Lambert here: More trouble….

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

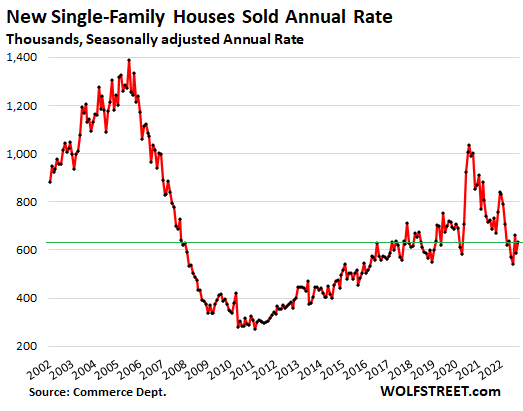

Sales of new single-family houses have been zigzagging along low levels for months. In October, they rose 7.5% from September, after having plunged 11% in September, according to the Census Bureau today. At a seasonally adjusted annual rate of 632,000 houses, they were down 5.8% from the already low levels a year ago, and down 37% from two years ago.

These sales are based on signed contracts between buyer and homebuilder, and they’re no indication of how many of those deals actually close. And those sales that actually close are far lower amid a huge wave of cancellations. Homebuilders have been lamenting those cancellation rates for months. But those cancellations are not reflected here. We’ll get to them in a moment.

A similar plunge occurred in sales of previously owned homes: -34% from peak in October 2020 and -28% from a year ago.

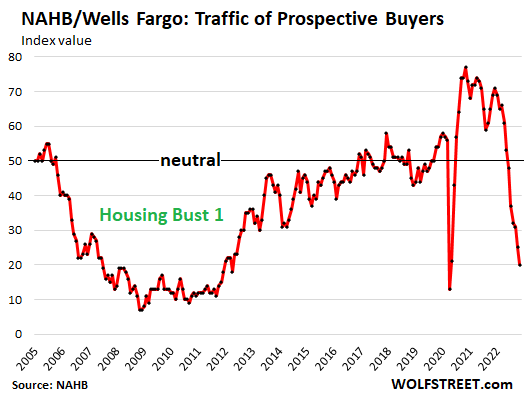

Homebuilders reported plunging traffic of prospective buyers of new single-family houses, according to the National Association of Home Builders last week. Its index of Traffic of Prospective Buyers has plunged for eight months in a row and in November fell below the May 2020 level.

Beyond the lockdown-low of April 2020, it was the lowest since 2012, during Housing Bust 1. But this time, the descent has been far faster than during Housing Bust 1

Cancellations Spike, worst in the Southwest.

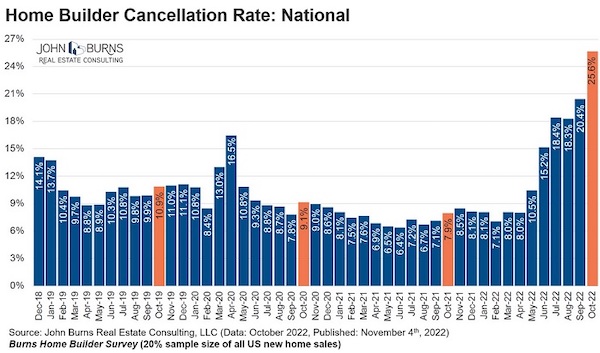

And many of those folks that do show up to look at a house, and that then do sign a sales contract are massively getting second thoughts, followed by buyer’s remorse, followed by canceling those contracts – and those spiking numbers of cancellations are not included in the new-house sales data by the Census Bureau above, which just tracks signed contracts.

According to the homebuilder survey by John Burns Real Estate Consulting – with a sample size of roughly 20% of all new home sales – the cancellation rate spiked to 25.6% in October, up from a rate of 7.9% in October 2021 and from 10.9% in October 2019. Over a quarter of the signed contracts are cancelled! Chart via Rick Palacios Jr., Director of Research at John Burns (click to enlarge):

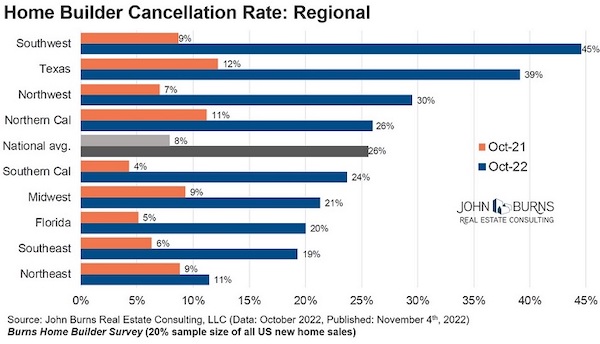

The cancellation rates vary substantially by region: In the Southwest, the cancellation rate spiked to 45%. Nearly half of all contracts signed are then cancelled! This was up from a cancellation rate of 9% a year ago. In Texas, the cancellation rate spiked to 39%, up from 12% a year ago.

This kind of huge spike in cancellation rates renders the sales-contract signings data a practically irrelevant figure because a cancelled contract is no longer an actual sale (chart via Rick Palacios Jr., John Burns, click to enlarge):

From shortage to glut: Inventories continue to spike.

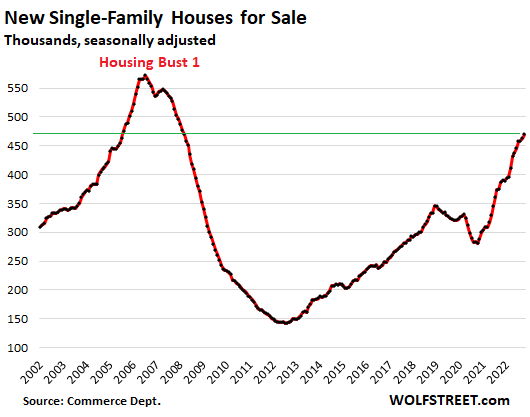

Inventory for sale in all stages of construction jumped to 470,000 houses, up by 21%, from the high levels in October last year, the highest since March 2008. Compared to the early phases of Housing Bust 1, it was the highest since September 2005:

Supply of unsold new houses has been in the 8-10 months range since April, due to the combination of low sales and the surge in inventory. Supply in October was 8.9 months, Housing Bust 1 levels.

But supply is figured as how many months it would take to sell the current inventory at the current rate of sales – but the current rate of sales is based on contract signings, and those contracts are getting canceled at record rates, and the fact that sales keep falling through is fueling the relentless surge in inventory.

Another thing: inflation. Just when you thought…

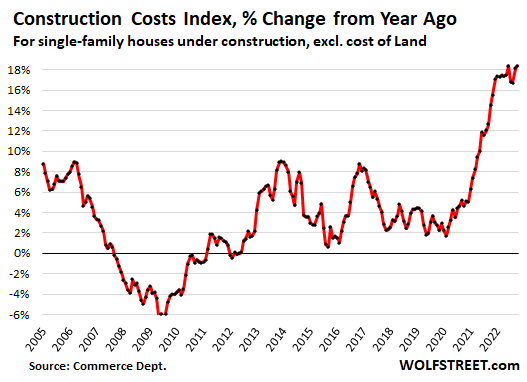

Construction costs of single-family houses – excluding the cost of land and other non-construction costs – seemed like they’d peaked in June, and then the spike slowed or stalled, and on a year-over-year basis, the spike backed off from a historic record of 18.3% in June to 16.7% in August. But then it started spiking all over again and in October hit a new historic record of 18.4%. This inflation will continue to dish up surprises, just when you least expect it.

There was a massive rush to build McMansions all over our neighborhood in the last year or so, but that seems to have ground to a halt in the last couple of months. It seems like some of the houses still have not been sold and some lots that got cleared are now just empty patches of ground. I wonder if some of the bigger new houses are underwater because they were built when interest rates were lower, and construction costs were very high. The builders will have to sell them for very premium prices to make any money on the sale.

That drove me crazy in Charlotte. Nose bleed levels of hubris, especially in corner lots near center city. That’s where more affordable townhouses were supposed to go, or a small apartment building. Bonus points if they torn down a previously smaller home.

So the wealthy sprinted into a previously affordable neighborhood. Built their mini-castles jacking up prices for everyone. Slammed the door shut behind them. Soon it will be an ‘exclusive neighborhood’.

7,000 square foot corner lot has been on the market for 13 days in my beloved neighborhood in Charlotte.

Priced for an absurd 500,000$. Priced hopefully and specifically for a McMansion builder. Builders don’t want to spend more than 25-30 percent on land costs. So that house is going to be 1.5$ million or 2$ million dollars.

and abandoned.

The destruction of New England woodland to clear land to build McMansions has been disgusting. I imagine something similar has been happening all over the country.

Insult to injury: these municipalities heavily restrict the construction of apartment buildings and smaller single-family houses supposedly to “preserve the character of the community.” This includes storied places like Lexington, Massachusetts as well as much more humble suburbs.

Hoist by their own petard!

The financing for the construction you see taking place was put in place a year or mo ago in most cases,

There’s a tremendous amount of construction going on for multifamily and quite a bit of single family construction happening as well.

With higher rates many if not most of these projects no longer make economic sense and the builders will keep building until the terms of their financing require them to stop.

When it comes to used homes, the high end is doing well with no shortage of cash buyers.

Mostly I’m seeing “Incentives” rather than price drops, but that will change as the market progresses.

There’s a realtor in our area who has a habit of finding people a little desperate to sell, listing their home but not really trying too hard to sell it, then offering to buy the home from the client themselves to “help out” when no buyer appears. Then once the realtor has become the owner, a new buyer is suddenly found willing to pay the realtor’s full asking price and he pockets tens of thousands of dollars.

Hadn’t seen many listings from this guy in recent years and he went from being an independent realtor to part of REMAX for a while, which I hoped was a sign he’d been struggling with his little scam operation. Recently though as rates rose making sales more difficult, a neighbor up the street passed away and the surviving spouse had to sell. The house is a big old Victorian that has lost its former glory – the neighbors were hoarders and the inside is trashed, and the outside hadn’t seen a can of paint or replaced shingle in decades to the point the neighborhood kids would call it a haunted house. This shady realtor’s sign went up out front but the house didn’t sell for a few weeks. Then a cleaning crew shows up and the sign comes down. I asked another neighbor if it had been taken off the market while the owners tried to spruce it up but was told the house had sold already. That seemed odd, since normally a realtor will leave the sign up with an “under contract” or “sold” addendum to advertise themselves. Now the neighbor and I suspect this realtor is up to his old tricks again and bought the house from the little old lady himself- they tend to be his favorite people to rip off. I will have to check the public records to confirm, but in this market, I’d be extremely wary of realtors looking to “help” by taking properties off sellers hands themselves.

That realtor himself needs to become “liquidated inventory.”

Massive violation of fiduciary responsibility. Is fiduciary responsibility a state requirement in your neck of the woods?

I believe there is and I’ve complained about it before. Same realtor ripped off a 90 year old neighbor of mine several years back just before she died. I called the applicable state board at the time to report the realtor, and while they seemed interested, they also said the complaint would have a lot more weight coming from the aggrieved party and not from an annoyed neighbor who wasn’t personally affected. The neighbor’s family wasn’t interested in pursuing it since by that time their mother had died and they had other worries.

Dante reserved the 8th, and 9th, circles of hell for fraud, and treachery.

Calvin? Is that you?

Still too cool.

Where have I read this comment before? Or is this post by NC a rehash, or whatever its called?

As a Bostonian area resident, so far the only weakening I see is properties selling only slightly above asking. Even in the most affordable locations in working class Brockton – Chateaux Westgate a complex of 252 carbon copy layouts of apartment style condos – listings are selling promptly and just above asking in the $230-250k range depending how well the owner has updated. Yes, a quarter of a million for a 800-900 sq ft apartment. A reasonably solid if unglamourous type of property and always wondered why they didn’t get rid of the common pool as it is rarely used and must be an inordinate financial drain and could be filled up with soil and made into a nice yard/garden area. Listings in my area have recovered to about an average of 130…up form about 70 a year or two ago.

For perspective, my first partner owned one of these units about 30 years ago. He purchased it for $80k with his uncle, bought his uncle’s half out even though it fell in value to about $40k.

Today they sell quickly for about $250k.

For those not familiar with the Boston area, Brockton is seriously unglamorous; actually, downright dangerous.

Brockton is majority working-class, heavily immigrant, quite historically architected and possibly majority non-white (if you include Latinos in that designation).

I would breathe a lot easier there than in the vast tracts of white bread across Greater Boston.

I judge the immigrants to be crime deterrents because they are family oriented hard working and help make neighborhoods super safe, for example I guess my immediate neighbors to be with extended family that become the eyes and ears of the area which causes me to wonder if that helps I’ve never had any delivery stolen having sat in plain sight on my front door steps all day. And….you get the same house in Brockton at lower price vs if you walk a few blocks into and identical neighborhood across the Easton line which has “cache” but much higher prices and real estate taxes.

I will say inner city Brockton is daunting and a mess in general. I’m sure something can be done but I don’t know about things like that.

Please.. it is only “dangerous” if you talk about today’s crime rates. Compare it to the crime rates of the 80’s and it’s Disneyland.

The listings here in the xburbs are dropping from the low 300’s to high 200’s. A house that was attempted to be sold in the summer for 319k has sold recently for 270k. This house was bought in 2010 for 68k.

The complete destruction of affordability is starting to reverse.

>>>The complete destruction of affordability is starting to reverse.

Maybe. I just heard on Breaking Points that the minimum yearly income needed to buy house is over $100,000. The average income in the United States is under 60k. We are looking at a ratio of cost to income of 2-1. I guess people are just suppose to live on the streets.

What always amazed me about Somerville is all the homes split into three or even six apartments, each selling for like 300-500 thousand. When I there stuff in Arlington was half a million.

Wow. Only 250k?

In Vancouver condos are going for $1000+/sq ft. So for those they would be $900,000

An example how completely divorced from sanity prices here are.

And despite the interest rates hikes and sales drop, etc, they are barely budging

Brockton is way, way, way out from the center of Boston. Per Google Maps, from Brockton City Hall to Boston City Hall, 24 miles, 37 minutes driving in low traffic, over 1 hour by commuter rail, and both options frequently have problems since transportation in Greater Boston is a total mess.

The usual scam here is to loan the heirs a little money to tide them over until the house sells and perhaps do a little sprucing up.

The listing is for six months, exclusive, and the loan is a second or 3rd mortgage with a balloon payment due in 90 days.

There are always a few bottom feeders and other agents know who they are, but criticizing them publicly will cost you your license.

It’s a damn shame horse whips have gone out of style.

I would love to see some date that breaks these numbers out along urban vs. rural lines.

Theory being, and experience telling me, this is more an urban phenomenon.

Existing home prices have tapered some, sure +/- 10% ???

New construction due to non-existent housing stock; however, seems to still be jumping right along. You can’t find a contractor to save your life still.

But, I live in the “American Redoubt.” If you know anything about the movement, you’ll understand why the market seems largely unfazed.

Meanwhile, Newsom and the California State Legislature, whores for the lending, construction industry and labor unions, has just force fed 3.5 million housing units into California like a foie gras goose with a funnel stuck down its gullet.

Based on “McKinsey Estimates” ™

https://www.2preservela.org/the-3-5-million-unit-housing-shortage-in-california-is-bad-data-causing-legislative-missteps/

Here in Tucson, I’m seeing “for sale” signs that have been up for a while. And then they suddenly disappear.

I’m thinking that these are not houses that have suddenly sold. Around here, the “for sale” signs sprout “sale pending” riders. Or they hit the ultimate home run with the “sold” rider.

Instead, I’m thinking that these are listings that are being withdrawn until after the holiday season. Y’know, when the market improves.

Or they just can’t afford to sell. They’d be underwater on one of their mortgages and/or couldn’t afford to buy another place with today’s interest rates.

Every time I’m at the local Home Depot or Lowes it seems that the display of “garden sheds” complete with French doors and nice windows continues to grow. I generally check them out to see how these are made, and conclude that’s it pretty easy, and cheaper, to build something better even without getting a significant material discount.

My wife asked why so many are now on display to which the proper response is “affordable housing, American style.”

I mean come on, who needs such a fancy schmancy gardening sheds? And now I see them at smaller locally owned stores too.

Thanks, Glen, sounds like the new affordable housing

Up in far north Queensland, stock is very low, which is surprising as demand is very high. Construction costs, including labour appear to be up 15 per cent or so. Holiday lets have made the region more unaffordable for renters, with many long term rentals seeking a better return (for instance here in Cairns), those properties are seeing renters face an increase per annum of 10 per cent or so. Almost impossible if relying on welfare, so the caravan parks are full too.

Happy thanksgiving all

We have been shopping for homes in western Washington, north of Everett. The prices are still shocking but the market is beginning to soften with the higher interest rates. The days of bidding $5-10k over asking price and waiving inspections(!) are over. What I’m seeing a lot of when I look at property records is a significant number of people flipping houses – many of these people are likely realtors. It’s a dead giveaway when you see the person has only lived in the house for 2-3 years, just long enough to get the income tax break from the sale. Many listings now tout the properties as “investments” rather than homes to live in. Some new paint, a few appliance upgrades, some faux wood floors and then you ask $100,000-$200,000 more than you paid a couple of years ago. Many of these flippers will be disappointed in the current housing market and I love to see it.