This is Naked Capitalism fundraising week. 630 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year,, and our current goal, rewarding our guest bloggers.

Yves here. In this fresh interview with Ben Norton, Michael Hudson turns to news topics.

By Ben Norton. Originally published at Multipolarista

BEN NORTON: Hey everyone, this is Ben Norton of Multipolarista. I’m joined by one of my favorite guests today, the brilliant economist Michael Hudson. And there are a lot of things that we plan on talking about today.

We’re going to address the partial student debt relief in the United States, and the problem of debt, which is something that Professor Hudson has written a lot about.

We’re going to talk about the inflation crisis, and some of the history of responses to the inflation that we’ve seen in the US. For instance, I’m going to pick Professor Hudson’s brain about Richard Nixon’s response. Nixon imposed price controls and froze wages for the first time since World War Two.

We’re also going to talk about the history of the Volcker shock, when Paul Volcker, who was the head of the Fed, raised interest rates to a level never seen before.

We’re going to talk about neoliberalism. I’m going to ask Professor Hudson about comments that French President Macron made about the “end of abundance.”

And I’m going to ask Professor Hudson about disaster capitalism in Ukraine. Ukraine’s leader Zelensky just did a virtual bell ringing to open the New York Stock Exchange, and announced $400 billion of giveaways to foreign corporations, mostly US corporations, who are salivating to get access to Ukraine’s assets.

And then finally, I’m going to ask Professor Hudson about the challenge of the petrodollar that China has been carrying out, and the potential emergence of the so-called petroyuan, whether or not Saudi Arabia will list its oil in the yuan.

So a lot of things are on the table to talk about, today, Professor Hudson. I’m sure you have a lot of thoughts about the madness going on in the world today. It’s a pretty interesting time.

But let’s just start with something closest to home. You have lived and worked in the United States for many decades. You worked on Wall Street. You’ve been involved in advising governments. You’re an economic expert.

For people who don’t know you, I hope everyone listening and watching to this, they should know you, they should read your work. People can find that at michael-hudson.com.

But let’s start with the recent decision by the Biden administration, which announced that it’s going to pardon up to $10,000 in student debt.

This is estimated to impact around $300 billion of student debt in the United States. But there’s a small problem. That’s a small fraction of the $1.75 trillion worth of student debt in the United States.

So I’m curious what you think about this decision. Of course, the Republicans, Fox News, they were attacking Biden and saying that this is irresponsible because it’s $300 billion that the government is supposedly going to lose – although it’s actually just money that the government could write off.

It’s not like you’re spending money; it’s just debt they’re writing off. But clearly, this is actually a tiny fraction of the amount of debt in student debt in United States.

So what do you think about this decision by Biden to forgive a little student debt?

MICHAEL HUDSON: Of all the politicians in Congress, Biden has always been the most pro-bank and pro-financial sector, largely because he comes from Delaware, which is the corporate headquarters for most companies in the United States, including the credit card companies.

Also, Biden has been the most hostile toward students. He recently characterized students who are going to college, saying, who needs a college degree? A lot of them just get in the humanities, and we really don’t need them.

So he has a kind of a visceral contempt for students. And it was Biden who made sure that in the bankruptcy law that was reformed, I think, over a decade ago, that student debt could not be wiped out from bankruptcy.

So of all the politicians, Biden has been the most hostile, personally hostile, as well as just serving the banking interests in opposing the interests of students.

And this is what really sets American social policy and economic policy more against other countries than any other policy.

Basically for hundreds of years, and still in many, many countries, Germany to China, education is free, because you want the population to be educated.

And in the United States, the whole structure of the United States politically was to divide it into school districts, because they all realized the importance of of education.

Basically, if education should be free, students shouldn’t have to run into debt to get it. And in fact, I think in Germany, not only is education free, but if you’re going to college, you’re given a stipend for living costs, so that you don’t have to take a separate job at Starbucks or some other menial job to pay your tuition.

So if education should be free, you shouldn’t run into a debt; and if you shouldn’t have run into debt in the first place, the debt should be forgiven.

That I think should be, that is, the basic moral ethic of most people. And it’s not in the United States.

And you’re right, the amount that is so-called forgiven is only a small fraction. And Biden did not even forgive the penalty fees, the late fees that have doubled and tripled the amount of student debt for many people.

So Biden is still leaving, even for the low-income people, debts that are two or three times what it costs to get education in the first place, just for the banks to get these extra fees.

So this is a slap in the face – so typical of his position, and of the Democratic Party’s position – for students.

Biden is not alone in this. The Democrats were backing him, saying, we want to make it clear to our base, the campaign donors, the donor class, that we’re going to forgive the wealthy financial sector, their carried interest charge, and make that free of the income tax, but we’re not going to favor the working class.

Because the class war is back in business.

BEN NORTON: And Professor Hudson, you’ve written a lot about debt. You’re in fact an expert on the history of debt, and debt forgiveness.

Going back to antiquity, and even before, for thousands of years, debt forgiveness, debt jubilees had been a key part of governance, governing society, to maintain stability.

And in the United States, we’ve seen a massive skyrocketing of debt in the past several decades. Now, student loan debt is estimated now at $1.75 trillion. And that is certainly something unprecedented compared to other countries, you know, imperialist, colonialist countries at a similar level of development like the U.S. and Europe.

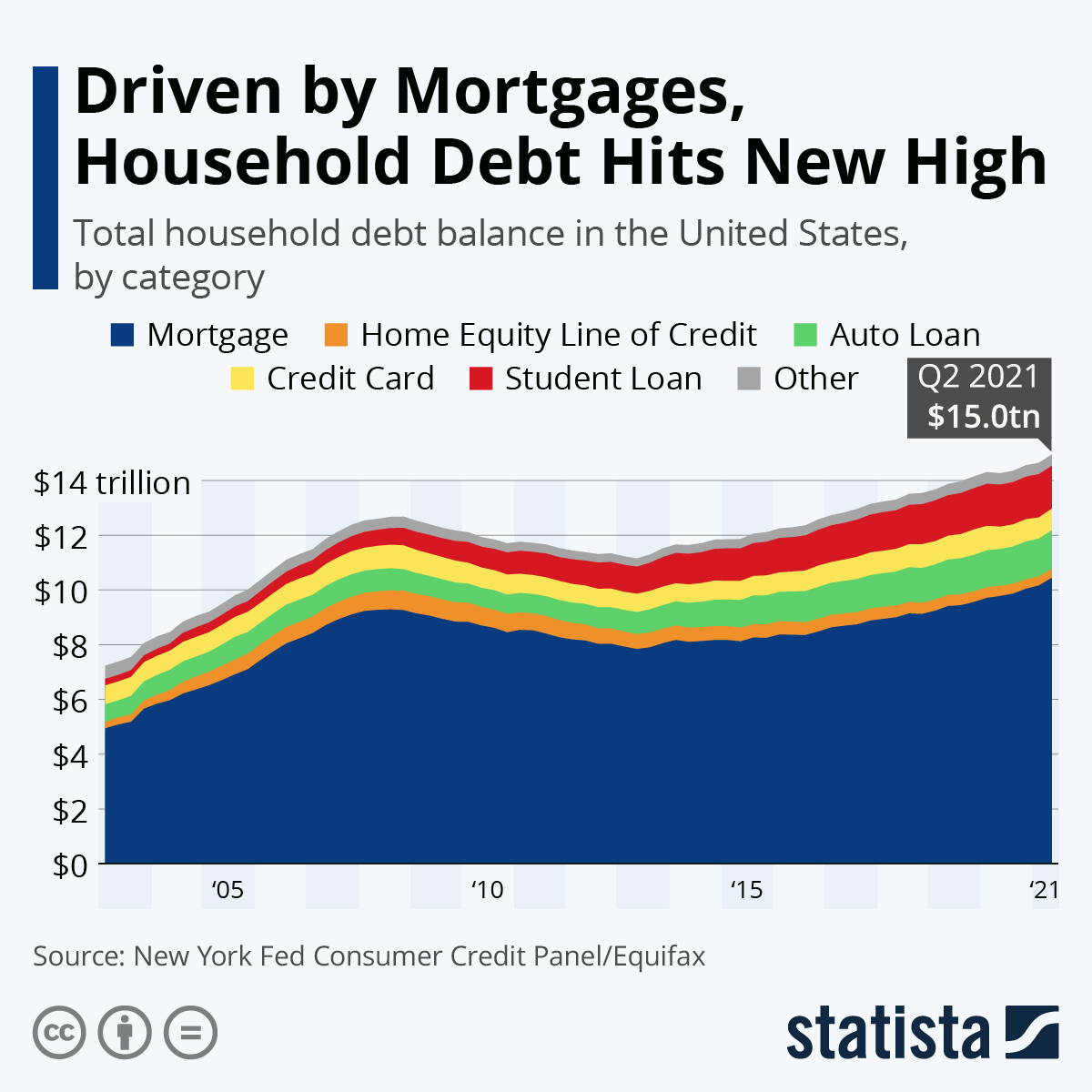

But if you look at this graph here that shows the total debt in the United States, the vast majority is mortgage debt.

US household debt from 2000 to 2021, via Statista

And you’ve written a lot about mortgage debt. And you’ve emphasized that when we talk about debt, we need to understand that the other side of the balance sheet is the wealth of the debt holders and the bond holders

There are $15 trillion in debt in the United States, and most of that is mortgage debt. This is something that is barely ever commented on.

Can you talk about how the finance capitalist model that the United States has imposed around the world is a model predicated on debt, not only indebting other countries, but indebting its own population with $15 trillion worth of debt.

MICHAEL HUDSON: Well, I’m going to make one point: In Biden’s twisted mind, there’s a silver lining for keeping the student debt on the books and not canceling it.

By not canceling it, the students and the young people won’t have enough money to qualify for a mortgage. They’ll have to continue to live at home with the parents. So that actually alleviates the mortgage debt, by keeping graduate students too poor to afford to take out a mortgage, because they’ve already committed their income to the student debt.

And that $1.7 trillion you mention has now soared ahead – just in the last two years, student debt has surged ahead of credit card debt and ahead of automobile debt.

So it’s really become the fastest growing largest debt, and it’s the fastest growing debt because of all the penalties for late payments. And of course, with the Covid crisis and limited employment, you’re going to have this debt growing even more.

And also the amount of paperwork that the administration imposes on students trying to get debt relief is so great that a lot of students are simply not going to be able to get through the maze and pierce the bureaucratic shell that protects the banks and the debt. So I just want to point that out.

Regarding the mortgage debt, the whole policy of the Federal Reserve since the 2008 bank crisis has been to bail out the banks by inflating, re-inflating, the prices of houses so that you have to take a larger, and larger, and larger mortgage in order to buy a house.

And not only that, but now as of yesterday (September 7), the mortgage rate is 6%. And I think that’s the highest since the 1970s.

So you not only have to pay a very high price for the house – the carrying charge in the mortgage is basically, within a 10-year-period at 6%, you actually have repaid as much as you paid for the entire house, you have paid in the form of interest charges.

And on the 30-year-mortgage, you have paid three times as much to the banks for the house than the owner of the house got who sold it to you. So the banks end up getting much more than the actual seller of the home.

And the way the mortgage market has ended up with increasing the debt ratio of mortgages, Americans now own only about 40% of the value of homes.

In other words, home equity has been shrinking, and shrinking, and shrinking for most of the real estate sector as a portion of homes. And of course, if you’re earning less than $200,000 a year, you have much less equity in the home.

Basically, buying a home is getting on a financial treadmill, to the point that if you either have a home, or now if you pay the soaring rent rates, you’re not going to have enough money to spend on the goods and services that are being produced.

So the effect of debt is to leave less in the budget for actual spending on goods and services. It’s an austerity plan.

And the effect is very much like the kind of austerity plan that the International Monetary Fund imposes on Third World countries, or Global South countries, as we say now.

So basically, you’re right, the economy is being sacrificed. But there is a silver lining, and that is 90% of the population owe this debt to the 10%.

So there’s been a sucking up of income and wealth to the top of the pyramid. And the mortgage debt has been the single largest lever that is shifting wealth and income from the 90% to the 10%.

BEN NORTON: Very well said. Professor Hudson, let’s talk about inflation. The United States has been going through decades-high level inflation.

I’ve asked you about this before and you’ve emphasized that a lot of that that inflation we’ve seen in the consumer price index recently is because of monopolization of certain key industries, because of the recovery from the Covid pandemic, and bottlenecks in the supply chain and all of that.

But a point that you’ve consistently pointed out for many decades, Professor Hudson, unlike other economists, is that this consumer price index inflation that we’ve seen in 2021 and 2022 is certainly new, but in general, inflation is by no means new.

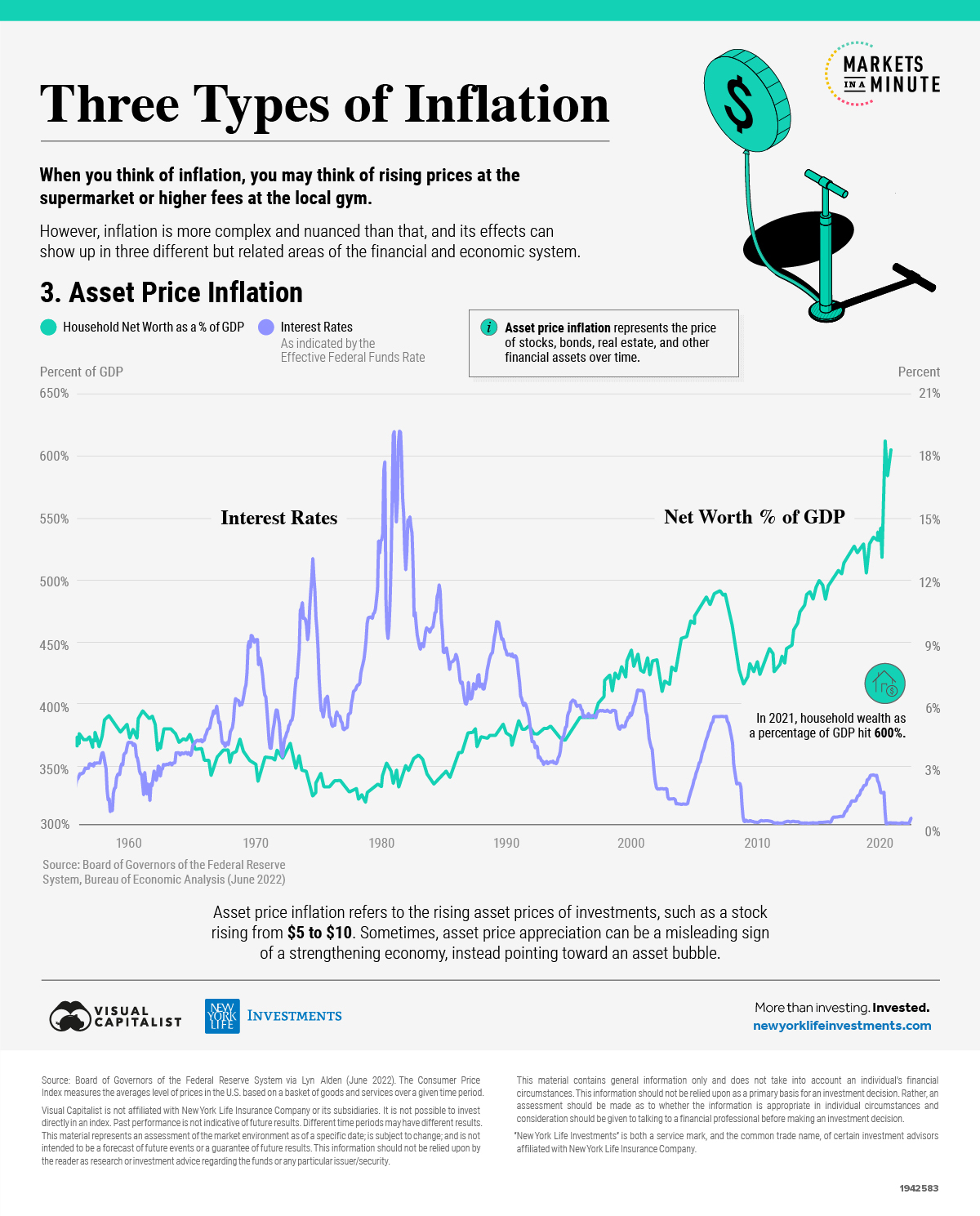

We’ve seen massive asset price inflation over the past few decades, which of course has been intentionally pushed by the financial system in the United States in order to push up the value of real estate, of stocks and bonds.

Here’s a graph showing asset price inflation in the United States. The green line is asset price inflation, and the purple line are interest rates set by the Fed.

And you can see really from the 1990s forward, so in the neoliberal era going forward, there’s been a massive skyrocketing of asset price inflation.

And I should point out that with the bailout after Covid, and the trillions of dollars pumped into the financial sector by the government, this big giveaway, we’ve seen a skyrocketing in asset price inflation.

So I’m curious if you can expand more on this idea that inflation is something new, because we’re now seeing it in the consumer price index, and also its relationship to interest rates.

This is something in a bit here, I want to ask you about some of the history of the Volcker shock and all of that, Paul Volcker.

But let’s start with asset price inflation, because this graph I almost never see mentioned in kind of mainstream discussions of economics in the business press. They act as though this consumer price index inflation – some people call it, you know, the Biden inflation or whatever; and certainly Biden bears responsibility for the sanctions on Russia, which caused an energy crisis in Europe, which led to skyrocketing prices of energy, and that fueled the inflation – but why isn’t this inflation, the asset price inflation that has been consistent over decades, ever discussed?

MICHAEL HUDSON: Well, the asset price inflation is the response to the Obama depression that we’re still in.

In 2008, when the banks crashed, you had Citibank being insolvent, a number of other banks insolvent. The worry was that throughout the whole U.S. economy, banks had made so many junk mortgage loans and lost so much money on derivative gambles that they had a negative net worth.

Now, the problem was when Obama came in, the problem was, who are you going to save, the debtors in the economy, the victims of junk mortgages or the crooks, or the crooks, the victimizers, the banks that wrote the junk mortgages?

And Obama came in and said, we’re not going to save any of the homeowners who bought these junk mortgages. Most of them are minorities anyway. Most of them were Black and Hispanic people, who the banks, especially through the Countrywide lending company, had exploited more than anyone else.

Obama invited the bankers to the White House and said, I’m the only guy standing between you and the mob with pitchforks – those being the people who voted for him – and saying, don’t worry, you contributed to my campaign; I’m backing you.

And so he directed the Federal Reserve to essentially re-inflate the real estate prices and the stock market so much that the banks wouldn’t have to be taken over into the public domain for insolvency.

He wanted to rebuild the banks’ balance sheet. And the reason he did it was to pump money into the banks.

And the result has been $9 trillion, essentially, of bank liquidity that the Federal Reserve has pushed in.

Now, despite the fact that it is asset price inflation, the fact is that asset price inflation has all occurred on credit.

The asset price inflation has occurred when the Federal Reserve makes basically repo swaps with the banks, enabling the banks to deposit some of their packaged mortgage loans, or bonds, government bonds or even junk bonds, with the Fed.

And they get a deposit with the Fed that enables them to now turn around, as if the Fed was depositing money in the bank like a depositor, letting it lend more, and more, and more for real estate, which has pushed up the price.

Real estate is worth whatever a bank will lend against it. And the banks have been lowering the margin requirements, easing the the terms of the loan.

So the banks have inflated the real estate market, and also the stock and bond market.

The bond market from 2008 today has had the biggest bond rally in history. You can imagine the bond prices going down to below 0%. This is a huge capitalization of the bond rate.

So it has been a bonanza for people who held bonds, especially bank bonds. And it has inflated the top of the pyramid.

But if you inflate it on debt, then somebody has to pay the debt. And the debt, as I just said, is the 90% of the population.

So the fact is that asset price inflation and debt deflation go together, because the wealth part of the economy, the ownership part, has been vastly inflated, the price of wealth relative to labor.

But the debtor part has been has been squeezed by families having to pay much more of their income on mortgages, or credit cards, or student debt, leaving less and less to purchase goods and services.

So if there is a debt deflation, then why do we have a price inflation now? Well, the price inflation is largely a result of the war [in Ukraine], the sanctions that the United States has imposed on Russia.

Russia was, as you know, a major gas exporter, oil exporter, and also the largest agricultural exporter in the world.

So if you exclude Russian oil, Russian gas, Russian agriculture from the market, you’re going to have a shortage of supply, and you’re going to have the prices way up.

So the oil, energy, and food have been a key element.

And also, under the Biden administration and certainly the Trump administration, there has been no enforcement of monopoly prices.

So essentially companies have been using their monopoly power to charge whatever they want.

And even though there wasn’t really a shortage of gas or of oil earlier this year (2022), you had a huge spike in the price, for no other reason than the fact that the oil companies could charge it.

Partly this was done by financial manipulations in the forward markets. The financial markets had bid up the price of oil and gas. But also other companies have.

And right across the board, if you have a company in a commanding position of being able to control the market, you have essentially permitted monopolies to take place.

Well, Biden had appointed a number of anti-monopoly officials that were going to try to impose anti-monopoly legislation. But they’re not supported by the Democratic Party or the Republican Party enough to really empower them to have had much effect so far.

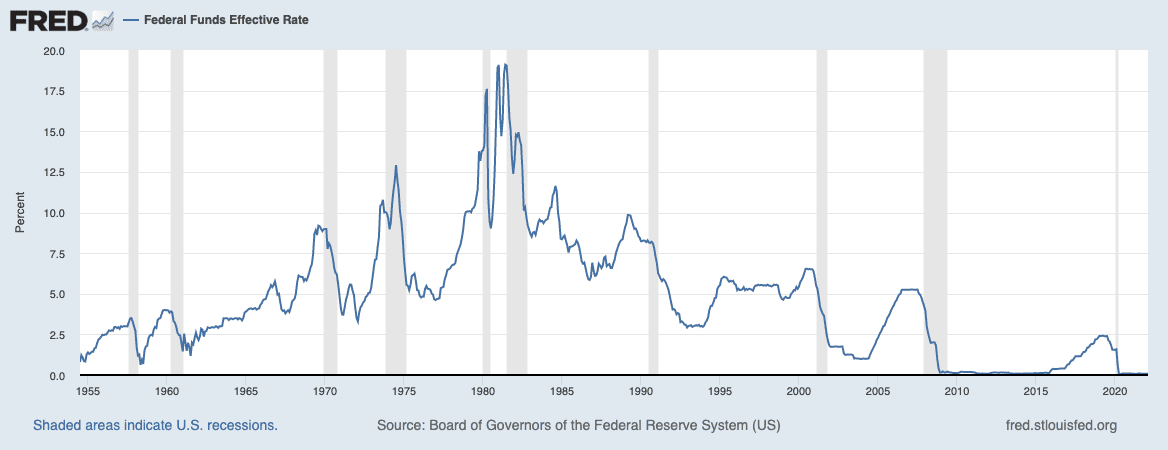

BEN NORTON: I had you on in June, Professor Hudson, to talk about the Fed’s interest rate hike. It’s now at around 2.25%, and there’s discussion of potentially increasing it by another 0.75%.

And you warned that there are signs that there’s going to be a depression, an economic depression. And certainly after raising interest rates there typically have been recessions in the past.

I want to talk about some of that history. Because a name that’s come up a lot in this discussion of inflation in the United States is Paul Volcker, who was the head of the Fed.

And he was actually appointed by Jimmy Carter. He is more often associated with Ronald Reagan, but he was first appointed by Jimmy Carter and then continued with Reagan, and reappointed by Reagan.

In the ’70s, there was a similar crisis of consumer price index inflation, like what we have seen in the past year. And Volcker had this famous Volcker shock. He raised interest rates to as high as 20%, and then gradually dropped them.

The way that Volcker is discussed in the business press, the financial press, is they say that he’s this admirable man who was unpopular in his day, but that’s because he was giving people the medicine they needed, right, and he was he was willing to do the hard thing and be unpopular in order to bring consumer price index inflation down.

Can you reflect on why there was consumer price index inflation in the United States in the ’70s, what was causing it?

And this portrayal of Paul Volcker as like this great economic wiseman who saved the U.S. economy – I’m curious what you think about the Volcker shock and his decision to raise interest rates so high and why he’s so beloved today.

MICHAEL HUDSON: Well, Volcker was my boss’s boss at Chase Manhattan in the early- and mid-1990s. And once a week or so, there would be a meeting of the economists and the policymakers at Chase. And because I was in the economic research department and knew how to do speedwriting, I often took the notes for these meetings, so I had a chance to watch him.

And just before he was appointed, I had to be at the White House for some reason and was asked by a member of the Council of Economic Advisors, what was it like working for Volcker?

And I said, well, at the meetings, a number of officers would give their impression of what was going to happen, and Volcker would say, well, so-and-so says this, and that’s that position, and you say this, and that’s this position. So let me state what the argument is all about.

By doing that, everybody thought, oh, he understands my position. So he was very popular. Because he didn’t make any enemies. He could state everybody’s position and basically be neutral and not take a position.

Well, the Council of Economic Advisors person said, that’s the guy we want. And he was appointed about a month later for the the job.

And his own view was that of a banker. He had gone back and forth. He had begun at Chase; he moved to the Treasury; and then he actually went back to Chase, and that was something that wasn’t often done at the time.

And when he went back to the Treasury again, he met with the Carter people. And Carter – people don’t realize because he’s a sort of a nice old man now – but he was viciously, viciously neoliberal, much more right-wing than anybody could have expected at the time.

I think Volcker sensed where Carter was at. And Volcker said that he carried around a piece of paper, an article with him, a chart, and the chart was the wage levels in the construction industry.

And Volcker would say the job of the Federal Reserve is to keep down wage rates. He said, although the nominal purpose of the Federal Reserve is to prevent inflation and support full ployment, it’s actually the opposite – it’s to make sure there is not full employment so that there will be a reserve army of enough unemployed that wages are not going up.

And of course it’s to inflate asset prices, which is just what the federal Reserve has done. So Volcker was quite aware of what to do.

Today you would say what he did was – I guess, what the current Federal Reserve head would say – well, we’re going to have to impose a depression to cure the inflation.

And for Volcker, curing inflation was an excuse to lower the wage levels and to bring about a recession.

And by increasing the interest rates to 20% – I think 20.5% was the bank discount rate – you had lowered bond prices, and packaged mortgage prices, and housing prices to such a low level that once you changed course, which of course happened from the 1980s on, you would have a huge explosion of capital gains for anybody who bought the bonds at those prices.

By pushing interest rates to 20%, Volcker made a buying opportunity, a guaranteed path to doubling, tripling, quadrupling your capital on the capital gains from the rise in bond prices.

Well, most people don’t think of the bond prices as being the most important thing to talk about in the news. But actually, as Bill Clinton said when Robert Rubin explained the facts of life to him, he said, oh, it’s all about the bondholders. Well, he got it.

And that’s exactly what Sheila Bair said when she was working for Obama. She said she found out it was all about the bondholders, especially the bondholders of the banks, that led Obama to support the banks and do all of that.

So what Volcker was doing was using the Vietnam War inflation that had been a bonanza for the working class because it had created basically a drive for employment – the guns-and-butter economy had created rising wage levels. You did have guns, but you also had a lot of butter.

And that was really what was ended. You did keep the guns part of the economy. But Volcker’s action, while keeping the guns part, squeezed down the butter part.

And that was the idea, that in order to make the industrial economy thrive and make profits, he thought, you need low wages. And by keeping interest rates high, lowering employment to the point that wages went down, you were creating enough of a profit that you would somehow create a re-industrial economy.

Well, we all know what happened: the economy was de-industrialized under the financialization policies of the Reagan and Bush administrations, and the Clinton administration that was coming up.

But that was at least the idea at that time. I don’t think that anyone, even Volcker himself, had an idea that what was going to come after him was going to be de-industrialization.

He thought lower wage rates would make industrial profits and help America regain its industrial power.

BEN NORTON: Professor Hudson, can you talk about what caused the consumer price index inflation in the ’70s?

This is a graph showing CPI inflation, changes in price. And you can see that there was a big peak in the ’70s, into the ’80s. And it’s been relatively low since then, until past the past year.

“There are persistent issues in supply chains,” the chief U.S. economist at Deutsche Bank said. “And the most recent developments have not been positive.” https://t.co/FBxXGZAjWk

— NYT Business (@nytimesbusiness) May 12, 2022

Of course, people probably know from the interviews that I’ve done with you and from reading your amazing books like “Super Imperialism” and others, you have talked a lot about the Nixon shock and how important that was to understand the financial system today, when in 1971, Richard Nixon took the dollar off gold.

And at the beginning of the Nixon shock, there was an inflation crisis. And he responded in an interesting way – in a way that you can’t even discuss today; it’s no longer on the table for discussion.

Nixon imposed price controls, and froze wages as well, but he imposed price controls.

Now, in this most recent inflation crisis, I didn’t see anyone in the mainstream calling for Biden to impose price controls. Of course they would all say that if the government imposes price controls, it would lead to a shortage of goods, and scarcity, and all this.

So can you talk about Nixon’s response to the inflation?

And then you mentioned that Jimmy Carter, really even before Reagan, ushered in neoliberalism.

Why, after Nixon imposed those policies, the inflation came back – so why did the inflation come back in the 1970s and ’80s?

MICHAEL HUDSON: Well, remember, I think that Kennedy also imposed price controls on steel. There were early price controls on the steel industry.

The inflation of the ’70s was the result of America’s military spending in Southeast Asia. Copper – every soldier in Vietnam used an average one ton of copper per year in bullets. So there was a huge copper increase that went up. I think the price tripled.

BEN NORTON: Sorry to cut you off, Professor Hudson – and that was of course a factor in the 1973 CIA coup against Salvador Allende, Chile being one of the world’s leading producers of copper, the Anaconda Corporation wanting to get access to that copper.

MICHAEL HUDSON: The Anaconda already had been producing the copper.

BEN NORTON: Well Allende nationalized the copper.

MICHAEL HUDSON: That’s another long story that I was very involved in, but it’s another story.

Basically the [U.S.] government was spending so much on military that you couldn’t have guns and butter. And that’s where the guns and butter phrase came from. I think it may have come from Terence McCarthy using it. At least he was the main expounder of that theory, along with Seymour Melman of Columbia University.

And it was very clear that the military and the consumer economy was pushing up demand so much that there was a shortage. And there was a shortage of labor, because of the labor that was being diverted, that was needed for the military.

So there was a military inflation in the ’70s. That’s quite different from today’s inflation.

Today’s inflation is much more – well, the companies can do it, we’re now in a much more highly monopolized economy. We’re in a deregulated economy.

Back in the ’70s under Nixon, his policies actually, when you look back, they were much more liberal than the policies of anybody who has come after him, simply because he was pragmatic.

It wasn’t because he was a liberal, but because it was accepted by Republicans and Democrats that when you have inflation stemming from companies using purely monopoly power, the right thing to do is to prevent them from raising their prices, so that the economy will not be bled by super rents, monopoly rents that are paid to the monopolies.

Well, that was before the monopoly lobbyists fought back. And basically the Republicans and the whole attempt to put [Robert] Bork on the Supreme Court, and later to control the Supreme Court, has been very largely an attempt by the monopolists to do to the Supreme Court what they’ve done to the Democratic Party and the other political parties, to basically have privatized the political process and the legal process, to give a free rein to the monopolists at the top of the pyramid.

[It is] to make their money, not by employing labor to produce goods and services for a profit, but simply by charging more for what they’re doing, simply by getting monopoly rent, and financial rents, and natural resource rents, which is where most of the money is made today, along with capital gains, the asset price inflation, which are euphemized as capital gains, but it’s certainly not industrial capital gains; it’s finance capital gains.

BEN NORTON: Professor Hudson, I have a kind of complicated question and I really want to pick your brain on this.

The issue of interest rates is something that I’ve been researching a lot because there has been this debate about it in the past year or two about the Fed interest rates.

And I’m curious if you think if it’s correlation or causation in that, with the rise of the neoliberal era – excluding, you know, after the Volcker shock, in this neoliberal era – in general, there has been a tendency toward dropping interest rates.

And of course we have seen that after the financial crash of 2008 and the policy of quantitative easing, interest rates were zero or even technically below zero.

And there was this extremely loose monetary policy, basically, the government just investing in all of these junk bonds, giving this massive cash infusion to the financial sector.

I’m curious if you think that that’s just correlation or causation – do you think that, if you look at this graph just from an ignorant perspective, not knowing anything about fiscal policy, that in the Keynesian era, in that ’50, ’60s, and ’70s, there was a general tendency toward gradually increasing the Federal Reserve’s interest rates.

And in the neoliberal era, there has been a tendency toward dropping those rates all the way to zero. Is that correlation or causation?

Obviously raising the interest rates can cause a depression, which hurts working people. But at the same time, you’ve pointed out that, while there there are negatives to raising interest rates, like we’re seeing now, in that it’s going to make average consumers have to pay a little bit more on their mortgages and car loans.

But it seems to me that the people who benefit most from low interest rates are not average working people who are trying to buy a house; it seems like it’s actually stockholders, and bondholders, and corporations.

And there has been this big bubble in the past 10, 20 years where there’s such a loose, expansionary monetary policy, that there was this big bubble of all these corporations and start-ups that basically made no money.

Uber, Twitter, all these big tech companies in Silicon Valley, they’ve never really made money. They basically were able to thrive because they were surviving on free money and all these zero interest loans. And now that bubble is kind of bursting.

So do you think that in some ways, even though there could be a depression in the short term, raising interest rates can in some ways be better for working people, because it’s the financial sector that benefits most from low interest rates.

I don’t know. It’s a difficult question. I’m curious what you think.

MICHAEL HUDSON: That chart is very important, but it’s very misleading the way you put it by itself. What should be alongside of it, the [Fed] interest rate chart, would be the interest rate on credit cards and late fees.

At the same time, you had 0.1% of interest rates all toward the end there, you had credit card rates of 19%. And if you’re late on your credit card, as most people have become, the interest rate is 29%.

So you have a steady rise in the rates that debtors have to pay, that the 99% of the population have to pay.

So the interest rates that fell were the interest rates that banks had to pay to the Federal Reserve and to each other, and that bank customers, financial customers had to pay for, say, borrowing from a bank at maybe 1%, and buying corporate stock that could pay dividends of 3%, 4%, or 5%.

So the low interest rates created what’s called arbitrage for the financial sector – borrow cheap from the banks, and buy a higher yielding asset. You could borrow at less than 1% and buy a foreign bond that is yielding more.

That’s called the carry trade. That’s what Japan did so much in the 1990s.

Or, mainly, you could borrow at 1% and buy junk bonds that would pay much, much higher prices.

And so much borrowing from the banks was done to buy junk bonds, that the interest rates on junk bonds actually came down, even though the risk didn’t come down.

It turns out that interest rates don’t really reflect risk at all. Interest rates reflect the opportunity to make an arbitrage trade or straddle in the financial sector.

So you’re right, the people who benefited from the interest rates were corporate raiders and speculators, and the people who were borrowing at low interest rates to buy real estate.

Now, in the past, before 2008, the way to make a profit in real estate was, you take out a loan, and you buy real estate, and the real estate value will go up, and the price will go up.

Well, what happened with private capital is they said, well, we can borrow from the banks at a very low price and we can buy the houses as absentee owners. And we can make much more money in rent than the low interest rates we have to pay.

So the low interest rates helped finance large real estate private capital companies to come in and begin to become absentee owners of a rising amount of housing in the United States, which is what has turned the home ownership rates way down.

At the point Obama took office, about 59% of Americans were homeowners. Now it’s under 50%. It’s fallen by about 10 percentage points as a result of the Obama evictions and the rules that Obama put in, the anti-Black rules, the anti-Hispanic rules, the anti-minority rules, and the anti-consumer rules that Obama put in.

[These] have essentially transformed the real estate market away from a home-ownership economy into a rental economy, where you’re recreating a landlord class financed by the banking class, and merging between the finance, insurance, and real estate sector, the FIRE sector.

It’s the FIRE sector that has really taken off since 2008. And it’s not simply that the economy has polarized, it’s that the shape of the economy has shifted away from an industrial, manufacturing, agriculture economy into a rentier economy, into a FIRE sector economy.

It’s not even an agricultural economy in the sense that farmers, and dairy people are making money off the farms. It’s the trading companies, Archer Daniels Midland, and the other companies that are essentially the marketing choke points that have made money.

So you’ve had the American economy since 2008 turned into a chokepoint economy.

You need housing; you need food; you need medical care. And all of these have become monopoly rent-gouging opportunities that have essentially paid the wealthy 1% or 10% very, very highly, but squeezed out of the rest of the economy.

BEN NORTON: So this might be a very simplistic question: is a looser monetary policy in general better for the financial sector and the speculators, and a tighter monetary policy is in general better for working people? Or is that just one factor among many and it’s more complicated?

MICHAEL HUDSON: Look, the key is who is going to be the debtor and who is going to be the creditor.

If a looser monetary policy would lower your credit card rates from 19% to 1%, at which that the banks get to borrow, fine. Then you can pay off your credit card debt. Instead of paying 29% with a penalty fee, you’d be paying 1%.

That kind of loose monetary policy would be great. A monetary policy of forgiving student debt would be a great.

But what’s called a loose monetary policy has been a very, very tight monetary policy for most of the population, but not for Wall Street, not for the financial sector.

So you have to think of the American economy as divided into two sectors: the productive economy, of goods and services, production and consumption; and then the wealth economy, of assets and debts, the real estate sector, the financial sector, stocks and bonds, and ownership of monopoly companies.

BEN NORTON: Very well said, very well said. I want to pivot a bit and talk about the situation in Europe.

Professor Hudson, you have said in the past that the economic war on Russia that the U.S. and the EU are waging – which has caused an energy crisis inside Europe, as winter is soon approaching – you have said that this is basically going to turn the eurozone into a dead zone, economically speaking.

We have seen that German industry, German capitalists, are in fact protesting against the government, saying that they really need cheap Russian energy. We have seen German labor unions warning that their industry could go bankrupt and could be offshored, like we saw with the deindustrialization of the U.S.

And French President Macron – who of course is an investment banker; we should always keep in mind his own class interests – he gave this very interesting, you could say, historic speech, in which Macron announced the “end of abundance.”

And I just want to read one quote from this from The Guardian here: “Macron said France and the French felt they were living through a series of crises, ‘each worse than the last.’”

And the French president said, “What we are currently living through is a kind of major tipping point or a great upheaval … we are living the end of what could have seemed an era of abundance … the end of the abundance of products of technologies that seemed always available … the end of the abundance of land and materials including water.”

Now, I basically interpreted this as Europe, acknowledging that neoliberalism – this financial, parasitic phase of capitalism that you have spent so much time analyzing and writing about – it is collapsing essentially in on itself.

But I guess you disagree. So what do you take of of Macron’s speech on the “end of abundance”?

MICHAEL HUDSON: When he said the “end of abundance,” what he really meant was the beginning of an IMF austerity program applied to Europe.

And the end of abundance for the 90% is a bonanza of abundance for the 1%, for the financial sector. They’re making huge, huge gains in all of this.

For instance, the electric companies in Europe are allowed to charge electricity in proportion to the highest priced marginal input. Well, the highest price input now of course is natural gas.

So even though most of the electric companies will make their electricity in the usual way – through atomic energy, or oil, or other sources of energy – they have had a huge marginal increase in energy prices for all of this.

The end of abundance means, when you look at it and say, what’s on the other side of the balance sheet? Austerity for the population means we are now going to put the class war in business here.

We’re going to show you what European “socialism” is. European “socialism” is the same as it is in the United States with the Democratic Party.

It’s lower wages, enabling higher profit opportunities for the companies. It’s going to be the end of abundance for wage earners, but it’ll be a bonanza for the monopoly owners and for the banks.

In England, for instance, you can see this energy crisis. They announced the last week that I think the average electricity bill per family is going to go up by about £5,000, which means about $6,000 a year, just to heat the home, just for families.

And for businesses like pubs, banks have asked for a $10,000 deposit so that the pubs, if they go bankrupt, can’t wipe out the amount of money that they give to the banks.

So the banks have right away said, well, we’re going to make sure that as energy prices go up, we don’t have to suffer the end of abundance. Certainly the large companies aren’t.

And from the US point of view – and basically the sanctions of Europe are a US policy – this is a bonanza for American companies that are replacing the German industrial companies in Europe.

You had Germany’s Foreign Minister Baerbock go to the Czech Republic and said, my job is to support Ukraine; it’s not to represent my voters. I don’t care what my voters want. I know that they’re unhappy, as you just pointed out, but I’m going to support the sanctions on Russia. The most important thing is to keep up the sanctions on Russia.

So you’re basically having almost all of the European Union officials and English officials are acting as local proxies for NATO.

NATO is really running European politics. And it shows that Macron could have said – when he said we’re at the end of abundance and the beginning of austerity, he meant we’re at the end of democratic politics. We’re at the end of social democracy.

Social democracy wouldn’t do what they’re doing. And socialist policy wouldn’t do what they’re doing.

He said, we’ve turned the “socialism” into neoliberalism, just as Tony Blair did in England, and [Keir] Starmer is doing it today with the British Labour Party.

You’ve had the end of any kind of social-democratic politics, and basically a concentration of policy – I guess you could call it the Davos class, the neoliberal class – it has really been centralized, largely under US direction and US financing.

That’s why the United States, in discussions with Europe, has said these sanctions and the Ukraine war are only the opening overture for what’s going to go in 20 years.

What’s at issue is how we are going to restructure the entire world economy. And in order to restructure the entire world economy, in the way that we want and that the Davos crowd wants, is you have to make sure that it is indeed a unipolar economy, not a multipolar economy.

We first have got to knock out Russia, so that it can’t support China. Then we’ve got to oppose China, India, Iran, the rest of Asia.

We’ve got to make sure that the United States, with our European partners, can impose this neoliberal, financialized economy over the entire world, and make sure that the dream of the 19th-century classical economists, of social democracy and socialism, was only a nightmare from our point of view.

BEN NORTON: Yeah, well, maybe I was much too optimistic saying this is the end of neoliberalism, I guess. I think you’re right that what we’re now seeing is that this is the end of the last vestiges of European social democracy. And the very same policies that the IMF and World Bank, the structural adjustment and Washington consensus policies, that they imposed on the Global South for decades, are now coming home to Europe itself.

But I do want to talk about something very related. I’m glad you mentioned German Foreign Minister Baerbock’s comments at this conference in the Czech Republic, where she said, what’s important for us is this war on Russia and supporting Ukraine, regardless of what voters want.

Now Ukraine itself is being subjected to these same neoliberal shock-therapy policies. A friend of mine, a Canadian activist and writer, Jake Kallio, and I wrote an article over at Multipolarista.com titled “West prepares to plunder post-war Ukraine with neoliberal shock therapy: privatization, deregulation, slashing worker protections.”

A conference was held this July in Switzerland called the Ukraine Recovery Conference, in which a bunch of Western governments and corporate leaders met together to plan neoliberal shock therapy to impose on Ukraine.

And we couldn’t have seen a more blatant symbol of this than the fact that Ukraine’s Western-backed leader Zelensky, on September 6, he rang the opening bell, digitally, at least via Zoom, in the morning at the New York Stock Exchange.

I mean, it’s really incredible. It says so much. With the hashtag #AdvantageUkraine and the slogan, “We are free. We are strong. We are open for business.”

And if you read what the financial press is saying about this, this is from this website Business Wire: “President H.E. Volodymyr Zelenskyy rings bell at NYSE to signify Ukraine is open for business.”

It notes there are $400 billion in investment options. It spans “public private partnerships, privatization and private ventures.” And “a USAID-supported project team of investment bankers and researchers appointed by Ukraine’s Ministry of Economy will work with businesses interested in investing.”

They quote the president of the New York Stock Exchange Group who said: “we stand for freedom, investor protection and unfettered access to capital. We are pleased to welcome President Zelenskyy virtually to the NYSE bell podium, a symbol of the freedom and opportunity our U.S. capital markets have enabled around the globe.”

So this, to me, it says everything. It points out that Ukraine has been working with the G7 in the EU to reform the country’s tax system – that is, cut taxes on corporations and the rich – to create a new legal framework and to adopt “rules and legislations to allow companies to build a transparent corporate structure, attract foreign investment more easily, and use additional mechanisms to protect intangible assets.”

So, I mean, honestly, what they’re announcing is a massive corporate giveaway. What do you think about this policy of Ukraine being “open for business”?

MICHAEL HUDSON: Well it certainly didn’t say everything. The day after Labor Day, significantly, Tuesday, on September 6, the day that Zelensky rang the bell at the stock exchange, he had an editorial in the Wall Street Journal that did say everything.

He said, what we’ve done is abolish the right of labor to join labor unions. We have abolished the right of collective bargaining. Every wage agreement is going to be an individual choice between the worker and the employer. That’s a fair market.

We are abolishing all of labor’s rights that are in the constitution. We are rejecting the European Union labor laws. We are rejecting everything that the UN International Labor Organization said.

Labor, we have reduced labor, under the new law that I just passed, to absolute abject dependency. So if you work in Ukraine, not only are we going to give you whatever you can buy from the kleptocrats, giving them an appropriate markup and owning it, but you will have a completely docile labor force such as no country has seen since the era of Pinochet.

You’ve got to read the Wall Street Journal editorial. It’s jaw dropping. It is absolutely – it’s like a parody of what a socialist would have written about how the class war would be put in into action by a fascist government. This is literally what fascism is.

So of course he was welcomed on the stock exchange for abolishing labor’s rights. You could not have a more black-and-white example from what you just pointed out.

BEN NORTON: Yeah, and I mean, it’s really sad considering that Ukraine already is the poorest country in Europe. And it’s one of the most corrupt countries in Europe, even according to these metrics of Western-government backed organizations.

So we have seen that, after the overthrow of the Soviet Union in 1991, that, in Russia in particular, there was this brutal neoliberal shock therapy.

Gorbachev just died. You know, he helped bring this in. Gorbachev did this famous Pizza Hut commercial, basically showing that he sold out his country for Pizza Hut.

And we saw that under Yeltsin, this alcoholic US puppet, in Russia, the life expectancy of Russians decreased by several years. According to UNICEF, millions of Russians died excess deaths because of the neoliberal shock therapy imposed on Russia.

And of course, Ukraine suffered, but the neoliberal shock therapy imposed on Ukraine wasn’t as severe as it was on Russia. And there still are some state-owned assets in Ukraine that all of these Western corporations are just frothing at the bit, they’re salivating about trying to get their hooks into and to privatize all of these assets.

So this is a country that is already the poorest in Europe. It’s already one of the most corrupt countries on Earth. It has a massive problem with far-right extremism.

And now it’s being flooded with $40 billion of weapons just from the US, billions of dollars more weapons from Europe.

I mean, this seems like such a massive powder keg. I can’t even imagine how disastrous it will be, considering the effect of the neoliberal shock therapy imposed on Chile, you mentioned, under Pinochet, and the neoliberal shock therapy imposed on Russia and the disastrous consequences.

I mean, what do you think this is going to do, not only to Ukraine, but to Europe?

MICHAEL HUDSON: Well, this is exactly what Mr. Macron said when he said the ‘end of abundance.’ The Ukrainian labor force has just experienced the end of affluence, neoliberal style.

And as Mr. Zelensky said, it may be the end of affluence for the labor force, but it’s going to be a bonanza for you investors in the New York Stock Exchange. Come on in and join the party!

Somebody’s loss is turned into somebody else’s game. And that’s what happens in a class war. It’s a zero-sum game. There is no attempt at all to raise living standards.

And the problem – you said Ukraine is the poorest country in Europe – but Zelensky said it’s not poor enough. He said, you think this is something, wait until our new law takes effect. That’ll really show you what it means to be the poorest country in Europe.

But it’ll also be the richest country in Europe for the 1%. Because, as you just pointed out, the kleptocrat class there was the most corrupt. I’ve met some of them, and it’s an experience.

BEN NORTON: Professor Hudson, I mentioned at the beginning of this episode that I also wanted to ask you about the petrodollar.

There have been signs that the petrodollar, which Saudi Arabia established in the 1970s, by selling its oil in the dollar, that era might be coming to a close – or if not ending, at least it has a new challenger.

There was a report in the Wall Street Journal that Saudi Arabia is now considering selling its oil in the yuan. And it probably will continue selling it in dollars. But maybe it will have a joint system where you can buy it in either yuan or dollars. This is from March of this year.

And since then, there have been other developments. There are reports that Chinese President Xi Jinping is actually going to take a trip soon to Saudi Arabia, which would be historic, because this is going to be one of his first trips abroad since the Covid pandemic.

And this also explains why President Joe Biden of the U.S. recently just visited Saudi Arabia. Clearly he was trying to pressure Riyadh and Mohammed bin Salman, the crown prince, to cut ties with China and Russia.

Saudi Arabia has been increasing military ties with Russia as well. And actually Saudi Arabia is buying Russian oil for domestic consumption, below market price, and then selling its own oil on the market.

So anyway, the point is that there are there are more and more reports now that the petrodollar could be challenged by the petroyuan. What do you think about this? And China’s increasing relations with Saudi Arabia?

MICHAEL HUDSON: I think we’re seeing a multipolar financial system. This is part of the de-dollarization of the whole rest of the world.

I think that Saudi Arabia felt under attack for two reasons. Number one, the United States criticizing the fact that it killed a foreign critic. To Saudi Arabia, this is America’s interference with its philosophy, where if somebody disagrees with you, you kill them.

Secondly, America was protesting the Saudi Arabia’s butchering of Yemen, of Yemenis. And Saudi Arabia thought, well, they’re threatening not to sell us arms if we’re going to use them to kill Yemenis. We better diversify.

Most of all, though, all of the wealthy sovereign funds of the world were shocked by how the United States announced this year that, if a country does something we don’t like, and that would include Saudi Arabia, we’re going to grab all of its reserves.

We grabbed Afghanistan’s reserves, because we don’t like the way they treat women. We grabbed Russia’s reserves, because they want to have a multipolar world. We grabbed Venezuela’s reserves.

Well, what’s going to stop them from all of a sudden grabbing Saudi Arabia’s reserves?

Any multibillionaire is going to diversify their investments and diversify the assets. And I think Saudi Arabia thought, well, we’re going to be doing a lot of trade with China, because who else are we going to buy our manufacturers from?

We’re not going to buy them from Europe, because that’s finished. We’re not going to buy them from America, because that’s de-industrialized. We’re going to have to make our own pivot to Asia.

And that means that they’re going to want to be paid in their own currency. So, of course, we’re going to want to begin selling or pricing our oil in their currency so that there can be a mutual trade.

And we’re not going to suffer from ups and downs and squiggles in the foreign exchange rate that’s caused by US intervention or US sanctions.

The United States is driving Saudi Arabia and driving every country out of the dollar, by its statements that, if you have dollars invested in Treasury bonds or in US banks, we can grab them. And that’s how we can control the world.

Well, if you’re going to tell the world that, this is not a way – everybody had thought of the dollar as being something nonpolitical and objective, and they were closing their eyes to the fact that holding dollars is a loan to the US government, that basically is debt that is created by America’s military policy and military spending abroad.

So all of a sudden they realized the whole dollarized financial system is an extension of the Pentagon and the military-industrial complex.

And they’re becoming more and more bossy. We’ve seen what they’ve just done to Europe. What if America would do to us in Saudi Arabia and other Arab countries what they just did to Germany, and to England, and to their friends, and to Russia and Venezuela?

We don’t want, we can’t afford to take the risk of depending on America.

So to use Putin’s phrase, America is no longer agreement capable. That means that it’s no longer safe as an investment place.

BEN NORTON: Professor Hudson, I actually I had one other question, because we mentioned Chile earlier. And I don’t want to keep you too long; I know you’re a busy man.

We just saw that Chile had a referendum to vote on a new constitution. And in that new constitution, it wouldn’t have necessarily nationalized the natural resources and minerals of Chile, but it would have been a step toward protecting them and at least putting some slight restrictions on foreign corporations from exploiting the huge copper and lithium reserves in Chile.

And there was a massive campaign by right-wing oligarchs, multimillionaires and billionaires, and the media to demonize this new constitution. And it was voted down; it was not passed.

And there of course is a long history of Chile being exploited by foreign powers because of its large mineral reserves. You mentioned your time working in the banking sector and the role of U.S. corporations in trying to get the copper in Chile, after Salvador Allende, the socialist president who was elected, after he nationalized the copper, which which was a significant factor in the CIA coup in Chile in 1973.

Before we talk about that really quickly, I just want to point out that Jeff Bezos, who is of course the founder of Amazon, one of the richest people in human history, estimated at $200 billion in wealth, he also owns the Washington Post.

And before this referendum in Chile, the Washington Post editorial board published an article lobbying against the new constitution.

And what was incredible about this article is the first paragraph is not about democracy; it’s not about the horrible crimes against humanity committed by Pinochet; it’s actually about lithium.

The first word in this editorial board article from the Washington Post is lithium, and about how “Chile sits atop the world’s largest lithium reserves,” which is “reason enough to pay attention to Chile’s impending Sept. 4 referendum.”

So I’m curious if you can talk about the history of US corporations trying to exploit Chile’s copper and lithium. And maybe you can respond to this this media propaganda demonizing a mild attempt at not even nationalizing the minerals, but just putting restrictions on foreign corporations.

MICHAEL HUDSON: It’s not really about lithium or copper itself. It’s about the pollution that is caused by the mining.

If a company comes in and mines lithium, it’s going to create a lot of environmental problems, very much like an oil slick, like the American oil companies that went into Ecuador and other countries and had a big oil spill, and the countries were not allowed, were not able, to recover the cost of cleaning up the oil spill and the damage to the economy done by the oil companies.

Same thing in lithium. The proposed constitution basically says, if make a contract with a foreign investor developing lithium, they’re going to want just to dig the mine, take it out, and leave a mess behind – sort of like drilling an oil well and then capping it, and then the oil well is going to leak more and more as the pipe rusts, and you’re going to have oil in the water supply.

Well, you’re going to have lithium being a huge environmental disaster. You’re also going to need a huge government expenditure on infrastructure of transportation, and electrification, and power, and roads to the lithium.

Who is going to pay for all of this infrastructure? Chile might get some dollars in foreign exchange for the lithium, but it would have to have a huge, it’s called external economy, external to the balance sheet, or off-balance sheet costs of this.

Who is going to be liable for the off-balance sheet costs and the clean-up costs of the lithium? That’s what it’s all about.

Chile would be quite happy to sell lithium, as it’s quite happy to sell its copper, as long as it can make a national benefit from selling the raw material. And really that’s what it has, the raw material.

But the problem is, when you’re dealing with a messy mineral – sort of like the rare-earth minerals, that also create a lot of problems, which is why China is one of the few countries that has dominated the rare-earth market, because it’s willing to tolerate all of the environmental destruction that the mines create. Well, other countries don’t want to take a risk on the environmental destruction.

So it’s really, how do you think about corporate investment? Do you think of just what’s on the balance sheet for the company, what it spends, and the sales price and the profit it makes? Or do you think of the minerals industry as involving all of these external economies?

That was the whole disaster of the World Bank, and why the World Bank has been so destructive since the time it was formed and began to make loans to Global South countries.

It would tell Global South countries to make exports, and the loans it would make would be roads for export, ports for export. The countries would take over all of the cost of producing the raw materials and the agricultural crops, the plantation crops for export, leaving all of the profits for the companies that invest.

And the countries are stuck with the foreign debt, at inflated prices, to hire US companies to build the ports, and the roads, and all of the infrastructure loans that the World Bank would would lend for.

They’re finally becoming aware in South America that the cost, including the foreign exchange cost, of building infrastructure costs much more than the export proceeds that they get. It’s the tail wagging the dog.

And they realized that they economic doctrine that they have been told that excludes all of the social costs from the balance sheet of national income, and exports, and the profit, is a tunnel vision.

And they’re trying to break away from the tunnel vision. And of course, the companies back the economic profession, which is all tunnel vision.

The economic profession says ignore the external costs; ignore the clean-up costs; that’s not what economics is all about.

Well, the fact is, that’s what it should be all about. And more and more of the countries are realizing that you have to think of economics as a whole system that includes the environment, which it used to be, already in the 1840s, 170 years ago, the United States was developing a national income analysis to take environmental destruction into consideration.

But all of that has been rejected by free-market economics. The free market says a free market is one where all of the profits go for the exporter, and all of the external costs and pollution are stuck with the host country.

Well, it turns out it’s the host the host parasite relationship, basically. So there’s an argument in Chile over what the economics is all about.

BEN NORTON: Well, I know we’re running out of time here. I just want to ask a brief question here from the chat comments. This is from a Babylon, they wrote, “Please ask Michael to explain why the US dollar continues to be so strong.” Obviously this is a very open-ended question, but go ahead.

MICHAEL HUDSON: Well it’s strong because of we talked about at the very beginning of this show. It’s strong because Europe has created an economic suicide.

If Europe is unable to produce industrial exports, if the European steel companies are closing down, the fertilizer companies are closing down, the Italian glass companies are closing down because you need gas to make glass and all of a sudden the price goes up, they’re not going to be making much money.

And the dollar is going up against the pound sterling. It’s not that the dollar is rising; it’s that the sterling is going down. And the yen is going down, by holding Japanese interest rates low. And the euro is going down, by following the NATO sanctions policy.

So this is really a policy of other countries mismanaging their economy, not that the United States is actively doing everything positive, except positively disrupting Europe and England.

BEN NORTON: And speaking of England, a lot of people in the comments have been pointing out the latest news that Queen Elizabeth has died. While we were doing this interview today, on this stream, they announced that she had died. I don’t know if you have any thoughts on that.

MICHAEL HUDSON: No, I mean, she had pretty much played out, stayed out of politics, and just played a ceremonial role that I think certainly helped their tourist trade. I don’t know what the royal family does except a sort of pose for tourists.

It will be very interesting. Prince Charles always had much more of a concern for the environment, and was much more broad-minded and probably activist than Queen Elizabeth was.

So he has a chance to really make his point of view more open, and perhaps play some kind of much more active political role than the the monarch did, where Queen Elizabeth thought she should stay out of economic and political affairs, not be activist.

We’ll have to wait and see whether Charles puts some of his personal views and convictions.

BEN NORTON: Yeah, and I’ll say, Elizabeth really represented a certain generation. Let’s not forget, when Elizabeth was a child, she was taught by her uncle, who was an avowed Nazi, to Nazi salute. And there’s this famous photo of her as a child Nazi saluting.

For me, it says a lot about the British royal family and its attempt to rebrand, as you said, to appeal to tourists, erasing this ugly history of support for fascism, of genocidal colonialism, and all of that.

So the British monarchy moves into a new era. We see the new, ultra-neoliberal Conservative Prime Minister Liz Truss. So there’s a lot there’s a lot to say there.

But Professor Hudson, as we wrap up, what projects are you working on now? Is there anything that you want to plug? I will link in the description to your website michael-hudson.com, and encourage everyone to check it out.

What are you working on right now?

MICHAEL HUDSON: Well, I’m finishing a book that I have been working on for 20 years, the sequel “And Forgive Them Their Debts.” And the book is “The Collapse of Antiquity.”

It’s about how Greece and Rome basically collapsed as a result of the failure to cancel the debts, and the class war of the creditor oligarchy.

And the big point is that what made Western civilization different, what made Greece and Rome break from the Near East, is the fact that democracies are not very good at resisting financial oligarchies.

And in Greece and Rome, especially Rome, the oligarchy took over at the point where it overthrew the kings and established an oligarchy from the very beginning, ruling by terror, and by force, and violence, and political assassination.

So this essentially is an economic history of not only why Greece and Rome ended, but why the pro-creditor laws, the legal system, the whole economic system that Rome bequeathed to the West, when it collapsed, we’re still in it.

And what is happening today, with the debt crisis we’re talking about, is really a process of how Greece and Rome shifted the West onto a completely different way of organizing society than had existed earlier in the Near East and which survived and many parts of Asia.

So we’re just doing the index and typesetting of that book now. It’ll be out in a few months.

BEN NORTON: Great. Well, I look forward to seeing that. Professor Hudson’s books are always amazing. I’ve learned so much from them. They have really influenced my economic and political worldview.

With that, I want to remind everyone that every time I do an interview with Professor Hudson, we always publish a transcript of the interview. You can find that over at multipolarista.com. And it will also be on his website, michael-hudson.com.

As I wrap up here, I want to thank everyone who joined in the chat. It was a very lively discussion. I wish I had more time to respond to questions. But I want to be respectful of Professor Hudson’s time.

Professor Hudson, I’m sure I’ll have you back sometime soon to talk about all of the the latest developments. Things are changing pretty rapidly these days. So I know you’re always writing about what’s going on in the world. You’re always doing great interviews.

Anyone who wants to find your writings can go to michael-hudson.com. There’s always a wealth of knowledge. So thank you so much for joining me today.

MICHAEL HUDSON: Well, thanks for having me. It was a good discussion. And we touched on all the important topics of this week.

BEN NORTON: Thanks, Professor Hudson. And thanks to everyone who watched or listened. If you want to support this show, you can go to patreon.com/multipolarista. And I’ll see you all next time. Thanks a lot.

> And Volcker said that he carried around a piece of paper, an article with him, a chart, and the chart was the wage levels in the construction industry.

Average Hourly Earnings of All Employees, Construction (CES2000000003)

(only back to 2006)

All Employees, Construction (USCONS)

Thanks for this post.

I wonder if Powel and the Fed are raising US interests rates as much to defend the dollar and keep it attractive to foreign buyers of US treasuries as it is to fight domestic inflation. The perception that the dollar is now weaponized, is now part of the military can’t be good PR in foreign countries, imo.

Great stuff. Is there any way out of our current age of corruption other than political reform? Perhaps we need to put the guillotine, not to monarchs, but to the political parties themselves, here and in Europe. Bernie would say it’s all about the billionaires but then turn around and support Biden who, according to the above, is central to the problem. It’s the politicians who enable the billionaires that allow all this to happen. Democracies do still exist but mean nothing if the public lacks an actual choice,.

‘Perhaps we need to put the guillotine, not to monarchs, but to the political parties themselves’

Yes. Parties are essentially military organisations. Once you’re signed up, you cannot dissent from or challenge the party line, or battle plan. Certainly not publicly. You have an army of dittoheads to carry out orders from the top brass. Ergo, capture the top brass (through argument, intimidation, blackmail or graft) and the rest follow, must follow.

Pretty neat arrangement, particularly if you can limit the number of parties to a manageable number, like two. It’s money for jam for lobbyists, and a safety blanket or buffer state for their employers.

The apparatus of representative democracy has this fatal flaw, which consigns all solutions, or even good ideas, to history’s wastebasket. We have the technology to force a return to something like direct democracy, but it is not in our hands.

There is a continuity of US economic and monetary policy that goes back more than a century. ‘America’s 60 Families’, i.e. US economic elites, converted the country’s once abundant reserves of natural resources into gold-backed money. Their bankers, financiers, and politicians used that money to create more debt-backed money with fractional reserve, banking. But the reserve requirements for gold-backed money imposed too many restrictions on how much more money-as-debt could be created.

Banking and financial engineering are great gigs if you can get them. You create money as debt and exchange it for real wealth. To economic elites, it doesn’t really matter who creates that wealth – as long as countries and their workers are willing to part with it for dollars.

For people like Donald Trump who understand and benefit from this scheme, it explains the limits of their willingness to really “clean out the swamps”. They are just not going to seriously challenge a system that provides them with billion-dollar loans that can be used to buy up yet more of the world’s wealth – and give them power over the people who need it to live.

I know too many people who are still stuck on “Well, he’s not Trump.” How is it that so few people know his nickname was “The Senator From Mastercard”? They sure don’t want to hear this:

“Of all the politicians in Congress, Biden has always been the most pro-bank and pro-financial sector, largely because he comes from Delaware, which is the corporate headquarters for most companies in the United States, including the credit card companies…..So of all the politicians, Biden has been the most hostile, personally hostile, as well as just serving the banking interests in opposing the interests of students.”

My two cents is that starting in the late 70’s and going through the 80’s and coming/ forward, the Dem party decided to abandon its labor base of voters and began courting the banker/finance system adjacent voters. I’ll spare you the longer explanation for why I think this. / ;)

Just spitballing here, but maybe the actual policies and actions of the Dem party, i.e., the facts on the ground, provide a good explanation for your thinking. ;-)

Biden is smarter than he looks. If anyone knows it, it’s Biden. He knows that what goes around comes around and finance is a mirage without a functioning population to support it. So it’s like, if capitalism was a mirage and profits were always made by cheap credit and an expanding budget, inflation is the name of the game. And whereas capitalism perpetuated an eternal inflation, so will the coming age of austerity. In order to keep the rich “rich” and the poor functioning. Prosperity has always been inflation in disguise. So if it is the end of the age of abundance, or overconsumption, that’s not going to be austerity imposed on the poor unless austerity is also imposed on the rich. Imo. Not because they won’t try – but because that’s what’s goin’ around. Trickle-up. Let them eat cake.

I heard a guy who went to Vietnam and was part of Vietnam Veterans against the”WAR” he said the “WAR” represents the people and system who have everthing and then some ,and still it’s not enough .

Everything has be squandered for nothing just stupid white jets and big houses

“when they ask you ‘how much should we give’?

they only answer more more more”. John Fogerty ‘Fortunate Son’

Probably the best summation put down on vinyl. And it’s not just the lyrics- something about the sound captures the moment as well.

https://www.youtube.com/watch?v=9RUGJAWIslE

Michael Hudson is a God That Walks The Planet !!!!

Take it downtown and print it!!!!

Michael said that the “Davos” crowd are behind the EU leaders going along with the destruction of their industry. This explains who and how they get the leaders to go along with that self-destruction:

From The Power Elite Says The Quiet Part Out Loud

Ukraine is evidence of our immediate economic desperation because the petrodollar suddenly needs to be backed up by something other than petroleum – so an exploding free market is the answer for Ukraine. Like the starting point for a new paradigm of neoliberal extravaganza. It will never fly. It’s almost sickening to watch them try. Zelensky is either delusional or a skillful con artist. And Milley and Austin are both just talking nonsense. Maybe this adventure is a theatrical stopgap until we can prop up a failing population. What a disgraceful way to be forced to realize the importance of a nation of people. I hope all our “politicians” are sweating blood.

What Does Student Debt Look Like in Other Major Countries?

[Hint: only England is remotely close, and tuition costs are capped at $14k per year]

https://studentdebtusa.com/what-does-student-debt-look-like-in-other-major-countries/

The USA is a pretty-shitty place for most of us. And just because people flee here from places worse off doesn’t make it any better than it is. If more USAians had an inkling of what they were missing-out on or how other governments provided supports to their citizens from cradle-to-grave, the two-party system, or the good-cop/bad-cop system of extortion, would come to an end.

Personally, I’m trying to get the hell outta USA as quick as I can, while I can, and if I can. I’ve travelled the world, and yes, the grass really is often greener on the other side (not fleeing to Europe, either– hard-times and Americanization is heading there fast).

I’m surprised that Hudson did not mention the most obvious and biggest reason for the inflation of the 1970s – the oil shocks, especially 1973. This had a far greater public impact than the Vietnam War. And today it’s very much the same – the Ukraine War natural gas shock, still gathering steam.

The quadrupling of oil prices was a REACTION to the US quadrupling of grain prices. That was said clearly by the Saudi’s at the time.

But yes, both energy and food prices soared — just like is happening today.

However, the oil-price recycling into dollar-denominated securities supported the dollar and hence kept the price o imports down.

OK, dumb, basic question:

I follow all of this except “alleviates the mortgage debt”. Alleviates it for whom? How?

What strikes me here is that by saddling university students with huge debts, the pool of people to whom banks can extend credit for mortgages becomes smaller. Seems like a bug in the current order of things (because lenders have fewer opportunities to profit from mortgage debt), but maybe it’s a feature?

It makes perfect sense, as Hudson explained: The Renter class! The elite 10% want everything, including, We the People or better put, WAGE SLAVES with no other options. Their house will fall, and why? We the People will have no other choice but to put them down! It’s coming, be there or be square!

Yes, that’s what I meant: Having to pay student debt shrinks the market for people qualifying for mortgages. Less mortgage demand if you already have pledged all your available income to pay other kinds of debt.

that’s the problem with transcriptions of talking: I don’t have a chance to edit to clarify what I didn’t say clearly the first time.

Michael, did you mean in the 1970s? not 1990s?

Well, Volcker was my boss’s boss at Chase Manhattan in the early- and mid-1990s. And once a week or so, there would be a meeting of the economists and the policymakers at Chase. And because I was in the economic research department and knew how to do speedwriting, I often took the notes for these meetings, so I had a chance to watch him.

I looked for Zelensky’s article in the WSJ, but found only this:

https://www.wsj.com/articles/invest-in-the-future-of-ukraine-volodymyr-zelensky-stem-graduates-business-technology-sector-billions-partnerships-11662404585