Yves here. Gambling in Casablanca? Boatloads of money going astray in Ukraine? Quelle surprise!

Actually, the only surprise is how openly remiss the IMF has been in keeping tabs on the dough it has been funneling into Ukraine. Recall that the original loans to Ukraine were already in violation of IMF rules, since states in conflict are supposed to be no-go zones, and it was awfully hard to deny that Ukraine was in a civil war, with 14,000 dead and 1.5 million refugees fleeing to Russia and Belarus.

One also has to wonder if some of these IMF funds did wind up getting to intended targets, like mercenaries. Former Swiss intelligence officer and NATO small weapons program inspector Jacques Baud said the Ukraine armed forces needed to be beefed up quickly after the war in the Donbass started and came to be composed 40% of mercenaries. So the leakage could be partly by design, to hide key recipients.

But even if true, the best case scenario is an awful lot of official grift to get money to black ops types. Hard to believe we don’t have less greedy cutouts in the mix.

By John Helmer who has been the longest continuously serving foreign correspondent in Russia, and the only western journalist to have directed his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and advisor to government heads in Greece, the United States, and Asia. Originally published at Dances with Bears

A new report by the International Monetary Fund (IMF) reveals that the Ukraine has become a thieves’ paradise in which corporate loan defaults are written off; embezzlement from banks is not traced; the National Bank of Ukraine (NBU) no longer audits the country’s bank liabilities and reserves; and the IMF admits it cannot tell how much of the $35 billion in foreign cash grants and loans promised to Kiev has been disbursed, or to whom.

“Disbursements of all committed funds over the remaining months of the year is urgently needed and will make a difference,” declares Kristalina Georgieva (lead image), the IMF Managing director since 2019, “especially in light of the recent horrific damage to energy infrastructure.” Georgieva was speaking in Berlin on October 25.

“In a best-case scenario,” she added, “we estimate that Ukraine’s financing needs would be about $3 billion per month. When we incorporate some additional financing for higher gas imports and some repair of critical infrastructure, we quickly reach $4 billion per month. The recent missile attacks, which have clearly caused much more damage, not only confirms the validity of these estimates but leads us to consider $5 billion upper range.”

However, in a 32-page IMF staff report on the state of Ukrainian budget finance and the risk of system-wide financial collapse, the Fund experts have concluded that “large-scale forbearance with a delayed recognition of NPLs [commercial bank non-performing loans] and the suspension of NBU enforcement actions and audits of financial statements make a comprehensive assessment of the impact of the war difficult and uncertain.” The report has been released at this link on the IMF website.

“Uncertainty” is IMF officialspeak for black hole. “The balance of probabilities,” according to the staff paper dated October 3, “would suggest that Ukraine has an unsustainable level of debt.” According to the Fund rules, this should suspend or stop IMF and all other foreign government cashflows.

Georgieva and the IMF board, dominated by the US, say otherwise. The black hole, the staff report goes on to say, is “unique to the extreme circumstances now prevailing in Ukraine, [so] very high uncertainty makes it difficult, at present, to estimate with sufficient precision the impact of the war on the debt outlook, and what would be required to restore sustainability.”

Instead, they have accepted a promise issued in a letter to the Fund dated October 1 from the Ukrainian Finance Minister Sergei Marchenko and NBU Governor Kirill Shevchenko. “We commit to undergoing a new safeguards assessment of the National Bank of Ukraine and will continue providing IMF staff with the NBU’s audit reports and authorize its external auditors to hold discussions with staff.”

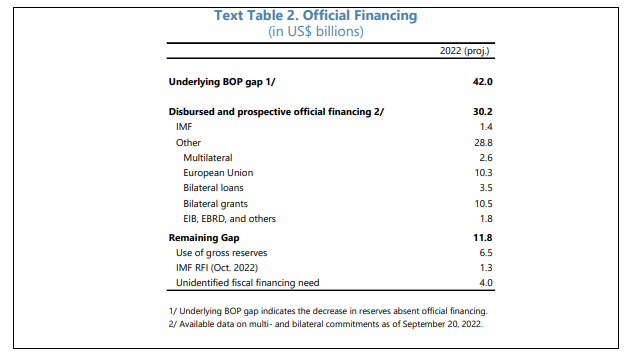

This is a future promise. The NBU audit reports already received by the Fund in Washington ought to show exactly how much foreign cash has been received at the NBU, and what has happened to it in the disbursement throughout the Ukrainian public finance system. They don’t. In fact, the staff report tables show “disbursed and prospective official financing” conflating the two numbers together, and treating both as imprecise and unreliable because they are “2022 proj[ected].”

On October 7 the Fund’s Executive Board met to agree to the despatch of a fresh $1.29 billion in cash, and to accept the NBU’s promissory note for future accountability. The staff report says the new money is to be paid through the “food shock window of the Rapid Financing Instrument (RFI)”. The black hole promise has been assigned an IMF acronym; it’s to be called the PMB – “Project Monitoring with Board involvement.”

Once PMB is put into operation, Marchenko and Shevchenko told the Board in their letter, “we expect [it to] help eventually pave the way for an Upper Credit Tranche arrangement in the near future”. This is Ukrainian officialspeak for turning “eventually” into the “near future”; and for throwing more good money after bad.

Since the present Ukrainian government was installed in Kiev in February 2014, the IMF has demonstrated a long record of failing to audit the NBU and commercial banks and of refusing to stop the multi-billion dollar diversion, fraud and embezzlement of the foreign funds by the oligarchs close to the regime and to Washington.

Read that archive here.

Source: http://johnhelmer.net/

Last March, shortly after the Russian special military operation had begun, Georgieva said at a press conference that “Ukraine has audited how the money was spent and has provided a very good account on the role this emergency financing played.”

Source: https://www.imf.org/

This wasn’t true at the time; the latest staff papers show it hasn’t been true over the interval of seven months and it isn’t true now.

“As the economy adapts to the now prolonged war, macroeconomic policies have forcefully adjusted to reduce non-priority expenditures, ease pressure on the hryvnia and FX reserves, and preserve financial stability. The authorities have also adopted wide-ranging emergency measures since Russia’s invasion including administrative FX and capital controls, a suspension of regulatory and supervisory enforcement actions, postponement of audits of banks’ financial statements, and forbearance with respect to restructured loans.”

“Asset quality is deteriorating, but large-scale forbearance with a delayed recognition of NPLs and the suspension of NBU enforcement actions and audits of financial statements make a comprehensive assessment of the impact of the war difficult and uncertain. Banks can access unsecured funding with a maturity of up to one year for an amount up to 30 percent of their late-January retail deposits. NBU enforcement actions have been suspended for breaches of prudential requirements regarding capital, liquidity, credit risk, net open positions in FX and for delays in prudential reporting. Audits of banks’ financial statements and regular bank stress testing have been postponed. Loans restructured during the martial law period are exempt from reclassification for credit risk, some regulatory risk weights have been decreased, and banks have been prohibited from related party lending, capital distributions (dividend payments and share buy-backs), and bonus payments.”

That last line is comprehensively contradicted by the preceding admissions. In plain language, Ukrainian corporate borrowers can default with impunity on their loans, and the banks are no longer required to report the sum of these defaults, set aside loan loss provisions, or increase their shareholders’ capital to compensate for actual or projected losses. These normal balance-sheet operations are no longer being audited by finance ministry regulators, the central bank, or the state’s prosecutors and financial police.

The IMF staff concede they are six months out of date on the sums. By calling them “official”, the IMF is admitting it doesn’t know if the sums they have been given by the NBU are a fraction of the truth.

“The official NPL ratio as of end-May was 16.5 percent. Banks have also granted payment holidays on retail [individual] and corporate loans for the duration of the Martial Law and cancelled fees and commissions on cashless payments as well as cash withdrawals. Prospects for banking system profitability are therefore significantly weakened. Although outstanding credit to GDP is relatively low at 14 percent, banks’ loan portfolios are also vulnerable to several adverse developments including rising interest rates; a declining exchange rate (a third of bank lending is denominated in foreign currency); and damage to real collateral used for credit enhancement. The banking sector recorded US$1.1 billion (UAH 33 billion) of loan loss provisions for credit losses between March and May, a four-fold increase over the previous year. Banks’ retail loan portfolios shrank by around 10 percent and mortgage lending came to a halt, but corporate lending has grown slightly due to various government support schemes.”

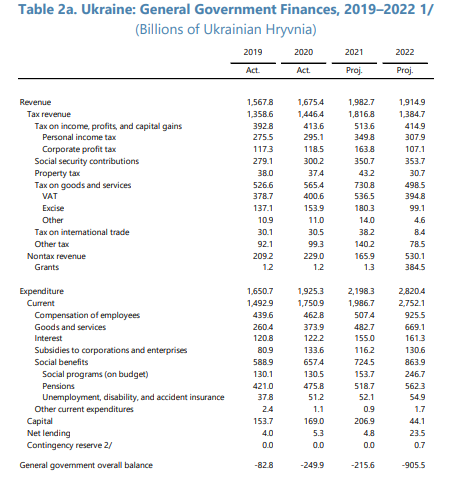

The state budget coffers, filled with foreign cash, are being emptied to “support” the defaulting banks as their cash disappears. This, the IMF accountants say, is their budget deficit red line. “The fiscal deficit is projected to reach close to 20 percent of GDP at end-2022, subject to a high degree of uncertainty.” After recording that this year $530.1 million is projected to be “non-tax revenue” – that is , US and other foreign cash to pay for the military – an increase of $364.2 million over 2021, it appears this money isn’t enough to cover the projected expenditure on “compensation of employees”, which should increase by $418.1 million over a year ago. The deficit must be covered by more US and foreign cash, the report recommends.

The uncertainties are tabulated in the staff report this way:

Source: Staff Report, “Request for Purchase under the Rapid Financing Instrument”, -- page 17.

Source: Staff Report -- page 12.

The operative term in these tables is “proj.”

Georgieva has admitted publicly this “uncertainty” and “proj.” On October 25 she told the press “the international community has acted decisively — it came together to commit $35 billion in grant and loan financing in 2022 for the people of Ukraine. Building on the laudable efforts of the Ukrainian authorities, this has put a floor under the Ukrainian economy. Disbursements of all committed funds over the remaining months of the year is urgently needed and will make a difference, especially in light of the recent horrific damage to energy infrastructure. From our side, we are acting—the IMF has disbursed $2.7 billion of own resources to Ukraine this year through emergency financing, and channeled an additional $2.2 billion through our Administered Account. But we also need to plan ahead. Ukraine’s financing needs in 2023 are enormous. The country will do its part, but it also needs a strong effort from its partners.”

Georgieva is admitting the only disbursements to the Ukraine she is sure of are the ones the IMF has paid itself. Georgieva’s use of the future tense camouflages the gap between commitments and disbursements on the part of the US, the European Union and Canada. When she urges a “strong effort from [Ukraine’s] partners”, the IMF chief is warning that US and NATO promises to deliver money have not materialised on time.

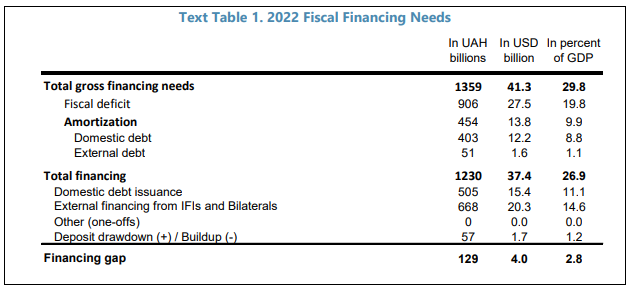

The staff report uses the euphemisms “assuming” and “timely” to concede the same point. “The fiscal financing gap for 2022 has narrowed thanks to sizeable support from international partners and coordinated suspension of debt service due by Ukraine. The deferral of debt service obtained from private bondholders, the G7 and Paris Club members is estimated to save about US$6 billion in debt service through end-2023. Assuming [sic] the authorities continue to tap limited purchases of war-bonds by the NBU (allowed under the Martial Law) and [assuming] timely [sic] disbursement of the US$31.5 billion of committed external loans and grants (including the proposed purchase under the RFI and about US$ 2.2 billion in loans and grants already disbursed through the Administered Account established by the Fund in April), the residual financing gap would be about US$4 billion (2.8 percent of GDP). This gap is primarily driven by needs to support the energy sector and additional defense spending.”

The following tabulation by the IMF experts of the Kiev regime’s “financing gap” of $4 billion is pure guesswork

Source: Staff Report -- page 11.

The western press coverage of the Ukraine has almost totally ignored the IMF staff reports and data tables. The Financial Times of London, for example, lists 74 publications on the IMF in Ukraine; not one of them reveals this year’s IMF staff reports.

The Wall Street Journal has attempted to portray itself as doing better than its rival by publishing a front-page interview on August 12 – ahead of the arrival in Kiev of the IMF staff – with Finance Minister Marchenko. However, Marchenko wasn’t asked to clarify how much of this year’s foreign commitments had been received in Kiev, nor how he and his government are accounting for their outlays to creditors, lenders, state employees, and the troops. Like the Wall Street Journal, the Financial Times has been promoting Kiev’s demands for more money, portraying its financial management “since Russia’s full-scale invasion began on February 24 [as] meeting its obligations in full in order to maintain the confidence of international investors.” The IMF staff reporting indicates this is false.

Source: https://www.wsj.com

The Financial Times has published two interviews with Marchenko -- in April and July of this year.

Social media from the Ukrainian troops on the battlefield indicate that surviving soldiers are not being paid on time and in full, while dead, wounded or missing soldiers are having their pay and benefits diverted and stolen by unit commanders and paymasters. Theft of cash and military equipment is rife.

The Pentagon has recently announced that it will – future tense – send inspectors to check what is happening to US weapons deliveries and prevent the black market diversion. A leak this week to the Washington Post has revealed that at best only 10% of US arms deliveries to the Ukraine have been confirmed as in stock – 2,200 of a total of 22,000 weapons delivered.

The newspaper also reported State Department sources as blaming the Russian Army for the arms resale and black market smuggling. “Since late February’s invasion, which prompted the closing of the U.S. Embassy in Kyiv for several months, U.S. officials have been able to conduct just two in-person inspections of items requiring enhanced oversight at weapons depots where U.S. arms had been brought in from Poland. ‘The conflict creates an imperfect condition for us to have to adjust quickly,’ a senior State Department official said. ‘We want to put some of those resources to working with our allies and partners to mitigate risk however, wherever we can.’ The scramble to adapt oversight rules designed for peacetime has taken on greater importance as the volume of American assistance reaches dizzying levels and congressional scrutiny intensifies. U.S. and Ukrainian officials say they have not documented any instances of illicit use or transfer of American arms in Ukraine since Russian President Vladimir Putin launched his invasion on Feb. 24. The State Department has acknowledged that Russian forces’ capture of Ukrainian arms could lead to those weapons being smuggled on to other countries. Other weapons have gone missing; a Swedish grenade launcher, apparently pilfered from a battlefield in Ukraine, exploded in the trunk of a car in Russia in May.”

The Pentagon and State Department have told reporters their new auditing effort “hope[s] to achieve a ‘reasonable’ level of compliance with U.S. oversight rules for those high-risk items [Stinger anti-air and Javelin anti-tank missiles] , but also acknowledge that they are unlikely to achieve 100 percent of normal checks and inventories as the country’s escalating war with Russia strains systems for ensuring weapons are not stolen or misused.”

The US Government terms “reasonable” and “normal” are the equivalent of the IMF’s “assuming”, “timely”, and “proj.”

Until now, however, the US Government’s official auditor, the independent General Accounting Office (GAO), has refused to audit Ukrainian expenditure of US military aid funds.

Source: https://www.gao.gov/

“Looking ahead,” the IMF staff declared last month, “it is crucial to implement policies that do not reverse hard-won gains from past Fund-supported programs to maintain donor confidence and pave the way for the eventual recovery. Effective transparency and accountability safeguards are critical to sustaining continued donor support, preventing misappropriation, and eventually ensuring high quality reconstruction efforts. Key measures should aim to promote procurement transparency in spending and investment, preserve key functions of the anticorruption enforcement framework, and maintain good corporate governance, including in state-owned enterprises and banks. More broadly, a successful reconstruction effort will require a timely and well-coordinated normalization of fiscal, monetary, and exchange rate policies, restoring financial sector health, gradually liberalizing capital flows, strengthening governance, and tackling key structural challenges, including restoring a well-functioning PFM-system which includes fiscal risk management.”

This is an admission that there are no accountability safeguards, no effective transparency audits, no prevention of misappropriation in the present Ukrainian government, banking system, and military operations. Promising there will be is a battery torch shining on a black hole – for as long as there is electricity to recharge the battery before the light goes out.

If you think that $35 billion going MIA in the Ukraine is something, you ain’t seen nothing yet. It has been estimated that the Ukraine will need $349 billion to rebuild itself after the war is over so when that happens, this first $35 billion will be seen as only a rounding error-

https://www.dw.com/en/ukraine-reconstruction-may-cost-349-billion/a-63069130

EIB estimates have already exceeded $1 trillion:

https://www.bloomberg.com/news/articles/2022-06-21/ukraine-reconstruction-may-cost-1-1-trillion-eib-head-says

Ukraine PM more recently put the damages so far at $750 billion

https://www.reuters.com/world/europe/ukraine-sees-post-war-reconstruction-costs-nearing-750-billion-pm-2022-10-24/

Ukraine has a convenient online guide to foreign grift opportunities, funded by the US government, called UkraineInvest. US and UK govts also fund research at Kiev School of Economics, which publishes updates of damage estimates by sector.

$100 Billion to Ukraine so far, approximately.

https://www.devex.com/news/funding-tracker-who-s-sending-aid-to-ukraine-102887

100 Billion is Five times what it would take to solve all homelessness in America.

Fuck the Democrats! Half the Republicans are against the Ukraine Giveaway, 100% of the Democratic congress voted for it.

I’m voting straight Republican this election. At least half of them will help stop this invitation to the barbeque that is you when WWIII starts, thanks to the Globalists.

Lol if you think the Republicans are any different and won’t just redirect all the wartime energy against China instead. There is a reason we are always at war and it usually has nothing to do with whoever we are at war with. Regular working class Americans need an enemy to redirect their pent-up frustrations against as material conditions decline, the MIC is a foundational component of the country’s economic health and thus we always need war for the good of the economy, and wartime propaganda nurtures a conservative and fearful mentality in the population making it easier for the citizenry to go along with leadership that does not act in the citizens’ interests. I hate the Democrats as much, if not more, than the next NC poster, but please do not kid yourself that *the* Republican party isn’t as eager to wage war too. They just have a different enemy in mind 🇨🇳

Giveaways they aren’t. They are fighting a war for the democrats. No official contract but promises and compromises there must have been made.

How can that be? The only cities damaged are now Russian and the electrical grid can only be repaired by Russia. So when NATO/ Washington realizes the games up they’ll bust put there missiles in Finland and repeat the process again.

Feature, not Bug.

Musical interlude:

Excellent.

Thank you, Lambert.

John Prine is one of my favorite songwriters and, as depressing as this song is, it’s one of my favorites of his because I knew a Sam Stone. Very sad.

As deeply antiwar as I am and was, I always felt that blaming the soldiers and the way so many treated them badly was just horrible. These men were, with rare exceptions, victims — not perpetrators.

They should have been welcomed back into the community and given all the support they needed to deal with their trauma.

I was part of the antiwar movement at that time and can attest that we did welcome the soldier-victims and understood perfectly well that that’s what and who they were. They played a key role in turning the country’s attitudes around, and we knew they were wounded and often deeply troubled by their experiences.

Returning vets and questioning active-duty soldiers often came by our group home referred by counselors who knew they would get a sympathetic hearing and a convivial atmosphere. We never questioned them for what they had been compelled to do.

The myth that Vietnam vets were mistreated by opponents of the war is just that–a convenient way to shift the blame on people who were against a pointless war and its many victims.

timotheus – I’m glad your experience was different from mine. Sounds like your group home provided the kind of support I was referring to. However, I did see plenty of antiwar folks treat vets with less than the respect and kindness they deserved.

It’s always the same with the IMF. Staff do a decent job of program analysis, and leadership completely ignores staff conclusions and tell the world that in these difficult times, if we stay the course success will be ours. Reading Georgieva’s speech to the assembled Euro-aristocracy it’s clear that these elites simply tell one another what they want to hear. The woman knows what’s going on, but not a negative word will be heard. The clock is ticking on Georgieva bailing out. In any case, they will all be assembling in the Fuhrer-bunker soon enough.

With the amount of looted capital about to be firehosed into the market for exclusive high end properties, every ultra-luxury real estate agent worth their salt should be learning Ukrainian, what better way to connect with and meet the exacting demands of the arriviste nouveau riche from the country of Ukraine. It’s raining so much money in Ukraine I bet the grifters are asking everyone they know to run outside with buckets…

As we well know it is more than the locals who steal the money.

A daily an analysis of Swift traffic would be illuminating.

Thank you, Gentlemen.

It’s been going on for three decades, as per this example, https://www.theguardian.com/uk/2011/apr/19/rinat-akhmetov-one-hyde-park. The oligarchs bring their glamazons, too, as can be, er, mmm, viewed around Mayfair.

Synoia is correct to point out analysis of SWIFT traffic. A decade ago, a (now) former chief economist at the Bank of England told me some tidbits arising not just from that sort of looting, but the QE money from London going into real estate, executive toys etc, at home and, largely, abroad.

Around the turn of 2016 – 7, I was approached for an audit job to cover the IMF and World Bank. Discussions went quiet for some years. It then turned out that the leadership of both institutions did not want to beef up their audit functions and uncover the scale of corruption.

@ Thuto: Don’t feel left out, though. The world’s richest trade unionist, Cyril Ramaphosa, is coming to London this month. He’s always good value for comedy and hypocrisy when begging for crumbs from the top table (e.g. at the Cornwall G7) and rabbiting on about good governance.

Thank you, CS.

If Cyril isn’t dodging questions in parliament about the Phala Phala scandal (where $4m in foreign currency was stolen at his Phala Phala Game farm by a gang of thieves aided by his house keeper) he’s jetting off overseas to debase himself along the lines you mention, providing further material for his detractors to mock the abysmal failure otherwise known as his presidency. His political opponents are treating the scandal as a heaven sent to hobble his run for reelection as ANC president at the December elective conference. The country would benefit from seeing him walk off into the sunset to never return as president, but much like the UK, SA’s lack of credible alternatives across the political landscape means someone like him keeps limping along.

Great point Synoia, Ukraine is probably a pit stop for most of this money before it zips out across the border and into the waiting pockets/offshore bank accounts of the western handlers of Zelensky and co.

International Monetary FundInvesting My Funds

There isn’t any audit trail if one isn’t wanted.

Do these figures include the 10% to the Big Guy?

If the GOP takes the House or Senate, if they are smart (which is a stretch) they ought to order a thorough audit of where all the money to Ukraine has gone.

Quelle surprise.

When money can be plucked out of the air, why would one bother to account for it. But, when it floats to earth be there with a capacious satchel.

did they check the Caymans?

But..but…but this cannot be true, surely? Canada’s Finance Minister and deputy Prime Minister Chrystia Freeland, herself a staunch supporter of Ukrainian ultranationalism, in announcing the issuance of ‘Ukrainian Sovereignty Bonds’, recently stated that:

‘The money from the bonds will go directly to the Ukraine through an IMF account, which insures accountability and transparency,’ Freeland said…” In view of Helmer’s excellent, alarming article, a word to the wise, don’t buy Canada’s ‘Bandera Bonds’!

Canada’s Finance Minister Responds To Ukrainian Sovereignty Bonds

https://globalnews.ca/video/9234664/canadas-finance-minister-responds-to-ukrainian-sovereignty-bonds/

More on Trudeau/Freeland’s ‘Bandera Bonds’

Canada Prepares War Bonds For Nazi-Infested Ukraine

https://mronline.org/2022/11/02/canada-prepares-war-bonds-for-nazi-infested-ukrainian-government/

“The Canadian government has once again reintroduced war bonds, this time for a Nazi-infested Ukrainian government used by NATO to wage a proxy war against Russia…”

Ukraine spends 10x more on pensions(~500m UAH) than on Unemployment benefits(~50m UAH)? This strikes me as odd, even for a country with such a youth migration problem.

Ukraine may be like Greece, where the pension system is the big safety net and there are no other meaningful programs.

A plane carrying arms from Bosnia crashed a while back It was destined for Bangladesh.

Could some of the ‘missing’ funds be headed east, possibly as arms rations etc., to the border with Myanmar? China had close ties with Myanmar. Preventing the rail and canal possibilities by PRC, is USA policy, is it not?

Never waste a crisis….

BlackRock’s Larry Fink has indicated his interest in creating and managing a reconstruction/ investment fund.

Seems like this is what they mean when they talk about a “Big Israel”