCORE] strether [DOT] corrente [AT] yahoo [DOT] com, and I will give you directions on how to send a check. Thank you!

Is there a resource or book that delves into a history (slash) compare/contrast of monetary systems of recent eras?

Namely the current fiat system(and MMT) post 1971 to the semi-fiat/semi-gold standard period between early 1900s?-1979 to before that among the era of state and wildcat banks.

The sense I get from popular zeitgeist, is that people pull “truisms” from all these various systems and try to apply them to a current system that has moved beyond those conditions.

This one is still on my list and I haven’t read it yet myself, but it was recommended here a while ago and it might be what you’re looking for – https://www.harvard.com/book/ages_of_american_capitalism/

I am currently reading Gangsters of Capitalism by Jonathan M. Katz. It follows the exploits of Smedley Butler (the famous Marine that is quoted as saying “War is a racket…”. It not only is a biography, it details the rationale for the expansion of US imperialism throughout the third world, as it existed at that time.

The author follows in the footsteps, in current times, of Smedley as he is ordered from country to country to spread Democracy American Style while enriching Wall Street and the capitalist class. A very interesting read. Using the military as capitalists private army.

Butler is alleged to have alerted FDR to a ‘Wall Street’ cabal’s plot to remove him from power.

An amazing life.

“Ages of American Capitalism” is a great book, but it doesn’t have all that much to say about monetary systems nor the political economy assumptions lying thereunder. Still, by all means DO read it because it is excellent on so many other aspects of American economic history.

A Nation of Counterfeiters: Capitalists, Con Men, and the Making of the United States, by Stephen Mihm is a fine tome on wildcat banknotes before any Federal currency was issued in 1861.

Around 1900, there were 4 or 5 different kinds of banknotes in circulation in the USA and then with the addition of Federal Reserve Notes in 1913 even more. We were never on a strict gold standard as far as our currency was concerned, the only banknote redeemable in gold coin being Gold Certificate banknotes, and Silver Certificate banknotes were kind of silly as all of the coinage was made out of silver, it wasn’t like there was any other choice and you’d get silver coins back in any transaction involving a Legal Tender Note, U.S. Note, or the most common and widespread of currency before the Great Depression, National Banknotes-of which some 12,635 different banks issued currency in their respective names.

Lords of Finance: The Bankers Who Broke the World, by Liaquat Ahamed is as good of an explanation of why the gold standard fell apart as you’ll find, and was supplanted by fiat. Much of the action in the book takes place from the Treaty of Versailles to Bretton Woods. He’s a great writer and the book really flows, I enjoyed it immensely.

Appreciate these Wuk!

I agree on Lords of Finance and was surprised at how well Liaquat Ahamed put the story together.

Also look up Steve Keen or on u tube, “ProfSteveKeen”. He goes through the macro view of MMT and plucks away at current events.

The Book entitled ‘A Nation of Counterfeiters: Capitalists, Con Men and the Making of the United States,’

Thanks for that. I recall hearing of it when it came out. About a year ago, I thought about trying looking up the title but got distracted.

Re: ‘Lords of Finance: The Bankers Who Broke the World’ made me realize that if you are on the gold standard and all the gold leaves the country, either you have no money or you are driving a Fiat.

Pip pip!

Michael Hudson’s “Super Imperialism”, third edition (recently published), and Nomi Prins’ “Collusion”, which goes from the 2008-09 crash to around the end of QEII.

The Creature From Jekyll Island A Second Look At The Federal Reserve by G. Edward Griffin

I thank you all for the great recommendations!

I really do appreciate it.

They are now on a list to procure.

Might want to do yourself a favour and watch the 2015 film “The Big Short” which is about the 2008 crash. Here is a sample-

https://www.youtube.com/watch?v=MesrrYyuoa4 (7:25 mins) – some swearing

Neohnomad, your instincts are excellent where misapplication of gold-standard era verities are misapplied to an era of floating fiat currencies. It’s not for nothing that Warren Mosler titled one of his books “Soft Currency Economics”

Giovanni Arrighi, Historical Sociologist, wrote a book about the history of capitalism that isn’t _quite_ about monetary systems, as I recall, but is so illuminating otherwise that I think it worth adding to anyone’s pile:

The Long Twentieth Century: Money, Power, and the Origins of Our Times

https://www.versobooks.com/books/359-the-long-twentieth-century

Arrighi convincingly (haven’t read it since 2004 as an undergrad) traces the rise of capitalism and various geopolitical hegemons, from Venice through the Hapsburgs through the Dutch through the British to the USA to …? (it was written in 1993, but Arrighi clearly saw the writing on the wall).

He was a student of the great French historian of the longue duree, Fernand Braudel.

> Giovanni Arrighi

Arrighi is excellent!

https://twitter.com/DrEricDing/status/1503272773745094661

Anyone else having the feeling of deja vu?

Quite a lot. Also, the war in Ukraine has absolutely displaced covid. What’s happening in China deserves attention, and I feel no one is paying any.

I’ll bet that the Russians are paying attention. Now that Russia and China, plus various and assorted ‘friends,’ are laying the groundwork for a regional economic sphere, what affects the economy of one affects all. Another nationwide ‘lockdown,’ especially of industrial hubs, in China, will slow down world trade, again. It will also reduce Chinese demand for Russian energy supplies. Add to this even more disruptions of American supply chains.

We live in interesting times.

I never look back darling, it distracts from the now…

Yeah, quite a feat to see our national catastrophe completely sidelined by war on all officials channels in the blink of an eye. It will be interesting to see what happens next. I can’t game out if this will help or hurt Biden even more than he’s already been wounded by his performance and current events. I’m fairly certain that if we have sky high gas prices, another COVID surge, and scarcity, the Dems are toast in 2022 and 2024. But perhaps the Biden administration can turn it around by appealing to everyone’s sense of patriotism and praise the hardworking people who have been out there for the last 2 years making the country work? Maybe we’ll build new factories here too. A guy can dream…

Its not just Covid – there is chaos in the Chinese markets right now – and not just China, shares in Chinese companies worldwide. There are a lot of swans of various colours all arriving at the same time (Ukraine, Covid, the property company collapses, the Nickel Market).

The Chinese government will have to make a very quick decision. They will have to either shut down some of their biggest cities indefinitely to suppress Omicron, or let it loose. Either choice can cause chaos in world supply chains.

Also in that Twitter thread:

“Shenzhen health official Lin Hancheng warns Sunday that this #BA2 strain is “highly contagious, spreads quickly and has a high degree of concealment”, leading to widespread community transmission if control measures were not strengthened soon. ? “

China’s coronavirus lockdowns could trigger ‘shock waves’ across global supply chains.

https://www.scmp.com/economy/china-economy/article/3170416/chinas-coronavirus-lockdowns-could-trigger-shock-waves-across

I think this covers what is going down.

Talk about synchronicity.

We really need to get rid of the time change. What neoliberal insanity has us doing this year in and year out? Is there ANY evidence that it saves energy at this point, in the era of LED light bulbs?

Circadian rhythms are super important, but we voluntarily and profoundly disrupt them twice a year. No wonder Lambert is tired.

I think it has five more years at most. More and more contrary information about its detrimental effects is making it into the mainstream, where it used to be ignored. I guess message control is all about Covid and Ukraine now.

For obvious reasons, Slim doesn’t miss the time change.

Reason: Arizona doesn’t do Daylight Savings Time. We’re all Standard Time! All the time! And we like it that way!

I remembered Arizona had it, along with a handful of other states. I actually like DST instead of standard, but would be fine with either. DST gives you more evening light.

Department of Transportation at the federal level either lets you have standard time, or lets you have the time change, but does not let you have DST. Or that’s what I remember.

“DST gives you more evening light.”

Living anyplace that is hot during DST season makes one want the sun to set as early as possible so it is not still 105 degrees at 10PM at night.

I remember going to a Marilyn Manson/Smashing Pumpkins concert at Champions Square- an outdoor concert area next to the Superdome. NO ONE was moshing because it was 95 DEGREES F!!!! Even though the sun went down the water in the air boiled us until we broke down and bought 8 DOLLAR WATERS ?!!!

I prefer my extra hours of light in the morning, thank you.

@ HotFlash – ‘But soft, what light through yonder window breaks? Be it Daylight Saving Time?’

Foul fiery fiend!

How does it compare to when you lived “back East” and had the time changes?

See: https://en.wikipedia.org/wiki/Daylight_saving_time

Neither Uruguay nor Argentina do daylight savings savings time either. I much prefer the upcoming season, when I’m only 1 hour ahead of posts here at naked capitalism!!

If daylight savings time was ended, I believe I would always be 2 hours ahead of the east coast and 5 hours ahead of the West Coast…

Data shows that especially during the day the change when we lose sleep occurs and slightly after, there is a recognizable spike of maybe 100 or more cardiac issues, heart attacks etc. nationwide, maybe more (haven’t looked at the stats nationwide recently.) More car accidents also. Obviously a trigger for the vulnerable . . . not a fan of Arizona (I left California recently for the midwest due to the 2 decades and counting serious Western drought) but glad to hear they do one thing right!!

Problem is, retail lobbies are pushing hard to make it permanent DST, even though we’ve tried it twice already, and it always ends up with early-morning tragedies involving children.

Permanent standard time is the way to go. There just isn’t a big lobby pushing for it.

“Assholes who golf.” Those neoliberals.

I find it extremely interesting that the supposed ‘nationalist’ faction of the GOP is not going crazy making hay with Ukraine and linking it to all the various congresscritters and their families. Are they still waiting to see which way the wind is blowing or something? I am pretty sure the same (very large) swathe of the country who was hammered first by covid and now by critical necessity inflation would turn out in huge numbers for whatever party or group of officials who managed to successfully link the many collapses of management over the last several years to those in charge who personally profited from the disaster(s). I’m no fan of the nationalists (who even is that any longer? Bannon? Trump? they seem more motivated by setting up a new form of gentry for their people at the neolib’s expense) but this seems to be power just waiting to be picked up by whoever can get it together well enough in time.

Just speculating, but right now the pro-war sentiment (at least in the “respectable” media) is so strong that any alternative view is laying low. By the fall, I expect the Republicans to take US involvement in Ukraine (especially the sanctions) and tie it around Biden’s neck with $6 gas. Much of the attacks will be lacking in coherence. Too aggressive! Not aggressive enough, USA, USA, USA! Nonetheless the attacks will be successful because of economic suffering.

But I just saw on CNN the headline that gas “could” “soon” come down!!!

Just thinking of the BA.2 timing…if the US follows Europe by about 4 weeks each wave, that means we get really rolling here right about Easter, yes?

Fun times. Just a reminder – if you have previously ordered COVID tests from the post office, they are allowing you to reorder them now. Good idea to have some on hand because at least here in VA, most of our testing infrastructure has been broken down.

Reports from the field on Biden’s sacrificing of what’s left of our economy for the benefit of those that benefit from war in Ukraine. Didn’t think it would happen this fast.

Tourist traffic to San Francisco, the lifeblood of the city for taxes, businesses and employment was threatened pre-pandemic as far as cancelled conventions and family tourism by the thousands of homeless lured to the city by billions in benefits and services.

The pandemic lock downs killed most small and some large businesses and eliminated almost all of what was left of the personal choice tourist travel to the city. Now With $6 to $7 gas, it has ended. Gone. Overnight.

The thieves, many commuting from the east bay are still working however, but instead of blatantly breaking tourist rented car windows and grabbing luggage, they are turning to locals garages, homes and muggings. Essentially zero arrests.

Here’s the Old School criminal action.

https://www.sfchronicle.com/news/article/Gone-in-5-seconds-SF-neighborhood-police-12545144.php

People get the politicians and district attorneys that they voted for and deserve. Do not let this happen to your community.

I too am looking for particular book recommendations. Does anyone know of any good books out there that 1. explain the stock market and all these various financialization mechanisms and what not for an audience totally new to the jargon, while 2. being highly critical of the whole thing, and 3. apply these explanations to real world examples?

I really want to understand all this better but I feel like when I try to look up like “what is [x economic term in article]?” the answers I find use at least five other terms I don’t know the meaning of. Also I feel like a lot of stuff out there ala “stock markets for dummies” or whatever is targeted at people who want to learn (or convince themselves they’ve learned) how to start investing well, which I’ve no particular interest in.

Thanks for any suggestions anyone thinks of!

I only recently learned what a Short is, but I’d like to know what a Put is. Are they referring to a putt instead?

No. It really is spelled “Put.”

See: https://www.investopedia.com/terms/p/put.asp

It’s a put because you put it to someone I think. It’s the flip side of a call, a call is a deal to buy at a price if you want, and a put is a deal to sell at a price if you want, and the buyer gets the optionality, and the seller sells it. Don’t touch, especially don’t sell, unless you know what you are doing.

Seems to me like puts/calls were a good idea for a tool for use by fund managers, then it started getting used like a roulette wheel.

forgive the snark but you might want to read a book on gambling too.

Mandelbrot’s “Mismeasure of Markets” should be a part of that library.

Wall Street by Doug Henwood. Old but good. Henwood has strayed lately, but this was my primer.

ECONNED by one Yves Smith.

Which is a deeper dive into causes of the GFC than any other book I’ve read that isn’t really technical.

On the other hand, the language has moved on: the whole point of financialization (other than ripping everyone off) is to create opacity, confusion and misdirection from which those generating it benefit.

So if there’s a word in it you don’t understand the case law on, you are probably not understanding who is making money on it and how.

I look at the stock market like this.

One walks into the Wall Street Casino and it’s something like this:

Garden variety buying and selling stocks is like Blackjack.

Puts/Calls is like the roulette wheel.

Trading options on volatility is like shooting craps.

Shorting stocks is like poker.

And index fund/fund investing is like playing the slot machines.

Matt Taibbi’s old book Griftopia still holds up.I bought copies of that for friends. Goes over much else too, and a fun read……. And Yves’ book is good, I also liked Nomi Prins It Takes a Pillage, ..also…that old documentary Inside Job, I think is free on you. tube….I really liked Henwood’s book from way back then, but not sure …it might seem kinda overwhelming ….also Michael Hudson essays here and all over, are very basic and readable!!!!! Though he dives deep still……

For a break from the serious, technical tomes, I cannot recommend “Where are the Customers Yachts?” highly enough. It’s old, but evergreen …

Open thread. Okay, I’ll take the opportunity to mention another example of “crapification”.

I do a lot of walking so shoes are important to me, especially durability. Well, my favorite brand (a well-known one) seems to have been officially crapified. It used to be so reliable. I got four good years out of one pair, but the last two pairs had the soles separate from the uppers after little use (I’m talking weeks or a few months). Consequently, they have joined all the other crap in today’s landfills.

Crapification. It’s another word for thievery. Can’t trust brand-names, price is no indication of quality. I’ll never buy new shoes again. And if my erstwhile favorite brand is available in the second-hand store I’ll know enough to steer clear.

I wonder if its the same as my brand. I run a lot. Usually get 300 miles of actual running miles on my Brooks shoes and I have deemed their $120 a pair cost worth every penny in saved trips to the chiropractor over the past 10 years (common before I switched to good shoes). I got a new pair in Spring of 2021 – first new pair marked as manufactured in the COVID world, and that pair broke down so badly that they were the first pair not “retired” to walking around/grass cutting shoes. They went straight into the shoe store’s recycle bin.

My next post-COVID pair (September 2021) held together better physically, but invisibly broke down resulting in much more hip and back pain for me. They have been retired to my walking around shoes at least. My latest pair purchased last month seem half a size smaller (or maybe I really do need a 12.5 womens now, which don’t exist) and they cost $25 more.

I have loved my Brooks Ghosts since my first pair. I think these Ghost 14s will be my last and I am a little heartbroken – although this is one of those most first-world of First World problems.

Hoo boy. Brooks became my shoes (Bedlam) after Asics became terrible.

There are literally just about no shoes I can wear. I need a lot of lateral stability and a well cushioned heel strike.

I bought 2 pair of my old Bedlams. I bought 2 pair of a new version and I suspect I won’t be happy. They so narrowed the toe box I can barely put it on. And to your point they feel flimsy.

Clark’s. Used to be great walking shoe.

Bout 12 years ago went to get a new pair. Different shoe altogether.

Clark’s had been financialized. Just a brand name for sales and marketing.

All production outsourced to independent vendors in Asia.

I found company on internet who resoled restored my old shoes with original Clark’s materials. Worked great at half price or less than inferior quality new shoes.

I’m fortunate thanks to my late wife who would now & again turn up with a pair of shoes for me, that she would believe would go well with such & such jacket, shirt or whatever – perhaps it was due to a touch of guilt as she was a bit of an Imelda Marcos in that regard. I still have about 6 pairs including Clark’s left – with a pair of cowboys boots she bought with a matching suit for one New Years Eve fancy dress party. I also nave a pair of 20 lace Doc Martens that I have over the last 42 years only worn in icy, snowy conditions . They were the first footwear items she bought me & I wish I could remember what they were supposed to go well with – maybe Ice & snow ?

Yeah Clarks are now Crap. In the 1990s they were shaped like a human foot, not “fashionable” but great fit and comfort. Now they are like everything else, fashionably shaped but terrible for your feet.

I used Wallaby’s as my work shoes for years, owned at least 5 pairs… the last two pairs lasted a year before the soles wore out, while the older ones lasted 3 years a piece… at $150 a pair, they haven’t seen my business since.

Here’s a suggestion for you – https://originmaine.com/durable-goods/boots/

I’d been meaning to go to the brick and mortar store to check them out for a couple years since I didn’t want to pay $300+ without trying on what I was getting first. I finally went to Farmington, ME where the factory is located a few weeks ago and they had a bunch of overstock on sale for $75. They are heavy duty real leather and the salesperson said it would take a couple weeks to break them in. That was definitely the case and they made my feet sore for a few days but now they’re breaking in nicely.

These are definitely not the best for walking since they are a heavy shoe, but I’ve had them a month now and so far they are very durable. I probably wouldn’t have paid $300+ for them without having someone who’d had a paid for at least a year vouch for them, but for $75 I felt I couldn’t go wrong. You can barely buy a paid of shoes that falls apart in a week for under $75. So far, so good in my search for a non-crapified paid of shoes!

I’ve become a big fan of buy better/buy less, especially with clothes. I don’t run but occasionally take long hikes over rough ground. I have cared for a pair of Red Wing Irish Setters since 1978. Leather uppers, vibram soles. The insoles (cork?) form to one’s feet. Roomy enough for wool socks. Most comfortable shoes I own. Free replacement shoestrings. Saddle soap and mink oil every fall.

For other shoes I’ve switched to exclusively leather resolable, and take care of them. Petroleum/plastic-based shoes end up in the landfill when they wear out.

I own a pair of 20-eyelet DocMartens from the early 90s (inherited – I could never afford these boots back then or even now really). I have cared for the leather all these years so they still look incredible. The soles are beginning to wear down but because of the quality, I can easily go get them replaced (and yes, I will be going with Vibrams too). I wonder if modern Docs still go this hard? Somehow, I doubt it.

Edited to add that I love Aussie brand Beeswax Leather Conditioner and I love their saddle soap.

Sadly, I don’t think they do. I remember seeing Docs falling apart, starting around 2000 or so, which was a first for me. In a different vein, I recently purchased a small pocket knife a few weeks back and the can opener snapped off after two uses. The break revealed it was some kind of cheap composite metal.

I bought Doc’s around ’87 and they were great, but then a few years later in 92 when they’d shifted production and the new ones were awful, uncomfortable and didn’t last anywhere near as long.

First pair of real work boots I was gifted when I “went to the woods” were White Smokejumpers. Hand made in Spokane WA over an American last.

Had a hand made pair of Buffalo Loggers too. Nicked the heal of one with an axe, and the toe of the other with a chainsaw. They were rebuilt and I still have them. Buffalo is out of business I believe.

Back in the day, if you were on a fire crew you had a pair of Smokejumpers. Nothing else came close.

I have had mine resoled 3 times and they are still in great shape.

https://whitesboots.com/

Smokejumper: https://shop.whitesboots.com/legacy-boots/the-original-smokejumper/

I feel the same way about buying better so I can replace less and repair more. I got into White’s Boots (and Nick’s Boots) through wildland firefighting in Montana. They are great for high arches, and they last forever. I’ve resoled one pair 4 or 5 times and rebuilt them once over the last 7 years; the factory will replace every part of the boot in a rebuild as long as the uppers are still good. They are all I wear. They are expensive, but in the long run they are cheaper than garbage boots.

In that same vein, Danners sells some decent hiking boots in the PNW.

Re: walking shoes.

Yes. Crapified. Most. It seems that the shoe companies produce a good version, then as soon as it sells they ‘outsource’ the manufacturing. Early shoes are good, then a year or two later the same model turns to flimsy crap. I’ve sadly learned not to trust *any* brand name. They all seem to do this crap.

I’m currently using a pair of made-in US Merrells, which seem to be holding up. But only have 100 miles on them, so not sure yet.

Early in the pandemic, when all was chaos, I tried to buy a pair of Danner Light Cascade –also made in US– based on great reviews, but couldn’t find any for sale in my size. They are outlandishly expensive for my budget but I still hope to try a pair.

I have a pair of redwings from 1970, and they are still in excellent shape. Unfortunately, my elderly feet have gotten slightly bigger so they no longer fit.

Merrell are good but you need to get them in the shop or with free return so you can flex the sole and get a good look at the seams before you commit. I think they’re the best under $500 pair of walking shoes you can get. And yes, there are plenty available over that price. I can’t get my head around buying 1k walking shoes but if they last 20 years, maybe it’s worth it. I had a pair of Hi-Tech brand hiking shoes last 15, and they were very cheap. The best shoes I ever owned. Climbed multiple New England peaks wearing them.

Yes on buying in store. Flexing soles and looking at seams is great advice.

If REI ever gets the Danners in my size I will stop by and check them.

Will also check out high-tek.

Thanks.

I have a pair of Merrell walkers that squeaked and grunted right out of the box. Sounded like walking on frogs.

You’re feet haven’t gotten bigger. You’re arches have fallen a bit making the length of your feet longer. Shoes with good arch supports would feel uncomfortable while you got used to them, but down the road you will be healtheir for it.

Yes on arches. Podiatrist fitted me with good supports and now i can walk pain free. Big cheerleader for podiatrists here. And custom orthotics.

Count me as someone else who’s in the market for un-crapified walking shoes and boots for working in the yard. USA-made preferred.

Redwing.

New Balance made in the USA…

https://www.newbalance.com/made-in-the-usa/

I believe the cheaper models of NB now made overseas. I wore NB for years and remember when they no longer felt ‘right’. Hated leaving the brand. I might be wrong tho. Might be my aging feet.

I bought a pair of Vasque leather walking shoes in the 1980’s. Have had them re-soled three times with Vibram . Have held up well.

Vasque was on my list last purchase but I found they didn’t quite “fit” my feet. Felt narrow.

From all reports they are great shoes.

For my money, these Asolos have been the best hiking boots. I’ve had Lowa Alpspitz, Galibier Superguides, and Scarpas in the past, but the Asolo had a short blister-free break in period, and very comfortable and durable (over 3 years, every day except when it’s really hot in the summer). Asolo TPS 520 GV Evo Hiking Boots – Men’s

For women: Munro shoes. I bought a used pair about seven years ago ($3.99 at a thrift shop). I wear them every day (I walk a lot) and they are the most comfortable, sturdy shoes I have ever owned. I think they are rather expensive bought new but they last a long time.

I only recently learned what a Short is, but I’d like to know what a Put is. Are they referring to a putt instead?

A put is the opposite of a short and no, it is not a putt

A put is the right but not the obligation to sell an asset at a specified price. They are time limited. So if you don’t exercise or sell the option before it expires, you lose the money you spent to buy it.

Happy to be corrected, but my understanding is that a put is an options market bet on the decline of a stock’s price. Instead of purchasing the stock – a la shorting – you purchase an option to buy the stock.

I recommend against trading options, but information is here

https://www.investopedia.com/options-basics-tutorial-4583012

It really is not for the faint at heart. I remember when Dad used to play on the commodities exchange. He was a quant back then and used numbers theory as his guide star. (As I mentioned earlier, he broke even, which is a good thing in that arena.)

His biggest “score” was based on some ‘inside information’ he stumbled upon at a cocktail party.

My dad was the king of calls and puts, and used to call the latter when he lost: ‘shot puts’.

Oh man. Dad had some very inventive invective whenever the market took an unexpected turn. I believe that it broke his heart when he finally realized that the entire “game” was rigged.

“Numbers don’t lie, but liars number, in the millions.”

Old mnemonic tag: Don’t put me down, call me up.

They’re useful as ‘insurance’ up or down market collars on stock positions.

If nothing goes cattywampus, “out of the money” puts or calls will expire, the writer will collect their fee and that’s that.

Unless there’s a blowout to the upward or a stomach churning drop below. Then the call or put will act as a mitigation against missed profits or lost principal.

I view them like OSHA safety harnesses. Wear them and hope to high heaven they’ll never get tested.

I got to ‘test’ an OSHA safety harness at a construction training session. I had done some basic parachuting before, and it reminded me of that to a great extent. Knowing that you have ‘backup’ will take the edge off of a normally tense situation. Less tension usually translates out as calmer and more rational decision making.

A labourer fell off of, I think, the seventh or eighth floor of a Gulf Coast casino hotel project once. I was working on the project at the time and remember the utter joy on the man’s face when he was recovered from the net that had been strung a few floors below where he fell from. That’s why I didn’t really complain when reading about the Foxxcon “safety nets” strung around their factory/dormitory building.

Taking precautions of that sort require that one admits to him or her self that they are not “in control.” That’s one reason why I am very worried about the international situation just now. Too many of the ‘decision makers’ in the West do not have the required level of humility to adequately judge the risks they are taking.

We have our Potassium Iodode tablets, located in a ‘safe’ spot within easy reach.

Or just return page 404. option not found.

Betting against RF etfs per Bloomberg. Cannot close position. Market closed . no shares available

https://archive.ph/y2YTS

A put is an option that’s similar to a short in that you are betting the price will go down. With a short you have to purchase (or technically, borrow) the underlying security whereas with a put you just have the option to do so, and the price of a put is less than that of the underlying security.

The other main difference is that with a short, if you guess wrong and the price goes up, you lose some of your money. With a put, you lose it all.

I don’t listen or watch any western MSM but I’m sure they are spinning the missile strike in Donetsk as being from the Russians.

❗️Statement by Russian Defence Ministry

▪️ On March 14, at about 11.30 a.m. Moscow time, Tochka-U tactical missile was fired at a residential block of Donetsk city from the territory controlled by the Kiev nationalist regime.

▪️ The shelling of the city was carried out from the north-western direction, from the area of Krasnoarmeysk settlement, which is controlled by Ukrainian nationalist units.

▪️ As a result of the explosion of a cluster warhead in the center of Donetsk, 20 civilians were killed. Another 28 people, including children, were seriously injured and taken to medical institutions.

And.. they ran some ads to try to get a rally of the mothers of soldiers in the target location for several days before. Criminal and just plain evil.

Just saw this on Twitter:

https://twitter.com/raymcgovern/status/1503446362104512513

Ray McGovern

@raymcgovern

Gil Doctorow reports that Donetsk forces have defeated neo-Nazis in Mariupol who holding civilians hostage; have opened humanitarian corridors to east; are evacuating civilians in several hundred buses that were waiting outside city. Also brought in 450 tons of medicines and food

If that’s true, I would imagine that the Donbass forces would be looking for any Azov Nazis and converting POWs & WIAs into KIAs.

According to the Donbassian Telegram channels it’s partially true. This morning about 5000 Chechens joined the battle and by afternoon they had breached the outer circle of the Ukrainians defenses and advanced a mile inside the city – which was enough to open the humanitarian corridors without Ukrainians being able to prevent it anymore.

The situation is far from clear, but apparently the Ukrainians have withdrawn to the huge Azovstal factory area (mile wide and two long) on the East bank of river Kalmius. It may not be over by tomorrow, but in a few days certainly.

For those of us for whom Covid isn’t dwindling in the rear view mirror, this week’s TWiV 874: COVID-19 clinical update #105 with Dr. Daniel Griffin is chock full of interesting commentary and cautionary tales. It’s a 40 minute presentation. The topics and relevant links at the site include:

Infection and changes in brain structure (Nature) 2:22

Dementia among pneumonia survivors (Open Forum Inf Dis) 4:36

Narrative dynamics around COVID-19 vaccines (FSI) 7:16

Children and COVID (AAP) 8:55

Paxlovid in pediatric patients (Pfizer) 10:34

Mask effectiveness in schools (MMWR) 13:08

Host factors and severe disease (Nature) 14:34

Antiviral efficacy against BA.2 (NEJM) 19:48

Post-acute symptoms, Denmark (medRxiv) 27:02

Risk of sequelae after infection (BMJ) 27:23

I notice that Texas is already curving back upwards. I wonder how long this little minima will last for us… weeks? a month? It seems inevitable that we’ll end up back where we were.

This. These past few months I’ve been reviewing all the ailments that viruses leave people with long term.

All this “living with _________” is more like “dying with___________”.

Proper ventilation and masks would battle more than Covid. But the power trippers care more about control than productivity.

So this is terrifying. The Fed stands ready to whack the working class, to tame prices, a feat it cannot accomplish, but will punish American citizens trying to anyway:

Powell Admires Paul Volcker. He May Have to Act Like Him.

(bold mine)

And whether “it worked” is questionable.

The most admired investor during Volcker’s day was a saver who bought CD’s paying 16%, but who gives a fig about savers these days?

No need to worry about Putin nuking us. Powell will have dropped a neutron bomb on the economy all by his lonesome. 16% mortgage rates will obliterate the housing market and all leveraged debt attached to it. PMI insurers will go bankrupt. Consumer demand will plummet, probably taking out a good chunk of Amazon. Less cash to buy Apple kit. A sizable collapse of those two stocks alone will destroy billions in 401k portfolio values. Even at the PMC level, that’s not inconsequential.

Probably giving him way too much credit, but if Putin really gamed all this out and the Russian sanctions blow back so violently on the US, that cat has legitimately earned a Nobel for Economics.

IIRC, one of Mr. Volcker goals was to destroy the unions, the labor movement, and the working class. He used the real problem of high inflation as cover for the ungodly interest rates. And the same time, President Ronald Reagan destroyed the Professional Air Traffic Controllers Organization (PATCO). Just like how the PATRIOT Act was essentially pre written before 9/11 and just waiting for the right moment. People like Mr. Ron Klain are put in their position because they will serve the wealthy and not because they are any good either in their job or as human beings.

The imposition of Neoliberalism onto the United States was a multi decade project and after destroying the American Left, the labor movement and the working class were next. President Bill Clinton using the DLC (the Democratic Leadership Council) extirpated what was left of the actual Left in the Democratic Party and shifted the party from center left to center right right along with the Republicans shift from center right to conservative.

Both parties kept using the same language that they used pre-shift, but abandoned their traditional constituents: working class, minorities, small businesses, and family farms. Eventually they also abandoned their allies, unions, traditional civil rights organizations, religious organizations, and manufacturing again while saying the same words as before while shifting their covert, unstated allegiance to finance, the security state, and war profiteers.

Abortion, guns, wokeism are among the things that are used to divide, manipulate, and keep distracted the peons. That is not saying that politicians might not believe in some way, but it is more important to use them like politicians used the waving bloody shirt merely as a political tool for decades after the American Civil War.

Your understanding is precisely my own — those who worship at the altar of Volker and the price stability fetish are akin to Moloch’s acolytes sacrificing labour to their neoliberal god.

and it didnt work until he increased the bank reserves requirement.

Warren Mosler argues inflation was already falling before Volcker drove interest rates to the moon. Oil had peaked and was falling.

If you read William Greider’s The Secrets of the Temple, Volcker was explicit about wanting break union bargaining power. He kept an index card in his pocket on which he kept a record of weekly average construction wages as his proxy for whether his measures were working. He also said he wanted unions to “get the message.”

The manufacture of consent is nearly complete: the tone of Twitter appears to have turned pro-No Fly Zone, consequences be damned.

The argument I’m seeing is that “Putin won’t use nukes.” Okay, let’s assume for the moment that he doesn’t. Let’s say NATO establishes a NFZ—-what exactly do you think happens next? You think that Russia’s just going to run back to the Homeland with their tails tucked behind their legs and then the conflict is over?

The stupid—it hurts!

Look at it this way, war helps the citizens think everything is back to normal.

Decade after decade after decade in some countriy’s fly zone dropping big ones.

I would love to see one of those studies where people are quizzed on whether they support a no fly zone, then told the actual definition and implications of one and then quizzed again.

Bill Carson:

+1000

Putin might not use nukes, but after the Russians shoot down a bunch of US planes and sink a carrier then Joe Biden might use nukes.

… but Joe Biden would only use *tactical* nukes …

If the US/UK was unable to set up a no-fly zone over Syria because of the Russian fighters there – and remember how Syria is hundreds if miles from the Russian border – then what makes people think that they can establish one over the Ukraine which borders Russia itself? And I do not think that the Pentagon will want to see a headline saying ‘Russian S-400 shoots down US F-35’ as that would be bad for arms sale, especially since Germany is foolish enough to want to get some themselves now. And will countries like Poland & Germany be willing to have fighters take off from their bases to attack Russian fighters when Putin has already said that he will attack any base that does so? It may be OK for Washington but Washington is a coupla thousand miles away while countries like Poland and Germany are ground zero.

I think the real demand destruction for F-35 sales comes when other countries realize that a contract to buy these dogs does not guarantee that the omnipotent US cavalry will come riding to your rescue.

> demand destruction for F-35 sales

Not to mention that the software no doubt has a backdoor switch that, if thrown, will cause the F-35 to fall out of the sky, like bees when the lights are turned off.

Someone here made a really good point about this situation. Up until now, in any conflict with the US vs. Russia (which this is), Russia has always been the party to take the lumps and back down. It would seem this time, Putin has said “nyet”. While I don’t profess to know what he’s thinking, especially with regards to nukes, I don’t think enough USains have realized what just happened and that Russia may be done taking it. Anyone who thinks they would just accept a no fly zone is delusional, nukes or not.

Those pounding the drums for a no-fly zone are almost certainly entirely clueless as to how such an operation is accomplished.

The whole “go after the Russian oligarchs” is a mighty big tell to our adversaries.

Want to control America? Go after it’s oligarchs and CEOs. They employ people that have every Senator and senior Congresscritter on speed dial, and can get a new law passed in weeks or less.

So one wonders where those tit for tat sanctions went? But why would our adversaries do this when the American oligarchs and CEOs are wrecking America for free?

Plenty of oligarchs have foreign influence globally. They have lobbyists in the Beltway.

If anything, this should shine a light on how much influence foreign oligarchs have in alleged democracies.

There’s a reason the legislators in the West are slowly cherry picking who to “sanction” and to what degree and they know just where to pick.

The BBC is reporting that Julian Assange has lost another round in his appeals process.

https://www.bbc.com/news/uk-60743322

You tend to lose when, shamelessly, you are being railroaded.

If the foreign exchange reserves (at least those denominated in Western currencies), how is Russia able to still receive and use energy payments in dollars? (Even with the carve-outs from the sanctions on Russian banks, exempting energy transactions.) Aren’t the new dollars Russia receives also immediately frozen, and therefore worthless? And if so, why would Russia continue to export oil and gas?

I have been looking for a statistic: How many Americans are employed to commit fraud? I found general information about who they are, from a site called “Consumer Fraud Reporting,” but I can’t find a source even for how many Americans were actually employed as scammers.

from Consumer Fraud reporting:

Among perpetrators,

77.4% were male and

50% resided in one of the following states: California, New York, Florida, Texas, District of Columbia, and Washington.

The majority of reported perpetrators (66.1%) were from the United States; however, a significant number of perpetrators where also located in the United Kingdom , Nigeria , Canada , China, and South Africa.

OK, two thirds were from the US. But two-thirds of how many? Any ideas where to look? I began with Dan Davies “Lying For Money,” and there are, it seems, hundreds of histories, but no stats.

> many Americans are employed to commit fraud

That’s a very good question!

Good times for Lockheed and Airbus. Not so good for Boeing.

Germany just announced its buying the F-35A.

To sweeten the deal with unions they are also buying more Eurofighter Typhoons. The loser is the F-18 – Boeing was hoping to sell these, but the Germans have gone for the most expensive option.

I guess Germany thinks that it works?

Or Germany is wholly unserious about fighting a war. You buy your ally’s biggest piece of shit and spend the campaign hiding in a maintenance shed with it. It’s not a terrible strategy.

My theory is that Germany turning itself into a military superpower would destabilize NATO so in a sense it’s in their interest to be unserious about fighting.

They must have a very short institutional memory if they’re buying from Lockheed again after the Starfighter. I’m saying this in the most charitable and optimistic way possible.

No kidding! Lost 32% if their aircraft in 31 years!

https://en.wikipedia.org/wiki/Lockheed_F-104_Starfighter#Safety_record

HERE’S WHY THE LUFTWAFFE DUBBED THE ICONIC F-104 STARFIGHTER “WIDOW MAKER”

https://theaviationgeekclub.com/heres-luftwaffe-dubbed-iconic-f-104-starfighter-widow-maker/

It was a hot-rod of the skies– Mach2+, 100,000’… sure it could kill you, like most fun things: fly fast and crash a lot– a machine for adrenaline junkies if there ever was one (aside from motorcycles). I would have loved to have strapped myself onto one of those aluminum death-tubes and light my hair on fire, but sadly born decades too late.

Breaking Points reveals that the wording of polls concerning a “No Fly” zone makes a huge difference in public support. Basically, when you point out it would lead to war, people back off quickly:

https://youtu.be/vNkmJtTdJ68

Lithuania, a Vulnerable NATO Link, Readies for Putin

Apparently no irony from the NYT that the Lithuanian Riflemen’s Union was a proto fascist organization during the Lithuanian Republic between the wars. Even before the Nazis arrived, the LRU was rounding up Jews, leftists, communists, trade unionists and murdering them. This current bunch are their great grandchildren. Another flavor of Banderites.

See “The Nazi’s Granddaughter” by Sylvia Foti. Denial in the Baltics is the new religion.

Department of Culinary Home Defense

The personal flamethrower has arrived:

https://sear-pro.com/

Can’t wait to sear some steaks!

From Russia with love (by Natasha from Rasha): LOL

“ok bye now I have to go feed my bear”

https://twitter.com/SAM_Volhov/status/1501883688187015169

I watched that video twice before I noticed that she was wearing a hat. :)

It ain’t the first thing ya notice hahahaha

Think you could keep you ears warm Rev?

She was wearing a hat?! Lol

https://arstechnica.com/gaming/2022/03/ars-talks-to-werner-herzog-about-space-colonization-its-poetry/

Mankind is facing a crossroad – one road leads to despair and utter hopelessness and the other to total extinction.

Along the way, Last Exit: Space follows a pattern. First, it lists a problem that might make a certain space travel proposition impossible. Then it briefly explains the most promising solution to that problem as developed by modern science and engineering. Finally, it brings the interstellar dream crashing back down to Earth with a grim recounting of why the solution won’t work.

In one scene, a futurologist seen floating on a small boat over an idyllic Idaho river explains his wide-eyed hope for accelerating space flight by combining matter and antimatter, then capturing the resultant photon energy. The film warmly acknowledges that this wild idea does have some scientific merit. The crew travels to the sweeping, beautiful CERN particle accelerator complex in Geneva to have one of its staffers explain the concept and point to physical evidence that his team has indeed captured antimatter, which is held in a tube buffered by electromagnetic shielding.

Soon after, though, the hypothesis is shot down, at least for the time being. The CERN staffer explains that current antimatter generation methods not only consume massive amounts of energy but are also so slow that the amount needed for legitimate rocket propulsion would require billions of years—or, as he counts it, from the moment the Big Bang erupted until the theoretical end of the Universe.

Gawd. Democracy Now pushing the propaganda points-

Aaron Maté

@aaronjmate

“…calling for peace, and a No Fly Zone.”

https://twitter.com/aaronjmate/status/1503416318971756546

That’s like calling for chastity and a year’s supply of condoms.

Amy Goodman lost me years ago, not so much for her often ill-considered positions but because she is such a terrible interviewer. I recall her stumbling over her words, asking loaded, unfair questions of her guests that they bristled at, and interrupting them over and over to blurt out her points. She seems kind of dumb.

RK

if you boink in a forest, does it make a sound…if no baby is born

If anybody feels the need to dress up in Azov-themed gear, then Amazon is here to meet your needs-

https://sputniknews.com/20220314/azovmazon-ukrainian-neo-nazi-regiment-themed-merch-appears-on-us-online-retail-giants-site-1093865819.html

If I wear an Azov shirt to a Trump rally, would the WA Post call me a Nazi or a right-aligned reformer?

To be honest, you have me stumped. Suppose that you did have a Trump rally and the media spotted an Azov flag and maybe the extremist Ukrainian red-and-black flag as well near him, would they say something? Would they make that a big deal about it?

Have a gander at this Lambert …

https://www.news.com.au/finance/markets/world-markets/bitcoin-price-drops-after-enthusiasm-wears-off-for-bidens-crypto-executive-order/news-story/3b6d0f8eb9e936379f1998e18b240ff7

Giggle, chortle, snort ….

The C.O.N ?✌

@NickMargerrison

·

Mar 13

Replying to

@NickMargerrison

Unofficially our media has always been loosely censored. Light touch stuff. Nods and winks more than anything else. It’s all very mercurial but suspicions were raised after ‘pub chat’ with a mate in the tabloid press. It’s a notable change of tone:

https://twitter.com/NickMargerrison/status/1502732002595905537

Then some wonder why others do drugs.