Yves here. While it seems that Russia has reached the conclusion that it needs to reorient its economy permanently away from Europe and the US to Asia and the Middle East, economists are only starting to grapple with the implications for supply chains. I’m not as confident as these authors are that difference in degree are not differences in kind.

By Tobias Korn, PhD candidate in Economics, Leibniz Universität Hannover and Henry Stemmler, Postdoc, ETH Zurich. Originally published at VoxEU

The war Russia is waging against Ukraine has already halted most of Ukraine’s production capabilities. Similarly, the sanctions raised against Russia by the international community end decades of economic cooperation across several economic sectors. This column draws on empirical evidence from over two decades of civil wars across the world to inform the debate on how international supply chains will adjust to the economic disruptions brought by violence, and how likely it is that the international economy will ever return to the pre-war situation.

The havoc brought upon countries by violent warfare causes, next to immeasurable personal pain, heavy economic disruptions. Destruction of production sites, disrupted supply chains, and the displacement of people often provoke a sudden and durable rupture of economic activity. While we do not have much generalisable empirical evidence on the economic costs of international wars, which used to be a rare phenomenon in recent decades, the literature on civil wars coined the term ‘development in reverse’ to describe the often persistent, negative economic effects of sustained episodes of warfare (Collier et al. 2003).

Currently, we see such a development in reverse unfolding in Ukraine. Only weeks after Russian forces commenced their invasion of Ukraine, millions of people have left the country, and formerly prosperous towns lie in ruins (Skok and de Groot 2022). At the same time, the international community punishes Russia with sanctions of an unprecedented scale, which have the potential to hurt the Russian economy significantly and end decades of economic collaboration (Berner et al. 2022, Felbermayr et al. 2019). Nonetheless, an embargo on oil and gas imports from Russia has not yet been implemented despite intensive public discussion, as several large European countries fear the economic consequences of forfeiting these hard-to-substitute imports (Bachmann et al. 2022) . Looking at how the international economy coped with prior disruptions to economic exchange caused by violent warfare helps us form expectations about the economic future of Ukraine, Russia, and the sanctioning countries.

(How) Do Supply Chains Adopt to Economic Disruptions?

In a recent study, we investigate how international trade flows respond to unilateral economic shocks (Korn and Stemmler 2022). For this, we focus on national civil wars, which have been found to cause significant disruptions to countries’ production and export capabilities (Blattmann and Miguel 2010). Specifically, we ask whether and how importers adjust their trade flows if a civil war breaks out in one of their main trade partners (see Arezki 2022 on the international spillovers of the war in Ukraine). To answer this question empirically, we use bilateral trade data that include over 150 countries for the period 1995 to 2014.

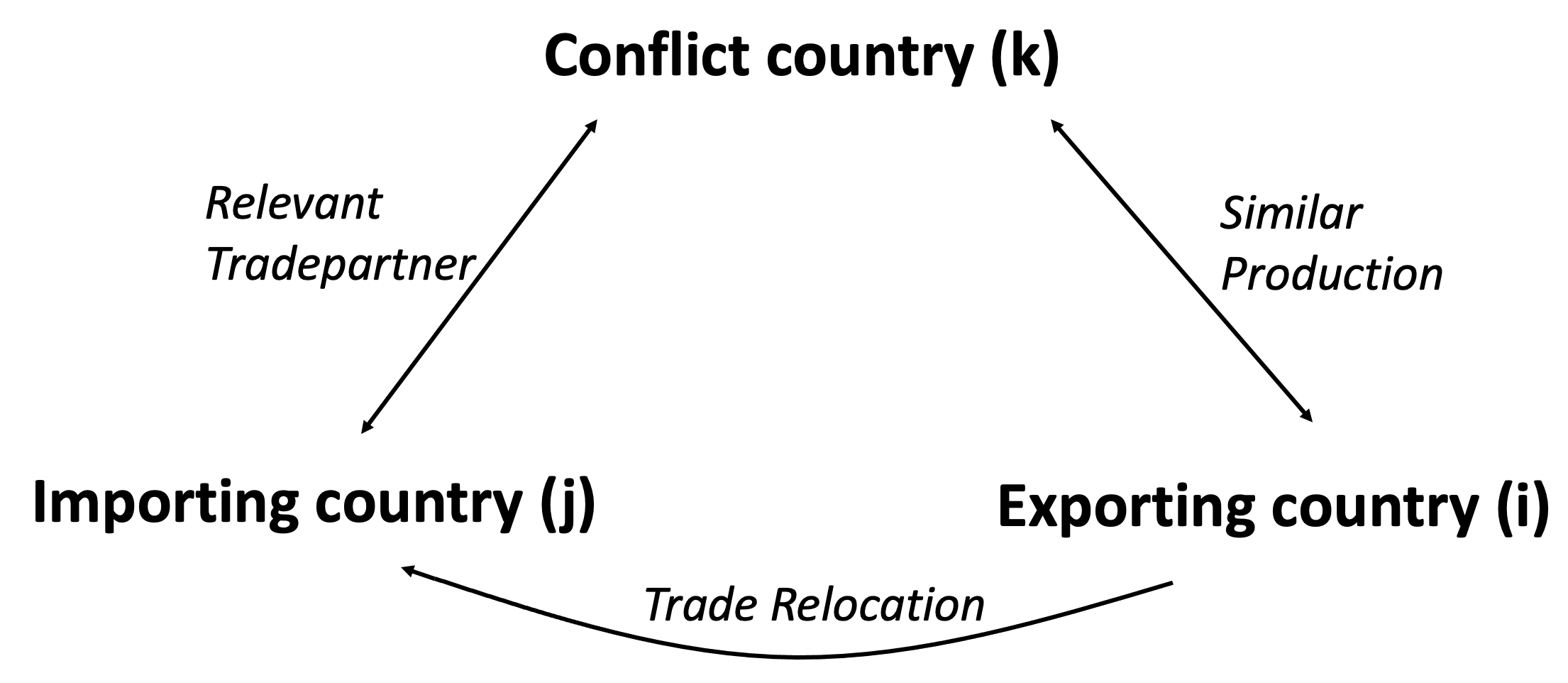

In this dataset, we first identify exporters that experience a civil war in a given year according to the civil war classification from the Uppsala Conflict Data Program (Sundberg and Melander 2013). Then, we code which trading dyads are most likely to be affected by trade relocation away from the conflict country. We base this coding on two characteristics, which we illustrate in Figure 1. First, we identify all countries for which the conflict country used to be a main trading partner (i.e. among the top seven exporters to this country).1 Second, we identify all countries that offer a variety of goods similar to the conflict country. Using various classification algorithms, we sort countries into clusters with similar production portfolios based on production volumes across 61 SITC product lines. We combine these relevance and similarity conditions to code which importer-exporter dyads are likely to experience trade relocation effects, as the importing country substitutes its demand away from the conflict country towards another exporter who offers a similar variety of goods. Finally, we investigate empirically whether trade values increase between these ‘relocation dyads’ in response to a civil war.

Figure 1 Illustration of trade relocation coding

Notes: This figure illustrates our coding of relocation propensity. For each conflict country k in a given year, we identify its main trading partners as well as all countries that provide a similar production portfolio. For each dyad ij where both conditions overlap, i.e. where the importer j is a relevant trading partner of conflict country k, and the exporter i produces similar products to conflict country k, we expect a trade relocation effect to materialise.

We find robust evidence that global supply chains adapt relatively quickly to economic disruptions from civil conflicts, but that this trade relocation effect exhibits a fair amount of heterogeneity. First, the reactions of supply chains in agricultural goods and the mining sector are exceptionally strong. On average, trade volumes between such ‘relocation dyads’ increase by 12% and 13%, respectively, already one year after the start of a civil war. In the manufacturing sector, trade values increase by 7% on average, and only if conflicts last for several years. Hence, manufacturing supply chains seem to be more hesitant to relocate compared to imports of primary goods. Interestingly, we find no evidence of supply chain adjustments in the fuels sector. If anything, importers cut back on fuel imports from alternative trading partners to maintain their current fuel imports of their main exporting partner who is now at conflict. This is a reaction we see again today, where countries highly dependent on Russian oil and gas struggle to scale back on these imports, even though they support various other sanctions. Our findings further add to the recent discussion in Kwon et al. (2022), who find evidence that sanctioning countries substitute for exports from third, non-sanctioned countries. If our results apply similarly to the economic effects of sanctions, and in light of the current debate on oil and gas embargos against Russia, we would not expect to find such a substitution effect for trade in fuels.

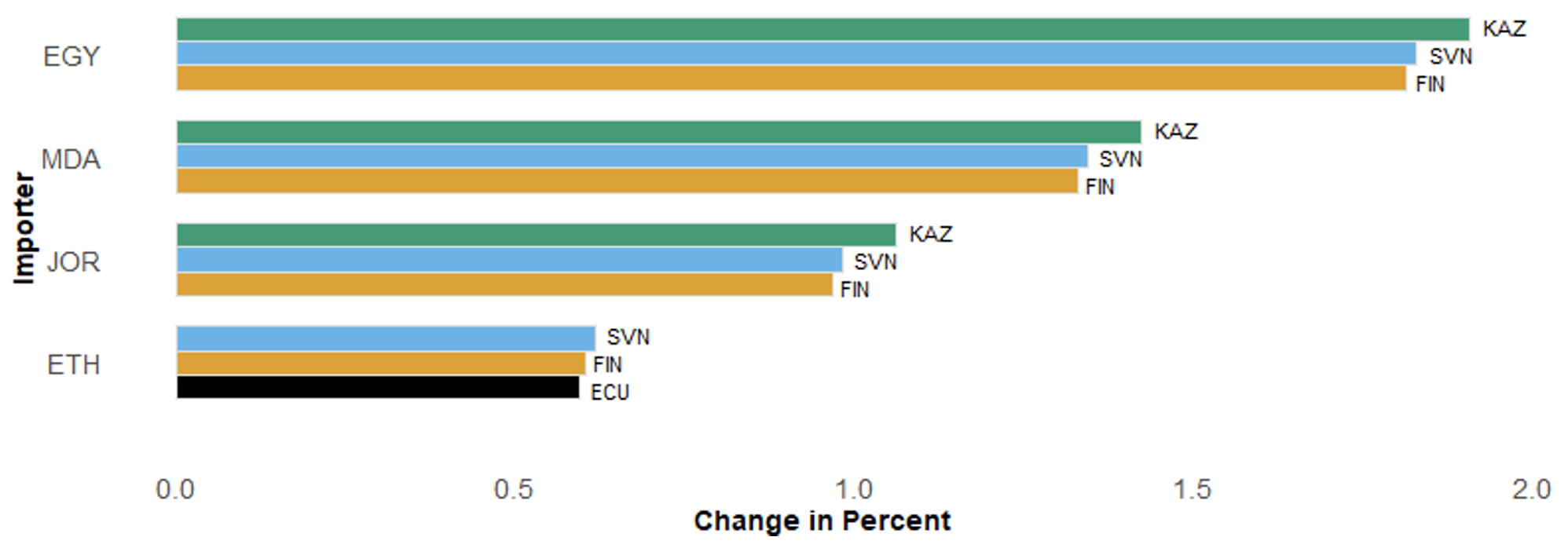

Figure 2 Trade relocation after Ukraine’s civil war

Notes: This figure reports the changes in bilateral trade values in 2015 compared to a hypothetical counterfactual world where the 2014 civil war in Ukraine never took place. On the y-axis, we report the four importers that reported the largest trade relocation effects in response to Ukraine’s civil war (Egypt, Moldova, Jordan, and Ethiopia). For each of these importers, we provide three bars, which indicate the size of the relative trade increase for the three main substitution partners (Kazakhstan, Slovenia, Finland, and Ecuador).

What do our findings imply for Ukraine’s global supply chains? Here, we can draw on case study evidence from Russia’s annexation of Crimea and the subsequent civil war that erupted in Ukraine’s Donbas region. Applying a similar structural gravity-general equilibrium estimation technique as in Kwon et al. (2022), we estimate the reduction in Ukraine’s exports following the outbreak of the civil war in 2014. We then use this estimate to compute hypothetical trade patterns and welfare levels of countries worldwide if this conflict would never have happened. Comparing actual to hypothetical trade flows and welfare levels, we get an idea of how this conflict affected the global economy. While we can hardly compare the scale of violence during the civil war to today’s situation, the qualitative tendencies are likely to be similar. We find that several dyads increase their bilateral shipments in response to the civil war. The countries most affected by the disruption of imports were Egypt, Moldova, Jordan, and Ethiopia. For most of them, Kazakhstan, Slovenia, and Finland resembled the main substitution partners, as they increased their imports from these countries by up to 2% in response to the civil war. Looking at welfare changes, however, we find that all countries are left worse off compared to the counterfactual where the civil war did not take place. While it is not surprising that Ukraine itself suffered the most, even those countries that benefit from trade relocation (e.g. Kazakhstan and Slovenia) become worse off overall from the civil war, as the increases in export demand do not compensate the loss relating to trade opportunities with Ukraine.

The Future of the Global Economy

We conclude this column by looking ahead. How can the Ukrainian and Russian economies recover from the war once the violence ends and the sanctions are lifted? As far as international trade is concerned, it highly depends on how long the war and sanctions will go on, and on how the rest of the world reacts. In our study, we estimate how trade relationships behave after a civil war ends. Here, we find that the trade relocation effects we estimate during a civil war remain of almost the same magnitude up to nine years after a civil war ended. Our 20-year sample unfortunately does not allow us to look for much longer periods. Especially in the manufacturing sector, the relocation effects robustly remain unchanged after peace is established. That is, whereas manufacturing supply chains tend to remain intact during shorter periods of violence, they also stay relocated once a substitution took place. As a possible explanation of this persistence, we provide evidence that (sustained) periods of violence and the resulting trade relocation effects increase the likelihood that the substituting importers persistently decrease the bilateral trade costs with their substitution partners by signing Preferential Trade Agreements with them. Hence, relocation persists because the world economy reaches a new equilibrium, in which the (former) conflict countries’ relative trade costs have increased compared to the pre-war situation.

This has implications should the war in Ukraine continue for so long that the relocation of supply chains and the subsequent conclusion of new international cooperation agreements cement a new structure of the world economy. In that situation, our analysis suggests that both Ukraine and Russia would find it hard to recover their international economic standing from before the conflict (Chepeliev et al. 2022). The recent visit of Germany’s Secretary of Economic Affairs to Qatar and negotiations on better trade relationships may be one of the first steps in this direction. Nevertheless, current considerations to foster economic and political relations with Ukraine, and even to initiate the process of Ukraine joining the EU, can be a valid measure to counteract the loss in trade access brought upon them by Russia’s declaration of war.

See original post for references

While many people do not know where the Donbass region is located, it is crystal clear that the Dumbass region is Washington, DC.

“Russia would find it hard to recover their international economic standing from before the conflict”. The authors should clearly define what constitutes “international” in this case. Is it the whole world or only US, Canada, EU, Australia, NZ, Singapore, Japan, and maybe South Korea?

Yes, it seems the underlying premise of this article is that the direction of capital and goods in the currents underneath the supply chains remains the same. That is that the West will retain its ability to direct the capital and goods of other parts of the world back into its consumption. It may be that ability has been flung to the dustbin.

the authors are clueless. if you want to see the destruction caused by free trade, millions of hungry desperate mexicans headed for america in a matter of months, because free trade destroyed their livelihoods.

the supply chains left north america, and destroyed the livelihoods of tens of millions of americans.

russia can come out of this in far better shape than we ever will.

mean while we are still being flooded with the refugees from free trade. inside and outside of the country.

Look, I have read this and perhaps I am dense or something but what the hell? About 40% of the world’s production of wheat has just dropped out of the world market. Where are countries supposed to substitute for that? Ask Musk to fly to Mars in his rocket and see how cheap their wheat crops are? And what about other commodities like titanium and neon and god knows what else. Are we suppose to ‘assume’ those commodities? The models they are using are now broken. Trying to predict what is going to happen by basing it on what happened when Crimea went back to Russia is disingenuous at best. And assuming, just assuming, that this war finally ends soon do they seriously believe that these sanctions will be lifted? Maybe only on stuff that is absolutely vital to the west but the rest will be kept in place to try to implode Russia – so long as Russia agrees to let this happen. So I am here to say that ‘globalization’ is now dead and the new supply chains will too an extent follow the emerging new power blocks. But i is too early to tell yet what form they will be.

Well, the model is a little wonky because there hasn’t been a case like this where the magnitude of disruption is this large (civil wars occur in countries that are usually relatively poor and might disrupt a single commodity but never to the degree of a country like Russia). Sanctions against Russia have to be treated as “temporary” for their recovery conclusions to hold since the analogy is civil wars end and thus that country “enters” back into the global economy.

RK

I assume my can opener will open all the canned wheat that I assume I can buy…

Yes. I that as airy fluff: “When the war is over and the sanctions lifted…”

Not in evidence, as they say.

As the famous Australian poet once said,

“If there be no corn in Egypt, surely Africa has some!

Keep your smile in working order for the better days to come!”

– When Your Pants Begin To Go, Henry Lawson

The sanctions against Russia are not going to stop. The break is irreversible — and will spread as China and Russia create new international trade and financial vehicles to replace the IMF, World Bank, ITO and NED.

Mr.Hudson, does this schema not imply that Russia must still trust western banks to honour its obligations to Russia? Why would they accept such an arrangement if the funds could again be seized at a more convenient time?

That is why they’re requiring payments in Rubles, even if that arrives in the form of Euros deposited in a Russian bank. Until sanctions get a lot tighter those Euros can be recycled through third parties not engaged with the sanctions regime.

As the US sanctions regime represents an existential threat to the idea of national sovereignty, the next indeterminate period will be one in which global “leaders” are asked if they really want to be that, and if the answer is yes, they’ll end up being cut off from the US system.

But it will take some time for this to play out.

I agree, the Zone A and Zone B Pepe Escobar has been talking about for a while are now fully defined and, as long as current regimes remain in place across Zone A (the US, EU, Japan, South Korea, and the rest of the Five Eyes countries), they will be separate economic and military systems. The BRICS-led Zone B countries will have to be satisfied with their higher economic growth, innovation, and cultural energy – but perhaps no Netflix…

I am in New Zealand at the moment, and I’ve got to wonder how NZ will hang with the Five Eyes if China is lumped in w Russia. Trade w China is what made the economy boom here. (Australia, too, for that matter, but their politicians are more reliable puppets to what the US and UK decide.). Europe isn’t going to buy all the dairy products that China does now.

It is very hard to see Europe given birth rates and immigration not either going Far Right or ending up full Eurabia, and either way, destruction of the welfare state and destruction of the “European” way of life. Further, it is hard to see how German industry will compete trying to buy American gas/oil, so the whole region is just going to de-industrialize and crater. America stands a better shot at a multicultural melting-pot, but its still a dying empire with a fake financialized economy propped up by dark magic at the Federal Reserve. It is unclear why you would want to tie your future to EU/USA/NATO when China and India have enormous populations and enormous capacity to grow economically and get wealthy.

“China and India have enormous populations and enormous capacity to grow economically and get wealthy.” Under the manifest acceleration of global heating and its associated “disruptions,” China and India, with their enormous populations and world-leading volumes of coal-derived greenhouse emissions, are headed for economic and social catastrophe unless they abandon (not later than “yesterday”) their suicidal intentions to “get wealthy.”

which they will because they are now able to de-couple in a sane way. The removal of the oligarchs and US-accolytes is of course a pre-requisite.

The study’s conclusions make sense for most civil war conditions, but the extrapolation for the current conflict in Ukraine and sanctions against Russia severely underestimates the magnitude of impact. In the entire Uppsala dataset, civil wars that massively disrupted a country’s production are usually in countries with much smaller economic footprint than Russia. Even the limited civil war in Donbas starting from 2014 restricted the conflict geographically to one region of Ukraine with again limited sanctions against Russia (compared to the financial nukes lobbed against Russia this time around). So, I think the effects are probably several orders larger than what this study is suggesting.

I posted this a few threads back, but it probably fits just as well in this one. The context of the prior thread was “What will Russia do with all those Euros it gets for its gas sales to the EU?”

The context of this thread, of course, is “what about those trade flows?”

IMHO, this is the entire crux of the matter. Trade flows = rent extraction points.

Rent extraction points are moving West to East. That’s the pivot around which all this commotion revolves.

====

New situation for Russia:

a. Payments will be made to Russian banks, under Russian control and that removes the possibility of reserves-theft by EU or US. Goal 1 met.

b. Precedent set, expectations set, for preventing reserves-theft for other resource flows (grain, iron ore, oil, titanium, etc.). Goal 2 met.

Now the question comes “What can Russia buy with its Euros?”

A.1: Whatever the EU wishes to continue selling to the Russians. That’s the EU’s decision to make, and if the EU blocks those flows, then Russia steps it up one (crucial) click and says “Further purchases will be denominated in Roubles or Yuan or Rupees, which Russia can use to buy the things it actually needs” *

A.2: Whatever the rest of the world chooses to sell to Russia in exchange for Euros. Euros are used widely – not as much as dollars, but still pretty widely. If EU decides to choke off that flow by sanctioning the intermediary banks that handle the exchange process, then Russia reverts back to a stricter version of A.1 above.

The demand for Russian resources isn’t going to abate. All those resources are fungible, key inputs to any modern economy.

Russia will concurrently ramp up trade with China and India. That’s the long-term fundamental play. The thing the West fears most is Asian integration. And that’s exactly what I’d provide, in spades, if I was a Russian policy-maker.

Trade flows controls economics, politics, and standards of living. Move the trade flows.

=======

Looking at the problem from the West’s point of view, I hark back to Dr. Hudson’s core question set out a few posts ago: “How can you have a good Western standard of living if you’ve hollowed out your national wealth-building capacity?”

Well, you can’t, of course. That’s what the smash-and-grab Western tactics are all about. We have to extract wealth from others, because we’re not creating enough of our own.

Russian/China have got most of the groundwork in place to prevent the smash-and-grab.

So when does the West “stop digging”, and start building Western domestic economies that actually work?

What level of failure, pain, humiliation and stupid does it take?

=======

* another key question is “what does Russia actually need from the West?”. Every week of EU shutting off exports to Russia, and possibly to China, is another week that Russia and China devise alternatives to Western products.

Once the alternatives are in place, there’s no incentive to return to Western sources, even under very different political circumstances.

Habits endure.

in the final analysis no one will exchange real stuff for FIAT paper.

The way the authors frame the story leaves out the origin of the problem, how can they justify an analysis that leaves out the central character in the play?

The question isn’t limited to “How can the Ukrainian and Russian economies recover from the war once the violence ends and the sanctions are lifted?”

The question is whether the USA will allow a diplomatic solution to end the hostilities.

So far, it looks as if American leadership is doing everything they can to prevent the warring parties obvious efforts to reach an agreement that will end the violence.

And what can be said about the likelihood of sanctions on Russia being lifted any time soon?

Do you know whether euro pricing, say, of the gas is unchanged by this? If so, and if the rouble rises against the euro, won’t Gazprom receive less for its gas? How would that not damage Gazprom while leaving the ‘unfriendly’ customer relatively unaffected financially? (I’m really out of my depth here so any help in understanding this is appreciated.)

Academics speak of the “supply chain” as if it was one firm entity, almost a theoretical construct. For the purposes of modelling and prediction, maybe this works. But the truth is, a “supply chain” is made up of people, trucks, ships, warehouses, railroads, containers, security systems, and data systems, and this is by no means a complete list. The entire thing is vastly complicated, interdependent, and made up of materials that decay every second in an outdoor and marine salt water environment.

For the last 20 years there has been a huge effort to get ships to burn cleaner fuels, lighter fuels with less toxins. Huge. The effort has been to stop contaminating the air and to reduce carbon output. There are even efforts to build ships powered by natural gas or hydrogen. None of these solutions has made much of a dent on air emissions, yet, and all require more expensive product.

The immediate impact from the Ukraine-Russian conflict (and the sanctions imposed after it began) will be much higher prices for goods and even more for fuels, including marine bunker fuel, railroad and truck diesel fuel, and gasoline. The costs to transport goods will rise, greatly. Shipping companies will, to save fuel, slow down their ships (it is amazing how much fuel you can save if you steam at 15 knots instead of 24 knots) which will lengthen the time for delivery.

Point being, even before understanding the overall supply chain shifts from this war, the immediate impacts will be sudden and large, based purely on inflation and fuel supplies.

A bigger question might be this: since the 1950s the entire world manufacturing and delivery system has expanded to be truly global, all relying on cheapo marine transport using containers. The impact has been enormous, maybe as great as the economic impact in the early 1800s when railrods were invented and in a decade made most canals obselete.

Everyone is modelling this to see the impacts on existing systems so as to get back to the way it has recently been, ie continued global manufactures. What if, instead, the entire system breaks down and instead of a world wide system we end up with basically a bloc-based system? What would that look like?

I think we’re going to find oiut.

A better term bight be supply network. Or supply web.

That’s the ‘missing factor’ in their analysis of why manufacturing chains move slowly, and don’t move back. Of course the factory doesn’t move countries in the first year of the civil war, and of course it doesn’t move back once the war is over! That’s building, plant and thousands of people to move!

Yep, they are just running algos based on past flows of goods from place to place. Nothing about the distribution of the distribution of those goods once they arrive at a place.

Aaaaand…IT’S GONE!

“Putin Signs Decree Ordering Gas Exports To Be Halted If Buyers Don’t Pay In Rubles”

Good luck, Germany and the rest of “The International Community” aka The Whole World.

Germany agreed to pay in roubles yesterday – although finessing it as refusing by saying they’ll pay euros to Gazprom Bank which will be converted into roubles to make payment.

“A source told Reuters that payments for gas delivered in April on some contracts started in the second half of April and May for others, suggesting the taps might not be turned off immediately.”

https://www.reuters.com/business/energy/russia-sets-deadline-rouble-gas-payments-europe-calls-it-blackmail-2022-03-31/

What we are watching, a war between Russia and neo-nazis in Ukraine, which looks more like intentionally establishing new trade connections rather than a “civil war”. Pre-planned by outside forces. The Germans tried for decades to make the Russian gas-trade work but the US stepped in and put its foot down. That’s what it all looks like to me. That the long term plan, going back to Zbig. Brzensky, was to separate Ukraine from Russia because Ukraine was a conduit to the east and to Eurasia. The fact that Germany has just sent an envoy to the Gulf oil giants means that oil and gas will be coming west from the Gulf states to Germany and possibly all of the EU. Oil and gas from Russia, Iran and the Capsian will go east. Somebody wants this division to happen. And Russia and Ukraine were caught in a situation that only war could resolve. And etc.

Well, the U.S. is certainly trying to play catch-up in a big way from its “invasion ” of Irag, Syria, Libya, et al. It’s like a juvenile delinquent headed for the Big House…

The earth is engulfed with total case of human cognitive dissonance. The West went to war against the Russia China Axis with economic sanctions. The Ukraine Russia conflict is the first real battle in WWIII. In order to negotiate a peace treaty to end the conflict, the West must first acknowledge that this is now a multi-polar world. They can’t. The whole western financial house of cards will crash.

WWIII will end globalization forever unlike after WWI & WWII when globalization bounced back one last time. Right now, in the West; 1) Labor is sick, 2) Just-in-time Logistics broken, 3) Climate Change is impacting life, 4) Leadership corrupt and incompetent, and 5) resources depleted. What simply cannot be acknowledged is that without another Reformation, a poor, sick and unequal world is the best of all possible outcomes; if somehow, humans avoid a nuclear holocaust.

0225 CST– Ukraine bombs Russia

No joke:

Eight reservoirs ablaze at Belgorod oil depot – Russian emergencies ministry

“The fire erupted at the oil depot as a result of an airstrike delivered by two helicopters of the Ukrainian Armed Forces. They entered Russian airspace, flying at a low altitude. There are no casualties…”

https://interfax.com/newsroom/top-stories/77700/

Somewhere there’s video of the airstrike, but RT is 502/ blocked to me, as well are the links on this channel:

https://sputniknews.com/20220401/fire-hits-oil-depot-in-russias-belgorod-near-border-with-ukraine-governor-says-1094377942.html

Add this to the mix:

Ukraine conflict: Russia to allow unauthorised imports from West

Russia is allowing imports without a trademark owner’s permission, in reaction to sanctions that have halted an array of Western products.

The prime minister said until now goods could not be sold in Russia without the trademark owner’s authorisation.

The aim of letting retailers import products without the companies’ permission, he explained, was to saturate the market so that people had fast access to necessary goods, guaranteeing supply despite the “unfriendly actions of foreign politicians”.

https://www.bbc.com/news/world-europe-60932975

All your IP is belong to us

Walk back from this, suckers.

‘All your IP is belong to us’

Hah! Love it.

How does free trade actually work?

Why is it so much cheaper to get things made elsewhere?

The early neoclassical economists took the rentiers out of economics.

Hiding rentier activity in the economy does have some surprising consequences.

The interests of the rentiers and capitalists are opposed with free trade.

This nearly split the Tory Party in the 19th century over the Repeal of the Corn Laws.

The rentiers gains push up the cost of living.

The landowners wanted to get a high price for their crops, so they could make more money.

The capitalists want a low cost of living as they have to pay that in wages.

The capitalists wanted cheap bread, as that was the staple food of the working class, and they would be paying for it through wages.

Of course, that’s why it’s so expensive to get anything done in the West.

It’s our high cost of living.

Disposable income = wages – (taxes + the cost of living)

Employees get their money from wages and the employers pay the cost of living through wages, reducing profit.

High housing costs have to be paid in wages, reducing profit.

The playing field was tilted against the West with free trade due to our high cost of living

The early neoclassical economists had removed the rentiers from economics so we didn’t realise.

That’s why it’s so much cheaper to get things made elsewhere.

The interests of the rentiers and capitalists are opposed with free trade.

No one told the Americans.

“Income inequality is not killing capitalism in the United States, but rent-seekers like the banking and the health-care sectors just might” Angus Deaton, Nobel prize winner.

Oh dear.

No wonder all their forms off-shore and import back into the US leading to a massive trade deficit.

I watched the film “Greed” the other day.

What does Sir Richard McCreadie work out?

He can pay workers in Sri Lanka 50p a day, which is much lower than he would have to pay in Leicester.

You can pay people 50p a day in Sri Lanka and they can actually live on that.

A low cost of living allows you to pay very low wages.

Sri Lanka is much better than Leicester for garment manufacturing when you want to maximise profit.

“Thanks mate” Donald Trump

He had been blaming other countries for the US trade deficit, but can now see it was Americas fault.

They didn’t understand free trade.

The early neoclassical economists had taken the rentiers out of economics so they didn’t realise the interests of the rentiers and capitalists are opposed with free trade.

Employees get their money from wages and the employers pay the cost of living through wages, reducing profit.

High housing costs have to be paid in wages, reducing profit.

And you added healthcare costs– check.

Cost of post-secondary education…

Transportation/mobility, all the costs entailed…

Food– holy s**t– I just went to the grocery store last week for the first time in two months… …to buy heavy cream, eggs and some veggies. Bread… bread? I think I’ll keep making my own.

Yeah, how are high cost-of-living countries supposed to compete with low cost-of-living countries? Our competitiveness is eaten by costs… And unless you have a high income in a high cost-of-living country, you’re probably living like s#!t.

Most of my travels take me to and through fly-over. I rarely step foot in the islands of affluence, but when I do I am struck by the contrast– much of USA seems shabby, grey, run-down and soviet; the pockets of wealth stand out and seem obscene.

The very vitality of USA subjects is consumed by a cancer of costs, at great cost to our society, at great cost to our quality of life. I wish more attention was given to this subject

I have only been to the US once, in the early 1990s, and that was to Florida, which is probably not typical.

Anyway, what struck me about it?

Where are the big American cars I have seen on the TV?

They weren’t that much different to the cars in Europe, especially my hire car, which would have been very at home in Europe.

McDonalds in the US must be something really special.

I went to one; it looked pretty shabby and was obviously not frequented by more affluent Americans.

It is designed to drive everywhere, not walk.

I noticed the contrast too.

The nice bits are really nice, but the bad bits are really bad.

It was amazing how close together the good bits and the bad bits can be.

free trade requires war. this was stated by the nutcase that got us entangled in free trade.

under free trade whats mine is mine, whats yours is mine. any country that was foolish enough to believe they were special and not subject to smash and grab, were fools.

nafta billy clinton made this quite clear.

clearly this is fascism,

“bill clinton did this,

NATO bombed Yugoslavia for 78 days following accusations that Milošević was ethnically cleansing Albanians in Kosovo.

The late Milošević was quietly and de facto cleared of all charges by the Hague Tribunal in 2016, but by the time the truth came out, Yugoslavia was long gone, broken into seven, more manageable and exploitable, countries. One of those profiteers, Albright’s financial management company, was involved in the privatization of Kosovo’s telecommunications company. From Wikipedia, one can learn that she too likely profits well from her war mongering, along with other untouchables”

bill clinton did this to the mexicans,

“There’s no other option for us. It’s either certain death in our villages where we can’t survive, largely due to NAFTA, or maybe dying on the road.”

“a bill clinton mouth piece,

In a March 28 New York Times article, Thomas Friedman wrote:

“For globalization to work, America can’t be afraid to act like the almighty superpower that it is… The hidden hand of the market will never work without a hidden fist. McDonald’s cannot flourish without McDonnell Douglas, the designer of the F-15. And the hidden fist that keeps the world safe for Silicon Valley’s technologies is called the United States Army, Air Force, Navy and Marine Corps.”

As NATO troops entered Kosovo, the same newspaper announced Kosovo’s new currency will be the U.S. dollar or German mark, currencies of the two countries most responsible for Yugoslavia’s break-up. And after months of being told that Slobodan Milosevic was the problem, we heard Washington Balkans expert, Daniel Serwer, explain:

“It’s not a single person that’s at issue, there’s a regime in place in Belgrade that is incompatible with the kind of economy that the World Bank… has to insist on…”

” Bill Clinton elaborated:

“If we’re going to have a strong economic relationship that includes our ability to sell around the world Europe has got to be the key; that’s what this Kosovo thing is all about… It’s globalism versus tribalism.”

“Tribalism” was the word used by 19th century free trade liberals to describe nationalism. And this war was all about threatening any nation which might have ideas of independence.”

“Globalization undermines both democracy and national sovereignty, the only guarantors of human rights. Unfortunately for Messrs. Clinton, Chretien et al, that message was not lost on millions around the world watching NATO bombs pulverize Yugoslavia.”

“Globalism is the creation of a set of property rights that, precisely because they span multiple sovereignties, cannot be touched by one government without inviting conflict with another.

Organizing property and production across borders—whether through free trade, protections for foreign investment, currency unions or other devices—does more than limit the power of governments. It also serves, “to dissolve the small, discrete collective of mutual identification—which means a country.”

offshore tax havens are a direct result of free trade: the pathology of free trade is being exposed

Today’s global rich are increasingly stateless, detaching their money from nation states and conventional representations of ownership to hide and preserve it. A global oligarchy is growing — and it does not bode well for everyone else and the planet.

free trade enables the plundering of the wealth of nations, especially hurting the world’s most poor and vulnerable populations. It allows wealthy individuals and corporations to dodge and evade their tax responsibilities, shifting obligations onto those with fewer resources. It empowers criminals, deadbeats, and kleptocrats

in 1983 there were only 15 billionaires in the u.s.a., under nafta billy clintons free trade,