Yves here. Richard Murphy describes how companies are preferring dividends to employee wages as if that’s a bad thing!

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

Having taken a quiet Friday afternoon I posted this thread to Twitter this morning:

We are continually being told by Tory politicians and the Bank of England that businesses must not give employees pay rises that might match inflation because this would create an inflationary spiral. But what about dividends? Aren’t they the real cause of the problem? A thread…

The data I am using in this thread was researched by me with @adamleaver and others at Sheffield University Management School and Queen Mary, London, which is available here. https://productivityinsightsnetwork.co.uk/app/uploads/2021/06/PIN-Report-29-6-21-FINAL.pdf

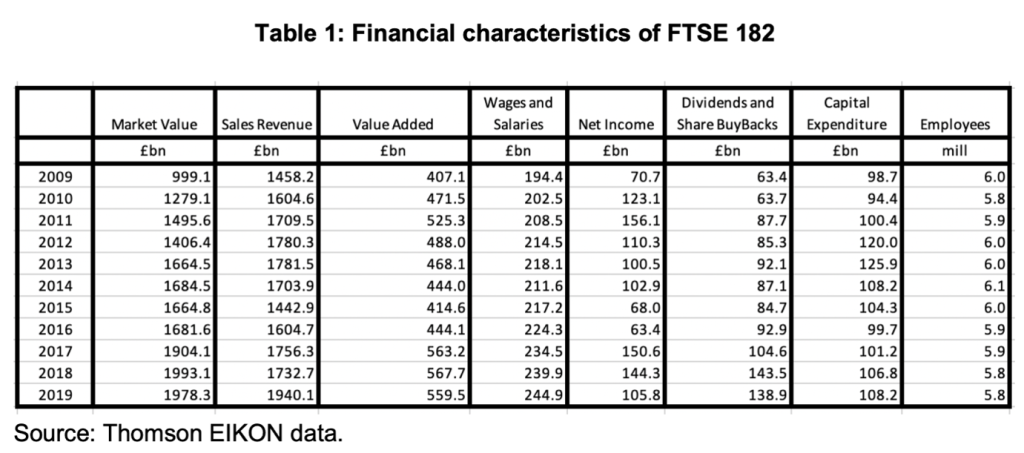

We researched 182 companies that had continuously been in the FTSE 100 from 2009 to 2019 to provide data for the research. Some of these are amongst the biggest companies you’ve heard of. Others are somewhat smaller. The sample is broadly based.

The findings were pretty staggering. What we were looking at was:

- Profitability

- Rewards paid to shareholders

- Employee costs

- Investment

- Borrowing

- What companies were investing in

What was apparent from the data was how odd it was. If 2009 is ignored as a year of crisis the value of these companies grew by 54% in a decade but sales only grew by 21%, and added value was further behind at 18.6%.

What is also apparent is that whilst employee salaries grew by 21%, profits on average fell but shareholder reward payments like dividends more than doubled with those at the end of the decade 218% above those at the beginning.

Notably, the number of employees in these companies was virtually stagnant over the decade and capital investment went up by only 14%, with some variation on the way, with 2012 and 2013 being the best years by far.

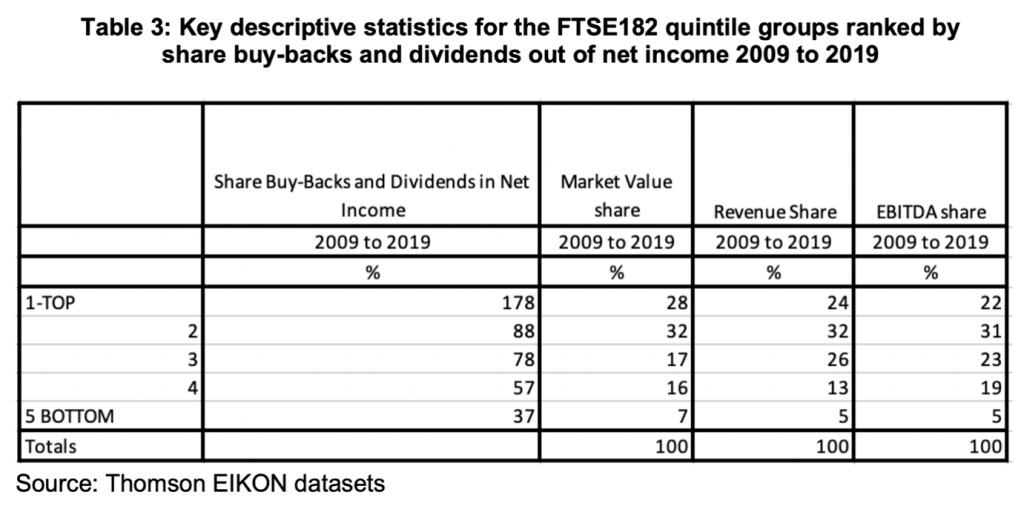

But this is not all that was weird. We then split these companies into five quintiles, which simply means we ranked them into groups of 36 or 37 companies each. We ranked them according to the percentage of their net profits that they paid out to shareholders and got this data:

The top 36 companies paid out 178% of their profits on average. The next 36 or so paid out less: they only rewarded their shareholders with 88% of the profits earned. Together these companies represented 60% of the market value of the companies surveyed and 56% of all sales.

As is apparent from the data, smaller companies paid out less of their earnings to their shareholders. Relatively speaking they were also worth less.

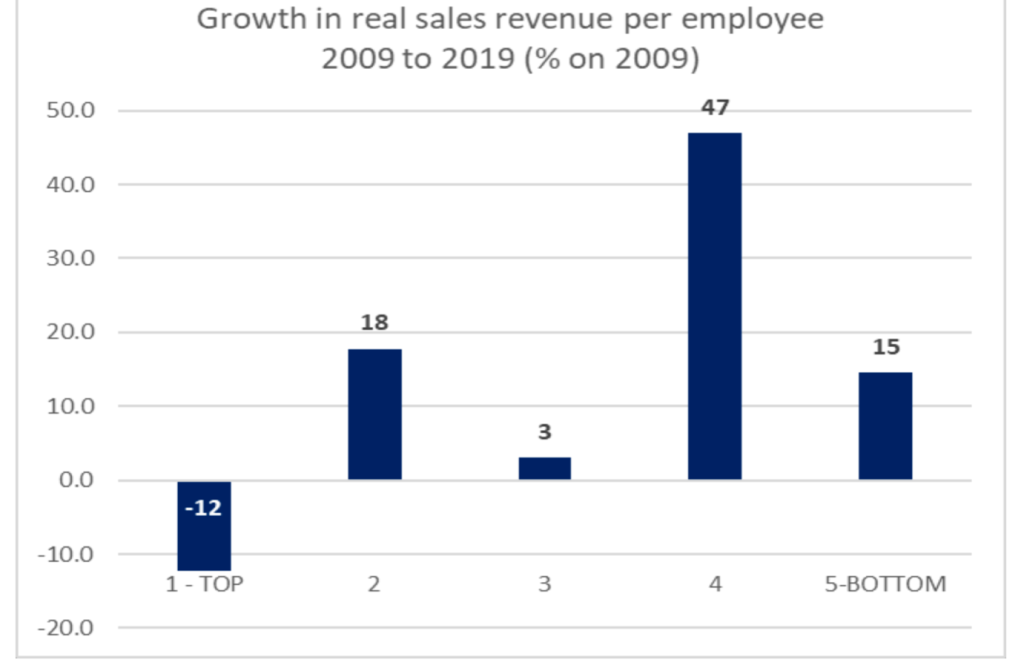

However, looking at the data on how these companies actually behaved suggested that these valuation differences were hard to justify. Take real sales growth, for example where real means that we have eliminated the impact of inflation:

The companies overpaying dividends actually saw their real sales fall. The second group fell well behind the fourth group and hardly bettered the fifth. Value was clearly not related to ability to really grow a company.

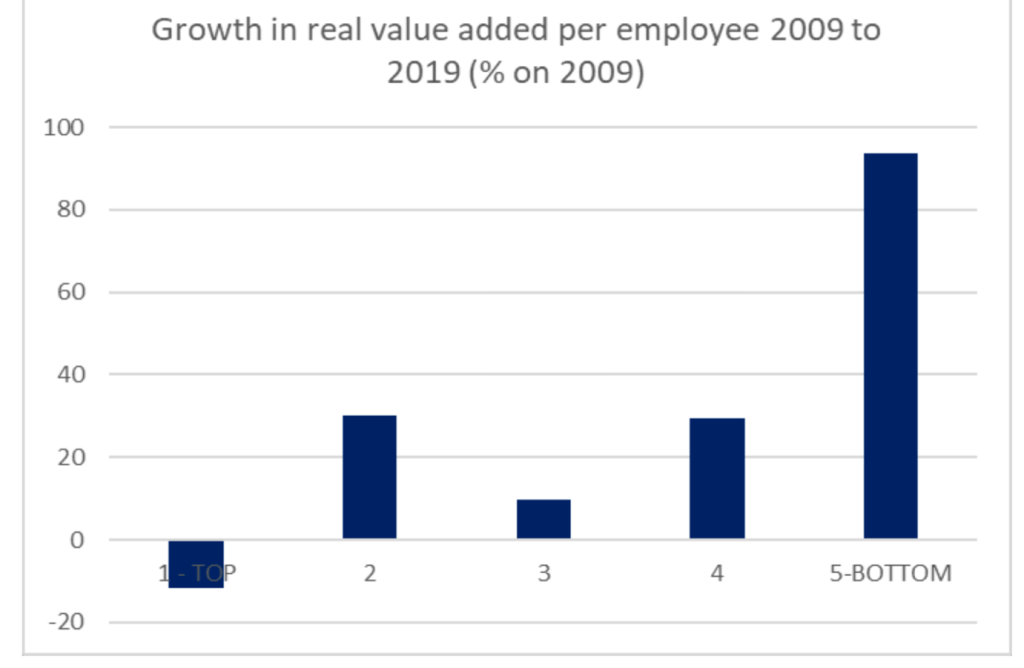

Then we looked at real added value per employee (i.e. again, inflation adjusted). This might be thought of as a measure of just how much of the growth within a company is really generated by its own skills and those of its employees.

Again, the top group did really badly. Their performance actually declined. The companies paying out least by way of dividends out of earnings did best, by a long way.

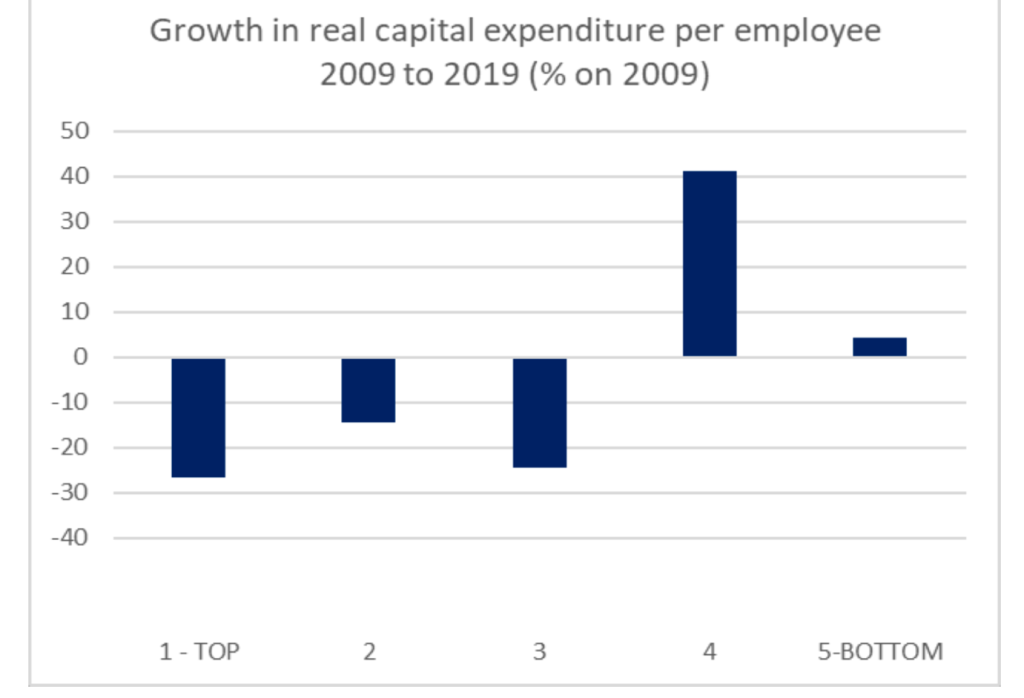

This may not be surprising: we then looked at investment in capital per employee, with the comparison by employee letting us rank the companies consistently whatever their size:

The companies who paid out less by way of dividends invested more in new capital equipment per employee. No wonder their real value added per employee was better.

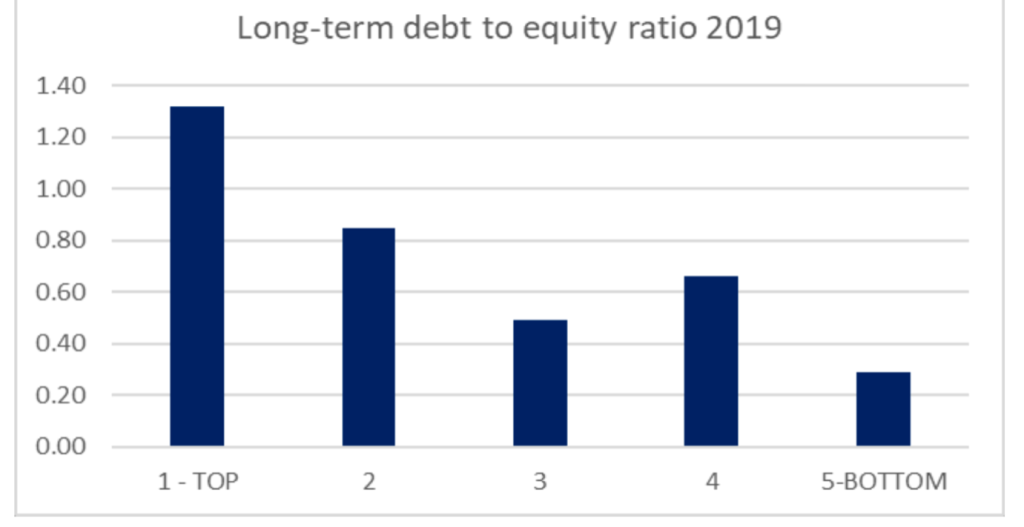

So, then we asked the obvious question, which is how do these companies that pay out more by way of dividends than they earn by way of profit manage it? They do, of course, achieve it by borrowing, much more than average:

The less a company borrows and the more it relies on shareholder funds to support its activities (including profit not paid out by way of dividends) the more resilient it is against financial shocks, because it still has the capacity to borrow when the unforeseen happens.

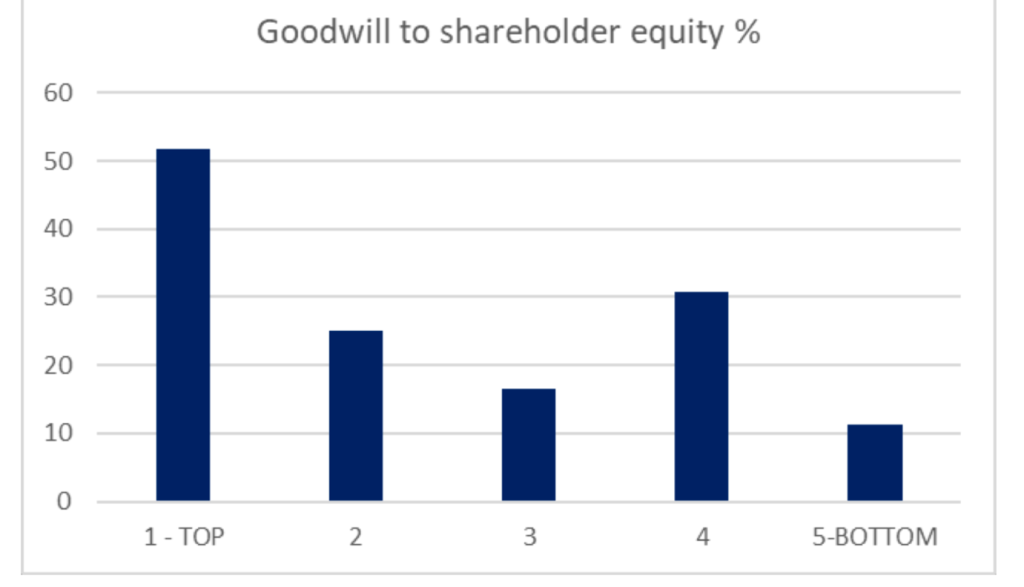

There was another big difference amongst the companies. Those who paid out most by way of dividends had the highest ratio of goodwill to shareholder’s funds on their balance sheets:

Goodwill is the amount paid to buy another company over and above the physical equipment bought. Bluntly, it’s the price paid to get your hands on the future profit another company might make. The high dividend paying companies are much more willing to do that than the low dividend paying companies.

Maybe this is because they know they lack the ability to grow their own companies that those paying fewer dividends seem to possess.

I do not pretend that this research answers all the questions that could be addressed on this issue. It’s also most certainly not investment advice. But it does suggest a number of really important things.

First of all, a majority by value of the FTSE 100 has, over a decade, been paying out almost all, or much more than its profits earned by way of dividends to shareholders, which is staggering.

Second, these companies borrow the money to pay out these dividends. They seek to turn borrowing into excess dividend payments in relation to sums earned to inflate their stock market values, which seems to be working as the companies doing this dominate the FTSE by valuation.

Third, this suggests that these companies are much more interested in financial engineering than they are in actually creating real value within their companies. How they might do this is suggested in a paper I have co-authored here. https://www.sheffield.ac.uk/media/28677/download?attachment

Fourth, as a result these companies under invest, except in buying other companies, in which they might overinvest, creating risk for their shareholders, and employees of course.

Fifth, by looking at those companies that decide not to pay out nearly as much by way of dividend we can see that the behaviour of those companies paying excess dividends is a choice, and not necessity. No law requires them to behave this way, in other words. Their recklessness is chosen.

But, and this is key, the larger companies (by value and sales) who focus on over-paying dividends as if it is their corporate purpose do create real victims in the process. They achieve their result by suppressing wages and real investment, so we have poor pay and productivity.

The companies that overpay dividends also increase their borrowing, putting their shareholders, employees and the economy at large at risk.

And by over-investing in buying other companies rather than in creating real value-added through their own abilities they stress their own balance sheets, and also promote overvaluation of the FTSE as a whole, which is only a short-term gain.

Which brings me to another core issue, which is why do the managements of these companies seek to exploit all those that they engage with, from lenders, to shareholders, to employees, by pursuing these policies? There has to be a reason.

Of course, there is. The management of companies screwing their companies to pay excess dividends do it to inflate the share prices of those companies. And their directors’ bonuses are almost always related to increases in that share price. In that case their exploitation pays.

So, when the argument is made by companies (usually the largest ones) that they cannot pay inflation-matching wage rises, what they’re actually saying is that they want to continue paying inflation-busting, and very often unearned, dividends instead.

The message is that these companies don’t want to pay inflation matching pay rises because they’re not interested in employees, the future of their companies, their sales or keeping anyone happy so long as they can by financial engineering keep turning borrowings into profits.

Not every company is guilty of the financial engineering that is going on. The Institute of Chartered Accountants in England and Wales is guilty of enabling it by the guidance it issues on how dividends can be paid, which lets this abuse happen. And corporate greed is guilty of exploiting that advice.

But the truth is that if the largest companies acted responsibly and stopped driving up dividends by making payments they cannot justify they could make the wage payments the UK economy needs them to deliver now to prevent many of their employees falling into poverty.

If business acted responsibly in this way it would also set the tone for all wage settlements. That it is not doing so is by choice. And that choice must be challenged. Even shareholders are at risk from what is happening. This behaviour must end, and now is the time to stop it.

Simple changes to the law could prevent this: Adam Leaver and I have presented those rules to relevant government departments during discussions on audit reform but big business has lobbied hard to keep this situation, and has won it seems.

As a result the likelihood that shareholder rewards will continue to outstrip pay, whilst fuelling inflation and imposing hardship is likely, and all to feed the greed of managers who seem to get to the top of a company and see their once-in-a-lifetime chance to get rich quick.

Finally, my thanks to co-authors Adam Leaver, Colin Haslam and Nick Tsitsianis and Sheffield University Management School for enabling this work to happen. The opinions here are all my own though.

We The People deserve to get our dividends. And we can get our just due “dividends” from the “investing” our government has – in this case The Federal Reserve – has done with our very own money that belongs to each of us, on our behalf.

Bernie Sanders should introduce a bill that requires the Federal Reserve within 6 months to sell it’s roughly $9 trillion balance sheet of assets, and distribute the proceeds to us, the People who paid for those asset purchases and to whom they belong to by right of ownership, by sending every US citizen a check.

I believe that would be approximately $25,000 for every person – $9 trillion divided by 350 million.

It’s only fair. Every single American has invested their hard earned labor via Fed asset purchases, finally get back what belongs to them.

That’s not at all fair. Only taxpayers should get the payout. That’s a whole lot less than 350 million people.

Fed asset purchases were not funded by taxes but by the creation of money out of thin air, because reasons. Every citizen has as a legitimate claim as any another.

IMO, this is must read. I think this is not noted in the article but I believe that those, the largest and most reckless of the companies are probably those that lobby the most and influence the most on short sighted politicians that cannot see beyond stock exchange values. Possibly, the revolving doors involve mostly people from the greediest companies. That would explain a lot about the idiotic stance of current crops of politicians.

I wish the authors of this really good essay would be able to explore these two other issues.

While the authors of this article focused on the FTSE 100, the same problem occurs in the US.

Using SP500 data, I’ve compared company earnings to the sum of dividends paid and stock buybacks over the past decade. Over that period, earnings were never able to cover the shareholder payout, and the gap has been increasing. Other indicators, such as sales growth falling far behind growth in market value, were also evident in my data. Artificially low interest rates, which enabled/encouraged company borrowing, funded working capital in lieu of cash flow from earnings. The circus is still in town.

Apparently, investors could care less. Financial engineering myopia trumps reality.

When I read articles like this one, I’m reminded of a comment I often hear these days:

No one wants to work anymore.

In response, I have this question:

Why would they?

Current goals for people:

1. Annuity

2. Womb with a view

Now, how to work that into a political platform.

No kidding. I’ve never wanted to work.

Yep – essentially hard work just makes the shareholder class rich and workers are paid as little as companies think they can get away with.

I would be interested in the tax implications of the practices above

Would be curious to see what the figures would be on the US side of the pond. I’m thinking the money was instead mostly directed to bonuses and buybacks. Not that that’s good either.

^This!

How much blood and treasure, or other inputs, are spent on tax dodges, buybacks, dividends or other essentially non-productive activities?

The usual suspects will fulminate about markets, not just any markets, you see, but efficient markets.

They’ll also mutter about distortions.

To an observer, those efficiencies just transfer money from you to them. The distortions are obstacles to be overcome.

In the meantime, yachts get stranded and people starve and die.

Its no different on our side of the pond. See my comment above to Ignacio….

It’s interesting to compare the behavior of European companies in the dividend realm. In my experience they tend to be lower. I also note that European pension systems are still comparatively intact.

So do US corporate dividends fill the pension gap for those who can afford to invest? And Neoliberalism Rule#2 for the rest? (“Go die.”)

Divide and conquer.

Another game not mentioned above is scarcity, real and artificial.

Charge way more for less, even hobble the corporate capacity to produce more, and pay dividends with the windfall. Shipping, fossil fuels, commodities. Ukraine can be seen as a way to do this.

Isn’t that how economics is supposed to work?

You give the oats to the horse not the sparrow.

If the sparrows need more then you have to feed the horses more.

Huh? The company and/or the employees are the horse.

>>The Institute of Chartered Accountants in England and Wales is guilty of enabling it by the guidance it issues on how dividends can be paid

So who got to the accountants? That sounds like the linchpin of the whole thing.

From a list of 287 (US) stocks that received at least a B+ rating from S&P, the average dividend payout is 41%. This is from subscriber data for a particular paid newsletter I get. I didn’t try to adjust this by market cap or anything, this is just an average of the pay out percentage. It actually varies widely by company, and it might be interesting to see what it is by sector, but my spreadsheet skills are quite limited. Could also break it out by quintiles. The average yield across this whole universe is 2.5%.

I know it was relayed here recently that Intel actually decided to forgo some (a lot of?) capital investment in favor of continuing it pay and increase its dividend. Disappointing, to say the least.

Using the above information, it would be interesting to see that listing of 287 stocks broken apart into two substantially different segments for investment grade and not investment grade. Credit quality can really help to divine which corporations are equipped with proper debt management. And those corporations who do not manage debt well or the specific industry is known for speculation (aka, energy exploration or leading edge health biotech) or a long run time before revenue is a meaningful result (aka, need FDA approval before developmental drug is ok for humans).

Added point, Verizon is often quoted to offer a healthy above market dividend yield. There are salient reasons why that is the case, and off hand I don’t recall the specifics. Maintenance and future proofing technology delivery systems is expensive, that’s my two cents.

I have a few shares of Verizon, legacy of a gift years ago of GTE shares. Since 2009 I’ve been reinvesting dividends. On 5/1/2012, I received a dividend which was reinvested in the stock at the then-price of $40.79 a share. That is the LAST dividend I received that is worth more in nominal terms than the dividend that was paid. For over 10 years, reinvesting dividends in this company has been a disaster (note: when the stock was selling near $60 a share, nearly all dividends were positive). So that healthy, above-market yield is to pay shareholders to hang around a company that is shrinking In market cap in absolute as well as inflation-adjusted terms.

I worked for a company that had been acquired by private equity. After refinancing the debt used to acquire the company private equity took a special dividend to make cash payments to the fund shareholders and the acquired company management. The non-management employees of the acquired company received nothing.

We should all remember richard’s efforts to destabilise j corbyn, who obviously was on the wrong side of this argument.

I hope he is entirely happy with the outcome.

This is ad hominem, a violation of our written site Policies. You are accumulating troll points.

I think that’s fair

Essentially the shareholder class has become the rent seeking parasite of society. Workers work hard, but the shareholder class gets the fruits of their labour.

Keep in mind the upper 10% own close to 90% of all stocks.

https://www.cnbc.com/2021/10/18/the-wealthiest-10percent-of-americans-own-a-record-89percent-of-all-us-stocks.html

So really the bottom 90% isn’t getting much from these dividends. The only way I could see this changing would be mass nationalization and state ownership.

Yes, reform the regulatory laws, but audit and accounting laws aren’t going to change the issue. Management is doing these things to boost the stock price and by extension, increase executive compensation.

The root cause is simple. The rich do not feel any sense of noblesse oblige to the working class anymore.

First off, the shareholders have always been parasites. Being a shareholder was one element of being a Victorian gentleman.

As for nationalization, good luck with that without an armed uprising given regulatory capture to a massive degree.

Boil it down and it is the same issue that crumbled the roman empire. It was stable as long as it expanded, as it promised the legionaries farmland in the conquered territories.

But over time, by hook or crook, the senators and other “elites” of the empire accumulated said land for themselves.

The root cause is simpler: ownership must be a fundamental aspect of every employer-employee relationship. Mondragon seems to square this circle pretty well. If employees receive dividends for working for their employer, which they own, the tax rate in the USA is 0% up to about 90,000 for a married person. That even beats carried interest for hedgies, which is valuable mostly because there is no SS or Medicare taxes on it.

If the UK Gov increased corporation tax, but amplified the rules around using profits to invest in R&D and training and development to reduce CT. Wouldn’t this be a great way for UK companies to help increase GDP?

The tax laws are what needs reform – the accountants don’t run things – the tax laws are what drive the methods of alchemy that coverts ordinary income into capital gains and other less taxed or no taxed areas with gains being offset by expanding loopholes, shelters, credits, deferrals, deductions, structures, depreciations real and fantasy, offshored etc……

It is the special dispensations in the ever expanding tax laws that the accountants use.

Tax Laws are written by elected officials.

In the USA it is Ways and Means and the Finance Committees that pile the stuff through behind closed doors and with stakeholders input …. I do not think the group of stakeholders includes the 95% of the American public or much of the rest of the Senate and House but does include special interests, lobbyists with a heavy dose of campaign cash from those listened to groups who help get the committee members elected and on the committee.

Campaign finance reform to a public finance of elections – paid for by the closing of some loopholes in the tax code??? Address citizens united?? include corporations to the emoluments clause as was originally debated in our Constitution?

No doubt the cost to Taxpayers and the nation is huge when the corporate tax rate published is (50%??) and most large companies pay 0% or significantly less that published.

100s of billions a year or Trillions lost over years …revenue that normal taxpayers need to pick-up?

All of the wise comments I’ve seen involve our coming to our senses. I think we’ll keep spinning the wheel of unbecoming as long as we can.

I’m hoping that, perhaps magically thinking that, a kind of selective comeuppance will sort some of the deadweight companies (countries?) from those that actually invest in their businesses, (people, innovation, etc).

Since we are apparently locked in to our status quo behavior the sorting wheat/chaff hat will have to come from outside.

A bit more de-dollarizing perhaps? Slicing and dicing the petrodollar from many directions might set off some kind of impromptu Rube Goldberg linkage…

Poem

I am, on the surface of things,

a clod. Yet wedged under a

hoof at just such an angle at just

Such a time I am a

Horse-Toppler,

(Dirt’s version of a Knight Templar),

As horse’s parts and rider’s parts

Describe perfectly contiguous arcs.

Spelling a signature in air.