Yves here. I did caution on my chat on my first Roundtable, with Izabella Kaminska, hosted by Gonzalo Lira, that despite all the Twitter uproar, the economy was likely not yet in a recession per the NBER criteria, and it’s the NBER that makes the determination. But no one expected this jobs report. Note, however, despite the apparent strength, average real wages are lagging inflation. Lower end workers still lack bargaining power.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

It wasn’t the hottest growth in jobs ever, but it was big and exceeded the pre-pandemic average job growth. Employers added 528,000 workers to their payrolls in July, and 2.79 million over the past three months. Wages jumped, but less than raging inflation, and the number of unemployed people actively looking for work fell to the lowest since the year 2000, at the verge of the dotcom bust.

It was a shock-and-awe disappointment for the recession mongers out there that want a recession more than anything because, according to their thinking, it would “force” the Fed to pivot and start cutting rates – despite what the Fed actually says – and end this horrifying QT in a market that is addicted to QE and will suffocate under QT. They want the Fed to reverse the tightening though it has barely started (way too late), so that stocks can continue to get inflated to the moon.

Someday we’re going to get a recession – eventually there always is one. Knuckling under this raging inflation will likely require a recession, yet a shallow recession might not be enough to get the job done as this inflation is getting more and more entrenched.

But it’s just very tough to have an official recession with this type of labor market, with employment growing and wages growing sharply, and with unemployment falling.

The National Bureau of Economic Research (NBER) calls out recessions in the US, and the NBER’s definition has been the same for decades, and it hasn’t changed, and its definition includes labor market metrics, some of which we got today.

This strength in payrolls is supported by other data, such as the still historically high number of job openings that employers reported for June, along with massive churn and job hopping among very confident workers that are going for better-paying jobs, and amid aggressive hiring by employers to fill their jobs.

OK, cash-incinerating startups are now worried about running out of cash to incinerate, as obtaining new fuel to incinerate has become more difficult, and they’re trying to cut their cash-burn rates by reducing their payroll. Among them are Robinhood and other former high-flyers, some of which have become heroes in my Imploded Stocks column, that have lost oodles of money during their existence. But that’s a small – and very crazy – corner of the labor market, and the layoff numbers are minuscule compared to the overall labor market.

Overall, layoffs and discharges in June and in the prior months were at historic lows. And there are still large-scale staff shortages in the healthcare system, school systems, airlines, and many other industries.

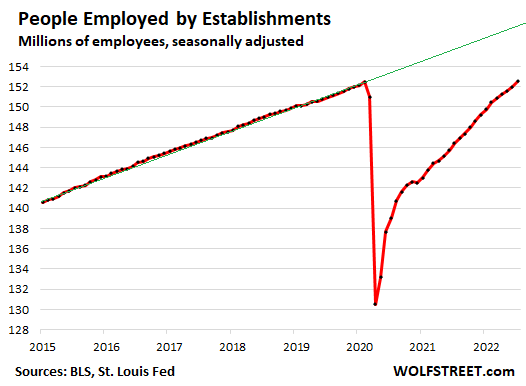

So the total number of workers on nonfarm payrolls rose by 528,000 in July to 152.54 million workers, a new record, finally and for the first time beating the pre-pandemic high, according to the Bureau of Labor Statistics’ survey of establishments today. And this number of workers on payrolls continues to catch up with the pre-pandemic trend (green line):

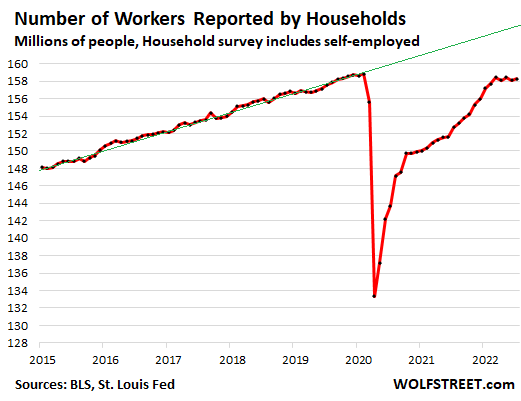

Workers, Including Self-Employed and Entrepreneurs

Households reported that the number of people with jobs, including the self-employed and entrepreneurs that are not captured in the employer data above, rose by 179,000 in July, and by 185,000 over the past three months to 158.3 million.

It is interesting that the number of people on the payrolls of employers is rising sharply, while households are reporting a much smaller increase in the number of working people, which include the self-employed and entrepreneurs. This could be in part due to self-employed people returning to regular employment with a company, to where employers are reporting the gain, but for households, the person just shifted from self-employed to being on a company’s payroll. And that would make sense amid the aggressive hiring by employers.

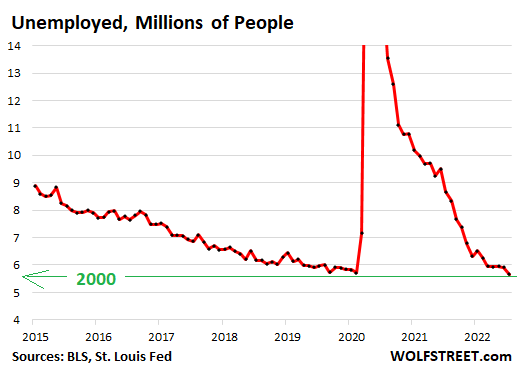

The Number of Unemployed People Lowest Since Dotcom

The number of unemployed people who are actively looking for work fell by 242,000 to 5.67 million, edging below the pre-pandemic low, and marking the lowest level since the year 2000.

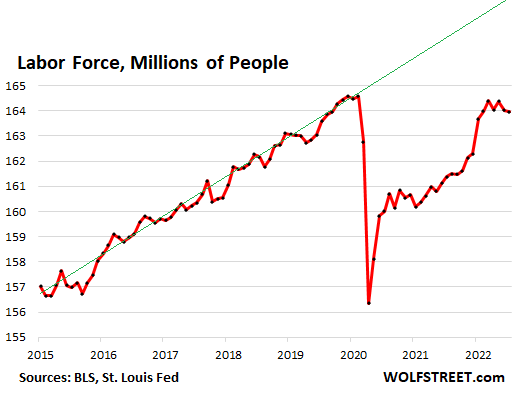

The Labor Force Is Stuck

The labor force – the people who are working or are actively looking for work – dipped by 63,000 in July, the second month in a row of declines, to 163.9 million, essentially where it had been in February.

There has been a lot of thinking about why the labor force has gotten stuck. All kinds of logical reasons are being cited that work together: The difficulty and expense in finding daycare; the need to care for elderly relatives; the excess mortality since 2020; health problems associated with covid; a massive wave of “retirements” by people who have enough already thanks to the massive inflation of asset prices; and as I phrased it, ageism, where older people who want to work stop looking for work because they cannot get anyone in their industry to take them seriously (particularly in tech), and when they stop looking for work, they come out of the labor force. And the list of reasons goes on.

Many folks, including the Fed, are now suggesting that the old normal labor force may never return, that there were permanent changes in the labor market that we’re just now trying to figure out.

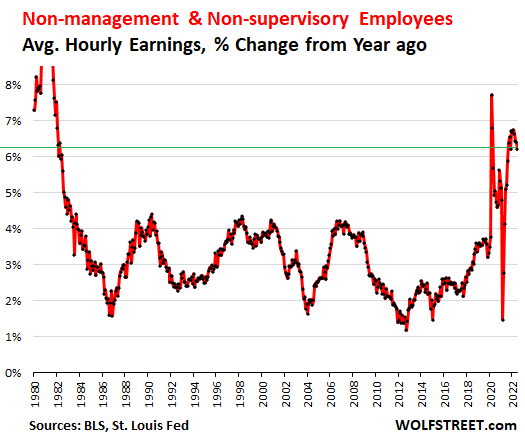

Wages of Non-Managers Surged, but Still Outrun by Raging Inflation

Average hourly earnings of non-management workers – coders, waiters, teachers, police officers, engineers, construction workers, etc. – jumped by 0.4% in July from June, and by 6.2% from a year ago to $27.45 per hour. This was the 10th year-over-year increase of over 6% in a row.

These year-over-year increases of over 6% – beyond the distortions in 2020 – were the biggest since early 1982. But they were still outrun by raging inflation, with CPI inflation at over 9%.

The Employment Population ratio, which tracks the percentage of people in the working-age population who are working, ticked up to 60% and has been roughly in the same range since March, but a full percentage point below the pre-pandemic range of 61%, which parallels the labor force getting stuck.

The unemployment rate, at its narrowest definition – the percentage of people who are in the labor force, but are not working – edged down to 3.5%, where it had been before the pandemic. If the labor market weakens, this rate will spike, as it has done every time before. But it remains grounded.

Has any economist considered that perhaps at least some of the jobs growth is people having to get a second (or third) job in order to make ends meet? Probably not, or if they they did, they wouldn’t mention it because it would cast a pall on the ersatz rosy picture.

That is the elephant in the room, isn’t it? The number of people in the labor market is decreasing while the number of jobs is increasing. Wolf tries to attribute it to self-employed going back into the labor market. Wolf tends to be really good at numbers but he has a blind spot about what is happening to people in the working classes. Around here having two jobs is becoming more and more common. I have grandaughters who are working two jobs because they can’t get enough hours at a single job (nobody wants to pay full time benefits) to earn enough to make working worthwhile.

I’m getting a lot of requests from professional acquaintances to listen to them pitch me about ways to “diversify my income streams” and “leverage my skills into lucrative side hustles”. I’m also seeing people ask me about buying into “exciting franchise opportunities”. Not sure what to think about people who have at least one job that pays six figures looking to get side hustles.

A decade ago when I was unemployed and forced to sit through soporific presentations at the Dept of Labor as a condition of receiving my meager benefits, we were regaled by an aspiring capitalist about the opportunities to own a franchise, and he would hook us up with the one that was right for us, providing of course that we recently unemployed people could come up with a couple hundred thou to get the ball rolling.

They sure have been humping these franchise opportunities, and people are biting if the number popping up on every crappy strip mall is any guide. I have noticed that even with pandemic restrictions lifted, many of these franchises are still drive through only – not sure if that because it’s more profitable to just run the drive through or they can’t get enough help. My guess is the latter, since I do see the one franchise I frequent for my weekly cheeseburger turning away business, as people leave the drive through line not wanting to deal with the wait.

So here’s my question – with everyone wanting to be an “entrepreneur” these days, is there really a labor shortage, or is it instead that we have an oversupply of businesses?

We have a strange situation as far as I can tell. I think many of these businesses have cut staff levels to the bone. I think they’ve also cut back on training quite a bit too. And they’re not offering everything they could offer based on their menus. That applies regardless of whether we’re talking milkshakes or pick-up trucks. What you see advertised is not actually available a lot of the time. Or what we have offered as a set of choices is entirely false. Like, 10 different pop tart flavors but there’s almost no difference between the ingredients despite the different colors on the box.

It’s likely that we don’t need a Dunkin Donuts on every street corner from Maine to North Carolina. But I don’t think reducing the number of those type of franchise stores would change much about our current economic situation.

Interesting question you ask. A recent Doug Henwood/Behind the News segment featured an interview w/an Italian political/sociological type who posited that Italy has too many entrepreneurs, not enough managers, lots of small businesses, a less developed economic model.

Am I correct that “diversified income streams” is the current shiny happy euphemism for “second job.”

“Wolf tends to be really good at numbers but he has a blind spot about what is happening to people in the working classes.”

I actually think that this is an even more important point than the OP. Being a good statistician isn’t about finding a curve to fit your data (anyone can do regression analysis); it’s about *understanding* your data enough to explain why the model makes sense for what you are seeing.

To understand these employment numbers, I think the following context is important: (1) the federal government flooded people with cash; (2) people made outsized gains from artificially inflated assets; and (3) laborers quit their jobs in droves. Saving part of (1) and (2) gave many Americans more financial security than they had ever had, which, in turn, caused (3). I think what we are seeing now is that (1) and (2) are running out, and employers are raising wages to combat (3). Instead of using stimulus checks and Gamestop/AMC/crypto gains to pay the bills, people are taking shifts at Jack in the Box. And, instead of paying the $7.25/hr federal minimum wage, Jack in the Box, which has been desperate for warm bodies, is sweetening the deal to $7.75/hr.

Without context this looks great, and Democrats, desperate to avoid a recession, can barely contain their glee. In the past adding jobs and raising wages meant the economy was doing better. But is the average American who was living off government largesse (and frothy markets) economically better off now that they are relying on Jack in the Box? No. The economic security they had is gone, and they are back to the grind, only now they have to do it with Covid lurking in the background and massive inflation eroding whatever pitiful wage gains they got.

I suspect this is the first wave of people moving from stimmy checks/frothy market gains to Jack in the Box, and each month between now and the midterms will continue to present numbers like this. Democrat PMC types will think this is Mission Accomplished, but the dude working at Jack in the Box knows that his position has not improved. If I’m right, then I think there will be some very surprised and sad Donkeys on November 9.

Anecdotal, but I have a friend that just got back from 6 months of traveling abroad, needs money, and was excitedly recounting just how much unskilled service jobs are paying in Florida. There’s a luxury? gas station that opened in St. Augustine recently, and it pays $22/hr for shift leads. He planned on taking a few of these jobs, to cash up, so he can travel again in a few months.

I wonder if that gas station is a new or recently opened Buc-ee’s, which is known to have an expansive store front in addition to plentiful gas pumps. Lot of work to maintain the cleanliness standard one would assume.

It’s a known franchise of stations in the south and Texas. They are expanding here, or about an hour+ south of Charlotte to be more specific.

Good point. Also the Feds could just be lying about the job growth like they do about most other things.

That wouldn’t show up on the employment stats. If you have one or three jobs the government still counts you as employed.

The interesting one for me is the prime age labor force, which Wolf did not analyze:

https://fred.stlouisfed.org/series/LNS11300060

We are above the ten year trend there (82.4%), and although we have not hit the maximum historically (Dec 1998 I believe was around 84.4%), its still impressive.

I think we have demographics to blame here, and the retirements/removal of people from the workforce (Why should a mother go work part time at a school for 15 dollar an hour when day care sucks all that money away?) that has put us where we are.

Don’t worry, the Fed is on the case to cure this issue!

Beat me to it! This is what inflation will do to low end workers, a group there are proportionally far too many of.

The cost of daycare has been over the top for more than 40 years. Everyone has complained about it and nothing has been done. So the only conclusion is that it is policy. Part of austerity policy to keep inflation down. It’s now a pressure cooker. And when daycare is good and also affordable the American labor force will skyrocket. Where will it all be channeled? That’s a good question because the world cannot continue to compete for capital. It’s a death sentence for the planet. All that labor will need to be subsidized. And all the jobs will need to be green.

Average monthly cost of an “affordable rental” + daycare for a child under 2 years of age where I live is $3800. That’s $45600 per year. That means the floor of reasonable living as a single parent in my area is 60k$/year if you ignore income limits for rental costs as a percentage of income. If you don’t ignore that, and assume your rental should be 1/3 of your income, the floor is 103k$ before taxes and deductions. The problem with that of course is that if you make that much there’s no way you’ll get assistance from the state or federal programs. So unless you have a partner or you’re lying about your income it’s not really feasible to be a single parent where I live unless you have a high paying job. And by high paying I mean 200k$+. If you’re part of a family and have multiple employed adults working then you need to make a lot more than most part time jobs can offer to justify working.

If the pay and conditions and benefits were decently good in a pro-family/ pro-mother day care system, a lot of the labor force would go work in that day care system.

See my comment below … Stephanie Kelton tweeted about it, and I’m sure others have – I’m thinking Claudia Sahm for one.

Multiple job holders is good to look at, but oddly enough, that too suffered because of the pandemic. If you look at the Fred graph since 2017 – when you get to this page (via fred.stlouisfed.org), click on the “5Y” link above the graph to shorten the time frame – you can move the mouse over the graph line to see the numbers. Looks like the US entered the pandemic with about 8.1M people working multiple jobs. This bottomed out at around 5.3M in April 2020, and things have been “recovering” since. My perspective is that the US is essentially a low wage economy and that high numbers of multiple job holders is a sign of this. To the degree that this number is catching up to where is was in January 2020 is good in one sense, but perpetuates the underlying economic violence of too many people not being able to meet their needs through one job.

PS: Increase from June was: (7572 – 7432) = 140K additional people working multiple jobs.

Too good to believe ? I’m a bit on the fence when it’s the “recession is on” or the “recession is not on” debate turns up as it frequently will on CNBC. To me it appears a bit of dissonance on what people can observe on the ground. The slow down of home buying, just one example of recent discussions here, has to have an eventual impact on industry jobs.

I noted the paragraphs discussing wage increases. That is pretty solid but is still lagging the inflation. But I would not expect a self respecting politician from DC, no matter the party, to decipher how wages lagging the inflation index is a thing for common folk.

There is the issue of falling labor participation suggesting multiple jobs, another is that the “recession” to date is really driven by the whipsaw effect related to covid supply chain bottlenecks. Supply chain delays caused shortages, followed by catch-up consumption and gluts, as many anticipated (NN Taleb for one). The recent GDP contractions coincide with the glut phase. It is too soon to see the impact of Fed rate hikes (and QT is mostly talk to this point).

I wonder what happens when the economy does contract to the point unemployment goes up, and employers find they still can’t fill jobs say, because of long covid? Expedited immigration? If the Republicans retake the house?

Higher up on the income and job ladder, I wonder how many people are taking advantage of remote work for BS jobs to get multiple of them. Like, if I only need 20 hours a week to handle job one, and 30 hours a week to handle job two, but I’m at home full time and can manage my own calendar…maybe some one could do that. I wonder how such a thing would be counted?

Just caught this from Stephanie Kelton (via Twitter) about multiple job holders – up 549K YoY July. You can find the relevant BLS data here (via bls.gov). The biggest jump was in the “full time primary job, part time secondary job” category, up over 400K since July 2021.

I jumped over to look at some basic organizational info on the NBER. I used wiki for expediency

Here’s what jumped out:

– “The recession markers are made by the Business Cycle Dating Committee, whose eight members are selected by the president of the NBER. The eight members tend to be highly distinguished economists…. Business cycle dates are determined by the NBER dating committee under contract with the Department of Commerce. Typically, these dates correspond to peaks and troughs in real GDP, although not always so…”

(you can see a list of economists involved to see what “distinguishes” them)

– In September 2010, after a conference call with its Business Cycle Dating Committee, the NBER declared that the Great Recession in the United States had officially ended in 2009 and lasted from December 2007 to June 2009.[14][15] In response, a number of newspapers wrote that the majority of Americans did not believe the recession was over, mainly because they were still struggling and because the country still faced high unemployment…

These are the people that give rise to the concept of “the jobless recovery.”

They are just as likely to tell you there is no recession with unemployment high.

My opinion, but being contracted to the Dept. of Commerce makes them as influenced by who is in the executive branch as much as the apparently very flexible definition of a “business cycle.”

A generalization: NBER is to business cycles what the FED is to interest rates.

Isn’t the labor force decline fundamentally demographics? The boomers are retiring and being replaced by z’ers, and z has a lot fewer people than the boomer generation.

No, prime age labor force participation is down, from its peak and from before Covid.

https://fred.stlouisfed.org/series/LNS11300060

American Boomers in the workforce are not being “replaced” by Gen Z, the oldest of whom are still only 25 years old, except perhaps for the lowest rungs of employment. If they are being replaced in their roles by younger people, they would mostly be millennials, the oldest of whom are now in their 40s. And as it happens, there are more millennials than boomers.

The question is about the entire labor force, not the particular positions in the labor force. Young people enter the labor force, old people exit the labor force. That old and young people hold different positions in the labor force is immaterial.

Let me see now. Layoff announcements have been surging over the past few weeks. The jobs report may be misleading, and giving a false read of the strength of the economy. A recession is when my neighbor loses his job. A depression is when I lose my job. For all practical purposes that saying is a more accurate descriptor of the economy than anything the NBER publishes.

I wonder how many people are ‘treading water’, working ‘service’ sector wage jobs . Attempting to pay off credit card debt, monthly, that was offered to them liberally, to make it appear that the economy was humming, along , statistically speaking.

Perhaps that accounts for the puzzling perception of a large amount of workers doing poorly, yet still in the job market. And yet, the stats can affirm a high employment rate.

If a person is making $15/hr, how can they even afford a house/rent or a car? Something doesn’t compute. I bet the cost of health care is not factored into the avg person/familys cost of living either. What a ‘revolting development this is’. ….

I’m not feeling the cognitive dissonance on this one.

Yes, I expect the economy to do progressively worse over time, but there are lots of powerful forces keeping things afloat right now, like:

a. Money is still pretty easy. Mortgage rates are still low (historically), the 10 year Fed Bond rate is at 2.8%, about one point above it’s all-time low

b. Fed covid stimulus is ongoing. We’ve used about $4T of the $4.5T budgeted

c. Transfer payments from Fed to families is still going strong. Had a few spikes for covid, but still on-trend at $3T per year

We’re OK for now. If interest rates go up a lot, and/or Fed Gov has to restrict spending, if housing construction craters…then the complexion will change.

We’re still using the money fire-hose.

Until interest rates rise, and Fed stim-bucks back off, we’re still riding a strong pony.

>>>Fed covid stimulus is ongoing. We’ve used about $4T of the $4.5T budgeted

It’s interesting how almost all of that “stimulus” did not go to the poor, working, or even middle classes, the ones who actually need it, isn’t? No checks for over a year and SNAP has been cut again. Yet, this Covid stimulus is somehow ongoing. Somehow, someway.

I’m South African. The politically correct term is that we’re a ‘developing country’ but the reality is that we’re the archaic ‘third world’. Like others, we flounder on the whim of American bankers and politicians playing fiat games. Despite our government being ruled in partnership with the Communist Party, and supporting Putin, there’s wannabe Americanism. And money always yells no matter whose offering it.

A jump in American jobs is bullshit to me. It doesn’t change the 14% we lost to the dollar in the past year. It doesn’t stop American rating agencies seemingly favouring us with higher ratings than we deserve. It doesn’t stop American NGOs playing with our politics. It’s notable that our presidents first overseas trip was to the CFR. It’s notable that he’s currently in a scandal where he allegedly and illegally stashed millions of US dollars in his couch. American covid policies influenced us, our lockdown becoming one of the world’s most severe. The proxy war in Ukraine affects us too – inflation is higher that what Government proclaims.

We’re bursting to implode. In fact, in my city, we had helluva scary riots last year. That spread to other cities. 354 people died. More than 200 shopping centres were looted. That included Malls in 3 directions from where I stay, the last direction saved by residents. There was political bent to it, and the violent nature of my country, but effectively opportunistic because of lockdown stress affecting the half of our population that is unemployed (like the U.S., our official unemployment rate excludes those who have given up searching for jobs).

Making matters worse were 3 floods the past 5 years, with two of those finding cars floating in the highway nearest me. This has been another warm Winter.

We’re suffering from long-term water shedding and power shedding (major service outages).

Our education system is not surviving these knocks. a generation is being screwed which, in turn, screws the future of everyone older too.

We fear more unrest.

When the U.S. sneezes its financial selfishness, the snot of its bankers and (inappropriately named) quantitative easing, our little (but big on corruption) countries get sick.We get sick.

Yet our television screens broadcast the effects of America actions on itself as if its the be all and end all. We don’t matter. We’re as important as a Ukraine or Iraq that Americans can’t find on a map.

I’m a doing a big picture rant. I wouldn’t be commenting here unless I was acutely aware that there are brave souls fighting that rotten system. But do they, like me, sometimes feel overwhelmed that we’re bleeding our fists against a strengthening wall? Do they ever hesitate to read the next financial report?

Mike:

The greed squashes us all. Yes, we’re dismayed and disheartened, pretty overwhelmed. It’s a rough scene all around.

We here in the U.S. are bereft and dismayed and angry at the endless stupid, made worse by the realization of how good things could have been, if only we’d seen and understood sooner.

What little I know of South Africa suggests that it’s an interesting, lovely, exciting place to be, especially if you’re a young(er) person. Keep your antenna up – clearly you’ve got that part going. To address the “carrying the load by yourself” syndrome (characteristic of people who are aware, and are surrounded by others who aren’t so much), I encourage you, if you’ve not already done it, to make friends with people who share your values and are willing to _act_ on those values. The “doing”, even if it starts off trivial, is therapy for the soul. It does help.

Things might be tough, but being on a team of people you have confidence in will help make the journey soooo much more fun. Just as hard, but a lot more fun.

Good luck to you.

Btw – it’s been some time since we’ve had a report from South Africa. Please write something about what it’s like to live there, and especially what the young people are doing.

Lastly, the “wall” is _not_ strengthening. That’s what the Russia-China .vs. U.S. fight is all about. The wall is in trouble, hence the desperation. Things could break for the better. If that actually happens, how will you respond?

Thanks for the encouragement but I’m currently silenced my my government, in limbo under the threat of imprisonment for exposing corruption. The crooked politicians have been promoted and I’m beaten. This wall has no dent.

On the bright side, that’s given me time to get to grips with what’s happening internationally. I’m aware of the Greater Wall and cheer the cracks. I intend writing about that next month. But I’m unconvinced that those eventual gains will trickle down to my country. Despite its potential, I don’t see Africa rising. The culture of leaders for sale is too entrenched.

at the risk of being off-topic, for the tourists with dollars and pounds, South Africa is paradise. The town of Knysna is a special place, and my firm favourite.

It’s our sweetness that makes the sour more sour.

Thanks, Tom.

Mike: The corrupt state repression puts an entirely different light on the matter. You’re not just fighting general ignorance and selfishness, you’re fighting against directed evil with the State’s power backing it up.

Different matter altogether. Sweet words of encouragement are not all that helpful in this situation.

When I encountered a much-milder version of this sort of repression, my response was to find the ready-willing-and-ables, spin up a quorum, and pick a project that the corrupted ones would have no interest in (no money to extort).

If you’re under threat of prison, then it’s time to change arenas.

If you’re under threat of prison, then it’s time to change arenas.

Strongly second that. While in LE here in USA, I had many attempts intended to put my head on a stake– from set-ups to hits, prison to dead. It’s no way to live, and quite frankly, few will give a shit if you’re gone: being a martyr is way over-rated. Best to move to safer ground, and if so inclined, lob bombs from afar.

I enjoy Wolf Street for the “hair on fire” comments by all the vulgar monetarists whingeing about “the most reckless Fed EVAH!” and I appreciate Wolf’s way with charts, but if I want context and analysis give me William Mitchell at Billy Blog, thanks …

he is quit good!

It’s just conjecture, but it appears the US economy [and thus some others somewhat following our lead] is crazily, crazily, crazily presently wholly run on the basis of whacked out theory. Of course, the conjecture could be a little paranoid itself if it ignores this apparently “good” news.

Paul Jay was mentioned in the Aug 6th “Why Give a Damn About Pelosi?” piece. He seems to be one of few around that-gets-heard who puts things bluntly, though I also agree the Pelosi trip in some senses is a big deal.

“Rising Interest Rates Intended to Create Unemployment”

June 7 https://theanalysis.news/rising-interest-rates-intended-to-create-unemployment-bob-pollin/

Sooner or later isn’t someone gonna start worrying the whole schtick/maya is being perpetuated by speculators somewhere…who are shorting the west? Unless Trump and a number of Trump backers are involved in this shorting…you could almost ask why give a damn about Trump’s coup attempt while something like this is going on?