Lambert: If you’re exposed to Russian energy, more volatility for you.

By Raphaël Lafrogne-Joussier, PhD candidate in Economics, CREST-Ecole Polytechnique and Economist, INSEE, Andrei Levchenko, Professor of Economics, University of Michigan; CEPR Research Fellow, Julien Martin, Professor of economics ESG UQAM, and Isabelle Mejean Professor of Economics, Sciences Po. Originally published at VoxEU.

What are the potential costs of cutting Russian energy imports as a further tightening of the sanction regime? One of the many uncertainties regarding the size of these costs is related to the diffusion and amplification of the shock in production networks. This column discusses what can be learned on this topic from the analysis of firm-level data. Micro-level evidence suggests that some firms adjust, mitigating the effects of the shock. However, exposure to these shocks is heterogenous across firms. This has distributional consequences, with less exposed firms gaining market shares over more exposed ones.

Imports from Russia are largely made up of energy inputs, most notably oil, coal, and natural gas. The centrality of these inputs in production networks implies that shocks affecting the price of energy have the potential to propagate downstream, leading to sizeable amplification of the shock. However, recent estimates, recovered from calibrated multi-sector, multi-country models with input-output linkages (Bachmann et al. 2022, Baqaee et al. 2022), suggest that the effect of an import ban on Russian oil and gas would generate a relatively limited GDP contraction.1 Even in a country like Germany, cutting Russian energy imports – which represent 30% of German energy consumption – would induce a 0.5-3% decline in GDP, a sizeable but manageable economic cost.

In sector-level models such as those used in Bachmann et al. (2022) or Baqaee et al. (2022), such a relatively small effect results from a non-zero elasticity of substitution among firms’ inputs. If Russian oil and gas were perfect complements to other inputs (a zero elasticity), GDP would fall one-to-one with energy imports. Some of the firms in sectors dependent on Russian energy are assumed to be able to switch to other suppliers and the same is true of firms in downstream sectors, which need to cope with the reduced production of their suppliers. In particular, the open-economy structure of the model implies that some of the inputs that can no longer be produced domestically due to energy rationing can be substituted by foreign goods.2

The assumption that there exist some substitution opportunities in production networks may seem controversial, as they are typically thought to be rigid structures shaped by relationship-specific investments. Is it more appropriate to instead be conservative and assume a pure Leontief production structure? Addressing this question is tricky in the absence of direct evidence on how technologies adjust to energy shocks.

Is Technology Leontief at the Firm Level?

In a recent paper (Lafrogne-Joussier et al. 2022), we tackle a related question using the early stage of the Covid crisis as a quasi-natural experiment. In this empirical study, we use monthly panel data on French firms and investigate the dynamics of their sales in the first semester of 2020. Our strategy exploits firms’ early exposure to supply chain disruptions induced by the lockdown in China in January 2020. By comparing firms that were exposed to the productivity slowdown in China through their value chain with comparable firms that were not, we can quantify the extent of the propagation of shocks, at the root of the amplification formalised in models of production networks. By March 2020, when the virus was just beginning to spread in Europe and France, firms exposed to supply chain disruptions from China were already reporting 7% lower export sales than their unexposed counterparts.

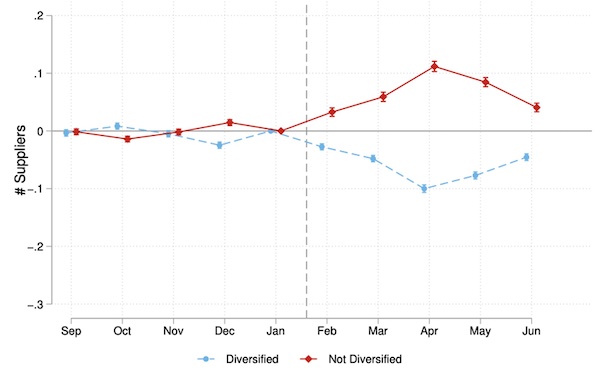

The exercise also makes it possible to examine heterogeneous adjustments of exposed firms to input disruptions. A first finding is that exposed firms holding inventories managed to absorb the shock better. Whether managed at the firm level, as in our example, or by public authorities, strategic inventories (in particular of gas and oil) appear to be essential to help exposed firms mitigate the shock. A second, more surprising result is that firms that were most dependent on Chinese inputs absorbed some of the shock by diversifying their supply chain following the early lockdown. Among the treatment group, firms that had a non-diversified supply chain have a significantly higher probability to start importing their inputs from elsewhere just after the disruption induced by the Chinese lockdown, in February and March 2020 (Figure 1). Whereas such evidence does not directly address the question of the possibilities of substitution away from Russian gas, it does support the view that, even in the very short run, firms that face important disruptions in their input purchases do adjust.

Figure 1 Impact of the early lockdown in China on exposed firms’ number of foreign partners.

Source: Lafrogne et al. (2022).

Notes: The figure shows the result of an event study design that compares firms exposed to Chinese inputs prior to the lockdown in China (“treated” firms) and firms that were not (“control” firms). The treatment group is further split into “diversified” firms that were connected with at least one other sourcing country for the input sourced in China and “non-diversified” firms that solely relied on China prior to the shock. The estimated equation explains the number of source countries, before and after January 2020, in the group of treated firms in comparison with control firms, using a Poisson estimator. The difference is normalised to zero in January 2020.

DistriButional Effects of the Shock

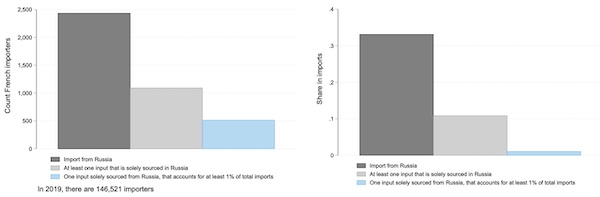

Another margin of adjustment, which textbook sector-level models do not directly incorporate, is substitution within a sector across firms. Since firms in the same sector produce output that is probably more highly substitutable than inputs within the firm, heterogeneity in who uses Russian gas provides another shock attenuation mechanism (di Giovanni et al. 2020). As discussed in this paper, heterogeneity in exposure to a foreign shock has significant aggregate consequences on the overall impact of the shock. The heterogeneity in exposure to Russia from the import side is illustrated in Figure 2. Out of 150,000 French importers, less than 2,500 directly imported from Russia in 2019. However, these firms are substantially larger than the average and their total imports account for one-third of France’s overall imports. Providing exposed firms are large and connected to other domestic producers, their sensitivity to the shock has aggregate consequences. But the heterogeneity also has distributional consequences: non-exposed firms gain market shares over exposed firms. To account for these substitution opportunities, the analysis in di Giovanni et al. (2020) maps firm-level data for France with the sector-level input-output data used in Bachmann et al. (2022) or Baqaee et al. (2022).

Figure 2 Exposure of French firms to Russian imports

Source: French customs data for 2019.

Notes: The figure shows the number (left panel) and share in aggregate imports (right panel) of firms that i) import from Russia (dark grey bar), ii) import one of their inputs solely from Russia (light grey bars) and iii) import one of their main inputs solely from Russia (blue bars). In the third case, statistics are based on the sub-sample of a firm’s imports that account for at least 1% of the firm’s overall imports in 2019.

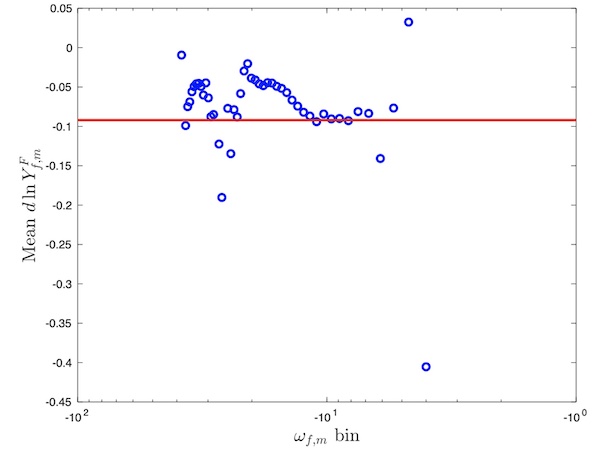

Figure 3 illustrates how heterogeneity in exposure and substitution opportunities affects the response of French firms to a 10% drop in Russian productivity. Under our baseline calibration, the aggregate impact of such shock is a 0.9% decrease in France’s real GDP (the red line in Figure 3). Blue circles display the average firm-level responses depending on the firm’s size. Whereas firms in the top two percentiles of the size distribution experience a sizeable 4% adjustment, some firms in lower percentiles expand as they gain market share over the most exposed firms. These substitution opportunities are not accounted for in textbook models with input-output linkages but they could be important in the context of a possible ban on Russian gas if there is heterogeneity across firms within a sector in their dependence on Russian gas.3

Figure 3 Heterogeneity in the response of firms to a 10% productivity drop in Russia

Source: Authors’ calculation using the model in di Giovanni et al. (2020).

Notes: The figure shows the mean elasticity of firms’ real value added to a simulated 10% drop in the aggregate productivity of the Russian economy. Average elasticities are computed for 50 bins of individual firms, grouped by their (value added) size.

Concluding Remarks

Existing evidence recovered from detailed firm-level data thus supports the view that foreign shocks do diffuse in production networks. Despite the rigidity of modern production networks, some firms adjust their technology, even in the very short run, when confronted with a disruption in their value chain. Moreover, the heterogeneous exposure to the shock has distributional consequences: less exposed firms gain market shares over the more exposed ones. Assuming some substitution across inputs in models of production networks is consistent with this micro-level evidence. But what the discussion also shows is that a ban on Russian imports will have very heterogeneous consequences. Some well-known firms and some iconic products will be strongly affected by the sanctions. Beyond GDP figures, huge but concentrated losses may have a stronger impact on public opinion than small diffused losses.

This analysis reminds me of the climate change impact studies that conclude that since agriculture is only 4% of global GDP, it will only be a minor problem if it completely collapses.

Plus, there is the larger and equally silly assumption that Russian energy has easy substitutes by comparing it to Chinese supply chain lockdowns, which was over in a matter of months. The sanctions against Russia on the other hand has no visible termination date (at least in the foreseeable future). So, just that assumption alone makes the analysis completely messed up. Economic analyses are only as good as their assumptions, and these assumptions are bonkers.

Great comparison. In the back of my mind I was wondering what happens when if there was a drastic shortage of gasoline and diesel oil.

Back in the 1880’s, IIRC, much of North America and parts of the Caribbean were hit by an equine flu. It could have been worse as most horses recovered but most cities in Eastern Canada and Eastern and Central USA lost their prime “last mile” motive power. At one point in Boston the fire department was dragging their fire appliances to fires. Trains were operating but without horses it was virtually impossible to get goods to or from a railway station.

A diesel shortage might be Europe’s equine flu revisited. Only longer and worse.

Some countries will choose to sanction themselves from buying Russian coal, gas and oil. Other countries will choose to keep buying it.

Since the counries under self-sanction will be kept under self sanction by their governating elites, we will have a Darwin test over the next few years as to which set of countryconomies does better, the self-sanctioners or the still-buyers.

Can’t see countries like Germany just shrugging off gas shortages. A modern economy has so many interlocked parts that if one link is taken out of a production facility, that the whole thing comes to a grinding halt. But what nearly all companies – and homes for that matter – have in common is a core requirement for energy. You can have a Porsche 911 but without energy aka gas, it ain’t going anywhere. Same with production. And don’t forget that all those homes and companies need heating in winter as well as schools and hospitals. But I fail to understand why the leaders of so many countries don’t seem to understand that and seem intent on running their economy into a ditch instead. Maybe when crunch times come they can sit around a fire and use all those economics papers assuring them that all will be well as fuel instead.

I think @redleg nailsit. Also showing a bit of my own prejudice as I think a lot of mainstream economists are badly blinkered, I suspect that the authors expect the invisible hand of the market to deal with it. I do not think they really grasp that the market might work but that one cannot built critical infrastructure overnight.

How long, outside of full war-time situations is it going to take to build LNG terminals and LNG ships assuming we can find some gas somewhere?

Potash for fertilizer? Can Canada ramp up production maybe? How long?

This is more econo-speak for: if the stretched budgets of the Proletariat have to contend with unexpected price inflation it can lead to social/political disruption. (See: France; and then US in November.)

So, if for instance you do long commuting in your car every day, f&cked you are. If you are a fisherman the same, when you go to the groceries… the same. Particularly true if your income is not positively influenced by high oil derived product prices being that the case for most of us.

This ignores the question “how does an x% cut in global energy availability get replaced?”

Looking through the zoom lens at a problem when the panorama is the realistic view of it.

It would be interesting to see more analysis of the effects of losing gas as an input into industrial processes and not just as a source of energy. Sure is worrying German industry.

And then, as this site rightly points out frequently: what are the repercussions in a tightly coupled system? Personally, I do not believe the modest GDP losses predicted.

Once the full extent of the economic fallout from the sanctions becomes apparent, I expect to see a lot of Europeans and people in other nations openly revolt.

Food Prices, heating prices, fuel prices, will all skyrocket. Historically this has led to revolutions.

Being a puppet for Washington means unnecessary hardship and ironically, this, along with the gradual abandonment of the US as the reserve currency could very well be the long term decline of the American hegemony.

An example, Macron may have won most recently, but winning could very well be a poisoned chalice. The next few years will bring extreme economic hardship to the French, even if they are less exposed than other nations. Plus Macron will no doubt make sure to implement his other unpopular austerity measures and raise the retirement age.

That would give Le Pen several specific things to run on cancelling and reversing in the next election.