Yves here. Note that the notion that the Bank of England is independent is more due to deference than law.

For instance, Richard Murphy has repeatedly called for its Governor, Andrew Bailey, to be dismissed, which the Government could do at any time. Some detail from an October 19 post:

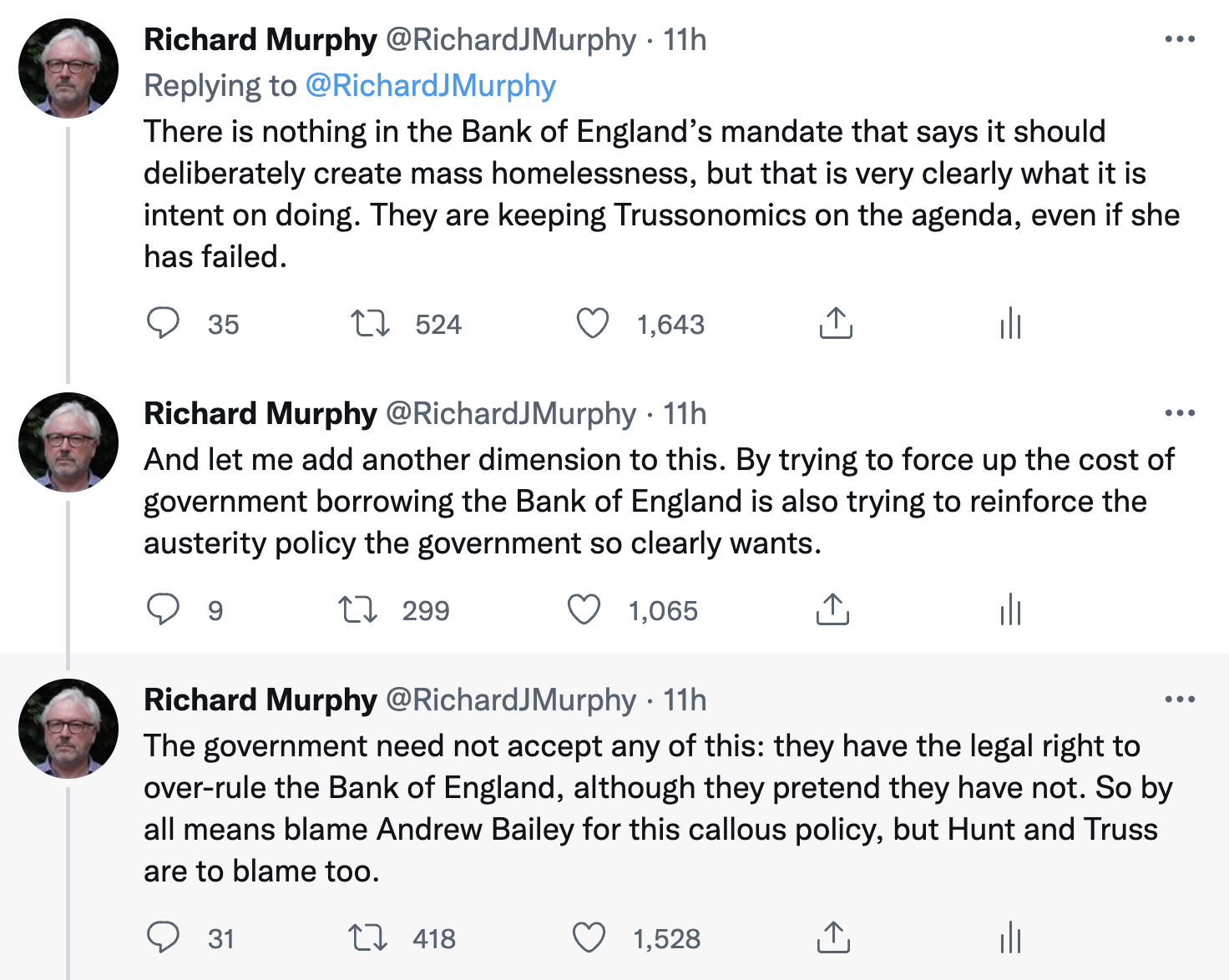

I posted this short thread on Twitter last night:

….There is class warfare going on in our economy right now. The financial elite is very obviously planning to devastate the well-being of the majority in the UK. I cannot explain this policy in any other way. Why else would quantitative tightening, a policy that can only have the goal of increasing the interest rate, be going on otherwise?

But let’s also address that austerity point as well. The government is saying it cannot borrow to pay for pension increases, social care, the MHS or decent education. But apparently, the capacity to sell binds into the market that could fund that does actually exist but is instead to be used to force up interest rates with no social benefits attached.

This is the Bank of England waging economic warfare on this country. I have no other way to describe it.

One hates to say it, but the point of a central bank is to serve as a bankers’ bank, as in above all protect the payments system and as needed, put down or rescue banks. As Perry Mehrling has pointed out, central banks also engage in war finance, a conflicting role. And as advanced economies become more financialized, central banks have been allowed or assigned mission creep and made the chief stewards of the economy, as executives and legislatures have either lost their nerve or been indoctrinated to believe that magical Mr. Market is best left to his own devices. That leaves central banks to move into the resulting authority vacuum when things get ugly.

By Andrew Fisher, Labour’s executive director of policy, oversaw the production of the 2017 and 2019 Labour manifestos. He is now a columnist for the i paper. Originally published at openDemocracy

Bank of England governor Andrew Bailey has been increasingly hawkish on interest rate rises in recent days, saying “inflationary pressures will require a stronger response” and he “will not hesitate to raise interest rates”.

The bank’s monetary policy committee (MPC) will meet on 3 November to set the Bank of England base rate (the rate of interest charged by the bank to commercial banks). Expectations are that there could be a sharp rise from the current 2.25%, to which it was increased in late September.

Interest rate rises are damaging on a number of levels. For government investment, it means borrowing at higher rates – bad news when the nation’s debts (currently £2.36tn, or 99.6% of GDP) are rising. It also means spending a growing share on debt interest.

But my major concern is for households. The current hike in interest rates means the average mortgage holder who may have got a two- or five-year fixed rate mortgage at around 1.6% interest will instead be paying around 6% when they come to renew their fixed rate term. That leap in interest rate adds around £500 a month to the average UK mortgage, and that rises to an extra £915 in London.

Interest rate rises also widen inequality as poorer people are more likely to be in debt (and to be at risk of problem debt), while rich people are more likely to have savings that benefit from higher interest rates.

So when the MPC meets in two weeks’ time, they will hold in their hands the lives of millions of people who are struggling to make ends meet.

Tony Benn’s quintet of questions are pertinent here: “What power have you got?”, “Where did you get it from?”, “In whose interests do you use it?”, “To whom are you accountable?” and “How do we get rid of you?”

Independent Since 1997

The Bank of England has power over interest rates, and that power was granted by the incoming New Labour government in 1997. Operational independence meant the bank had control of monetary policy – the power to set interest rates and, though not foreseen at the time, the power to intervene through measures such as quantitative easing.

Previously, the chancellor had held a monthly meeting with the governor of the Bank of England at which interest rates were agreed.

Independence for the bank had been the aim of Thatcher’s longest-serving chancellor, Nigel Lawson. He wrote in his memoirs: “Politicians, however austere they may be, are subject to electoral pressures which will be thought, rightly or wrongly, to affect their judgement.”

This idea – that decision-making about the bank should be independent of “electoral pressures” – is profoundly anti-democratic. Interest rates have political consequences on the electorate, so why shouldn’t democratic pressure be brought to bear on those that set them?

Bank of England independence was created in an era of relatively stable growth, rising living standards and high employment, with a government that was reducing poverty. The bank’s mandate was simple: to target inflation at 2% – a largely arbitrary figure – to help consumers and businesses plan.

We are far from that world. The banking crash, austerity, Brexit, the coronavirus pandemic and the energy price spike have all caused significant and ongoing hits to the UK economy – each crisis compounding the last.

On several occasions these crises have necessitated significant policy co-ordination between the government of the day and the Bank of England – most notably during the banking crisis and then during the pandemic, when Andrew Bailey, sounding more like a politician, intervened, saying: “We can help to spread over time the cost of this thing to society… We have choices there and we need to exercise those choices.”

Economic crises have necessitated the politicisation of the Bank of England. Far from technocratically fiddling with interest rates to move steadily towards target inflation, the bank has been in a semi-permanent state of monetary activism for 15 years.

Ed Balls, who as a special adviser to new chancellor Gordon Brown was one of the architects of delivering Bank of England independence in 1997, wrote nearly 20 years later: “As these unelected, technocratic, institutions become increasingly powerful, the pre-crisis academic consensus around central bank independence – put crudely, ‘the more, the better’ – has become inadequate.”

Repeated crises and the need for a more interventionist monetary policy has led central bankers into political terrain, with former Bank of England governor Mark Carney frequently enraging Brexiteers with his public comments on the impacts of leaving the EU. Likewise, his successor Bailey angered unions when he told workers to show “restraint” in their pay demands.

Bank of England independence was created in a world that no longer exists. The decisions the MPC will make in the coming months will affect the lives of millions of people – and should not be made by unaccountable technocrats.

But more importantly, pulling on the interest rate lever will not help solve inflation. Interest rate rises dampen inflation by reducing excess demand and encouraging saving. But in the UK today, demand is already weak: incomes are falling and retail sales are collapsing. Further reducing it now by raising mortgage costs and making it more expensive to borrow will only deepen the coming recession, as consumers end up spending more on mortgage and debt costs, meaning they have even less to spare for sectors like retail, hospitality and leisure.

The problem for the ‘independent’ Bank of England is that it does not have access to the levers that could properly help to control inflation – price caps, rent freezes, windfall taxes. Those rightly sit with elected politicians.

One could reform the Bank of England’s mandate, broadening the criteria for decision-making on interest rates from simply targeting inflation to “including [the impact of interest rates on] growth, employment and earnings”, as former shadow chancellor John McDonnell advocated.

At this moment of profound economic and social crisis, the bank risks becoming demonised for worsening the economy. It may not be in the bank’s interests, either, to maintain independence.

As the great British economist John Maynard Keynes said: “When the facts change, I change my mind.” Whatever the past merits, Bank of England independence in its current form is neither good for the economy, nor for the people nor for the bank itself.

The bank and its MPC should have an advisory role – but in a democracy the government must weigh up wider issues. It needs a co-ordinated policy to tackle inflation that involves more than just the (currently) impotent lever of interest rates.

How else to rein in inflation. Rates are the only tool. Inflation existed in the times of gold and silver. Kings would devalue their money by size or my alloying it with less costly metals like copper. What’s the difference? Doesn’t the little guy get hosed? Anyway, as long as we try to serve two masters we’re going to have this tension. It’s above my pay grade to come up with a ‘solution’ but expect the haves to fight like hell. And if this offends you, are you giving away all you have earned and opening your doors to the poor to live in your home? Thought not. Me? I am as hypocritical as you.

Interest rates are not the only tool. Income, capital gains & corporate tax rates indexed to rise and fall as inflation does would seem to be the obvious answer. At least then the burden of reining in inflation would fall heaviest on those most able to bear it.

May I offer my humble services to be Director of Margin Requirements?

How about a financial transaction tax. The City of London would hate it but it would go a long way to helping out. The idea is that every time that money moves, it is taxed. Tough luck if you indulge in speculation rather than investments but hey, it would do the job.

I suspect that a financial transaction tax wouldn’t actually raise much revenue because most financial trades (serving no purpose beyond raising revenue for the financial services industry) simply wouldn’t happen if a tax was levied on them. That’s not to say that such a thing wouldn’t be beneficial anyway but when you want to actually withdraw spending power from the economy to tackle an inflation problem then perhaps not so useful.

A financial transactions tax taxes Stock sales, credit default swaps, etc. Currently a person who buys or sells 1,000 shares of stock pays a 2 penny tax. The latest effort in Congress would increase the tax by 1 dollar raising it to 0.1% and increasing federal revenue $77.7 billion a year.

https://d3n8a8pro7vhmx.cloudfront.net/ufe/pages/2849/attachments/original/1480609003/FTT_Primer_Final.pdf?1480609003

https://www.brookings.edu/opinions/congress-wants-to-tax-stock-trades-investors-shouldnt-fret/

New York actually has a financial transaction tax… However during the great transition commonly known as Gerald Ford to Abe Beame… Drop dead… The Mac bonds era came up with a waiver/rebate which would go away as soon as the city of New York was in better shape… That was what… Almost 50 years ago… NYC doesn’t look as though the movie warriors could be remade there anymore… Stock transfer tax was first collected in 1906…but a full 100% rebate has been in place since 1981…Cuomo tried to officially kill the tax… But…

The UK already has one, stamp duty. It is one of oldest taxes. Share transfer documents must be stamped to be valid. 0.5% of transfer value.

Rates are the only tool that our elites are willing to use. We’re human beings – making tools is what we do.

Tax the rich.

Without dissenting from the policy recommendation, I don’t think this would do much to reign in price rises caused by external supply shortages. The rich have low propensity to spend marginal income, and tax rises on marginal income would not have much effect on demand. (Though, I suppose one could redistribute, which might actually increase demand and inflationary pressures).

Interest rate increases, I think, can work well to quell internal demand-driven inflation — which is not UK’s present problem. I think there’s very little that can be done about UK’s present situation over the short term. Perhaps industrial policy aimed at moving in the direction of autarky would help, over a span of years or decades. That might be a productive use of the policy freedom UK has in principle gained through Brexit.

How much autarky can UK pursue when is short on raw materials for everything: energy, industry, food?

Will UK start again issuing letters of marque for privateers, to bring in tankers of oil and LNG, cargoes with coal and iron ore, aluminum, copper, and other metals, wheat and other grains, etc., etc., etc. I don’t see other way of achieving UK “autarchy”.

I seem to recall that the UK illegally arrested an Iranian oil tanker a couple of years ago, so maybe the ‘letters of marque for privateers’ are not far away. And of course the US has ‘frozen’ money from Russia, Iran and Afghanistan in the last few years too. This sort of lawlessness cannot and will not go unpunished, although probably not immediately.

Raising interest rates would immediately lower import inflation via higher exchange rate of the GBP. Energy and food prices (the biggest contributors to current CPI inflation) will be lower immediately.

Why is this point never made in the financial press? Because elites want a lower currency to suppress real wages. Policies like this is why corporate profit margins have trended higher and real wages trended lower in recent decades.

I don’t see how that works!

Oil and gas are traded in USD and the GBP/USD rate has increased to near parity recently. Meaning that you pay more for your energy just because GBP is weaker.

The idea is that higher interest rates will encourage the flow of foreign hot money into the country supporting the exchange rate and making imports cheaper. A strategy more characteristic of third world countries than supposedly developed economies.

GBP/USD = 1.13 at this moment. With oil at $85, that is £75.22 per barrel.

If GBP/USD were 1.5, oil would be £56.67 instead.

Exchange rates are largely driven by carry trades: investors borrow in a currency with a low interest rate, then sell it and buy currency with a higher interest rate. They pocket the interest rate difference.

In the current climate, you want to have the currency that is bought, not the one that is borrowed and sold. You achieve that with higher interest rates.

Relying on the hot money carry trade to kick the can a little further down the road is a terrible way to actually fix your economic problems – look at the history of emerging market currency crises over the last 50 years.

Except there is no guarantee that raising interest rates will lift the pound if the other consequences are to crush domestic demand. If high interest rates meant a strong currency, everybody would do it, and then you would be back to square one.

correct. the u.s..a will have to move that way soon. keynes laid it out best in being as self sufficient as possible.

u.k. is to small, but there is a lot they can do to allevaite the mess that the free traders have caused.

The rich might have a low propensity to spend an extra dollar, but in the US, for example, the bottom 20% get a roughly 3.5% share of the national income and the bottom 80% roughly 50% so there’s no doubt that if you’re trying to manage demand the vast amount of spending power is located at the top. I’m pretty sure that if the top marginal tax rate were indexed to double when inflation broke 10% it would result in a substantial decrease in effective demand (and bonus – a wealthy class intensely focused on solving the inflation problem). Marginal propensity to spend doesn’t have to be symmetrical, give a dollar to a rich person and they probably won’t spend it, take a dollar away and they have to decide whether their previous spending patterns are sustainable just like anyone else.

“It no longer makes sense for the FED to be independent,” if it ever did ..

Your amnesia is convenient, Mr. Beech — governments exercised a wide range of policy levers to control prices during WWII. Oh, and precisely none of them involved attempting to control demand via a single interest rate lever.

They still work. All that is required is the political will.

Tony Benn’s quintet of questions is indeed pertinent here. They are even more pertinent here in the land of exorbitant privilege. With the exception of question number one, whose answers people around the world constantly mull over, the other four questions go unaddressed in this piece. Nothing new about that. It would probably take a book to adequately discuss them all. In any case, the last four questions get to the meat of the problem. This is kind of like eating spare ribs…lots of gnawing, a big pile of bones and the appetite remains…where’s dinner?

6% mortgage rate is not high. It’s about the same as it was in the period 2000-2008, and before that it was (much) higher. It is also still a negative real rate, so it is still a rate that is subsidized by savers and pension funds (or whoever owns these mortgages). If you cannot even pay a 6% mortgage, then you bought a house that you can’t afford, and (I hate to say this) you are part of the cause of the mess we are in now by blowing this housing bubble.

I have to believe there’s still some prudent people left in Britain. When the animal spirits have been tamed from the housing market, hopefully those people will be rewarded.

If everybody had bought only the cheapest house they could afford, all houses would now be equally expensive but either distributed the same as today (because the algorithm would ultimately result in the same distribution) or with the richest in the erstwhile cheapest houses and the rest of us homeless! Think about it! There is a fixed housing stock. It is impossible for everybody to trade down, it will blow out the prices in that market segment and force some people to buy beyond their means.

Land price inflation is a crime against society, not an individual mistake. It is like public health. We need zero covid and zero land rents. Which is less likely…?

What were the prices in 2000-2008? And the salaries?

House prices are only sustainable at a certain percentage of peoples wages. In the past, a typical house price would be 4-5x annual household income. If that ratio remains constant, then there are a lot less problems.

Unlimited money creation has removed the link between money and what the economy actually produces. That is why everything is now out of whack, including house prices. Money is the fruits of peoples labour. If you create lots of funny money to “stimulate the economy”, then suddenly 5 years of work don’t buy you a house anymore, because the people who were the first to received the funny money have jumped the queue and bought all assets.

6% means one pays about triple the price of a home on a 30 yr. All that extra jack, decades of work, for bean counters who often run afoul of basic human decency beyond their massive original looting. If I were an alien observing from afar this bit of lunacy alone would be enough for me to say let us wait another few thousand years before checking back on those pitiful humans. Not far enough from the ball and chain yet… do they even understand there is a choice?

Perhaps they pay triple today’s price over 30 years, but at least they end up with a house. Renters pay a lot more than that, but end up with nothing. But everybody always side with home owners and not with renters.

The obscene thing about this is that the negative real mortgages rates of the past decade have been subsidised by plundering savings and pensions of renters (through negative real interest rates). This has blown an epic housing bubble that has caused housing to be now completely out of reach for these same people that were forced to pay for this obscenity.

Inflation goes up so the value of the mortgage amount goes down. The homeowner is happy. Inflation goes up so the lender prices the new interest rate at “inflation plus the usual interest” so the lender stays even. The homeowner’s payment goes up so the homeowner is unhappy.

If the Bank of England were instructed to ignore this reality and to order interest rates to stay low, nobody would lend. In a high inflation-rate/low interest environment would you?

If nobody lent, mortgages would be quantity-rationed. Land prices would fall. Higher rates would be affordable. Lenders would lend. A new equilibrium would be reached.

Conversely, if rates are raised by the BoE, nobody can afford to borrow. Land prices will fall. Houses become affordable at higher rates. A new equilibrium would be reached.

But in both case, at the cost to mortgage-backed buyers experiencing eviction or homelessness / under-housing.

Housing is an essential good and its supply should not be be dictated by commodity price shocks or financial crises. Particularly because raising interest rates will not turn Russian gas back on (and high energy costs are the origin of inflation in many sectors) or fix supply chain issues or under-supply in markets that have been looted of capital by rentiers preferring monopoly profits from structural under-investment or dis-investment.

The financiers and elite were also waging class warfare with negative and near negative interest rates. Social spending was still on the chopping block then.

The bubbles are popping now. Housing prices in fantasy land. What goes up must come down.

“But more importantly, pulling on the interest rate lever will not help solve inflation.”

This is not true. Most of the high inflation is caused by high import prices of food and energy. By raising interest rates (i.e. reducing the interest rate difference with the US$), the exchange rate of the currency goes up. This would dampen import inflation.

It is true that if every country does this it won’t work because it doesn’t cause more supply. But you can definitely improve your position relative to other countries, which is the duty of every government/central bank, who are supposed to serve the best interests of their population.

With even nominal interest rates still ridiculously low (let alone real rates, which are deeply negative), the central bank is still in “thrash the currency”/”thrash real wages”/”stick it to the working classes”/”shift wealth to asset owners” mode. That shit has to stop.

“”The current hike in interest rates means the average mortgage holder who may have got a two- or five-year fixed rate mortgage at around 1.6% interest will instead be paying around 6% when they come to renew their fixed rate term. That leap in interest rate adds around £500 a month to the average UK mortgage, and that rises to an extra £915 in London.””

A lot of variables to spread across the pain threshold. Some will get hurt for sure. Some who bought with 1.6% rate may be way ahead on home value increase.

Don’t know the details of UK home loans, but in US we generally have 2% per year rate increase limit.

Plus amortization is much higher at 1.6% than 6%, so there may be “return of principle” involved.

I refied earlier this year at one of the bottoms in CA and happily took a 2.35% rate fixed for 5 years.

Principle and interest components are equal. No interest only loans available for low LTV borrowers.

FD I have never had a 30 yr fixed rate loan in 42 years of home owning.

A key factor in this situation is the structural reality of financial dominance– which has been defined generally (by Carolyn Sissoko) as a situation that forces the central bank (or government) to bear losses so the private sector does not.

As Carolyn Sissoko (Oct. 2022) has recently pointed out the Liability Driven investment funds that forced the Bank of England to act were, in fact, designed by Blackrock to nudge the Bank of England to act in the manner in which it did.

Supposedly, these collateral demands of the LDI strategies had been clearly understood by sophisticated financial asset manager professionals, like Black Rock, for at least a decade. In fact a Black Rock executive, Mark Weidman, stated that “this is a market with a small number of natural buyers called pension funds and the Bank of England, so when there are margin calls and there is no one on the other side of the trade that creates a little bit of instability.”

Sissoko emphasizes that the inclusion of the Bank of England as a “natural” buyer of gilts in a period when its stated policy was one of selling gilts is remarkable–and speaks directly to the expectations that Blackrock held when it designed the funds.

In essence, according to Sissoko, Liability Driven investment funds were offered to small pension funds by asset managers such as Blackrock and were designed around the correct presumption that forced sales of gilts would result in Central Bank intervention, resulting in benefits to Blackrock at the expense of pension fund beneficiaries as well as the public that has to live with the consequences of volatile interest rates.

Sounds like a systematic failure of regulation (in this case of private pension plan behaviour) to me.

I have a major quibble with this piece…. they are not faceless technocrats. They are people who are part of a minority with a very specific agenda. Full stop. They answer too and implement the policies that purposefully benefit a small group of elites who put them there. This is a sin of commission, not omission.

But those people are made of property, not substance. And the fundamental attribution error which you are committing usually leads to some cultish fantasy that capitalism, having been failed, can be redeemed by gluing a scold on its (our) shoulder. If that were so, it would have worked by now.

Every system is perfectly optimized for the results it actually delivers.

….So when the MPC meets in two weeks’ time, they will hold in their hands the lives of millions of people who are struggling to make ends meet…

Boris Johnson’s father has a solution for that since 2012 (1 minute). Reduce Britain’s Population to Around “10 or 15 million” by 2025. (2012)

https://twitter.com/FBNHistory/status/1547685928042278915?utm_source=substack&utm_medium=email

It never ceases to amaze me that the standard solution to rising prices is raising prices. How does this logic work? If we make things more expensive, the price will come down? Give me some of what these guys are smoking.

With our new era of “elite experts” who are neither, public organisations are starting to seem more like paperclip maximisers.

The BoE is going to chase low inflation via interest rates and if it has to burn the whole economy to do it, then so be it.

It’s an interesting exercise to try and work out which KPI is going to be the paperclip for each public organisation, most aren’t as transparent as the BoE’s interest rates. I’m sure Lambert could name the CDC’s, probably something like vacant hospital beds.

“Economic crises have necessitated the politicisation of the Bank of England. Far from technocratically fiddling with interest rates to move steadily towards target inflation, the bank has been in a semi-permanent state of monetary activism for 15 years.”

By jove – substitute ECB for ‘Bank of England ‘ – spot on!