Even though your humble blogger is not shy about having an opinion, even in the best of times, the economy is overly dynamic, and if anything it is more so than usual. That is why, as the cliche has it, “If you must forecast, forecast often.” And Mark Thoma, retired proprietor of the well-regarded blog, Economist’s View, who taught macroeconomic modeling, said they were no good at predicting more than six months out. Ergo, even though we’re going to talk about a pressing issue for households all over the world, inflation, it’s not as if anyone has a very good vantage.

For instance:

A year ago, the #Fed was confident about #inflation, asserting that it would be back around 2% by the end of 2021.

Today, inflation is 3-4 times that level and likely to remain high into 2023.

Today's Fed, it is confident about a "softish landing."

Let's hope so. A lot at stake.— Mohamed A. El-Erian (@elerianm) May 15, 2022

Nevertheless, the Twitterverse has more than usual wrangling on this topic because Jeff Bezos whinged that Biden should quit touting taxing rich corps more as an inflation treatment:

You know what is more regressive than inflation? Not having a child allowance, paid family and sick leave, pre-K, free community college, etc https://t.co/9m7TbZA851

— James Medlock (@jdcmedlock) May 15, 2022

Needless to say, you can be sure that Bezos is more concerned about the impact of Fed interest rate hikes on his portfolio than he is on the financial wellbeing of ordinary Americans.

Bear in mind that rising interest rates are also hitting homebuyers, although higher interest rates have yet to (much) dent housing prices. I’m shocked at how much Zestimate thinks the house I need to sell has gone up from Feb to now, so not all markets have been affected. However, the Wall Street tonight describes how buyers of newly built homes are getting hammered:

People who agreed to buy homes under construction but haven’t yet closed are facing mortgage-interest rates that could be nearly double what they anticipated when they paid their deposits.

New-home buyers are confronting multiple obstacles this year, from surging mortgage rates to home construction that is taking longer than usual due to supply-chain and labor constraints.

Many home buyers who signed contracts for new homes in 2021 or early this year calculated monthly payments based on near-record-low mortgage rates of around 3% or less. But average mortgage rates have climbed this spring to 5.3%, according to Freddie Mac, as the Federal Reserve started raising short-term interest rates.

But one case where high prices appears to be putting an end to high prices is used cars.

Unfortunately, the two categories that are in the public’s face the most, fuel and food prices, are not pretty. As you know all too well, prices at the pump are at new high levels. Diesel is even worse. It’s telling when a supposedly current story is behind the state of play. Kevin W sent us a link to Russia Diesel Exports Drop Sharply In April in OilPrice which included:

“I’ve started to use the term diesel ‘crisis,’ Tom Kloza, head of global energy research at OPIS, told CNBC in late April. “It clearly is a crisis that’s happening before our eyes. I wouldn’t rule out lines, shortages or $6 [price] in places beyond California. I wouldn’t say it’s a shortage yet. Europe, I think they’re headed for a shortage,” he said.

One has to wonder why OilPrice relied on a dated quote. Resilc, in Vermont, wrote the day before: “Diesel $6.50???????? I almost stroked out today.”

And food…we have the US chicken cull thanks to avian flu. Cooking oil prices are high. Corn prices reached a nine-year high last month. Wheat harvests are expected to be poor everywhere but Russia, leading the EU to whine that Russia might “weaponize” food. Gee, wasn’t it the US that was supposed to be the breadbasket of the world? And maybe it would have been a good idea to look at Russia’s position in key commodities before attempting to sanction them into the Stone Age? Oh, and Russia has a key position in fertilizer inputs, when fertilizer has been in short supply in recent years and even more so now.

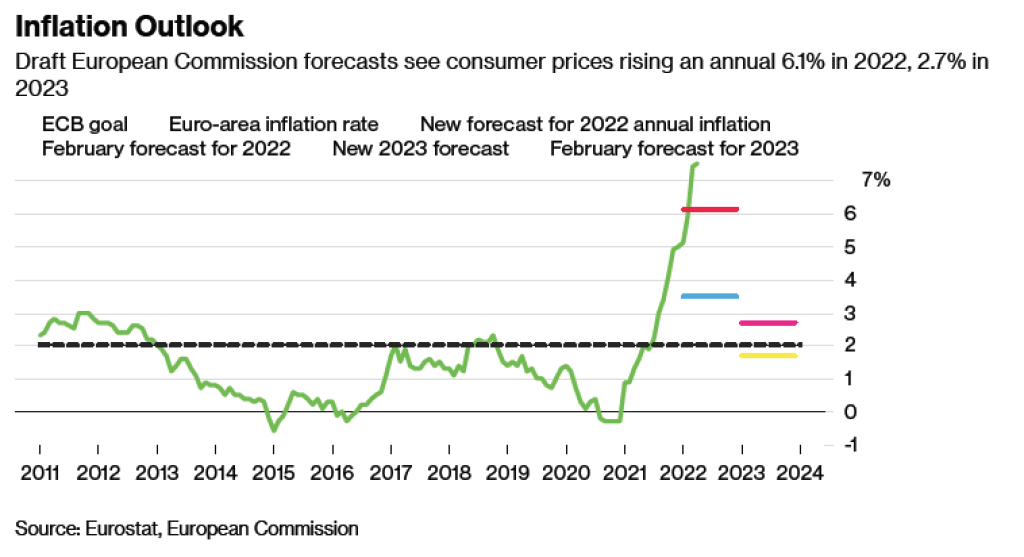

Things are even less pretty in Europe:

Good Morning from Germany where #inflation pressure keeps rising. Wholesale prices jump 23.8% in April YoY, highest annual rate of change since beginning of calculation of the wholesale price indices in 1962. Wholesale prices mainly driven by raw materials & intermediate products pic.twitter.com/WYgnKK8ajJ

— Holger Zschaepitz (@Schuldensuehner) May 16, 2022

And from a new Bloomberg story:

A gathering storm of renewed energy price-spikes, surging food costs and corresponding social and economic dangers is focusing the minds of Brussels officials who worry of multiple shocks cascading through the European Union from Russia’s war in Ukraine….

An initial crystallization of views on the economy will emerge on Monday, as the commission releases forecasts likely to acknowledge a significant slowdown in economic growth, according to a draft of the outlook seen by Bloomberg.

What Bloomberg Economics Says…

“The impact of the war in Ukraine could still be significantly bigger than either markets or the ECB expect and there remains scope for escalation. Severe energy disruption could easily tip the eurozone into recession.”

Apologies for talking around the inflation issue, so let’s step back a bit. The origin was Covid-induced supply chain disruptions. Despite people like Jeff Bezos trying to act as if the current inflation is due mainly to government overstimulus, that’s largely incorrect. The issue is that many areas of the economy suffered and still suffer from diminished productive capacity. Hospitals are short-staffed. Restaurants and grocery stores and even NYC bank branches are having trouble hiring. The probate court here in Alabama has a big backlog due to Covid which if anything is getting worse due to the impact of new Covid cases.

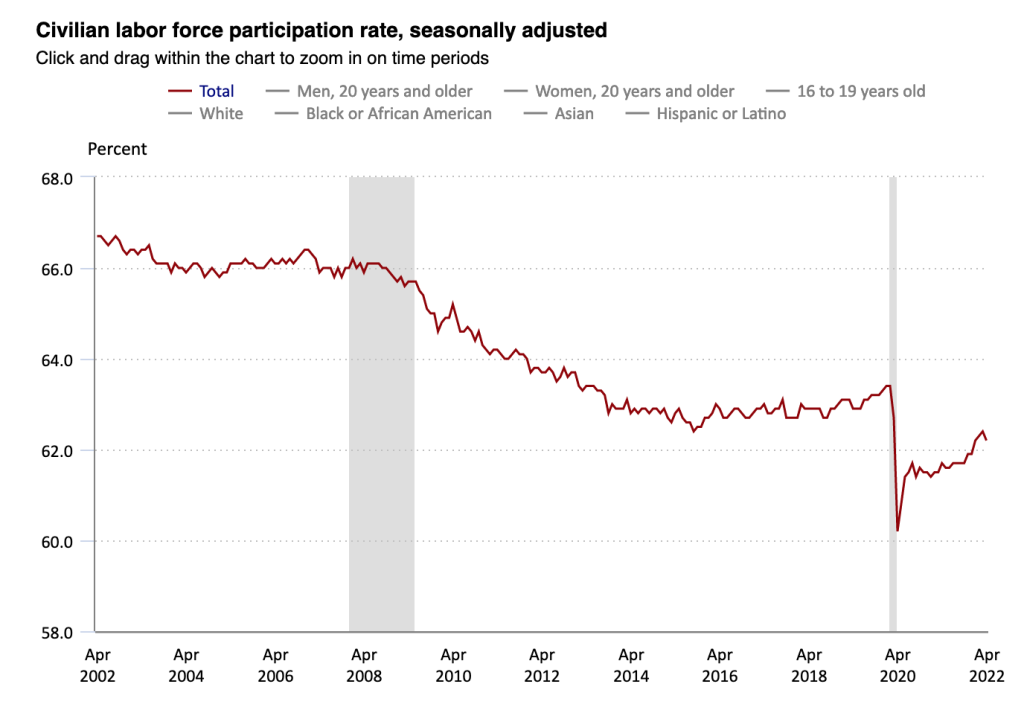

Now if you listen to CEOs and macroeconomists, the supply chain disruptions are getting better. But we have the China lockdowns hitting their output, so I’m not so sure. And as indicated above, many businesses in the US are still short handed. I’ve read a lot of theorizing and anecdata, but I don’t recall anyone doing a study on why workers are not taking up job opportunities when we aren’t yet back to pre-Covid levels of labor force participation (as in there are workers who could work but aren’t).

Is it long Covid? Is it households figured out a way to really get their costs down during the lockdowns and decided they’d rather have more free time? Is it early retirements? This is too important a topic for policy not to have a better idea. The reports on this topic all have a blind man and the elephant feel: they may describe one component very accurately, but we still lack a good big picture.

So given the diminished capacity of the economy, which is still continuing in quite a few sectors, it actually may not be entirely wrong to suggest that the Trump/Biden stimuluses were excessive (or perhaps too much too fast), or at least not well enough targeted to increasing productive output. Two factoids support that view. The first is the chip shortage, which resulted from demand for cars crashing, chip makers moving output over to consumer electronics (where demand remained strong) and then not being able to supply automakers very well when the stimulus led auto orders to rebound. The second was the runup in fuel prices, which resulted from economic activity rebounding faster than oil producers could (or wanted to) rev up output (they didn’t want to be caught again with an oil price demand if they ginned up production and the global economy went into reverse due to another bad Covid wave). Mind you, I’m not saying that level of spending was necessarily wrong, but it was targeted almost entirely at supporting demand, when output was a problem too.

Here the contrast with Russia is striking. They had a big inflation shock due to the loss of imports, particularly from Europe, and Russia’s economic team is very much focused on import substitution, with creating/increasing domestic capacity the preferred solution. Admittedly this may be a positive holdover from the old central planning days, but their meeting notes show they are trying to figure out how to alleviate bottlenecks in particular sectors, something our top brass never seems willing or able to do (the politically toxic baby formula shortage is a case study).

So a big and continuing contributor to inflation is extended supply chains plus widespread just in time inventory practices. They create lot of points of failure, and failure means production shortfalls pronto, which translate into scarcity and/or rationing by higher prices.

And the general high prices are not going away soon because OPEC+ is not about to cut anyone else a break. They have a schedule for increasing output, and they are not going to move faster just because everyone else wants them to. High energy prices propagate through the economy.

And the collective West is not helping matters by shooting itself in the foot so it can’t buy shoes from Russia. Hungary and some other less noisy allies have managed to stop the EU from launching a wildly impractical embargo of Russian oil, which would have resulted in a lot of laundering getting pretty much the same oil to Europe at much higher prices. But some countries may still try self-sanctioning, to the detriment of their industry and voters’ standard of living.

And the West is exposed to lower supplies of and higher prices for other Russian commodities, due to being barred from dealing with sanctioned Russian entities and/or Russia implementing more counter-sanctions in retaliation for property heists.

So this inflation is due largely, if not entirely, to the supply side. But all the Fed knows how to do is kill demand via interest rate hikes:

From @greg_ip:

There are good reasons to think inflation, after diminishing, will stay around 4% or even drift higher.

That'd be unacceptable to the Fed and opens the door to higher rates than markets now expect, more market carnage and a weaker economy https://t.co/HlvYPGF84h

— Nick Timiraos (@NickTimiraos) May 15, 2022

However, it’s possible that consumers are so shell shocked that they will clamp down on spending. They might not eat less or more cheaply but they can cut back on other spending categories: travel, entertainment, clothes. Goldman’s Lloyd Blankfein is talking his own book tonight in saying the US is at “very very high” risk of recession, since an economic downturn would get the Fed to back off interest rate increases. But that does not necessarily mean he is wrong. Readers?

Ultimately the only real solution to addressing inflation would be to dramatically increase the amount of oil and natural gas, which is harder to do.

Development projects often take years and are a financial net that the price years from now will be above breakeven. Theoretically, the US could do so with a state owned enterprise, but that is heresy for those who are true believers in the Chicago School of Economics and its neoliberal ways.

Although the US is rich in natural resources, it is going to remain at previously planned rates of production. The private sector is not going to be a saviour. Contrary to the Conservative argument that capitalists are entrepreneurial risk takers, oil companies as a whole have become quite risk averse and more focused on dividends and share repurchases.

https://time.com/collection-post/6156525/gas-prices-oil-prices-oil-and-gas-industry/

https://www.bloomberg.com/news/articles/2022-05-07/big-oil-spends-on-investors-not-output-prolonging-crude-crunch

Oil companies are emphasizing low capital expenditures and taking a very conservative view on future investment because they have suffered past losses.

Part of that is because there was legitimate money burning previous investment in the industry, particularly fracking. It has made the oil industry much more cautious.

In theory, a state owned enterprise could bear some of the risk in nations rich in natural resources like the US, but it is not compatible with the Washington Consensus ideology.

Another consideration is that the rate of inflation is because of the corporations marking priced up because they can. The pandemic and unstable geopolitical events have given them a perfect opportunity to cover up their markups.

https://www.epi.org/blog/corporate-profits-have-contributed-disproportionately-to-inflation-how-should-policymakers-respond/

Raising the interest rate can’t solve either problem. The Federal Reserve can’t pump and refine oil with higher interest rates, just induce a recession.

It would require efforts that are at odds with the current economic ideology. A massive expansion of state owned production and anti trust legislation, possibly with price controls.

There are other issues. Ensuring that the right blend of oil products is made, ensuring more diesel, ensuring that the refining capabilities match up with production, etc. It is a very complex problem and not one easy to fix.

Once the Chinese are able to lift their lockdown, I think that the oil prices will soar again to previously unheard of heights. The Chinese haven’t been perfect, but they have the best coronavirus control attempt I have seen. Shanghai adopted a more Western attempt and failed, so now it is facing harsh lockdowns.

I think that the anti-government ideology of neoliberalism has really done itself in. There are no easy substitutes for oil from Russia and very limited state in house expertise internally among Western governments to solve these problems. What they will do is to make life worse for most citizens through the use of interest rates. Worse, there will be no attempt at any antitrust or anything else to bring greed to heel, which means that inequality will get worse. Some people, like oil executives, are going to make a lot of money off of this whole mess. For the common citizen, life is about to get much worse due to the greed and incompetence of the rich.

Quite.

There are perhaps two sources of inflation, and monkeying around with the inflation rate only control one of them (new money lent into existence by banks and credit card companies) while this round is related to the other (not enough supplies to fill demand, creating a runaway auction).

Oops a couple of typos there:

“Development projects often take years and are a financial net that the price years from now will be above breakeven.”

Should be:

“Development projects often take years and are a financial gamble that the price years from now will be above breakeven.”

But the point remains – there will be no rescue from the private sector in the oil industry.

I should also mention that other bottlenecks like refining capacities and whether they are suited for producing certain grades of oil remain as well.

No mention of the fact that “oil companies are emphasizing low capital expenditures and taking a very conservative view on future investment” because they face increasing regulatory hurdles and uncertainty, and rising cost of equity and debt?

Fossil fuel markets have gone from being reasonably robust to increasingly fragile as a result, so it’s no coincidence that Putin invaded The Ukraine when he did and no surprise that OPEC is not rushing to the rescue.

I agree that life is about to get much worse for most people, but I put it down to all around greed, incompetence and stupidity. There are no monopolies here!

add next year’s heating. This winter used less nat gas than 12 months ago, but heating still was nearly 2x.

Also add electricity. the spot market price for electricity in much higher year-to-date versus pre-war. Due to almost $8 natural gas and early unseasonal “heat domes” which squashed wind power. Natural gas was around $3 one year ago.

For consumers that inflation will hit all at once depending on when local regulators allow price changes.

no level of monetary policy is going to change the export of LNG to Asia and Europe and resulting energy inflation. even with a deep recession, energy prices will shoot back up in a recovery, barring an intermediate-term Star Trek-level energy tech breaktrough.

we are up the creek with no paddle and have a geriatric Establishment driving the canoe to the Niagara Falls.

2022, 2024 elections are coming. “(economic) winter is coming”

Here in New England, our oil supplier lets us play the futures: we locked in $2.90 a gallon back in September.

Saved us about a grand this year. I’m planning now to pay twice as much next year.

That will be demand destruction elsewhere.

>> Star Trek-level energy tech breaktrough.

A sweater would qualify as such, for people used to walking around in shorts and a T shirt in cold winters.

Seriously.

I spent childhood summers in the 90s in the Czech Republic visiting grandparents and was constantly reprimanded for my wasteful American habits: leaving the lights on, letting water run, not closing doors, etc. etc.

We’ve been conditioned to believe that cheap utility rates in the US are the way things are which has lead most to believe it’s their right to walk around in shorts and a tshirt all winter long, let the sink run while brushing teeth etc etc.

Not that doing away with wasteful habits will cover the inflationary expense from commodity hikes, but to many such behavioral changes are anathema and downright treasonous.

I’m picturing Biden in a cowboy hat, alone in a canoe, whooping it up like Slim Pickens in Dr. Strangelove, as he goes over Niagara Falls – with the United States of America in tow.

Am I wrong to view going back to higher rates of telework as a means to reduce demand for gasoline? I’m unsure how much of the increase in demand and inflationary price increases in fuel is as a result of just about everyone acting as though Covid is no longer a threat and bosses demanding everyone go back to work all at once, but it at least seems like a possible contributor.

Good points. Telework is only a part of the workforce, but more than ever. Hard to quantify, though, which is probably why it’s being ignored.

Reducing gasoline demand: I am so old I remember car pooling during the first energy crisis. ;p

Doesn’t matter if it wasn’t a cure all. People at least tried to do something that helped.

Will current USAins make any sacrifices to address today’s problems? I’ll take the down on that bet.

Better to blame the imaginary communist Russians.

Agreed. If we got more people off the road such as when Covid was considered a big threat, the demand for gas would go way down. Going back into the office is a really bone headed idea for a lot of reasons. Everything has sky-rocketed including gas prices. If you have to re-stock your wardrobe for the office, buy an over-priced unhealthy fast food lunch, and of course whatever transit you use is more expensive. It’s much cheaper to work at home for those who can and there are a lot who can 100% of the time, as opposed to the hybrid thing that is more annoying than helpful. You can’t get any economies of scale, for example using a garage daily instead of monthly. In any case, Covid IS still a threat but we’ve got a weird downplay of that news even as pharma is hyping ever more boosters. As someone said, we can find ways to economize but that is not going to stop the criminal hoarding of cash by the .01% that could of course be helping the rest if they weren’t narcissists. Our politicians are utterly hopeless and ancient. They lost the thread a long time ago. And can someone explain to me how (in reality) raising interest rates is helpful? So then even if we could re-finance our student loans, we’d be screwed there too!

Let me get local for a while. In Spain most diesel consumed is diesel for cars “Gasoleo A” which usually peaks by July when you see lots of vehicles with plates from France, Netherlands, Germany… including many vehicles from France in transit to their former homes in Morocco. Your analysis prompted me to predict a sharp reduction in European plates next summer that might have an important impact in tourism in both Portugal and Spain and possibly many less migrants returning home in summer to Morocco.

Current data on diesel consumption shows that after sharp y-o-y gains of about 18% in Jan-Feb March 2022 came with a yoy change of -7% and the decline looks poised for larger drops… and possibly rationing.

If you look closer you’ll find many of those vehicles were actually stolen and are being shipped to other countries like Turkey or the Maghreb to be fenced.

Demand destruction is another way to moderate oil prices.

Anecdotally, I am seeing many more electric cars on the streets of London, possibly because gasoline car drivers and Ubers no longer can afford to use them.

In France, my parents replaced their 40 year old gas furnace with a heat pump around Xmas, more than half subsidized by the government, and disconnected from their natural gas hookup altogether. It helps that France bet all-in on nuclear in the 70s, but the flip side is many of those plants are reaching end of life and EDF’s record on newer generation nuclear plants is far from inspiring.

None of this can happen quickly enough, and electric cars have their own supply issues, but the smart money in the oil-producing nations is investing their windfalls into green hydrogen production from solar. You also have projects like Xlinks, a 10GW solar facility in Morocco that would ship electricity to the UK over a high voltage DC line, which can apparently do so with only 10% loss over 2000 miles or so.

One thing to ponder about nuclear power, fissible material is not infinite.

While it may not have the same emissions issue as fossil fuels, there is still only so much uranium etc in the earth crust.

France is the only country that has experimented with breeder reactors that make more fissionable materials. US does not like those because it produces plutonium which can be used in bombs

Since the talk is of inflation, I thought that I would dig up a history of inflation in the US and found one that goes back to 1929. The thing that I found of interest is that in terms of inflation, it has been a rocky road from the early 1970s onwards. That is, until about the year 2000 when it drops down real low and has mostly stayed there-

https://www.thebalance.com/u-s-inflation-rate-history-by-year-and-forecast-3306093

So my takeaway from this is that a whole generation has grown up that has not experienced high inflation rates and would therefore have not planned for it in their personal finances.

post 2000 disinflation-deflation is labor arbitrage-de industrialization with the developing world.

all that easy cost savings (at the expense of the West’s blue collar jobs) is gone

Yes, and in some cases now going into reverse as companies re-shore.

There were no computers essentially in the 1970’s, so inflation was kind of on its own, as information flowed like molasses.

Nowadays, the order can come down from on high from corporate to raise prices and just a few clicks on the QWERTY will make it so all across the country, making it not only easier to deal with inflation, but to also garner a bit more profit vis a vis the gouge.

Back in the early 80’s there was a mechanism to allow oneself to battle inflation, they called them CD’s (certificate of deposit) and if inflation was running @ 17%, you could get 15% on your money.

You’ll get nothing (close to it) and like it, now.

I have two professional friends who are/where on the retire early track. Both federal employees, one was able to take advantage of voluntary early retirement, the other was planning on just quitting and coasting until retirement benefits kicked in.

They are both in their early fifties and have never experienced economic conditions like this before and now realizing that they need to change plans do to inflation. They are lucky because one still has full employment with benefits. But there are probably a lot of people out there who squeeked out an early retirement planning on low to no inflation who are really getting squeezed.

I dont think anything prior to 1970 is relevant. We were on the gold standard then.

…and the 1973 Oil Embargo likely explains much in the 1970’s.

Except that while on the gold standard etc, there were a host of banking crises etc.

Keep in mind that the great depression happened while the gold standard was in effect.

And the end of the gold standard happened because USA was abusing its seigniorage via Bretton Woods to fund the Vietnam war, and nations were starting to demand the conversion of USDs into gold.

Even old man Keynes considered MODERATE inflation a lesser evil compared to deflation.

Well, one thing that is relevant from pre-1970s is the business community and their economist friends crying about inflation. One can’t read anything about economic policy really from the end of WW2 onward without seeing the dreaded inflation boogieman. In the mid-50s, it was 3% inflation that was intolerable and you couldn’t even blame a war for it. One would see the argument that nominal prices had been more or less unchanged for the 200 years prior to WW2 and that is how it should be.

Economists have been crying wolf about the threat of inflation for my entire lifetime. They won’t tell you that real wages mostly rose over the 1970s until Volker intentionally crashed it all, because inflation makes people spend now rather than defer to the future when their money is worth less, which keeps growth high. This notion that people (in aggregate) cut back their spending when inflation is high makes no sense. The problem today is that the vampire squid wants all your money and refuses to invest it here in productive capacity, so the growth bounce from inflationary spending is muted to say the least.

This whole generation has seen inflation in everything necessary for life (housing, food, and medical costs). Trust me we are used to it.

Add higher education to that list too.

We began importing an increasing % of our oil in the early 70s.

Does this chart take into account all the changes made to the way inflation is calculated? That is also a huge issue with economic data in general. Unemployment, inflation, income, have all been changed dramatically over the years making comparisons and interpreting their significance difficult. Is 3.5% unemployment a true indication if participation is in the low 60% as it has even for years?

Thanks for this, Yves. Your wisdom in the midst of all this confusion is much appreciated.

Oh, ye of little faith. No need to plan or investigate. Trust in the Great and Beneficent Invisible Hand.

(Our elites all-in reliance on markets is truly cult-like.)

Per Hudson, there’s lots of “central planning” in the neoliberal regime — it’s just conducted by Wall Street rather than your democratically elected government.

Correction: It’s conducted by Wall Street 𝘢𝘯𝘥 your democratically elected government.

When free markets don’t go their way corporations and their government enablers stay the Invisible Hand. Creative destruction only applies to small fry without lobbyists and connections in Congress.

With the house you’re selling Zillow may be right. Anyone who locked up a 3.x or 4.x mortgage rate a few months ago when current rates are 5.x will be under the gun to close while the old rate is good.

One ironic inflationary blowback of rates going up this quickly.

Rates are also still low by historic standards.. I think people could still be rushing to buy before rates get even higher. And when you combine the moderately higher rates with incredibly higher inflation you actually have a lower “real interest rate” now then last year.

This housing market really seems to be skewed by investors buying houses; or I dunno what, but myself and others I know that have been looking to buy houses to LIVE IN for the last year keep getting consistently outbid by cash offers much higher than the sales price.

The proportions are crazy… I’m talking over-bids equivalent to a 1/4 or more of the asking price… $350K homes routinely going for $450K, when they’d have been selling for $300K in Jan 2021.

This is not an investor housing market, except to buy dated homes, upgrade and flip them. Single family homes in this suburb are not rented out, only condos. Housing prices too high for rentals to be attractive except for condos and the very few remaining starter homes (WWII GI bill homes) but those are mainly bought to tear down and replace with McMansion wannabes. The draw is that this is the best school district in the state.

There’s a flip happening right next door to the Arizona Slim Ranch. It’s a lot with two houses and those houses had been an eyesore for years.

That being said, the crew that’s doing the renovation work is, shall we say, less than first-rate. I can look out my window and see a half-family blogged shingle replacement job on one of the rooftops. I can also see a variety of other travesties, which include exterior painting with inadequate prep work and a replacement window that is way out of proportion to the wall where it was installed.

We neighbors can’t wait to see what this place will be listed for. (Sarcasm off.)

Housing: In my opinion the game has fundamentally changed, starting after the GFC in 2008/2009.

The easy money isn’t there, as it was in the past, for the super rich. Hence the big players are buying land, especially farm land, and housing instead of investing in the next greatest driver of growth. Approaching the limits of the planet, how much longer can growth drive prosperity?

Black Rock is a big investor in rental housing. What I anticipate is that, even with much higher mortgages rates, housing prices will not crash because big money has plans to own everything (and everybody, in a financial sense). Look for investor purchases to exceed 30% of the entire single family housing market in the near future. Of course I could be wrong but I don’t think so.

Virtually everyone understands that housing prices are basically set by the affordable monthly payment.

How many people have thought about the advantage corporations like Black Rock have versus families when they have been able to borrow at essentially the Fed Funds rate. If you can borrow at 2% and others must pay 5% your actual cost advantage is ridiculous. Buying housing to rent is a means by which wealth will mercilessly squeeze the non-wealthy everywhere.

Also, the investment capital value and rent income reliably follow inflation.

No, the house price is up 25%, now higher than during Peak Covid. And any mortgage rate lock is house specific. This is early Feb v. mid May. Rate locks are a max of 90 days, from what I can tell, so we’re rolling off that.

Not a study, but I can point to the aging of the population as a culprit for at least some of the decrease. There were over 2 million more Americans aged 65+ in April 2022 vs 2020. There was a decrease in the 25-64 population. Those 65+ have a participation rate of 19 percent. Multiply (1-.19)*2 million gives you 1.6 million we should expect to be missing from the workforce

That means the missing 1.6 million working age population can explain about 0.5 percent lower participation rate. Compared to April 2019 it looks like we’re still a bit short.. but compared to 2016-2018 it looks like we’re pretty well recovered. Maybe in 2019 the economy was running unsustainably hot?

throw in childcare prices are so high that the opportunity costs between two parents working vs. one staying home tilts the scale to having one parent drop out of the full time job market.

my neck of the woods, I was overhearing a conversation among nannies at the play cafe and their minimum going rate was $30/hr.

While the local private and school daycares are booked solid.

There is something else to consider. Many jobs are boring and tedious, even so-called professional level jobs. Increasing numbers of workers are growing tired of the tedium, repetition, and lack of any excitement on the job. Those businesses struggling to hire may wish to inject some fun into the workplace so employees will have something to look forward to each work day.

i shudder to think what a corporation running a bunch of essentially wage slaves will consider “fun”, and how long participation in such “fun” will be by choice.

isn’t it Japan that has some workplaces get there and do cheer routines and exercise before work?

being faced with that would make me quit.

the only conception of “fun” or fringe benefits that i ever saw going on in crappy retail was free candy, donuts or other such diabetic diet crash inducements. when i mentioned to the (noticeably trim and fit) manager that this wasn’t exactly healthy and that people were likely eating it as a stress reliever, he gave me a withering look (dog trainer behaviorist at heart, i guess) but the times per week of free sugar on tap did lessen. but even early diabetes would be better than enforced cheering sessions or raffles, games or whatever other torture devices a corporate master will find to “reward” his good little performers with.

“Fun” in the workplace usually refers to extremely non-imaginative childish get togethers like ice cream socials, raffles of low dollar gift certificates or other non-inspiring things. I get that people who live alone may need to get into the office or go nuts by themselves but there is no such thing as fun in the office or other workplace as manufactured by the leadership. Commiserating and joking with your co-workers when not being micro-managed gets you through the day but it’s a coping strategy, that’s all. I agree wholeheartedly on the tedium. In my experience (and I started working in the late 70’s and I’m still ticking) sadly the craziest most dysfunctional companies provide the most material for jokes. The tedium is replaced by fear and panic but that’s not sustainable. I truly feel bad for those just starting out in the American workforce. I encourage those who have 30-40 years ahead of them to move to another country now before you get embedded in this mess.

I suspect that the combination of time at home during covid, money handouts, booming financial markets and particularly skyrocketing crypto prices convinced many people they could quit their day job or even retire early and get rich quick.

If that’s right, then quite a few people will now have to get off the couch and go back to work.

Some possible reasons for people not returning to work:

* Covid deaths, some of those million people had jobs.

* Long covid, now estimated at 1.6 milllion people I think, but may be higher.

* Early retirement.

* An awakening due to facing the risks of being “frontline workers” with all the risk and no special compensation, often instead getting fired from their jobs anyway. If those workers see that no one cares about them, and especially if they got fired, why would they care in return, they are looking for something better now. Also knowledge workers have always had greater mobility and the pandemic may have convinced them there are more important things than often thankless, grinding work.

* substance abuse, people that fell prey to it are not working.

* cost of child care may have altered household calculations about one partner not working

I’ve only seen one report which tries to quantify the effects of long covid on the workforce:

https://www.brookings.edu/research/is-long-covid-worsening-the-labor-shortage/

They estimate about 15% of the worker shortage is due to long covid.

One thing to note about all these potential causes is that many of them are not likely to be reversed. The worker shortages may be permanent, which would be yet another thing that is not going to be solved by raising interest rates. There are likely other factors to consider also, such as mental health; I’ve seen no reporting that tries to put numbers on all these categories.

I anticipate that the Fed is cornered into being seen to be “doing something” and since its only policy instrument is the blunt hammer of interest rates, it will go on hammering nails into labour until it disemploys enough people to crush inflation a la Volker. It’s brought to you by the same logic that gave us “in order for the village to be saved it was necessary that it be destroyed.”

That the resulting recession will hurt the poor even more than inflation won’t discomfit the chattering classes much (if anything, tickling their sadistic puritanical streak), so, you know — feature, not bug.

free trade is inflationary, but deflationary to wage earners. add stimulus to a free trade economy, it creates massive inflation, bottlenecks, and chaos. the more money you pour in, the more free trade is supercharged.

it costs a lot of money to stock your shelves with products that have to be shipped to you burning immense amounts of fossil fuels.

its why nafta billy clinton instituted austerity, its why nafta joe biden is now.

I think Yves’ focus on “why low labor participation rates” is a very interesting line of inquiry.

Covid’s impact isn’t just on production capacity. It’s also on people’s attitudes about work. Not long ago, it was much more unusual for people to work from home. Now, – for many – it’s an expectation, and one they resist relinquishing.

There’s a recent article here @ NC on (my paraphrase) emotional burnout. Activity and stimulation overload. We may be approaching some sort of psychological endurance threshold, wherein the incremental income just isn’t worth the stress you have to endure to get it.

And on the subject of expectations, producers have wanted to raise prices for a long time, but couldn’t. The supply chain disruptions provided a plethora of convenient excuses for price-rises, and the consumers flush with extra stim money reduced the likelihood of buyers’ strikes.

Attitudes appear to have changed. And, while those attitudes were changing, the value of our money (e.g. of the incrementally printed dollar) has been changing (falling) relentlessly over the past few decades. Currency exchange rates can be (are) jiggered to achieve the appearance of currency stability, but it’s a lot harder to jigger grocery store prices.

How much of inflation is due to reduced buying power (domestically) of the dollar?

Here’s another slant: how much of increased asset prices is the very direct effect of anticipated further reductions in dollar buying power?

I think “quite a lot”. There are several forces at work that manifest as “inflation”.

Historically, has the Fed’s strategy for dealing with stagflation been to “back off interest rate increases”?

It was for awhile — then Paul Volcker stepped in and changed policy

Steve:

Stagflation is a tough problem because monetary policy (raise or lower interest rates, and thereby expand or contract the money supply) isn’t an effective tool to solve it.

Stagnation (one of the root concepts of “stag-flation”) means “lack of economic activity”.

Facing vanilla stagnation, the Fed would ordinarily cut interest rates, and that would spur investment, or at least some easy-money-asset-price bubbles (with the resulting “wealth effect” spending) and that would goose the economy, and all would be well.

But if you have inflation during the “lack of economic activity”, lowering the interest rates and/or doing QE (printing new money and injecting it into “strategic” points of the economy) makes inflation worse. The money supply increases while real economic activity stays relatively static. For me, “no inflation” equates to “create new currency at the same rate that wealth is being created”. Then buying power of each incremental dollar is constant.

The ostensible reason we had to resort to QE was that we’d reached the lower bound of interest rate reductions, and economic activity was still insufficient to buy up all the production (not just in the U.S., but globally). We had a glut of goods, and IMHO, _that_ was what kept inflation in check for the past 20 years: cheap imports. Increased our household buying power, while keeping wage increases in check. Two giant anvils holding inflation down.

When Covid hit, we didn’t have a glut of goods anymore, and all those latent (suppressed) price rises rushed out of the barn and into the marketplace.

So, now we’re edging toward stagflation: inflation’s on the loose, and economic activity is getting wobbly. If we cut rates, we get some more inflation. If we raise rates, we get less economic activity.

This is why I asked the question the other day: “If you’re tightening monetary policy (raising rates and turning off QE), can you still do fiscal stimulus in order to stimulate new demand (e.g. give away money in hopes it’ll get spent and drive up demand).

The reason that question is relevant is because whenever demand from the private sector falters (“stagnation”), the Government has to step in and start buying stuff to get “aggregate demand” back on its feet.

Does tightening monetary policy interfere with Gov’t “fiscal stimulus” ?

Fiscal stimulus (buying stuff) seems to happen via the Gov’ts unique ability to “spend money into existence”. If that money is used to create wealth, then by my definition, no inflation results. But fiscal stimulus doesn’t seem to create much new wealth, and is therefore somewhat inflationary…and that would tend to exacerbate “inflation”.

I’m trying to remember a time when inflation-fightin’ _and_ fiscal stim was policy. It’s been a loooonnng time…better part of 40 years since we’ve been fighting inflation, and I don’t believe we were doing Fed Stims at the time (’82, thereabouts, Volcker era).

Fiscal stimulus in the form of a Universal Basic Income may be the last arrow in the Fed’s quiver. Never been done. Sending $40 billion to Ukraine or any armament manufacturer certainly won’t achieve the necessary ends. And that sort of stimulus has been done before anyways.

We still have tenants here in SoCa currently getting Covid money from gov to pay the rent and they all are working.

Don’t get me started in the PPP, businesses got tons of free money which I am sure they didn’t put it in CD earning 0.1%

Will somebody explain to me why 2% is an acceptable economic growth rate whereas 5% is deemed inflation? When does the so-called growth rate become inflation? I would also like an explanation for why raising the price of crude and refined petroleum products is necessary except to capitalize on the psychology of “get mine before you get mine” economic thinking. What is the rationality of raising prices during crises except greed? And, have “costs” actually risen as much as the prices?

Tom P correctly writes about “attitude” and “expectations” and “anticipations.” These are all issues of psychology, and are independent of reality. These are signs of a “lemming” civilization.

What a grand world we would live in if politicians, economists, CEOs, etc. would simply ‘fess up and admit that the rest of us are sheep being slowly led where they want us to go – maintaining their power and lifestyle at our expense.

Gosh, I would love to be filthy rich. Better to be dirty than poor.

Growth rates are always expressed in units of “real growth”, ie after inflation. If there was 5 percent inflation nominal GDP growth would need to be 7 percent to achieve 2 percent growth. 2 percent nominal gdp growth and 5 percent inflation would be a real GDP contraction of 3 percent

There’s some fear in the markets that the Fed will tighten again, stocks will decline sharply, 401Ks will decline, and the Fed will revert to easy money. This would be rational if the Fed can’t fight inflation. But is it really true that excess money doesn’t cause inflation?

While I don’t have the chops to be know what level of excess money will cause inflation, I wonder if it is an exponential where a small change creates a tipping point. Jim Grant (Interest Rate Observer) observed that inflation comes in long waves and that if we are coming off a long “no inflation wave” then a long “inflation wave” often follows. Grant didn’t provide a cause and effect other than to observe we are at never before seen levels of liquidity.

It could be that there is a linkage between the possible coming dismantling of globalization, excess liquidity, and (related) very low interest rates. For sure this money has gone into the financial system and most of it has not created increased technology or productivity. As a result, the financial economy is out of balance with the non-financial economy.

For whatever reasons, we have inflation now and it looks like it will hang around. Fossil fuels shortages, raw materials quality, and decreased productivity are not fixed quickly. Also, there are very concerning signs that this generation of managers can’t deal with these problems (see baby formula).

Makes me think back to earlier posts here about the Limits to Growth modeling that was re-run with modern data (can’t be bothered to look up a link). One conclusion from that was that a global systemic breakdown would start with supply chain problems. We are tracking to that outcome, perhaps…

Virtual all the followup studies up to present to LTG showed collapse between 2020 & 2030, just like the original study.

Things are getting rough out there. I had my catalytic converter cot off my car. Found a little muffler shop in Mississippi that will put in a straight pipe for cash. If I replace the catalytic converter, it will just get cut off again.

Also, I looked on Craigslist for any fuel efficient Hondas/Toyotas for sale. Nashville, Huntsville, and Memphis, virtually zero for sale. Looks like those cars stopped being posted the 3rd week of April. Plenty of Ford, Chevy, dodge trucks/SUVs for sale though.

Yves, thanks. I generally agree with you that supply-chain issues are at the root of the problem, and that the stimulus was a bit too much and exacerbated things.

I’m surprised you didn’t bring up corporate profits as a source of inflation. On the one hand we have the Economic Policy Institute asserting that half of inflation is due to the huge jump in profits (Matt Stoller had a similar take), and on the other hand people like Catherine Rampall raving that higher profits were merely a result of higher demand (just like in Econ 101, apparently the big corporations are helpless when it comes to pricing). In any case, most of the stimulus (the direct cash portion, anyway) is done and gone, so we should see demand weaken anyway.

Also, last I checked we in the U.S. were still driving less and buying less gas than pre-COVID, so gas and heating oil are purely supply and profiteering issues.

Finally, the “great retirement” that was being bandied about was based on preliminary BLS data that has been substantially revised. There are probably about 800,000 more older folks (65+) who are not in the labor force (comparing today’s participation rate with pre-COVID), not millions, and calling them retirees is a bit of a leap of faith. While some may truly have retired, others may have long COVID, or may be taking care of their children or grandchildren due to COVID, lack of availability of child care or nursing care (both still down 10 percent in employment from pre-COVID.

Congress should give the Fed and the finance industry better tools, fine-tuned ones, to fight inflation. Instead we leave them to their own knee-jerk devices – or device – as the only fallback position they have is raising interest rates. Which slows the economy, by pushing it into recession, but increases the value of the dollar. The high value of the dollar is still the most important consideration of our capitalist class. Is it because of the carry trade whereby all financial investments gravitate to the highest interest rate? So who cares if the underlying economy sputters and collapses if the dollar is humming along? Well, just about everyone – it’s a clear and present danger. So what new device could both prevent a domestic recession and inflation? Not to harp and hack and beat an almost-dead horse, but the new device we need is direct social spending. MMT. (No, we do not need this absurd war for oil.) Congress should pass a law to require us to match the rising interest rate hardship imposed by the Fed and Finance by direct reimbursements to every citizen. And additionally we should spend on housing, food, health care and education like every other advanced society. Plus it is getting more complex because world resources are depleted. What seems to be simply a beautiful old house in an elegant old neighborhood is suddenly worth a fortune – for good reason. The resources to replace that kind of quality will cost a hundred times more these days. It’s a good way to invest – not to sell it, but to conserve it for a while. Put it on the historic registry. Take in some very fussy, quiet, neat-freak room renters. Good house rules.

Congress should pass a law to require us to match the rising interest rate hardship imposed by the Fed and Finance by direct reimbursements to every citizen.

A progressive rough ploy is to index capital gains taxation on interest rates. (interest rates drop, tax rates rise)

And conversely,

interest rates rise, tax rates drop

Helps to reduce asset bubbles and in general is a counterpush for stability.

One more thing–not to get too conspiratorial–but the whole media focus on wage inflation (when wages are rising less than inflation) and the demand to increase interest rates and bring on a recession (Larry Summers, the gift that keeps on giving) seem to fit in with a narrative of crushing the labor shortage and any labor militancy while jacking up profits. It seems to me that inflation and higher profits have sucked up the stimulus that went to average households and redistributed the money to the top. Sigh.

[The following has no references or discussion, just opinion – the subject is big enough that I don’t have time or space to be complete. Reader discretion is advised]

We don’t have what I would call inflation. Raising interest rates is not the answer. Greed is an incomplete description.

Inflation is primarily psychological: rising prices due to expectation of rising prices.

—

Prices reflect many factors, two of which are supply and demand. When supply is constrained or when demand increases, or both, prices rise. Even if for these reasons the price of many things rise, this rise is not inflation (although it may in time lead to inflation) and calling it inflation confuses two separate issues. Dealing with rising prices as inflation when it is a supply-demand imbalance is simply wrong.

The current rise is due to

This is made worse because much production is concentrated: obvious current and recent examples are semiconductors, baby food, packing plants, and so on. When something goes wrong somewhere a lot of production stops – there are few other somewheres to take up the slack – see baby food.

Furthermore, when producers don’t predict the future correctly and they make the wrong thing at the cost of the right thing (semiconductors), or cut back because they are fighting the previous war (oil and gas production), and production is concentrated, the mistakes are proportionally bigger.

And even if producers do predict the future correctly it takes time to build new facilities and they may be incredibly expensive (semiconductors). In that case it makes sense to delay construction to as late as possible but then, hey, maybe there will be an interim shortage.

All this is not inflation, it’s not prices rising due to expectation of rising prices.

—

Raising interest rates hits the economy. People lose their jobs. They buy less. Demand drops, prices fall. As the article states the default way to fight inflation is to “make life worse for most citizens through the use of interest rates.”

But guess what: if people remain employed and prices rise they will reallocate resources. Just as an example, they will drive less for pleasure, try to be more efficient in the driving they do and cut back on fuel usage. Higher prices will have reduced demand. Prices will stabilize. Rising interest rates are not needed.

Sure, if rising rates cause job loss, the car will be sold to cover living expenses. Fuel demand falls, but the people consequences are much more severe. The effect granularity is coarser. Rather than having many people cut back a bit, you have a few people forced to cut back completely. Recovery from the effects will be a matter of years, rather than a matter of months. It’s stupid.

—

Furthermore, greed is not the best or only explanation for businesses raising prices. Sometimes it’s simply caution, a fear of failure whether temporary or existential.

For example, frackers drilling with borrowed money went bankrupt and bank were not completely repaid. No wonder banks cut back on loans to drill and oil companies cut back on new drilling. Now they are getting money, recovering losses, starting to drill, but not nearly as stupidly quickly as they did in the past.

Had they been perfectly able to predict the future, the COVID pandemic, the unexpectedly relatively quick recovery, the war in Ukraine and reduced world production, they would have started drilling in June of 2021 when prices were around 65 dollars and started pumping this January and selling at prices from 85 to 130 dollars per barrel and helping bring the price down. Now prices are unlikely to fall in the next year.

Perfect prophecy would have brought better profits, but imperfect prophecy is not best described as greed.

I hate to tell you but your claims are flawed. Rising energy prices propagate through the entire economy and drive generalized price increases, albeit at different speeds in different sectors.

Yeah, of course – energy is an underlying cost for everything else.

But while I believe that fossil energy costs will remain high for the next year or so, I don’t believe they will continue to rise for much more than six months. At that point their contribution to continually rising prices will wane. Prices will stabilize, albeit at a higher level.

Fuel, fertilizer, heating, cooling, transportation and other costs will then also stabilize and when, eventually, fossil energy costs fall, they too will tend lower. To the extent that renewable or nuclear energy sources can replace fossils, energy and all the related costs may fall sooner; to the extent that energy usage increases, prices may rise further after all.

But the expectation of continually rising prices – inflation – is not a necessary consequence.

In any case, using the blunt instrument of higher interest rates will – as I said – mean “Rather than having many people cut back a bit, you have a few people forced to cut back completely. Recovery from the effects will be a matter of years, rather than a matter of months.”

It’s now at the point where we cannot afford to eat out and eating in is always a compromise.

So glad we’re doing our part to help American LNG exporters, American oil companies, SWIFT, the banks and the others that want to see a distant land destroyed at our cost.