Yves here. Hoo boy. Housing has gone from rosy to rusty in remarkably short time. But this report is all about newly built homes. I assume the perennially-in-demand homes in good school districts aren’t taking much of a beating.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

“Tighter monetary policy from the Federal Reserve and persistently elevated construction costs have brought on a housing recession,” said National Association of Home Builders Chief Economist Robert Dietz.

The confidence of builders of single-family houses, after the second-biggest plunge in the data last month, fell again in August, the eighth month in a row of declines, having gone downhill every month this year, “as elevated interest rates, ongoing supply chain problems, and high home prices continue to exacerbate housing affordability challenges,” according to the NAHB.

With today’s index value of 49, the NAHB/Wells Fargo Housing Market Index is now back where it had been in June 2014, and below where it had been in April 2006, at the eve of the Housing Bust.

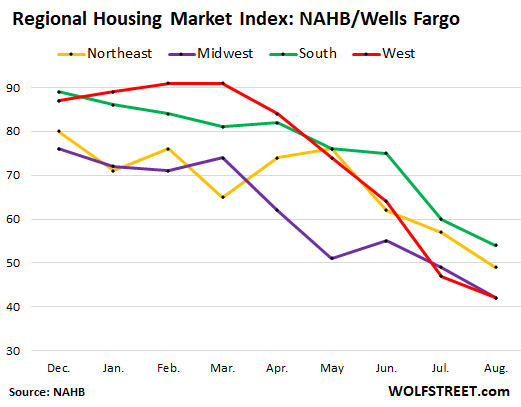

The NAHB/Wells-Fargo Housing Market Index has plunged across all four regions so far this year, but unevenly, with the index hitting the lowest levels in the Midwest and the West, and with only the South still being above 50 if barely. Note that in the West (red line), after still rising early in the year, the index has plunged since March from 91 to 42. Chart shows from December through August:

Traffic of Prospective Buyers Plunged.

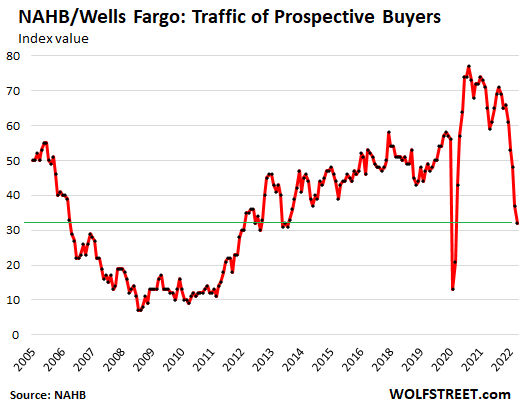

“And in a troubling sign that consumers are now sitting on the sidelines due to higher housing costs, the August buyer traffic number in our builder survey was 32, the lowest level since April 2014 with the exception of the spring of 2020 when the pandemic first hit,” the NAHB report said.

Traffic is an indication of interest by buyers. And with the headwinds buyers face, including sky-high prices and 5%+ mortgage rates, they’ve lost interest:

Homebuilders cut prices to prop up sales and limit cancellations: 19% of the builders said they cut prices over the past month to “increase sales or limit cancellations,” the NAHB said. This was up from 13% of the builders who’d reported having cut prices in the prior month.

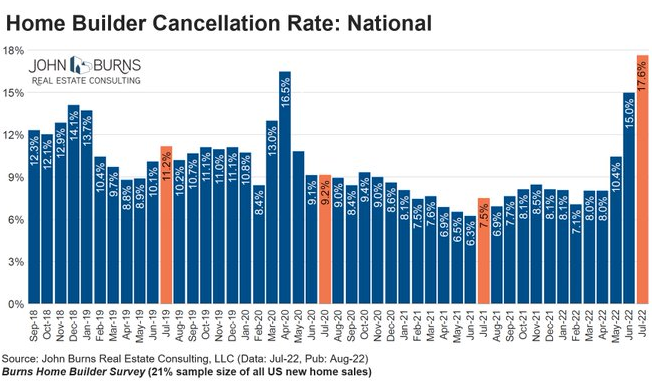

In terms of cancellations: Based on data from John Burns Real Estate Consulting, the cancellation rate homebuilders experienced in July, despite their efforts to limit them by cutting prices, spiked to 17.6%, out-spiking lockdown April 2020 (click on the image to enlarge):

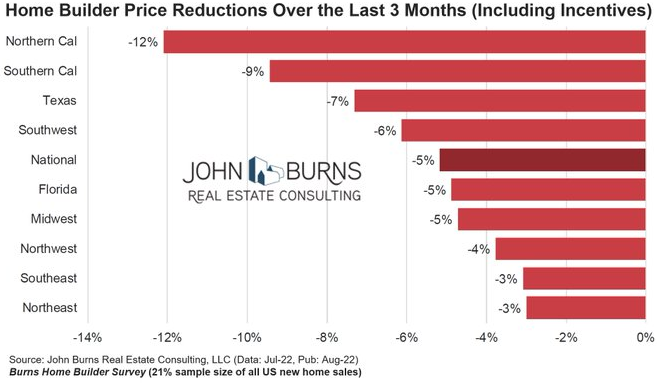

In terms of price reductions: They’ve started sooner and faster in California, Texas, and the Southwest, according to John Burns, for the three months through July. The price reductions include incentives:

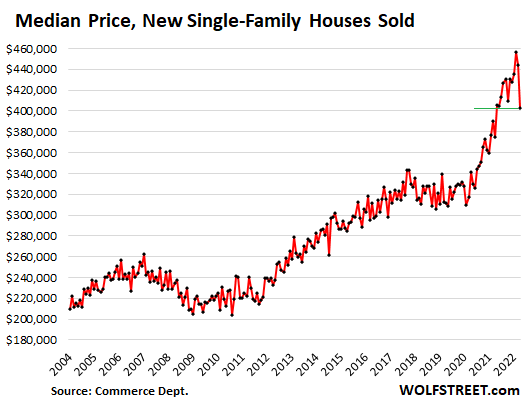

The Census Bureau reported earlier that the median price of new single-family houses sold had plunged by a combined 12% in May and June:

The NAHB index for current sales has dropped every month since February, and in August dropped 7 points, after the 12-point plunge in July, to a value of 57. A value of over 50 means that still more builders rated current sales as “good” rather than “poor,” and price reductions would certainly help.

Future sales look worse: The NAHB index for sales over the next six months fell by 2 points, after having plunged by 11 points in July, to an index value of 47, the second month in a row when more builders rated their future sales as “poor” rather than “good.”

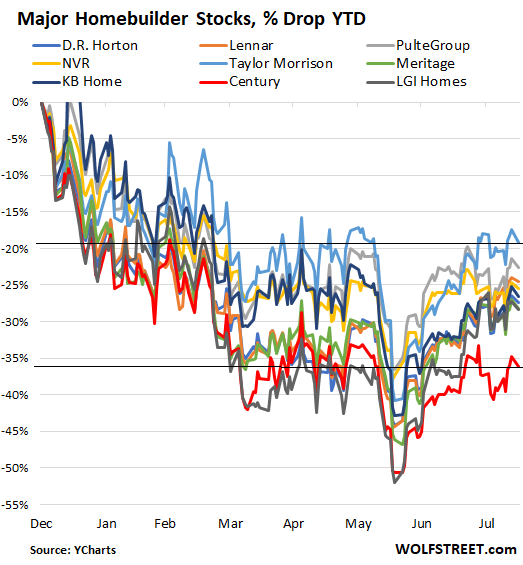

Homebuilder stocks, despite the blistering summer rally, are down between 19% and 36% so far this year, including between 0.8% and 2.1% so far today (data via YCharts):

This is for new construction, but we are seeing “Price Reduced” signage popping up at “gently used” houses recently. We live in a university town, so student rentals are a major factor in the local used house market. Even those rental units are now going up for sale in larger numbers than the historical norm.

Yet, rents are, from anecdotal data, still going up. Much of the apartment rental ‘scene’ is dominated by mid sized and larger holding companies. They either haven’t read the tea leaves yet, or are stubbornly denying reality.

When this finally breaks, it will be a major shock to “investors” everywhere.

>>>Much of the apartment rental ‘scene’ is dominated by mid sized and larger holding companies. They either haven’t read the tea leaves yet, or are stubbornly denying reality.

Is it true that many investment firms can get funding or loans at very good rates, which means they can force individuals out of the market and ignore economic reality? I am thinking of all the empty storefronts that never get rented because the owners don’t want to lower the rates even after years.

If commercial operators lower rents that effects the pro forma and ultimately their mark to market meaning they may not be able to refinance–that is the reason you see empty units there

Investment firms get good rates, but not as good as traditional conventional loans backed by Fannie and Freddie. Fannie and Freddie loans are de-facto subsidized by the government (which some investment loans are too, but generally not as much)

The reason you see incentives like “One Month Free” with a one year lease or “Free Upgrades” is also the

“Pro Forma” valuations.

These are not price reductions, nosirree Bob.

Price reductions would reduce the value of the collateral and that would be socialism.

Or worse…

Here in Sonoma County the place I used to live is in bad shape and the next door neighbor had in the past expressed an interest in it.

We ran the numbers separately and even if you acquired the property for nothing it did not come close to penciling out for two reasons.

1) Construction costs.

2) The time it would take to bring the structure to a habitable state.

This for a beat up craftsman on a double lot.

It wasn’t even close.

New home builders have their financing in place before they start and they will continue to build as long as they can to keep cash flowing and to keep their crews together.

[Edit: I wrote most of the below earlier this morning but wasn’t able to post till now. I see Objective Ace has provided a succinct reply that makes mine unnecessary but since I’ve spent the time writing it out, I’ll post it anyway.]

As to empty storefronts, two related factors may also play a part.

1. Valuation

When setting rents, as with house prices, you look to comparable properties in the area.

Important because when calculating property value, rent is naturally a major factor. A basic valuation method multiplies the annual net rent (aka Net Operating Income or NOI) by the (inverse of) the rate of return (aka Capitalization Rate or Cap Rate). All of which is just a reworking of the formula for Cap Rate.

As with rent, you can look to comparable properties in the area that have recently sold to get a Cap Rate. The sale price (property value) and Net Operating Income will generally be known, so Cap Rate can be calculated for the comparable property and used for calculating the value of your property.

Property value affects how much you can borrow.

So, if you lower the rent, you lower the property value, which lowers how much you can borrow.

2. Scale

If you own more than one property, than you’re even more sensitive to the above relationships. Reduce rent for one store, then that may push down rent for your nearby properties, which pushes down their property values, which reduces how much you can borrow overall.

Thus, keeping some properties vacant rather than lowering rent can help preserve income and valuations across the portfolio.

Note that landlords are likely borrowing against the portfolio and not on individual properties. And since occupancy rates are not expected to be 100% due to tenant turnover etc you can “hide” perennially vacant units within the portfolio’s overall occupancy rate.

Finally, money borrowed may be distributed to the landlord instead of used to cover operating costs. This is likely more tax efficient since rent, as passive income, may be taxed at the highest marginal rate whereas interest payments on the loan are tax deductible. Also, distributions to owners may take the form of dividends, or other lightly taxed income.

So, in answer to your question, no, large landlords and investment firms may not be ignoring economic reality when keeping properties vacant instead of lowering rent. Instead, it may make economic sense for them to make less money in rent on certain portions of their portfolio.

Put another way, the rich live in a different reality from the poor.

In my neck of the woods a prominent commercial real estate developer left a gleaming 16 story office building vacant for ten years because it wished to have a single leasee for the entire building, rather than lease floors to various businesses. Favorable tax laws enable this kind of thing.

Maybe, but don’t forget the reason interest rates are going up so much–inflation. That effects rents also. If rents/inflation falls the Fed’s goal will be achieved

It is nice to see that the price of houses is going down. It will be bad for those trying to profit from selling their house, and I am sure that that the economy will keep getting hammered, but housing is still too expensive; rentals are still too d—- high as well. It will take much more in decreasing costs for housing in California to become affordable for anyone outside of the upper, upper middle class. IIRC, according to HUD (Department of housing and urban development) anyone making less than six figures in the Bay Area qualifies for rental assistance of some kind.

Personally, since I am stuck with renting and probably for the rest of my life, when will rents go down? Or when is there ever going to be enough housing available for everyone? It seems like with the stock market, housing is more of either like a casino or as a store of money like gold instead of living in or renting out.

So, while this is an interesting, and yes, an important story, it still seems far away for me and I think for many people. Rather like the ups and downs of the

casinostock market. It’s important, and it will have a negative impact on our lives, but somehow irrelevant. If that makes sense?I’m not convinced that there is a real shortage of housing in the Bay Area. According to the latest Census the Bay Area has lost population. There are many vacant properties, perhaps tens of thousands across the region. Apartment complex owners are loathe to reduce rents even with rising vacancies.

In San Francisco alone, there are probably around fifteen thousand homeless. Then add the rest of the Bay Area. When you add the normal percentage of income that has to used to pay for housing, then add the couch surfers, RV and car dwellers, and the often multiple people renting small rooms or a single apartment, you have a lot of people who are suffering all for the owners to make an often theoretical maximum amount of income.

I agree with the idea of there being many empty homes especially as it seems that increasingly housing is being used as stores of value instead of means of income. Buy a home, condo, or even an apartment building to store your money, but do not rent it for whatever the reason. Then add the corruption in everything related to development, which only increases the closer you get to the city of San Francisco or the state government in Sacramento, that seeks to make as much money as possible regardless of the cost to others.

This is why people blaming the homeless for their homelessness drives me batty. Supposedly, somehow, in the past fifty years millions of people spontaneously decide to become homeless when before there was not much of any homelessness unless you had truly hit bottom.

Fed interest rates still are negative in real terms. Even the headline, generic 30 year mortgage is negative in real terms.

given the Russia-related (possibly China) and weather-related supply disruptions (beef, chicken, cotton, etc), over the next the next two years inflation will not fall below 4 percent (barring a hard recession), likely bounce between high 3’s and 6 percent.

Are we going to see a 4 or 5 percent fed funds rate? we ain’t seen nothing yet if mortages hit 7%.

the past 20 years of zero/near-zero interest rate policy have totally distorted expectations of what mortgage rates look like

How things have changed. Some are now talking stagflation like the ’70s. Pray that it’s not true and especially pray that the solution isn’t the same. Bought a home in 1980 with a 13.5% mortgage and a good friend who waited a little longer got his at 18%. I guess you could say we were a little more resilient back then.

Bought my house in 1980 also. “only” 12.75% mortgage as I’d locked it in two month before closing in September. I remember just how terrible the early 1980’s were with inflation and 18% interest rates.

When did the national debt really start to skyrocket? The economy presently sits on a very weak foundation due to the massive amount of public and private debt. This is why keeping interest rates ultra low is so vitally important. Imagine the reaction to a 7% federal funds rate? Even a 5% rate would cause major tremors on Wall Street, making October 1987 look like child’s play.

Back in 1995, 7.50 was a good rate—1 percentage point off the standard rate, if one got into a first-time home-buyer program.

In 1995 a house was a much smaller percentage of the median household income.

Median household income 1995 32k

Median home price 1995: 106k

Median household income 2021: 67.5k

Median home price 2021: 340k

I’m a commercial GC in Denver so I don’t see it but my roofer who also does residential roofs for cookie cutters has all of his 80 booked projects on hold. I still think people are kidding themselves if they think an 08 style crash is coming though. Maybe in certain regions but not nationally. The only thing that will drive down prices is interests rates, nothing else about the industry is getting easier… more regulations, only national home builders for the most part can cash flow what at least in Denver is a 2-3 year process with planning/development just to get started, major consolidation of material suppliers since covid (monopolies), labor shortage, building rate is way down since 08. 08 was an over supply issue in conjunction with a banking problem vs now is just a homeowner cash flow issue against interest rates. I think what we will see are new developments will be mid-century sized homes, like 1500-2000SF not these 3000SF+ McMansions, which i think is a good thing long term, but the big home builders will wait as long as possible before they do that because their margins will be way lower. Just my speculations…

I wonder if people would prefer a smaller, better insulated house than a bigger one (for same cost) but higher running costs.

Need a fridge style running cost sticker for new houses.

If I ever, somehow, was able to buy a house, a smaller mid twentieth century style and size home would be what I wanted. Just what is the purpose of a ginormous 3000ft home especially for 1-4 individuals aside from owner’s ego feeding and making more money for the builders? I have seen good sized fifty, 75, 100 plus year old houses in fair size lots destroyed and ugly two story mini castles that take up the entire lot put in.

Well, if you want an nice 75 year old house, please avoid an Eichler. No roof insulation.

And that very comfortable, but expensive, under the floor radiant heating. Still, I could always add some insulation, if I ever had the chance for the need.

I’ve mentioned our big construction boom of both rental complexes and new houses/condos. A couple of these near me have slowed down considerably in the last couple of months. However older homes in my built out neighborhood still sell within a few weeks.

Meanwhile traffic has bounced back now that gas is in the low 3s. Clearly driverworld missed their beloved gas hogs.

It’s so strange becoming class conscious as a land developer. I see an empty corner lot in a neighborhood a mile from downtown Charlotte. Okay, let’s see if we can build maybe four or so townhouses. The best I could be permitted with is two. Anything else and the planning department would sneer at it. I shrug and wait. Six months later, my jaw drops as I see the construction of a 1.2$ million dollar home.

So, that’s aggressive class warfare. That lot was 250,000$. Even if the value of the lot and building crash over 50%, it’s still much less affordable to develop now than before.

I’ve seen these new wealthy homeowners go to the local neighborhood meeting to complain about another small townhouse development (5 units). I heard from a local lawyer the project would of included an affordable unit. Another homeowner requested that be removed as well in a neighborhood. It’s all about opportunity hoarding.

Do land developers earn a dubious reputation, sure.

Will wiping out NIMBYS fix the market, not entirely.

I just look between the lines of these regulations and see the actual reason behind them. Keep the undesirables away. Many of these regulations +40 years old.

The Fed made the situation 3X worse meanwhile and stuffed every nook and cranny with cash. Turned real estate into a hysterical frenzy. Turned neighbor against neighbor and community against community. It’s going to take reform of the entire industry and I think it only begins when the housing market finally crashes.

Land Value Taxation, publicly funded co-ops, making building codes a bit more simple, end single family zoning, training more tradesmen. It’s going to take a while for all of that to be implemented.

Meanwhile the wealthy cackle, smirk, and laugh on their way to the bank. Kindof makes you a socialist or at least sympathetic to them.

…and Zuckerburg bought his neighbouring houses for privacy.

Do you think there is any hope for a “regulation arbitrage” approach like Uber?

Just get some deep-pocketed investors to start building the housing and pay all fines while they work on challenging these possibly unconstitutional restrictions in court and changing public opinion and lawmakers’ opinions.

Here in Honolulu builder is advertising “starter” SF homes “from the 800’s”. Land use policy puts a floor under any possible construction.

yesterday’s other big negative surprise:

the Empire State Manufacturing Survey from the New York Fed, which covers New York and northern New Jersey, reported their headline general business conditions index fell from +11.0 in July to -31.3 in August, the second largest drop on record… “The new orders index dropped thirty-six points to -29.6, and the shipments index plummeted nearly fifty points to -24.1, indicating a sharp decline in both orders and shipments.“

consensus forecasts were for that index to be +5.5 to +8.5..