Yves here. We were remiss in not writing up a recent and important Fed paper, which effectively argues against the central bank policies under way, of considerably increasing interest rates to tackle inflation. The assumption behind that is the current inflation is driven by wage increase, which isn’t the case despite the oft-mentioned tightness of the labor market. Prime age labor force participation is still below where it was before Covid. That means workers have gone missing….because they have long Covid? because they are shunning high-Covid risk establishments? Because some two income families with kids worked out during the lockdowns that they need only one or one and one-half incomes?

The Fed paper by David Ratner and Jae Sim describes how the declining labor bargaining power has changed inflation dynamics, but the models that the Fed and its peers like to use don’t acknowledge that.

Note that it is not uncommon for the research arm of an economic institution to be intellectually ahead of its policy arm; the IMF’s researchers have published many forward-thinking papers that appear to have had little to no impact on how the IMF runs its programs. It seems the way theses analysts influence their institutions is by changing opinions among the economics community and then having that work its way back to their employers.

And if you are relatively new to this site and have not heard of Kalecki before, please skip the post below and instead proceed immediately to his seminal and highly readable 1943 paper: The Political Obstacles to Achieving Full Employment

By Mario Seccareccia, Professor of Economics, University of Ottawa and

Guillermo Matamoros Romero. Originally published at the Institute for New Economic Thinking website

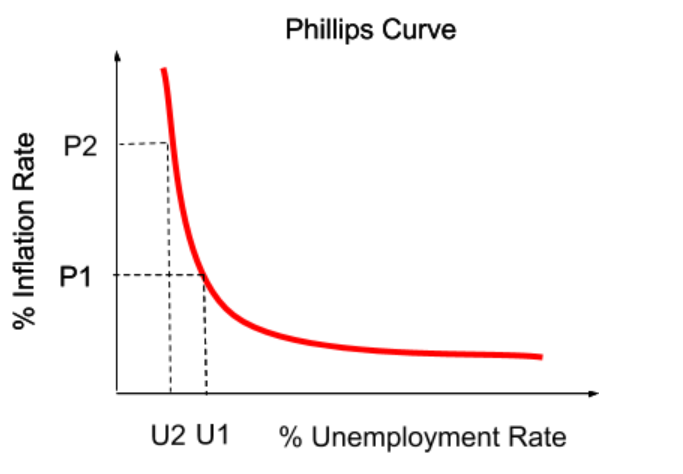

… the slope of the Phillips curve — a measure of the responsiveness of inflation to a decline in labor market slack — has diminished very significantly since the 1960s. In other words, the Phillips curve appears to have become quite flat.–Janet L. Yellen (2019)

A recent US Federal Reserve staff working paper written by David Ratner and Jae Sim (2022) has captured widespread attention, especially among economists, who, like ourselves, believe that a repeat of the anti-inflation policy scenario of the early 1980s of sharply raising central bank interest rates might prove inappropriate, if not catastrophic, as solution to dealing with the current inflationary environment. While inflation is hurting the poor disproportionally more because of their low incomes, a steep across-the-board rate hike may be a remedy that is worse than the disease, particularly since, as it has been well established (see, for instance, Storm 2022), we are not primarily facing with a demand-side inflation.

Indeed, not only might the inflation rate be quite insensitive to falling aggregate demand pressures, but sharp and persistent increases in interest rates could devastate many poor working households which would face the specter of increasing unemployment. This concern is amplified by the fact that, unlike the situation in the early 1980s, these poor households now tend also to be very heavily indebted as a proportion of their personal disposable incomes and may face even greater risk of insolvency both because of higher interest rates and because of the increasing unemployment (see Costantini and Seccareccia, 2020).

The US Fed as well as many other central banks internationally seem now to be united in favor of a steep hike in the Fed’s policy rate, as we witnessed with the most recent 0.75 percent jump on June 15. We are told, moreover, that there are many more increases to come since the Fed rate is, supposedly, still much below its “neutral” level. For a very recent plea in support of what may have been the “mother” of rate hikes in the United States, namely another “Volcker shock”, one has only to peruse the recent paper by Bolhuis, Cramer and Summers (2022) in which they suggest that, to get the current inflation rate down to align with the US Fed’s 2 percent inflation target, it would now “require nearly the same amount of disinflation as achieved under Chairman Volcker.” (2022, p. 1).

Given the nature of the current supply shocks affecting our weak Covid-battered economies, orchestrating another Volcker-style scenario by creating yet another deep recession is chilling. Besides, it would appear to be somewhat in conflict with the above assessment of former US Fed Chair Janet Yellen in 2019 as well as with the research of these two US Fed economists, Ratner and Sim, who suggest that the slope of the Phillips Curve is actually relatively flat and it has remained so for decades, for reasons that have little to do directly with the Volcker shock of the early 1980s.

While this was long established outside of the mainstream (for a review, see Seccareccia and Kahn 2019), numerous researchers in established circles have been writing recently about the flat Phillips curve. For instance, Engemann (2020), Del Negro, Lenza, Primiceri, and Tambalotti, (2020), as well as Del Negro, Gleich, Goyal, Johnson, and Tambalotti (2022), all recognize what had actually been obvious to many of us for a long time. The important implication is that, as Yellen (2019) recognized, the flatness of the relation implies an immensely high sacrifice ratio if pursuing a Volcker-style strategy (as recommended by Stanbury and Summers 2020), since it would require excessively high unemployment to get the inflation rate down by even a very small increment.

Yet, the conventional wisdom nowadays, which seems to willfully ignore this empirical evidence, still relies on some variant of the so-called New Keynesian Phillips Curve resting on the crucial assumption that the inflation rate responds to aggregate demand pressures as reflected in an economy’s rate of capacity utilization and/or the unemployment rate. If that were true, then this would advise the adoption of some “automatic formula” such as a return to some Taylor rule equation, as some conservative policy analysts are recommending, that would rest on an “inflation first” priority of central banking, which in the case of the United States would contravene its dual mandate.

However, evidence-based economics would suggest that the well-worn relation between unemployment and inflation does not actually exist, at least not in the form it is traditionally depicted by the mainstream. Since the 1980s, particularly during the disinflation era of the Great Moderation associated with falling unemployment and, even more so, when the US unemployment rate did fall significantly (as immediately after the Global Financial Crisis (GFC)), the inflation rate remained largely unresponsive and stayed close to the 2 percent inflation target even though the US civilian unemployment rate fluctuated a great deal from a double-digit level of 10 percent towards the end of 2009 to a low point of 3.5 percent just before the pandemic at the end 2019 and early 2020.

Apparently, for the mainstream, as it is now observable from recent central bank decisions to steer economies towards higher interest rates, what we have witnessed over the last four decades since the Volcker shock was some pure aberration. The current low unemployment rates, such as the US 3.6 percent unemployment rate in May, arising as economies recover from the pandemic, are now considered “unsustainable” low rates, even though the same central bank authorities deemed similar unemployment rates relatively sustainable in 2019 and early 2020. Now these low unemployment and high vacancy rates suddenly call for high interest rates and necessitate growing unemployment to prevent the acceleration of inflation.[i]

It is as if we have been abruptly thrust back to what were the confused arguments of the 1970s when economists like Milton Friedman had described those low unemployment rates resulting from the 1960s’ Keynesian expansionary macroeconomic policies as the cause of the accelerating inflation that had resulted during the 1970s. We now have reestablished a narrative with the same litany of arguments: governments have pumped too much money into the economy during the pandemic because of the massive deficit spending and because of the very loose monetary policy of quantitative easing and excessively low interest rates. These have now driven unemployment rates to unsustainably low levels that can only generate accelerating inflation. To prevent a galloping inflation, high interest rates have become an imperative.

The US Fed working paper on Kalecki’s economics, dated September 2021, but which appeared only recently, is a breath of fresh air. Ratner and Sim (2022) claim that the Phillips curve in the United States and the United Kingdom has been almost flat since the 1980s because of the significant erosion of the bargaining power of workers. This began during the Reagan and Thatcher years, and which was especially reflected in declining union density rates over the last four decades. Thus, the supposed triumph over inflation for roughly four decades, until the surge during this last year of Covid-19, cannot be fully attributed to the conduct of monetary policy by the US Fed and the Bank of England. The Fed working paper, therefore, casts serious doubt on the mainstream narrative, which posits that the policy of the late Fed Chairman Paul Volcker of large hikes in interest rates was responsible for taming the 1980s inflation. If the Volcker shock was actually not what caused the long-term change in the dynamics of the inflation rate since the 1980s, and until the current Covid-19 crisis, then what was the culprit that flattened the Phillips curve?

The main takeaway of their paper is clear: interest rate hikes could have helped but it was rather the class conflict — particularly the offensive against the working class — that stood behind the inflation debacle of the Great Moderation, which had long-term consequences. Putting it that way, this could sound quite subversive to many mainstream economists. Indeed, as Nick Peterson (2022) writes in the Financial Times: “coming from deep inside the Fed this is near heresy. After all, central banks have naturally long been in thrall to theories that made them the heroes of the story.”

However, the authors recognize that the ideas are not new at all. In an unusual display of openness to heterodox ideas, Ratner and Sim give credit to post-Keynesian economics, and especially to the famous Polish economist Michał Kalecki (1943, 1971), who was a contemporary of John Maynard Keynes and co-discoverer of the principle of effective demand, apart from advancing several of Keynes’ contributions. Indeed, Kalecki, along with such less well-known writers as Henri Aujac (1950), was the founder of the view that inflation is primarily an expression and the outcome of class conflict (or conflicting claims) over national output by the way firms price their products vis-à-vis workers’ wage setting.

As a tribute, the authors replace the New Keynesian Phillips curve with a more general “Kaleckian” Phillips curve, as they call it, in which they include an exogenously-determined parameter impacting on its slope that reflects the degree of bargaining power between workers and firms.

We believe that their main contribution is the introduction of the “Kaleckian” Phillips curve to the canonical Two-Agents New Keynesian (TANK) model with monopolistic competition (in this case, the two agents are workers and firms). This tweak implies that, apart from the usual bargaining over wages, there would be bargaining over the product price (or monopoly rents). Workers through labor unions would try to keep the markup as low as possible so that wages and the labor share would be larger, whereas firms would try to do the opposite. The degree of bargaining power would determine the winners and losers in the distribution of monopoly rents. It follows that the “Kaleckian” Phillips curve explains why the inflation and unemployment rates have been relatively low since the 1990s — without considering the recurrent crises and the most recent inflationary episode — because the bargaining power of workers has been extremely limited.

Apart from that, the model has additional interesting aspects, of course, within the obvious constraints of the DSGE framework, which, to many of us, is problematic (see Storm 2021). For instance, the fight over the share of monopoly rents involves two different and opposed channels that impact the level of output and the NAIRU. When the degree of bargaining power is roughly balanced, small increments in the bargaining power of firms have a very positive impact on output and employment since the investment incentives are higher, whence the job creation channel dominates. In contrast, when the bargaining power of firms is particularly high, firms prefer to increase their profits by selecting the highest markup at the expense of output and job creation; thereby the markup channel dominates. But there is no reason why the degree of bargaining power would vary over time because it is an exogenous parameter. Thus, within the model, involving the standard DSGE assumptions of “rational expectations,” a steady decline in the bargaining power of workers is unexplained (and conceivably “irrational”) from the point of view of labor unions since this simply goes against workers’ interests.[ii]

On the other hand, the authors contrast the “Kaleckian” Phillips curve with respect to the New Keynesian Phillips curve in response to a positive demand shock. The results are different because, in the former, the slope of the curve changes with the degree of bargaining power between firms and workers whereas, in the latter, it remains constant regardless of the degree of bargaining power. That is because in both models there is bargaining over the wage but, in the “Kaleckian” case, there is also bargaining over the markup and product price. As a result, a positive demand shock in the “Kaleckian” model would amplify the impact on inflation and diminish it on employment.

Finally, the paper presents some time-series and cross-sectional evidence for the United States and the United Kingdom that leads to a significant positive relationship between the bargaining power of workers and the slope of the Phillips curve, which would be supporting their model. Nevertheless, the econometric evidence does not discard the possibility that the respective monetary policies themselves did have a significant impact as well. In the authors’ own words: “The estimation results point to a possibility that both the post-1980s disinflation and the concurrent flattening of the Phillips curve owe as much to the labor market institutions of these two countries as to the monetary policies of these two countries.” (Ratner and Sim 2022, p. 26).

We appreciate their research findings and find ourselves broadly in agreement with their conclusions about the flatness of the Phillips curve. This is a view, however, that is somewhat inconsistent with the current hawkish position of the US Fed that seems now to believe that the short-run Phillips curve is more hyperbolic rather than flat, otherwise its whole current strategy of wringing the inflation out of the US economy through strong doses of higher interest rates would be futile, since we are not experiencing primarily a demand-side inflation. We have already argued above and have also discussed elsewhere (see Seccareccia and Khan 2019, Lavoie and Seccareccia 2021, and Seccareccia 2022) that the Phillips curve is quite flat for a very large relevant range of the unemployment rate.

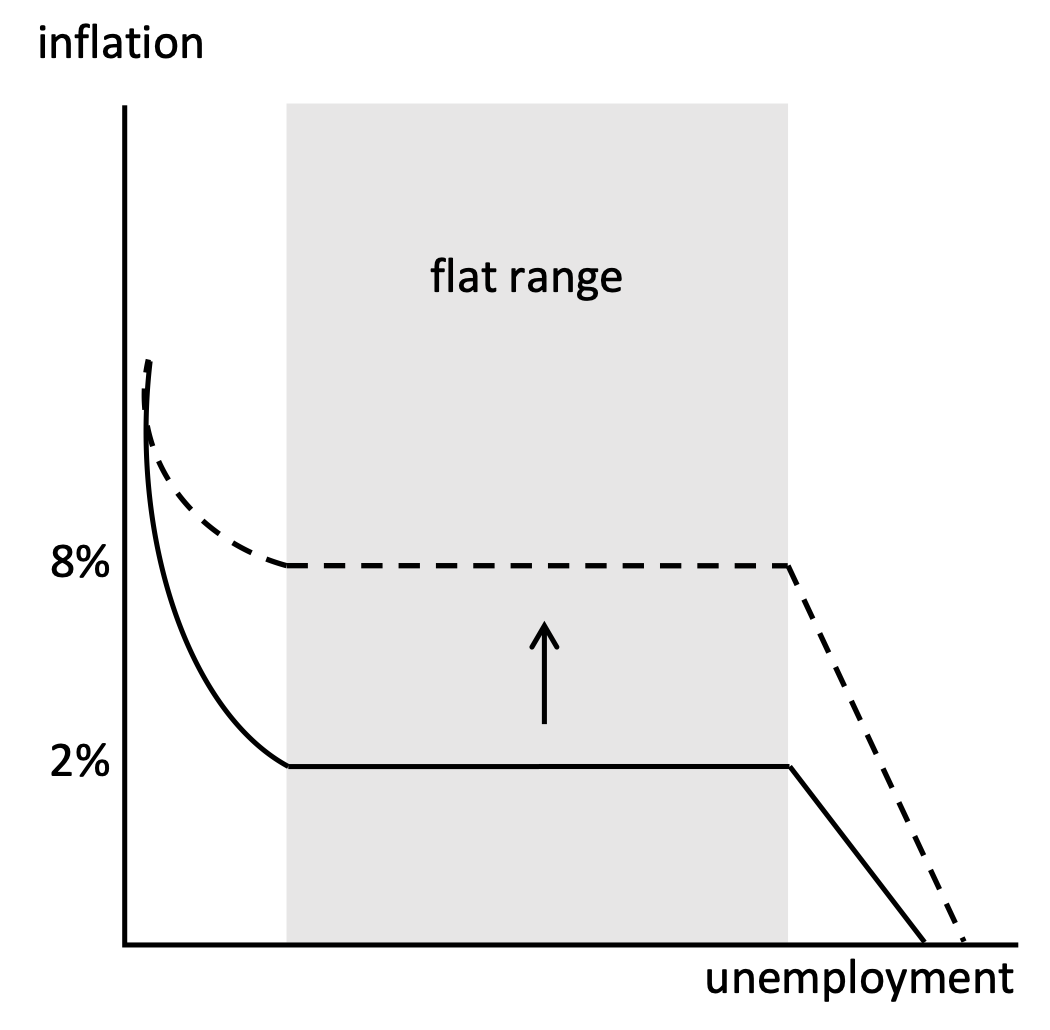

As shown in Figure 1 below, cost factors, such as international oil price shocks, can shift the whole curve upwards, but if we are in the broad flat range, the central bank cannot act on it to influence the current inflation unless it believes that the economy has reached the extremities of the curve (in this case at the extreme left). Indeed, as US Fed chair Jerome Powell has quite candidly admitted: “What [the Fed] can control is demand, we can’t really affect supply with our policies…so the question whether we can execute a soft landing or not, it may actually depend on factors that we don’t control.” (Jerome Powell (2022) cited in Shapiro (2022)). Although the paper by Ratner and Sim does not look at very recent evidence during the pandemic, the burden of proof rests on central banks to show (rather than assume) that the current inflation is primarily a demand-side one, where the economy now finds itself within the extreme left in the upward-sloping section of the Phillips curve.[iii] If the economy is still in the relatively flat range, and that all that has happened recently is that supply-side shocks have shifted the whole flat range of the curve to a higher range as firms have been marking up these sustained cost changes, then these interest rate hikes will merely slow down the economy with minimal impact on the overall inflation rate. [iv]

Figure 1: Phillips Curve with a Significant Flat Range

While appreciating much of what Ratner and Sim analyze, we do, however, have some further concerns. Up to this point perhaps anyone with some knowledge of Kaleckian economics would notice that the Ratner and Sim model is far from representing the core ideas of the celebrated Polish economist. First, the model sticks to Say’s Law in the sense that it is saving that determines investment as in a pre-Keynesian loanable funds world. Kaleckian economics, on the contrary, sticks to the Keynesian principle of effective demand, whereby investment is autonomous, saving is endogenous, and the rate of interest depends on central bank policy (Kalecki 1943). Thus, profits are determined by consumption out of profits and investment, assuming workers spend all their income. This important theoretical departure from New Keynesian economics led to the famous Kaleckian aphorism (wrongly attributed to Kalecki): “capitalists earn what they spend, and workers spend what they earn.” (Lavoie 2022, p. 332).

Furthermore, the technology assumed by the authors’ model depicts constant returns to scale and diminishing returns to labor and capital, implying increasing marginal costs. By contrast, Kaleckian models assume constant marginal costs (up to full capacity) and so “higher real wages will not necessarily entail a reduction in production and employment” (Lavoie 2022, p. 314) such that the labor demand curve would be upward sloping. Ultimately, output is constrained by demand both in the short and long run. In contrast, the model of Ratner and Sim (2022) entails that steady-state output and employment is supply constrained by the level of saving, in turn determined by workers’ and firms’ preferences and a natural rate of interest that would pin down the value of the NAIRU.

Finally, we suspect that Kaleckians might be uncomfortable in calling the paper’s curve a “Kaleckian” Phillips curve. While it is true that the degree of bargaining power affects the Phillips curve in the authors’ model, the former is just a parameter exogenously determined, i.e., given the bargaining power of workers, the NAIRU and the natural rate of interest are pinned down and are unique, which is inconsistent with Kaleckian economics. Kaleckians, and more generally post-Keynesian economics, explicitly reject the existence of a NAIRU or a natural rate of interest. Therefore, a genuine Kaleckian Phillips curve would portray a horizontal segment that might depend on the bargaining power of workers, among other institutional factors but, as remarked by Kalecki (1943) in his “Political Aspects of Full Employment”, the bargaining power depends on the rate of employment and monetary policy, which is itself influenced by class conflict as well.

As we have already discussed above, the shape of a genuine Kaleckian/Post-Keynesian Phillips curve could depict a flat part but surrounded by downward-sloping segments or even an upward-sloping segment given by a hypothetical full-employment situation, as suggested by Seccareccia and Khan (2019). It is also very likely that the trends in the unemployment rate have affected the bargaining power of workers and the conflict over the distribution of income (Seccareccia and Matamoros Romero 2022). Last, partly as a result and since monetary policy is embedded in the class conflict, the Volcker shocks, and the subsequent high-interest rates policies — up to the financial crisis of 2008-09 — should be seen as part of the policies that eroded the bargaining power of workers and not as an independent phenomenon, as Ratner and Sim seem to posit. Central banks would themselves be taking sides in the class struggle.

But there is more going on than just the conflict between workers and firms. As suggested by Seccareccia and Lavoie (2016) and Seccareccia and Matamoros Romero (2022), there are also the rentiers, much analyzed by Keynesian economists who may have conflicting interests that have long been understood by post-Keynesian economists. Rentier interests have played an important role in what occurred historically. Owing to the growing importance of the financial sector, we have seen how the rentier perspective hijacked monetary policy through the adoption and framing of inflation-targeting monetary policy regimes since the last major inflation of the 1970s and 1980s. In fact, much of the current political pressure to revive the “inflation first” monetary policy commitment through some formal adoption of an official Taylor rule reaction function in the United States is part of this rentier revival in the macroeconomic policy agenda that waned after the financial crisis.[v] Ratner and Sim (2022) are completely silent on this matter of rentier interests, which has been also of great concern to many non-mainstream economists and which transcends the traditional two-class analysis discussed in their paper.

______

[i] In fact, the model by Ratner and Sim (2022, p. 17) predicts that a low inflation-low unemployment environment would be consistent with high vacancy rates. This is because labor bargaining power would be particularly low, thereby firms would have much higher incentives to increase job postings. Hence, following the model, the current high vacancy rates in the United States would be in line with a low labor bargaining power, and the inflation surge would be unrelated to any supposed tightness in the labor market.

[ii] We are grateful to Servaas Storm for raising this point. Also, to be fair, Ratner and Sim (2022, p. 16) recognize that the degree of bargaining power is made exogenous for simplicity, but assert it could potentially be made endogenous in a more sophisticated DSGE model, despite being a challenging task. However, we have serious doubts that doing this in a DSGE framework would retain the Kaleckian insight that a long-run fall in the bargaining power of workers would be affected by monetary policies that are biased against workers’ interests.

[iii] A recent paper by Shapiro (2022) defending the Fed’s policy of raising rates suggests that, perhaps, about one third of the recent inflation arises purely from the demand side while the rest would be either “ambiguous” or of a supply-side nature, or to quote Shapiro (2022): “These results showing that factors other than demand account for about two-thirds of recent elevated inflation …” In our opinion, this methodology is somewhat flawed and highlights why understanding Kalecki’s model is important. Despite the complicated technique based on rolling regressions to generate predicted monthly values for quantity and price, his theoretical framework seems to rest on an elementary textbook division whereby, if the actual monthly values of price and quantity are both above or both below their predicted values, then it’s a “demand-driven” phenomenon, while if the values are of opposite signs, this would be a “supply-driven” outcome, analogous to the elementary textbook demand/supply analysis. Unfortunately, this binary distinction could easily confound a cost-push inflation arising from increasing business markups with a pure demand-side inflation, as might be the case in recent times as the economy is recovering from the pandemic, where presumably price and output would be moving upward in tandem vis-à-vis their predicted values as well as the price markup! By contrast, Ratner and Sim (2022) allow for this Kaleckian markup effect in their specific model. Many recent studies suggest that rising markups are ubiquitous and have been rising also because of growing industrial concentration. See, for example, Bräuning, Fillat, and Joaquim (2022), Konczal and Lusiani (2022), and Storm (2022).

[iv] This flat range is certainly well recognized at the US Fed, as Yellen (2019) points out about the importance of the “sacrifice ratio” along the flat range: “It’s important to point out, however, that a flat Phillips curve has a downside, which is that it raises the so-called “sacrifice ratio.” The sacrifice ratio measures the cost in terms of higher unemployment to lower inflation should it rise too high. With a flat Phillips curve, it’s necessary for monetary policy to create a good deal of slack in the labor market to return inflation to levels consistent with price stability. … Finally, even if the Phillips curve is quite flat over some range, it’s conceivable that it could become a lot steeper if unemployment is pushed to very low levels: that is, it may be nonlinear at very low unemployment. There is some evidence of such nonlinearity, so it’s a significant policy concern.”

We believe that this describes reasonably well what has been said for years by post-Keynesian economists. What at the US Fed may not be understood is that flat anchor is not governed only by inflationary expectations impacting on wage growth, but also other supply-side/costs that can shift the whole curve as shown in Figure 1 above.

[v] This well-known Taylor rule is discussed, for instance, in Seccareccia and Kahn (2019), and was rejected by former chair Janet Yellen for possible adoption at the US Fed (see Davidson 2016). This pro-rentier “rule” rests on three elements: (1) a “natural rate” of interest that central banks would sustain over time, (2) a deviation between current inflation and the 2% inflation target, and (3) an output gap. Since the output gap is of concern to policy makers uniquely as a predictor of future inflation based on some standard Phillips Curve model, then monetary policy becomes focused solely on how to get the inflation rate back on target through interest rate policy, while preserving a stable positive real interest rate over time. As we have said, this pro-rentier Taylor rule policy framework would actually contravene the US Fed’s dual mandate since the so-called output gap in the equation is only of concern to policy makers for inflation-fighting purposes. Instead, the minimization of the unemployment rate towards a full employment level is not directly of any concern since it is notan independent policy objective within the Taylor rule framework unless one defines the NAIRU as full employment, which it is not.

See original post for references

The Philips curve is one of those clear examples of Cambell’s law in action.

And one of my favorites, Sartre’s counterfinality.

“Note that it is not uncommon for the research arm of an economic institution to be intellectually ahead of its policy arm; the IMF’s researchers have published many forward-thinking papers that appear to have had little to no impact on how the IMF runs its programs.”

Yeah duh … ideological networking flexian picks to keep the upper crust in leisure class status is as old as Rome et la …

I shared this last month in comments about the time the paper first dropped but in case readers missed it, Bill Mitchell’s worthwhile take on the ‘Who Killed the Phillips Curve’ paper: US Federal Reserve Bank economists going Marxist on us

I’ll never forget the day we did the Philips Curve lesson in one of my macroecon courses. First the prof draws the standard curve on the board, with the nice even downward slope. Then he shows us what the actual data look like, and its basically just a swarm of points with no apparent relationship. Looking at the time series, there was no obvious connection between inflation and unemployment – sometimes they moved in opposite directions, sometimes they moved in unison, sometimes a change in one didn’t seem to affect the other at all.

And so, after showing us that the real world data didn’t fit the theory at all, we (of course) proceeded to use the Philips Curve concept throughout the rest of my degree.

Sounds familiar. When I did economics in the 1980’s our senior professor (who was unusually frank for a mainstream economist), used to talk about ‘the crisis in macro’. It took me a while to realize that what he meant was that the real world data didn’t fit all the models we were being forced to learn about.

This sounds to me exactly like a problem that should utterly and forever discredit neoclassical economics as a fraud equivalent to sightings of Bigfoot. Literally. (And I’m being literal in applying the word “literally.”)

LOL! I’ll unfortunately probably have to wait until after I’m dead before that happens. The article points out that even the paper still uses the assumption of an increasing marginal cost curve. There have been several well done research papers dealing with the measurement of firms real world margin cost curves and all of them have come back saying well in excess of 2/3 of businesses face a flat or downward sloping margin cost curve. Note a downward sloping cost curve implies natural monopoly pricing behavior when at scale. On top of it, one of those papers was done by Allen Blinder a former Vice-Chairman of the FED. So much for learning anything.

But our professors did not turn a blind to the data. They simply used the data that fit their models. The curves crossed in 1998 when US unemployment was 4% and inflation was clocked at well below 2%. Both NAIRU and the Phillips Curve should have both been deposited in the ash can of history, economists always prove that they are the superior shamans. Unless the profession undergoes a Khunian revolution they will still be debating this years from now.

OMG! When I was a first year graduate student in Economics I recall a professor stressing that you needed to mentally construct the “intuitive” economic model first mathematically and then prove it out with data. Trying to find a model to fit the data… “Data Mining”… was bad economic science.

Just as you mentioned this leads to finding the data that fits your “theoretical” model. But in the real world that’s bad science, the data should inform your understanding.

25+ years on now I spend many of my working hours doing “Data Mining”. I’m employed, in part, to produce the best forecasts for various company models. If the number of fairies dancing on the head of a pin was a data point that meaningfully moved my forecast then you can bet I’m going to use it.

Now do I really think the number of fairies dancing on the head of a pin has a causal effect on what I’m actually forecasting… Well since I can say it’s not my job to forecast the behaviors of Peter Pan & Captain Hook (now that might be fun) the answer is no. This is where REAL science comes in and it appears to be completely discouraged in most graduate econ programs.

Let me take a side detour for a second and swing back to graduate school… often when trying to model economic concepts… the ones your taught to first put together mentally… you will discover that you can’t find the specific data you need for your model. So you, again, go off and look for similar or correlating data that fits your ORIGINAL concept and can be used as a substitute. The famous one in econ circles for this category – at least 25 years ago – was to substitute smoker data for people who were short term oriented vs long term oriented.

Anyhow back to why econ isn’t practicing real economic science by discouraging Data Mining behaviors… I’ve admitted I don’t believe the number of fairies dancing on the head of a pin is a real causal behavior for what I’m trying to forecast. As I said in my current job I’d use it, but what I’ve learned over and over again over the past 25 years is that something else is going on. Yeah that variable is indeed important – it’s not just fairies. If I don’t figure out WHY the fairies are so good for my model then my model has a weakness I can’t explain or foresee potential pitfalls for.

Which leads me to recommending data mining for all economists! If you find fairies, it’s not a new economic theory, not by itself at least. If you find fairies you’ve most likely found one of 2 things, WHICH, if you follow the fairies you’ll find: 1) a correlating variable for a data point you need, 2) a data point that challenges your original model assumptions, 3) nothing which means you need to keep digging.

However, as you mentioned, most econ programs only teach you to find the data that fits your model which is predisposed to all your prior economic ideological teachings. They don’t teach you how to solve and economic modeling situation given all the real world data. When I first encountered MMT I struggled because I was taught to put it into my existing economic ideological framework. Fortunately by 2009 I had been working for a financial institution and I was able to take the business operational information (the real world data) and compare it to by ideological teachings and to MMT. MMT was the correct theoretical model for how banking works – not what I was taught in college or graduate school. Most econ programs tell you to not do data mining because it could lead you to fair theories, which is true, but it also means they are not teaching you how to practice science which can lead you to newer and better theoretical frameworks.

They prefer to employ “policy based evidence making” in the spirit of Sir Humphrey Appleby in “Yes, Minister/Yes, Prime Minister …

All these descriptions of economics as it is taught in university and economics as we are witnessing it here on earth make me feel as though the world has turned the opposite way on its axis. How can academics know that something is not true and yet teach the false/lying thing anyway? It sounds as though everyone in economics graduated from the School of Trump! It is very difficult to know truth from fiction anymore.

https://en.wikipedia.org/wiki/The_Emperor's_New_Clothes

The Metaphor’s New Clothes:

https://viruscomix.com/page434.html

— Subnormality, webcomic by Canadian cartoonist Winston Rowntree (pseudonym)

I do wonder how much of the social sciences suffers the same problem…

Paging Lina Khan for her input and policy actions.

Stoller’s work on monopolies, antitrust and similar would be intriguing overlays or supplements to the Kalecki expositions. That up-shifted Philips Curve and the flow of, er, benefits therefrom, now playing around the country.

“Prime age labor force participation is still below where it was before Covid….”

And as much as Covid is now a factor in labor force participation, the trend has been accelerating downward since about 2000.

The healthcare system’s focus on profit, the addictions, the shootings…it all adds up in affecting labor force participation. And no, just importing workers doesn’t really solve any issues. That’s just a churn that is often induced by some other trauma in another country.

But this will never be a country that can address priblems directly and deal with them with any sense of urgency or immediacy because of the infantile “confidence fairy” of the business world. It’s mentioned in the link to the Kalecki article:

“….Under a laissez-faire system the level of employment depends to a great extent on the so-called state of confidence. If this deteriorates, private investment declines, which results in a fall of output and employment (both directly and through the secondary effect of the fall in incomes upon consumption and investment). This gives the capitalists a powerful indirect control over government policy: everything which may shake the state of confidence must be carefully avoided because it would cause an economic crisis. But once the government learns the trick of increasing employment by its own purchases, this powerful controlling device loses its effectiveness. Hence budget deficits necessary to carry out government intervention must be regarded as perilous. The social function of the doctrine of ‘sound finance’ is to make the level of employment dependent on the state of confidence.”

This is part and parcel of way there is such a cottage industry of magical thinking books and trinkets….

So what about these interest rates? (That are still extremely low by historical standards). I have another rant for that at another time. Going to piss off many about the fetishization of mortgage ownership…but I see that a new Hudson post has appeared…

Didn’t someone write a whole book debunking the economics profession as being advocates for a political agenda? Its on the tip of my tongue… oh yeah, Ecconned. So why is anyone surprised that policy is a political agenda, not what the limited data says.

Our family friend Paul Sultan invented the so-called “Phillips Curve” prior to Phillips in 1957 in his textbook Labor Economics. Paul Sultan taught at Southern Illinois University in Edwardsville for many years and lived down the street from my father. When he died I inherited his desk, which I’m sitting at and typing this comment right now. Google his name and you will see I’m telling the truth! Anyway, I love Naked Capitalism. Thank you!

Also, in his description of the relationship between unemployment and inflation, he writes:

“The line relating unemployment to inflation… is strictly hypothetical, but it suggests that the tighter the employment situation the greater the hazard of inflation.”

See here: https://www.richmondfed.org/-/media/richmondfedorg/publications/research/economic_review/1985/pdf/er710502.pdf

Does anybody factor in the de-industrialization of the USA economy which is facilitated by China’s ability to substitute its industry for the industry the USA is giving up? How long can this substitution continue to increase? As long as it is more profitable to let China do all the manufacturing, why should the USA capitalists put their money into less profitable increases in domestic capacity? Leaving out de-industrialization and de-dollarization is leaving out the main factors influencing our economy. How can you have a good analysis and prediction when you leave out the most important factors in your models.

The Belt and Road Initiative is also a factor. It pours tens of trillions of USD into the world economy, albeit in the form of loans probably never to be repaid, which will eventually be written down in exchange for equity in ports, railroads, etc., dedollarzing all the way.

Funny this. Gee why would anybody want to kill the goose that laid the golden egg; i.e. the American worker.

A certain portion of society, not content to just have golden eggs, now want the whole goose. Well, at this point there might not be much left. Good luck with that.

Well wow – “right between the eyes” – It should be a given that if we have effective bargaining power for labor/wages on the one hand we should also have effective bargaining power to control prices and markups (aka bargaining power for effective price controls, no?). Because one without the other is useless. That is so obvious why hasn’t anybody said that repeatedly? And of course the Phillips Curve is a blunt instrument – it isn’t even an instrument, it’s just a convenient stereotype. Because there is such a variety of demand. Somebody should do a complete index of demand. And so how can Powell admit “we can’t effect supply with our policies” and then go totally brain-dead and invoke Volcker as the best way to control inflation (aka just kill the economy with brutal inequality)? If we allow the Fed’s benign goal of 2% interest rate over the long haul it produces steady-state inflation. But monopolists get impatient and before long they pull out ahead of inflation while they loudly blame it on demand. Because if wage demand is crushed, supply can make a brief but shining windfall. And even without this intermittent supply-side greedy little manipulation, a 2% interest rate all by itself can spin a balanced economy out of its orbit unless both supply and demand are in sync. Equitably that is.

I agree accounting for labor pricing power is critical to a clear understanding of pricing power. It isn’t only driven by unions, it is also driven by supply and demand of labor as we are seeing today.

People tend to forget about affects of long term trends. Globalization has been causing a steady net increase in labor supply for US businesses for decades (cheap labor that destroys local bargaining power completely), and now that is reversing. That is and will continue to put upward pressure on wages until the unwinding of globalization stop or reverses.

I like that phrase, I wonder how much of that actually goes on?

isn’t this an example of “just because you can plot two variables on an xy axis, doesn’t mean you should” and the old cautionary tale “height increasing with age” math story?

i want to go to this ceteris parabus world. it sounds more fun than Laputa, where we live now.