Yves here. Some economists, as well as yours truly, have said central banks can’t fix the current inflation with monetary policy because the source is real economy dislocations, and they’ll persist no matter what the price of money is.

Amusingly, this article, using models quite a few experts reject as bogus, notably the Taylor Rule, also concludes that the Fed won’t be able to dampen inflation short of causing a serious recession due to the impact of high levels of corporate debt.

By Charles Goodhart, Emeritus Professor in the Financial Markets Group, London School of Economics; Udara Peiris, Associate Professor of Finance at the International College of Economics and Finance, HSE University; Dimitri Tsomocos, Professor of Financial Economics and Fellow, Said Business School and St. Edmund Hall, University of Oxford; and Xuan Wang, Assistant Professor of Finance, Vrije Universiteit Amsterdam. Tinbergen Institute. Originally published at VoxEU

The COVID-19 pandemic has coincided with a further rapid increase in corporate indebtedness. This column argues that high levels of corporate debt may distort the transmission of monetary policy and make contractionary monetary policy less effective in controlling inflation. Consequently, the trade-off between inflation stabilisation and output stabilisation becomes more problematic when there is a large volume of corporate debt in the economy.

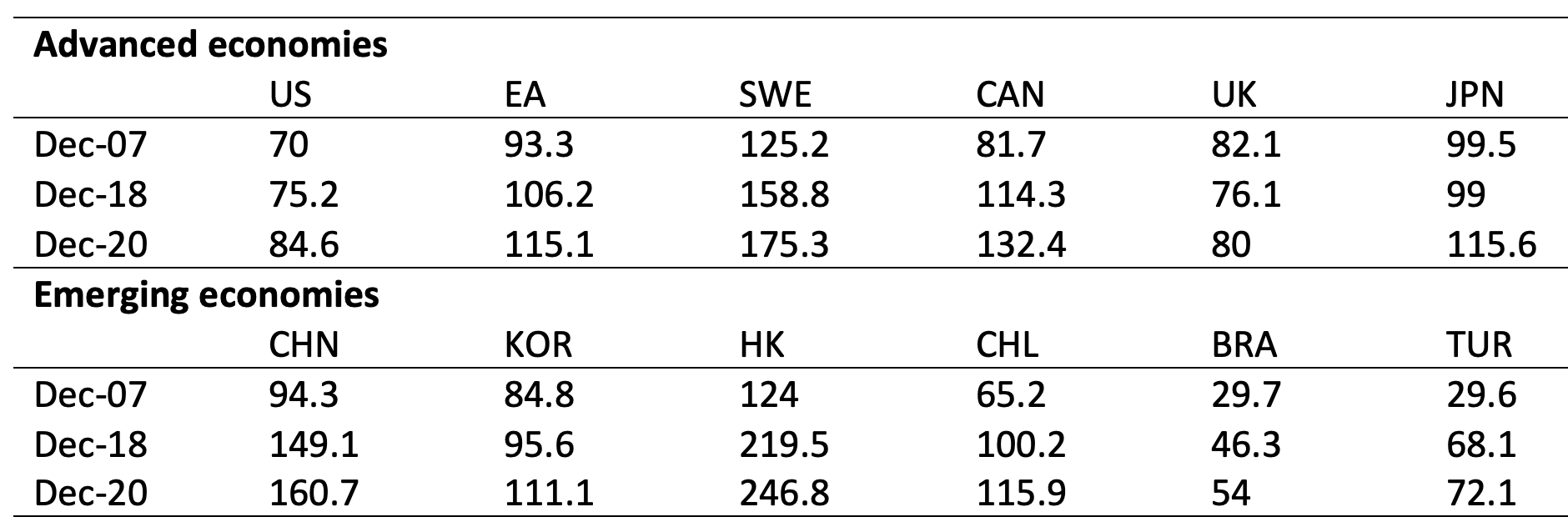

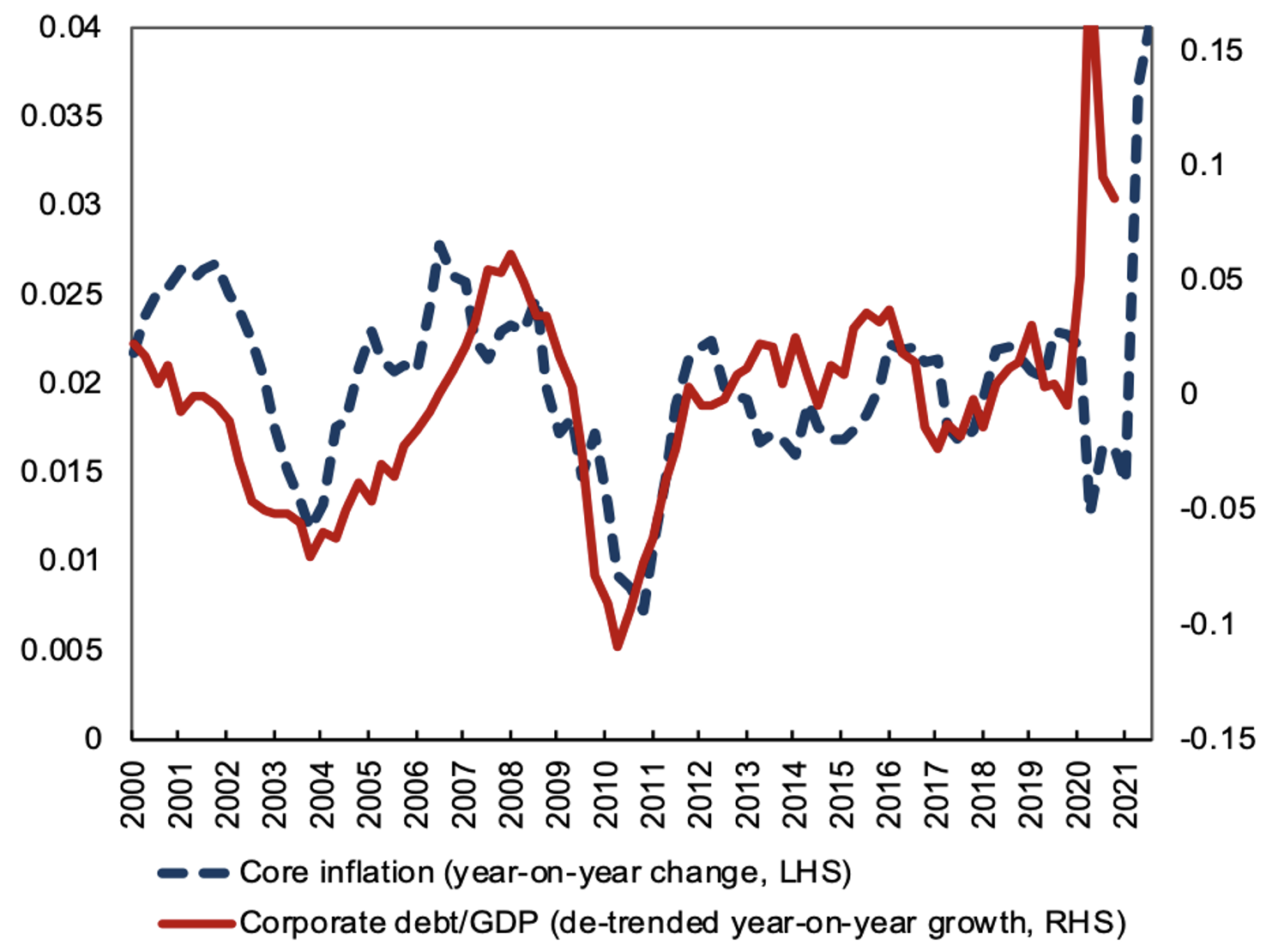

The COVID-19 pandemic has seen public sector debt levels rise to historic levels and concern has been expressed about the implications of this both for public finance and inflation. However, alongside the increase in public debt has been an increase in corporate debt – the implications of which has received far less attention. Corporate debt has been increasing globally since 2007,1 but the pandemic crisis has led to a further sharp increase.2 US corporate indebtedness rose by 12.5% between December 2018 and December 2020, much more than its total increase in the entire decade leading up to COVID-19 (see also Abraham et al. 2020 and Jordà et al. 2020 on the rising corporate indebtedness). Against this backdrop, inflation has risen. In Q2 2021, US CPI inflation has jumped to a 13-year high and the US economy saw the highest rate of core inflation since 1991, and UK inflation has topped the Bank of England’s inflation target. (See Table 1 for corporate indebtedness and Figure 1 for US corporate indebtedness and core inflation.). While the link between public debt and inflation can be analysed through models such as set out in the Fiscal Theory of the Price Level, there is little available on the role that corporate debt might play in hindering the control of inflation.3

In a recent paper (Goodhart et al. 2021), we argue that corporate indebtedness poses a challenge for monetary policy in two ways. First, it introduces an additional income effect across heterogenous households that shifts the aggregate supply curve and renders it more elastic. This effect counteracts the traditional substitution effect on dampening aggregate demand, thus affecting the overall effectiveness of raising the policy rate. Second, it creates a greater trade-off between output and inflation stabilisation that requires a reassessment of policy priorities.

Table 1 Indebtedness of non-financial corporations

Source: BIS, Goodhart and Pradhan (2020).

Note: Numbers express non-financial corporate debt as a percentage of GDP.

Figure 1 US Core inflation and de-trended corporate debt/GDP

Source: Board of Governors of the Federal Reserve System and US Bureau of Economic Analysis, retrieved from FRED, Federal Reserve Bank of St. Louis, and authors’ calculation.

The Effect of Raising Interest Rates for Controlling Inflation

The presence of debt necessitates the distinction between key savers and lenders of the macroeconomy. Thus, the economy in Goodhart et al. (2021) features two types of households: (1) lender households, i.e. the bondholders that accumulate safe corporate debt to save (in practice they hold corporate debt through financial intermediaries or mutual funds in the form of various types of nominal financial assets); and (2) owner households, i.e. the equity holders that own firms that in turn issue the corporate debt. The differentiation between these two types of households is consistent with Fisher’s (1910) narrative on the ‘enterpriser-borrower’ and the ‘creditor, the salaried man, or the labourer’.4 The income effect through debt that we identify affects both aggregate demand and aggregate supply. On aggregate demand, as the monetary contraction increases the financing costs of wage bills, there is a downward pressure on aggregate demand. This is the usual substitution effect. However, when the fixed cost of the legacy debt is high, firms feel the need to spread the fixed cost over a larger production scale and demand more labour, which leads to an upward pressure on aggregate demand. This is the income effect through debt.

On aggregate supply, the monetary contraction reduces the real wage and market price of corporate bond, leading to a deterioration of the lender households’ wealth. However, the bond price goes down less relative to real wages in a high-debt scenario than in a low-debt scenario. This is because the monetary contraction does not lead to a parallel shift of the term structure of the interest rate. Even though both the short rate and long rate go up, the long rate increases to a lesser degree, and the term structure becomes flatter. We show that the bond price goes down less relative to real wages in a high-debt scenario than in a low-debt scenario. Therefore, the negative impact on wealth in the high-debt scenario is less severe than in the low-debt scenario, which results in the effective labour elasticity being higher the higher legacy debt is. This is the income effect we identify on aggregate supply. This income effect on both the demand side and supply side obstructs monetary contractions from lowering inflation, for reasons shortly explained below.

When corporate debt level is below a threshold, the traditional Taylor principle holds: raising the policy rate lowers current inflation. However, we show that higher debt levels lead to smaller falls in prices, meaning that monetary policy becomes less effective in controlling inflation. Traditionally, raising the policy rate lowers aggregate demand and causes prices to fall, i.e. the substitution effect that puts downward pressure on aggregate demand and inflation. However, via the income effect through nominal corporate debt, the aggregate demand curve shifts less to the left. The aggregate supply curve becomes more elastic as a result of a higher effective labour supply elasticity, and it moves in the same direction as the aggregate demand curve. Therefore, in equilibrium, although output falls responsively, prices and inflation only respond mildly. Interestingly, when the corporate debt level is above a threshold, the Taylor principle becomes inverted. Raising the policy rate actually increases inflation because the income effect dominates the substitution effect.

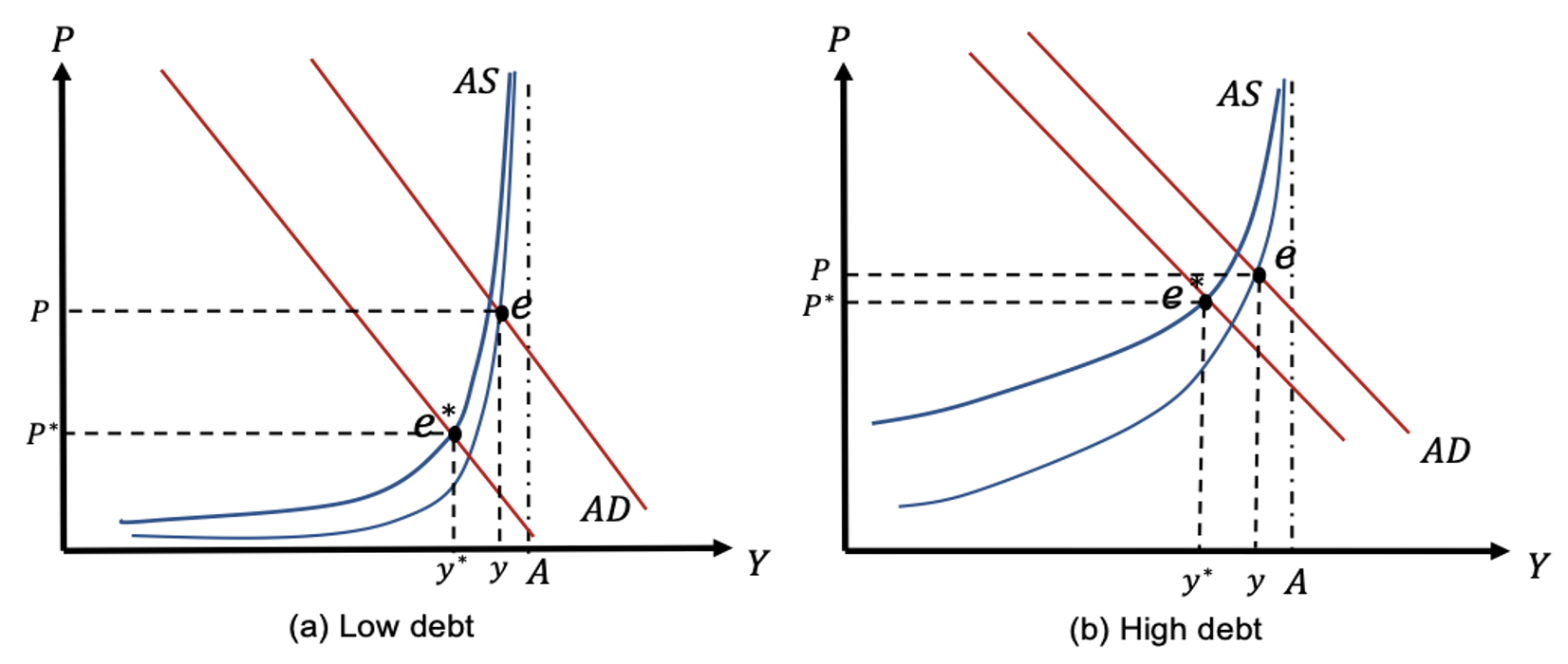

To reinforce this intuition, we use an aggregate supply (AS) and aggregate demand (AD) diagram for the goods market to illustrate a low debt scenario and a high debt scenario with a rise in the policy rate (see Figure 2). In the low-debt scenario, the rise in the policy rate significantly reduces inflation, whereas in the high-debt scenario, the rise in the policy rate only moderately reduces inflation, but output falls considerably. This is because with a higher debt level, the AD curve shifts less to the left and the AS curve becomes more elastic due to the income effect of debt. Indeed, if the debt level is sufficiently high, the rise in the policy rate would even increase inflation, and the Taylor principle becomes inverted. Therefore, the implication of Figure 2 is that with a standard Taylor rule, the decline in inflation would be much weaker and short-lived. If the Taylor rule puts a higher weight on output stabilisation, it could even amplify the inflationary pressure, and output would more quickly revert back to the previous level (the following subsection discusses this implication in greater detail).

Figure 2 AS-AD diagram: A rise in the policy rate

Notes: The left diagram (a) illustrates a low debt scenario. The right diagram (b) illustrates a high debt scenario. Equilibrium e is the equilibrium before the rise in the policy rate, and equilibrium e* is the equilibrium after the rise in the policy rate. The vertical line at A is the output when there is no debt in the economy.

In our model, we have assumed that no firm goes into bankruptcy. There are several reasons for making this assumption. The first is that policies have been so expansionary, liquid savings among consumers so high, and the labour market so tight that the vast majority of firms now would not expect that they might become bankrupt. Up to the point of bankruptcy, the prior argument about labour usage going down by less in a legacy debt case remains true, but should bankruptcy occur, labour demand would suddenly fall absolutely to zero. The second reason is that, with the possibility of bankruptcy, the basic problem of contractionary monetary policy in a world with high corporate debt is that a small increase in interest rates may not restore inflation back to target, while a larger increase in interest rates might cause such large bankruptcies as to bring about a recession. At the moment, the monetary authorities seem reluctant to implement a sufficiently contractionary monetary policy that might lead to large-scale bankruptcies. So long as they are more fearful of bankruptcies and recession than they are of continuing inflation, a model with no bankruptcy seems appropriate.

Reassessing the Trade-Off Between Inflation and Output Stabilisation

Figure 2 illustrates that at higher levels of corporate debt, larger reductions in output are needed to obtain the same reduction in inflation. We develop this argument within a New Keynesian DSGE model and show the responses of a high debt economy to a contractionary monetary policy shock with a standard benchmark Taylor rule and also an output stabilisation Taylor rule. The standard Taylor rule has inflation and output coefficients commonly used in the literature (an inflation coefficient of 1.5 and output coefficient of 0.2), but the output stabilisation Taylor rule has a higher output coefficient of 0.9, chosen according to the high range estimated in the literature, and suggested by policymakers (e.g. Bernanke, 2015).

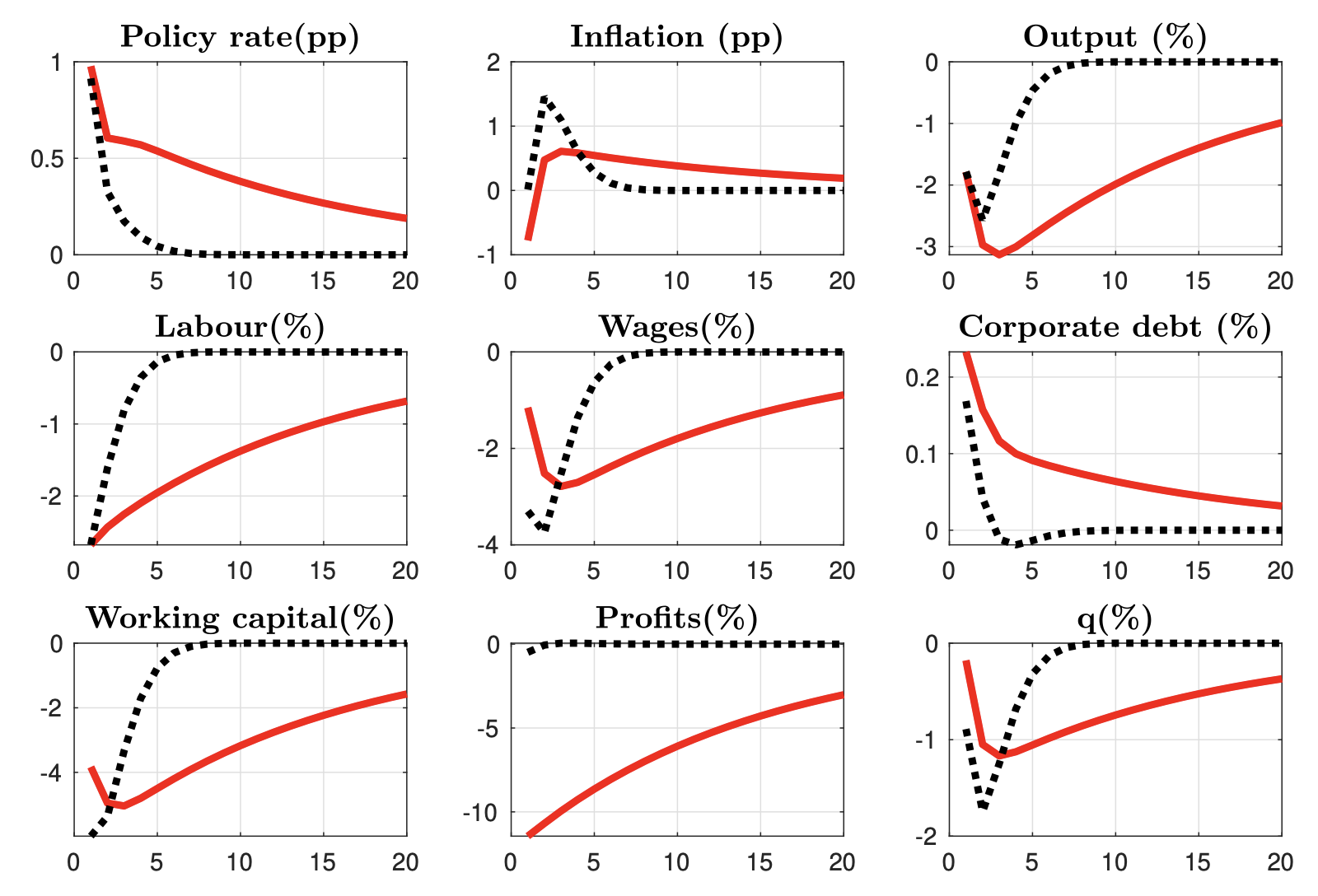

As Figure 3 shows, after a contractionary monetary policy shock, compared with the benchmark Taylor rule, the output stabilisation Taylor rule could bring output back up to the steady state swiftly, whereas with the benchmark Taylor rule, the loss of output and employment is greater and far more persistent. Nevertheless, the output stabilisation Taylor rule leads to a much higher inflationary profile, and moreover, the higher the debt level is, the more acute inflationary pressure becomes. This policy experiment underscores a greater trade-off between output and inflation stabilisation when there is a large volume of corporate debt in the economy, and thus, the absence of the ‘divine coincidence’ (Blanchard and Galí 2007).

Figure 3 Monetary contraction with a standard Taylor Rule an output stabilisation Taylor Rule

Notes: The red solid line is the benchmark Taylor rule and the dashed black line is the output stabilisation Taylor rule. The y-axis shows the percentage change and the x-axis shows the number of periods. q is the bond price. Other than inflation and the policy rate, all variables are in real terms.

Conclusion

Corporate debt has been on the rise globally for more than a decade. The COVID-19 pandemic has coincided with a further increase in corporate indebtedness with inflation having now risen. In Goodhart et al. (2021), we argue that high corporate debt levels may render contractionary monetary policy less effective in controlling inflation. Interestingly, when the level of corporate debt is sufficiently high, a contractionary monetary policy even increases inflation.

Indeed, this effect is reminiscent of the stagflation episode in 1972–73 after the oil shocks, where contractionary policy was associated with cost-push inflation, puzzling economists at the time. Again, the contemporaneous shifts of the AS and AD curves generate both output reduction and inflation. However, in our case the fundamental channel is via the increased debt servicing costs of legacy debt and not via higher costs of production. The monetary authority faces a much more difficult trade-off between inflation stabilisation and output stabilisation when there is a large volume of corporate debt in the economy and large scale of bankruptcies are not imminent. Under these circumstances, our work suggests that monetary policy will not be effective in reducing inflation gently towards a soft landing. This means that central banks ultimately have to choose between generating a recession, with significant bankruptcies, or accepting continuing stagflation. We believe this is also a policy conundrum for the post-crisis scenario, with high-debt zombie firms staying afloat with imminent firm defaults at record lows (e.g. Acharya et al. 2021, Caballero et al. 2008). Nevertheless, even though modelling the macroeconomic system with bankruptcy is more difficult, it could be a useful exercise for future research to examine the monetary transmission mechanism when large-scale bankruptcies are possible.

See original post for references

where contractionary policy was associated with cost-push inflation, puzzling economists at the time.

Those poor (not poor) things!

Pulzzled means….?

I’ll start learning to crochet in support of their contradictions / dilemma.

No obvious talent, but I’ll find a conclusion far quicker.

Along the lines of the enemy of my enemy is my friend, I’ll take just about any “explanation” that will increase awareness that monetary policy needs to take a permanent back seat to fiscal policy.

It is kinda funny how that stagflation lines up with the formation of Visa and Mastercard.

Assets with inflated prices have been used as collateral for loans. That would be a big factor in how fast and high Fed rates rise.

They have to look at stock market and real estate prices and see fantasy finamce support for the lending

Add to that, there are still big companies that have huge currency reserves. It will play out like a controlled demolition that presents them with opportunity.

Along with bankruptcy, expect more and accelerated wealth concentration.

Thanks for the post.

My two favorite lines…

On aggregate demand, as the monetary contraction increases the financing costs of wage

bills, there is a downward pressure on aggregate demand. This is the usual substitution effect. However, when the fixed cost of the legacy debt is high, firms feel the need to spread the fixed cost over a larger production scale and demand more labour, which leads to an upward pressure on aggregate demand. This is the income effect through debt.

and

At the moment, the monetary authorities seem reluctant to implement a sufficiently contractionary monetary policy that might lead to large-scale bankruptcies. So long as they are more fearful of bankruptcies and recession than they are of continuing inflation, a model with no bankruptcy seems appropriate.

Of course they don’t mind restricted individual bankruptcies from the cannon fodder among us, and they don’t mind PE purposefully fleecing companies through larding them up with debt and taking the profits and leaving a peanut shell behind…

I wallow on in a state of “divine confidence” that economists will, as paul notes above, remain puzzled…

So what is the solution?

Let inflation rip?

At this pace, the risk is that the inflation will become so destructive that the cohesion of civil society might become unhinged. Then given the current polarization, all bets are off.

Despite all deserved flak Summers get for past misdeeds, he has been calling this accurately.

And he thinks it is about to get much worse. I tend to agree with him.

I dont know if the “transitory view” of Yves has changed and what is the rationale for holding onto it currently.

The reason it will get much worse is because that is how the monetary system is designed. Larry loves it. This is Larry’s very own conundrum. However, there actually is a way out. It’s the Green New Deal. We don’t need more money chasing the same old goods – most of which are now bads. But moar-money is now required just to keep that rotten tent up. So Larry’s way would impose austerity in a time of hyper-austerity (aka inflation). Or it’s the sane way – find/create new valuable assets to invest in (aka a green economy). The more valuable the asset, the more invested money is made valuable. It’s the opposite of austerity. But it requires imagination and cooperation – concepts foreign to alpha-extractors. We know Larry won’t touch the GND with a 10 foot pole because he equates it with a bunch of useless infrastructure which will only create a million bridges to nowhere. Maybe – but the problem with Larry is that he also refuses to create new value; to create a million solutions to our problems, because he is stuck in his own misanthropic brain. The solution to inflated value (always mischaracterized as inflated money by people like Larry) is to create new value. Not destroying money. Larry is so stupid.

Let it rip is what I’m expecting. For some reason it seems everyone makes the analogy that this is like the 70/80s and interest rates will rise but we are in a much different boat. I think it’s more analogous to coming out of WW2. Capital controls, keep interest rates down and inflation running hot. Our government cannot afford otherwise, the debt is not serviceable above a few percent of interest. At least that’s my opinion that interest rates are not going to rise anytime soon on any large scale. Unless by some miracle we can keep the USD as reserve currency I think we are going to come out the other side of this in a very different position as a society.

What do we think a central bank is supposed to do?

Control the economy and inflation with monetary policy.

What is a central bank actually supposed to do?

1) Ensure the economy has the stable money supply it needs

2) Backstop the financial system

The FED did eventually remember what they could have done in the first place after 2008.

In the US, the Government loaned the banks the money with onerous conditions attached, and the bankers weren’t very happy with these onerous conditions.

http://www.nytimes.com/2009/03/11/business/economy/11bailout.html?_r=0

The FED eventually remembered what they could have done in the first place and started to take all those toxic assets off US banks at full value with money they created out of nothing.

The US banks could pay back their loans and get back to normal, without all those onerous conditions.

Ensuring the US economy has the stable money supply it needs has proved very difficult as no one seems to understand the monetary system.

It’s a debt based monetary system and you need to ensure the debt within the system stays at acceptable levels.

https://www.youtube.com/watch?v=vAStZJCKmbU&list=PLmtuEaMvhDZZQLxg24CAiFgZYldtoCR-R&index=6

At 18 mins.

Luckily the Americans had the Great Depression It cleared the slate, and allowed them to continue in the usual haphazard manner to which they have become accustomed.

They need to clear the slate again. Raising interest rates with all that debt in the economy could be dangerous move, but they won’t know that.

Japan has got a much better understanding of debt deflation than we do.

They have been fighting debt deflation since 1991, when they saved the banks and left the debt in place after their financial crisis.

https://www.youtube.com/watch?v=8YTyJzmiHGk

How does the capitalist system actually work?

I am trying to find out and it isn’t easy.

I have already put the foundations in place, which will be very useful.

How do the basic elements of the system fit together?

GDP measures the new goods and services being produced in the economy every year.

This is where the real wealth in the economy lies.

Private banks create the money supply.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

Money and debt come into existence together and disappear together like matter and anti-matter.

Bank loans create money and debt repayments to banks destroy money.

Bank loans create 97% of the money supply

The money supply ≈ public debt + private debt

Money and debt are like opposite sides of the same coin.

The money supply should grow with the economy, i.e. GDP.

More goods and services in the economy require more money in the economy.

It’s a debt based monetary system.

You want the debt to stay at a level where it will not adversely affect the economy.

You want GDP, the money supply and debt to grow together so the economy is not held back by the debt contained within it.

How do you achieve this?

The idea is that banks lend into business and industry to increase the productive capacity of the economy.

Business and industry don’t have to wait until they have the money to expand. They can borrow the money and use it to expand today, and then pay that money back in the future.

The economy can then grow more rapidly than it would without banks.

Debt grows with GDP and there are no problems

The banks create money and use it to create real wealth

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

When you have a firm grip on what money and wealth really are; and know how banks work, it all falls into place.

Neoliberalism is a top down ideology, and when you get to the base you find there are no foundations.

I think a bottom up approach is the way to go; now we have some solid foundations.

Japan also has a much better understanding of the value of owning foreign assets than we do. At least we used to. Then again, we essentially own the system as you describe below with the Eurodollar system, ours maybe is just more abstract I guess.