Yves here. Look out below! Wolf Richter’s latest report on the state of residential residential real estate is not pretty, not that that is surprising given rising interest rates. But new houses are doing much less badly in the South (well, price wise, not inventory-wise). Could that be that be due to prices not appreciating as much as ones in/near metro areas with a lot of “work from home” professionals hoovering up more shelter?

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

The median price of new single-family houses that were sold in June plunged by 9.5% from May, to $402,400, the lowest since June last year, according to the Census Bureau today. The plunge in June after the drop in May reduced the year-over-year gain to 7.4%, from the 20%+ in the spring.

Median prices are noisy with month-to-month moves, and some caution needs to be used here. But this was nevertheless an extraordinary plunge of a magnitude that occurred only three times before in the data going back to 1965: During the second dip of the Double-Dip Recession (Sep 1981), during the Housing Bust (Oct 2010), and in Sep 2014.

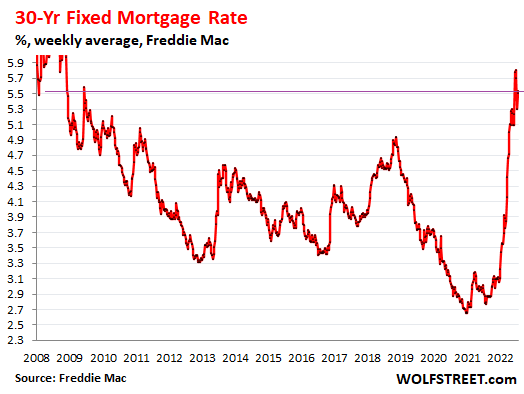

Clearly, potential buyers are now having second thoughts, given the spike in mortgage rates, and homebuilders are responding to this decline in demand and the surge in cancellations by piling on incentives and cutting prices:

The largest homebuilder, D.R. Horton, said in its earnings reportlast week: “The increase in our cancellation rate in the current quarter primarily reflects the moderation in demand we experienced in June 2022 as mortgage interest rates increased substantially and inflationary pressures remained elevated.

Sales Drop to Level of Lockdown April 2020.

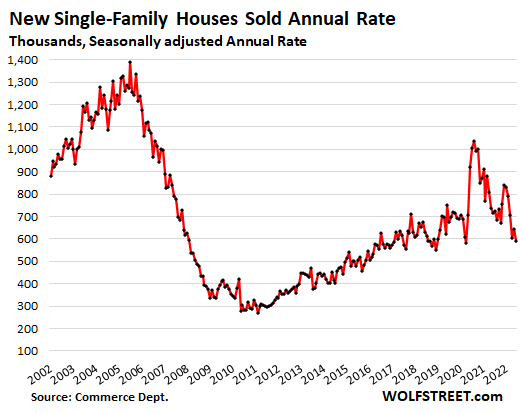

Sales of new single-family houses dropped by 8.1% from May, to as seasonally adjusted annual rate of 590,000 houses, down by 17.4% from a year ago, and just barely above lockdown April 2020, and beyond that the lowest since late 2018, when mortgage rates had hit the magic number of 5%:

Similar drops in sales occurred with existing homes where sales plunged 14% in June from a year ago. So that’s previously owned houses, condos, and townhouses. Particularly noteworthy with existing sales was California’s 21% plunge in closed sales and the 40% collapse in pending sales.

New house sales plunged in every regioncompared to June last year, but plunged the most in the Northeast:

- Northeast: -37.9%

- West: -32.9%

- Midwest: -22.1%

- South: -8.7%.

No Folks, There Is No “Housing Shortage,” but Prices Are Still Way Too High.

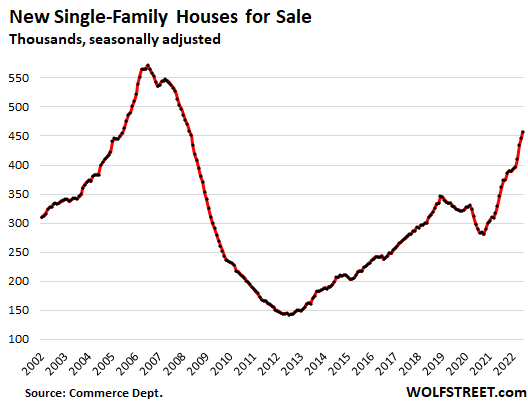

Houses for sale in all stages of construction continued to pile up in an amazing series that began in August 2020 and in June reached 457,000 houses, seasonally adjusted (and 463,000 houses not seasonally adjusted), the highest since May 2008, and up by 113,000 houses, or by 32%, from June last year:

By region, unsold inventory rose in all regions but spiked the most in the Midwest and the South, in terms of the percent increase year-over-year:

- Midwest: +62%

- South: +33%

- West: +28%

- Northeast: +4%.

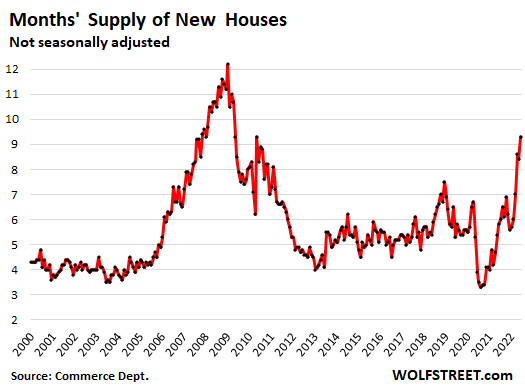

Supply of unsold new houses spikedto 9.3 months of sales, same as in May 2010, and both had been the highest since April 2009, during the depth of the housing bust. This is a huge amount of supply:

Potential Homebuyers Gaze at Holy-Moly Mortgage Rates.

They’re called “holy-moly” because that’s invariably the sound potential homebuyers make when they see the payment for the house they wish to buy at current mortgage rates and still sky-high prices.

The average 30-year fixed mortgage rate, according to Freddie Mac’s measure, was 5.54% in the last reporting week and has been above 5% since mid-April. With each increase in mortgage rates, entire layers of potential buyers abandon the market as long as prices remain too high:

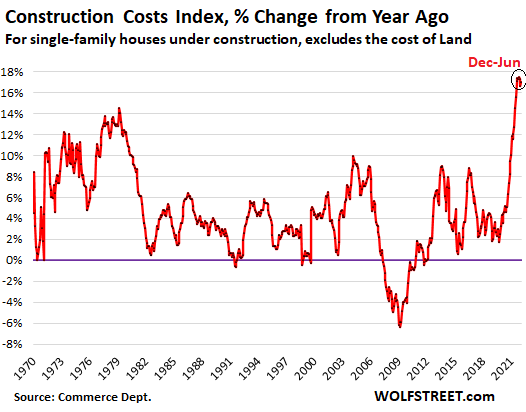

Homebuilders Struggle With the Worst Construction-Cost Inflation Ever.

Homebuilders have been facing shortages of materials, supplies, and labor that delayed projects, and price spikes that triggered astounding cost-overruns, and deliveries of completed houses got tangled up.

Construction costs of single-family houses – excluding the cost of land and other non-construction costs – spiked by 17% year-over-year, and has been in that range since December last year, the worst spike in construction costs ever in the data going back to 1964, according to separate data from the Census Bureau today. June was the 14th month in a row of double-digit spikes in construction costs:

Homebuilder Stocks…

Despite a powerful summer rally that now seems to have run into trouble, the stocks of homebuilders are down between 24% and 36% year-to-date and have easily out-dropped the S&P 500 Index (-18% year-to-date):

- Horton: -31%

- Lennar: -31%

- PulteGroup: -24%

- NVR: -26%

- Taylor Morrison: -23%

- Meritage: -30%

- KB Home: -30%

- Century: -36%

- LGI Homes: -33%

Lower prices in the South are partly due to lower fees.

When I looked into the cost of building a home in Sebastopol CA a decade ago permits ran $80K exclusive of sewer hook up.

I’d love to know who the heck is getting that money.

Typically, what I have seen in wealthy communities are high fees of all kinds related to housing, with the goal being to discourage home building and home expansion. It is a form of elitism.

Atherton, one of CA’s most expensive towns, is a few miles from me. There are no street retailers in Atherton, other than a few very old shops grandfathered in decades ago. There’s no downtown, that’s for Menlo Park to do.

Property taxes go to the state for redistribution. How does the town govt. support itself? Sales taxes on construction material! Those rich doofuses are constantly rebuilding their houses.

Ax to grind: title insurance. This is the silliest cost to home ownership. I had to get thousands in title research or whatever for a refinance of my own home, as if I was stealing the deed out from under myself like Nicholas Cage and the Declaration of Independence. How everyone still pays for this crap is beyond me.

Gatekeepers for entry to the “Middle Class.”

My law Professor told the class that Title Insurance is a rip off; it covers nothing.

It covers the mortgage company, if it turns out that the title is disputed and you have your house taken away, it insures the mortgage company’s investment. The borrower could probably acquire the same thing, but the lender doesn’t care if the borrower loses money.

Basically the same thing as PMI, but that insures the mortgage company against the borrower defaulting.

True in theory, but considering the industry only pays out like 3 percent of what they collect I’m okay with the quick summary/slight hyperbole “nothing”. 3 percent is much closer to nothing then what typical insurers payout.

I cant find the recent link, but here’s one from 1995 stating the industry paid out 7 percent back then https://www.tampabay.com/archive/1995/07/08/you-ll-probably-never-collect-on-title-insurance/

Having had successful coverage from title insurance — they paid the legal expenses — I tend to doubt your professor’s claims.

David Cay Johnston has written about title insurance in his book “Free Lunch”.

https://www.democracynow.org/2008/1/18/free_lunch_how_the_wealthiest_americans

Prices are still going up in smaller cities and towns in flyover country.

It’s all completely out of whack. We bought a second house this year for my wife’s job. It’s fine but it wasn’t worth $170K, though the mortgage is significantly less than rent there (and this is a rentable house in a college town). Here I’m told this house could sell for almost $250K. It was purchased 12 years ago for $112K. But 200+ is just the going rate in a small city with a median income of $50K. And that number is lifted by having a bunch of tenured professors, university administrators and outposts of all state and federal government (we’re a semi-state on the peninsula and this is the De facto Capitol). None of it makes any sense; it’s disconnected from reality and I can’t help but think that reality is going to bite hard when it bites.

Mid-sized college towns became an investment target for REITs and PE within the last 3-5 years. They’re driving prices much higher than the local market would support. It’s distorting the local market and the local property tax assessments. my 2 cents.

See for example: Student Housing REITs. Student housing includes high rise apartment complexes and single family houses to rent in college towns.

I can see a collection of those high rises from the front windows at the Arizona Slim Ranch. I’ve heard that the interiors of the apartments are very nice, and the cheap ones are something like $1,500.

Those complexes have been like giant vacuum cleaners that pull students out of neighborhoods like this one. Okay by me and my neighbors. We like to sleep through the night without being rousted awake by loud student parties.

A large number of these high rises have been built around the University of Arizona campus in Tucson arizona. They’ve changed the shape of the down town area

That does not appear to be a factor here yet. College is too small. The university is really a real estate development firm pretending to be an academic institution that has killed private development of high-density student housing. So far it’s locals running the student rental sector. We’re probably bottom of the barrel for the investment firms. We do have a lot of retirees buying sight unseen or people who come here on vacation and decide to buy a house.

There is your answer. There is an enormous upsurge in the number of households which are buying a second home. We have the usual wealthy folks, grabbing an extra housing unit wherever they might want to spend some time. We have the new stock millionaires cashing out and putting money in houses, both for themselves and to rent out. There are also people of more humble means who are keeping the paid off house in the city or up north as a home base, but buying or renting another unit in a better climate. Even at the very low end, they are locking up a unit in an RV park in Florida, year round because it’s cheaper than moving the thing around the country.

They predicted there would be lots of spare housing when the boomers retired, but in fact, there is more demand now, because so many households are consuming more than one housing unit.

See granolashotgun.com for a somewhat different experience regarding midsized college towns.

The prices are holding up in our college town for homes that are already built, and new homes start at around $400k. It helps that we are a two hour drive from Seattle. Near our place is a house owned by the president of the university. It is on a hill, has a great view of the mountains and has been sitting empty for a several years. I’m guessing the uni prez paid cash for it if he can afford to not rent it out. Meanwhile, there is a housing shortage in this area due to the college students and people continuing to move here from Seattle. It will cost you around $300k for an existing 2 bdrm house that is under 900 sq ft.

You are right. It is completely out of whack. Desades of “a house is worrh what a bank is willing to lend” has led to the building of faux luxury shitrock palaces that young people not in the PMC cannot begin to afford. With few exceptions, new houses are crap.

There are builders and architects who are trying to break that trend. But in my experience, a significant reason why some builders (and most flippers) are able to get away with shoddy offerings is because we as a people are much less informed about what good craftsmanship is. People don’t understand how plumbing, electrical systems, HVAC, structures, roofing, flashing, siding, windows, flooring works. So they aren’t aware of what they’re paying for and don’t know how to negotiate around it. This has created a Gresham dynamic of sorts where in some regions the bad builders have chased out the good builders. The banks and many home assessors don’t have an incentive to low ball valuations because then they don’t get paid. And one hangover from the financial crisis is the inspection and building departments in many areas were decimated by lay offs. Those hires have not been replaced. So here we are. We have a crushing need for new housing and we’re unprepared for how to manage it or evaluate it.

based on what? Thats much more then the replacement cost, and rents sounds like they support it so it doesnt sound out of whack to me. Just like stocks, yesterdays price is irrelevent. One trend that I think a lot of people have missed is the ease of buying investment properties out of state. Spend a couple minutes on roofstock.com This technology didnt exist a decade ago, barely even 5 years ago. While funny money from the Fed certainly played a large role, technology opened up all markets to everyone which puts constraints on how far housing prices can get from rents.

Anecdata from the well-do-to leafy Maryland suburb of DC: 5000 sq. ft. McMansion built in 2019 and sold for $1.5M back then. A new one just went up right across the street, maybe a couple hundred feet bigger, priced at $2.2M… and it’s bee sitting there for almost a month which was totally unheard of until very recently. I wouldn’t be surprised if in the time it took to buy the old 70s house that was there, tear it down, and build the new one the whole thing became financially undoable.

I think higher construction costs are helping keep home prices up. New construction is very expensive right now and that higher price has to be passed along to the buyer. I’d like to see a similar analysis for existing homes as I don’t think new homes tells the whole story.

With the official unemployment number close to 3% and everyone claiming there are plenty of jobs and the economy is doing well there is clearly a puzzling problem with housing affordability. How is that? Maybe wages are more like slave-wages? Or… the unemployment stats are just more BS. And all the while the homeless population is blowing sky high in most cities… WTF? If the government wants to keep pretending that everything is just fine it is going to have to go on a construction boom of its own and build adequate housing for the “unhoused” and they need to do it damn fast. The number of homeless people living on the streets never drops below half a million – so just taking that number alone (which is probably off by 2 or 3 million more) that’s lotsa apartment units and for some strange reason nobody can afford to build them. Let me guess.

I wonder if the quality of these new houses is suspect? I recall the quality was suspect for (some?) of those built during the housing bubble, as well. Remember the Chinese drywall scandal in south Florida? I’m still amazed people were waiving inspections in this wave.

Inspections will rarely find those types of issues. Builders dont skimp on the parts of the house that are easily visible–to either an inspector or buyer. Its whats underneath the paint, drywall, floors, and foundation that tend to cause massive problems

Yes,the quality of a new house should always be suspect to some degree.

In any home development you will have a spread of quality from best to worst, sometimes quite a wide spread.

This time it is different.

And long Covid is part of the reason, it is going to shorten the lifespans of most Americans, add that on top of social disintegration and the effects of the sanctions on the balance of power over the next decade…

Oh,and that climate change thingy has arrived.

I do not expect to see price appreciation in real terms for a long, long time in Real Estate..

With the possible exception of the very best properties.

Interesting times …

in Oregon $1700 for two bedroom apartment. Just a low standard apartment, nothing luxury. Wages going up, fast food pays $17 and above. Cost of everything up, hard to find Air conditioning shortage of supplies.

Dealers are low on inventories, no Toyota corolla or Camry sitting on the lot.

Why would anyone with good credit want to rent a $1700 apartment, and fast food is paying $17 an hour.

Common Sense People

here in Houston, the prices haven’t declined much, but the insane rise in prices over the last year slowed down.

I assume a lot of that is due to the interest rate increase… with more coming.

It’s fun to look at regional situations. Months of inventory Seattle? 1.34

https://www.noradarealestate.com/blog/seattle-real-estate-market/

Some realtor sites are saying we have 0.8 months of inventory in Maryland. Which is another flashback to the Long Recession. No one could get a house in the places with good jobs and good public support for schools and hospitals. But in the flyover places? Cheap houses all day long. They were still too expensive for the locals who couldn’t qualify for a mortgage. But they could be had for a song if you had the cash.

Haven’t seen problem with new builds here in Honolulu, but there are only two developments active. At one they just released a new increment of what they call condominium townhomes 990 sq ft at $660k is the cheapest.

I expect we’ll see a lot of the same from during the long housing crash in 2008 – 2014. People couldn’t get mortgages because their credit had been ruined. Or they could get funds but they couldn’t get enough money to pay for the house because the people selling needed way more than the market price to get out of their mortgage. So everything was just frozen, and what wasn’t frozen got vacuumed up by PE. Or just sat there and rotted because the bank would rather get fines for not mowing the lawn or having a meth pit than realize the loss. Through it all we can be sure of one thing – the banks will do nothing to help the situation. They didn’t before. Why would they take losses now?

Thanks for this, Yves, and Wolf. Amen. I have seen much in the MSM of “we need to build more” houses. Anecdotal, perhaps, but I’ve noted it in more than one “paper” or “source,” including the vaunted NYTs. Observing empty towers owned (likely?) by PE in many cities, I found myself muttering that the RE lobby must be at it again. Where one “needs more housing” likely depends on the ultimate profit and supporting never ending development, imo.

We do need more housing. Especially in the areas where there are good paying jobs and high rates of homelessness. We specifically need more affordable housing. The problem with that is most jurisdictions game the system as to what counts as “affordable”. For example, where I live, it’s a calculation based on averages and incomes. So an affordable rent is considered $2400 a month, give or take. That is a terrible definition of affordable.

Community land banks, focused development, and skilled builders who understand how to execute projects for affordable housing and still make a profit on them are needed to combat this problem. If you’re interested in some of the people who have written thoughtfully about craftsmanship and building affordable homes that are really affordable and that people want to live in, look up Fine Homebuilding from Taunton Press.

It’s 2008 all over again.

The housing boom was fueled by low interest rates. It drove the market and got people to buy a more expensive house than they needed. With interest rates increasing many people could no longer afford to buy. This is causing the declining the housing market.

I just read elsewhere that for the first time, more single family dwellings were sold to commercial buyers than to ordinary families.

We need to get some control on speculators. With the top 1% awash in oceans of cash, they have the capacity to distort whole markets.

There are at least 2 approaches to managing real estate: the privatization approach (title insurance, real estate brokers, tieing into utilities, etc.) and a purely socialistic approach i.e., government managed. The former makes each individual spend money for each and every action associated with home ownership thus enabling an entourage of rentier capitalists to grab their portion of non-productive effort in fees, while the second approach entrusts the provision of services to a single, trusted “other,” i.e., a government (local, state, or federal).

Is one approach “better” than the other? We are moving toward a completely rentier economy. Them that has will survive, the rest are doomed to deepening debt.