Lambert here: I’m loving the idea that there’s an “Integrity Council for the Voluntary Carbon Market.” No red flags there!

By Matthew Green, global investigations editor at DeSmog. He has previously worked at Reuters and the Financial Times. Originally published at DeSmog.

Proposals to boost transparency in the carbon offset market could shine a light on brokers who buy credits cheaply from Indigenous communities before selling them to companies at inflated prices.

The measures form part of a wide-ranging package drafted by the Integrity Council for the Voluntary Carbon Market, a governance body aiming to boost the quality of carbon offsets. The proposals were published this week, beginning a 60-day public consultation.

Major emitters such as banks, airlines and oil companies are flocking to carbon markets to help meet net-zero targets by financing projects that tackle carbon dioxide (CO2) emissions elsewhere. Each carbon credit represents a tonne of CO2 that has either been reduced at source or removed from the atmosphere – often through schemes to protect tropical forests or other ecosystems.

Critics of carbon offsetting have long argued that much of the money spent by companies on carbon credits ends up in the hands of “carbon brokers”, rather than Indigenous and other local communities stewarding the project sites.

The proposed new standards on financial disclosure would aim to level the playing field by revealing how much of the income generated by carbon credits flows to project developers, brokers and local people.

“When a buyer in the carbon market purchases a credit, the actual project developer may be getting five dollars a tonne. But the ultimate price in the voluntary carbon market might be $20. Where is the mark-up going?” Pedro Barata, co-chair of a 12-member expert panel that drew up the proposals, told DeSmog.

The proposed new disclosure standards were not intended to pry into individual transactions to work out which intermediaries might be “making a killing”, Barata said. But some market participants wanted access to more information about the amount of revenue reaching project developers and communities.

“That’s a controversial issue, but we’re not shying away from that controversy – we’re putting it out there with a formulation and asking people: is this correct, is this worthwhile, can we extract information that is actually going to improve the working of the market?” Barata said.

Carbon Credit Rush

Surging demand pushed the value of the carbon markets where companies buy offsets above $1 billion for the first time last year — more than double their value in 2020, according to Ecosystem Marketplace, a nonprofit provider of environmental finance data.

Known as the Core Carbon Principles, the Integrity Council’s draft proposals are designed to tackle the many pitfalls that plague the fast-growing offsetting industry, from land-grabs in developing countries to the risk that forest projects can literally go up in smoke.

It is hoped that companies who want to show they are serious about tackling climate change will only buy credits generated by projects that adhere to the principles – envisaged as a “gold standard” quality assurance stamp.

The 124-page draft document contains a wide range of options that may be revised and whittled down following the public consultation. The final version of the Core Carbon Principles is due to be approved by the Integrity Council’s board, chaired by Annette Nazareth, a former commissioner with the U.S. Securities and Exchange Commission, by the end of the year.

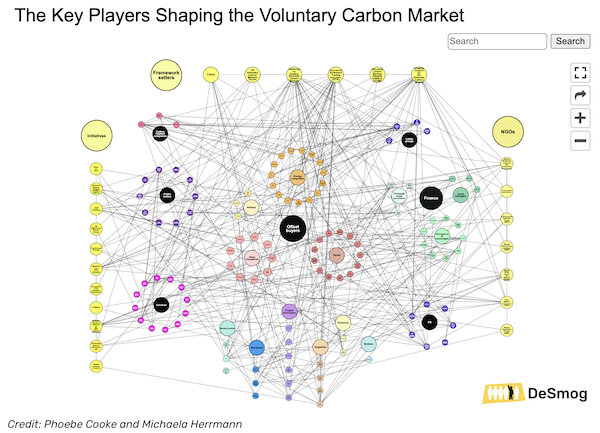

[Lambert here: Sadly, I can’t get this interactive chart to work properly in our page layout. But you can resize and search the chart at the original.]

‘Predatory Aspects’

The role of the finance industry in steering the Integrity Council has raised concerns among climate campaigners who fear that banks and brokers may ultimately prove the biggest beneficiaries of plans to rapidly expand the trade in carbon offsets.

Mark Carney, a U.N. climate envoy and former governor of the Bank of England, who launched a widely criticised forerunner initiative to the Integrity Council, serves on the Council’s advisory panel. BlackRock, the world’s largest asset manager, and the Institute of International Finance, a Washington DC-based financial services lobby group, are also represented.

“The so-called ‘Integrity Council’ is heavily-weighted by people who have zero experience of understanding the predatory aspects of offsets on the ground,” said Tom Goldtooth, executive director of the Indigenous Environmental Network, a coalition of indigenous and grassroots environmental justice activists. “It is dominated by banks and polluters that have terrible track records of ignoring Indigenous Peoples’ demands and who do not have a clue what a real solution to climate change looks like.”

DeSmog reported in March that the organisation had failed to fill three board posts reserved for representatives of Indigenous and local communities. Francisco Souza, a Brazilian economist and member of the Apurinã Indigenous Peoples of the Brazilian Amazon has since taken up one of the posts. There are also several indigenous representatives in the advisory panel.

William McDonnell, the Integrity Council’s chief operating officer, said the organisation was in discussion with various Indigenous groups to fill the remaining posts.

“There’s a very real prospect of further appointments to the board. I expect that to happen this year,” McDonnell told DeSmog.

Other campaigners argue that incremental improvements to the quality of carbon offsetting projects will do little to mitigate the risk that companies will use the practice as an excuse to continue polluting.

“No matter how ‘high’ the standards are, offsetting simply isn’t a substitute for action to rapidly and dramatically cut carbon emissions,” said Charlie Kronick, senior programme advisor at Greenpeace.

Despite the scepticism, Barata, the co-chair of the Integrity Council’s expert panel, said his colleagues had laid out robust proposals to ensure communities shared the benefits of offsetting projects. These include a possible levy on carbon credits to help implement the Paris Agreement by channelling finance to assist vulnerable countries to adapt to climate damage.

“On the environmental and social safeguards, we’ll never be able to please everyone. But I certainly think that we have done a good job in terms of putting the bar high,” Barata said.

“No matter how ‘high’ the standards are, offsetting simply isn’t a substitute for action to rapidly and dramatically cut carbon emissions,” said Charlie Kronick, senior programme advisor at Greenpeace.

That’s the whole point there, pretty easy to say why a carbon market is a joke. Principally it’s also easy to see that the market reinforces the control of large corporations who can run the finance models and compliance to participate. Regulations that cap and later reduce consumption would just make too much sense.

I don’t have any specific evidence but i would make the assumption that like normal the flaws of the carbon offset market are by design by a few players so they can get the upper hand.

I am afraid that I am not and have never been a fan of carbon offsets. If you are going to cut carbon, you have to do it at its source, not someplace else on the other side of the planet. The way that I would argue it is that it is like taking a massive dump in your desk draw and then going outside to plant a whole bunch of roses in the belief that one action will cancel the other. But we all know how that would work out and I am calling out this whole idea of carbon offsets being in the same category. The fact that this so-called ‘market’ is dodgy and rife with people taking a skim off the profits tells you all you want to know about this whole idea. In fact, I would put it in the same category as Uber, self-driving cars and AirBnB. Yeah, that bad.

So, sounds like just another racket then?

Mr. Rev Kev, you just provided the most clarity one could hope for with that analogy.

Thanks for the giggle. It is another ponzi scheme. Cap & Trade should be “Cap & Reduce”

Well that is a very accessible picture. I could not agree more. If we are going to control CO2 we must do it at the source and the best way to do that is give the producers a limit to their production; give the users a limit to their use; and then have some watchdogs like “the Integrity Council” pester them and shame them – with the teeth to back it up. Establish laws, rules and regulations. We need rationing first; friendly compliance officers come second. And also too, I do not think we can roll up “carbon credits” directly into social “credits” (improvements) so easily – there should be direct rewards for places selling off their carbon credits so that the proceeds can be verified.

I think the best method is to leave oil, gas and coal in the ground.

Sadly a cut in emissions will mean a cut in living standards, because emissions are directly connected to energy usage. Anything else will just invite Jevons paradox to rise once more.

I used to read an Australian energy blog called Peak Energy by someone named Big Gav.

https://peakenergy.blogspot.com/

When he redesigned it and made it visually ugly, I stopped reading it. Just now it looks like it is visually less ugly again.

When I read it, it was a renewable-energy techno-optimist blog. I don’t know about now.

I remember once something he wrote about “carbon markets” . . . that ending carbon skyflooding by having a carbon-emissions-credit market was like ending slavery by having a slave-owning credits-offset market.

I don’t know if he addressed the Full Metal Hansen FeeTax dividend against fossil carbon at-the-source.

I think it could work within America if America could somehow mass-exterminate its Free Trade Elite and all their minions, and be free to institute rigid militant belligerent protectionism. Then we could institute the Full Metal Hansen fossil carbon FeeTax-Dividend against all fossil carbon extracted and sold within America and we could ban economic contact between America and countries which did anything less.

And if junior-high-school style hypocrisy sniffers say . . . ” But then countries with even higher anti-carbon-skydumping regimes can ban contact with America till America adopts their approach and how do you feel about that, eh?” . . . . I would say that I would feel good about that because that is how we could all force eachother into a Forced March To The Top rather than the Forced Race To The Bottom which we now have.

I’ve never encountered reference to an Indigenous Leadership Class, but if it exists it’s certain to have representation in this Integrity Council — no scare quotes required. It’s payday, baby!

The carbon credit market has as its true goal to create a broadly based tax on the economy with the proceeds going to the Wall Street/City of London banksters.