The ongoing Western self-immolation via poorly-thought-through sanctions becomes more bizarre as the US and its allies keep piling on. The Biden Administration looks to have a contagious version of Dunning-Kreuger Effect as the press and punditocracy for the most part cheer the collective West going full Black Knight:

A fresh example is on the China front, where the Administration is moving to bar the export of advanced chips and related services to cripple China’s military and tech advancement generally. The Financial Times provides the orthodox view (for a full blown technical discussion, see this write up courtesy Covington & Burling).

The US has introduced sweeping export controls that will severely complicate efforts by Chinese companies to develop cutting-edge technologies with military applications, in one of the toughest actions President Joe Biden has taken against China.

The commerce department on Friday announced restrictions that will make it extremely hard for Chinese companies to obtain or manufacture advanced computer chips and will slow their progress in artificial intelligence.

The measures are also designed to make it much tougher for China to develop supercomputers with military applications that range from modelling nuclear weapons to developing hypersonic weapons….

Underscoring the scope of the controls, the US is using a far-reaching mechanism called the “foreign direct product rule” to make it harder for China to develop and maintain supercomputers and AI technology.

The rule — which was first used by the administration of Donald Trump against Chinese technology group Huawei — in effect bars any US or non-US company from supplying targeted Chinese entities with hardware or software whose supply chain contains American technology….

Analysts said China’s memory chipmakers, including YMTC and ChangXin Memory, would feel the most immediate blow…

But the ban on the export of semiconductor tools could significantly hurt Chinese chipmakers more broadly because US equipment makers have a stranglehold in a few crucial niches.

Triolo said there would be “many losers”, including US chip design leaders such as Nvidia and AMD, and tool makers including Applied Materials and Lam Research. He said the rules would also hit non-US players, including ASML, the Dutch company that produces the most advanced semiconductor tools, and TSMC, the Taiwanese contract foundry company.

One chip industry executive said the US was attacking China “from all angles”.

“The stunning thing about this move is that they have assembled a whole array of tools,” the executive said. “They are not just targeting military applications, they are trying to block the development of China’s technology power by any means.”

This salvo against China sounds devastating, particularly since the Trump measures against Huawei did diminish its global competitiveness.

But consider a contrary reading from Asia Times, which argues that these sanctions will so badly blow back to key US players that in due course, China will wind up net ahead. This article also points out that these various sanctions will not impede China’s military, since it does not use the most advanced chips. From the story:

The Biden administration’s unprecedented package of bans on chip and chip equipment sales to China announced on October 7 could not have come at a worse moment for the global semiconductor industry.

The damage to capital investment and R&D in the Western semiconductor industry will exceed Washington’s modest subsidies for the chip industry by a factor of five or more.

The US measures won’t affect China’s sensors, satellite surveillance, military guidance and other strategic systems because the vast majority of military applications use older chips that China can produce at home. But it may postpone autonomous driving, cloud computing and other efforts to digitize China’s economy.

It will also elicit an all-out Chinese effort to replace American chip-making and design technology. CapEx and R&D will shrink drastically in the US semiconductor industry while China allocates a massive budget to the sector.

On a five- or ten-year horizon, America’s technological edge in semiconductor design and fabrication is likely to vanish. As capital budgets collapse in the Western semiconductor industry, the damage to the US and other Western economies is likely to be greater than the harm inflicted on China…

The incipient global recession turned the chip shortage of 2021 into a glut, reflected in a collapse of the Philadelphia index of semiconductor stocks (PHLX) by nearly half during 2022. NVIDIA, the leading US chip designer, has lost 68% of its market capitalization so far this year.

The industry had already cut capital investment plans from about US$200 billion to $160 billion for 2022. US restrictions on exports of semiconductor equipment, design tools and high-end chips to China will shrink revenues further, putting an air pocket into R&D and capital expansion. The world’s dominant chip fabricator, Taiwan’s TSMC, planned $44 billion in CapEx just six months ago but on Wednesday announced a cut to $36 billion….

Smaller American fabricators like GlobalFoundries and SkyWater Technology, who make chips for the US military several generations behind the present state of the art, will benefit from the Biden subsidies. But companies with the most advanced technology have the most to lose, including American manufacturers of chipmaking equipment.

Some comments at the Financial Times article quoted earlier were also skeptical:

Michael Power

As it is, SMIC already produces 7nm chips and does so without embargoed EUV lithography: ironically these were developed to manufacture the MinerVa Bitcoin Miner system…before cryptocurrency mining was banned in China! SMIC are now developing the 5nm chip and expect it to be available within 18-24 months.Meanwhile Chinese foundries are flooding the market with 14nm+ chips, commodizing this segment. The only measure that seems to be falling faster than these chip prices is Intel’s share price!

So this may simply be a case of the US shutting the door after “the silk worms are already in Constantinople”?

Danny Barro

Nowhere does the article explain why the US is doing this, in the sense of how they feel they can justify this action. I don’t criticise the FT here (though they could do more) but it is interesting that there is an assumption, even looking at the comments below, that this is somehow a “good thing”. The ultimate result will be the acceleration of the Chinese semi-conductor industry and that will give the world more choice.

For the purpose of keeping the post to a manageable length, we’ll skip over the risk that China might retaliate, and the pressure points it could choose.

The next item on the sanctions front is a Biden Administration scheme, admittedly still under debate, to sanction Russian aluminum. As if our previous sanctions of Russian commodities and companies have been such resounding successes. The Administration looks desperate to be seen to be Doing Something. From Bloomberg:

A complete US ban on Russian aluminum threatens to upend a global market already reeling from multiple disruptions, throwing a spotlight on how China could fill any supply gap.

The Biden administration is considering options including sanctions on Russia’s top producer of the metal…

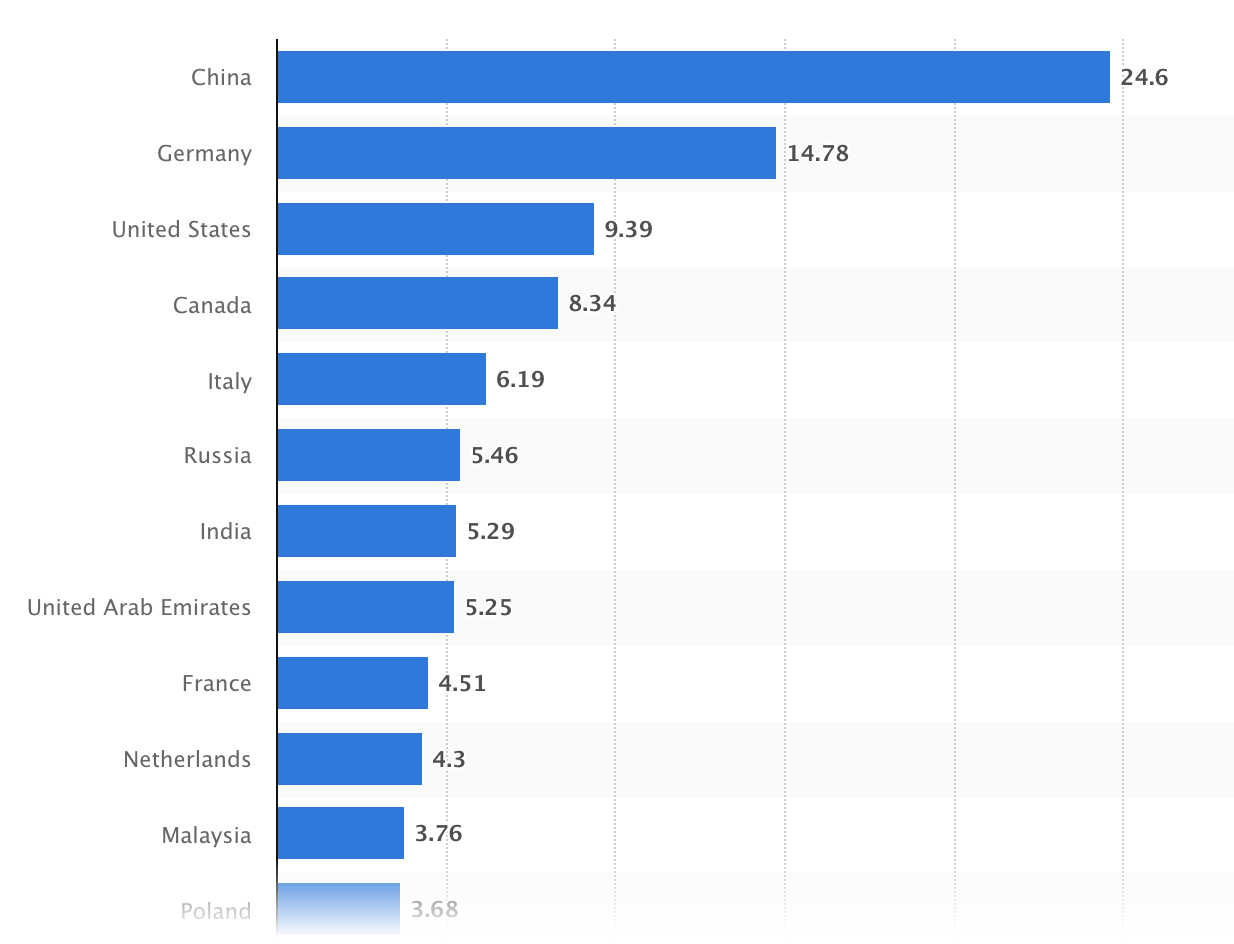

The biggest aluminum and aluminum product exporters in 2020 in billions of dollars, per Statista:

Keep in mind that aluminum smelting is extremely energy-intensive, so it seems likely that production in Europe will fall dramatically and/or become uncompetitive for export.

So the “worst” outcome, which seems likely if the Biden Administration proceeds, is that prices rise globally, Russia sells ore and semi-finished product at lower than new normal prices, but probably not much lower (and potentially even higher) while China, and potentially India, the UAE and Malaysia happily buy from Russia and sell to the US at a markup. Continuing from Bloomberg:

“The worst scenario is Europe and the US will block Russian aluminum,” Shanghai-based Chaos Ternary Research Institute wrote in an emailed note. “Stranded Russian aluminum will most likely flow to China, India and elsewhere, followed by China’s exports of aluminum products into Europe and the US to fill the gap.”

China is by far both the world’s biggest producer and consumer of aluminum. Under a reconfiguration of trade flows, metal from Russia could potentially be used by its domestic industries, with China then boosting overseas sales of its own metal along its well-established export routes.

Finally, Bloomberg broke the story yesterday that it has finally dawned on Biden Administration officials that the oil price cap idea could backfire. For some bizarre reason, it appears that the OPEC+ production cut triggered the recognition that Russia could deliver on the repeatedly-made Putin promise not to sell oil subject to a price limit. Perhaps it was seeing that Russia didn’t participate in the planned 2 million barrel reduction because it is already producing below its current quota. From Business Insider:

Officials in the Biden administration are signaling the plan to cap Russian oil prices could backfire, according to a report from Bloomberg.

OPEC+’s cut to its production quota last week could end up undermining the effort to cap prices, sources told Bloomberg. The cartel’s move has already added to volatility in markets, and a price cap on Russian oil could trigger a spike in crude, they said.

Officials also noted concern that Russian President Vladimir Putin could retaliate by slashing more supplies, sending prices higher. Putin has already signaled that the Kremlin will not sell oil to countries that participate in the price cap effort.

Mind you, I see no sign in these stories or on Twitter that the Administration is considering how to walk back this barmy idea. It apparently sees itself as beyond the point of no return.

In the grand scheme I’m seeing nothing but very short term decision making without consideration of medium or long term effects. That’s not new, obviously, but what is new is that the timeline for what used to be medium and long term effects of short term decision making appears to be shrinking.

There’s serious danger in this because decades of short term decision making have created brittle systems full of internal contradictions. Normally these can be smoothed out via financial manipulations or kicking the can down the road politically, but the shrinking timeline of current decisions also comes with potential for paying the cost of historical short term decision making now. And that means greater potential for cascading failures of the brittle system and/or inability to manage internal contradictions of that system.

Empires and nations don’t fall because of external forces, usually, even when those get assigned as the proximate cause in history books. Rather the failures are due to inability to manage internal contradictions or maintain brittle systems; the external force with the historical glory is most often a sharp jab to the system or something that exposes the emperor as naked.

I would only suggest that a desperately failing empire does not have the luxury of long term thinking. With the failure of the “mother of all sanctions,” a stalemate in Ukraine, looming recession (or worse), and likely disastrous midterms less than a month away, well, it makes for desperate measures.

I think that’s true and false. If the empire is to be maintained there’s little luxury for long term thinking in the immediate concerns, but there’s a necessity for it plan for after the current crisis. If a rational analysis suggests that the empire cannot be maintained and/or it’s prudent to draw it down for the benefit of the nation at the center of the empire, then the necessity of long term thinking dominates. (I don’t think anyone with power in this failing empire is smart enough to recognize the second option much less act on it.)

Or they recognize it but it offends their dearly held sensibilities.

A similar thing happened in UK in the 60s, where the government held the Pound too dearly to devalue it in order to shore up domestic production.

Devaluing the pound back then would turbo charge industry growth especially coupled with the North Sea oil. Now though, devaluing the pound == lower standards of living. Anyway it’s all over.

Honestly, these measures seem less desperate than I would expect from a senile president who retains just enough awareness to see everything crumbling around him. It’s likely we ain’t seen nothin’ yet.

A President that “plans” to survive his/her term for decades or at least several years might be less prone to short term decision making than some old Joe who sees things from the edge. You don’t want to spend the rest of your life being told how mistaken you were, so, you have a more prudential approach. He is in a hurry to “solve” things before he is out of the game forever so he could be more prone to entertain the ideas of the radicals in the mob that counsels presidency.

This is the way I try to explain to myself how Biden has turned to be the most destructive of recent US presidents.

Joe Biden reminds me of my late landlord in his last year, a case of “Red Ass” for the ages.

An angry dry drunk with dementia.

We are not dealing with a sane or responsible man, although he is only the titular head of the Hegemon he sets the tone.

Which is why we are on the edge of Nuclear extinction.

Maybe we’ll get lucky…

Sadly the old man is the last check against insanity in the ranks.

Even at his peak, Biden was always a mediocrity. And he surrounds himself with mediocrities like Blinken. Sullivan seems like the brains of the outfit, but he’s in over his head, too.

Queue Joe Tainter and the collapse of complex societies.

The Biden Administration looks to have a contagious version of Dunning-Kreuger Effect as the press and punditocracy for the most part cheer the collective West going full Black Knight:

=====================================

The US believes it can do anything without negative consequences, because the market supplies alternatives, and I believe the dems even believe it more than the repubs…

I really expect 2024 to be a 1932 event.

“Mind you, I see no sign in these stories or on Twitter that the Administration is considering how to walk back this barmy idea. It apparently sees itself as beyond the point of no return.”

I see the whirling blades of the huge fan just a few feet ahead of me, but I have chosen my path to my predetermined goal. Even though I can easily walk around the fan, others will mock me if I do not proceed to destruction.

I guess they really are that stupid and that ego driven. Bugs Bunny would look at such a creature and in an aside to the audience say, “Whata maroon.”

In reference to the article’s talk about Team Biden and the Dunning-Kruger effect, I get the feeling that Biden’s crop of (mis)managers has no understanding of how manufacturing and economics work. Certainly the scramble after the sanctions against Russia for natural resources and energy has made me consider them totally incapable of even the most basic statecraft.

We say the scene of Biden basically begging the Saudi government to not cut oil as of late, which failed, as of course in the past few days, OPEC+ has announced production cuts.

This article touched on 2 topics – aluminum and computer chips. The aluminum situation is worse for the US and Europe for another reason – aluminum is a very electricity intensive industry. (Full disclosure on my part, I’ve worked previously in industries where my employer has been a customer of the aluminum suppliers and I’m currently applying for a job for a major aluminum supplier in North America).

Europe in particular is screwed if they comply with a ban because they will need to compete against aluminum manufacturers from Russia and China, where energy costs will be lower. This will have implications in many fields – automotive, aerospace, and even more mundane things like aluminum cans for drinks. Other infrastructure like buildings (where aluminum is used) will cost more as well. North America might be somewhat more insulated because it has its own rich natural resources, but I suspect it will still hurt.

In Europe, either the governments of Europe bail out the smelters or they will be forced to close and move to a nation where energy costs are more reasonable.

https://www.bloomberg.com/news/articles/2022-09-04/energy-crisis-europe-s-aluminum-smelters-are-struggling-to-survive

This is basically a way of saying, the sanctions backfired on Europe and like many other industries, the only reason why Europe was cost competitive was because they relied on cheap Russia energy imports that are now gone.

Russia can produce aluminum at a lower price than the US or Europe.

https://www.bloomberg.com/news/articles/2022-09-21/rio-tinto-ceo-says-russia-aluminum-imports-are-hurting-us-profit

The Biden ban is also a product of lobbying in the US. The aluminum industry in North America is lobbying for this ban because they are not cost competitive. Given how much control the corporations have over the US political system, this should not be a surprise.

https://www.nasdaq.com/articles/alcoa-asks-white-house-to-block-u.s.-imports-of-russian-aluminum

If this ban goes through, it will be ugly. This will mean that manufactured goods that use aluminum produced in the Western world will have to cost more because the higher costs will have to be passed onto the customer. I expect that this will make inflation worse and make exported goods less competitive compared to those made in say, Russia or China or any other nation importing energy and aluminum from Russia.

—–

In regards to semiconductors, I think the Biden administration is just as ignorant. Right now the Western world does have a lead in semiconductors, but that’s more because of the billions that were invested in the past and decades of accumulated knowledge. Having companies like ASML banned from exporting EUV machines will be a setback. It will be a big setback. Eventually though, with enough capital investment (and China is pouring hundreds of billions of dollars into this field), it will be overcome. The same could be said about banning fabs like TSMC.

https://www.fudzilla.com/news/54602-china-spending-150-billion-on-semiconductors

The Chinese are starting from a position of being behind, but with enough money, and engineers, it’s going to be done. It won’t happen overnight and will take years, but it can be done. The Chinese are nothing if not patient and long term thinkers. Then we will reach a point where the Western world will be behind and playing catch up.

The irony of this situation is that far from keeping US hegemony, the most likely outcome is an acceleration of American decline.

So they’re operating in the tradition of the finest economists.

This to me seems like the logical next step for US foreign policy. The blowback, unforeseen and otherwise, are part of the long term goal of further bifurcating the west and Eurasian economies.

And speaking of blowback, this also falls in line with crushing American proles (central bank rate hikes, increasing precarity, co-opting populist reaction to declining living standards and directing it to more fascist expressions of political “consent”) so that any movements seeking downward wealth redistributions are further weakened before they take off. See Lambert’s rules one and two.

In the current state of things the actors/factions who are benefiting the most are not sacrificing much, if anything, at at all.

It’s so strange this. We are in such a cynical age and yet in so many countries like the US, it is the ideologues that are in charge and running things – badly. They come up with the idea of banning Russia from SWIFT and the professionals say ‘Don’t do this. It’s a bad idea’ and yet they do it anyway. They come up with the idea of stealing Russia’s reserves, the professionals protest that it will weaken the credibility of western institutions, but they do it anyway. They try to ban all Russian gas, coal and oil while the professionals shout at them that this will blow up the world energy market – and they do it anyway. They were set to try to bring in a price cap on Russian oil but Saudi Arabia has spiked that idea by reducing production. The ideologues are having a huge ‘mean girls’ hissy fit but the professionals would recognize that in a way, the Saudis just threw the collective west a life-line and not an anchor.

The neocon ideologues running U.S. foreign policy appear to be re-litigating papa and grandpapa’s dinner table stories of the collapse of the Tsar and the Kaiser and the European disaster of the first half of the twentieth century. Angry Joe appears to be even more obsessed with Making America Great Again than his predecessor.

On the schoolyard we called these sort of bullies “punks” because they’d constantly pick fights and lose. “What are you going to do? Bleed on me?”

This has created an even worse combination than the ideologues who financialized the American economy over the past quarter century and filled our parks and right-of-ways with the zombie army of cast-aside workers.

Good luck manifesting all those electric cars we’re supposed to drive! The “market” will not save us.

“Good luck manifesting all those electric cars we’re supposed to drive! The “market” will not save us.”

I wonder if the fascination with something like the “Metaverse” is its application as an adaptation for an immobilized populace.

Player One is ready

Rev, if Joe Biden entered the White house determined to do as much damage to the USA and the World as possible he has succeeded magnificently.

2020 gave Americans the choice between a disaster (Trump) and a Catastrophe (Biden) and we’ll be lucky as a species if we survive the experience.

I am in total agreement biden is a catastrophe but i dont think nuclear armageddon is ahead i only see a nuke getting dropped on Ukraine and thats if nato boots hit the ground and almost make it to moscow thats my thought on the matter doesn’t mean the west constantly saying the word isn’t having the intended effect which is scaring the shit out of everyone

we aren’t gonna get nuked hell the US economy is already nuked

Gee, who to believe? Before looking at NC site I had just scanned the NYT and read an op-ed be Paul Krugman who had praise for the Biden get tough with china policy as a necessary ( because China is our enemy ) and brilliant plan. In the past Krugman lauded the extension of the Trump tax cuts by Biden, much like his predecessor, Obama, extended the George Bush tax cuts. Should we listen to Krugman? After all, he is the economic genius who won the Nobel Prize in economics in spite of he fact that NC has pointed out that there really is no Nobel Prize for economics.

Tightening the screws with economic embargoes on Japan helped lead to WW2. Perhaps the Biden administration plans to have WW3. It would be a boast to our arms manufacturers.

China might go all Soup Nazi on Biden and say-

‘No rare earths for you!’

Scaling free market capitalism to a global enterprise underpinned by the Washington Consensus as an ideological lynchpin was all about prying open overseas markets and making them safe for American companies to enter and dominate. With the total addressable market for American companies being the entire world, US investors could feel confident underwriting the rapid expansion that would allow for the capture of global marketshare. This all-out sanctions war being waged against so-called adversaries, which in reality is about clinging to hegemonic power at all costs, has now brought US companies under the fold of, and weaponized them as part of, Washington’s hostile foreign policy. As more countries are sanctioned and added to the list of territories US companies can’t do business with, the global preeminence of American corporate power, which depends on servicing and selling into large global markets, is likely to erode as their government (aided and abetted by large online troll armies that threaten to boycott companies that do business in “authoritarian regimes”) shrinks their global marketshare through executive orders. This will cement the reputation of American companies as unreliable suppliers of critical technology and rouse the sanctioned countries from their US dependence induced slumber, driving them to start investing in their own innovation efforts and self dependence. The sand is fast draining out of the hourglass for American hegemonic power and the Biden administration response is to pluck the golden goose that has sustained US corporate power for decades through this sanctions frenzy. What’s strange is that American companies, which are supposed to have billionaire owners who are the “real” shadow government in the US, are sheepishly complying and not stepping in to stop their government from overplaying its hand.

In foreign policy these would be the billionaire owners of the MIC. They are like Krupp et al in Germany, 1939. The profits rolled in, then Gotterdammerung.

“The damage to capital investment and R&D in the Western semiconductor industry will exceed Washington’s modest subsidies for the chip industry by a factor of five or more….”

That’s assuming the current subsidies are a one-off.

Please read up rather than make assumptions. The subsidies are spending over time, not a one-off. CBO scoring is based on a ten year horizon and is a simple sum, not net present value.

https://www.crfb.org/blogs/cbo-estimates-chips-plus-bill-would-cost-79-billion

I know it’s over time.

Doesn’t mean that the total appropriated to be spent over time would never change.

Bad choice of word, but already knew it was over time.

You are being unduly optimistic. And that’s before getting to China’s huge advantage in its level of math and science graduates.

don’t forget the towering mental midgets that got us into the mess. remember, cheap stuff is good for america, as it drowns in unsold ever higher priced imports, and we lost our technology, skills etc.

https://www.huffpost.com/entry/the-bill-clinton-legacy_b_106089

“Free trade, democracy promotion, and the use of force to uphold global norms comprised the core of Bill Clinton’s foreign policy – and they remain the central ideas of today’s Democratic foreign policy establishment.”

https://jacobin.com/2022/07/free-market-neoliberalism-state-intervention-socialism

“Neoliberal politicians like Bill Clinton presented globalization as “the economic equivalent of a force of nature, like wind or water” that it would be stupid to try to reverse.”“Barack Obama in 2016 framed it in similar terms as “a fact of nature.”

Politics was presented as the management of the necessity of globalization, with economic decisions limited to those acceptable to international investors, with some sections of the moderate and soft left broadly accepting these ideological premises.”

the so-called left intellectuals have a giant blind spot, they to “PROFIT” off of their investments that are the results of free trade.so they chose policies that will not interrupt their own gravy trains.

when i was young, jeans were very well made, and if a hole was developed, you fixed it, same with shoes, t.v.’s radio’s plus many other things.

today we are flooded with cheap stuff that in reality, is very high priced. something breaks, dump it, and it ends up in the third world eventually.

lost skills, incredible damage to the environment and standards of living. there is no upside period.

If we stayed rhe course on globalization and free trade we’d be in a heap better shape than following the current right-wing neocon strategy under Biden, Graham et al. I’m no fan of globalization, but what we have now is jingoistic war mongering idiocy. We seem to be in the death throes….

The “free traders” made absurd promises about keeping competitive advantages in certain sectors. This of course would run into the problems of governments run by people not completely obsessed with the Transatlantic elite. Staying the course would never work because national defense of too many countries would be dependent on not relying on the US and the notion of lawyers for export is mind-numbingly stupid.

Ukraine is a current hot spot, but the failures to have industrial policy have moved Presidents to adventuring. If it wasn’t Zelensky, it would be Kurd Buttigieg or Kamchatka Buttigieg. Falun Gong was all the rage for a hot minute.

The big difference is we’ve made so many enemies and made the US so unappealing repative to its recent history countries like India can alter markets in ways they couldn’t 25 or even 20 years ago. Obama recognized Putin and Assad would react so he calmed things, but he was actively seeking to hit the end points of The New Silk Road through TPP and military action.

China is the world’s largest market for semiconductors. Killing your best customer is never a good idea. There desperately needs regime change in Washington. Many layers of the regime need to be removed. Biden and the Clinton, Bush, and Obama retreads need to be ousted from their posts. Failure to do this will lead to more pain for the average American.

We have too big to fail banks. When they are at risk of failure they get bailed out. Both Russia and China are too big and too important to fail nations. And yet the current administration seems hell bent on crushing both countries. China in particular is an interesting case. It is a major trading partner with the US. It is the world’s largest market for electronics of all sorts, and by some measures has the world’s largest economy. Rather than trying to destroy China the US and its “allies” ought to be friends with China, and doing their best to ensure that China has a vibrant economy that allows for mutually beneficial trade, as well as cooperation in tackling major global issues such as the climate crisis and the various pandemics that will come along. Nuclear war leads to mutually assured destruction. The sanctions regimes promulgated by the Biden administration will lead only to mutually assured societal destruction, even as the buildings remain standing.

Excellent comment and well put!

Don’t worry, our EU geniuses will still implement an oil cap even if the US now seems to recognize it won’t work. We’re so screwed in Europe.

The banks are not too big to fail or to be put into receivership. It may require novel government action or be done piecemeal. The politicians just don’t want to do it.

Anyone know if Nancy P lost a lot of money from her recent semiconductor speculations?