Readers likely know that your humble blogger is no fan of crypto, but we’ll shortly turn to a big news item of the last couple of days, how the “stablecoins” Tether and TerraUSD have proven to be anything but.

To be explicit about our dim view of crypto, it’s taken literally hundreds of years to make simple-minded banking not-too-dangerous for the financial health of its customers. There is no reason to think that crypto promoters are going to design a better and certainly not a safer mousetrap any time soon. Among other things, they are finding the hard way that they are having to replicate the features of traditional banking. And there’s no way they’ll match the transaction speed and cost of some of the current plumbing, such as the Visa/Mastercard network.

But it’s been disconcerting to see regulators who ought to have known better stand back and let crypto gain a following, as opposed to either outlawing it or making sure it remained a fringe activity. What Michael Lewis said about Salomon Brothers’ mortgage securities operation is true of having your own fiat currency: “Salomon Brothers let slip through its fingers the rarest and most valuable asset a Wall Street firm can possess: a monopoly.”

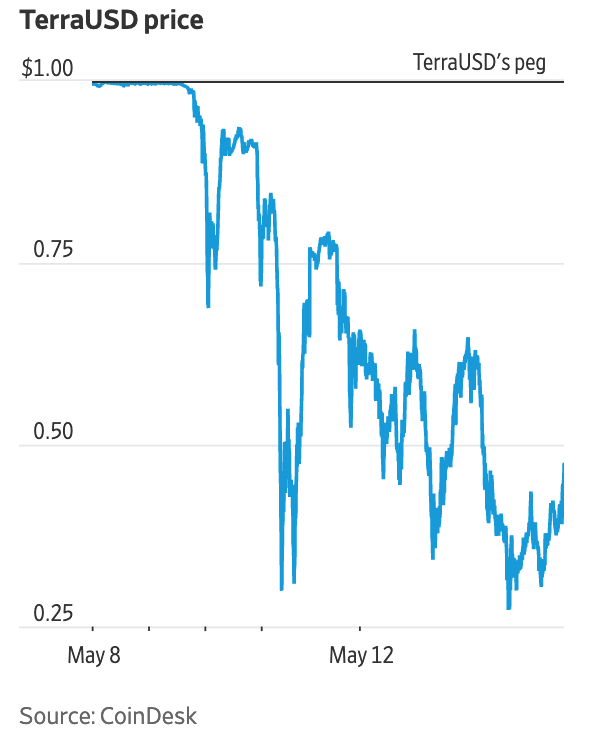

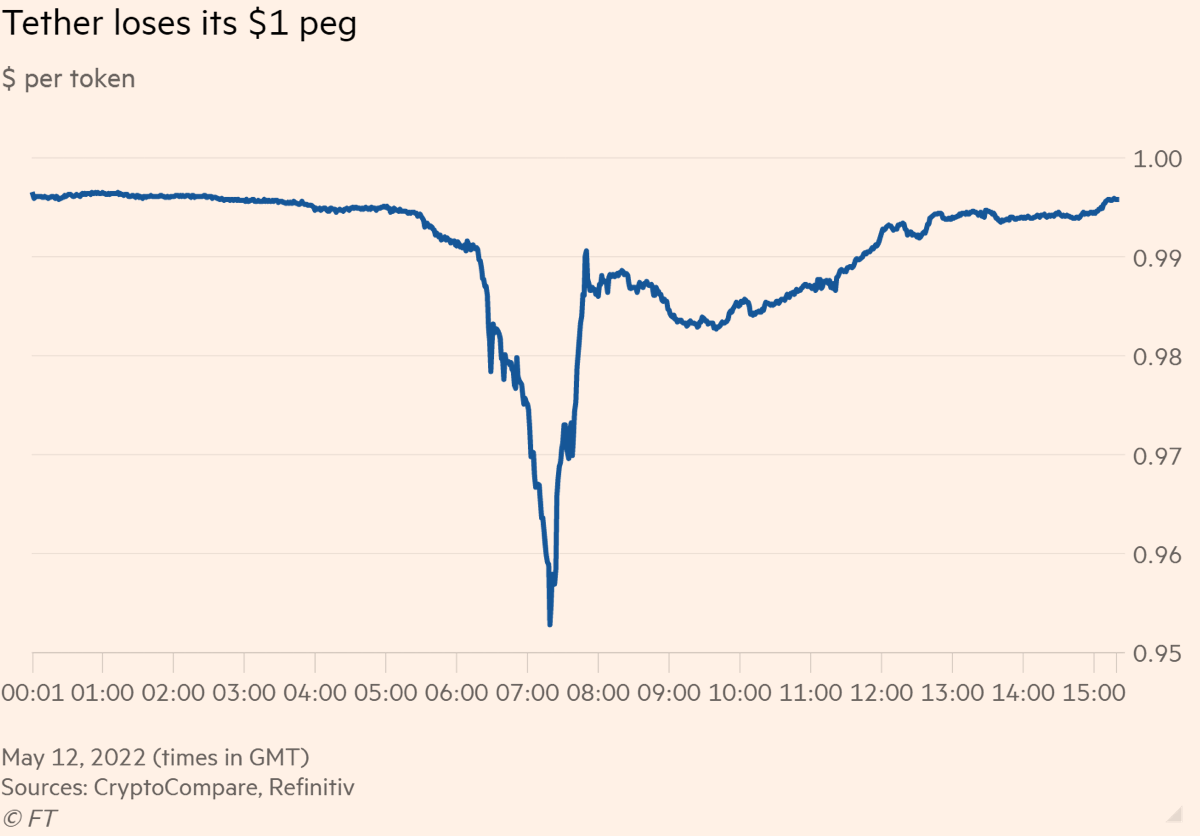

Now to TerraUSD and Tether. Both were supposed to be able to keep their trading value at $1. Instead both fell below that level, TerraUSD pretty dramatically. This is as damaging to crypto-land as the Reserve Mutual Fund (and later some others that held so-called asset backed commercial paper) “breaking the buck” was in the first acute phase of the financial crisis. The first chart is from the Wall Street Journal, the second from the Financial Times:

We’ll spend more time on Tether because it was theoretically the more stable and better designed one, and even then it was obviously a load of hooey.

But first let’s go back to the question of why anyone would bother holding a cryptocurrency that was meant to emulate the dollar, as opposed to dollars or a money market fund. The reason appears to be largely aesthetic. First, there seems to have been perceived value in presenting crypto as not always and every speculative and volatile, particularly in discussions with regulators. Second, crypto speculators strongly preferred to sell in and out of stablecoins, as in use them as de facto clearing and settlement accounts. Why that would be preferable to trading in and out of your real world currency is beyond me, save maybe for taxes if swapping in and out of stablecoin wasn’t a taxable event but trading in and out of dollars would be. Perhaps various wallets made it easier to move in and out of stablecoin than hard currencies. Otherwise, it looks like crypto boosterism: promote the ecosystem, regardless of the underlying risks.

As reader SimonJB at the Financial Times put t:

The reason people use it is that it is the only timely way to use to move money into or out of any Crypto coin on an exchange and it uses Blockchain like crypto. Without crypto there is no need for stablecoins. Stablecoins take the daylight risk between fiat money systems and instantaneous Blockchain systems. That’s why describing them as the plumbing for the Crypto ecosystem is apt. The problem is that the plumbing is lead pipes and the flow could be infinitely large, breaking the pipe and spilling the water. It could well be argued that we need Blockchain systems to settle our fiat money claims (chains) when we buy and sell shares, money funds, bank deposits etc..

The issue is that if stablecoins take a credibility hit and suffer large redemptions then Crypto will be much less easy to trade, reducing its liquidity and attractiveness and then its price. Causing further redemptions of stablecoin etc.

In many ways Terra Luna is like Creditanstaldt which failed due to settlement risk on foreign exchange. It went bust on May 11th……1931.

Now, of course, if you were going to run what amounts to a money market fund, you’d keep a bunch of very short term, low risk, liquid investments. But this swapping in and out of crypto appears to have addled the stablecoin operators’ brains and maybe added costs too.

A geeky new article at VoxEU explains the stablecoin design choices and why there could never be a winning formula. The piece explains why a stablecoin like TerraUSD was vulnerable to speculative attack, but I don’t find the alternatives it proposes to be anything more than less bad:

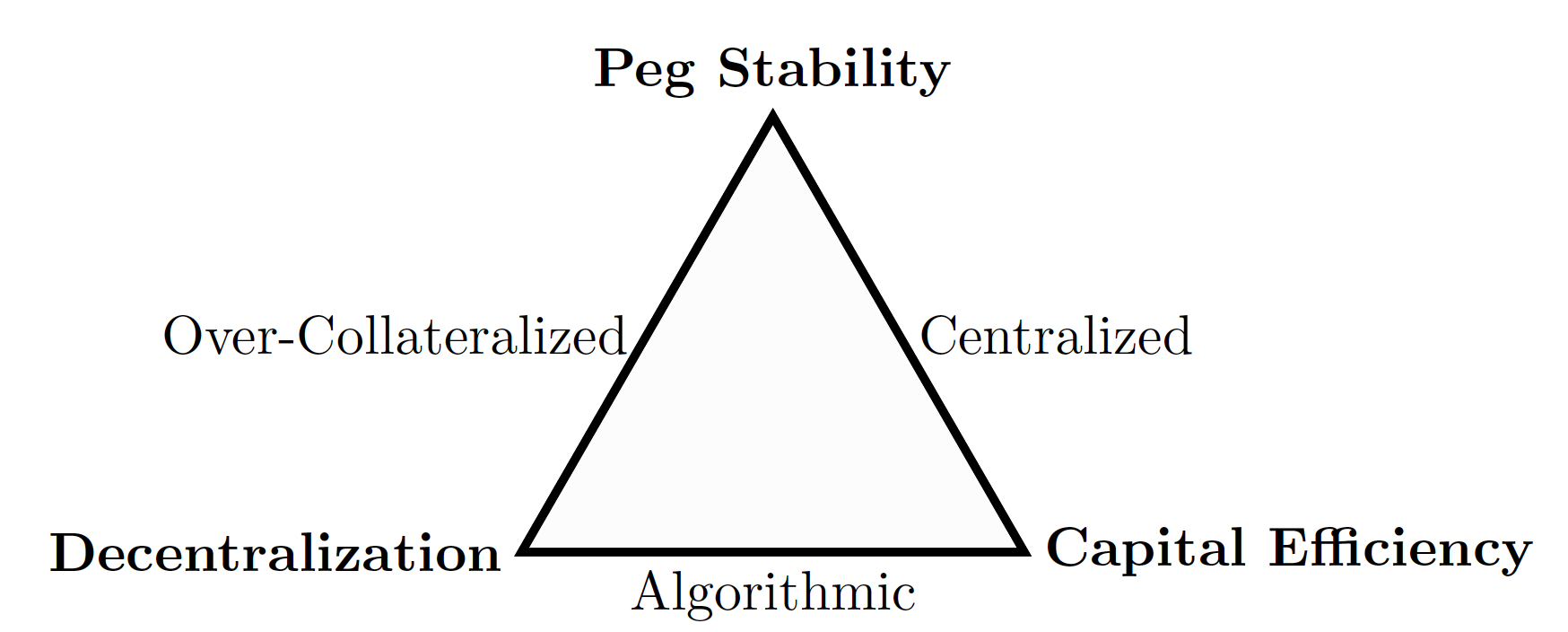

Stablecoins operate on the blockchain and are pegged at parity to the US dollar. They serve as vehicle currencies for trading cryptoassets generally due to a reduction in intermediation costs by operating on the blockchain. To understand stablecoin designs, we use the framework in Figure 1. Out of three objectives – peg stability, decentralisation, and capital efficiency – only two can be met by a given design.

Figure 1 The stablecoin trilemma

The most common stablecoin type is centralised stablecoins, led by Tether, the balance sheet of which includes commercial paper and less liquid assets (Lyons and Viswanath-Natraj 2020a). Decentralised (over-collateralised) stablecoins are led by MakerDAO’s DAI. In this design, individuals issue DAI tokens through over-collateralised positions in which they deposit cryptocurrency collateral (typically, ETH). While they are decentralised, they are less capital-efficient than their centralised counterparts (Kozhan and Viswanath-Natraj 2021). The third type is algorithmic stablecoins, led by TerraUSD, which are typically under-collateralised. While this is a more capital-efficient design, it has the drawback that they are prone to speculative attacks and can trade at a large discount (Eichengreen 2019).

The Wall Street Journal explains what happened to TerraUSD:

The cryptocurrency TerraUSD had one job: Maintain its value at $1 per coin…

The collapse saddled investors with billions of dollars in losses. It ricocheted back into other cryptocurrencies, helping drive down the price of bitcoin….

Stablecoins attempt to resolve a conundrum: How can you make something stable in a volatile financial system?

Some stablecoins attempt to do this by holding safe asset…

TerraUSD has a more complex approach. It’s an algorithmic stablecoin that relies on financial engineering to maintain its link to the dollar.

Previous attempts at algorithmic stablecoins ended in failure when the peg collapsed. [TerraUSD’s outspoken creator] Mr. [Do] Kwon and his colleagues believed they had created a better version, less prone to runs….

Jim Greco, a partner at crypto quantitative investment firm F9 Research, was celebrating his birthday at Manhattan’s Le Bernardin on Saturday night when he got a message notifying him that TerraUSD had dropped below 99.5 cents.

He told his team to sell the coin, which had been part of F9’s broader stablecoin holdings. Later his firm made a profitable bet that the coin would keep falling, said Mr. Greco.

“We all knew it was going to fail eventually,” Mr. Greco said. “We just didn’t know what the catalyst would be.”

Traders said the catalyst for the drop, which began over the weekend and snowballed Monday, was a series of large withdrawals from Anchor Protocol, a kind of crypto bank created by developers at Mr. Kwon’s firm, Terraform Labs. Such platforms allow digital-currency investors to earn interest on their coins by lending them out.

Over the past year, Anchor had fueled interest in TerraUSD by offering lofty returns of nearly 20% on deposits of TerraUSD. That was far higher than the rates available in traditional dollar bank accounts, and more than what crypto investors could get from lending out other, more conventional stablecoins.

Anchor, like other crypto lending protocols, would lend the TerraUSD to borrowers that used the coins for various trading strategies or for earning built-in rewards that blockchain networks provide for processing transactions.

Critics, including crypto investors who have attacked Mr. Kwon on social media, questioned whether such yields were sustainable. Still, by late last week investors had deposited more than $14 billion of TerraUSD in Anchor, according to the platform’s website. The bulk of the stablecoin’s supply was parked in the Anchor platform.

Big transactions over the weekend knocked TerraUSD from its $1 value. The instability prompted investors to pull their TerraUSD from Anchor and sell the coin.

That, in turn, led more investors to withdraw from Anchor, creating a cascading effect of more withdrawals and more selling. TerraUSD deposits at Anchor fell to about $2 billion by Thursday, down 86% from their peak, the protocol’s website shows.

Dunno about you, but a 20% yield on something that’s supposed to hold value is sure to be a fraud. And one has to assume that the developers behind Anchor knew that and may have been behind the big liquidations. The odds that lawsuits will eventually get to the bottom of this are high.

But the supposedly better stablecoin child, Tether, is a crock too, just not to the same degree. I recall reading about Tether over a year ago, with its vague claims that its stablecoin was backed by billions of “Treasuries.” SimonJB tersely restates what I’d noticed back then:

Tether is an unregulated unaudited bank registered in China that takes in dollars and earns nothing on those dollars unless it takes a risk, credit or duration. It thus is a Chinese controlled asset with virtually no expected return but considerable principal risk.

This is why the comment about “Treasuries” is a huge red flag. Even if that were true, that every dollar of token value was backed by a dollar of Treasuries, “Treasuries” usually implies Treasury bonds, not Treasury bills. And if you wanted to reassure investors about the not breaking the buck, you’d think they would have specified Treasury bills.

But when pressed about what exactly Tether had backing its tokens, it did a lot of not-remotely-reassuring handwaving. From the Financial Times:

Tether aims to maintain a peg to the dollar by keeping up a store of reserves of traditional assets. There are 80bn Tether tokens in circulation, meaning it should hold $80bn in assets — a sum that compares with the biggest hedge funds in the world. But details around how those reserves are managed are scant, and not subject to audits under internationally recognised accounting standards.

Paolo Ardoino, Tether’s chief technology officer, on Thursday vowed to defend the token’s dollar peg and said the company had bought “a ton” of US government debt, which it is willing to offload in that effort. But in an interview with the Financial Times, he declined to give details about its $40bn hoard of US government bonds because he did not “want to give our secret sauce”.

“Our counterparties are not public. We are not a public company,” he said. “So we keep that information [to] ourselves, but we are working with many big institutions in the traditional financial space.”

The use of the word “counterparties” is another red flag. If Tether simply had Treasuries in bank or brokerage accounts, those institutions are not “counterparties”. That nomenclature suggests at a minimum that Tether is repoing some of these positions, or alternatively, has constructed some synthetic positions rather than holding cash bonds. Mind you, repo is not all that exotic. But the combination of mystery counterparties and “secret sauce” says they are taking risks they don’t want their chump tokenholders to know about, particularly since Tether is maintaining the pretense that all those coins are fullly backed by safe collateral.

Back to the first red flag, that the use of “Treasuries” suggested that Tether was held longer-term positions and had gotten hammered when interest rates rose. Financial Times reader Mass Appeal shared that suspicion:

There is no secret sauce. They likely bought long bonds with short duration funding. And on a mark to market basis they are likely down 15 points on 40 billion like any bond fund. So 6 billion mark on 80 billion of assets.

I hope the rest of the 40 bln isn’t invested in AAA mezz CDO.

There used to be an insurance company called AIG that put on the same trade. Just goes to show you the ways to make money with other peoples money remain the same. The names change but the concepts are the same

But we’re all charitably assuming there are, or were, $80 billion invested somewhere. Tether was already in legal trouble for inadequate disclosures about its reserves, begging the question as to why anyone with an operating brain cell would trust them. From New Money Review in March 2021:

Last month cryptodollar issuer Tether agreed with New York prosecutors to come clean on its reserves, long a topic of controversy. But the general public may still end up none the wiser about Tether’s backing.

In its 23 February settlement agreement with the New York State Attorney General (NYAG), Letitia James, Tether committed within ninety days to provide documents substantiating its reserve accounts. The token issuer said it would also verify it is keeping clients’ money separate from its own operational accounts and those of Tether’s affiliate company, cryptocurrency exchange Bitfinex.

But the NYAG failed to respond to a question from New Money Review about whether it will be publishing details of Tether’s reserve backing once it receives them.

The settlement agreement states that Tether will itself publish the categories of assets backing tether, and whether any category constitutes a loan to an affiliated entity, for a period of two years…

According to James, Tether had also repeatedly lied about its asset backing and had operated for long periods without adequate cash reserves.

Given the fact that none of the financial press seems to know what Tether now holds or recently held to back its stablecoin, it sure looks like it failed to comply with the settlement.

And this tidbit from the same New Money Review story is plenty alarming. Tether had asserted its funds were in its bank in the Bahamas. But the amount that should have been there was way bigger than the total foreign deposits of the Bahama banking system!

Tether’s bank, Deltec Bank and Trust, is based in the Bahamas. But the total foreign currency deposits across all the country’s banks at the end of 2020 were far short of the amount needed to back all the tethers in issue with hard cash.

According to the Bahamian central bank, the total foreign currency deposits held by domestic banks were $5.67bn at the end of 2020. At the same date, the total value of tether tokens in issue was $20.92bn.

You were warned. We told you crypto was prosecution futures. The odds that both these big stablecoin players were flat out frauds is high. The amounts at issue are so large that there’s likely to be real investigations and hopefully criminal charges. Stay tuned.

What I have always failed to grasp is why crypto-iou’s are measured in other currencies.

I thought the whole romance was a great new life off world, or at least as far away from your neighbours as you could….yet

Why this project should be tethered to old fashioned liquidities baffles me.

If they are the future, they should lead by example, reounce any peg, challenge the supreme court about something they feel strongly,respectfully transact…and keep rubbing each others shoulders.

Because you can’t buy anything in the real world with it any more than you can buy milk with a card from your baseball card collection. Crypto is not even a currency. It’s personal property. Crypto owners may have conventions about trading among themselves, and it may be easier to trade into dollars than baseball cards, but that’s about it. You can’t use your very tradeable shares of Apple to buy milk either. You have to exchange them for dollars.

You have laid my fears to rest.

It is a gigantic,fascinating bunch of bullshit.

It’s virtual tulips.

Only tulips waste relatively very little in precious physical resources while crypto waste is gigantic

One of the things that fascinate me about crypto*, is the pick and shovel stuff, the constant touring circus, with superstars like max keiseir, who i recall as a goldbug before he moved to being a bitbug.

Its a real drag remembering over and over.

I completely forgot Max Keiser existed. What’s he saying now I wonder.

As his broadband outlet was rt europe, which has been decided we* are too weak to critique, we will never know.

As with all chat shows, it depends how attractive are the guests you invite.

I happily waded through the gold/bitbug bullshit to hear hudson and keane. They were not getting any attention anywhere else.

I am appalled that rt europe was cut off.

The jungfrau are in charge, ha ha.

*normal good natured humans

Although there surely must be other financial things to laugh at, Bitcoin et al are truly mockevelian, and I for one am glad they showed up in order to give us something with good humor possibilities.

The idea that its all going to end in tears is somebody else’s problem, for i’ve got my ducts in a row.

Once something such as crypto (was there a clue in there, as in ‘cry, p’to’ as investors spit out the dummy?) shows weakness as per Tether & Coinbase, its all over.

When the smoke clears and nobody cares anymore, oddly enough the only reminders will be the metallic Bitcoins on eBay which are featured in every Bitcoin story online, and sell for $2 to $5 per, almost all offerings coming out of China.

Metallic Bitcoins? Gee, I wouldn’t mind one of those and I can see a good looking one on eBay for AU$5.40. Ten years from now I could pull it out of my pocket and say ‘Hey, does anybody remember these?’

Put it right next to your Pet Rock and your Mood Ring (dating myself here)

Markus,not to mention your hula hoop

I am recalling the rise and fall of the Stanford Group, for whatever reason this morning. When the smoke finally cleared, all those investors purchasing the high yield certificates were crying into their cold cereal or oatmeal.

Stanford Financial Group was founded by Allen Stanford. Wrap a turd sandwich in something shiny and new, and fast forward another 12 to 14 years – progress!!

Opie Taylor claimed his Pa’s cuff link was a button from George Washington’s uniform and traded it for a new pair of skates.

I think Bitcoin will always be with us, even if it trades at a penny to the dollar, a collector’s item, a hobby. Like Roman coins or ham radio.

Baseball cards will always be with us too.

Won’t its blockchain seize up when the price and volume are too low to support miners?

Disclaimer: IANACB (I am not a crypto bro) and cannot evaluate this.

“The mining power is set so that the miners need 10 minutes in average to mine a block. If 50% of the miners would disappear because it’s not profitable any more, the difficulty would decrease so that it’s profitable again.”

https://bitcoin.stackexchange.com/questions/66516/can-bitcoin-exist-without-miners

i could well be mistaken and usually am, but i would liken this to gold in the CA gold rush days.

the more miners are in the region (with only a set amount of gold in that region, which is deliverable after panning/sluicing for so long), the less each miner gets and therefore everyone is walking around with dust. whereas with half as many miners, the gold amount per each would get slightly larger and thus perhaps be worth more than a bath and a hot meal in town. unless someone came up with an evolution in mining tech beyond individuals raking dirt out of the earth or panning rivers or whatever.

but since this is all dependent upon the virtual algowhatevers doing their thing, i have no idea if my analogy pans out.

disclaimer: i know someone who was going into mining early on in the crypto thing (before it became a huge fad and was simply a fringe activity for supernerds with too many computers). he said he and his consortium quickly realized it was not worth tying up the machines and the electricity (at CA rates) all day long to do those mining operations for the small payout in digicoins produced, and that they all gave up in disappointment and went back to their day jobs (web development, programming, washing dishes and delivering chinese food).

That is another wrinkle I’ve never been able to smooth out.

Who sustains the mockchain?

Blind Freddy could have seen this approaching from a mile off and people have railed about the whole dodgy concept here on NC for years. Unfortunately a lot of people were true believers and are now going to suffer the consequences, Already there are reports of people losing their entire savings, people in danger of becoming homeless and there is already talk of people considering suicide-

https://nypost.com/2022/05/12/crypto-investors-panic-amid-digital-coin-bitcoin-crash/

‘Caveat emptor’ was true 2,000 years ago and it still is.

Can the involvement of counterparties be explained by the following passage from this article: https://concoda.substack.com/p/the-coming-crypto-market-crisis

“On its website, Tether changes the definition of its 1-to-1 backing, from this:

“Every tether is always backed 1-to-1, by traditional currency held in our reserves. So 1 USD₮ is always equivalent to 1 USD.”

…to this…

“Every tether is always 100% backed by our reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities (collectively, “reserves”). Every tether is also 1-to-1 pegged to the dollar, so 1 USD₮ is always valued by Tether at 1 USD.”

I have included a couple of links from the Internet Wayback machine that captured the chance in verbiage.

https://web.archive.org/web/20190219054619/https://tether.to/

https://web.archive.org/web/20190409184733/https://tether.to/

Also from the same article: “During NYAG’s investigation, in an affidavit, General Counsel Stuart Hoegner admits Tether is only 74% backed.”

The affidavit is linked directly from the article.

While there are surely various forms of debt in the “reserves” (and I am not sure the term “counterparty” really applies to one’s debtors), I would also assume there are more complicated trades and agreements going on.

Maybe with exchanges to perform sudden buys of Tether when the price drops, backed by specific assets? This would seem to be necessary unless Tether was keeping large amounts of cash at the exchanges (which would be a terribly stupid idea!). Or maybe as Yves suggested, repo agreements with big players to accomplish the same thing if there’s a dip.

It would be interesting to know how similar the setup is at Tether compared to countries that peg against larger currencies.

From Investopedia. A repurchase agreement (repo) is a form of short-term borrowing for dealers in government securities. In the case of a repo, a dealer sells government securities to investors, usually on an overnight basis, and buys them back the following day at a slightly higher price. That small difference in price is the implicit overnight interest rate.

Sounds like short term debt to me involving repo counterparties (as they are often referred to), so I am not sure I follow what you said here “and I am not sure the term “counterparty” really applies to one’s debtors”.

Overnight repos are exactly short-term debt. A repo is a secured loan where one party lends cash to the other and holds the bond as collateral. The use of the term “counterparty” in this context is 100% appropriate. One counterparty is lending to the other. You can also “reverse repo” which means borrowing a bond and holding cash as collateral. You would do a reverse repo as a way of short-selling the bond. If you are thinking that a repo from my perspective is the same thing as a reverse repo from the perspective of my counterparty, you would be correct. There is usually some asymmetry in who is overcollateralized and who is undercollateralized–I could sell a $1000 bond to a repo counterparty and get $990 for it (I am undercollateralized and have unsecured credit exposure to my counterparty overnight), or I could be lending $1000 cash and get a bond worth $1010 for it (I am overcollateralized and have no unsecured exposure to my counterparty overnight) It just depends on the relationship between the parties. Also, these trades don’t need to be overnight, they can be “term repos” with terms like a month, 3 months, a year…

Wanna bet that Tether is taking unsecured exposure to its counterparties on term repos?

Other fun fact: “counterparty” is also used in the context of parties to swap and other derivative trades governed by an ISDA Master Agreement…

The conversion of the phrase ‘equivalent to 1USD’ to ‘valued by Tether at 1USD’ seems kind of a red flag as well…

Tether’s reserves “… may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities…”

I take that to mean they’re loaning financial vapor to themselves and calling it reserve backing.

This will be quite a show.

That is a lovely turn of phrase.

If i was wealthy enough to borrow a hat, I would tip it.

It reminded me of Terry Gilliam’s Brazil.

Hi there. I want to talk to you about ducts. Are your ducts old and tired?

Call Central Services to get your ducts in a row.

I would add this:

When duty calls:

It does not get better than this

America, you have ed neuimeir.

So, basically tulip bulbs, without the tulip bulbs.

>>Why that would be preferable to trading in and out of your real world currency

One place where I am told these are popular: Venezuela, because of US imperialism, excuse me, democracy-promoting sanctions, for receiving money from abroad.

Speculation is that Tether is heavily invested in bitcoin and etherium. There has been a lot of Tether printing over the last year coinciding with the rise in crypto values, which led to speculation that Tether is minting, using its own coin to buy bitcoins, which are then used as collateral to min more Tether. Rinse, repeat, and crypto prices go up and up.

The obvious problem is that, now that cryptos are down, all that Tether is not backed by assets, not even bitcoins. Also, putting pressure on Tether is leading it to sell its crypto assets, driving the prices down further. So even though Tether is supposed to be centralized stablecoin, through asset choice it’s behaving like an algorithmic one, it’s very susceptible to death spiral that did Terra/Luna in.

Herd a joke on Twitter, “Matt Damon’s crypto shill ad should’ve been called Bourne Yesterday.”

The Trueanon podcast covered crypto and tether in ep 180 of their podcast. It has a good rundown of the people and background, and complete fraud it is.

This is about all that one needs to know:

From above: “Jim Greco, a partner at crypto quantitative investment firm F9 Research, was celebrating his birthday at Manhattan’s Le Bernardin on Saturday night when he got a message notifying him that TerraUSD had dropped below 99.5 cents.”

Still more skimming by the “right kind of people,” who go to places like Le Bernardin. I’m getting a distinct whiff of ancien régime on the verge of being displaced (by even worse people like Zelensky?).

Tab?

From the restaurant’s own site: “Chef’s Tasting Menu – $295 per person – $445 per person with wine pairing”

Why does this seem like the place where Lambert Strether’s missing $600 from Joe Biden went to?

In short, as Yves Smith has consistently noted: Prosecution futures

May one hope for a hair cut or two with Dr. Guillotine’s cunning invention?

I believe that Enron had a “secret sauce” too.

Why Tether didn’t go to zero immediately after that comment I have no idea. Perhaps crowd psychology — if a crowd this be — is very strong.

Le Bernardin has prices on its menu now?!? Used to work for a wholesaler who sold to them, and one of the perks at that otherwise wretched job was the occasional comped dinner at a place I would never have been able to afford otherwise. When I ate there, there were definitely no prices on the menu, because I remember not being sure what amount to tip, and the rule of thumb always was that if you have to ask the price, you can’t afford to eat there. If even Le Bernardin feels the need to display prices now, well, things must be tough all over!

Side note: if you ever have the chance to eat there gratis, take it. It was a delicious meal, even if it isn’t at all worth the price.

Wow! that’s a lot of ducats. Sounds like, before “investing” too many of the investors knew everything they needed to know about crypto from A to B.

Flat out fraud indeed. As fraudulent as counterfeit money. The sentence above that turned my stomach was the one about our “regulators” allowing crypto to exist at all. And crypto-boosterism as well. All while crypto tries desperately to “replicate the features of traditional banking” which is reasonably safe and secure. Because traditional sovereign money is pegged to the good faith of the people. Crypto is the exact opposite. The question arises, since crypto was touted as a way to fight the devaluation of the dollar, similar to electronic gold, What happens in a long term inflationary period like the one we are in for the foreseeable future? If crypto isn’t declared to be counterfeit (which is exactly what it is) in the end crypto will be worth absurd levels of valuation and put any remaining dollar based economics into a tail spin. It will, in a word, multiply the effect of devalued money a thousand fold. If that were to happen; maybe it will soon fail of its own obvious and obnoxious contradictions. In the meantime we can watch as this absurd “money” establishes the very definition for a “free market.” We might even be able to say that the Free Market is synonymous with The Counterfeit Market. In that illegal profits are quickly scammed and skimmed at the flick of a click, leaving the underlying “asset” in question bereft of any remaining value. Exsanguinated. The regulators are fully to blame for this debacle.

Tether is the chips to the cryptoworld’s casino. Frees you of the necessity of maintaining a (potentially foreign) USD bank account, with far less friction in trade, facilitating rapid entrance and withdrawal from a position, without actually leaving the market.

This looks like an excellent analogy to me, better than the plumbing or ducts one. Comments?

The plumbing/ducts descriptions weren’t wrong, but from the perspective of the sucker, that is Tether’s raison d’etre. Bitcoin (the Xerox/Google/Kleenex of cryptocurrencies) originally served this purpose as the gateway to the market, when the rails for USD (and other cryptocurrencies) were not well established amongst the largely international exchanges; but everyone accepted bitcoin.

Tether stepped in to fill that gap in a somewhat spectacular way: instant international ‘USD’ payment network (which is why I don’t knock the technology, as it is innovative, if not misused).

Please don’t make shit up. Mastercard and Visa network transaction speeds and volumes are vasty faster than crypto.

True, but its monopoly money, and all their winnings are held as such USDT; Where they’re told its just like “GOLD US Dollars”.

So most day-traders of crypto lose their ass on in&out commissions and house cuts, even if you bet&win a 20% gain, the net might be zero, which is why 98% that play crypto online on their phones in ASIA lose all their money the first month; Then those millionaires who win, keep all their funny-money as USDT, and then its still gone;

So who are the winners in the crypto-scam? Certainly the exchanges while the scam lasted; But now everybody has to dump their bitcoin to get cash to cover redemption’s

The entire crypto space, is not unlike the derivative insurance scam said to be $600 Trillion USD, which is some 20x of world-GDP; They sold derivative insurnace so everybody could sell the same assets “GLD” to 100x different party’s, once there is a run, no chance of payoff on claim; Same here in crypto everybody getting rich on monopoly-money, then poof its gone;

Crypto has been a criminal paradise now for 10+ years, little mafia, while derivatives is the big-boyz; Nobody goes to jail for either; Crypto is un-regulated from prosecution, and derivatives are too big to jail.

The good news is that all party’s that play either will eventually end up in the poor-house.

Here is a supposed detailed explanation of how the con works. https://www.rebellionresearch.com/tether-and-bitcoin

I have to say i don’t understand a word, but it looks impressive.

I have a relative who got paid in bitcoin and turned it into good real estate. His ship came in, floating on bitcoin. So some people used crypto to good effect.

Being smart will not necessarily help you: once something ridiculous has gone on for long enough it begins to seem reasonable. People, after all, will tend to do what other people to in the expectation that not everyone can be a fool.

Almost exactly 300 years ago Isaac Newton lost money in the South Sea Bubble.

The first link talks about how even intelligent people come to believe the unbelievable when everyone else does.

The second shows optimism, naivete, the attraction of something never seen before in finance, financial legerdemain on top of a minor business, the value of liquidity, corruption, crime and finally punishment – albeit within bounds that excluded the king.

Populism spreads its wings toward foolishness; whatever is not mainstream must, by definition, be good. At least better until populism makes it so. Thereby, a secret medium of exchange builds momentum among people who vicariously live the life of Les Miserables. Thing is, it is fictional, or fantasy. While playing the game with willing partners, even monopoly money has value. In a friendly poker game, matchsticks have value. Outside the circle, though, at the airport cambio, for example, you will be left with the matchsticks.

No reserves what can go wrong?

Long ago, maybe even +5 years ago it was said Tether had 3% reserves, which meant that once they ‘break the buck’ only the first 3 in line of every 100 get their money back

So it broke to 94%, they sold some bitcoin got it back up to 98% and then it fell to 45%, and then they called everybody they knew to BUY; Then locked the selling, Enron style;

Surely at the bottom, lots of people lost money, as most who play crypto-gambling keep their winning’s in USDT, and then it was gone;

It was always going to end this way;

Like everything else, if you don’t own the private-key offline, under your control, where only you on the entire earth know the private-key of your bitcoin ( or any crypto ) then you don’t own it

All the exchanges like COINBASE were always IRS fronts, and people don’t even keep their deposits in USD cash, they keep it all in USDT so they can day trade in&out, if you trade cash-to-btc it can be 20% haircut each way in some places, in USDT it can be 0.01%, almost free, and the reason is there is no risk for them, as they pull USDT out of their ass like Luna;

Lots of people day trade, and then park their ‘cash’ in USDT at night, and this collapse to 48% happened at night western time, day in asia; So it was the perfect storm of a swindle.